Tax Withholding Templates

Looking for information about tax withholding? You've come to the right place! Whether you refer to it as tax withholding, withholding tax, or any other variation like tax withholding form, withholding taxes, tax withholdings, or withholding tax form, we have got you covered.

Tax withholding is an essential part of the tax process for individuals and businesses alike. It involves deducting a certain amount of money from income, payments, or transactions to meet the tax obligations of the recipient. This ensures that taxes are paid regularly throughout the year, instead of in one lump sum at the end.

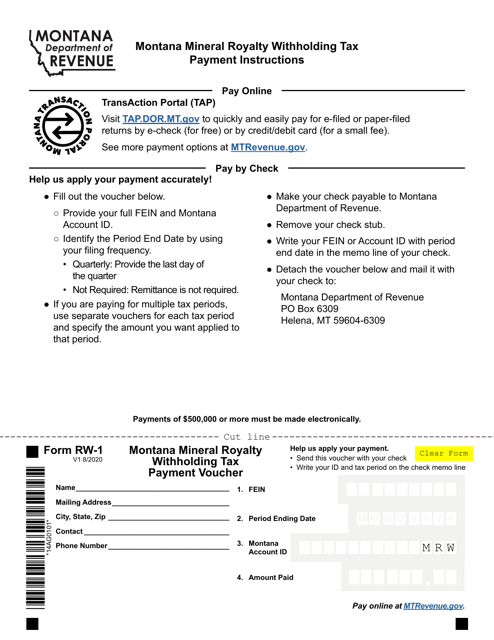

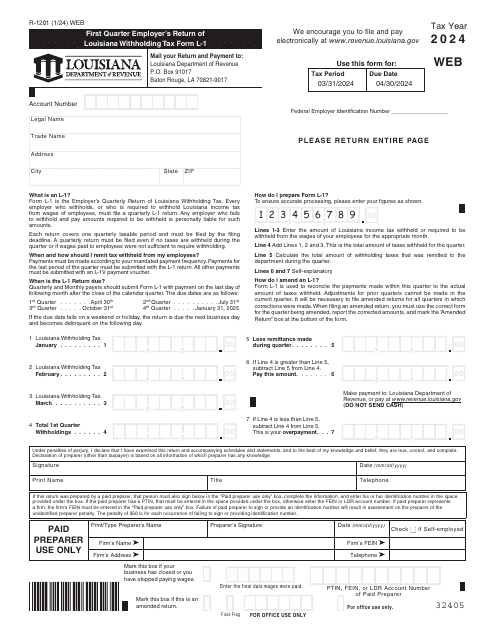

At our website, you can find a comprehensive collection of tax withholding forms, documents, and information. We provide resources from various states and jurisdictions, including states like Kansas, Montana, Florida, and Louisiana. For example, you can explore Form K-4 Employee's Withholding Allowance Certificate from Kansas, Form MW-3 Montana Annual W-2 1099 Withholding Tax Reconciliation, IRS Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding, Instructions for Form RT-6, RT-6A from Florida, and Form L-1 (R-1201) First Quarter Employer's Return of Louisiana Withholding Tax.

With our user-friendly interface and comprehensive documentation, you can easily navigate through the world of tax withholding. Whether you are an individual seeking clarity about your tax obligations or a business owner trying to understand the rules for employee withholding, we have the resources you need.

Take advantage of our extensive collection of tax withholding forms, guides, and informational materials. Stay informed, make informed decisions, and ensure compliance with tax withholding requirements. Start exploring now and simplify your tax withholding process!

Note: The text above provides a general overview of tax withholding and highlights the availability of various tax withholding forms and documents. The actual text for the webpage will be longer and contain additional information and relevant keywords for SEO optimization.

Documents:

407

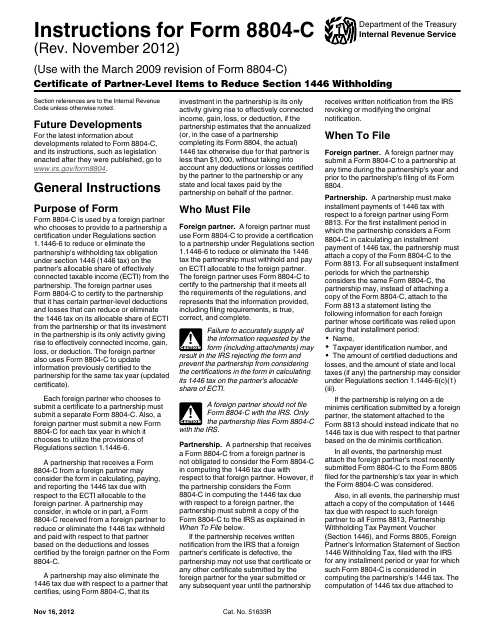

This form is used for reporting partner-level items that can reduce the amount of withholding tax under Section 1446.

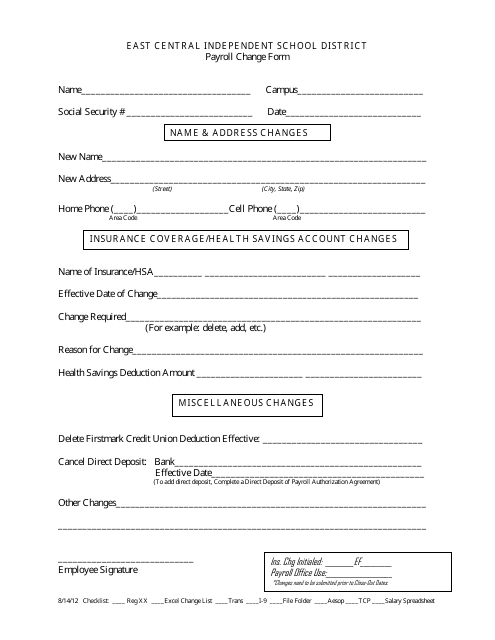

This form is used for making changes to payroll information for employees of East Central Independent School District in Texas.

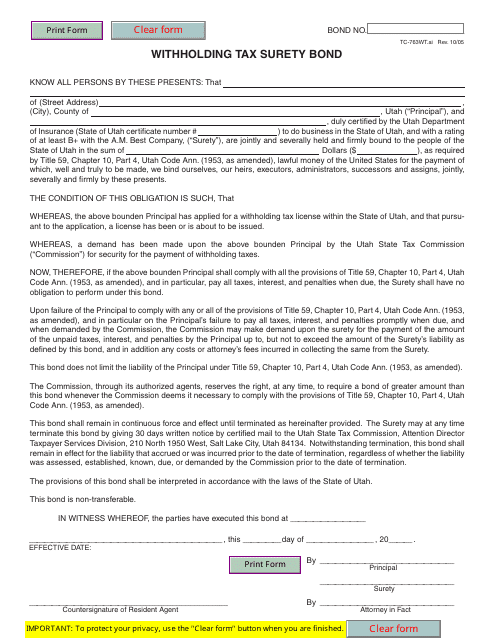

This form is used for filing a withholding tax surety bond in the state of Utah.

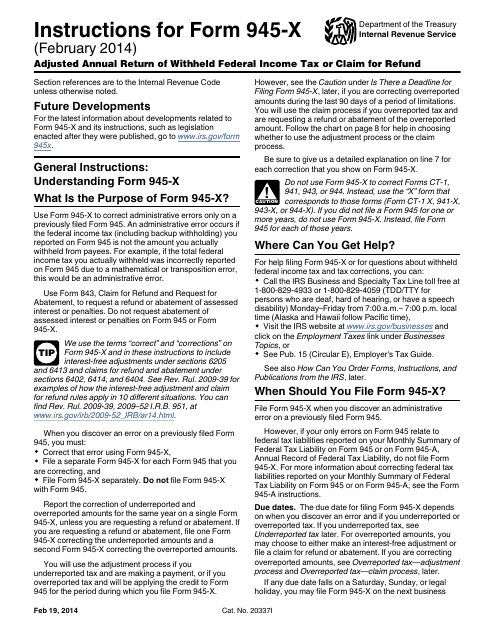

This Form is used for making adjustments to the annual return of withheld federal income tax or claiming a refund. It is specifically designed for the IRS Form 945-X.

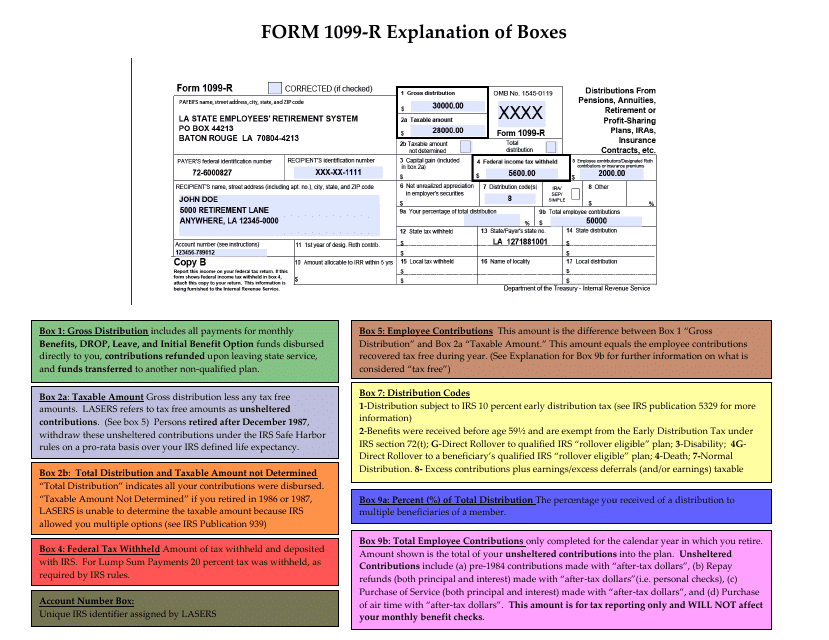

This document provides instructions for IRS Form 1099-R, which is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other types of retirement accounts. The document explains the different boxes on the form and how to fill them out accurately.

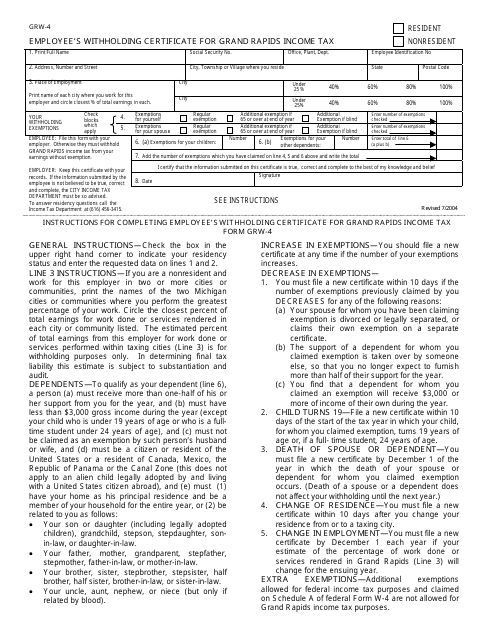

This form is used for employees in Grand Rapids, Michigan to declare their withholding certificate for Grand Rapids income tax.

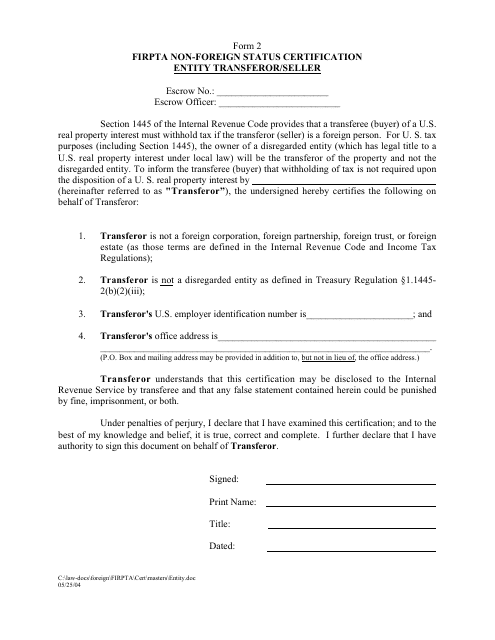

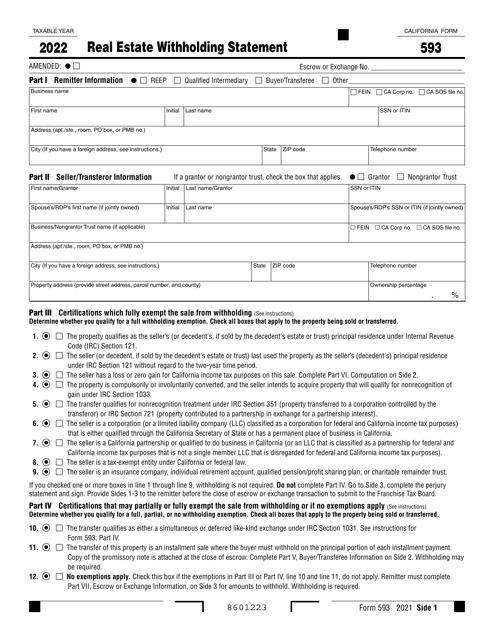

This document certifies the non-foreign status of an entity that is selling or transferring a property under the Foreign Investment in Real Property Tax Act (FIRPTA).

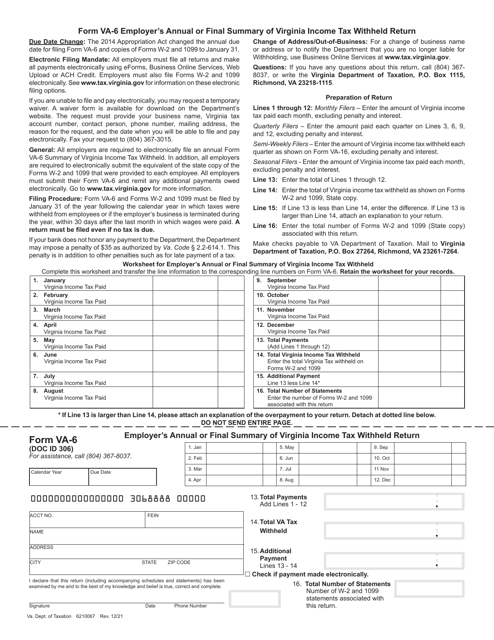

This Form is used for reconciling withholding taxes for the City of Vandalia, Ohio.

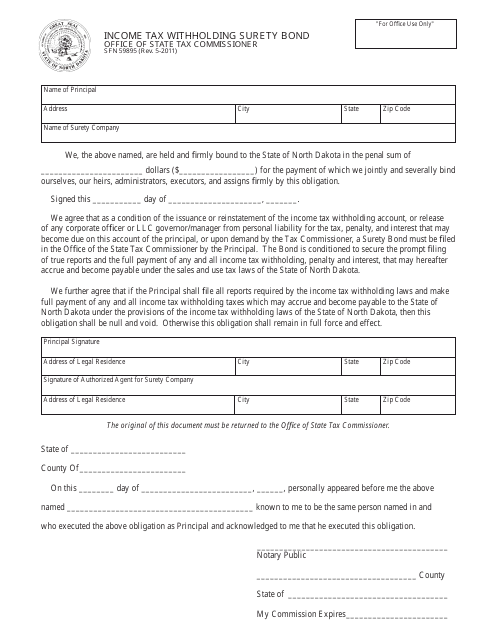

This form is used for obtaining a surety bond for income tax withholding in the state of North Dakota.

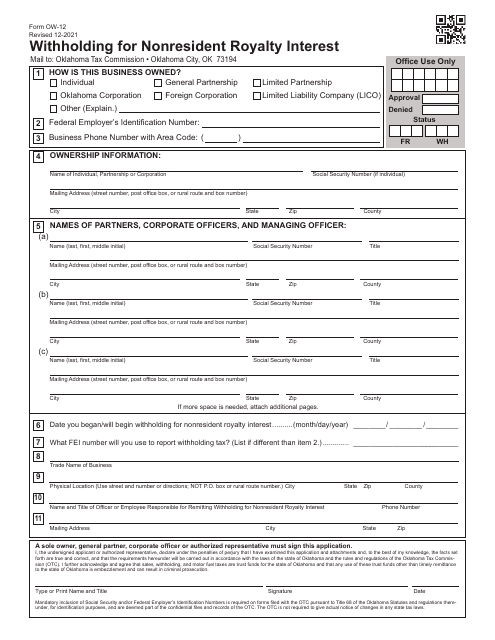

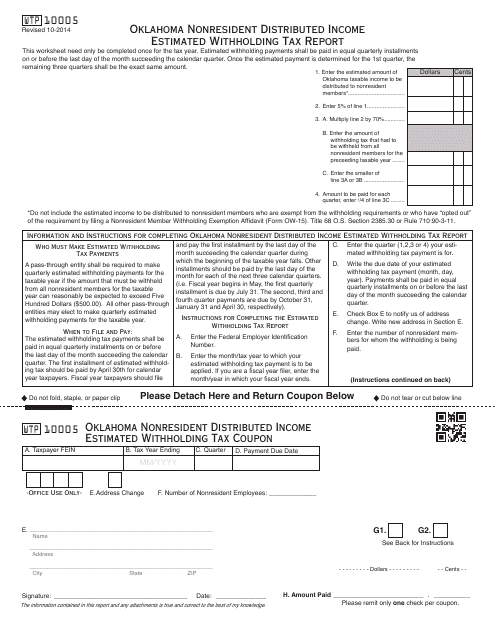

This form is used for reporting estimated withholding tax on distributed income for nonresidents in Oklahoma.

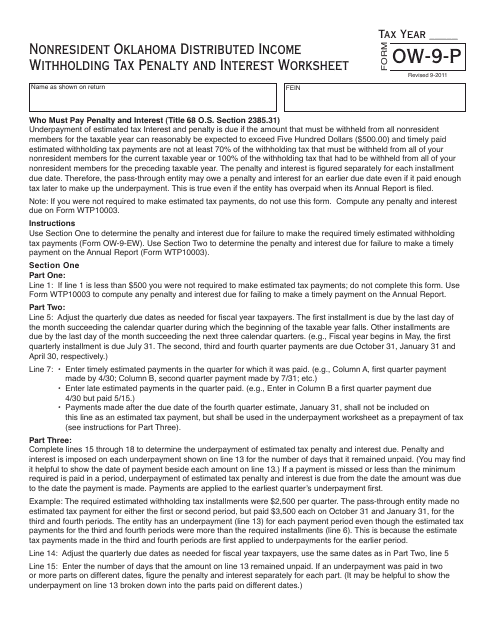

This form is used for calculating the penalty and interest on distributed income for nonresidents in Oklahoma.

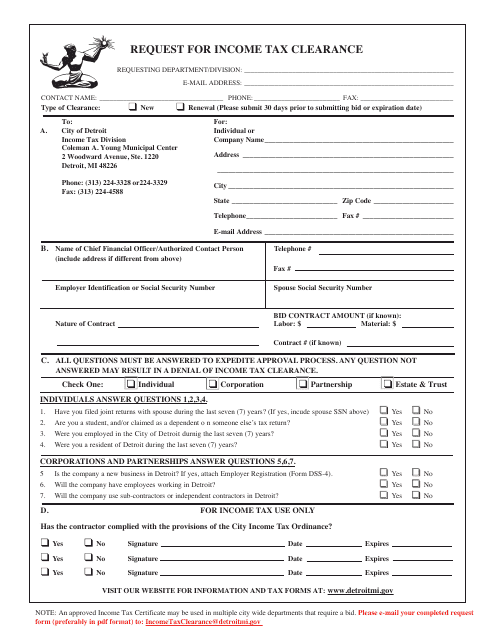

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

This is a supplementary form used by employers to handle errors they have made upon filing IRS Form W-2, Wage and Tax Statement.

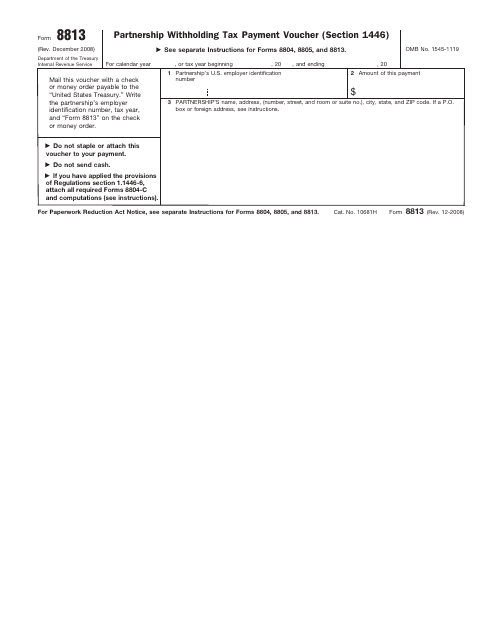

This form is used for making tax payments by partnerships to comply with Section 1446 of the Internal Revenue Code.

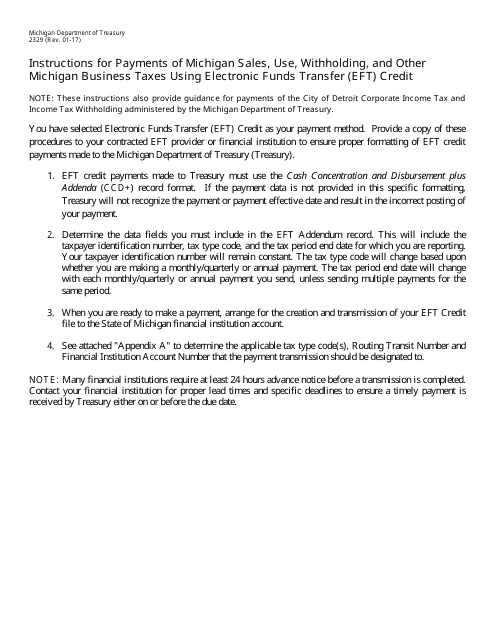

This form provides instructions for making electronic payments for various types of Michigan business taxes, including sales tax, use tax, withholding tax, and other taxes. It explains how to use the Electronic Funds Transfer (EFT) credit method for submitting these payments.

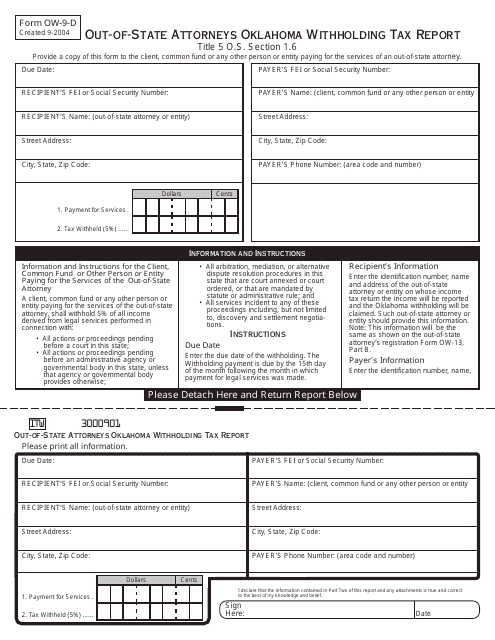

This form is used for Out-of-State Attorneys in Oklahoma to report Oklahoma withholding tax.

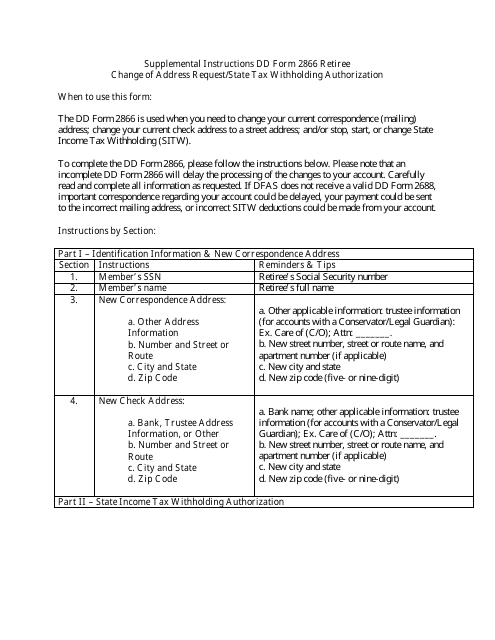

This document is used for retirees to request a change of address and authorize state tax withholding. It provides instructions on how to complete DD Form 2866.

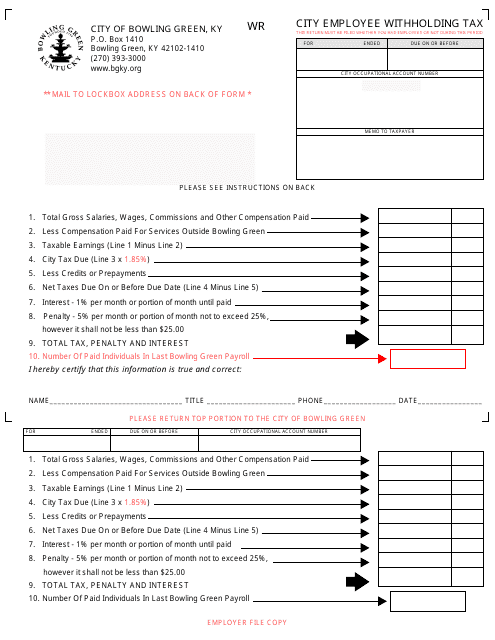

This form is used for the City of Bowling Green, Kentucky employees to report and withhold their city income taxes.

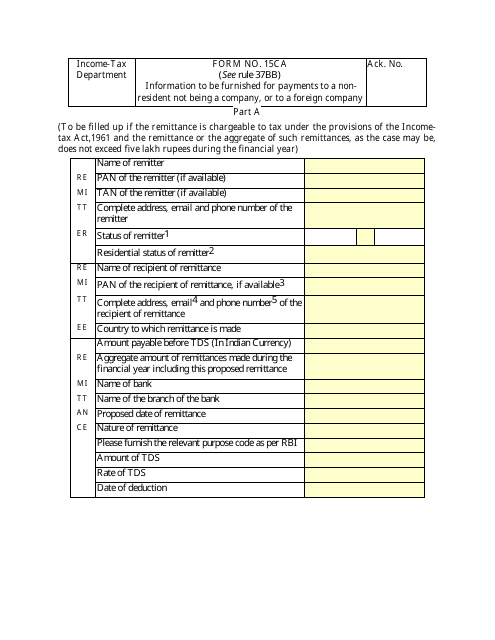

This form is used for providing information about payments made to non-residents or foreign companies in India. It is necessary for tax purposes and ensuring compliance with Indian regulations.

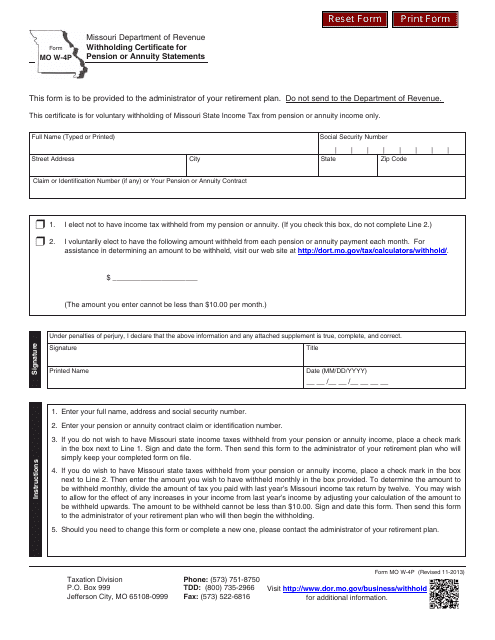

This form is used for pension or annuity statements in Missouri to determine the amount of withholding tax to be deducted from payments.

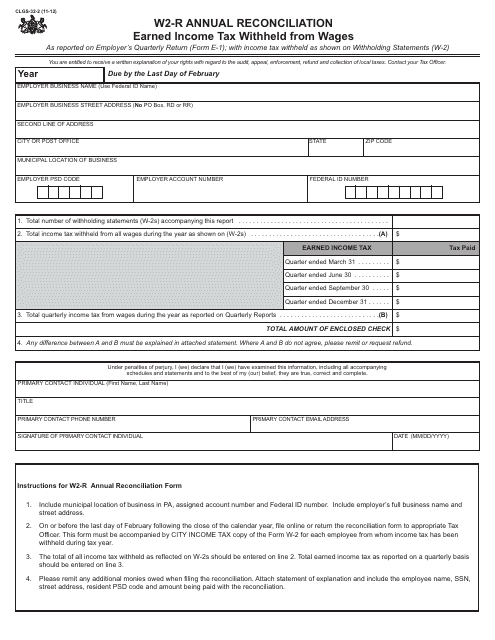

This form is used for the annual reconciliation of local earned income tax withheld from wages in Pennsylvania by employers.

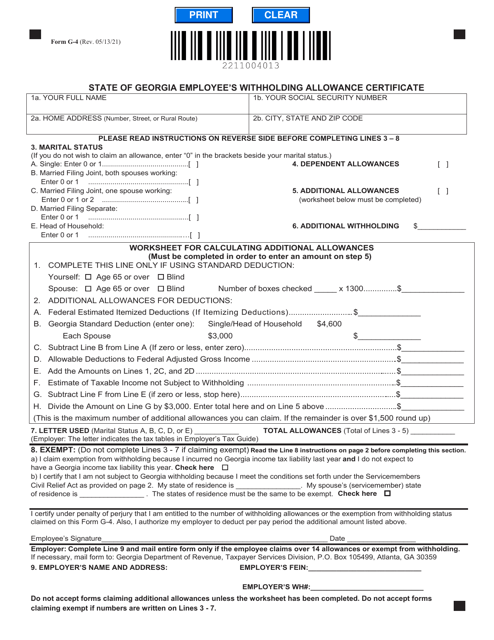

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

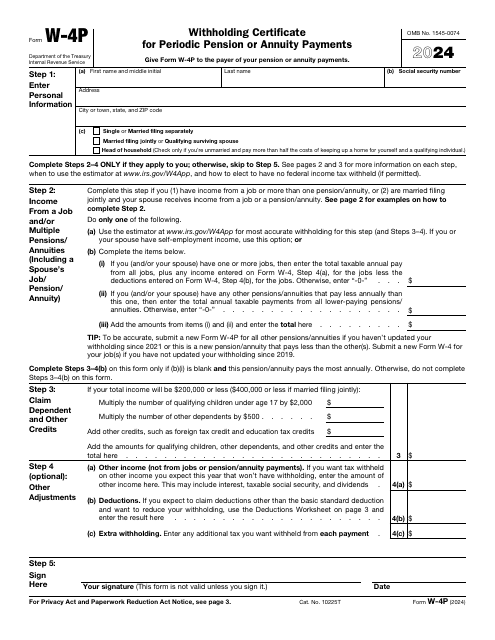

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

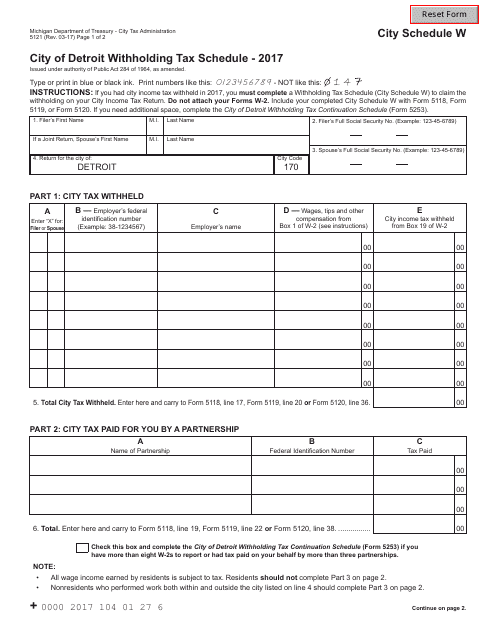

This form is used for reporting and calculating the withholding tax for City of Detroit residents in Michigan.