Tax Credit Templates

Documents:

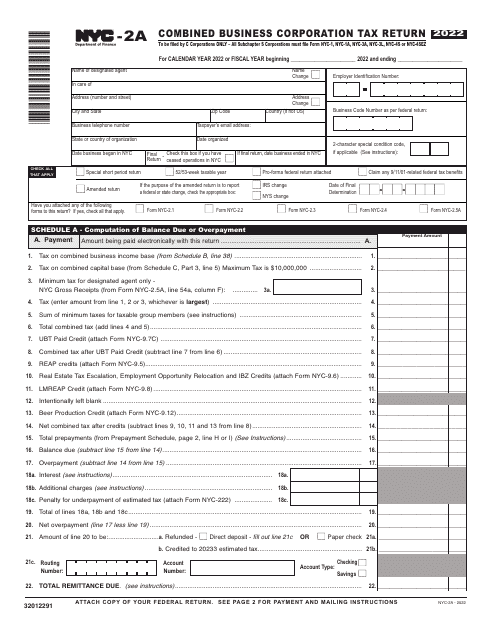

3232

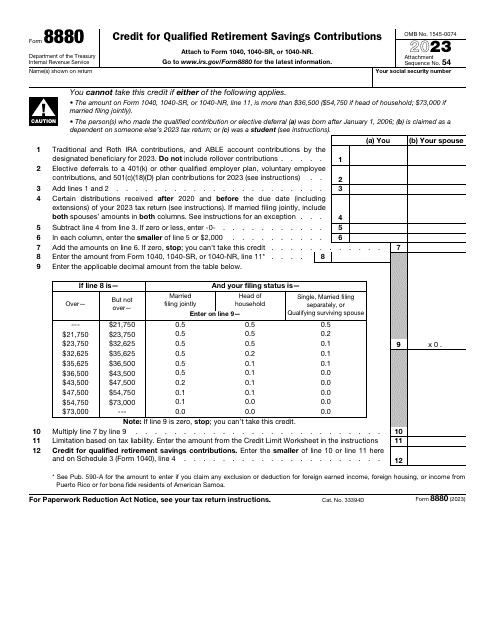

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.

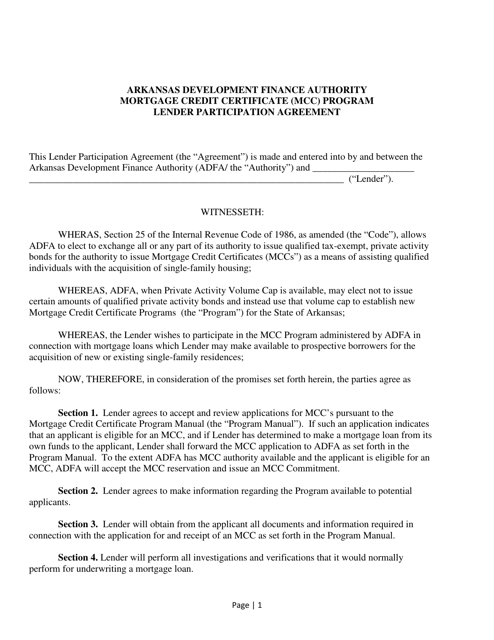

This document is for lenders in Arkansas who want to participate in the Mortgage Credit Certificate (MCC) Program. The MCC Program provides eligible homebuyers with a tax credit on a portion of their mortgage interest.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

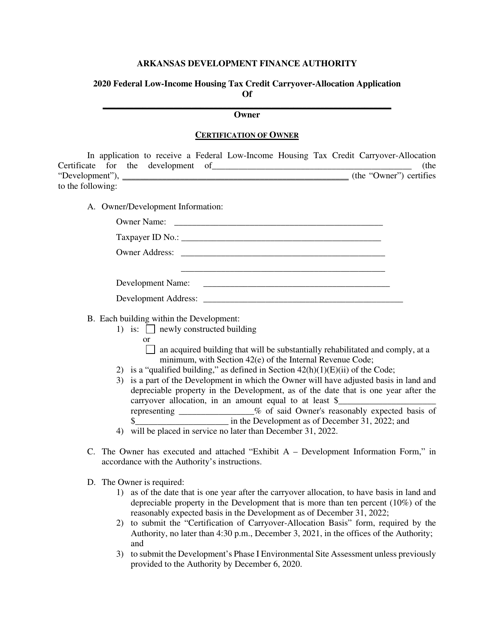

This Form is used for applying for federal low-income housing tax credit carryover-allocation in Arkansas.

This form is used for reporting income, loan repayments, pensions, annuities, charitable contributions, and tax allowances.

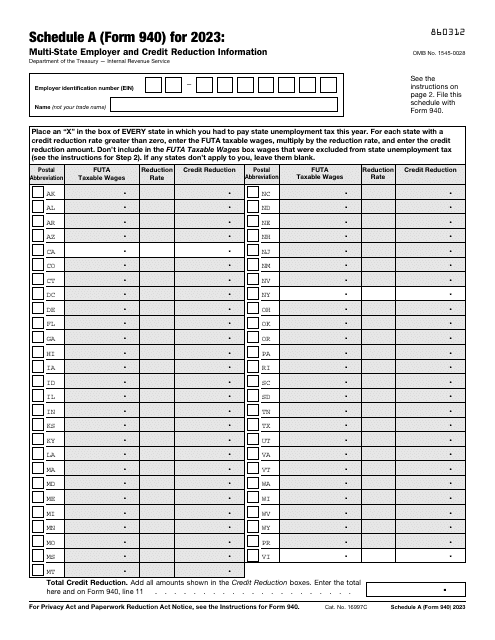

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

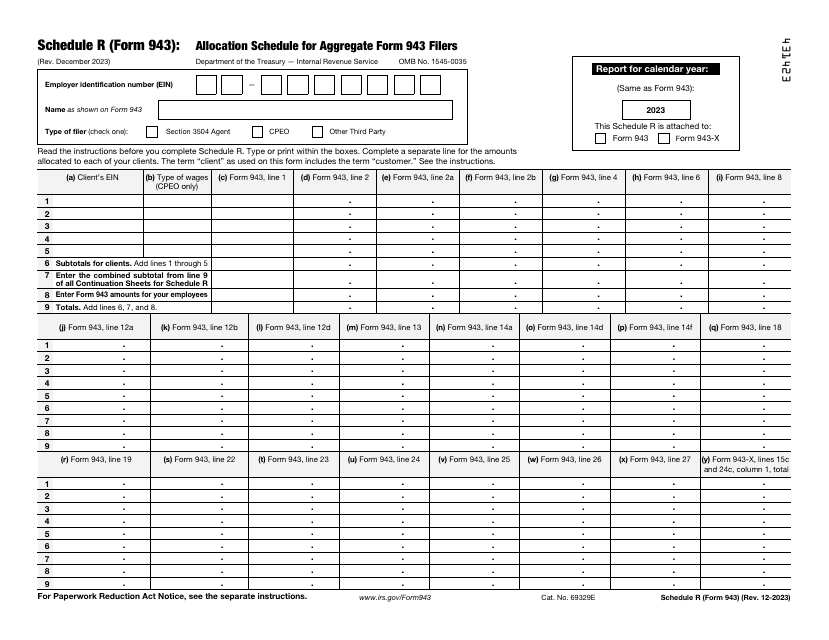

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

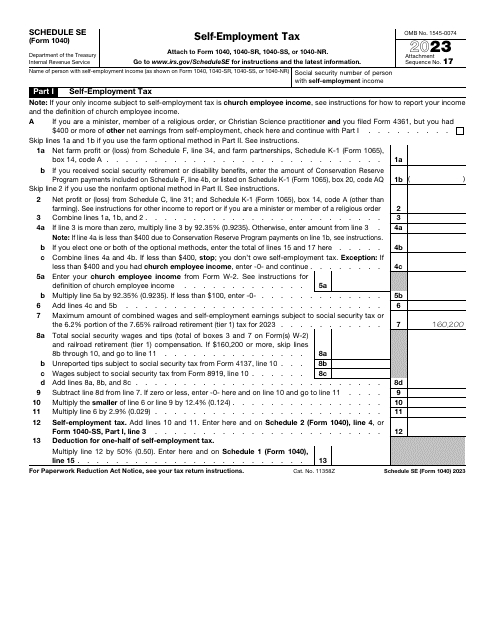

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

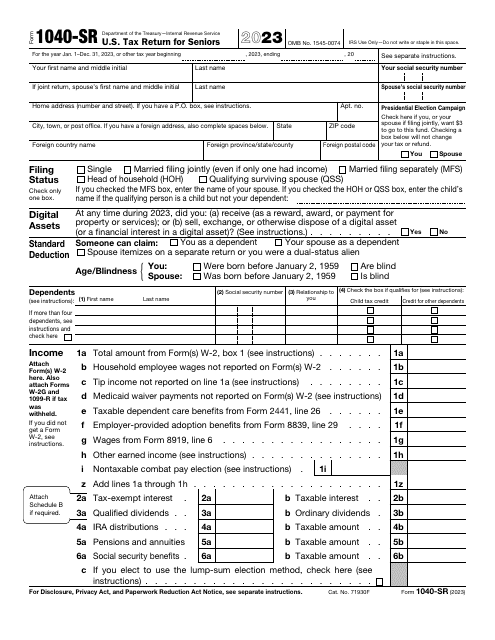

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.

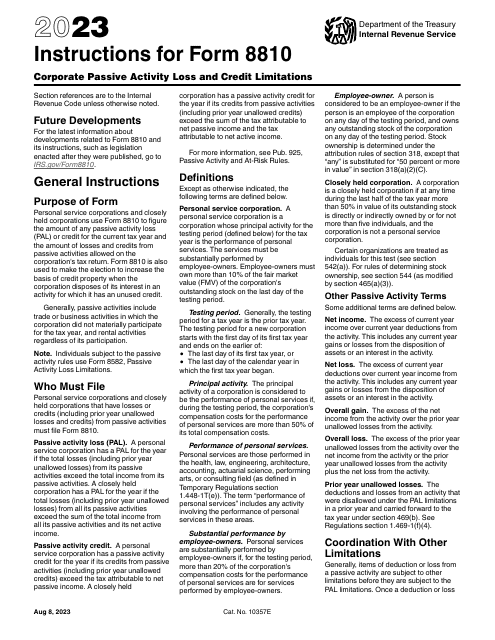

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.