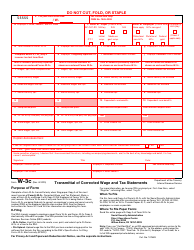

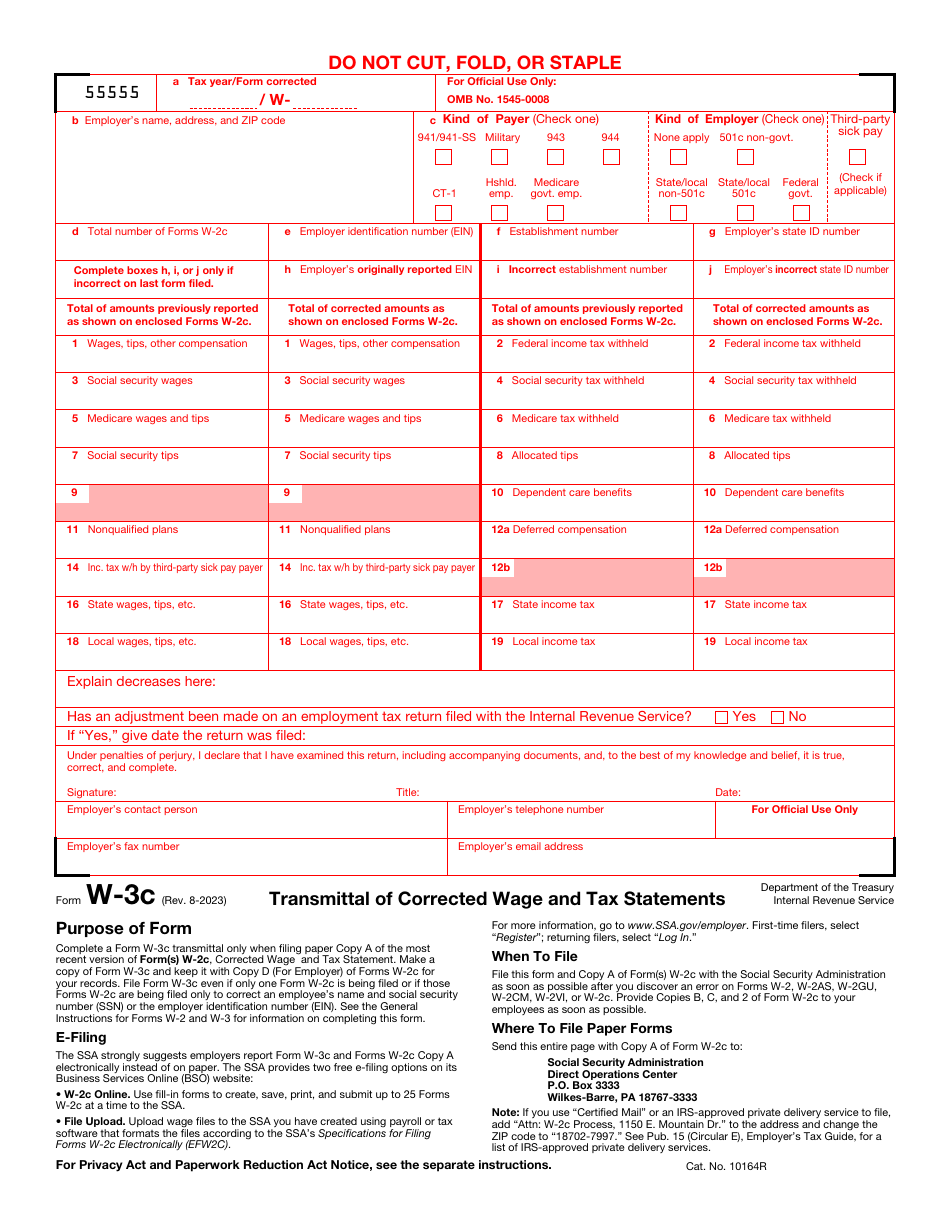

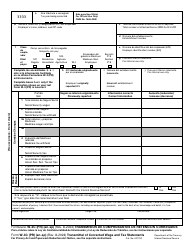

IRS Form W-3C Transmittal of Corrected Wage and Tax Statements

What Is IRS Form W-3C?

IRS Form W-3C, Transmittal of Corrected Wage and Tax Statements , is a supplementary document used by taxpayers to file IRS Form W-2C, Corrected Wage and Tax Statement.

Alternate Name:

- Tax Form W-3C.

The latter form works as a summary of changes you have made to IRS Form W-2, Wage and Tax Statement - as soon as mistakes are found in the initial form, employers are obliged to fix these errors and send a copy of the W-3C Form as a part of the submission package to the Social Security Administration and employee affected by the modifications.

This statement was issued by the Internal Revenue Service (IRS) on August 1, 2023 , making older editions of the form obsolete. An IRS Form W-3C fillable version is available for download below.

Form W‑2C is a form that can also be filed to correct errors on previously filed Form W-2AS, Form W-2GU, Form W-2VI, and Form W‑2C with the SSA.

Check out the W-3 Series of forms to see more IRS documents in this series.

Form W-3C Instructions

Follow these Form W-3C Instructions to properly submit Form W-2C to the authorities:

-

Specify the tax year you describe in the amended form and state the number of the document . List the business details of the employer - the name, mailing address, employer identification number, and the identification number assigned to your entity by a state. Check the applicable boxes to further elaborate on your status - for instance, you may file the documentation as a railroad or military employer.

-

Indicate whether you represent a tax-exempt organization or an entity with governmental authority . Put a tick in the box if you file the papers as a third party that has to report sick pay payments. It is likely you have to submit several Forms W-2C - include the total number in the instrument. Note that you are allowed to differentiate between establishments of your business - if necessary, add the number of the establishment to avoid confusion.

-

If you made a mistake when reporting crucial business details, fill out the fields that let you correct those errors first - leave the fields blank if the information was submitted correctly . Upon learning what numbers were wrong during the previous filing, you can modify the numbers - remember to list the amounts you have submitted previously as well as the most recent calculations. Skip the fields that were correct the first time. If there are any decreases, elaborate on them and clarify whether you adjusted the employment tax return as well.

-

Certify the paperwork - you need to confirm the information is true and accurate to the best of your knowledge, add your title and actual date, and sign the statement . It is also important to identify the individual that can talk to the IRS on the employer's behalf to discuss the instrument - enter their name and contact details. Make sure you send the paperwork to the Social Security Administration without delay - e-filing is advised but you may also mail the form - the address is Social Security Administration, Direct Operations Center, P.O. Box 3333, Wilkes-Barre, PA 18767-3333 .