Tax Credit Templates

Documents:

3232

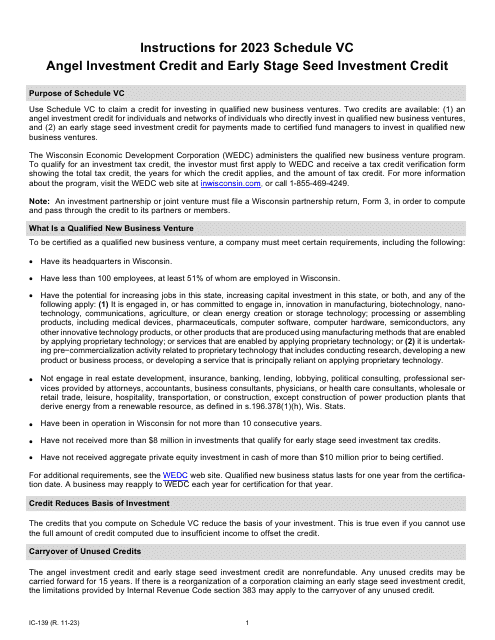

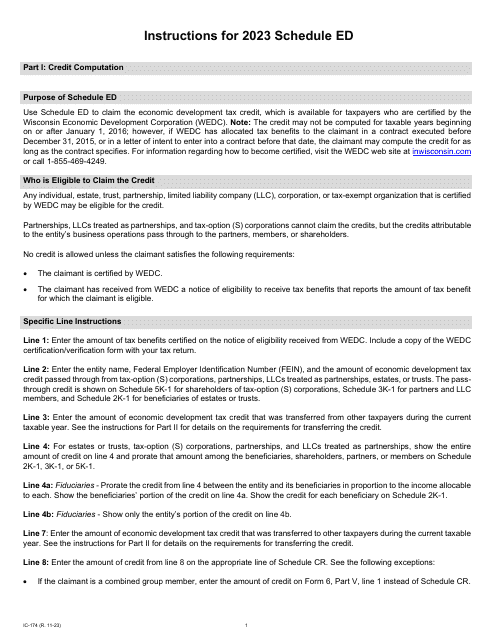

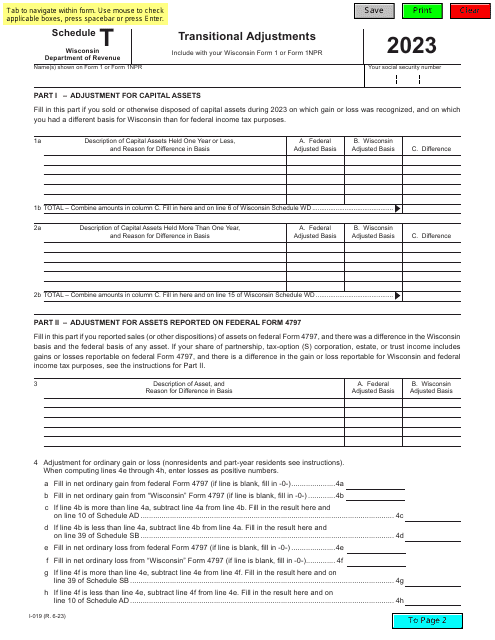

Instructions for Form IC-074 Schedule ED Wisconsin Economic Development Tax Credit - Wisconsin, 2023

The main purpose of this document is to serve as evidence for tenants who will claim homestead credit on their Wisconsin taxes - it will verify the amount of rent paid or property tax accrued.

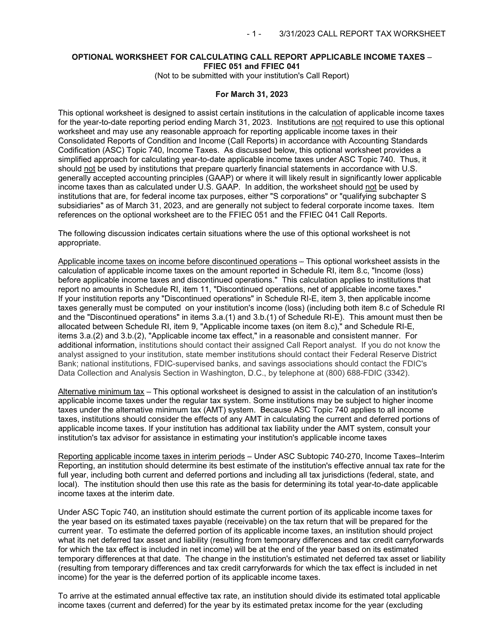

This form is used for calculating applicable income taxes for the Call Report. It includes an optional worksheet for FFIEC051 and FFIEC041.

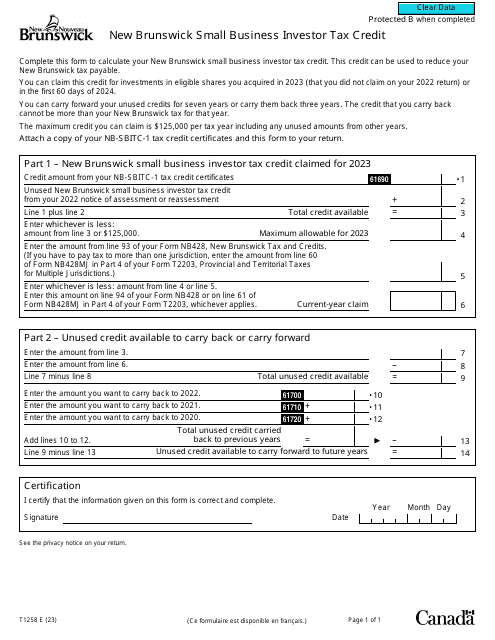

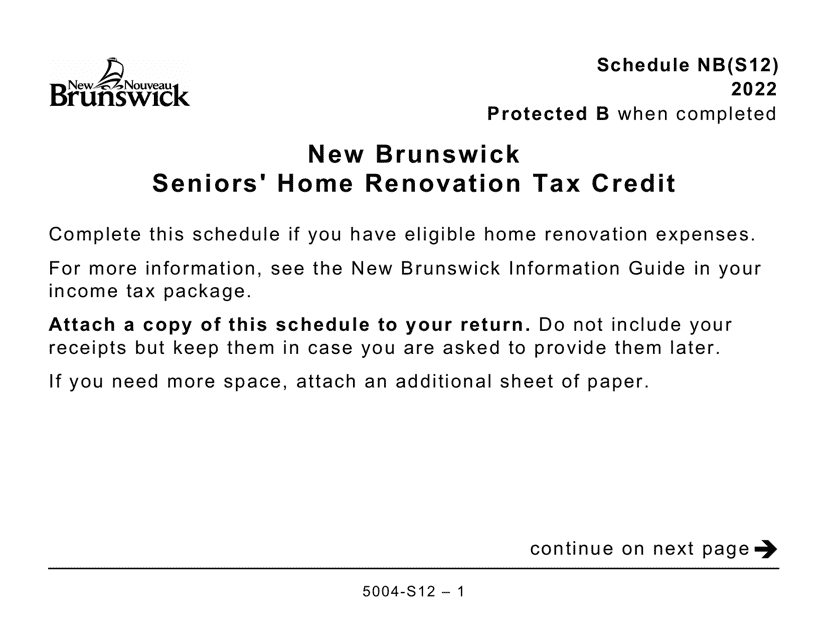

This form is used for claiming the New Brunswick Seniors' Home Renovation Tax Credit in Canada. It is a schedule specifically for residents of New Brunswick who are seniors and want to claim this tax credit. This large print version of the form is available for those who may have visual impairments.

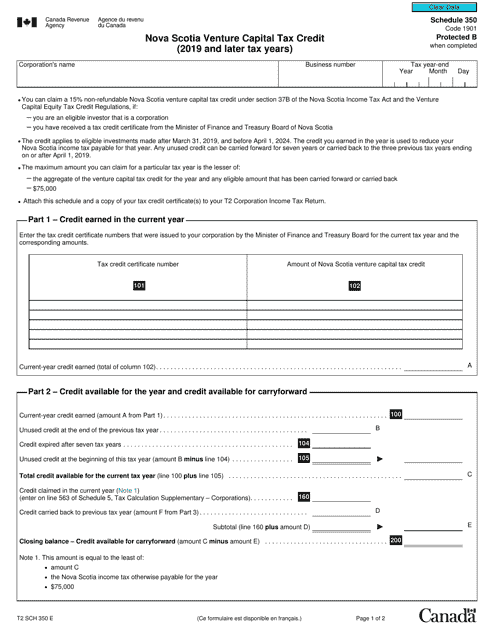

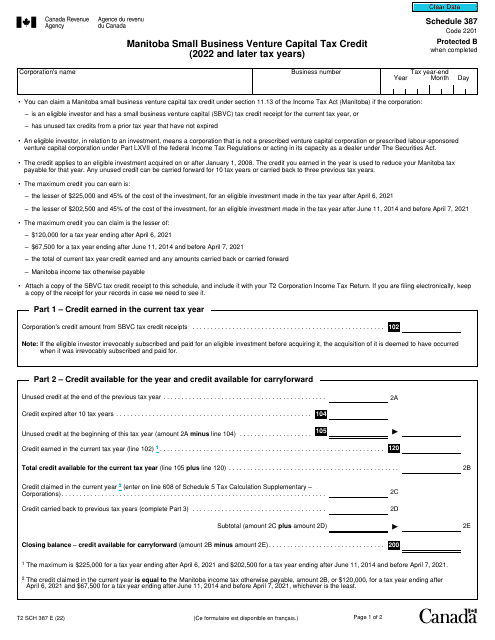

This form is used for claiming the Nova Scotia Venture Capital Tax Credit on the T2 corporate tax return for the 2019 and later tax years in Canada.

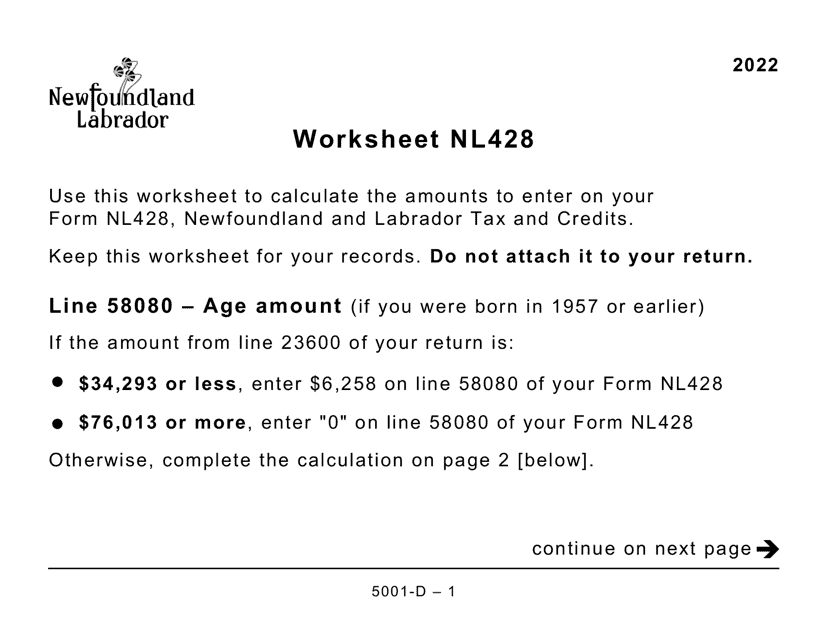

This Form is used for completing the Worksheet NL428 for residents of Newfoundland and Labrador in Canada. It is designed in large print format to assist those with visual impairments.

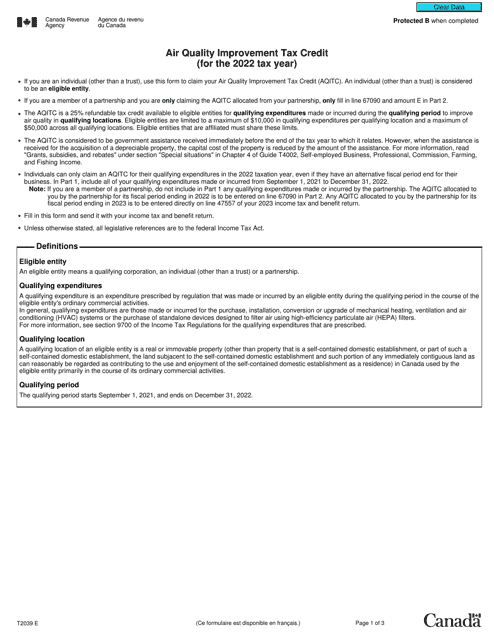

This Form is used for claiming the Air Quality Improvement Tax Credit in Canada.

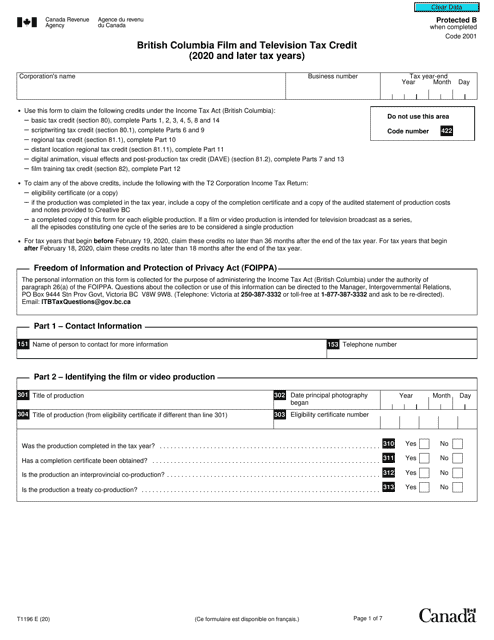

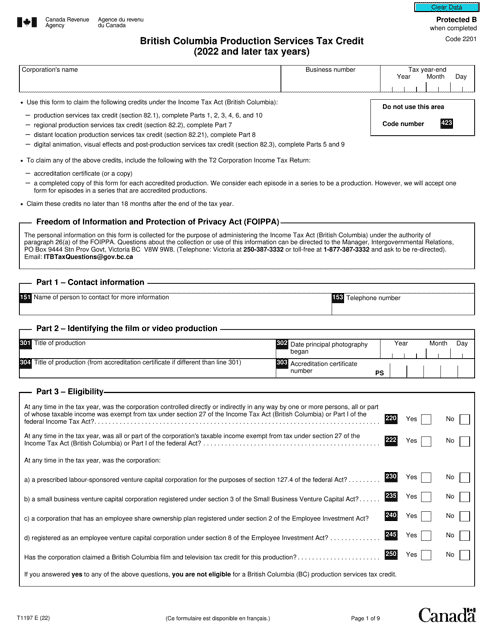

This form is used for claiming the British Columbia Production Services Tax Credit in Canada for the 2022 and later tax years. It provides tax incentives for film and television production companies based in British Columbia.