Tax Planning Templates

Documents:

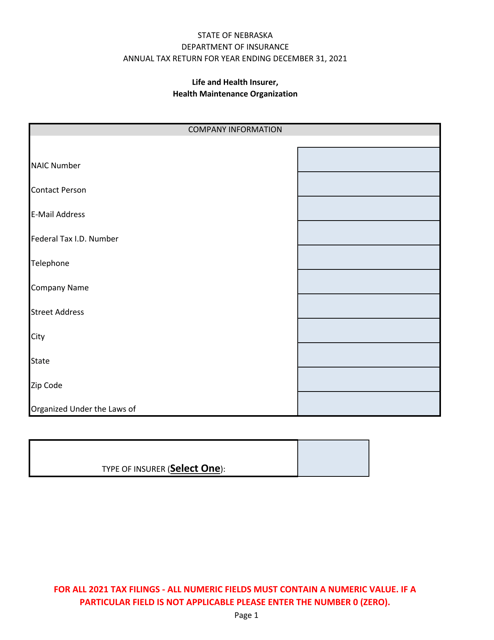

161

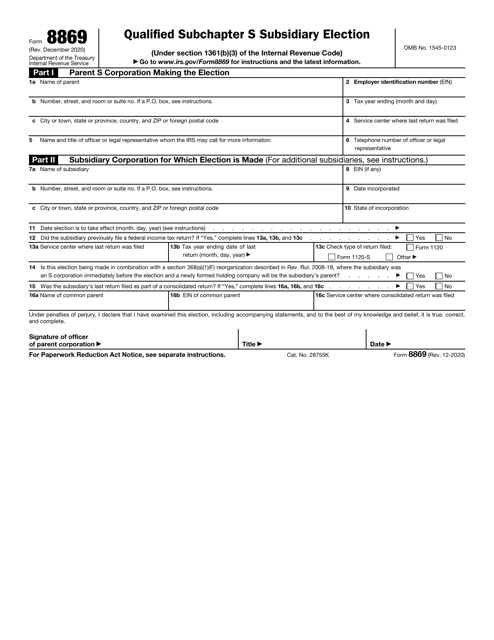

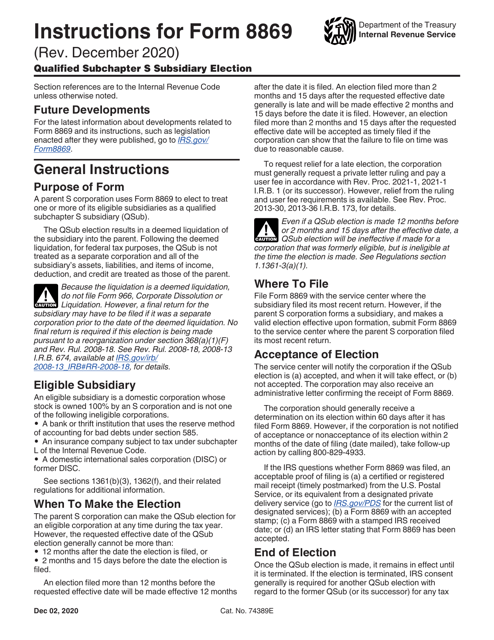

This Form is used for electing to treat a domestic corporation as a Qualified Subchapter S Subsidiary (QSub).

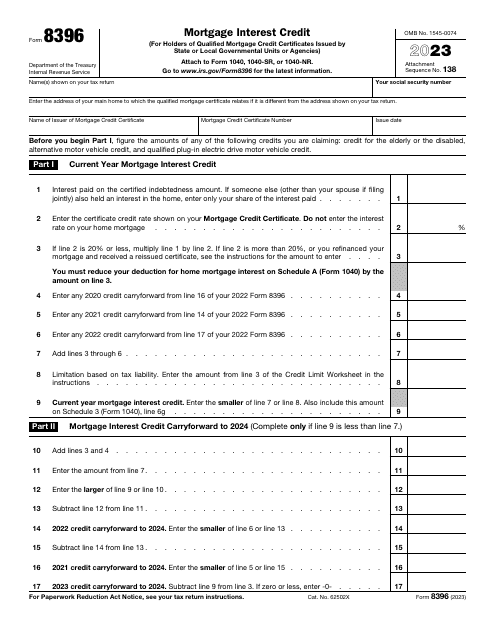

This is a formal document filled out by taxpayers in order to compute the amount of mortgage interest credit over the course of the year and report the information to fiscal authorities.

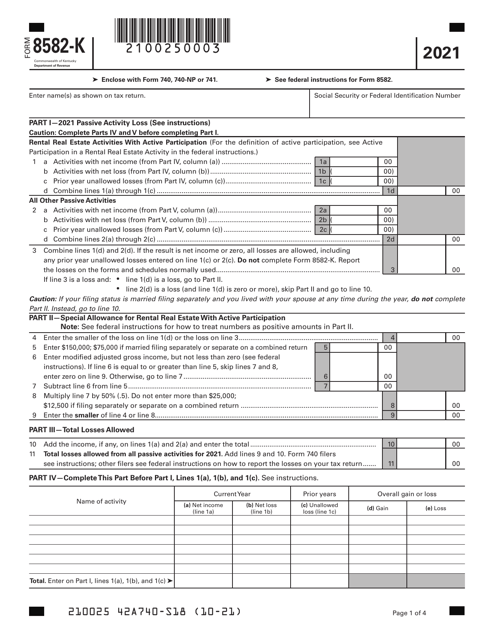

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

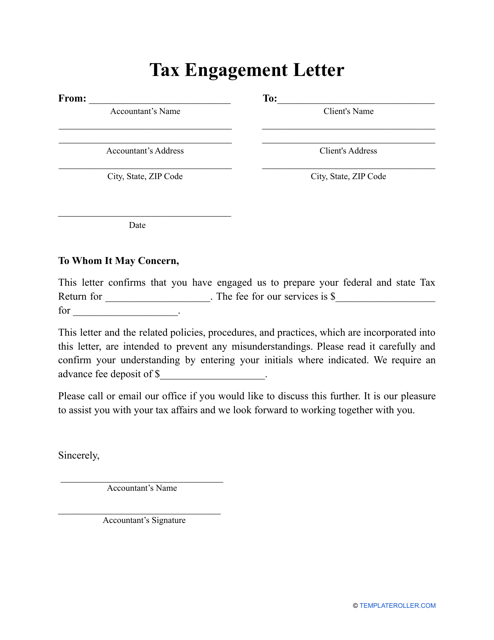

Complete this template to describe the work to be performed, the terms and conditions of performing that work, any limitations, and payment terms to the client.

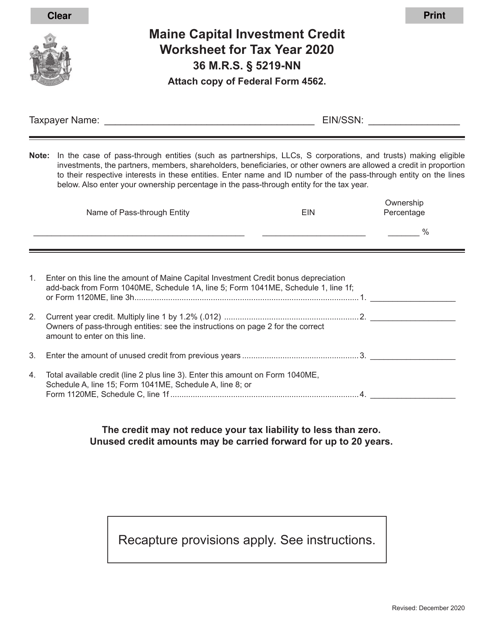

This document is used for calculating the capital investment credit in the state of Maine. It helps individuals and businesses determine the amount of credit they may be eligible for based on their qualified investments in certain industries.

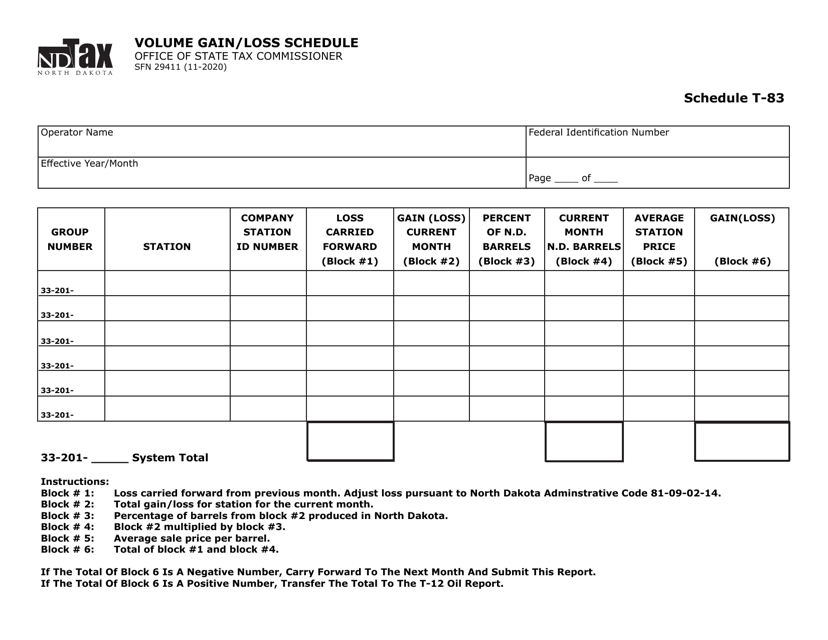

This Form is used for reporting volume gain or loss for certain transactions in North Dakota.

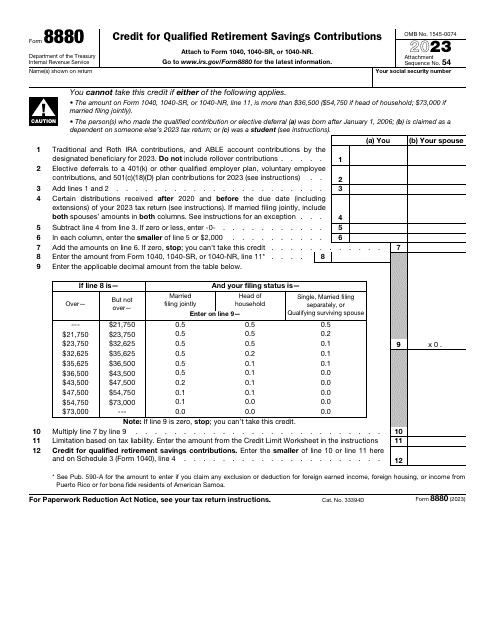

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.

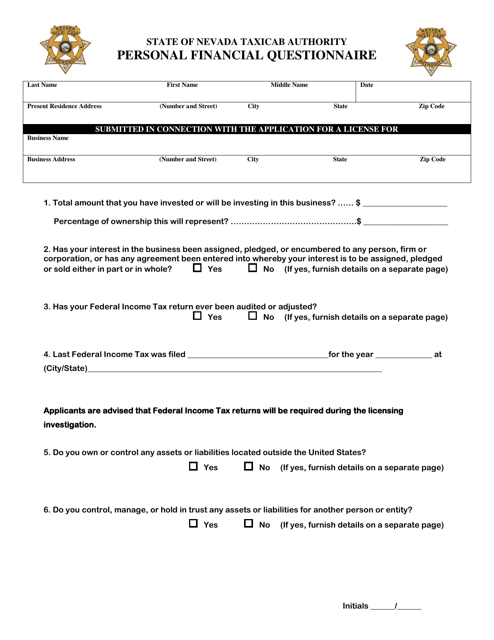

This document is for gathering personal financial information in the state of Nevada. It helps individuals to assess their financial situation.

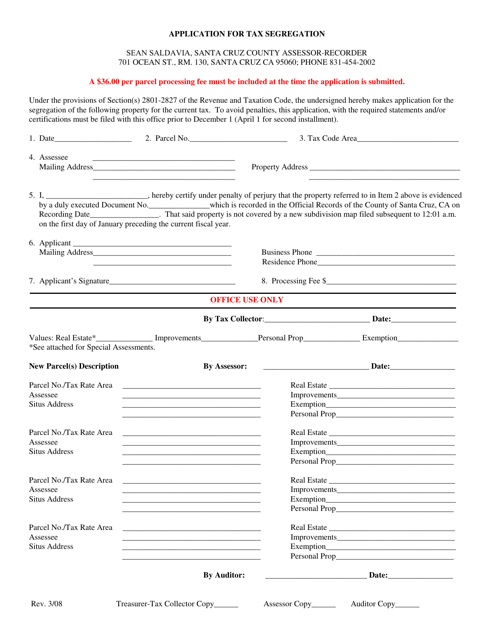

This document is an application form used in Santa Cruz County, California for requesting tax segregation. Tax segregation is a method of allocating costs of real property between different asset classes to optimize tax deductions.

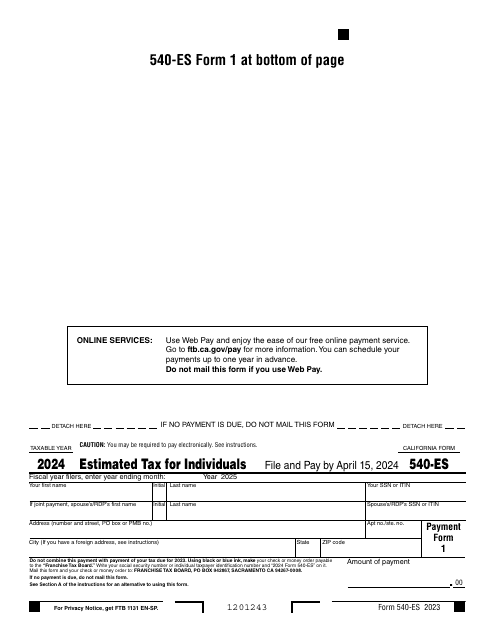

Fill out this form over the course of a year to pay your taxes in the state of California.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.