Use Tax Templates

Documents:

480

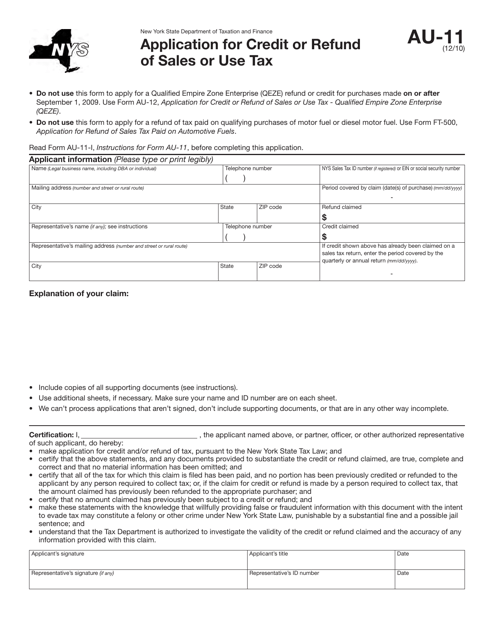

This Form is used for applying for a credit or refund of sales or use tax in New York.

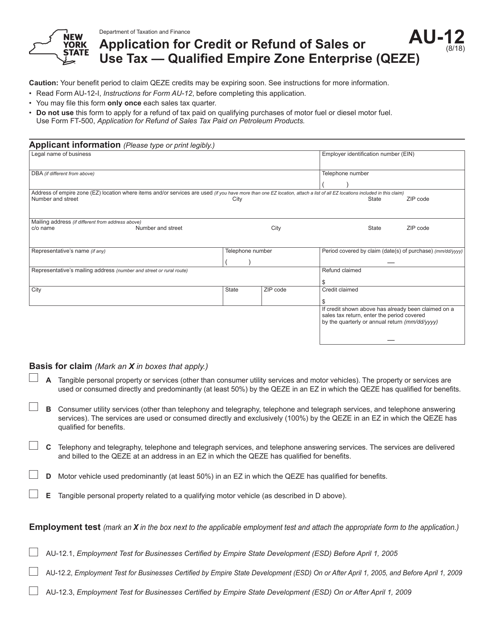

This form is used for applying for a credit or refund of sales or use tax for qualified Empire Zone Enterprises (QEZE) in New York.

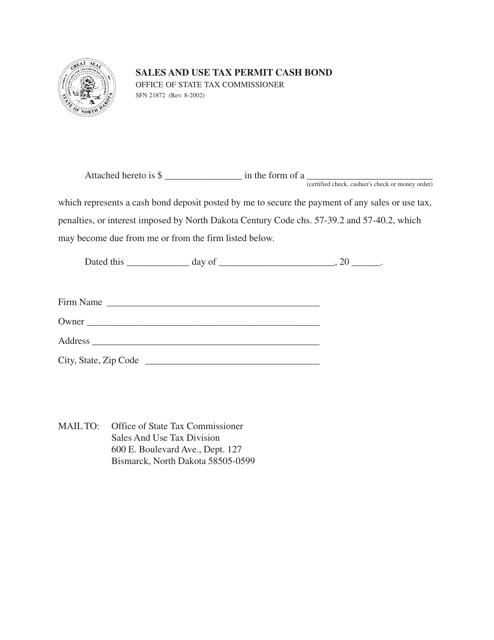

This form is used for obtaining a cash bond for a sales and use tax permit in North Dakota.

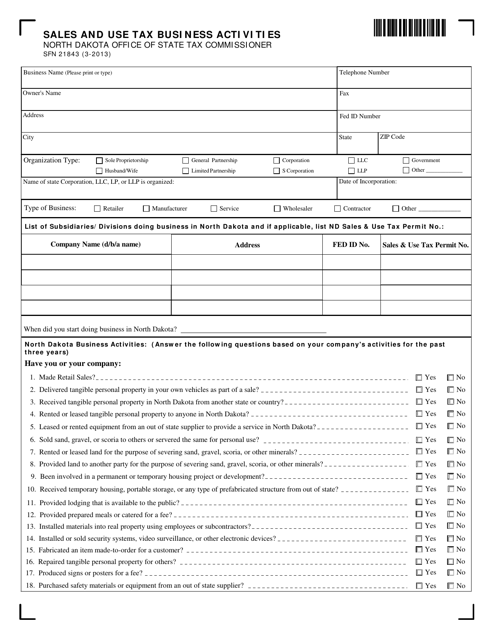

This Form is used for reporting sales and use tax for business activities in North Dakota.

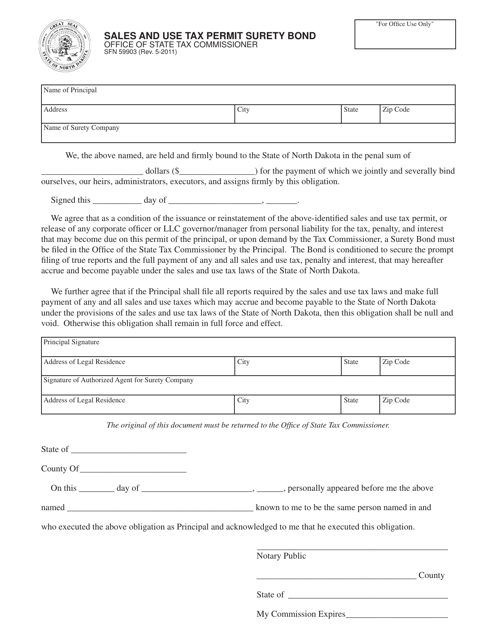

This form is used for securing a surety bond for a sales and use tax permit in North Dakota.

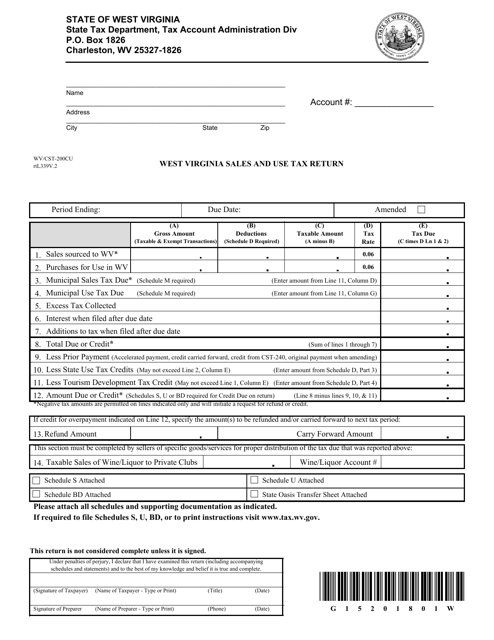

This Form is used for filing the West Virginia Sales and Use Tax Return in the state of West Virginia.

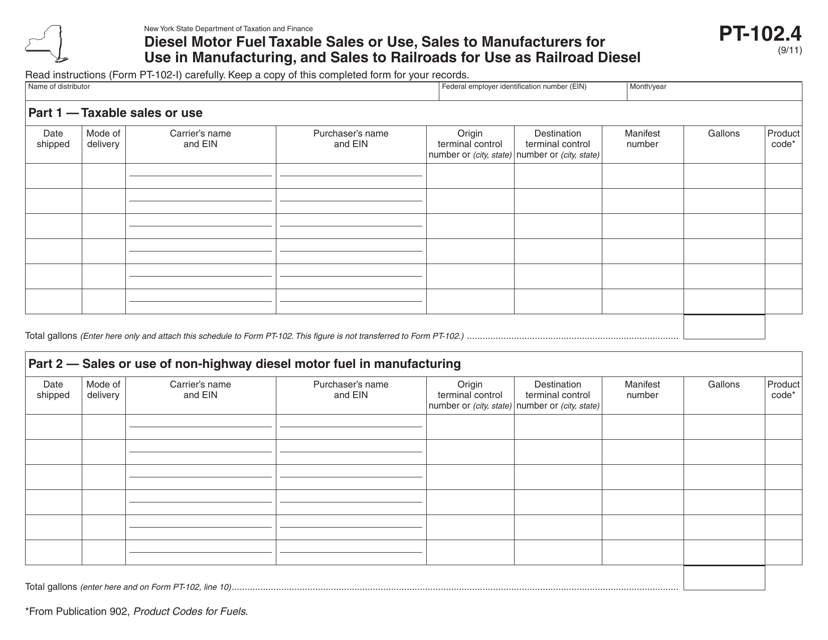

This form is used for reporting taxable sales or use of diesel motor fuel in New York, including sales to manufacturers for use in manufacturing and sales to railroads for use as railroad diesel.

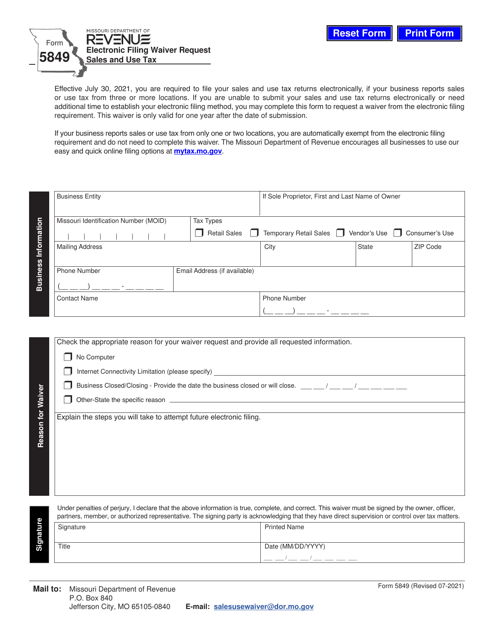

This form is used for requesting a waiver to electronically file sales and use tax returns in Missouri.

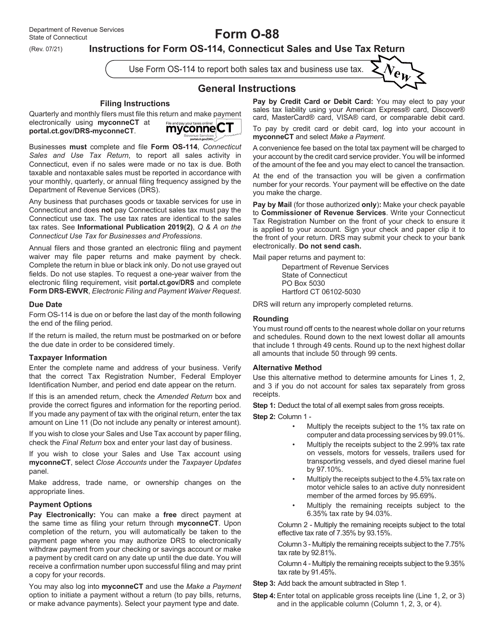

This Form is used for reporting and paying Connecticut sales and use tax. It is required for businesses operating in Connecticut to accurately report their sales and use tax obligations.

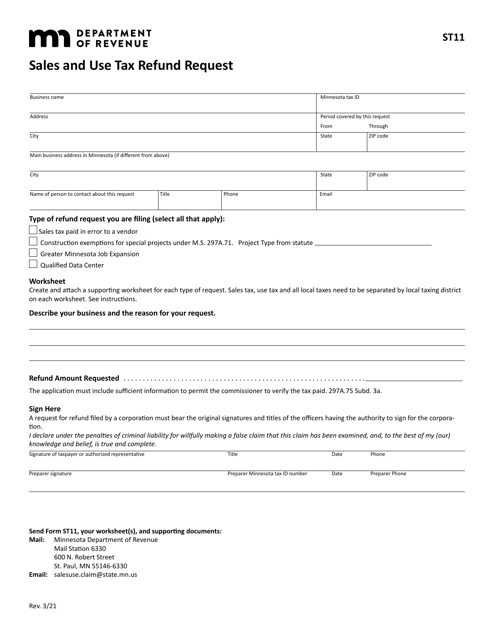

This form is used for requesting a refund of sales and use tax in the state of Minnesota.