Tax Planning Templates

Documents:

161

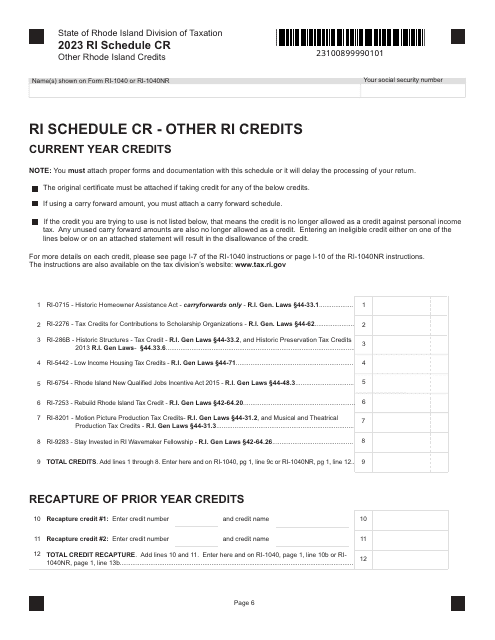

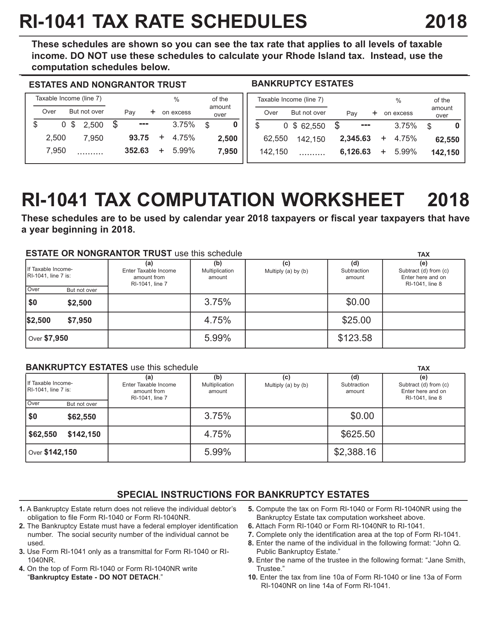

This form is used for calculating the tax rates and liabilities for fiduciaries in Rhode Island.

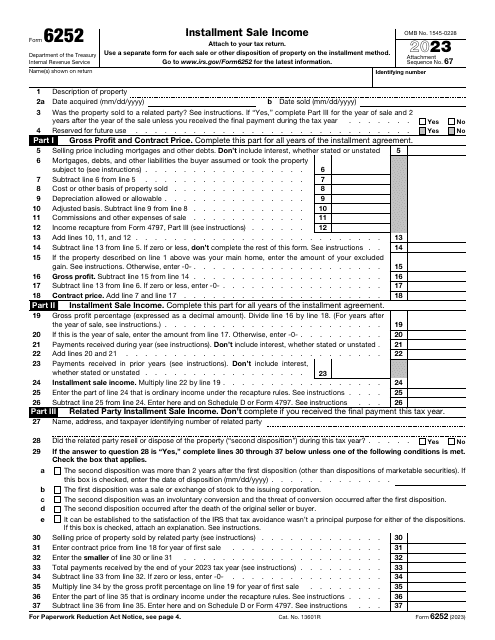

This is an IRS form that includes the details of an installment sale.

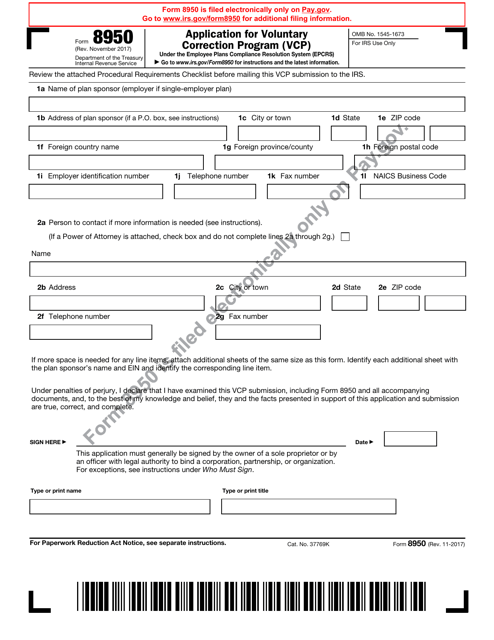

This form is used for applying to the IRS Voluntary Correction Program (VCP). The VCP allows employers to correct errors in their retirement plans and avoid penalties.

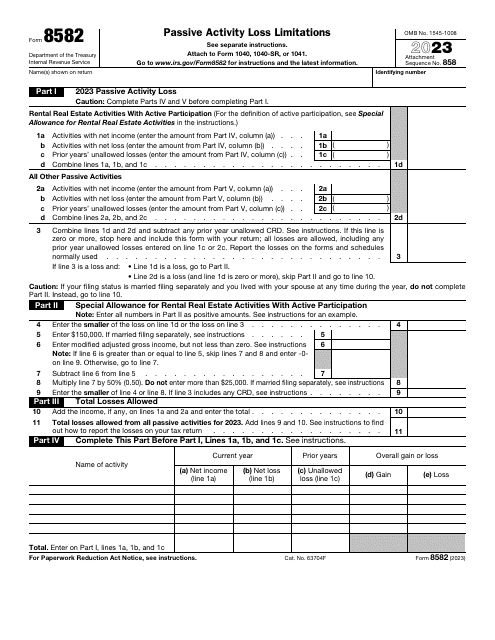

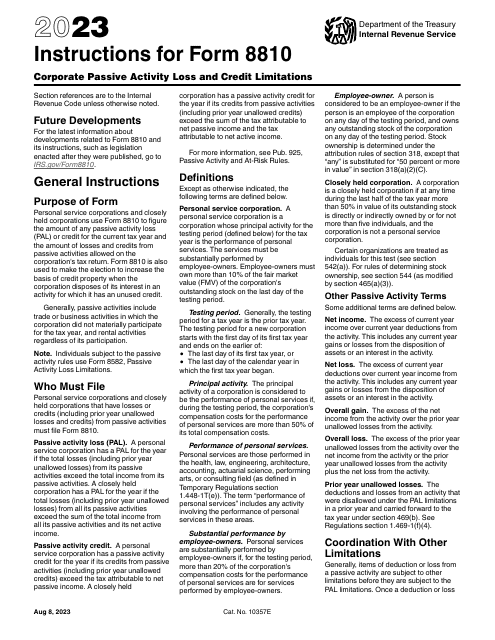

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

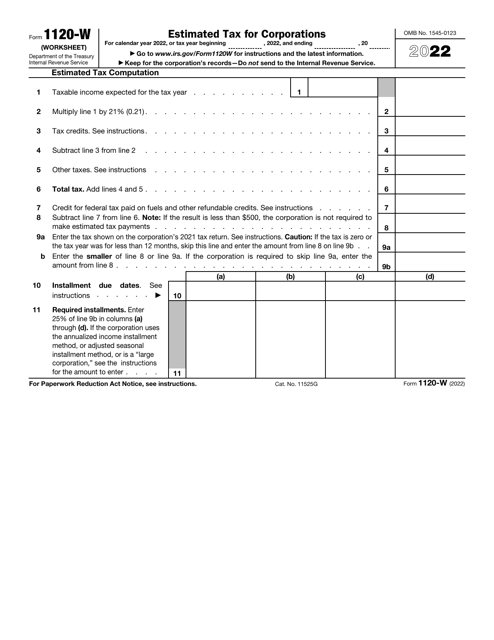

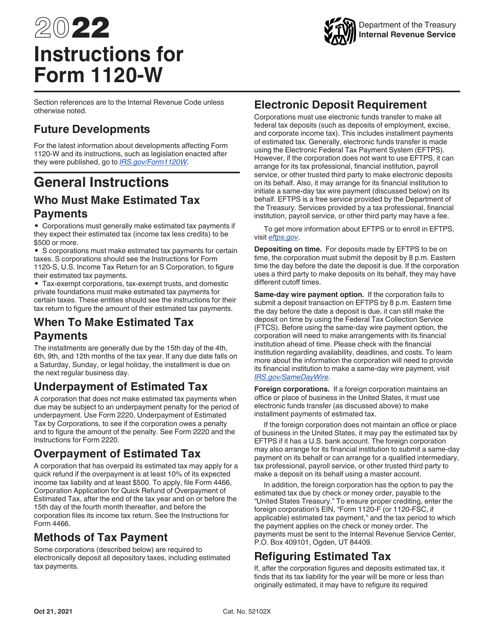

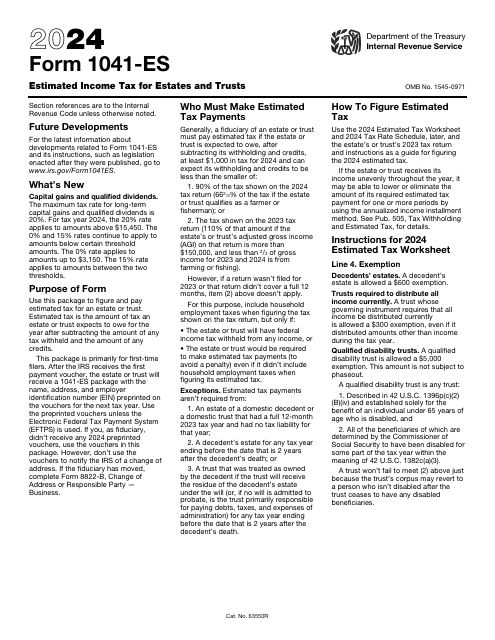

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

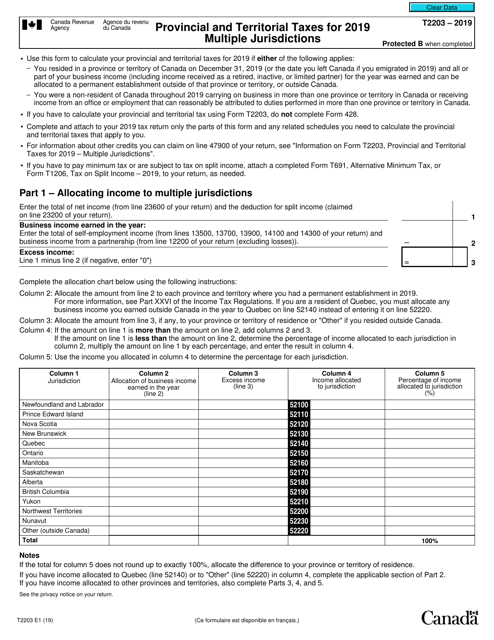

This form is used for calculating and reporting provincial and territorial taxes for multiple jurisdictions in Canada. It is used by individuals who have income or are residents in more than one province or territory.

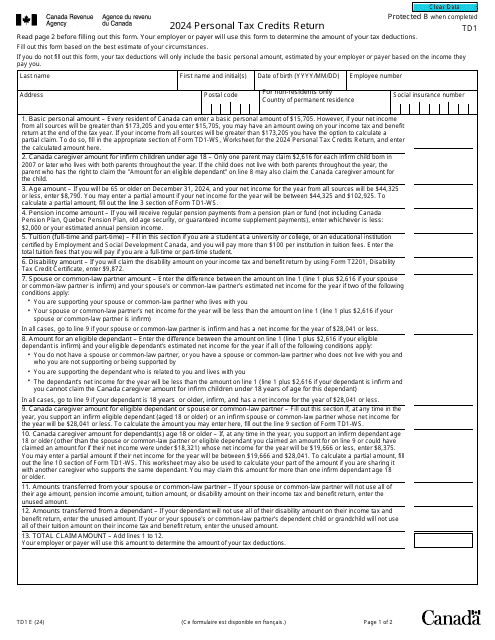

The purpose of this document is to provide a taxpayer's employer with all of the necessary information so that they will be able to determine the number of tax deductions for the Canadian taxpayer.

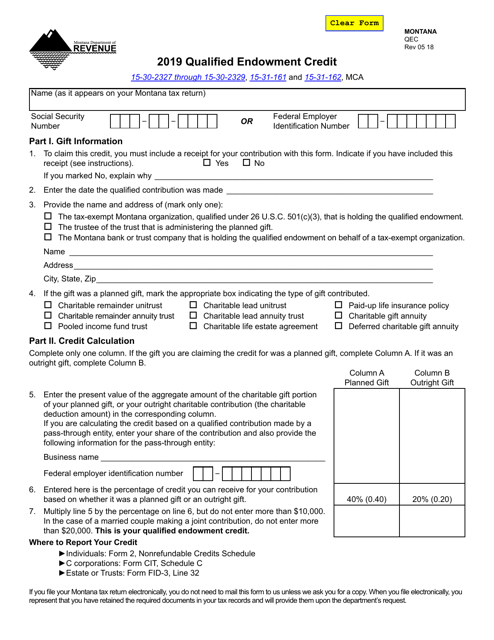

This Form is used for claiming the Qualified Endowment Credit in Montana. The credit is available to individuals and businesses contributing to qualified endowment funds.