Use Tax Templates

Documents:

480

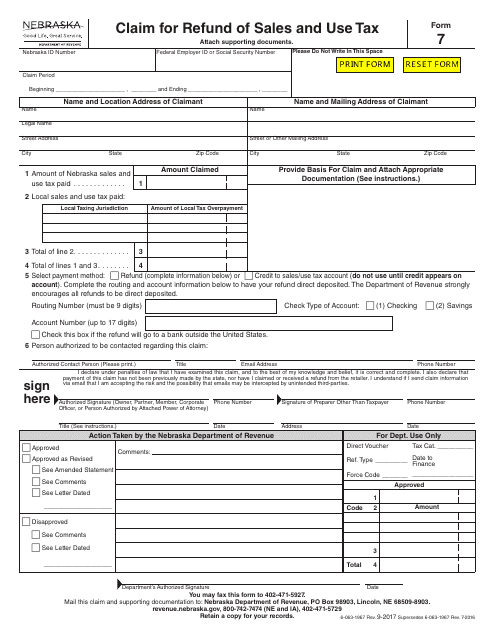

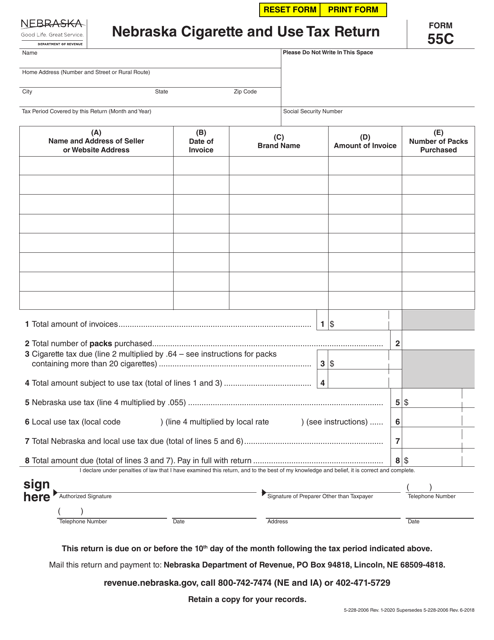

This Form is used for individuals and businesses in Nebraska to claim a refund of sales and use tax that was incorrectly paid or overpaid.

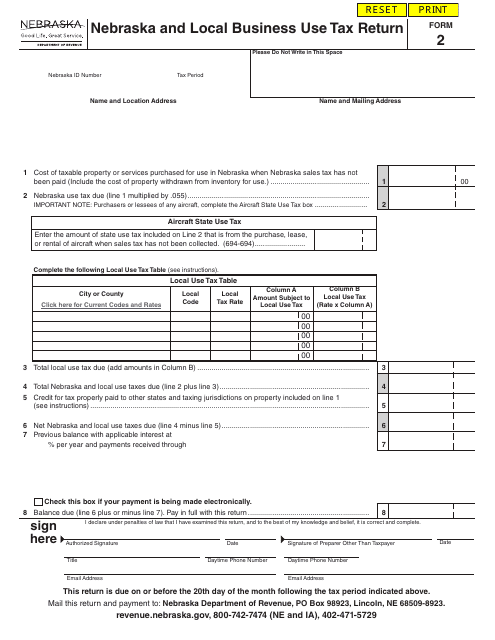

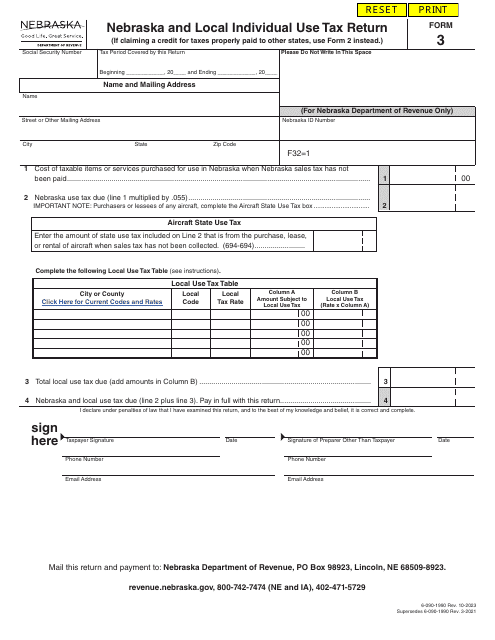

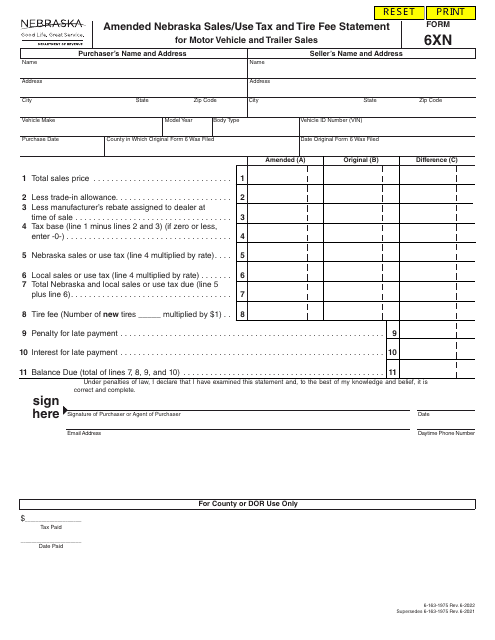

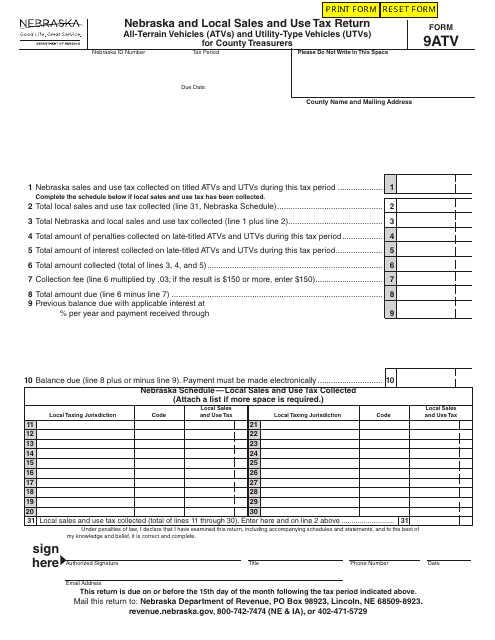

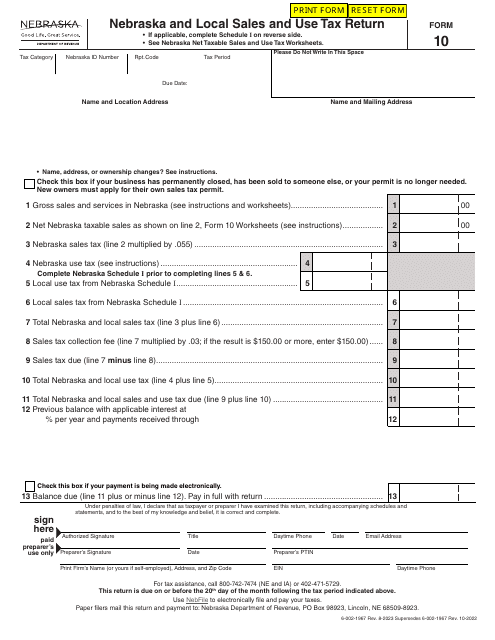

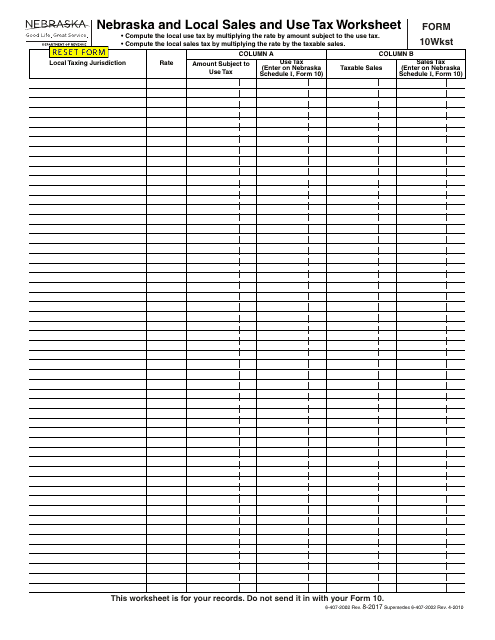

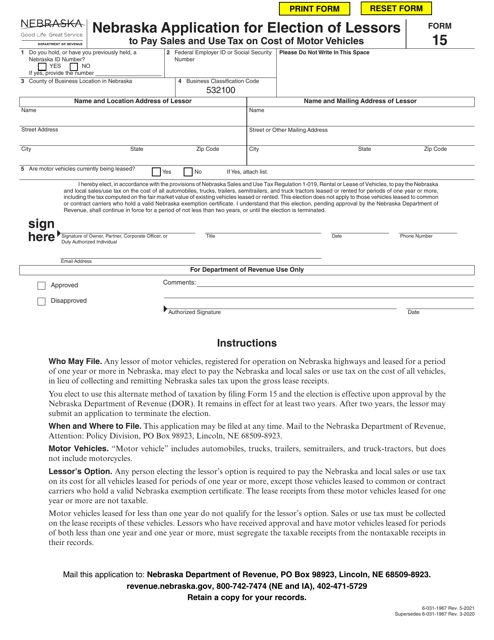

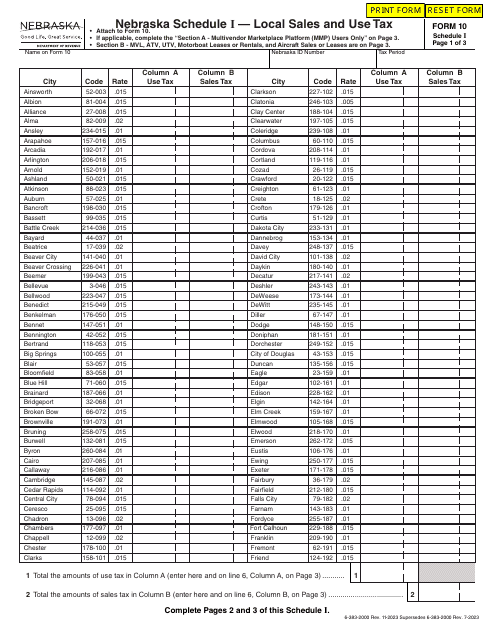

This form is used for calculating and reporting Nebraska and Local Sales and Use Tax in Nebraska.

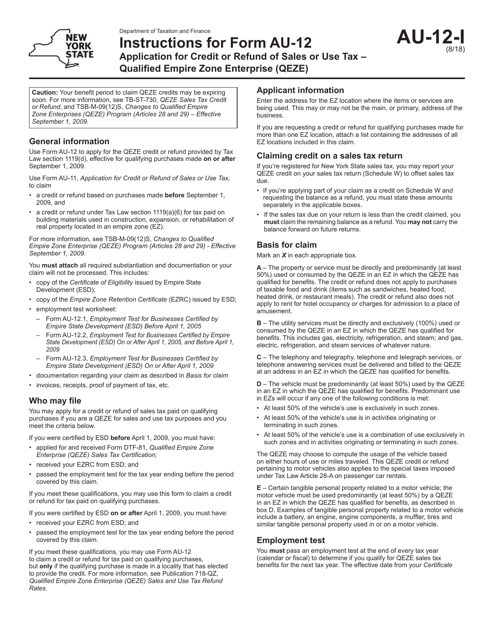

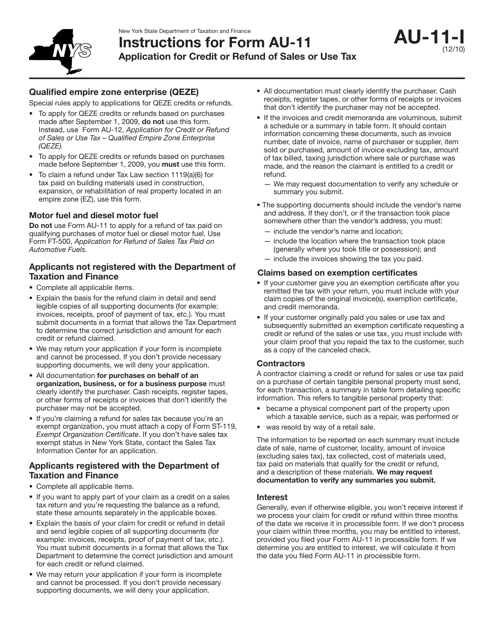

This document is for individuals or businesses in New York who want to apply for a credit or refund of sales or use tax for being a Qualified Empire Zone Enterprise (QEZE). It provides instructions on how to complete the application process.

This Form is used for applying for a credit or refund of sales or use tax in the state of New York. It provides instructions on how to complete and submit the application.

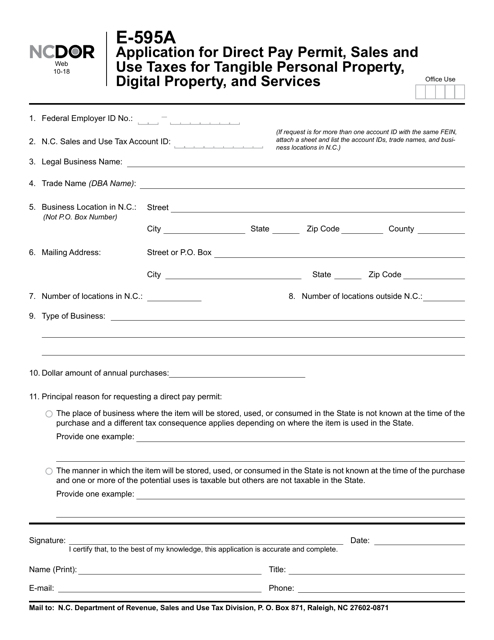

This form is used for applying for a Direct Pay Permit for sales and use taxes in North Carolina for tangible personal property, digital property, and services.

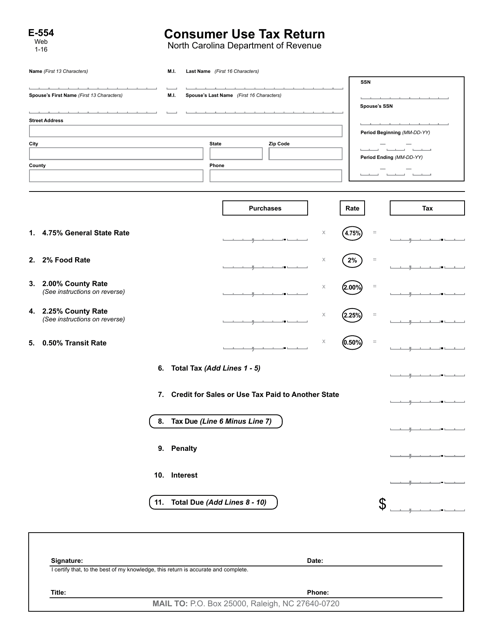

This form is used for reporting and remitting consumer use tax in the state of North Carolina. It is used by individuals who have made purchases out of state on which no sales tax was charged.

This form is used for state agency refunds of county and transit sales and use taxes in North Carolina.

This document is for businesses in North Carolina who want to claim a refund for state, county, and transit sales and use taxes. It provides instructions on how to fill out and submit Form E-588.

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

This form is used for claiming a refund on state, county, and transit sales and use taxes in North Carolina.

This Form is used for businesses in North Carolina to claim a refund on state, county, and transit sales and use taxes.

This form is used for interstate carriers to claim a refund of combined general rate sales and use taxes in North Carolina.

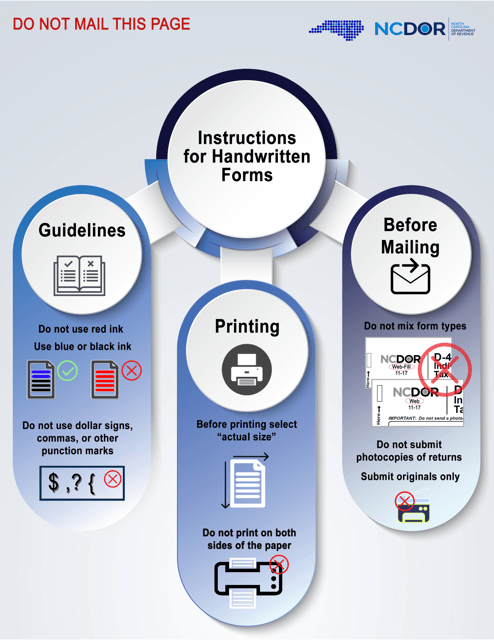

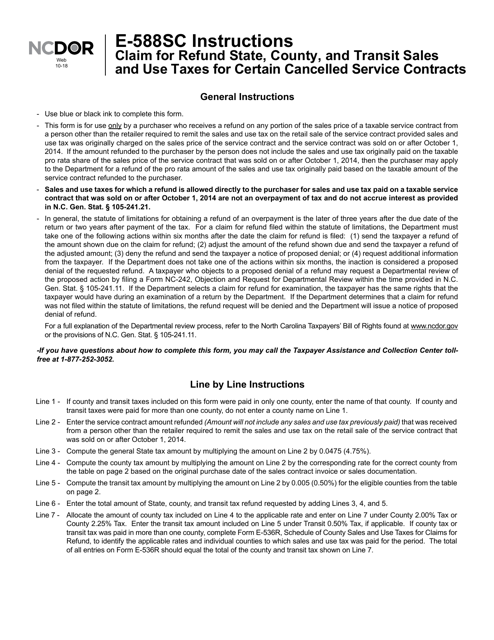

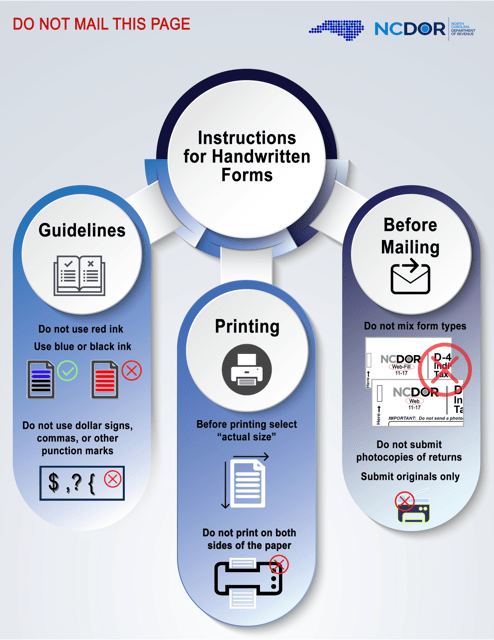

This form is used for claiming a refund for state, county, and transit sales and use taxes for certain cancelled service contracts in North Carolina. It provides instructions on how to fill out and submit the form to request a refund.

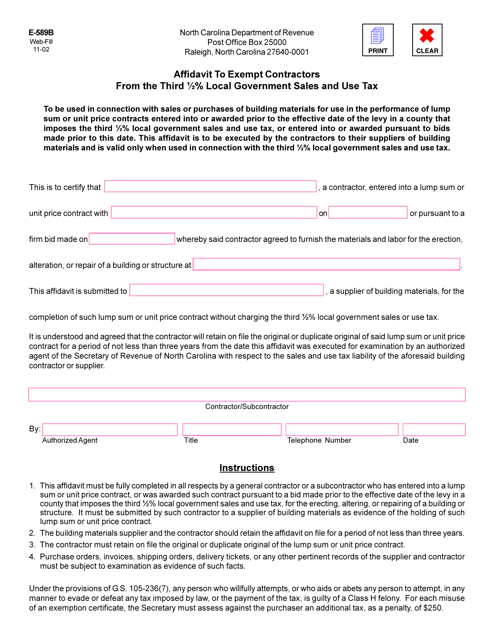

This document is for contractors in North Carolina who wish to exempt themselves from the local government sales and use tax.

This Form is used for utility companies in North Carolina to claim a refund for state, county, and transit sales and use taxes.

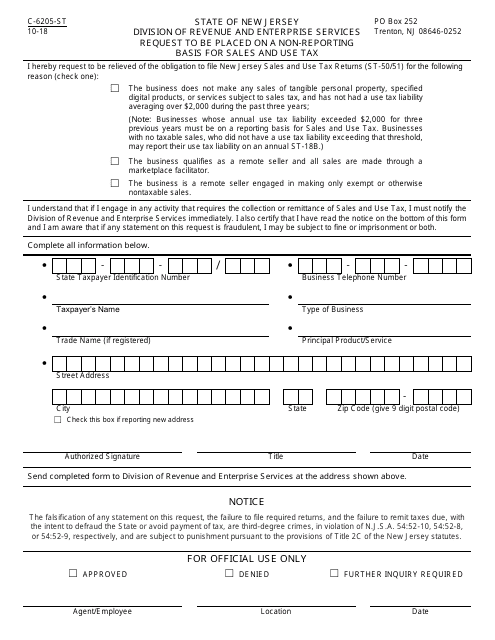

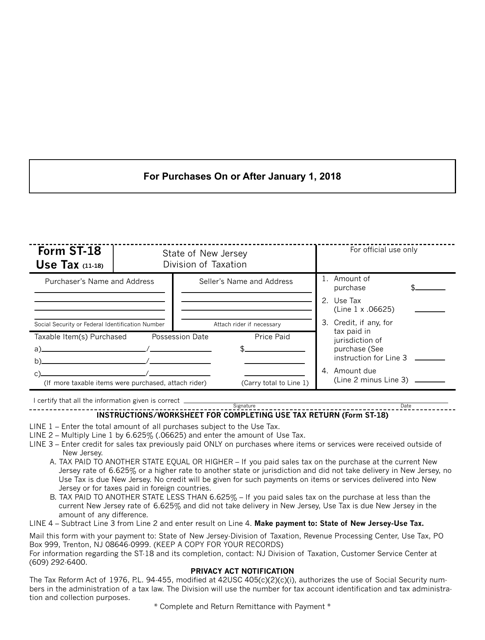

This form is used for reporting and paying use tax in the state of New Jersey. Use tax is a tax on products or services that were purchased outside of New Jersey but are being used within the state.

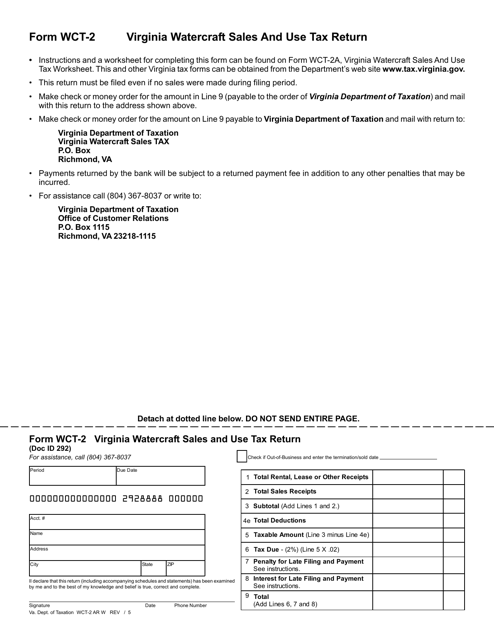

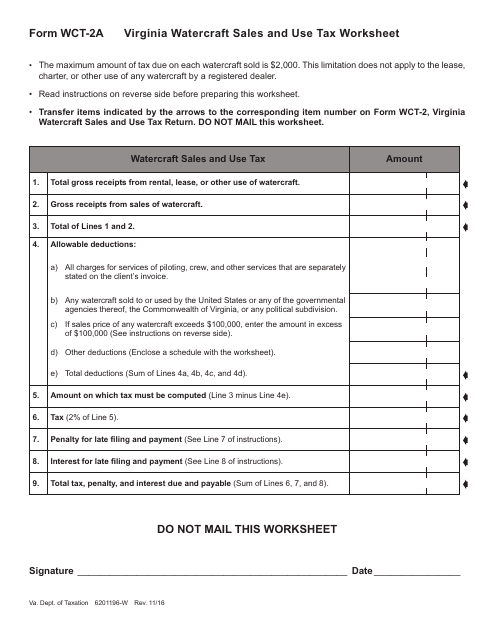

This form is used for reporting and paying sales and use tax on watercraft purchases in Virginia.

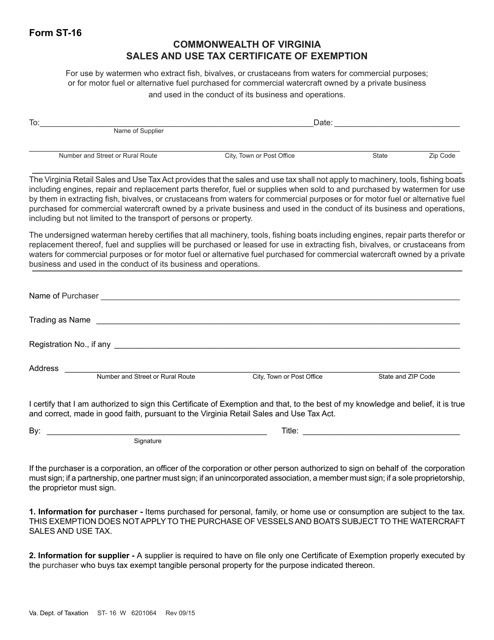

This form is used for the Sales and Use Tax Certificate of Exemption in Virginia.

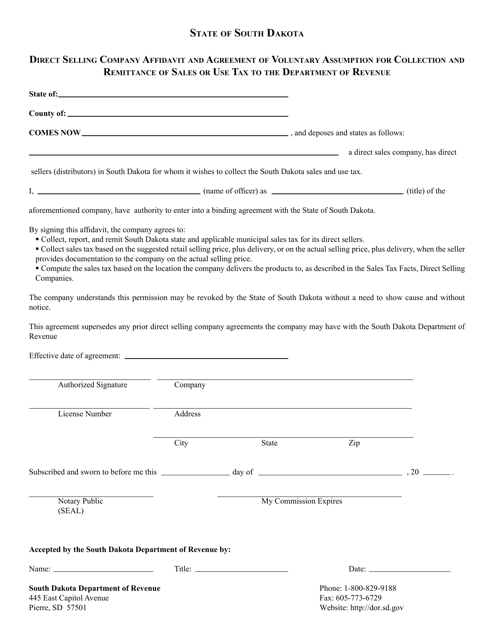

This document is used for a direct selling company to acknowledge and agree to voluntarily assume the responsibility of collecting and remitting sales or use tax to the Department of Revenue in South Dakota.

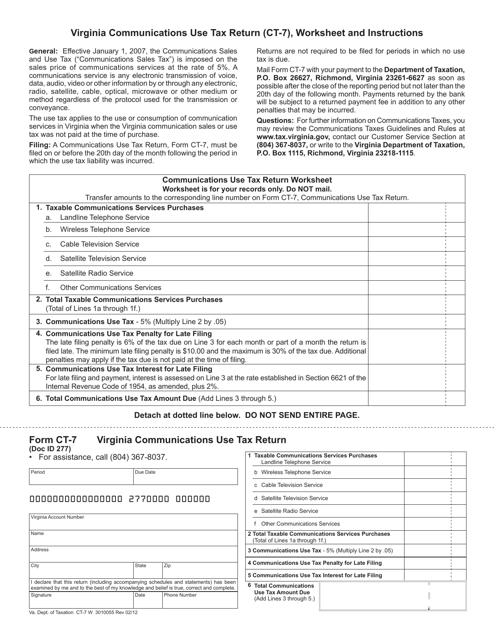

This form is used for reporting and paying the Virginia Communications Use Tax. It is applicable to businesses that provide certain taxable services in Virginia.

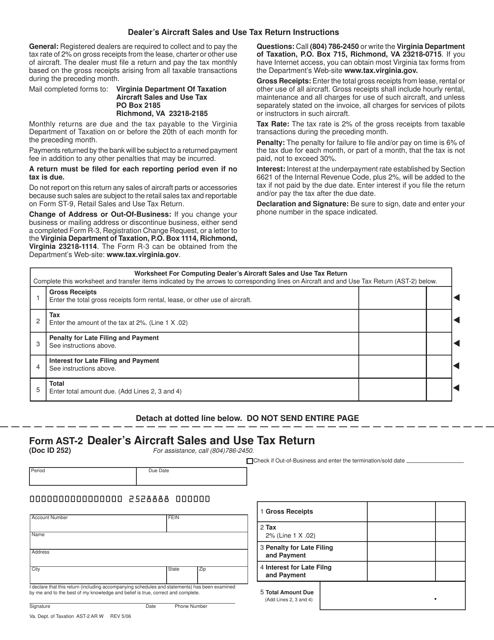

This form is used for reporting aircraft sales and use tax by dealers in Virginia.

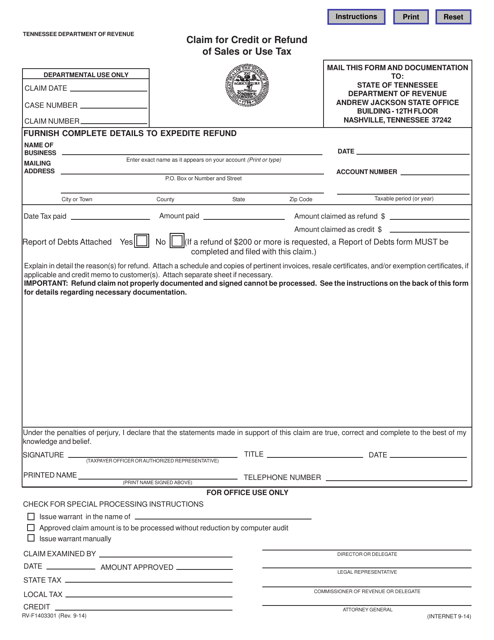

This form is used for claiming a credit or refund for sales or use tax paid in Tennessee.

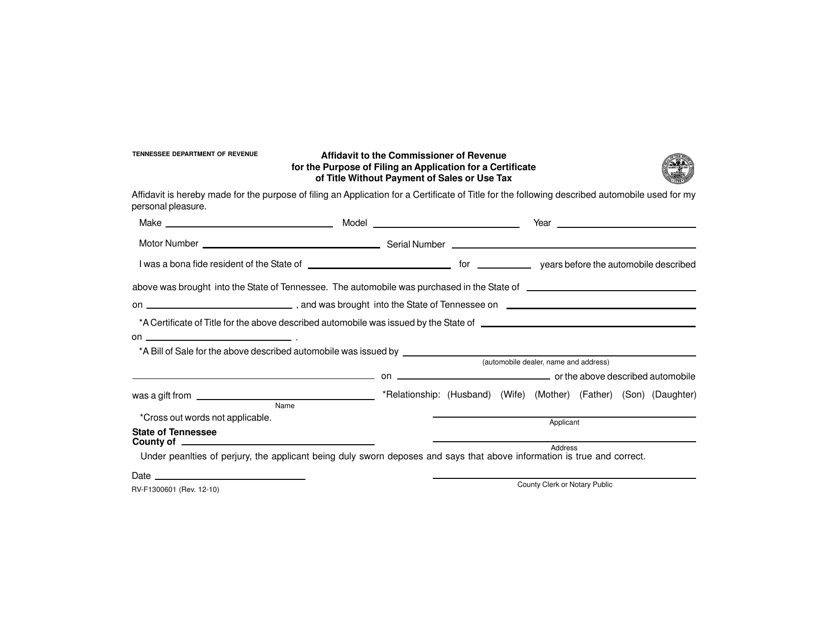

This form is used for filing an affidavit to the Commissioner of Revenue in Tennessee in order to apply for a certificate of title without payment of sales or use tax.

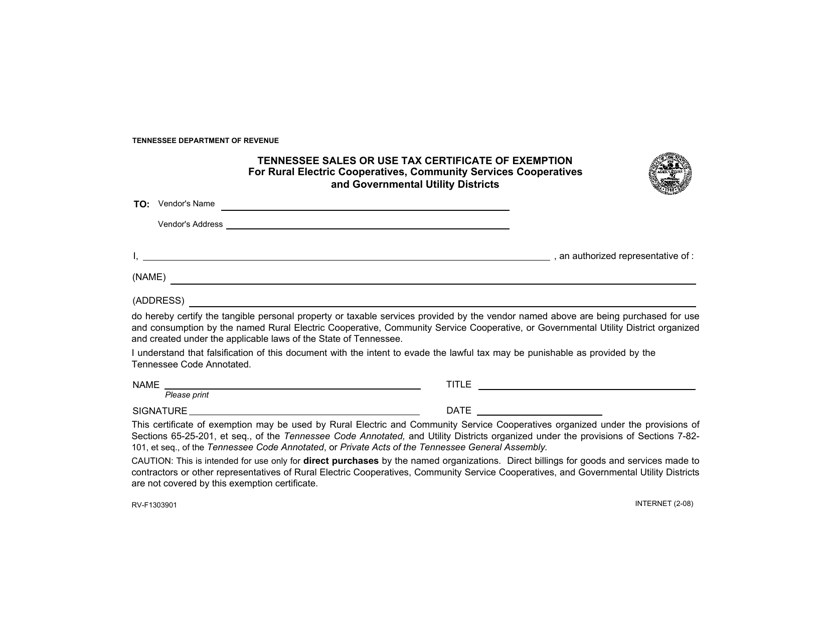

This form is used for rural electric cooperatives, community services cooperatives, and governmental utility districts in Tennessee to apply for a sales or use tax exemption certificate for certain items.