Tax Credit Templates

Documents:

3232

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

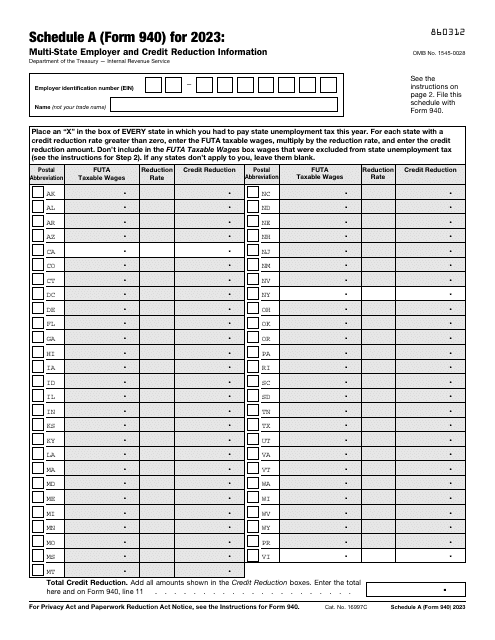

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

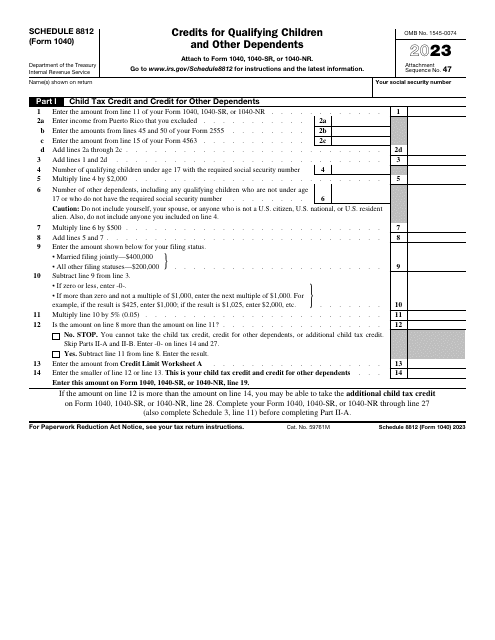

This is a fiscal statement created to let taxpayers with children make the most of the tax benefits they qualify for via extra tax credit.

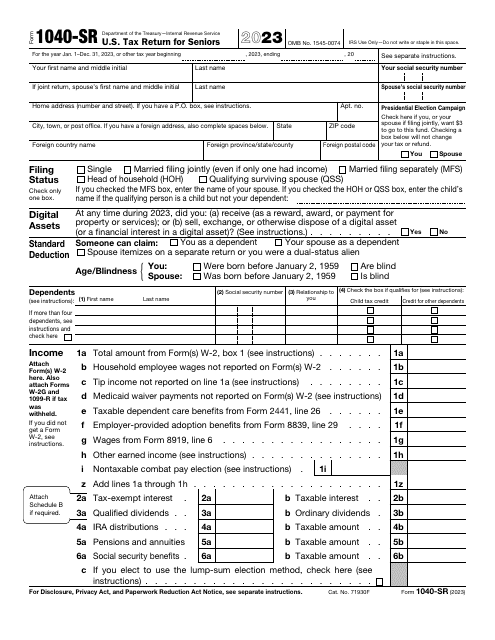

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

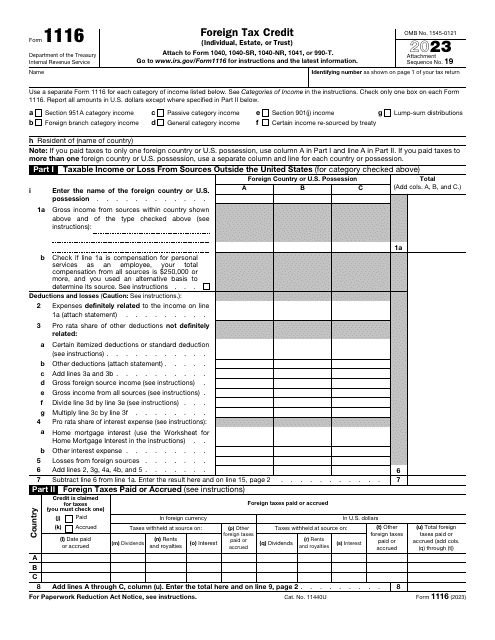

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

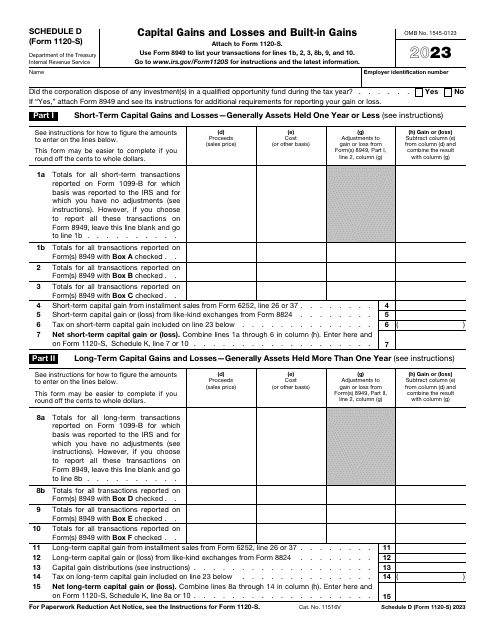

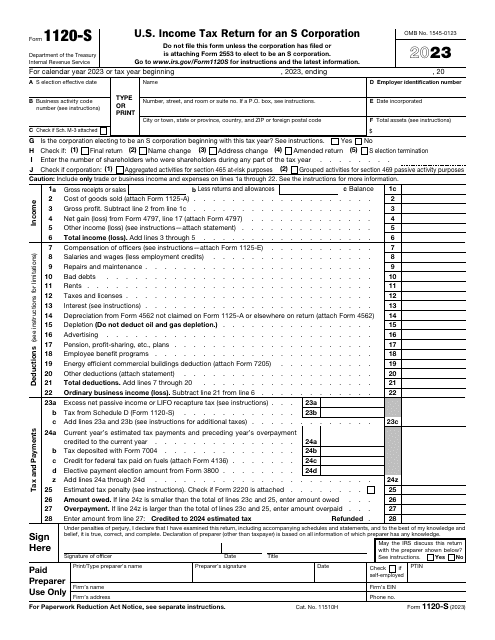

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

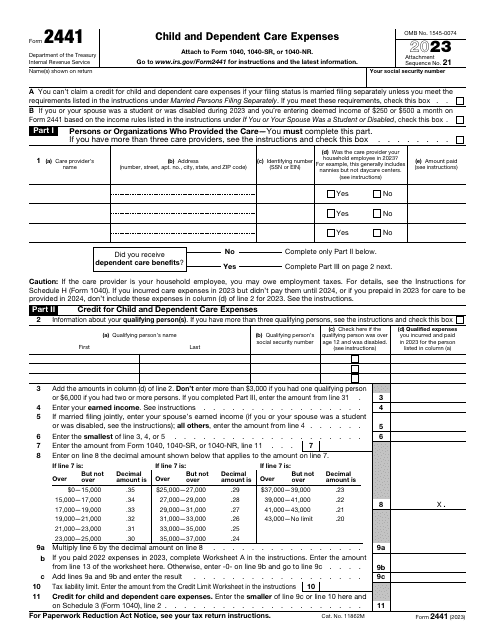

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

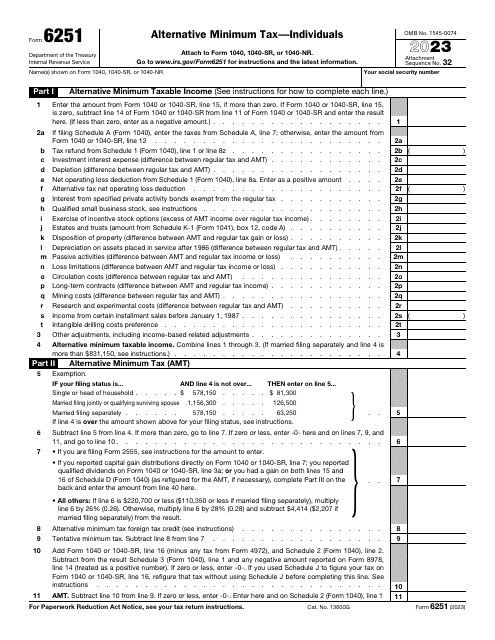

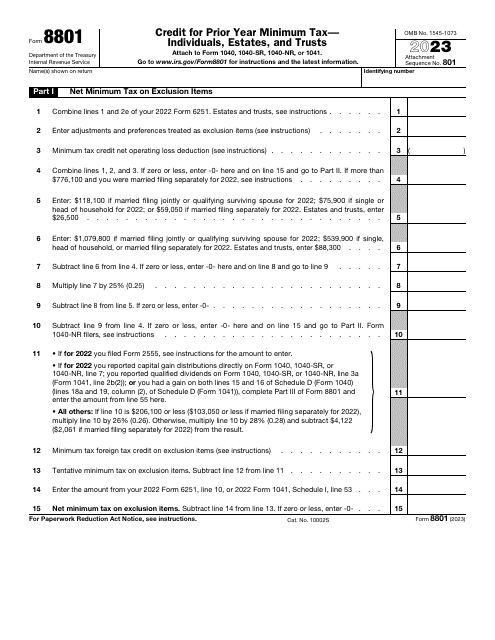

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

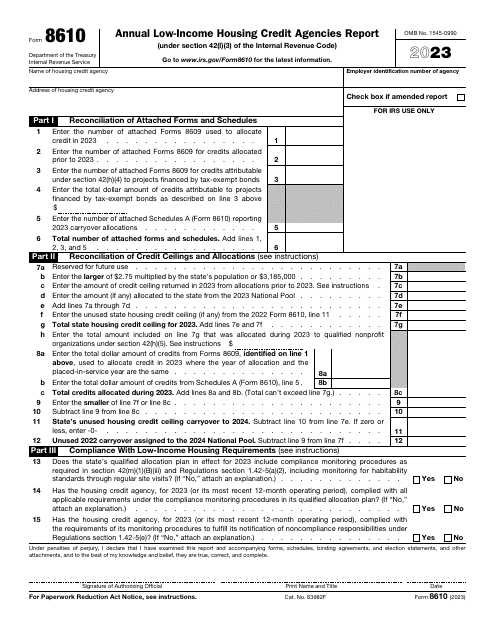

This is a formal IRS statement a housing credit agency is supposed to complete to inform the fiscal authorities about the total amount of housing credits their entity has allocated during the twelve months outlined in the form.

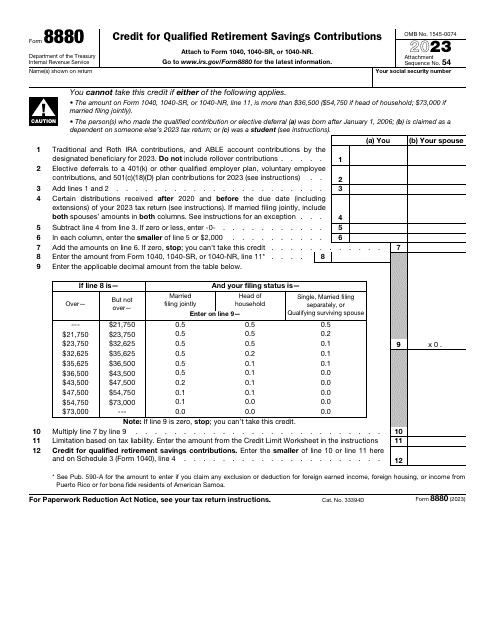

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.