Tax Credit Templates

Documents:

3232

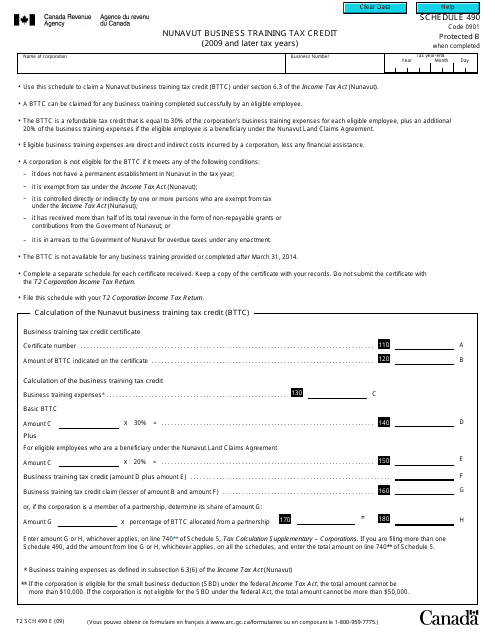

This form is used for claiming the Nunavut Business Training Tax Credit in Canada for tax years 2009 and later.

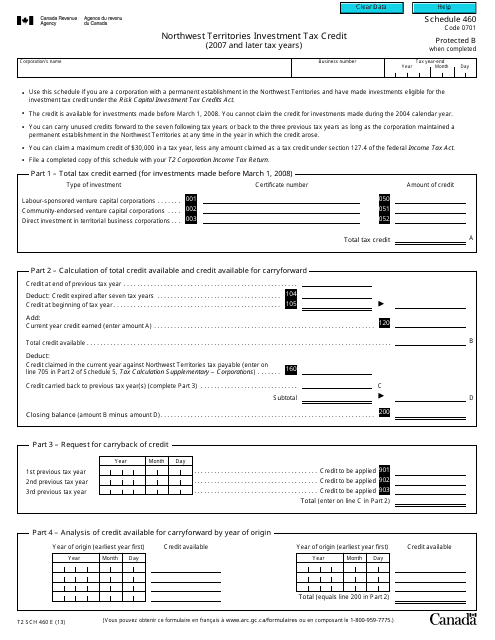

Form T2 Schedule 460 Northwest Territories Investment Tax Credit (2007 and Later Tax Years) - Canada

This form is used for claiming the Northwest Territories Investment Tax Credit on your Canadian tax return for the years 2007 and later.

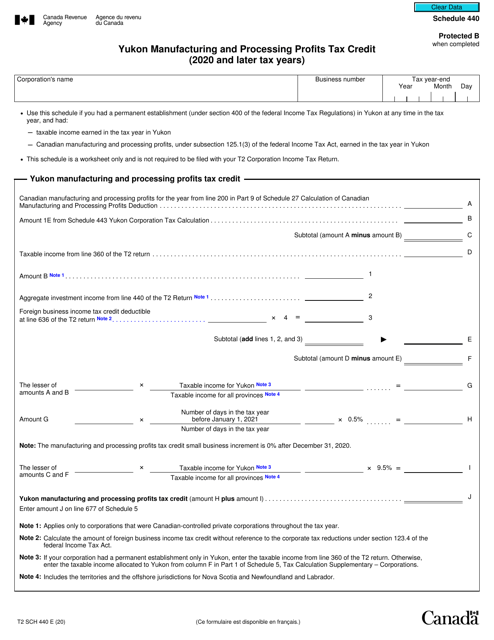

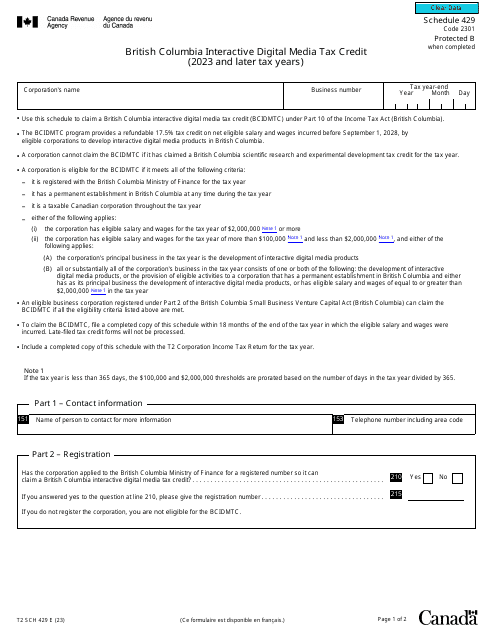

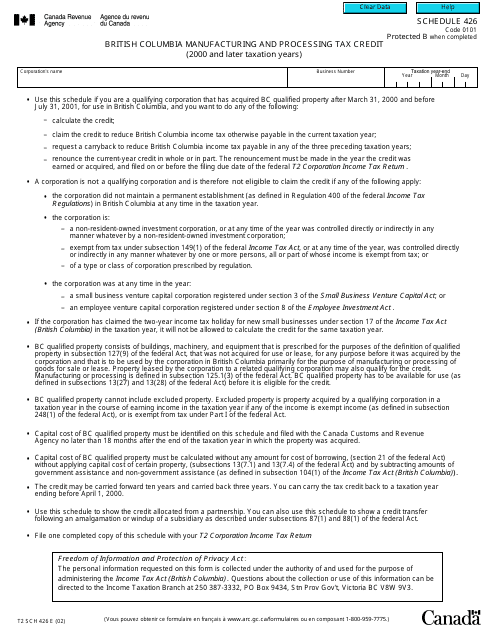

This form is used for claiming the British Columbia Manufacturing and Processing Tax Credit for tax years 2000 and later in Canada.

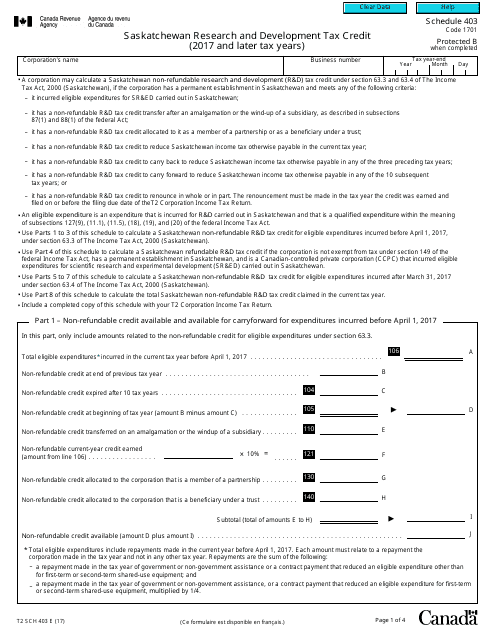

This form is used for claiming the Saskatchewan Research and Development Tax Credit in Canada for tax years 2017 and later.

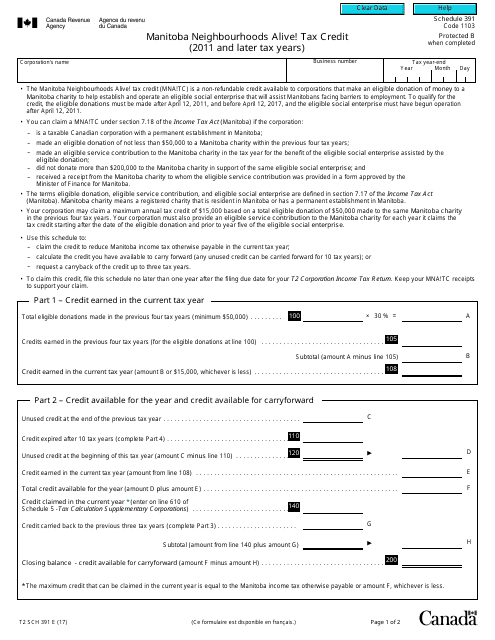

This form is used for claiming the Manitoba Neighbourhoods Alive! Tax Credit for tax years 2011 and later in Canada. It is specific to the province of Manitoba and provides a tax credit for investments made in eligible projects in designated neighbourhoods.

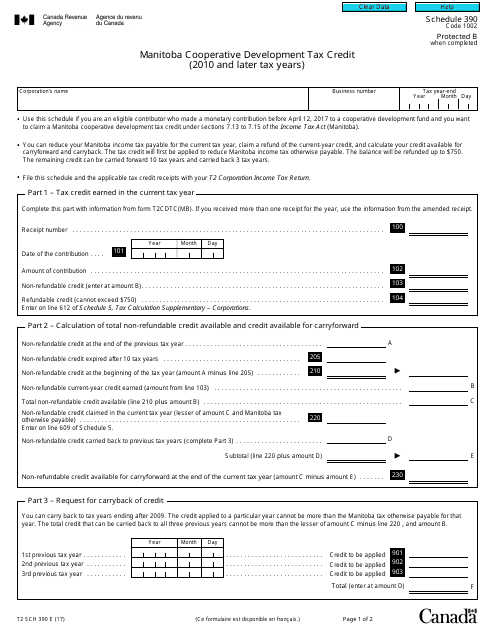

Form T2 Schedule 390 Manitoba Cooperative Development Tax Credit (2010 and Later Tax Years) - Canada

This form is used for claiming the Manitoba Cooperative Development Tax Credit in Canada for tax years 2010 and later.

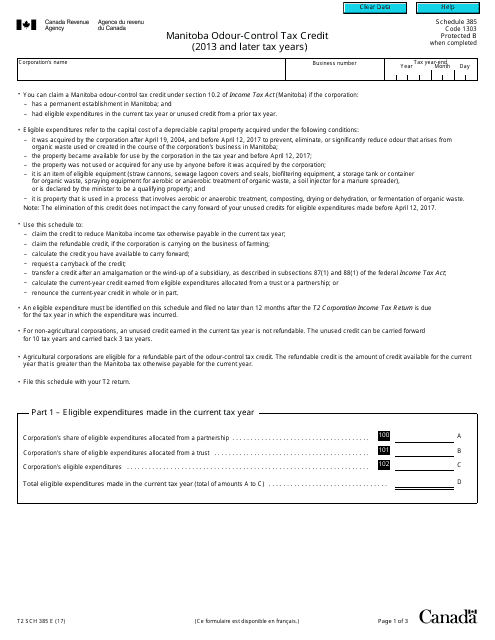

This form is used for claiming the Manitoba Odour-Control Tax Credit in Canada for tax years 2013 and later.

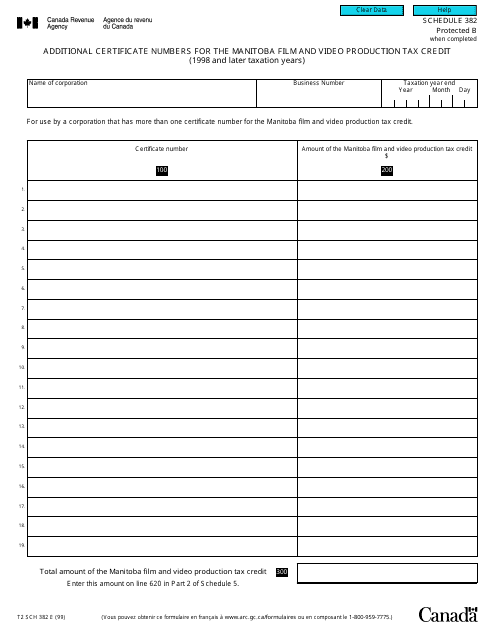

This form is used for reporting additional certificate numbers for the Manitoba Film and Video Production Tax Credit in Canada for taxation years 1998 and later.

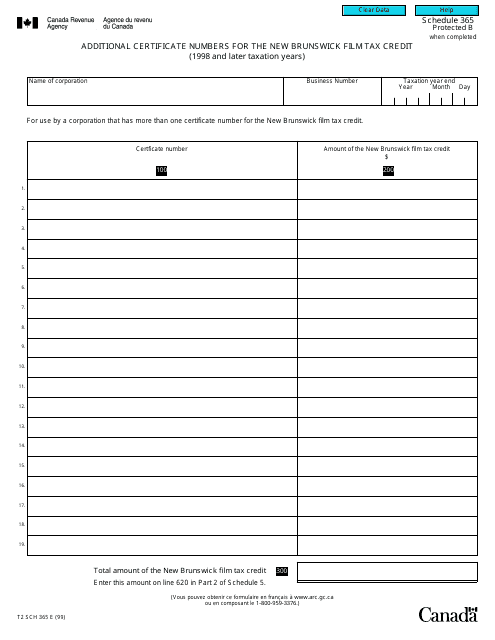

This form is used for reporting additional certificate numbers for the New Brunswick Film Tax Credit in Canada. It is applicable for taxation years 1998 and later.

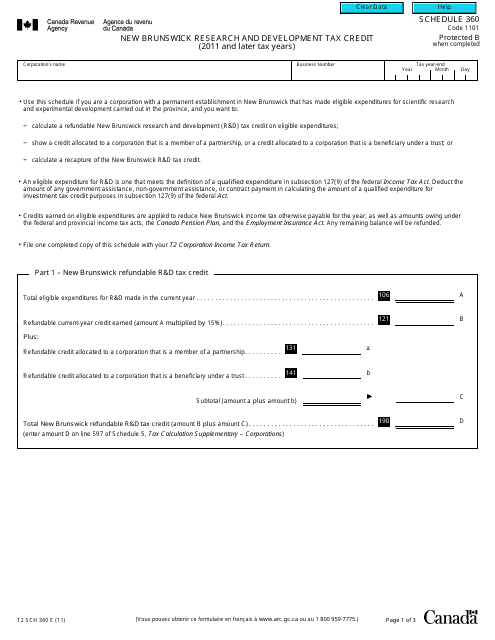

This form is used for claiming the New Brunswick Research and Development Tax Credit in Canada for tax years 2011 and later.

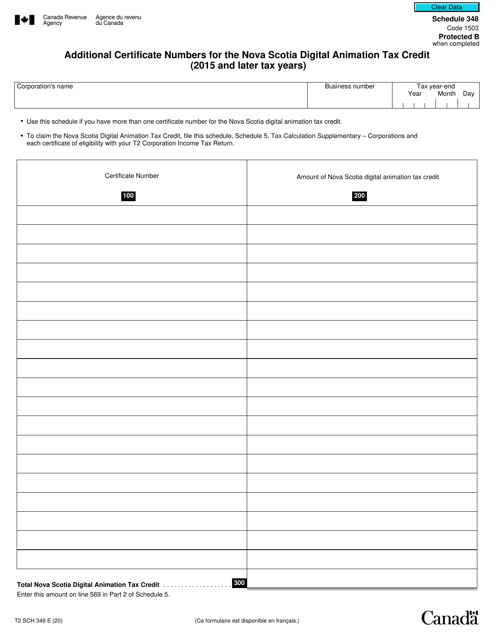

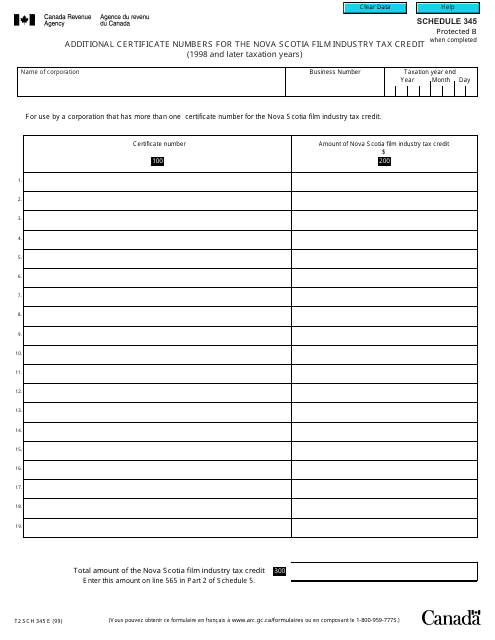

This form is used for reporting additional certificate numbers for the Nova Scotia Film Industry Tax Credit in Canada for taxation years 1998 and later.

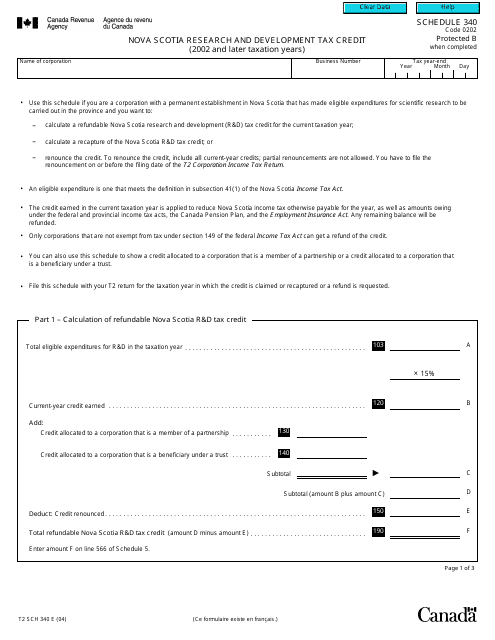

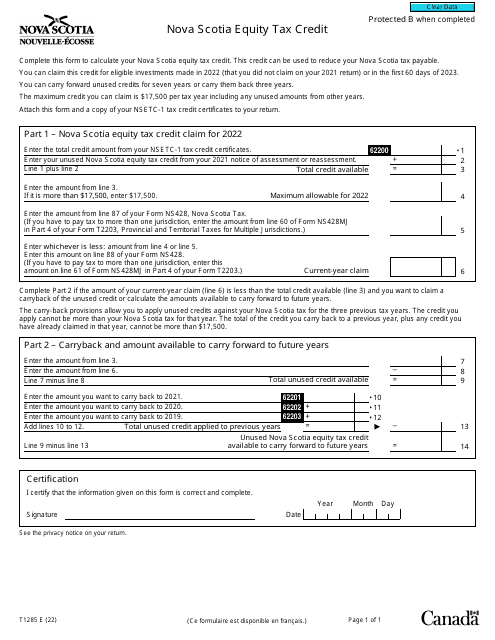

This Form is used for claiming the Nova Scotia Research and Development Tax Credit in Canada for the years 2002 and later.

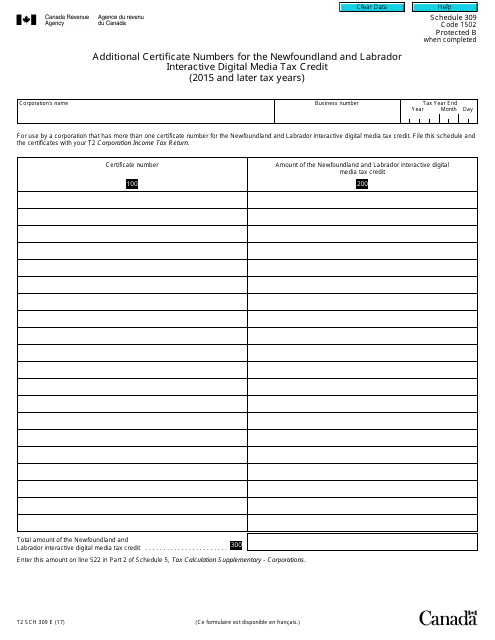

This form is used to report additional certificate numbers for the Newfoundland and Labrador Interactive Digital Media Tax Credit. It is applicable for the tax years 2015 and later in Canada.

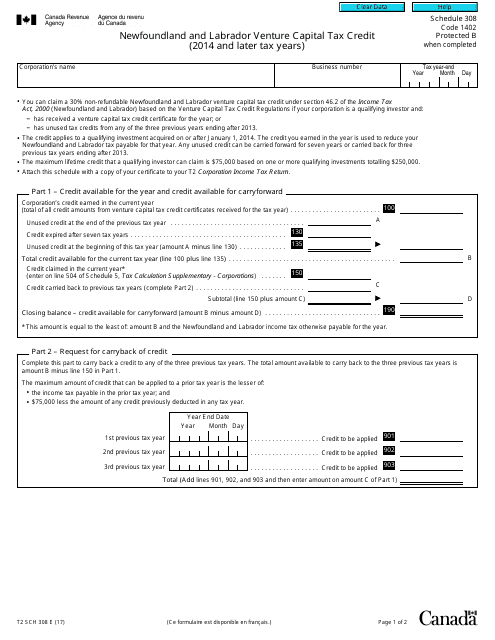

This form is used for claiming the Newfoundland and Labrador Venture Capital Tax Credit in Canada for tax years 2014 and later.

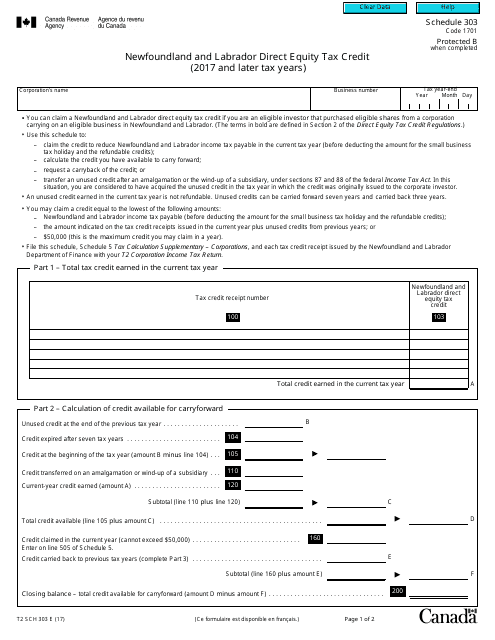

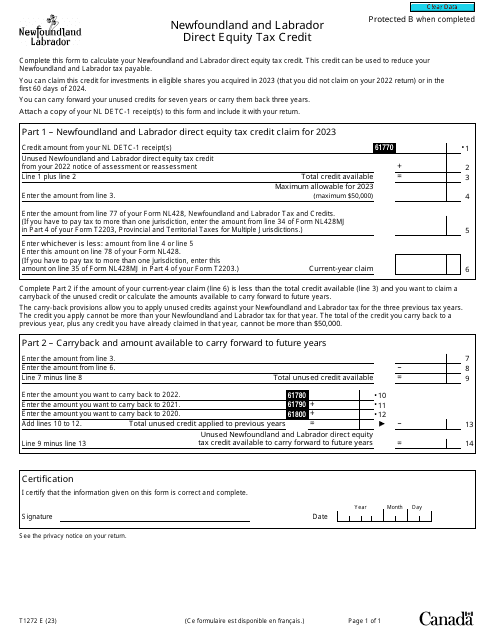

This form is used for claiming the Newfoundland and Labrador Direct Equity Tax Credit on your Canadian tax return for the years 2017 and later.

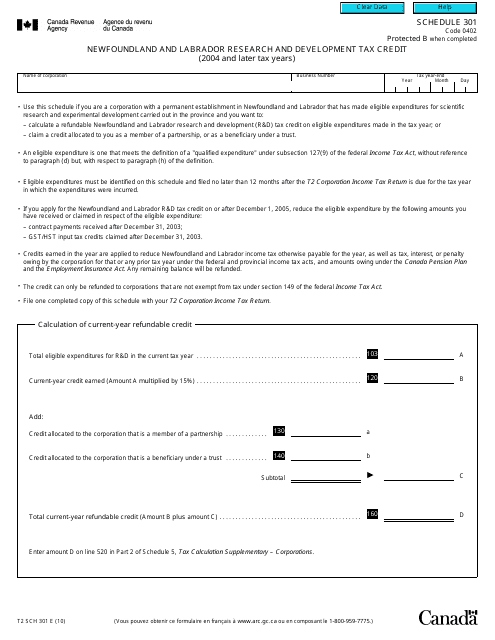

This form is used for claiming the Newfoundland and Labrador Research and Development Tax Credit for the tax years 2004 and later in Canada.

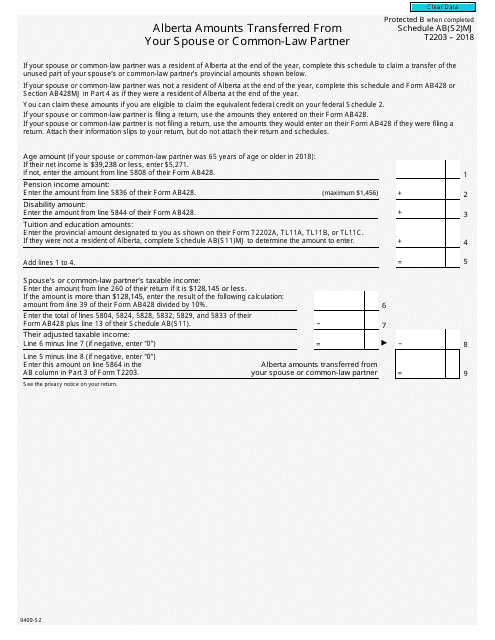

This form is used for reporting Alberta amounts transferred from your spouse or common-law partner in Canada.

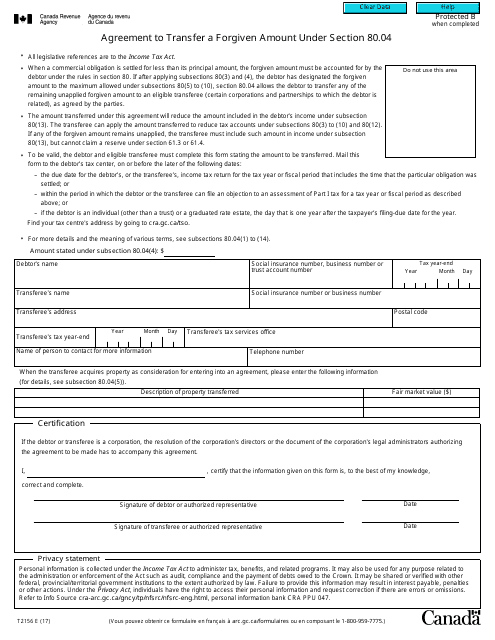

This form is used for transferring a forgiven amount under Section 80.04 in Canada.

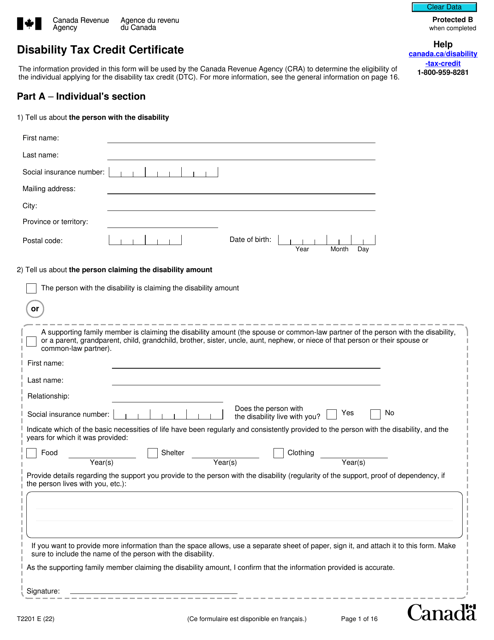

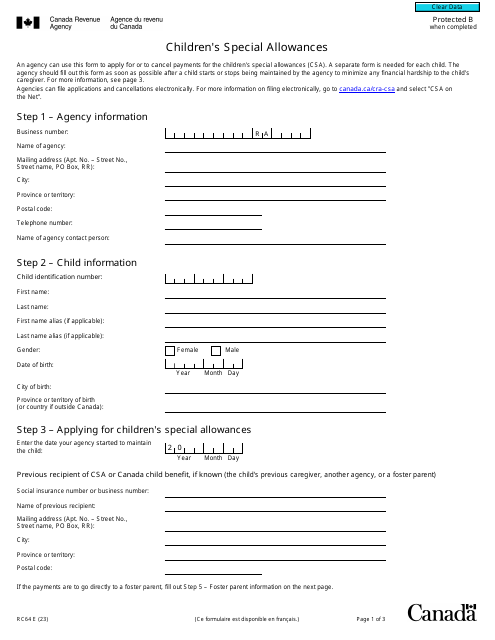

The purpose of this document is to provide the Canada Revenue Agency with information that will be enough for them to make a decision on whether an individual is eligible to receive a Disability Tax Credit.

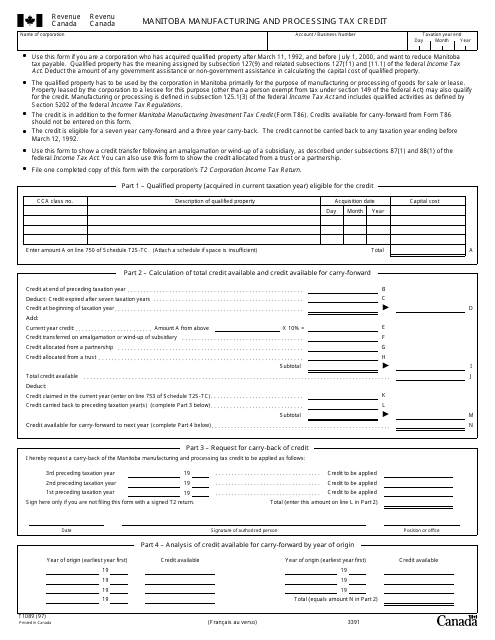

This form is used for claiming the Manitoba Manufacturing and Processing Tax Credit in Canada. It is used by individuals or businesses involved in the manufacturing and processing sector in Manitoba to claim a tax credit based on their eligible expenditures.

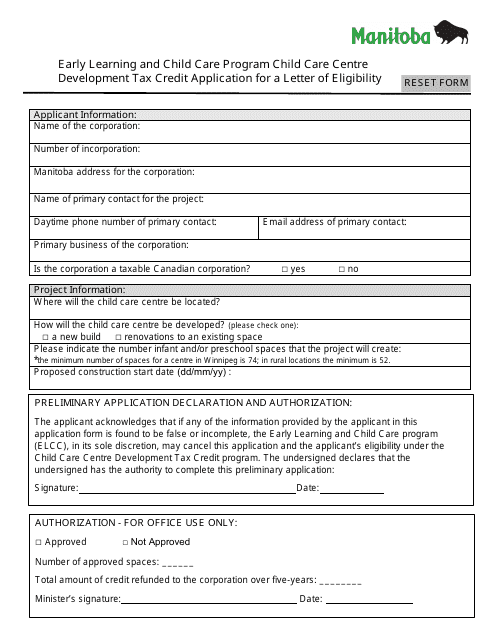

This document is for applying for a tax credit for the development of a child care center in Manitoba, Canada.

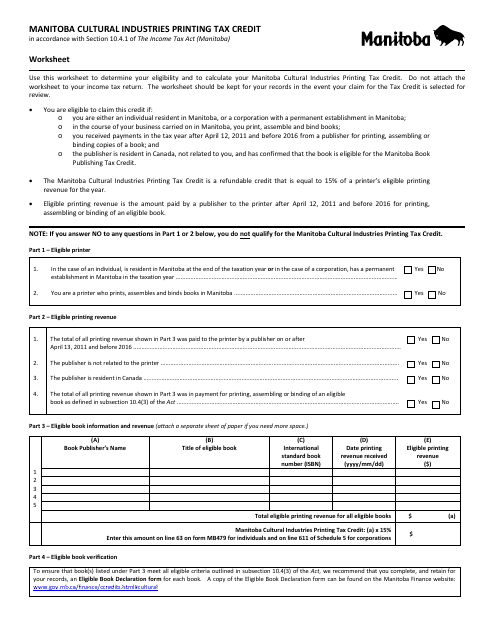

This document is for the Manitoba Cultural Industries Printing Tax Credit in Manitoba, Canada. It provides information on a tax credit available for printing businesses in Manitoba that contribute to the cultural industries.

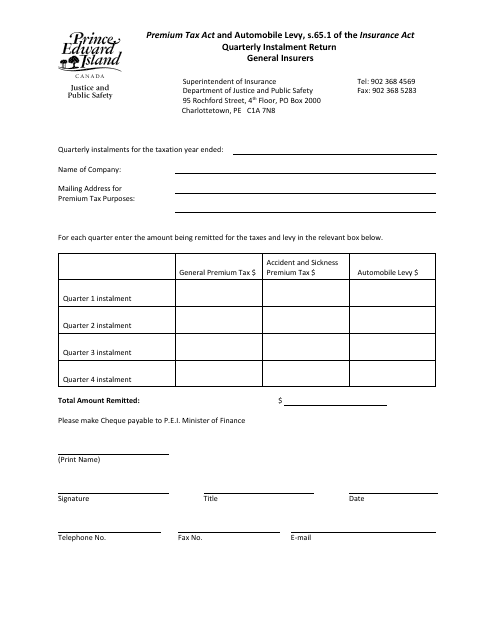

This document is used by businesses in Prince Edward Island, Canada to report their quarterly instalment payments to the government. It is a form that helps businesses calculate and remit the amount they owe for income tax or sales tax on a quarterly basis.