Tax Credit Templates

Documents:

3232

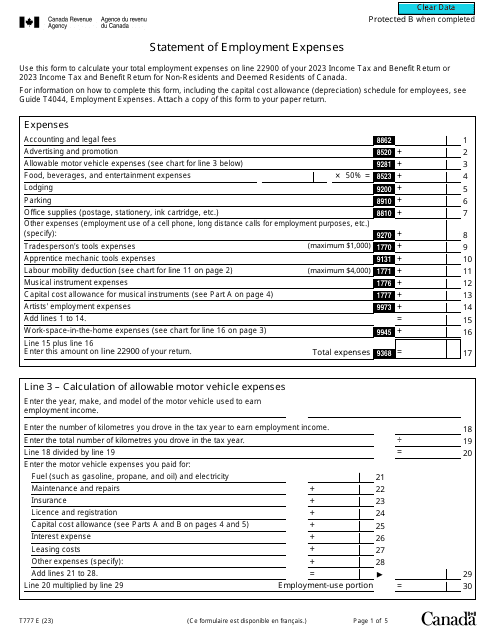

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.

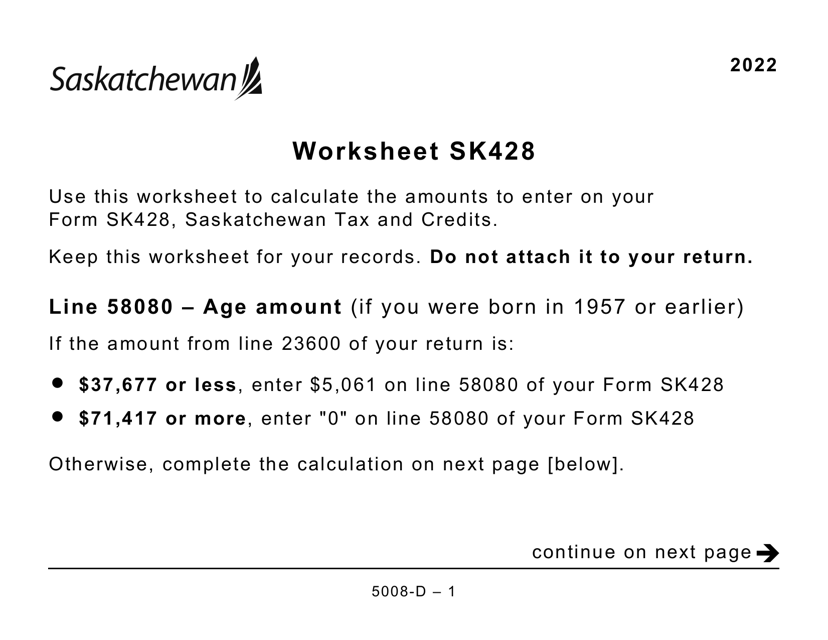

This form is used for completing a worksheet for individuals filing taxes in Saskatchewan, Canada. It is specifically designed for individuals who require a larger print format.

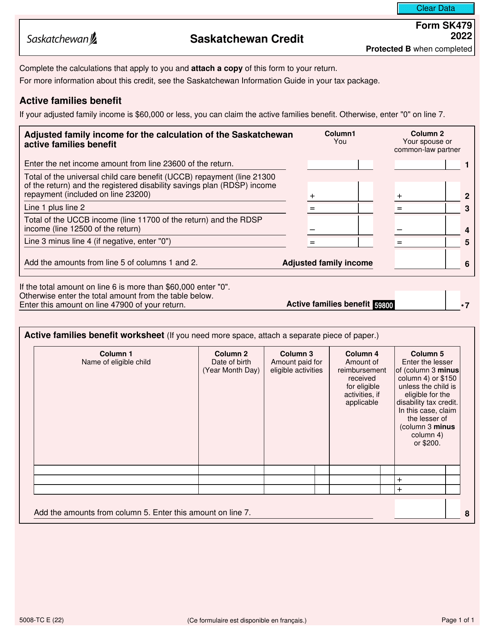

This Form is used for claiming the Saskatchewan Credit in Canada.

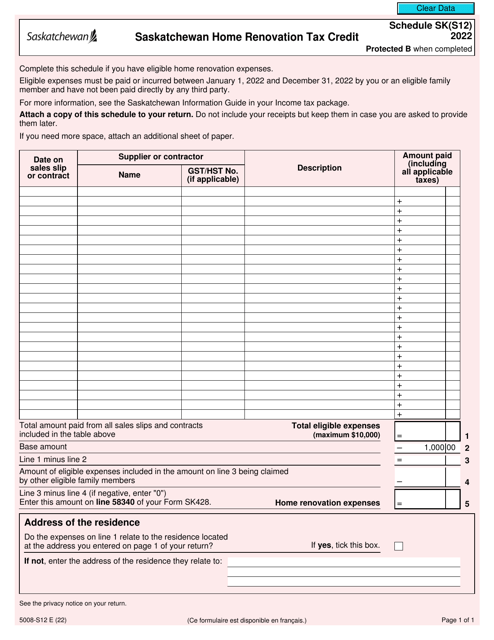

This document is a form used in Canada to claim the Saskatchewan Home Renovation Tax Credit for home renovations.

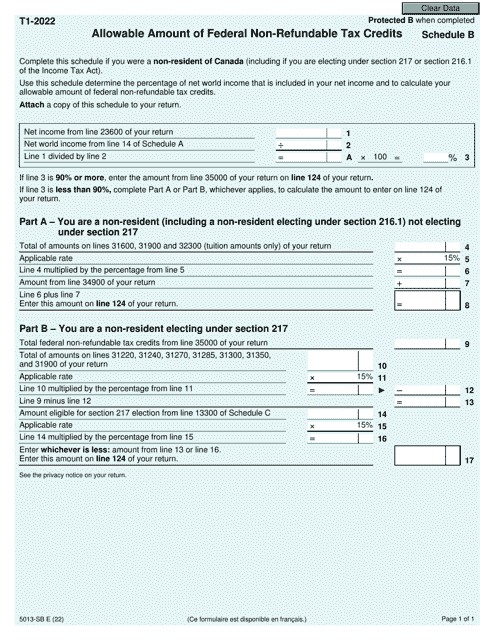

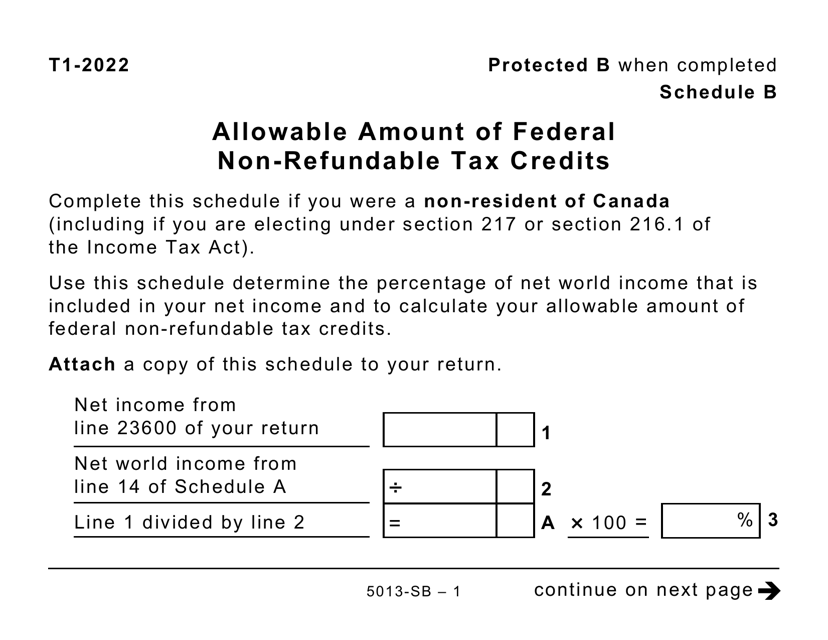

This form is used for calculating the allowable amount of federal non-refundable tax credits in Canada.

This document is for reporting the allowable amount of federal non-refundable tax credits in Canada.

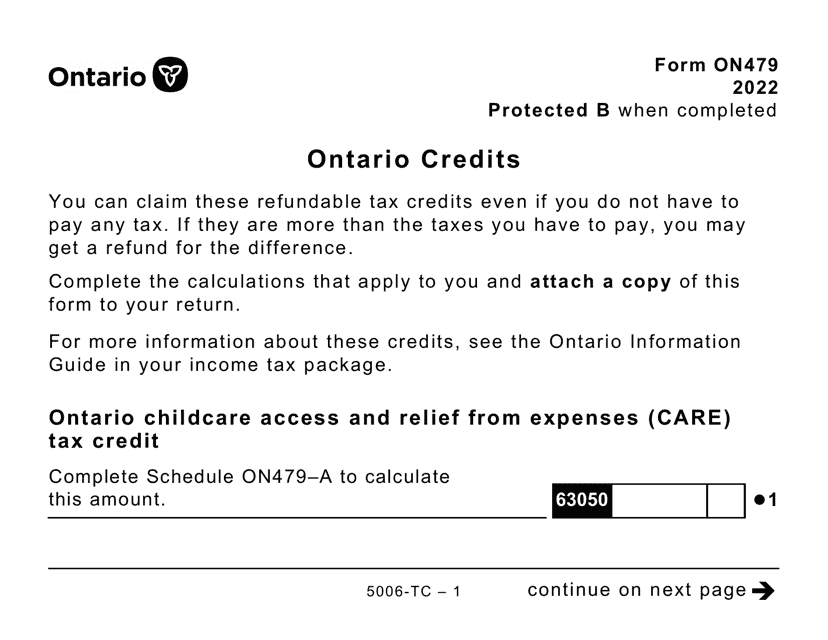

This form is used for claiming Ontario credits on tax returns in Canada. It is available in large print format for ease of reading.

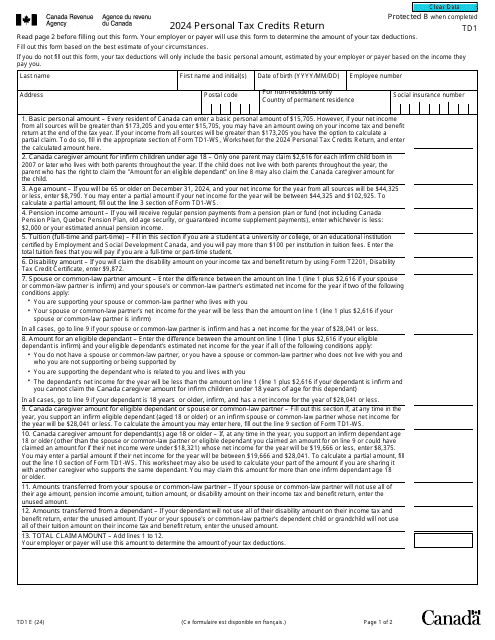

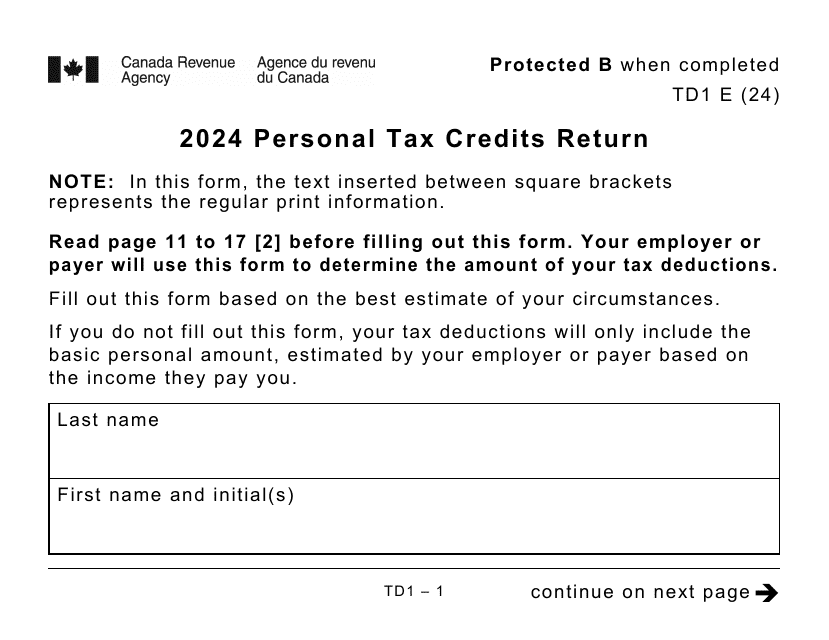

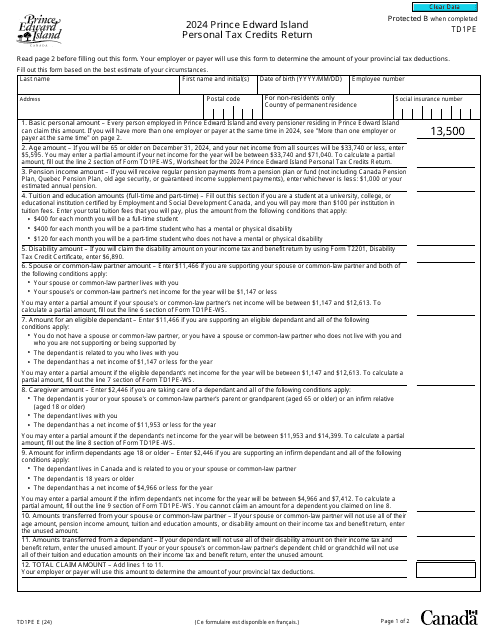

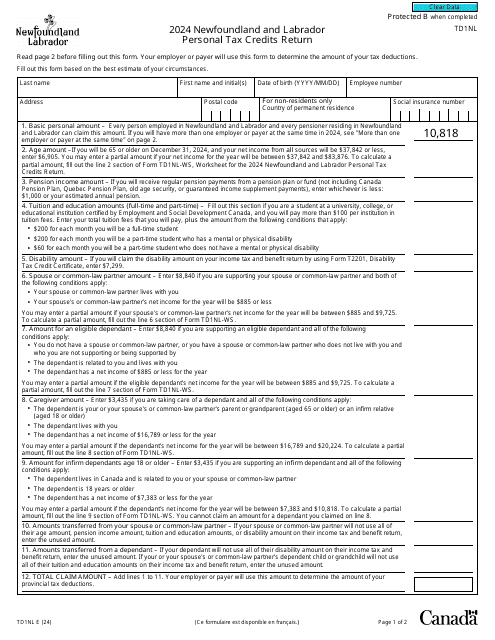

The purpose of this document is to provide a taxpayer's employer with all of the necessary information so that they will be able to determine the number of tax deductions for the Canadian taxpayer.

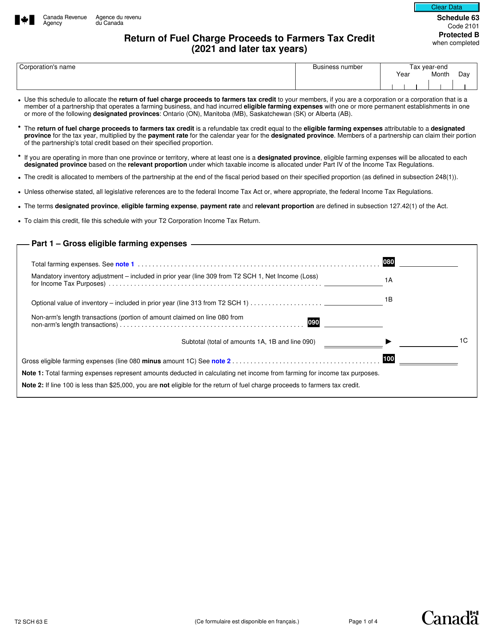

This form is used for Canadian farmers to claim a tax credit for fuel charge proceeds received. The form is applicable for the tax years 2021 and onward.

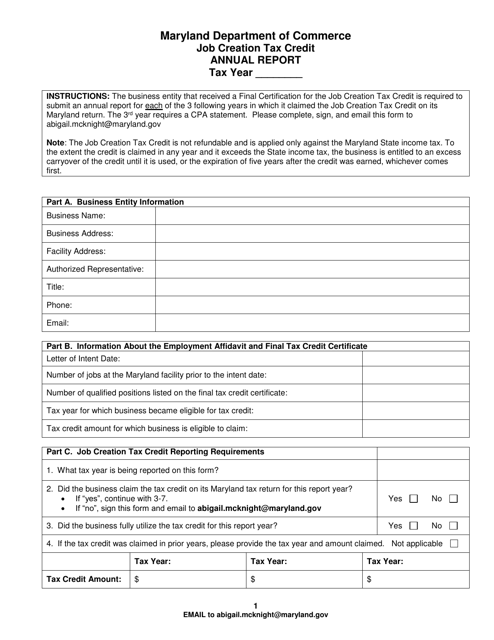

This document provides an annual report on the Job Creation Tax Credit in the state of Maryland. It highlights the progress and impact of the tax credit in promoting job creation and economic growth.

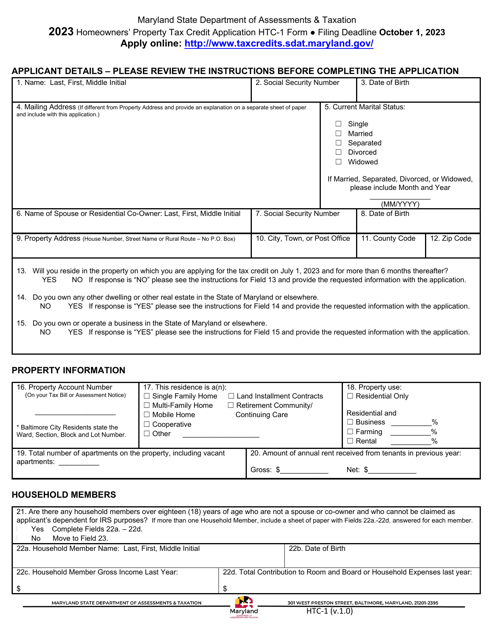

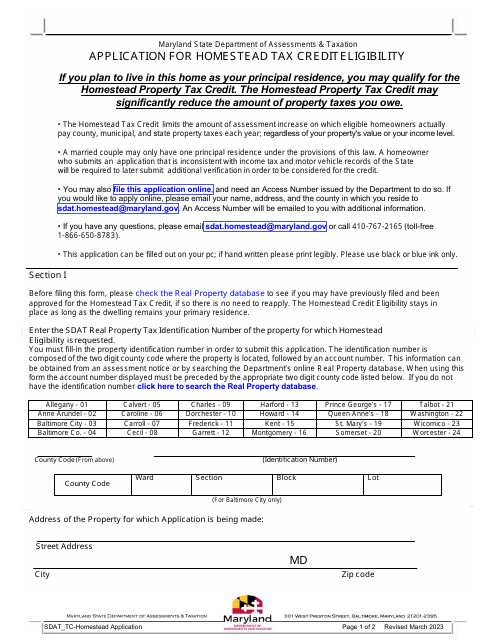

This document is an application for the Homestead Tax Credit eligibility in the state of Maryland. The Homestead Tax Credit is a program that provides property tax relief to eligible homeowners. To apply, you must meet certain criteria, such as owning the property as your primary residence.