Tax Credit Templates

Documents:

3232

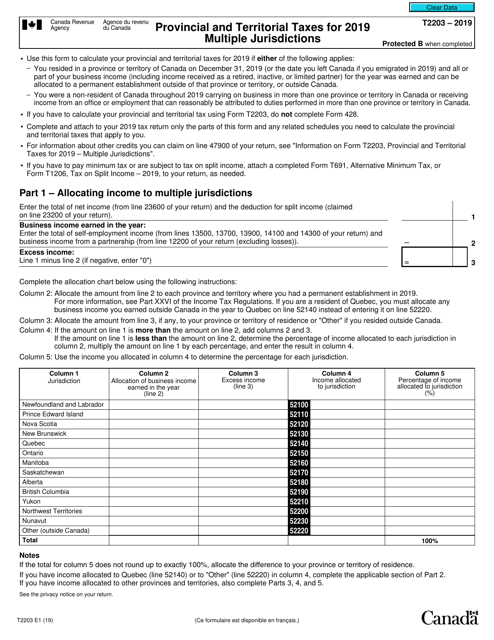

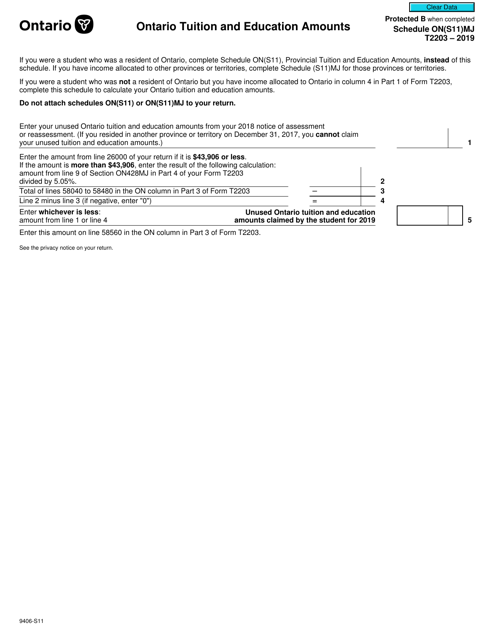

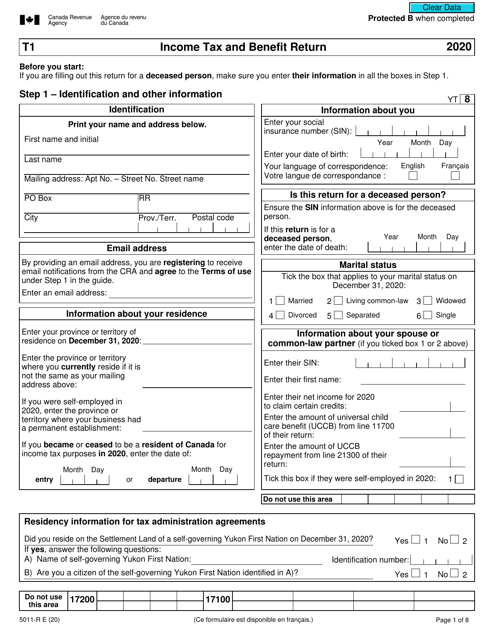

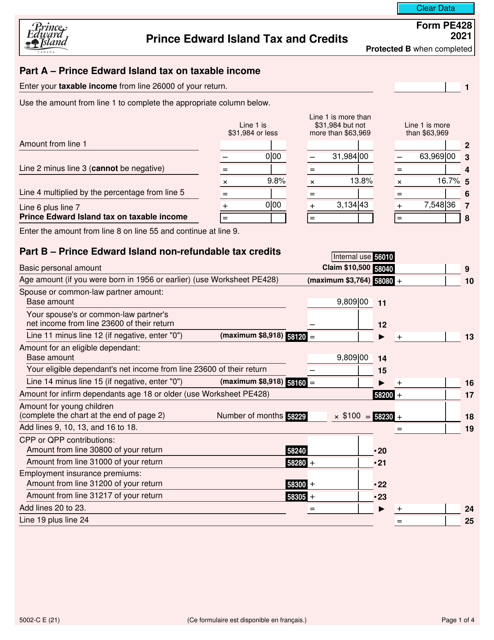

This form is used for calculating and reporting provincial and territorial taxes for multiple jurisdictions in Canada. It is used by individuals who have income or are residents in more than one province or territory.

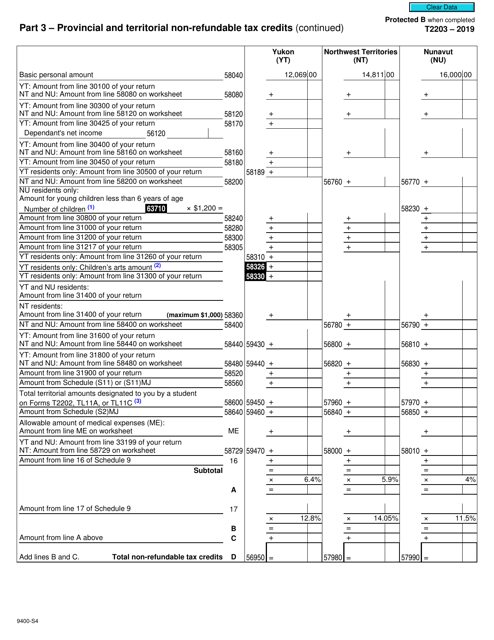

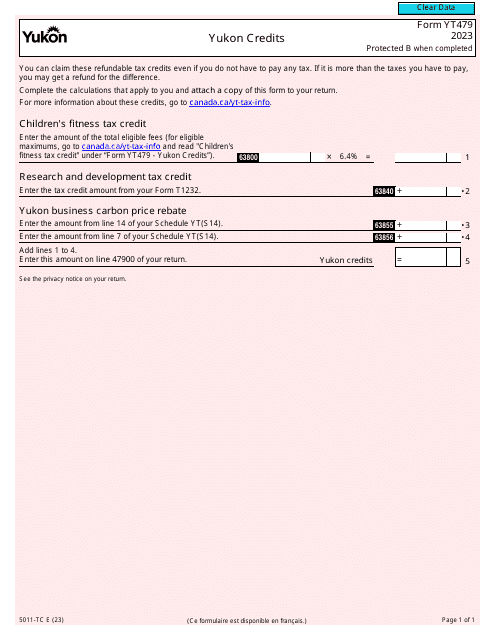

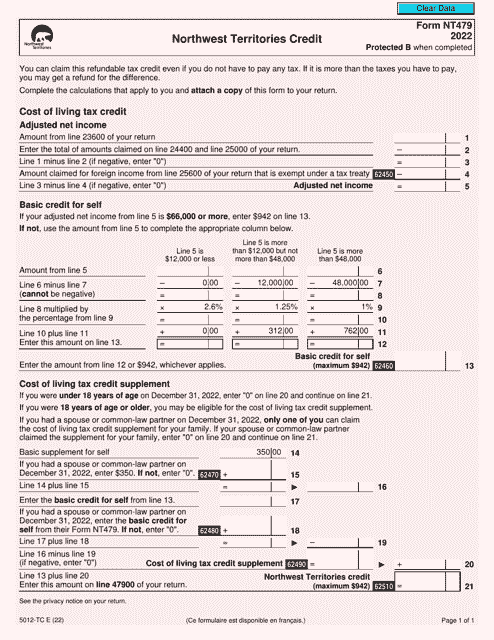

This form is used for claiming provincial and territorial non-refundable tax credits in the Yukon, Northwest Territories, and Nunavut regions of Canada.

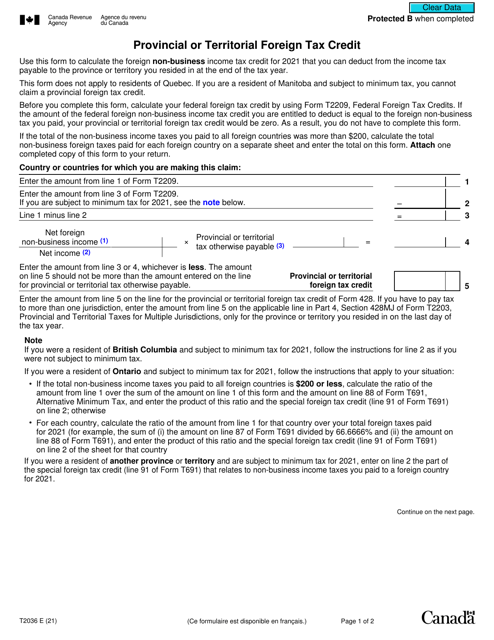

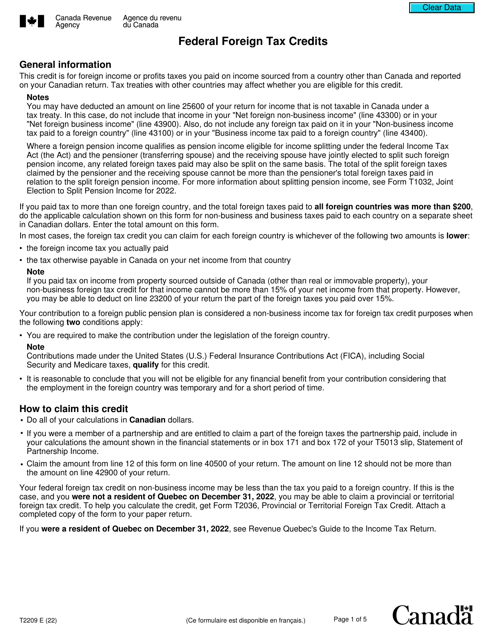

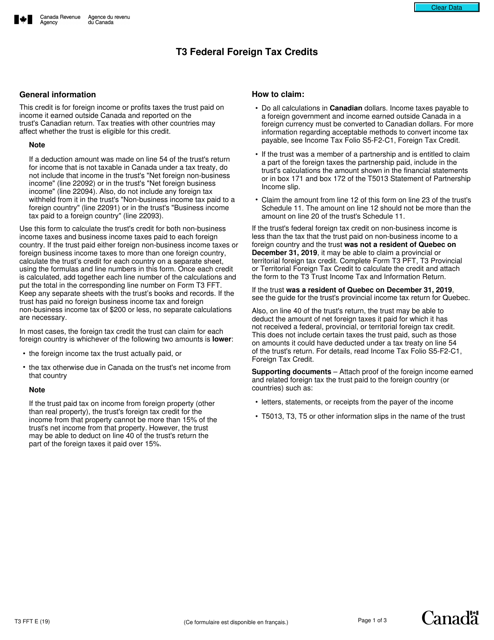

This form is used for claiming foreign tax credits on your Canadian federal tax return.

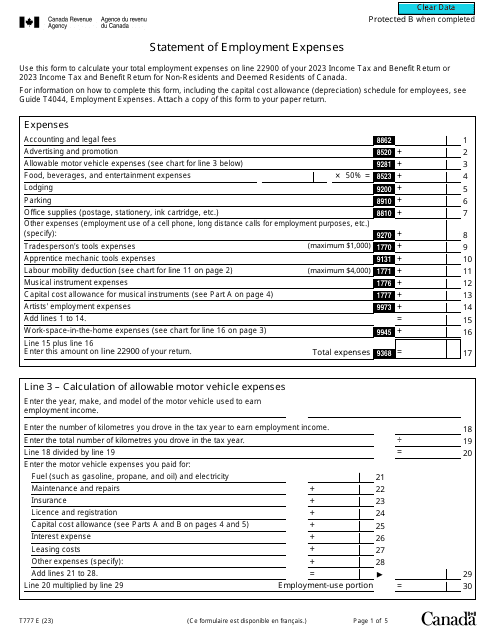

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.

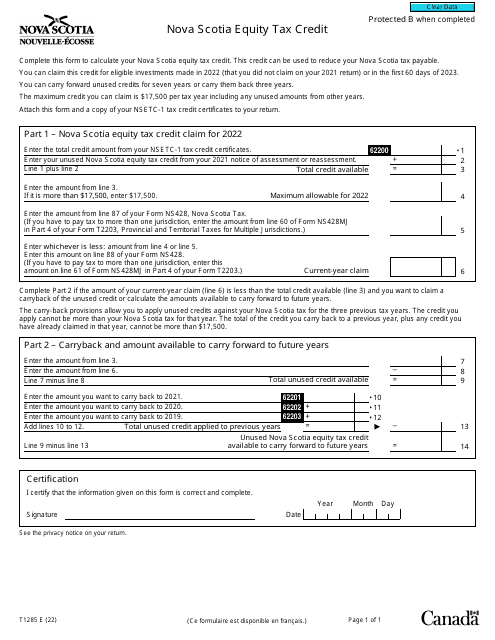

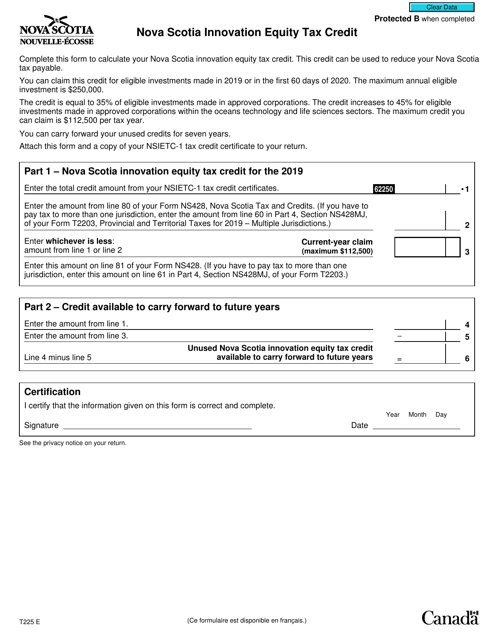

This form is used for claiming the Nova Scotia Innovation Equity Tax Credit in Canada. It allows individuals or corporations to receive a tax credit for investing in eligible Nova Scotia companies.

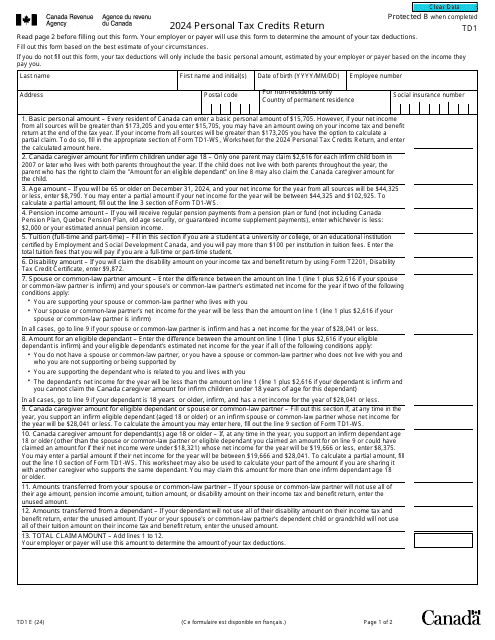

The purpose of this document is to provide a taxpayer's employer with all of the necessary information so that they will be able to determine the number of tax deductions for the Canadian taxpayer.

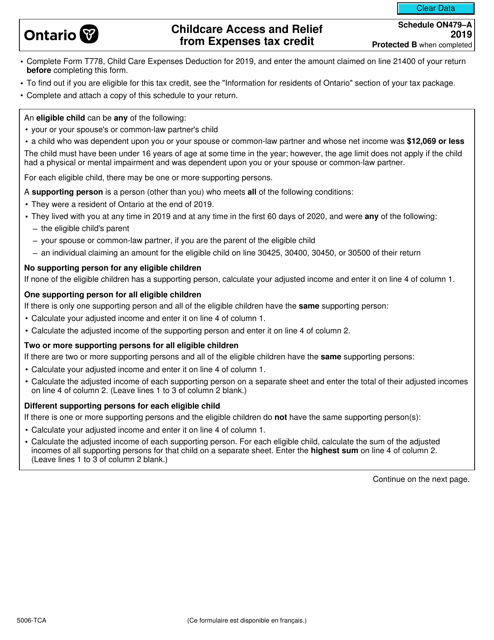

This Form is used for claiming the Childcare Access and Relief From Expenses Tax Credit (CARE) in Canada. It is specifically for residents of Ontario (ON479-A).

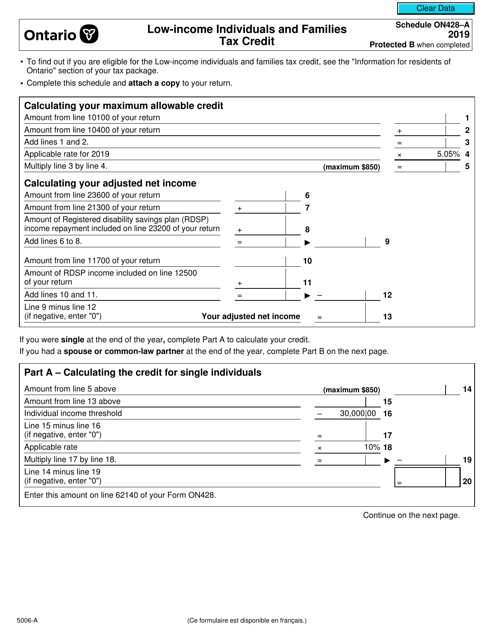

This form is used for claiming the Low-Income Individuals and Families Tax Credit in Canada. It is a schedule that needs to be filled out and submitted along with Form 5006-A. This tax credit is designed to provide financial assistance to individuals and families with low incomes.

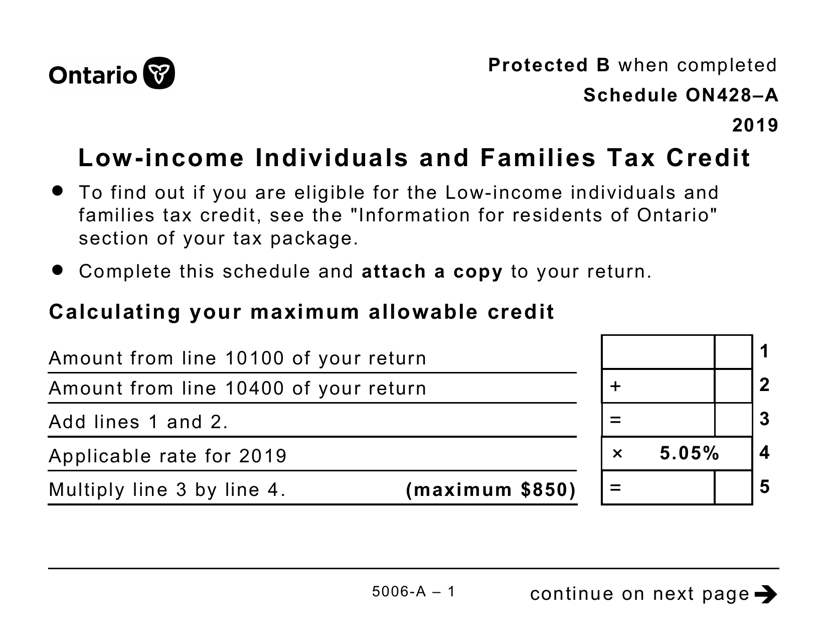

This form is used for claiming the Low-Income Individuals and Families Tax Credit in Canada. It is specifically designed for individuals who have low income. The form is available in large print format for easier reading and accessibility.