Use Tax Templates

Documents:

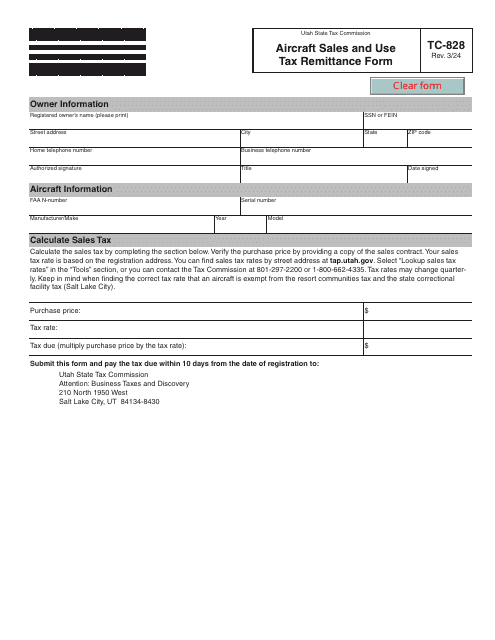

480

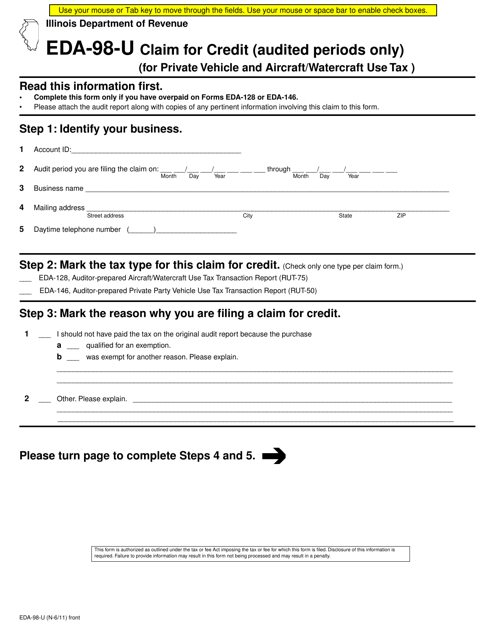

This form is used for claiming a credit for private vehicle and aircraft/watercraft use tax in Illinois.

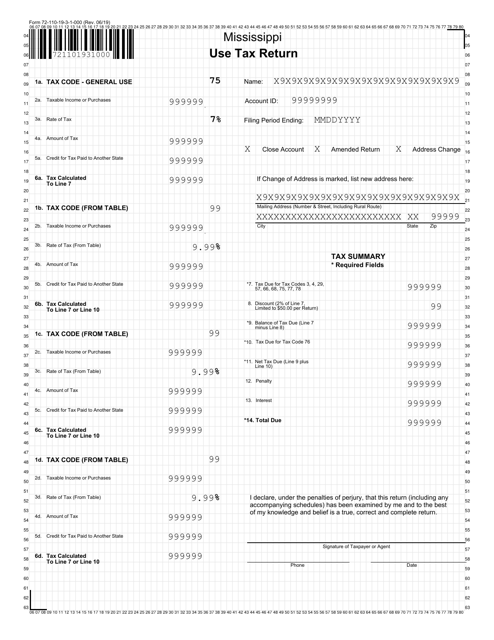

This form is used for reporting and paying use tax in the state of Mississippi. Use tax is a tax on goods and services purchased outside of the state but used within Mississippi.

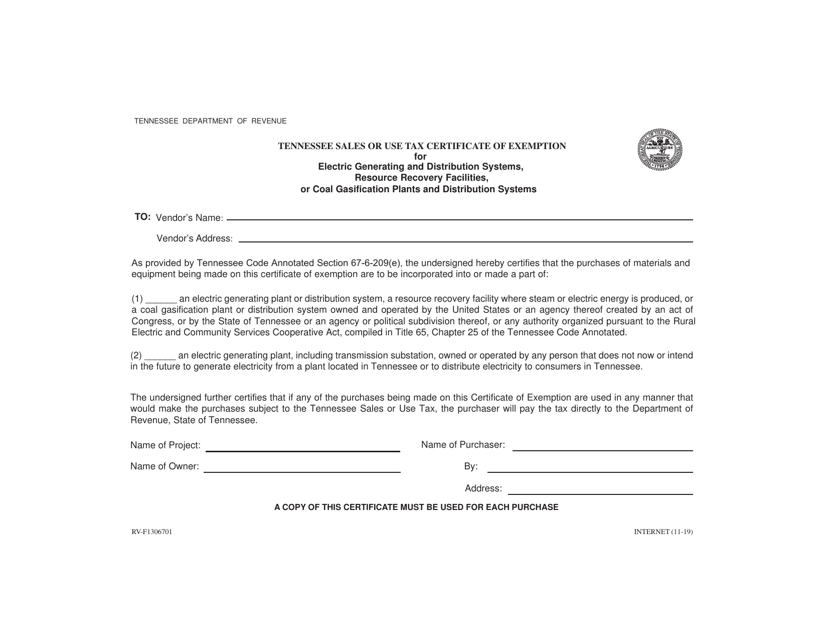

This Form is used for obtaining a sales or use tax exemption certificate in Tennessee for electric generating and distribution systems, resource recovery facilities, or coal gasification plants and distribution systems.

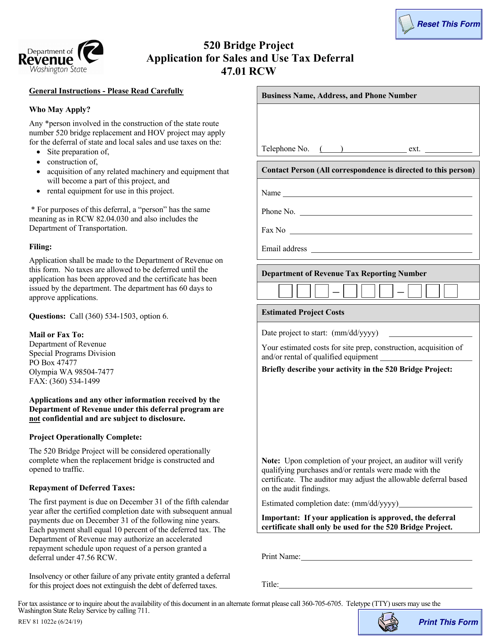

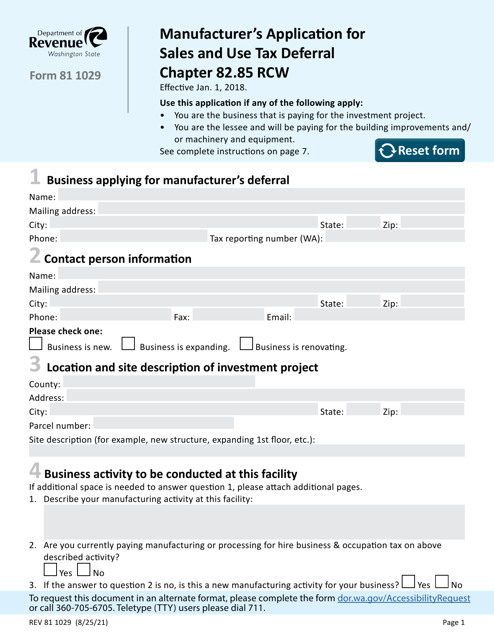

This document is an application form for the Sales and Use Tax Deferral program for the 520 Bridge Project in Washington state. It is used to request a deferral of sales and use tax for eligible construction and improvement projects related to the 520 bridge.

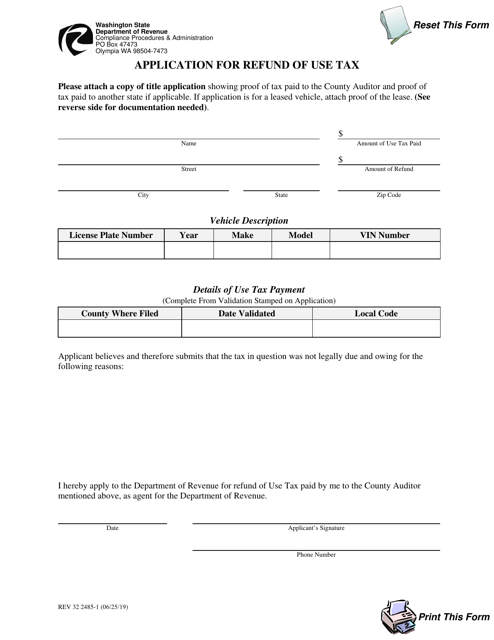

This form is used to apply for a refund of use tax paid in the state of Washington.

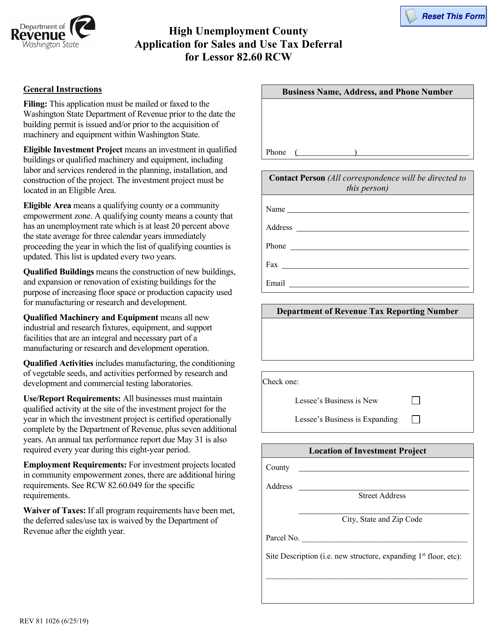

This Form is used for applying for sales and use tax deferral for lessors in Washington counties with high unemployment rates.

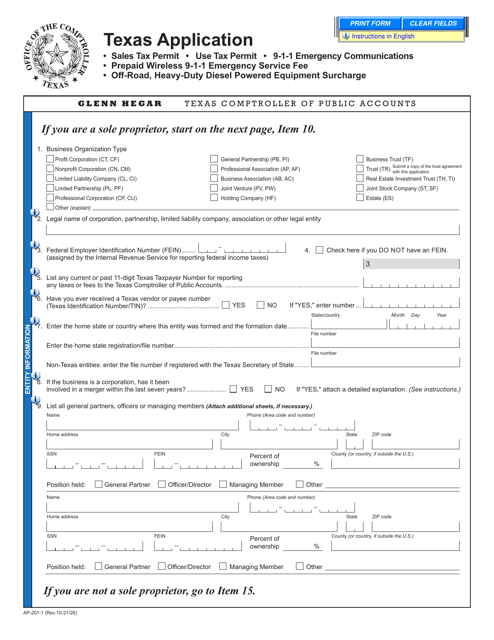

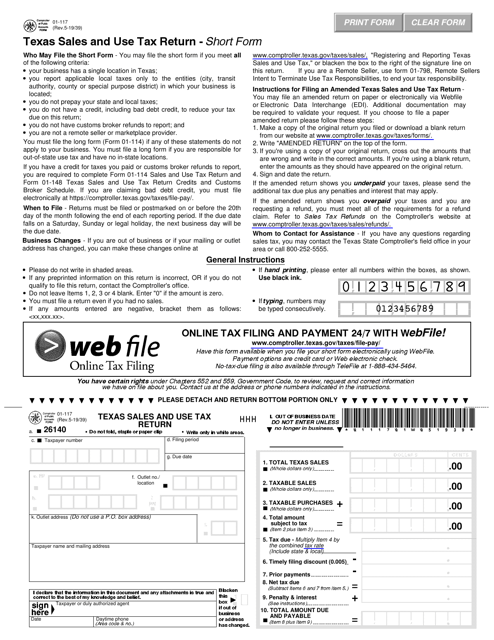

This type of document is used for filing a short form of the Texas Sales and Use Tax Return in the state of Texas.

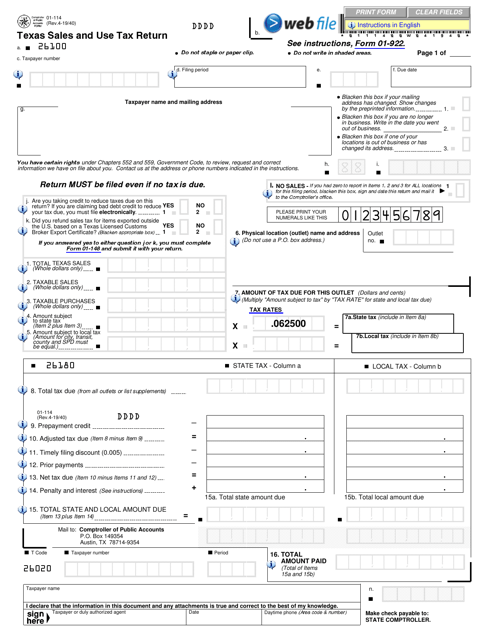

This is a form used in the state of Texas that is used by taxpayers when they want to report information related to the Sales and Use Tax they are supposed to pay.

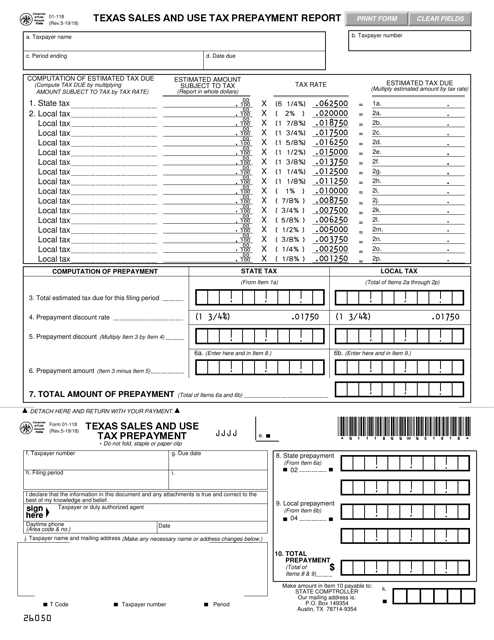

This form is used for reporting and prepaying sales and use taxes in the state of Texas.

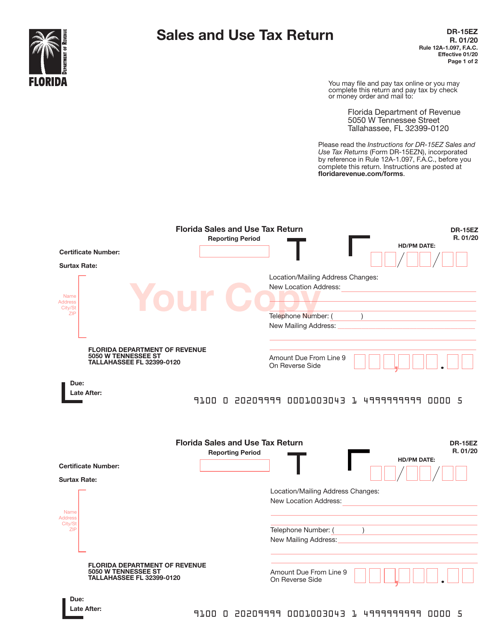

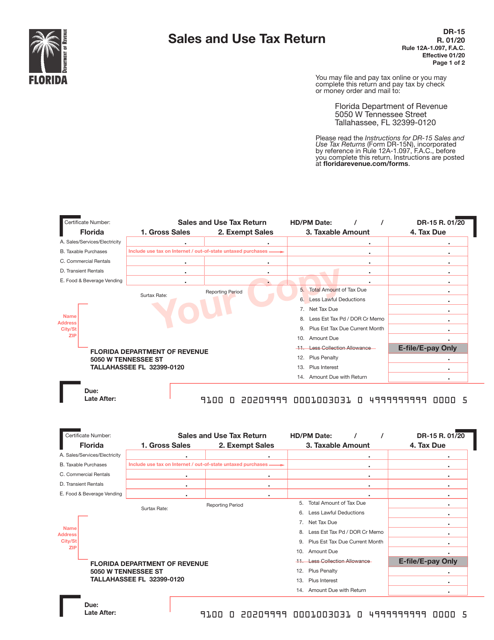

This Form is used for reporting sales and use tax in the state of Florida.

This Form is used for the filing of Sales and Use Tax Return in the state of Florida.

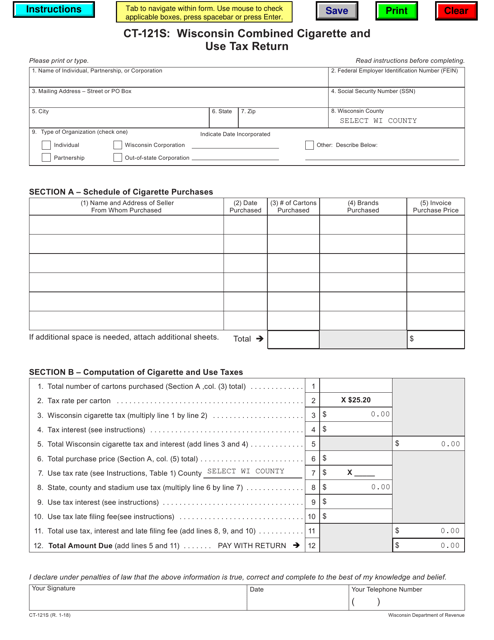

This document is a form used in Wisconsin for reporting and paying combined cigarette and use tax. It is used by businesses that sell cigarettes and other tobacco products.

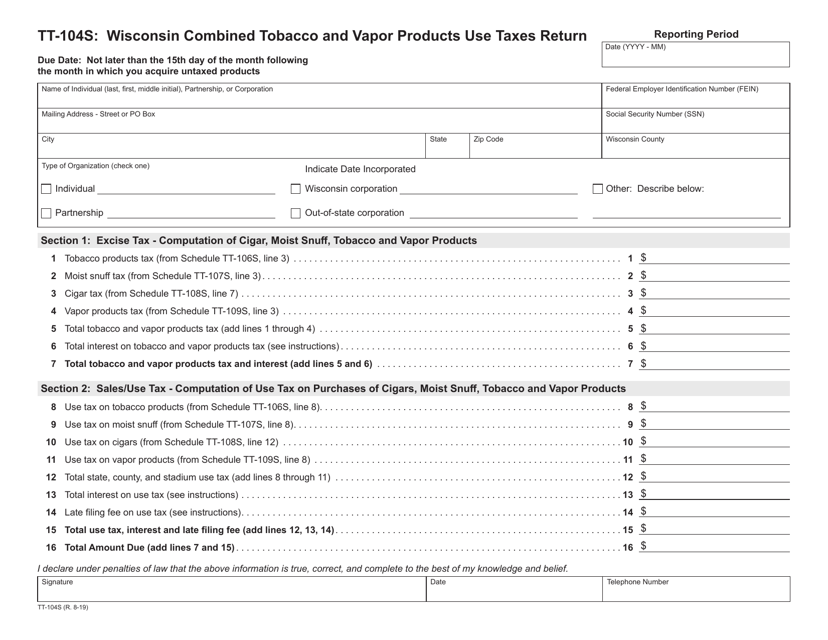

This Form is used for reporting and paying combined tobacco and vapor products use taxes in the state of Wisconsin.

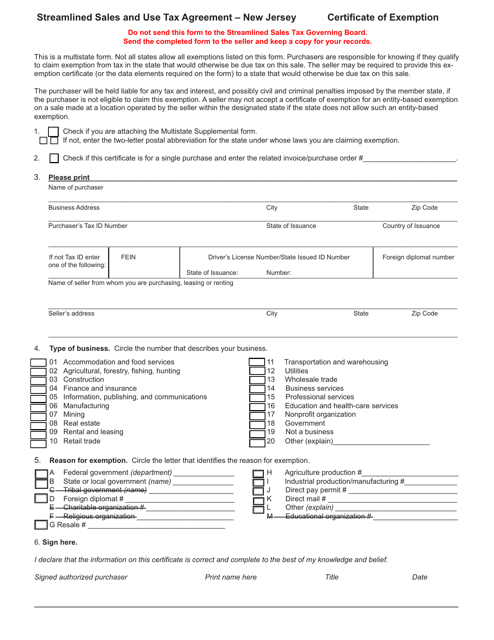

This form is used for applying for a certificate of exemption in New Jersey under the Streamline Sales & Use Tax Agreement.

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

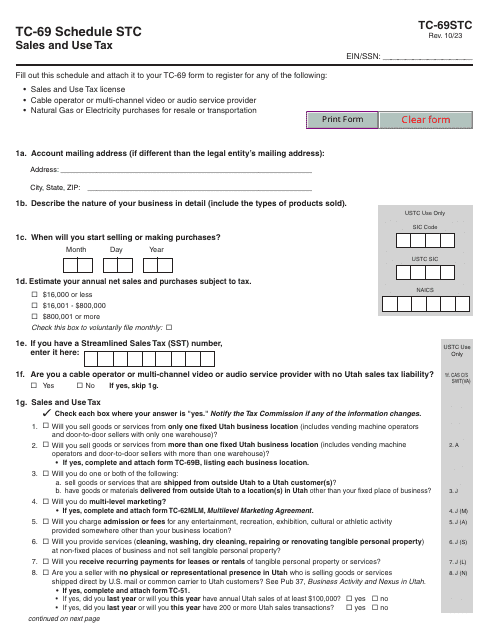

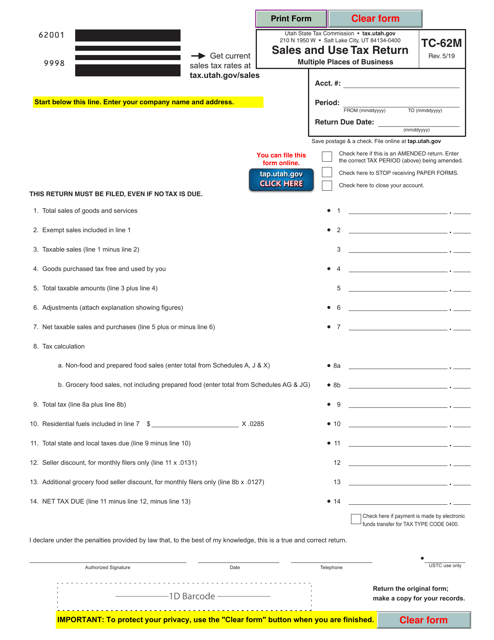

This form is used for filing sales and use tax returns for businesses with multiple locations in Utah.

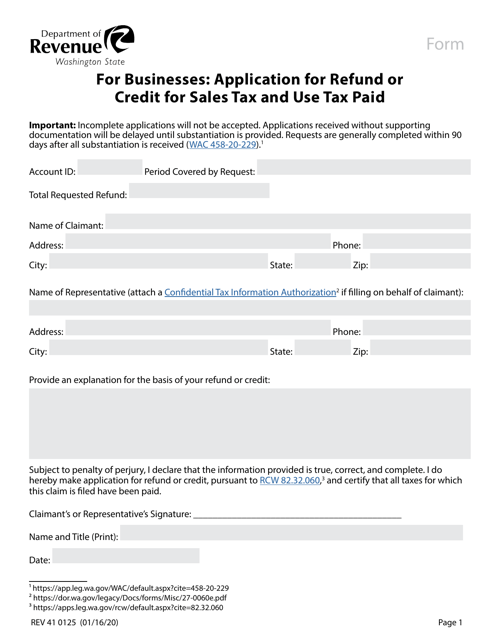

This form is used by businesses in Washington to apply for a refund or credit for sales tax and use tax paid.

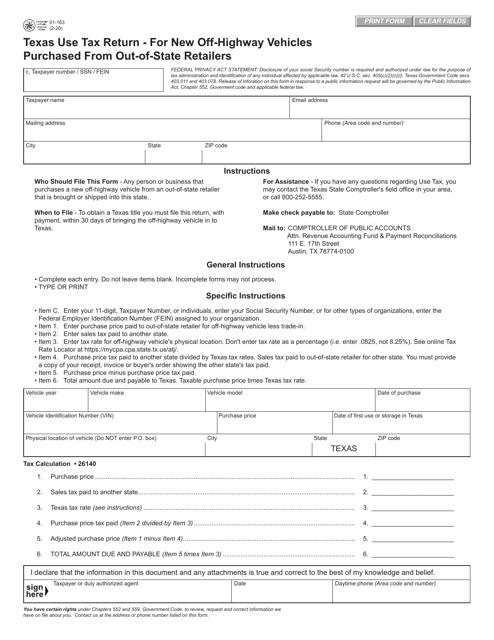

This Form is used for reporting and paying use tax on new off-highway vehicles purchased from out-of-state retailers in Texas.

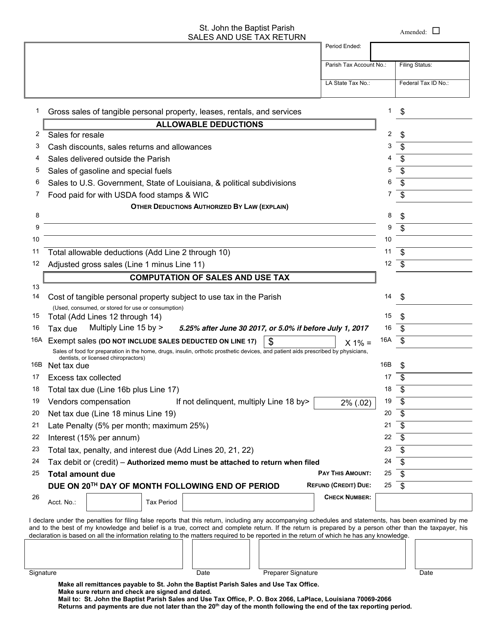

This form is used for submitting sales and use tax returns specifically for St. John the Baptist Parish, Louisiana. It is used to report and remit the taxes collected from sales and use of goods and services within the parish.