Tax Planning Templates

Are you looking for effective strategies to minimize your tax liability and maximize your financial well-being? Our tax planning documents provide you with the tools and resources you need to navigate the complex world of taxation. Whether you're a farmer or fisherman looking to utilize income averaging, a business owner seeking deductions for qualified business income, or an individual with itemized deductions, our extensive collection of tax planning documents has you covered.

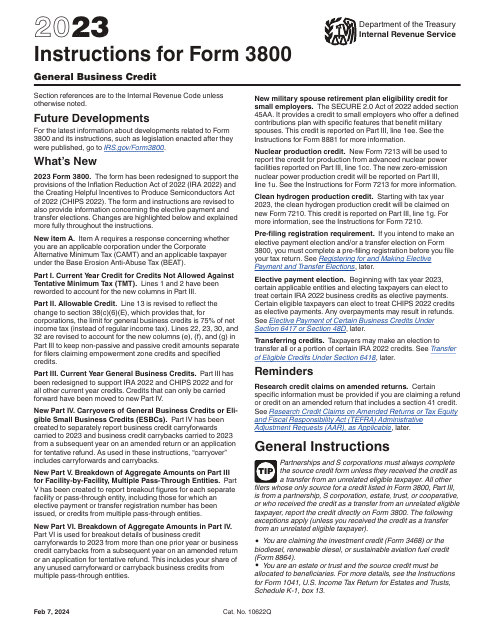

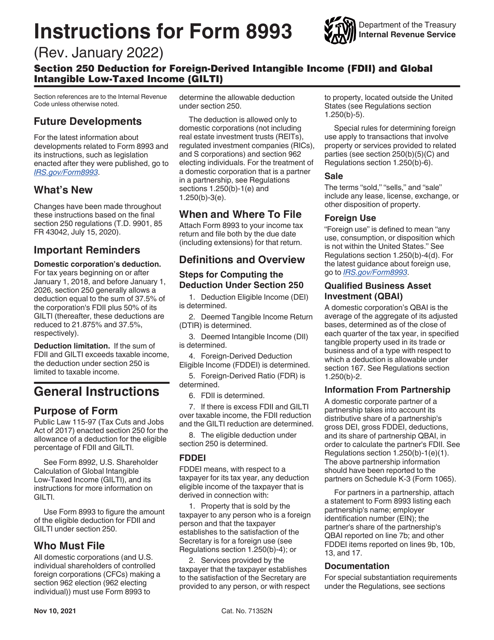

Our tax planning documents cover a wide range of topics, from state-specific disclosure statements like the Form CT-8886 Connecticut Listed Transaction Disclosure Statement, to federal forms such as the IRS Form 1040 Schedule J for Income Averaging. We also provide detailed instructions for completing forms like the IRS Form 8995-A for the deduction of qualified business income, and the IRS Form 1040 Schedule A for itemized deductions.

When it comes to tax planning, having the right information at your fingertips is crucial. Our tax planning documents empower you to make informed decisions, ensuring you take advantage of all available tax breaks while staying in compliance with the ever-changing tax laws.

Don't let tax season stress you out - let our tax planning documents be your guide. Take control of your financial future and optimize your tax strategy with our comprehensive collection of tax planning resources. Start exploring our tax planning documents today and reap the benefits of smart tax planning.

Documents:

161

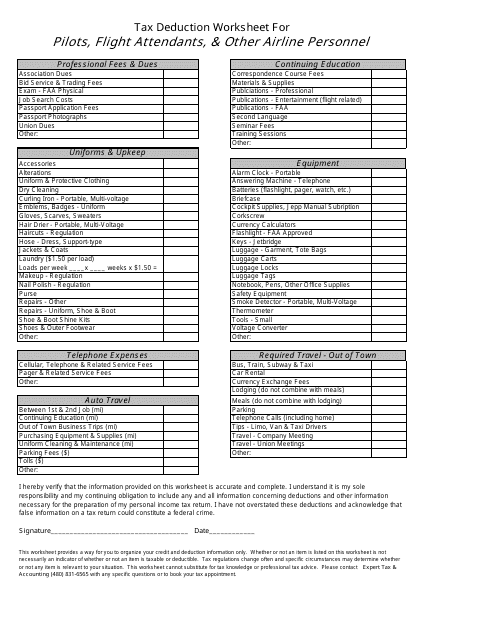

This form is used for calculating tax deductions specific to pilots, flight attendants, and other airline personnel. It helps ensure that eligible expenses related to work in the aviation industry are properly accounted for.

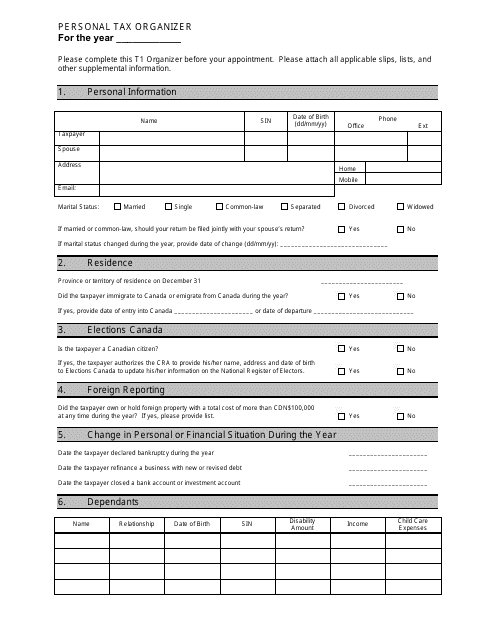

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

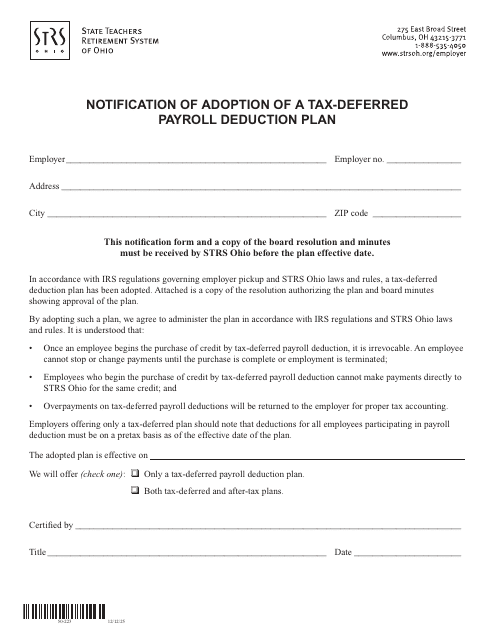

This document is a notification of the adoption of a tax-deferred payroll deduction plan by the State Teachers Retirement System of Ohio. It provides information about the plan and how it will affect Ohio teachers' retirement savings.

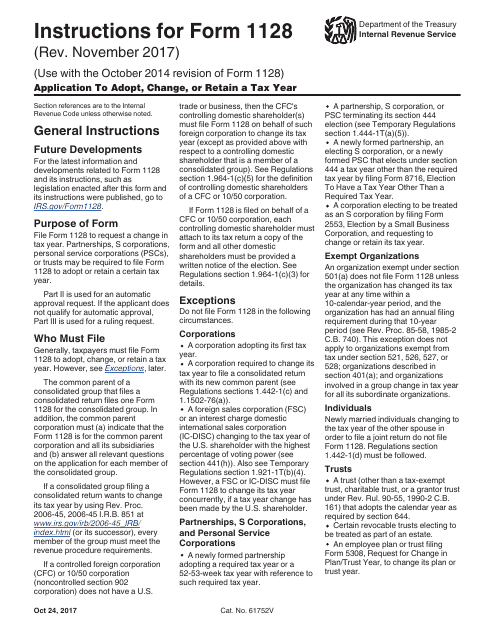

These are instructions for IRS Form 1128, Application to Adopt, Change, or Retain a Tax Year.

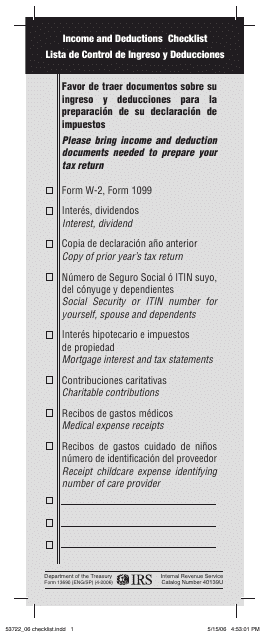

This form is used for checking income and deductions. It is available in both English and Spanish.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

This guide provides essential information and tips for starting a small business in Northern California. Learn about local regulations, permits, and resources to help you navigate the start-up process.

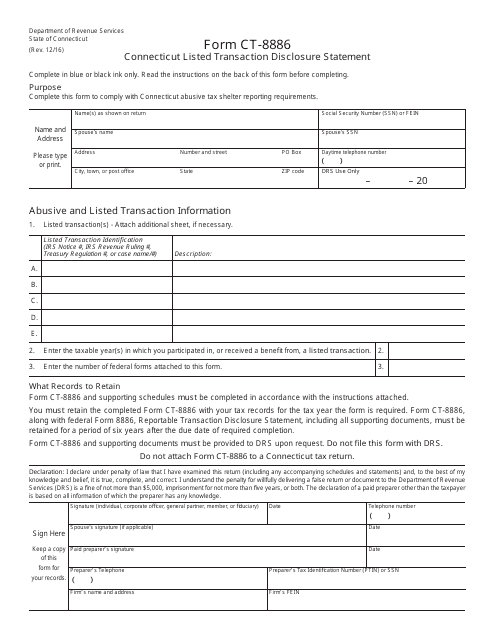

This Form is used for disclosing listed transactions in Connecticut.

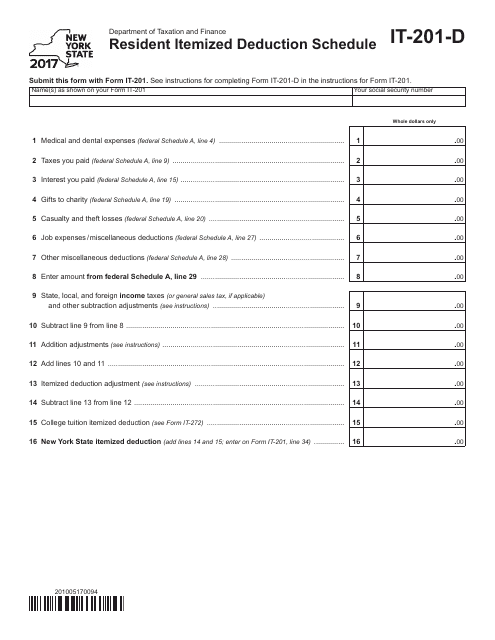

This form is used for reporting itemized deductions for residents of New York on their state tax return.

This form is used for reporting and paying inheritance tax for residents of New Jersey.

This is a document you may use to figure out how to properly complete IRS Form 6765

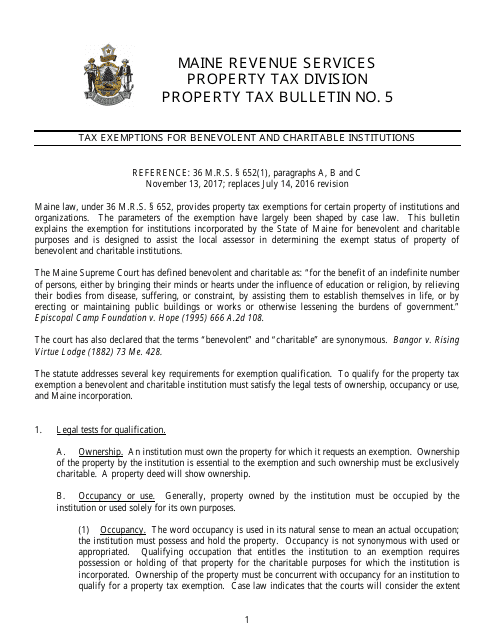

This document provides information about tax exemptions available to benevolent and charitable institutions in the state of Maine. It outlines the eligibility criteria and the process for obtaining these exemptions.

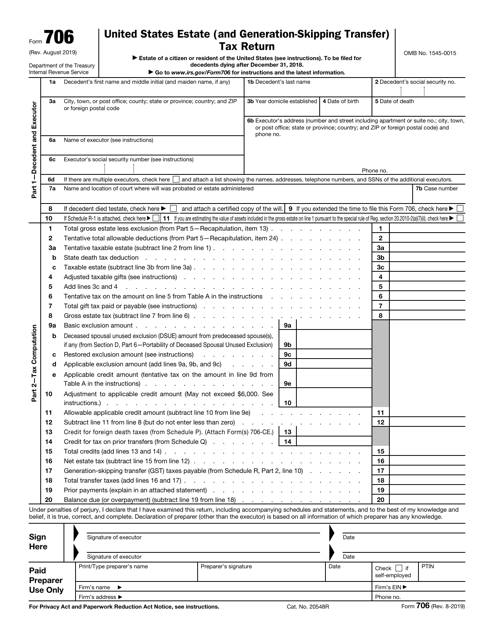

This is a formal statement prepared and submitted by estate administrators to calculate the estate tax liability of the person that recently died.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

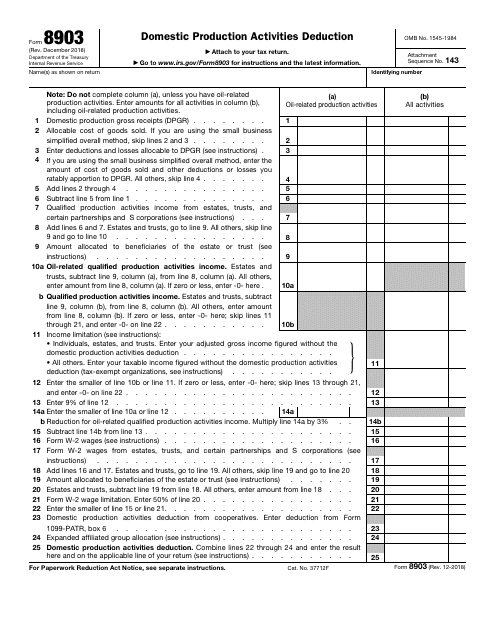

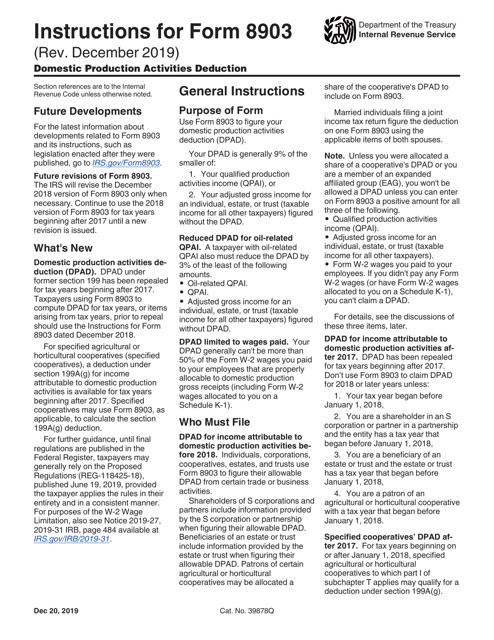

This Form is used for claiming the Domestic Production Activities Deduction on your federal tax return. It is for businesses that engage in certain qualified production activities within the United States.

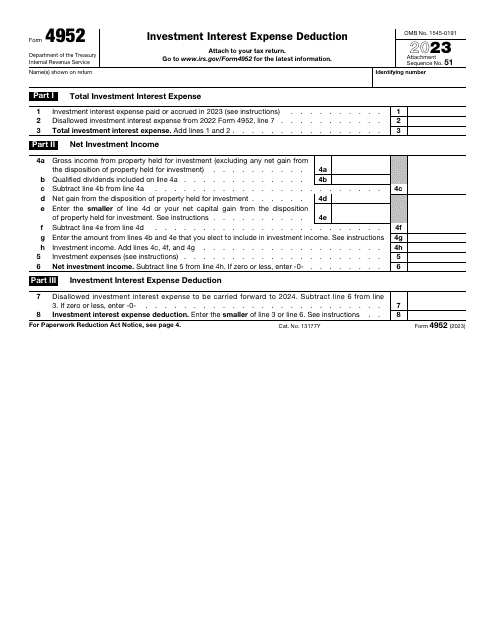

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

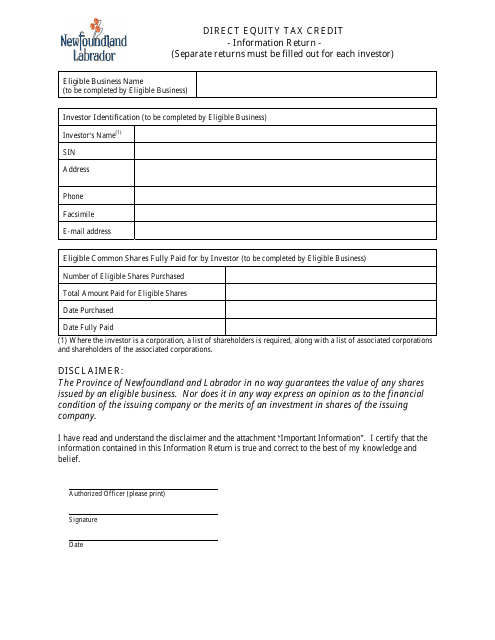

This document provides information on the Direct Equity Tax Credit Program in Newfoundland and Labrador, Canada. The program offers tax credits for investments in eligible businesses.