How Much Should People Save? - Alicia H. Munnell, Anthony Webb, Wenliang Hou

"How Much Should People Save?" by Alicia H. Munnell, Anthony Webb, and Wenliang Hou is a research paper or study that provides insights into how much individuals should save for their future financial security. It may offer guidelines or recommendations on saving habits and financial planning.

Alicia H. Munnell, Anthony Webb, and Wenliang Hou file the "How Much Should People Save?" document.

FAQ

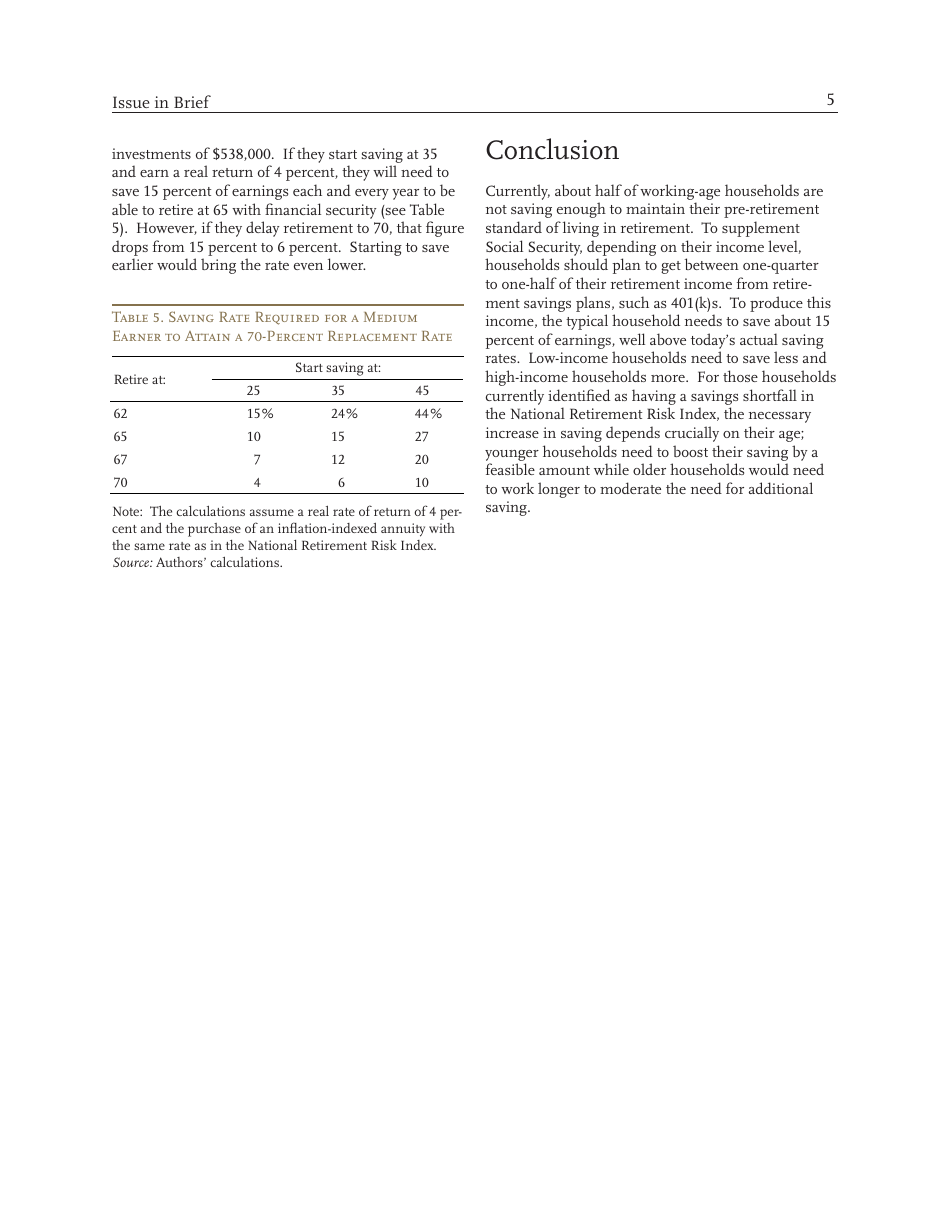

Q: How much should people save?

A: The amount people should save depends on their individual financial situation and goals, but experts generally recommend saving at least 20% of their income.

Q: Why is saving important?

A: Saving is important because it allows people to build an emergency fund, afford large purchases, and prepare for retirement.

Q: What are some tips for saving money?

A: Some tips for saving money include creating a budget, cutting unnecessary expenses, automating savings, and setting specific savings goals.

Q: How can I start saving if I have debt?

A: Even if you have debt, it's still important to start saving. You can start small and gradually increase your savings as you pay off debt. Creating a budget and finding ways to reduce expenses can also help free up money for savings.

Q: What are some retirement savings options?

A: Some retirement savings options include employer-sponsored plans like 401(k)s or 403(b)s, individual retirement accounts (IRAs), and other investment vehicles like annuities or brokerage accounts.