Tax Credit Templates

Documents:

3232

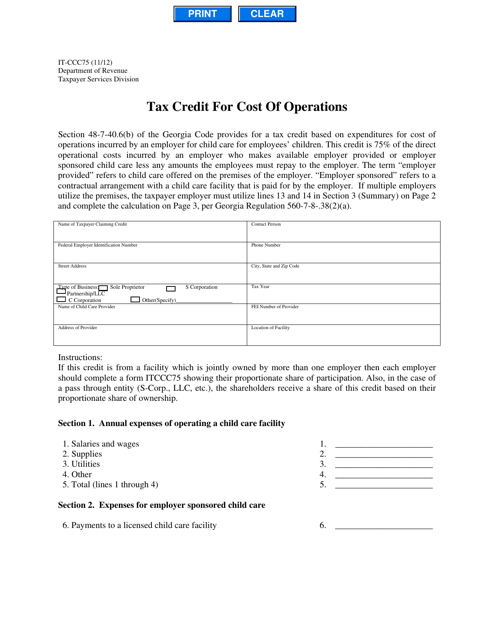

This form is used for claiming a tax credit for the cost of operations in the state of Georgia.

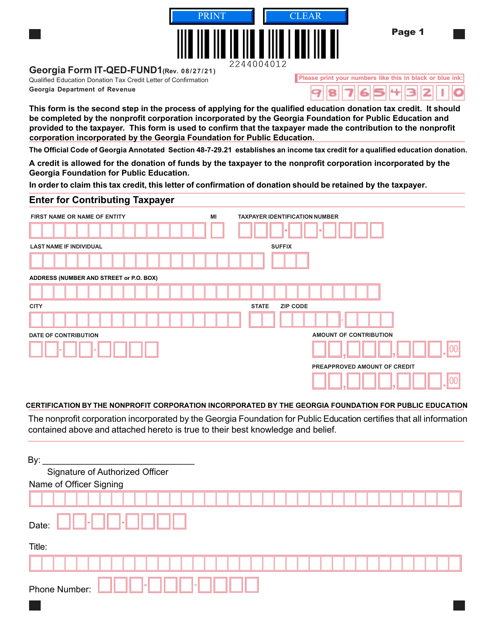

This form is used for obtaining confirmation of the qualified education donation tax credit in the state of Georgia.

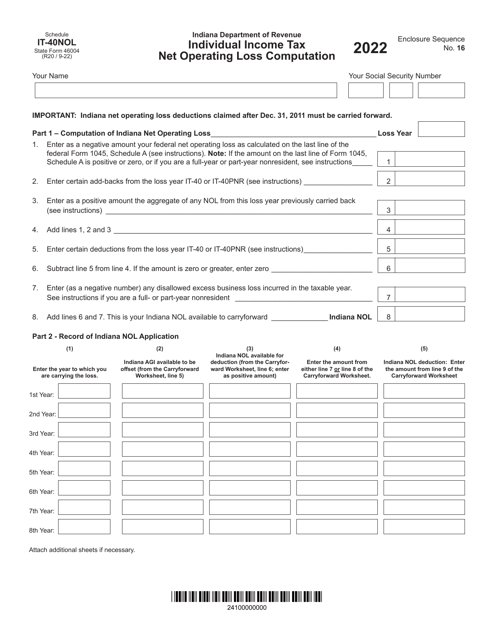

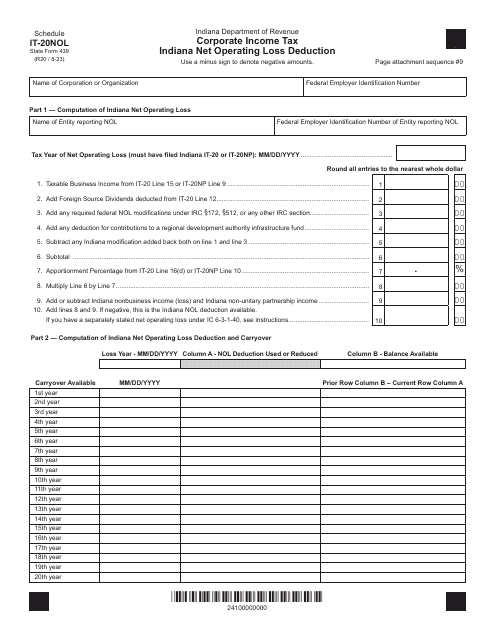

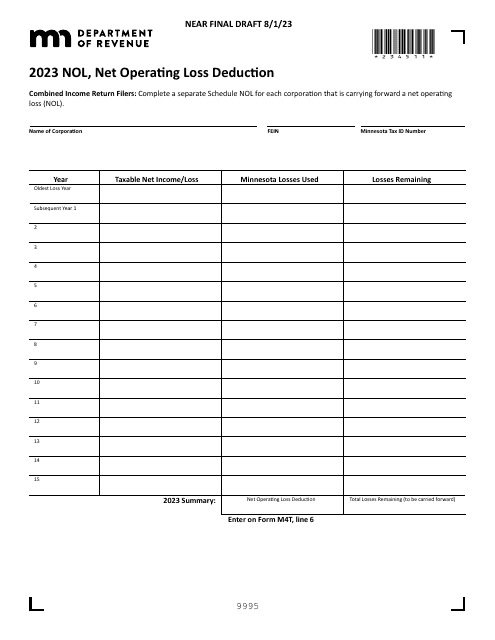

State Form 439 Schedule IT-20NOL Corporate Income Tax Indiana Net Operating Loss Deduction - Indiana

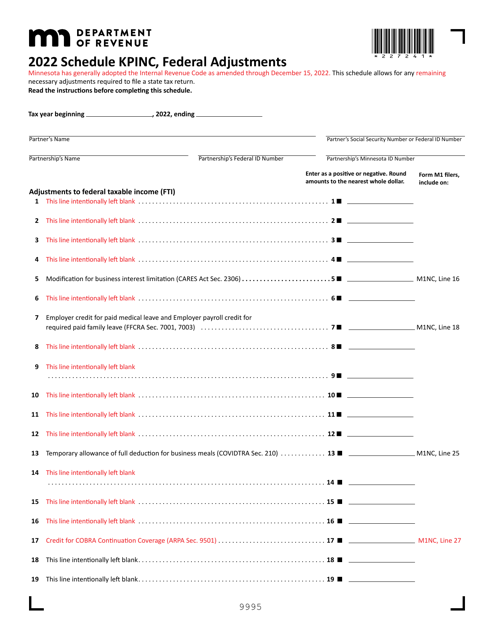

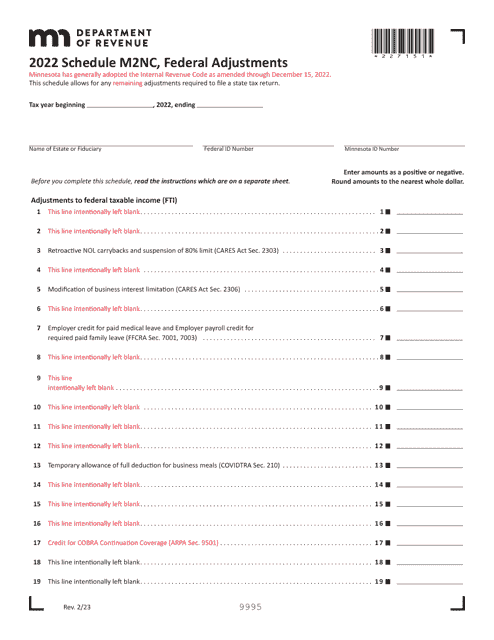

This document is used to schedule federal adjustments for the state of Minnesota as part of the KPINC tax filing process.

This document is used for reporting federal adjustments on your Minnesota state tax return. It helps ensure that you are accurately reporting your income and deductions for state tax purposes.

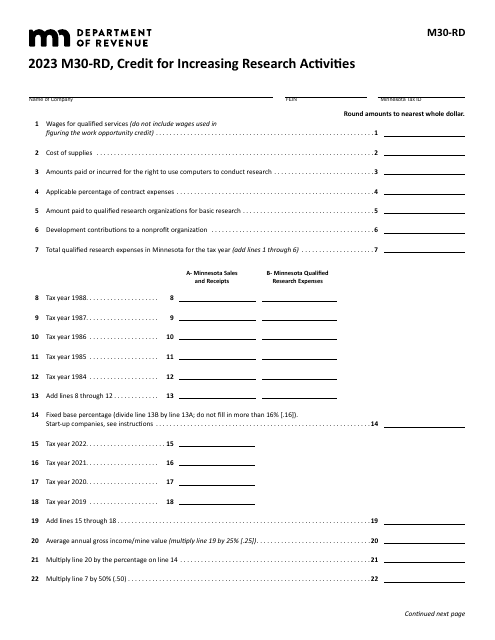

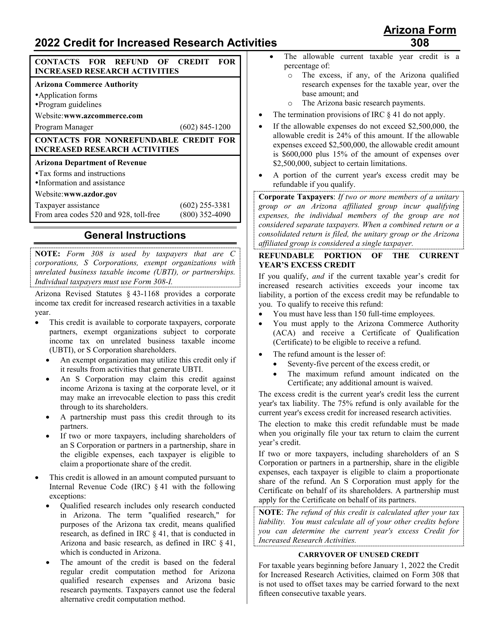

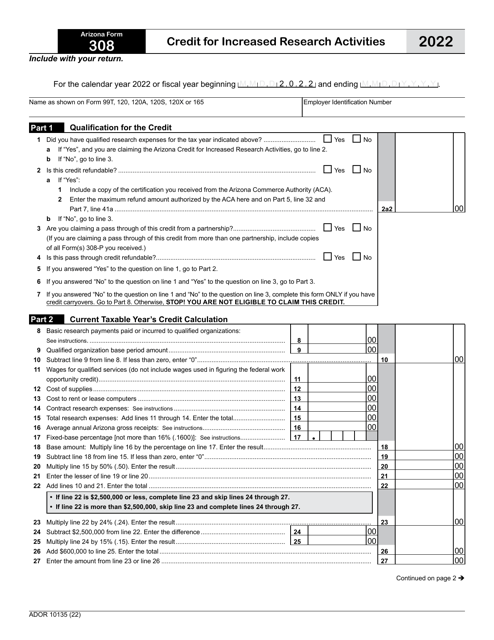

This Form is used for claiming the Credit for Increased Research Activities in the state of Arizona.