This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-3C

for the current year.

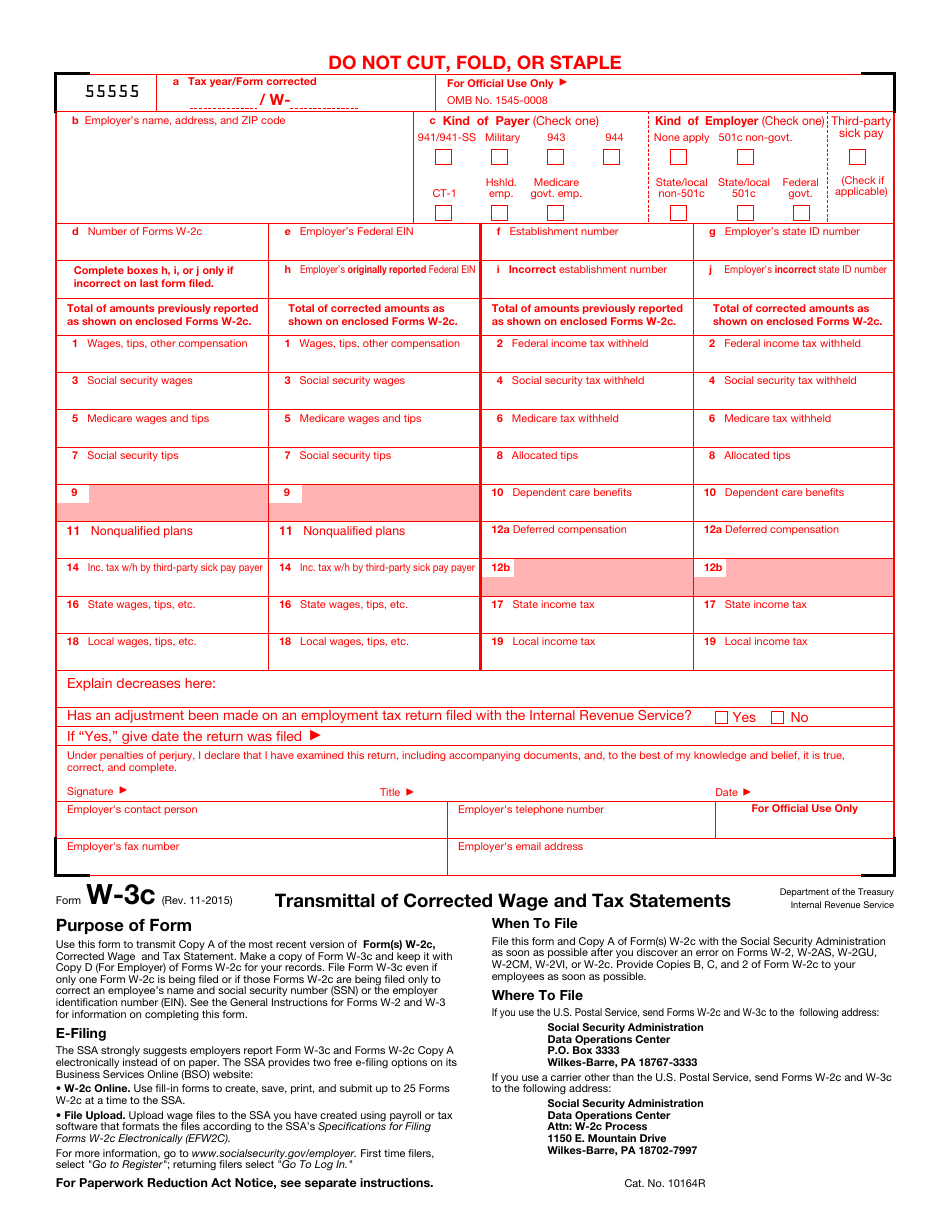

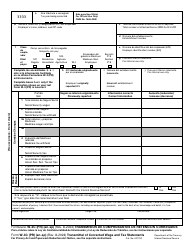

IRS Form W-3C Transmittal of Corrected Wage and Tax Statements

What Is Form W-3C?

IRS Form W-3C, Transmittal of Corrected Wage and Tax Statements, is a form used for transmitting Copy A of IRS Form W-2C, Corrected Wage and Tax Statements to the Social Security Administration (SSA). Form W‑2C is a form filed to correct errors on previously filed Form W-2, Form W-2AS, Form W-2GU, Form W-2VI, and Form W‑2C with the SSA.

The form is issued by the Internal Revenue Service (IRS) and is revised annually. The latest fillable Form W-3C is provided for download below. The transmittal is part of a three-piece series of forms that includes:

- IRS Form W-3, a form that employers complete and file for the SSA when they need to file a paper Form W-2, Wage, and Tax Statement;

- IRS Form W-3SS, a form that must be filed by anyone who needs to transmit a paper Copy A of Forms W-2AS, W-2GU, and W-2VI to the SSA.

IRS Form W-3C Instructions

Instructions for Form W‑3C are as follows:

- File Forms W-3C and W-2C as soon as possible after you discover an error (such as incorrect name, Social Security Number, or amount), and provide Form W-2C to employees as soon as you can.

- In the money boxes, enter the total amounts from each box and column on the W-2C Forms that you are sending. If any item on the form shows a dollar amount change and the amount is zero, you must not leave the box blank, but enter "-0-" instead.

- If filing either of the two forms on paper, all entries must be completed using dark or black ink in 12-point Courier font, and all copies must be legible to allow proper processing.

- When correcting more than one type of Form W-2 (which were mentioned above), make sure you group forms of the same type and send them in separate groups using a separate Form W-3C for each group. In addition, you are required to file a separate form for each kind of employer/payer combination in box c, as well as for every tax year. Do be aware that Forms W-2C and Form W-3C must not be stapled or taped together.

If using the U.S. Postal Service, send the forms to the Social Security Administration Direct Operations Center P.O. Box 3333 Wilkes-Barre, PA 18767-3333. If you use a different carrier, send the forms to the Social Security Administration Direct Operations Center Attn: W-2c Process 1150 E. Mountain Drive Wilkes-Barre, PA 18702-7997.