Tax Credit Templates

Documents:

3232

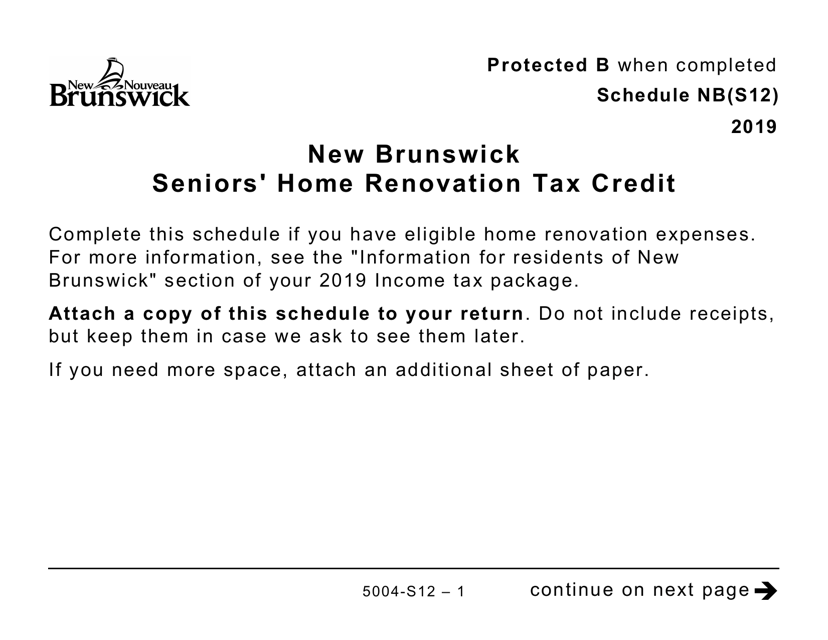

This form is used for claiming the New Brunswick Seniors' Home Renovation Tax Credit in large print format for residents of Canada.

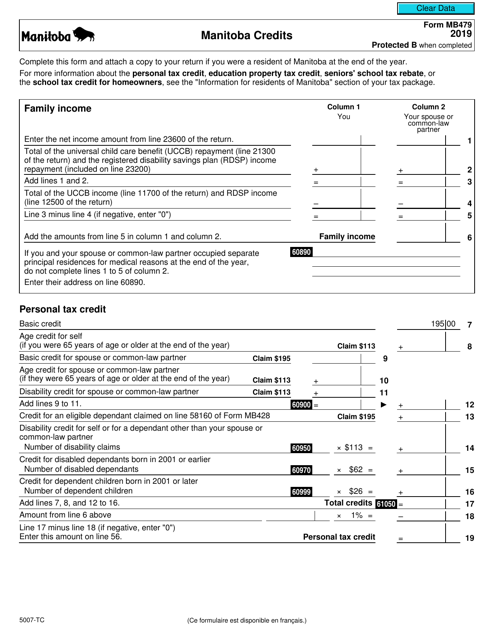

This form is used for claiming Manitoba credits in Canada.

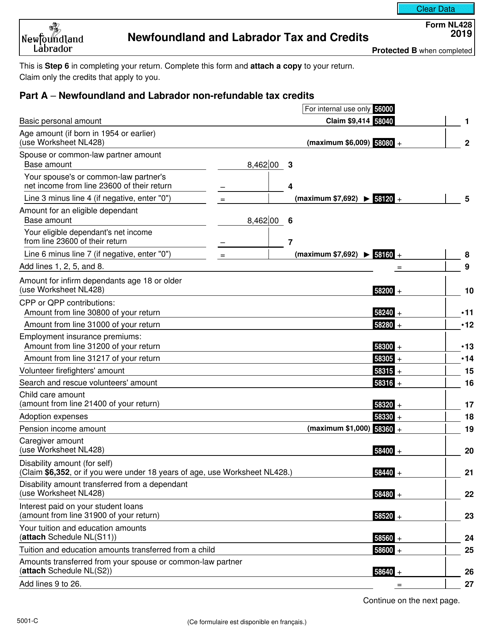

This form is used for reporting Newfoundland and Labrador tax and claiming credits in Canada.

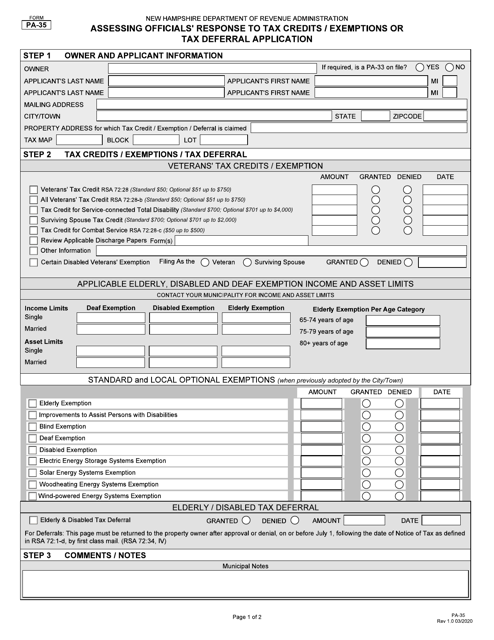

This form is used for the Assessing Official in New Hampshire to respond to applications for exemptions, tax credits, or deferrals.

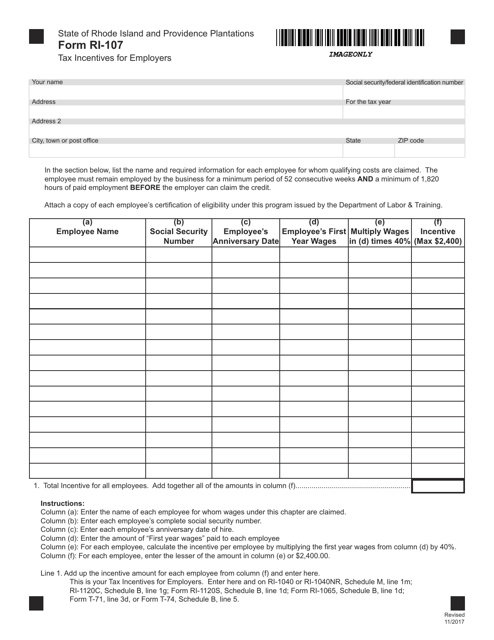

This Form is used for employers in Rhode Island to claim tax incentives and benefits.

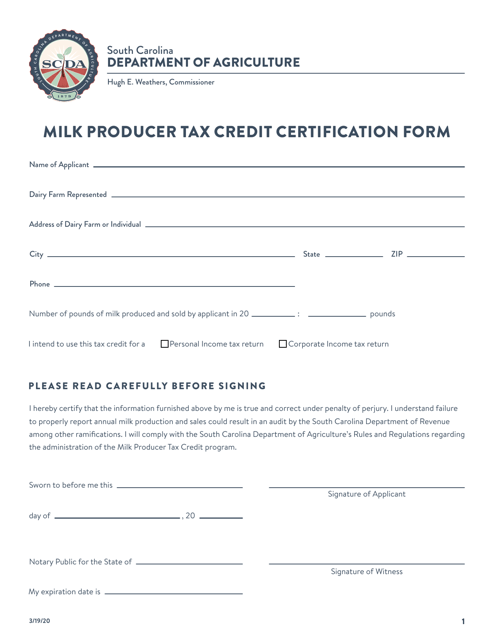

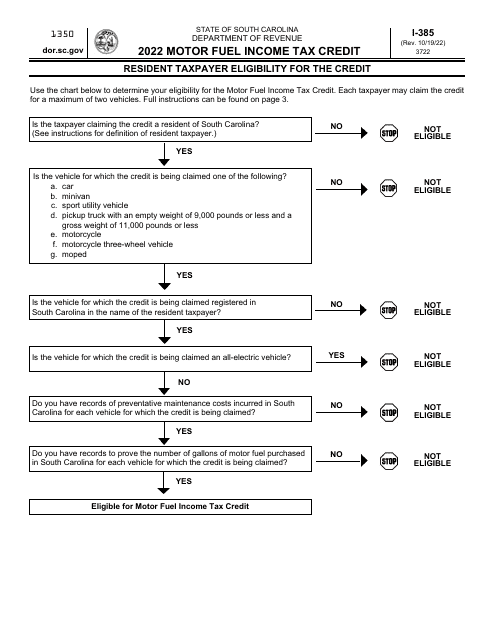

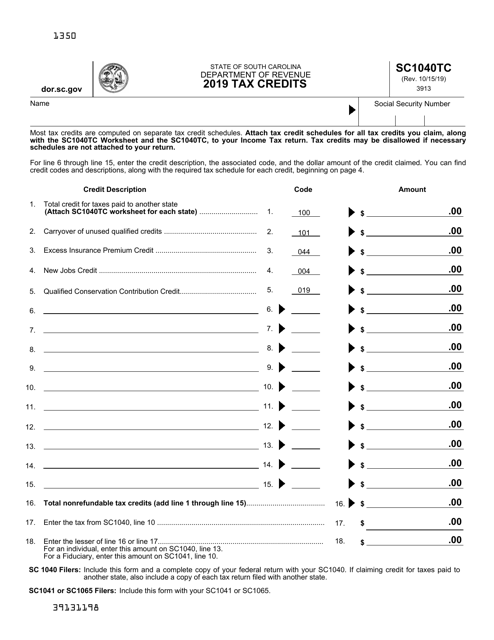

This Form is used for certifying eligibility for the Milk Producer Tax Credit in South Carolina.

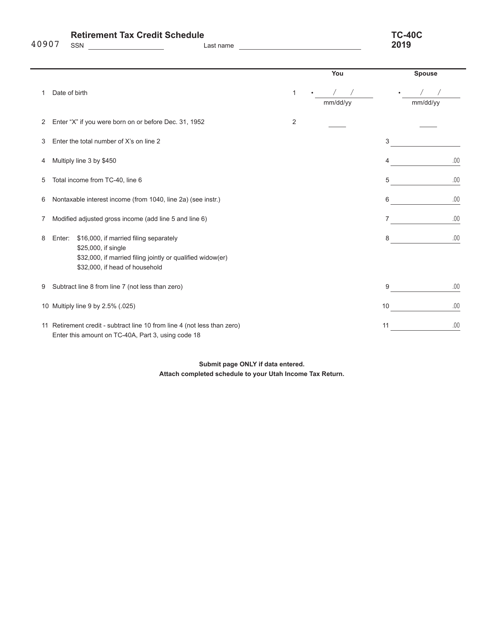

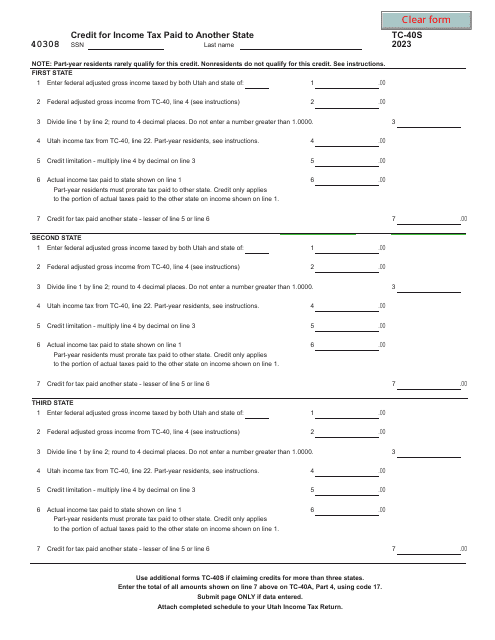

This Form is used for reporting retirement tax credits in the state of Utah.

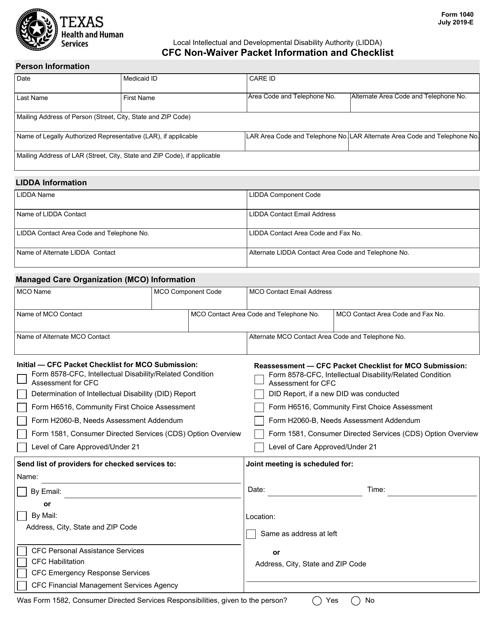

This Form is used for providing information and checklist for filing Form 1040 CFC Non-waiver Packet in Texas.

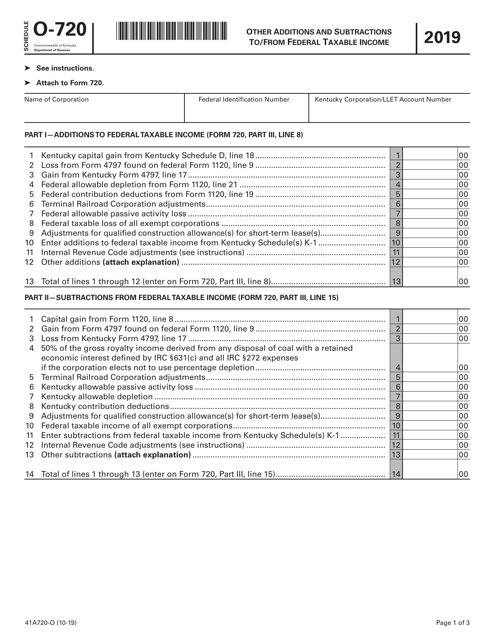

This form is used for reporting other additions and subtractions to or from federal taxable income for residents of Kentucky on their state tax return.

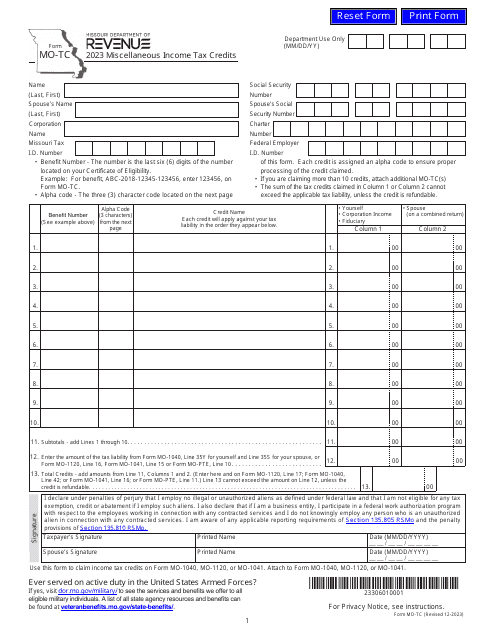

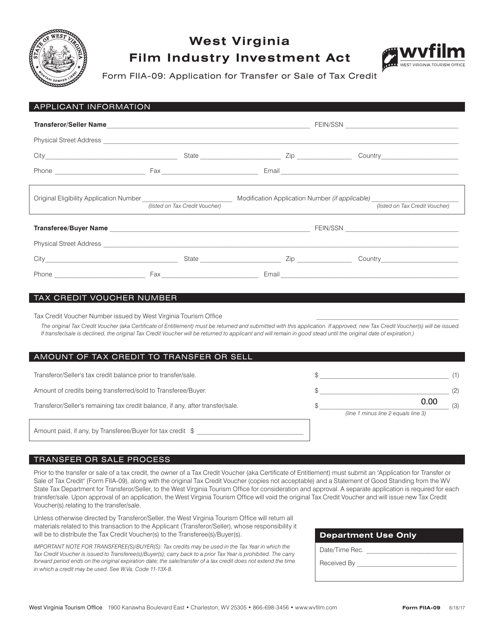

This form is used for applying to transfer or sell tax credits in West Virginia.

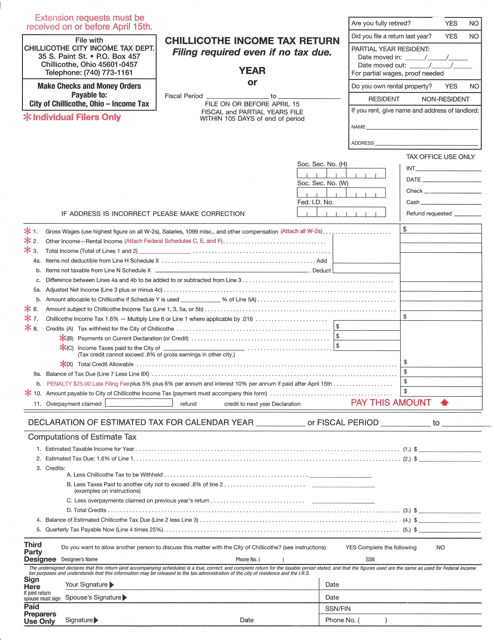

This document is used for filing your income tax return with the City of Chillicothe, Ohio.

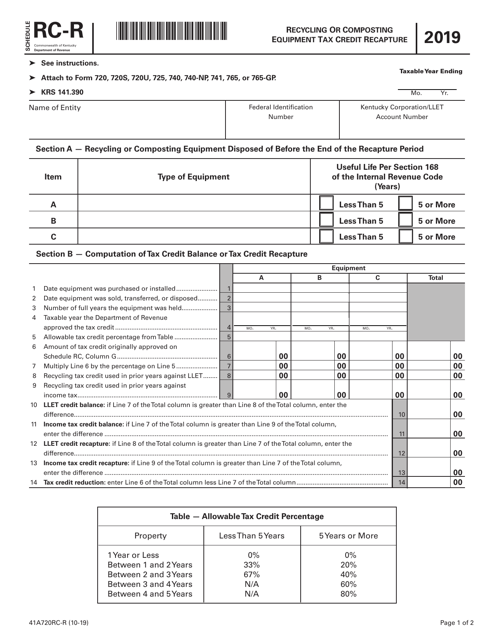

This document is used for reporting and recapturing the tax credits received for recycling or composting equipment in Kentucky.

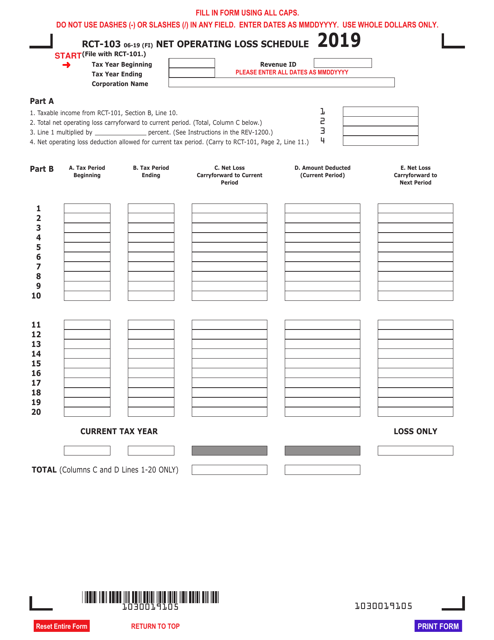

This form is used for reporting net operating losses in the state of Pennsylvania.

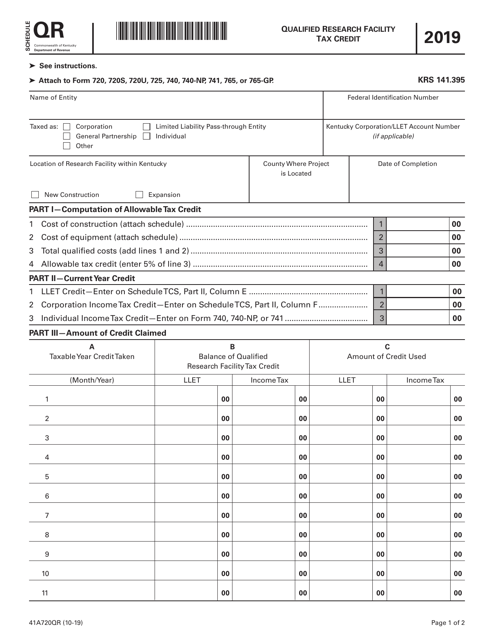

This form is used for claiming the Qualified Research Facility Tax Credit in Kentucky.

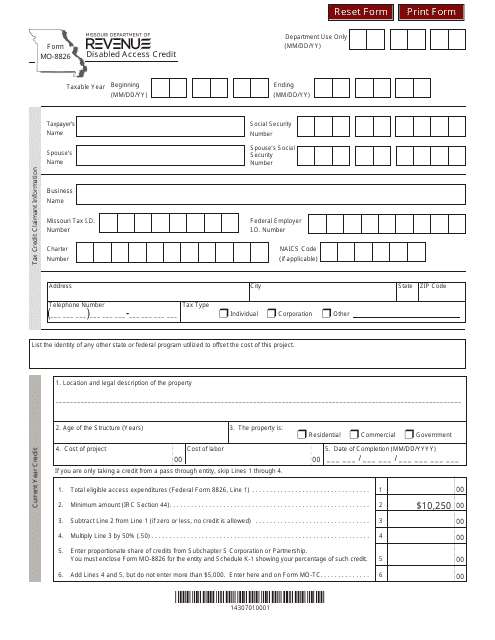

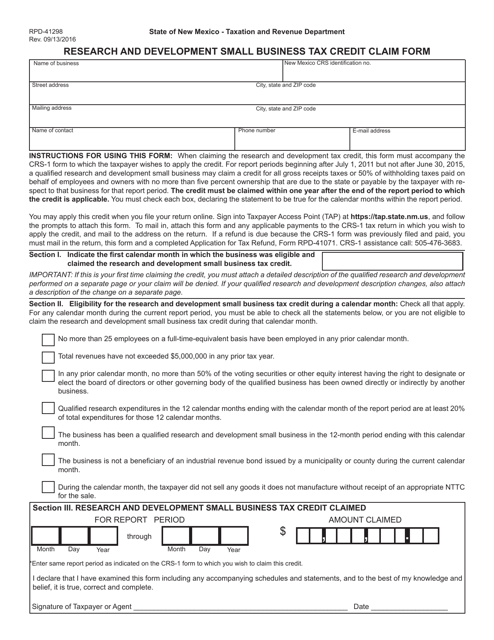

This form is used for claiming the Research and Development Small Business Tax Credit in the state of New Mexico.

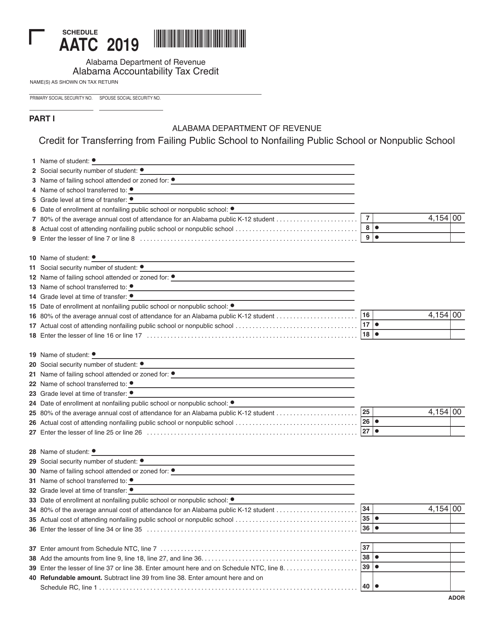

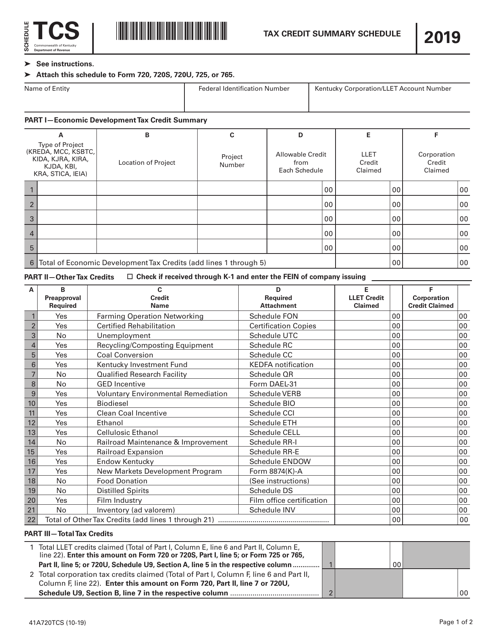

This form is used for reporting the summary of Tax Credit Schedule TCS in the state of Kentucky.

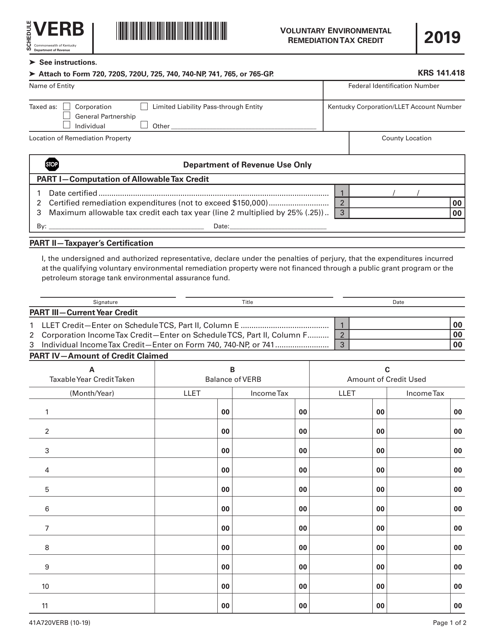

This form is used for claiming the Voluntary Environmental Remediation Tax Credit in Kentucky.