Use Tax Templates

Documents:

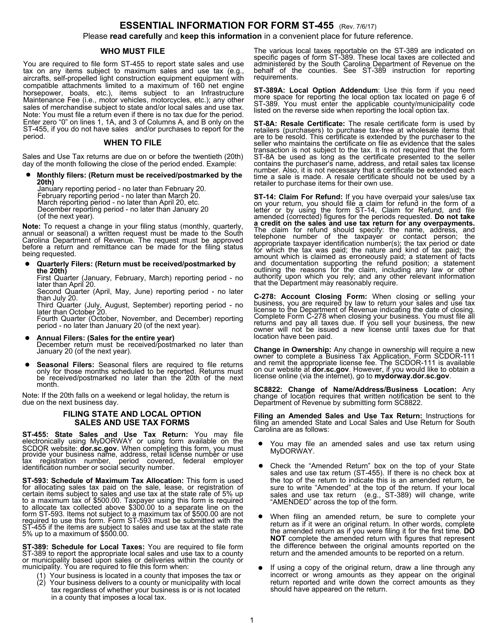

480

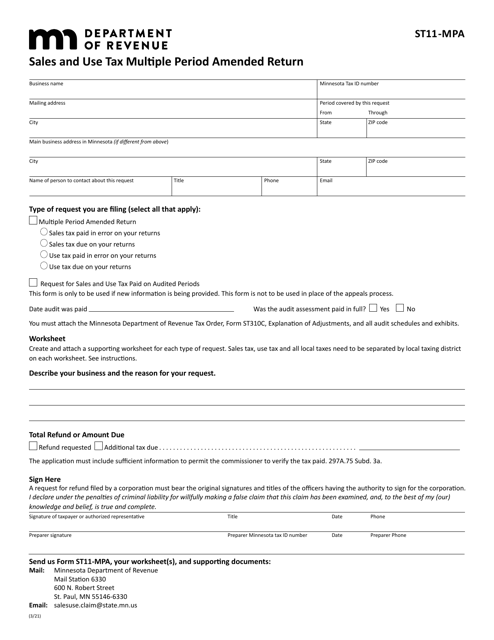

This form is used for filing an amended sales and use tax return for multiple periods in Minnesota.

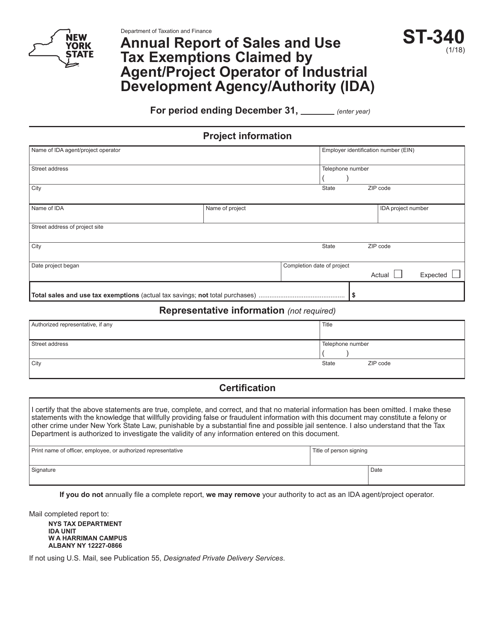

This document is used for reporting sales and use tax exemptions claimed by an agent or project operator of an Industrial Development Agency/Authority (IDA) in New York.

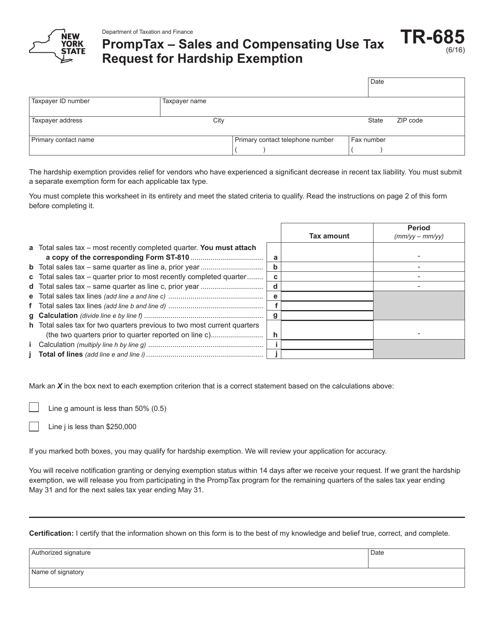

This form is used for requesting a hardship exemption from the sales and compensating use tax in the state of New York. It is specifically designated as Form TR-685 Promptax.

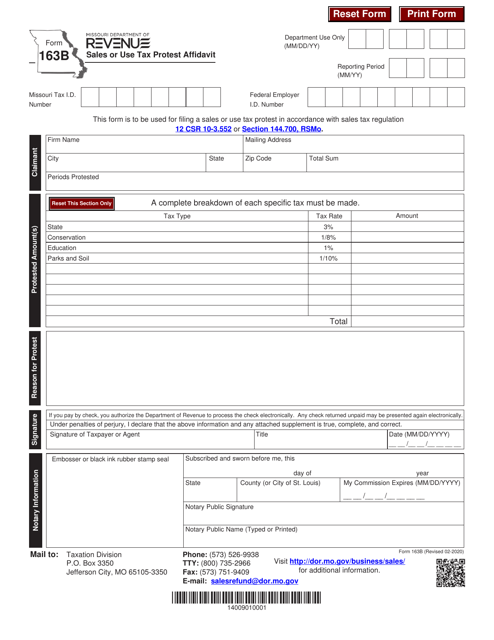

This form is used for protesting sales or use tax in the state of Missouri. It allows individuals to submit a formal affidavit to challenge the amount of tax owed.

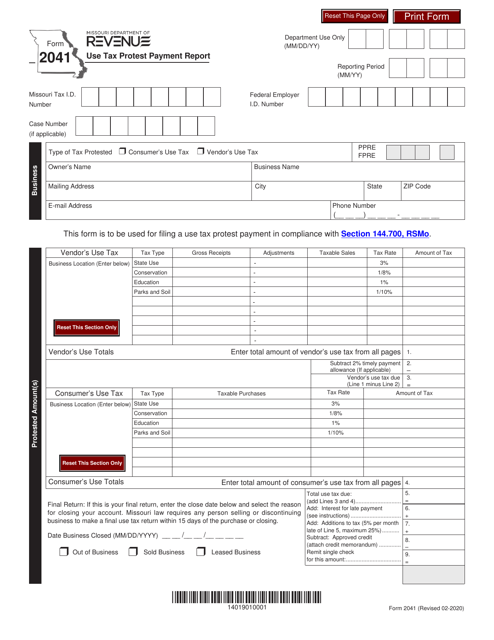

This form is used for reporting and protesting use tax payments in the state of Missouri. It allows individuals and businesses to dispute any taxes they believe were incorrectly imposed on their purchases.

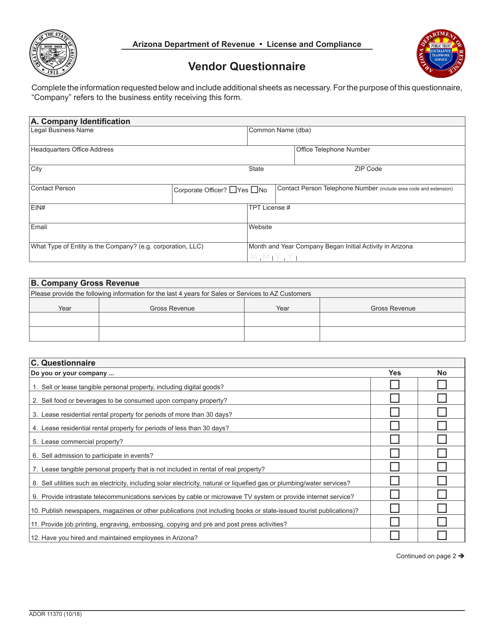

This form is used for vendors to complete a questionnaire in Arizona.

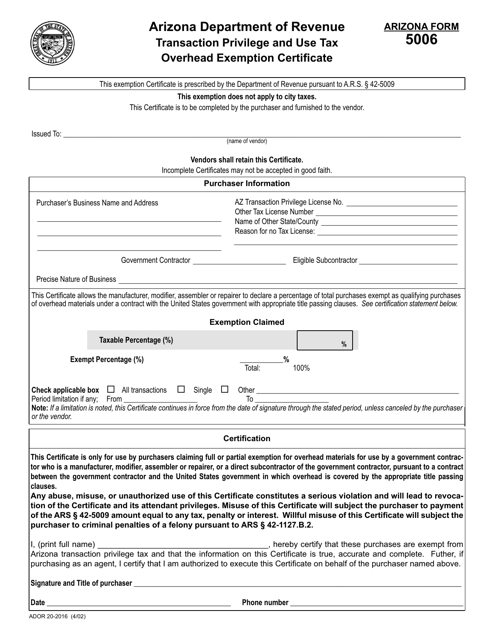

This Form is used for claiming an exemption from transaction privilege and use taxes related to overhead expenses in Arizona.

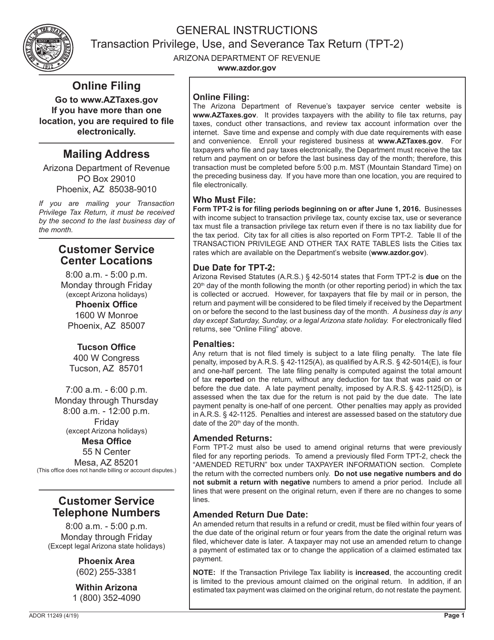

This Form is used for filing the Transaction Privilege, Use, and Severance Tax Return in Arizona. It provides instructions for completing Form TPT-2, ADOR11249.

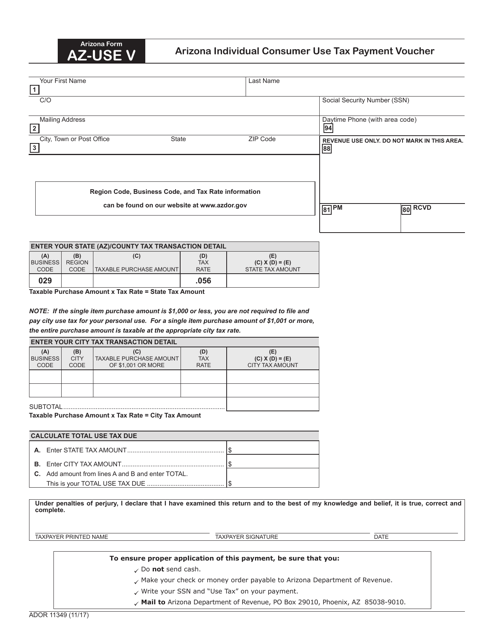

This Form is used for making individual consumer use tax payment in Arizona.

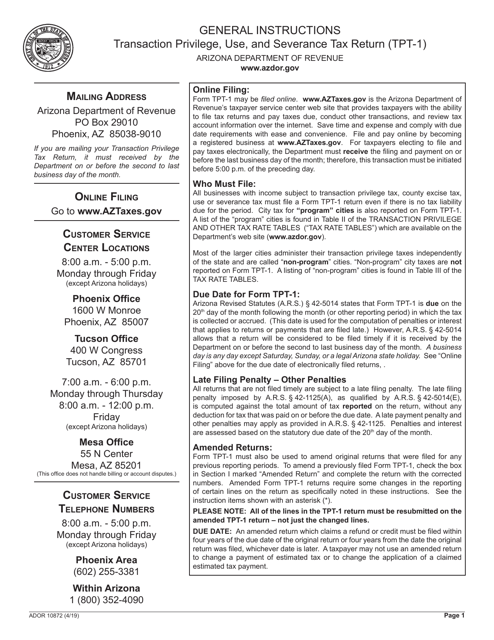

This Form is used for filing the Transaction Privilege, Use, and Severance Tax Return in the state of Arizona. It provides instructions on how to accurately fill out and submit the form to the Arizona Department of Revenue (ADOR).

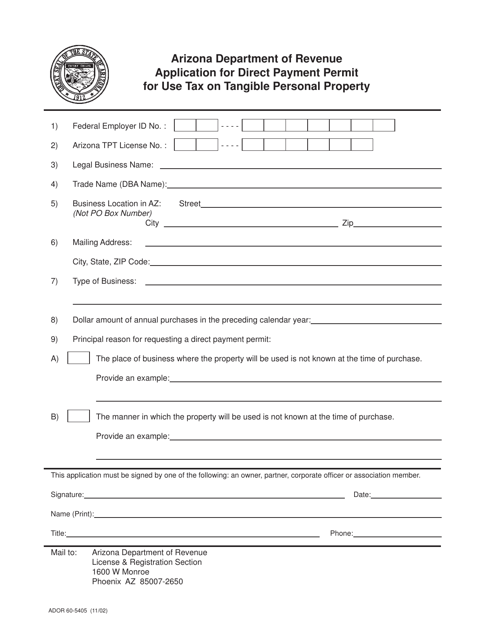

This Form is used for applying for a Direct Payment Permit for Use Tax on Tangible Personal Property in Arizona.

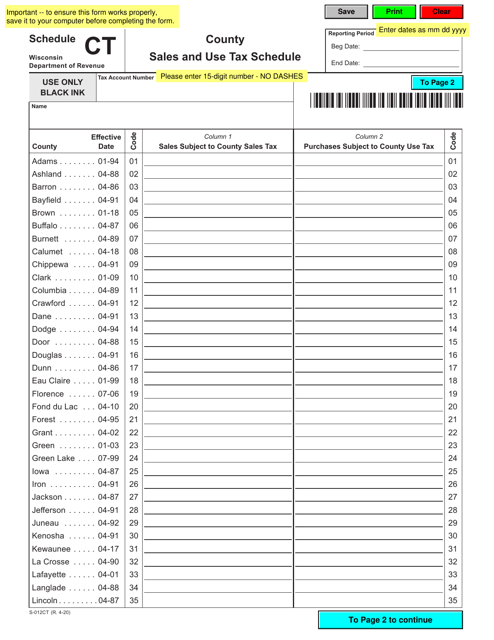

This form is used for reporting county sales and use tax in Wisconsin.

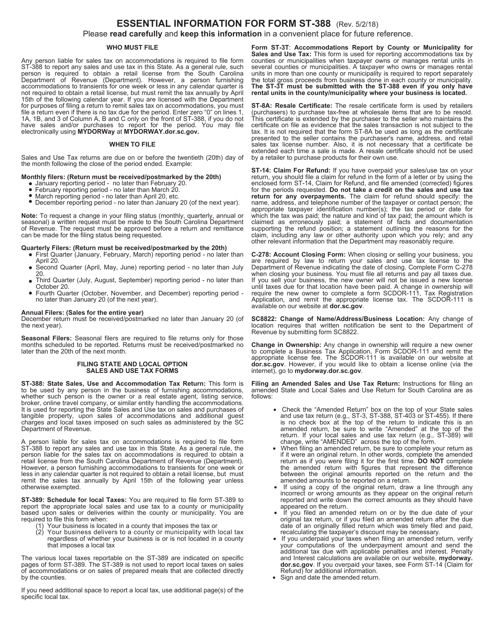

This Form is used for filing the State Sales, Use, and Accommodations Tax Return in South Carolina. It provides instructions on how to report and pay sales, use, and accommodations taxes to the state.

This Form is used for filing state sales, use, and maximum tax return for businesses in South Carolina. It provides instructions on how to report and pay the taxes owed.

This Form is used for remitting the consumer liquor excise and use tax in the state of Wyoming.

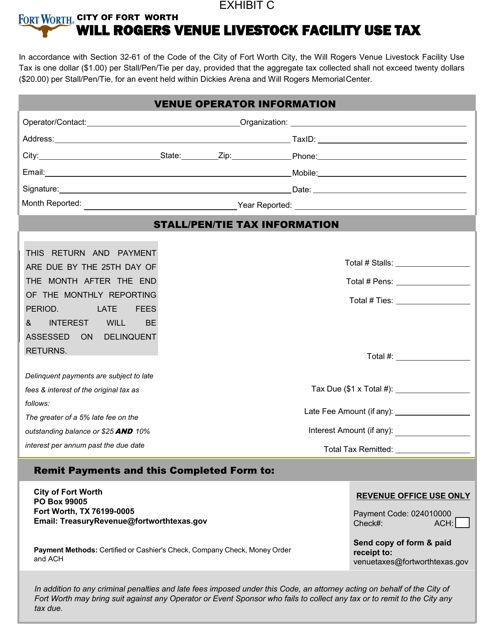

This document is for the Will Rogers Venue Livestock Facility Use Tax in the City of Fort Worth, Texas.

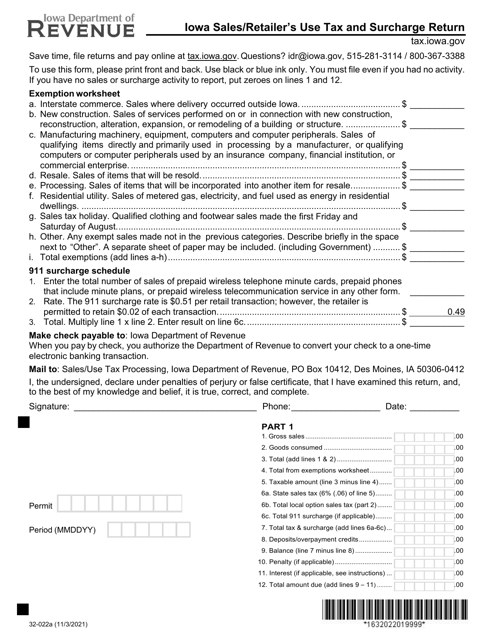

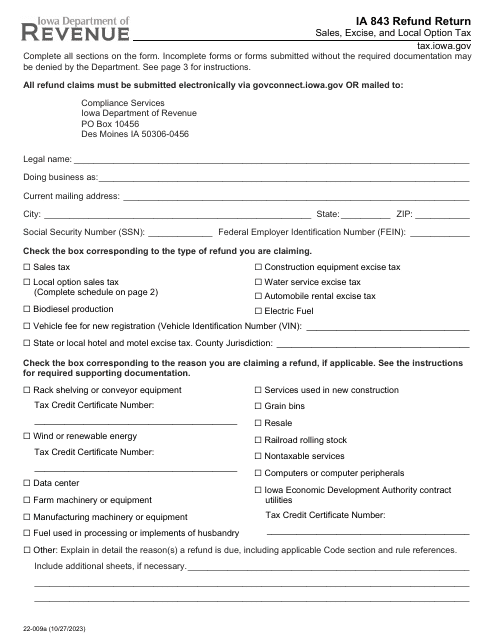

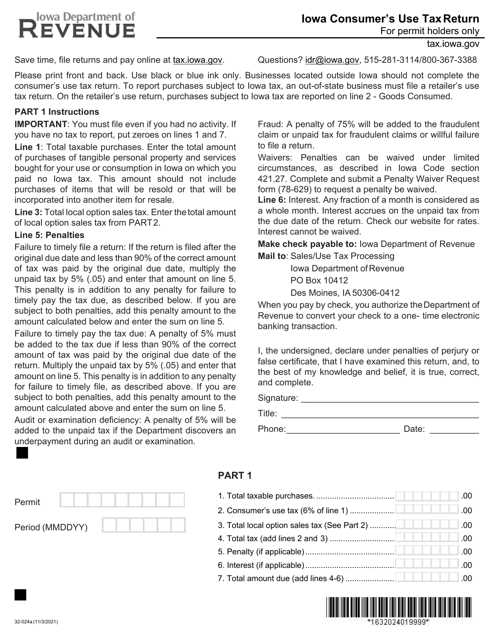

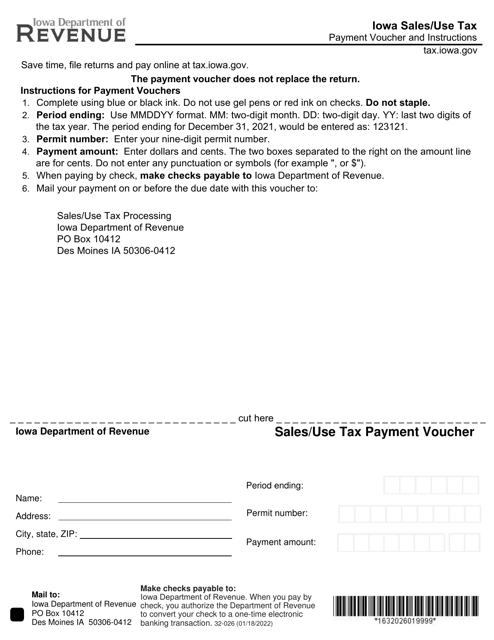

This form is used for making sales/use tax payments in the state of Iowa.

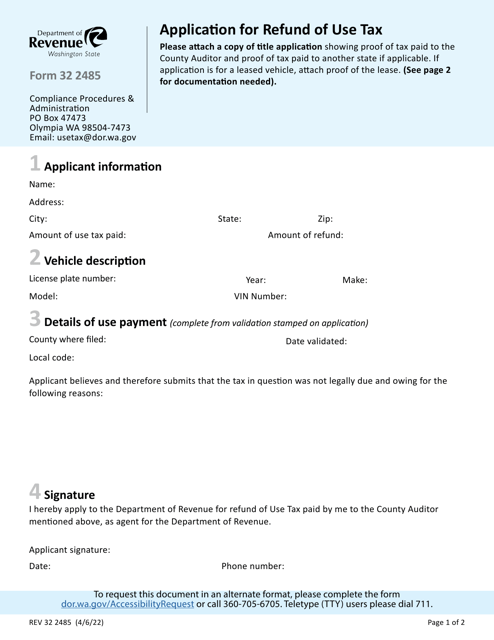

This Form is used for applying for a refund of use tax paid in Washington state.

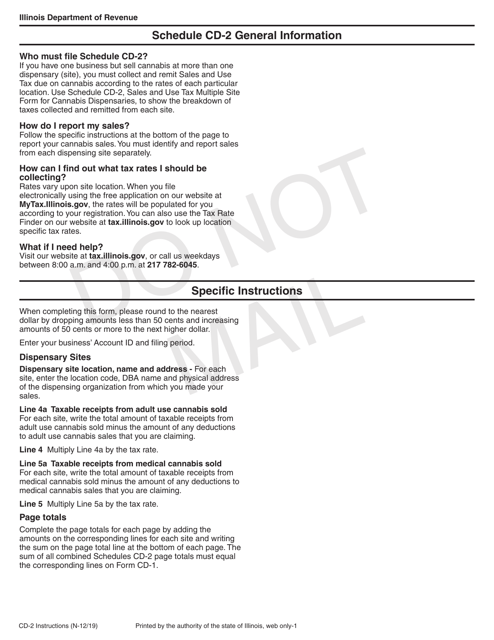

This document provides instructions for filling out the Schedule CD-2 Sales and Use Tax Multiple Site Form specifically for cannabis dispensaries in Illinois. It outlines how to report sales and use tax for multiple locations.

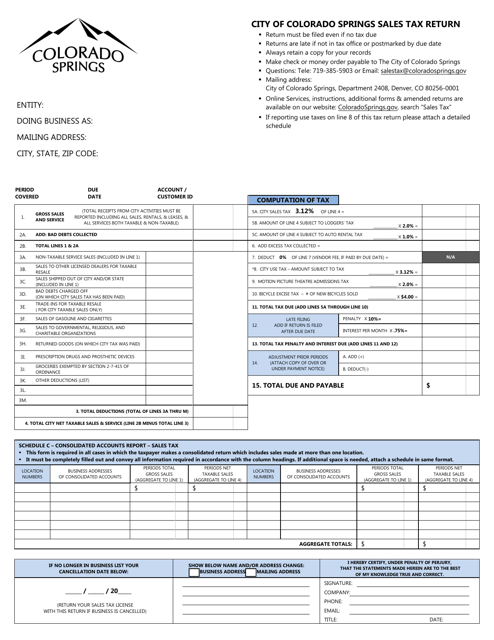

This sales and use tax return form is used by businesses in the City of Colorado Springs, Colorado to report and pay their sales and use tax at a rate of 3.12%.

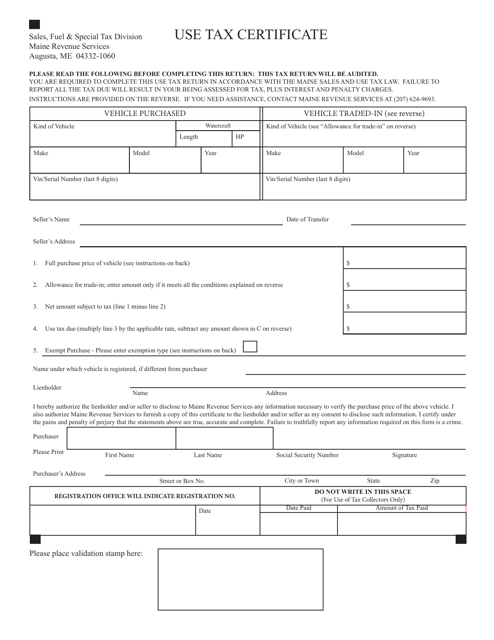

This document is used for reporting and paying use tax in the state of Maine.