Self Employment Templates

Documents:

284

If you are an Ohio resident, this type of agreement is a critical document for those individuals wanting to establish and outline in writing certain terms that are agreed upon by a customer and an independent contractor.

This type of template is needed in Oklahoma in instances when a customer is forming a business relationship with an independent contractor.

This template is used in Oregon to detail in writing all conditions that are effective when an agreement between a client and an independent contractor is formed.

This is a document used in Rhode Island that needs to be signed by an independent contractor and the customer that has hired them, regardless of whether or not their customer is a business or a private individual.

If you are a South Dakota resident, this type of agreement is a critical document for those individuals wanting to establish and outline in writing certain terms that are agreed upon by a customer and an independent contractor.

This is an agreement used in Texas that outlines the terms and conditions of the working relationship between a customer and a contractor.

In Utah, this type of agreement can be used to clearly lay out the terms which are included as part of a short-term job offer.

This is an agreement used in Virginia that outlines the terms and conditions of the working relationship between a customer and a contractor.

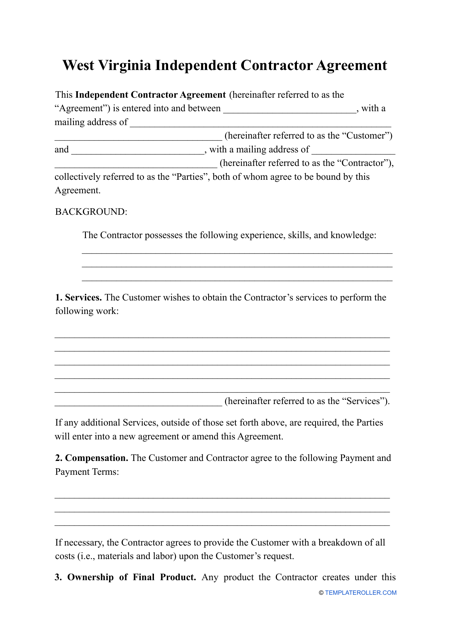

This template is used in West Virginia and the aim of the document is to verify the status of the contractor as an independent contractor and not an employee.

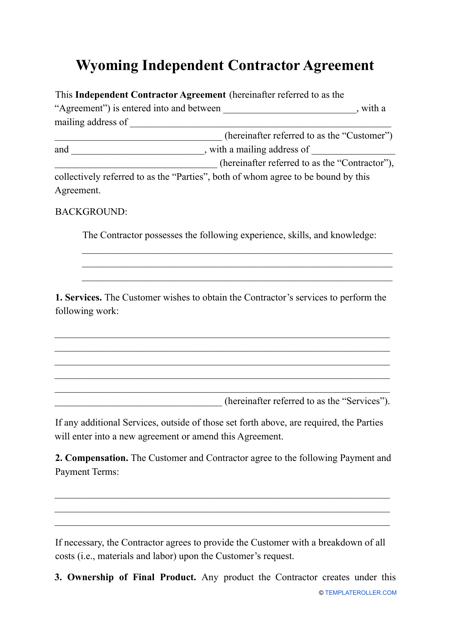

This template is used in Wyoming and acts as a business arrangement formed by a customer and a contracted professional in order to establish a short-term business relationship between the two parties.

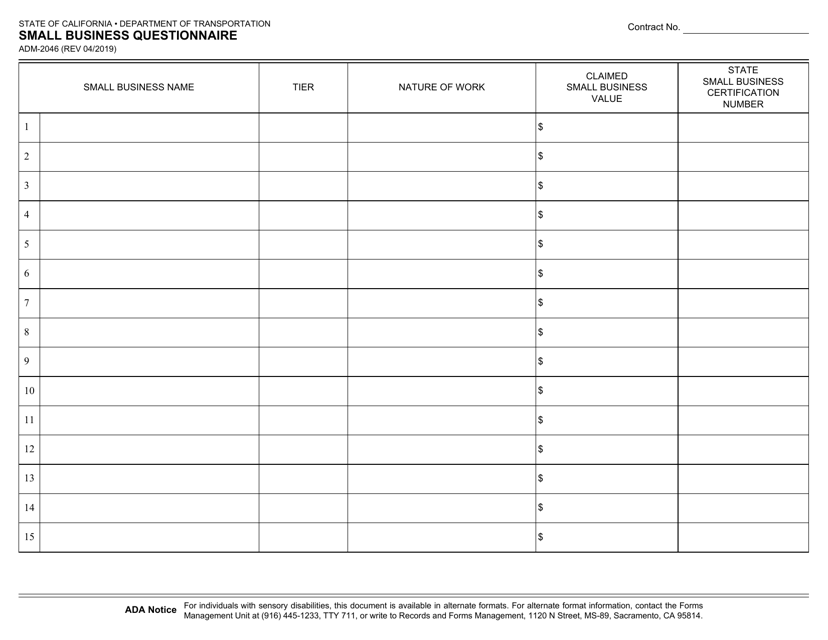

This form is used for small businesses in California to complete a questionnaire. It helps gather information about the business and its operations.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

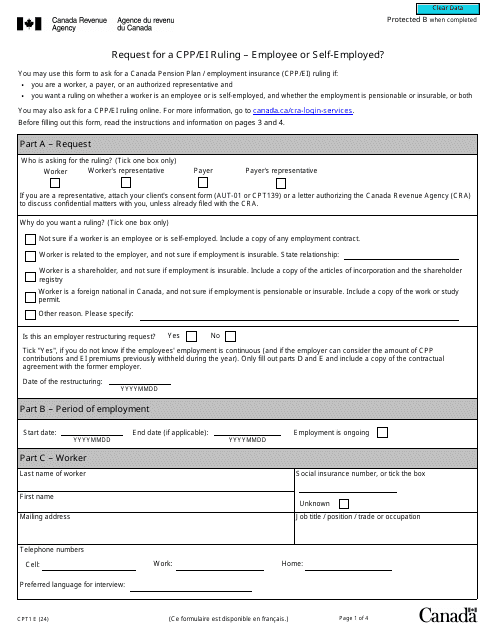

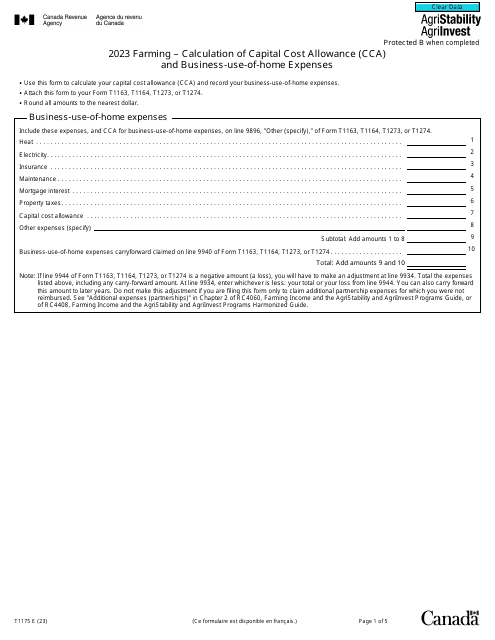

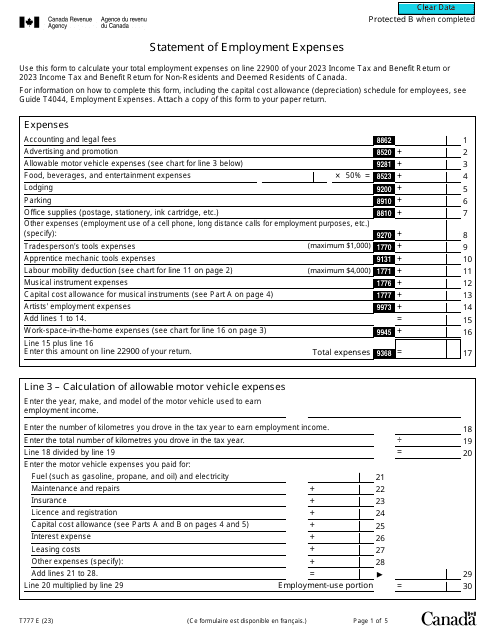

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.

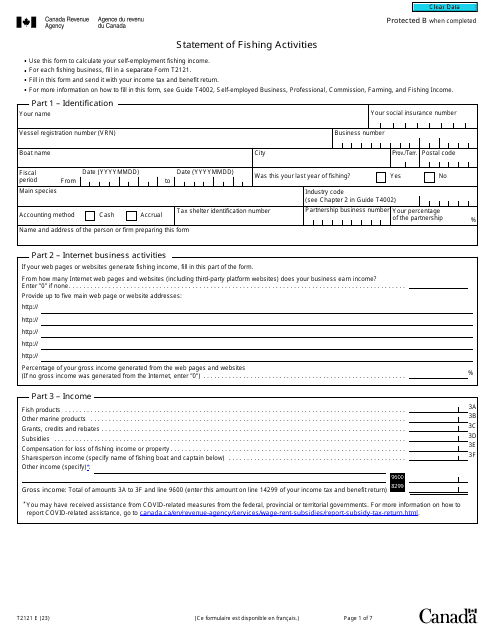

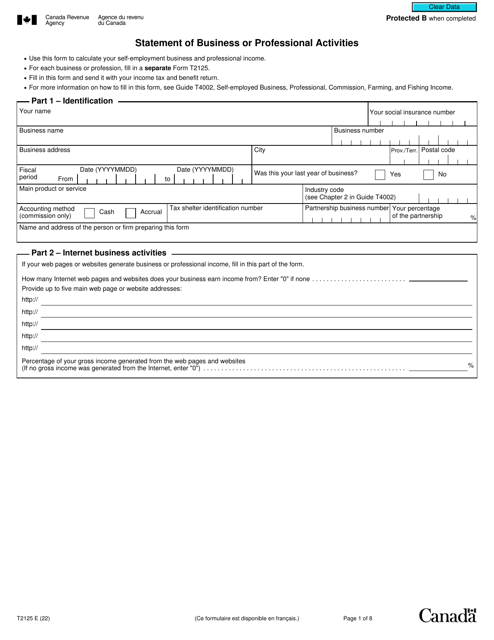

This a legal document that was specifically developed for Canadian taxpayers who receive self-employment business or professional income that they may use when they want to report their income.

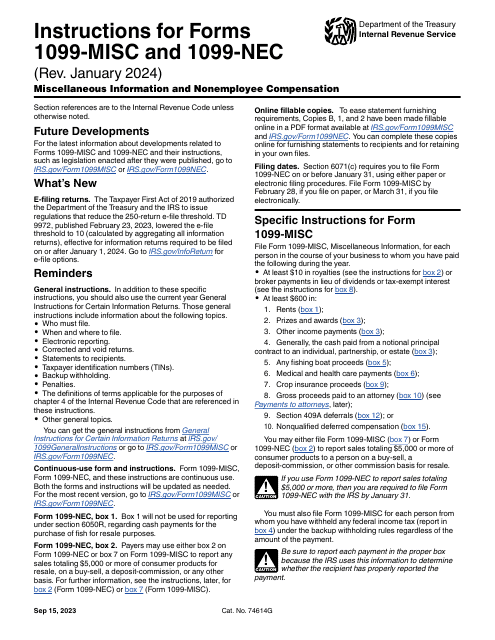

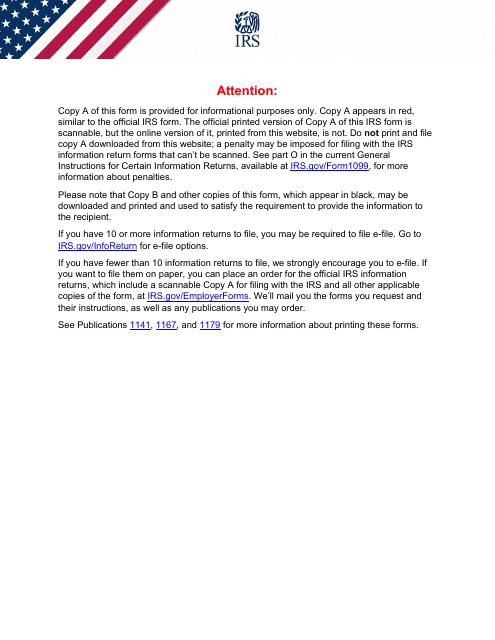

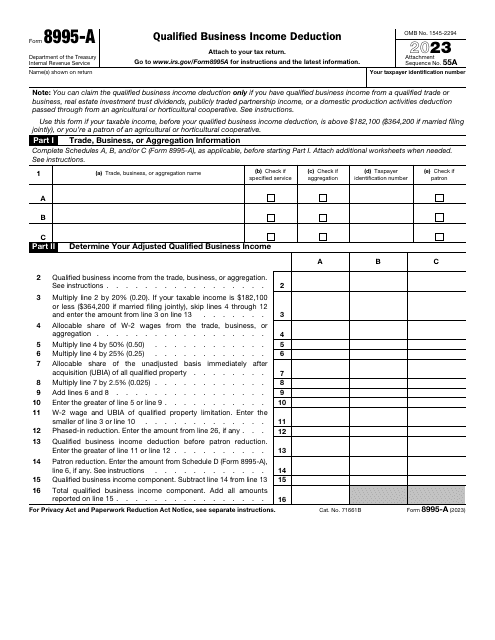

This is a fiscal IRS document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

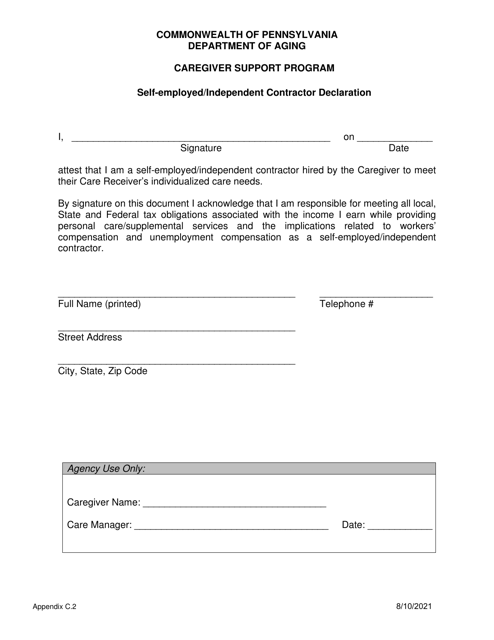

This document is for self-employed individuals in Maryland who are attesting to their employment status.

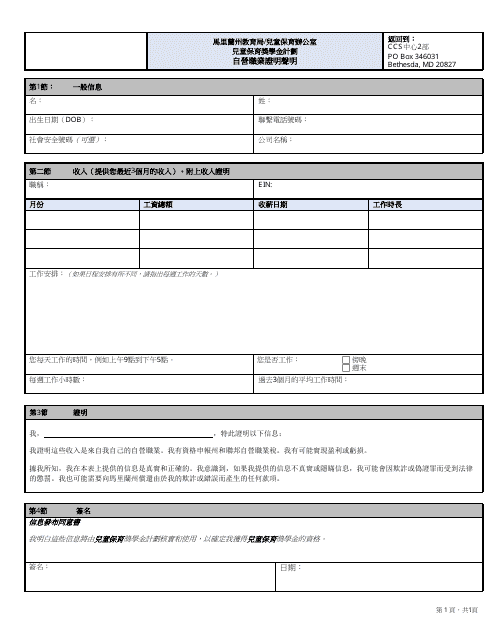

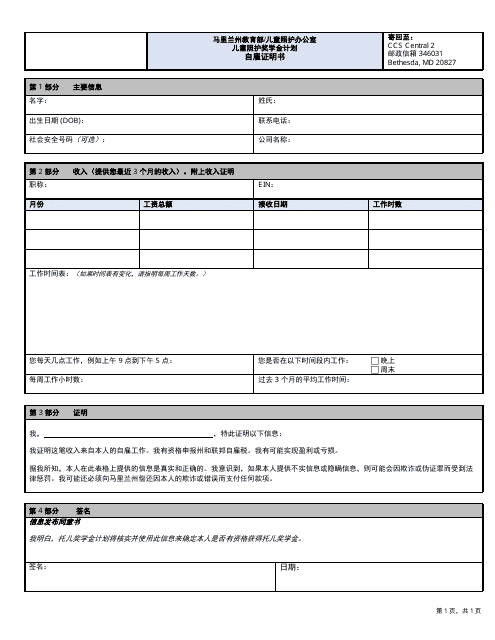

This document is for self-employed individuals in Maryland who need to provide an attestation statement. It is available in Chinese Simplified.

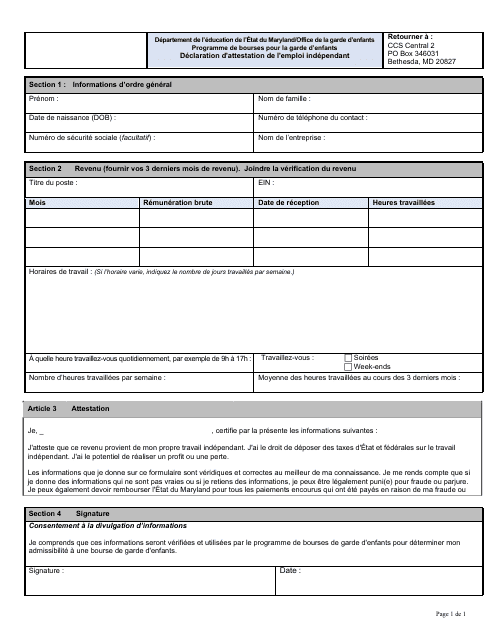

This document is for self-employed individuals in Maryland who need to provide an attestation statement in French. It is used to verify their self-employment status.

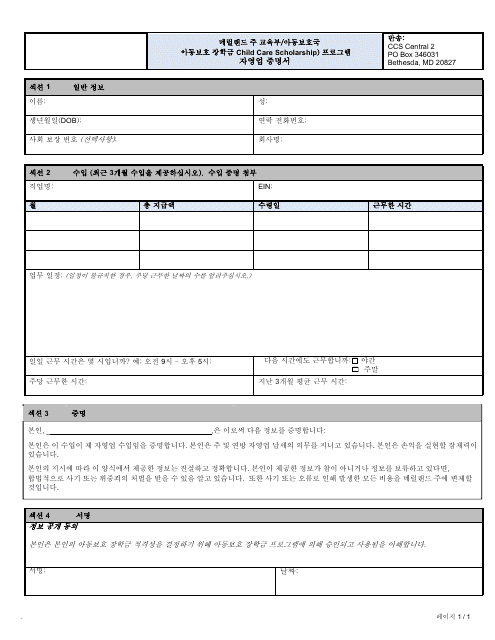

This document is a self-employment attestation statement specific to the state of Maryland, translated into Korean.

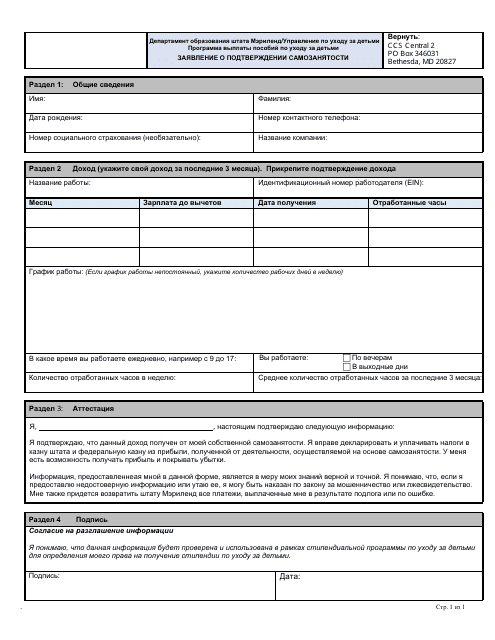

This document is used for attesting self-employment status in Maryland for Russian speakers.

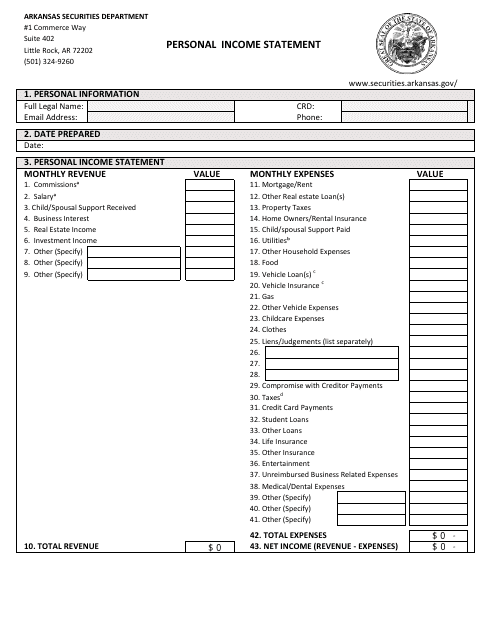

This document is used for keeping track of your personal income in the state of Arkansas. It helps you calculate your earnings and expenses to better manage your finances.

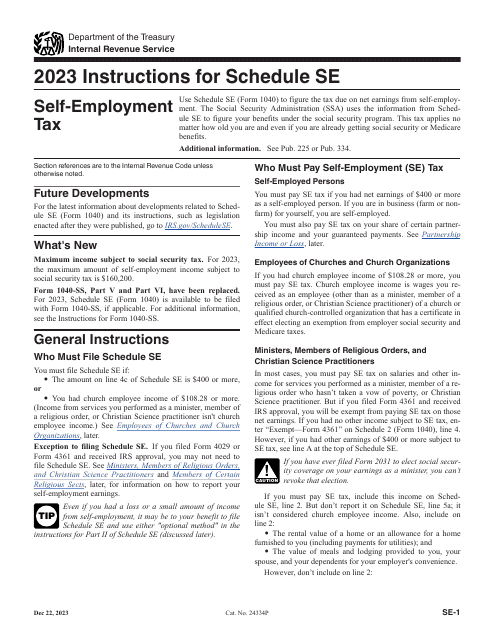

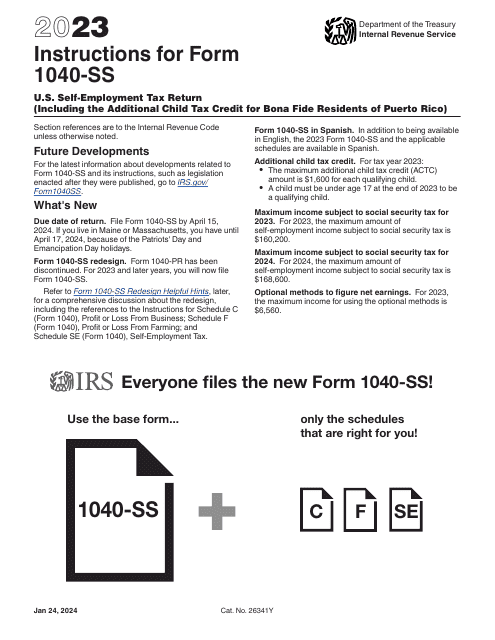

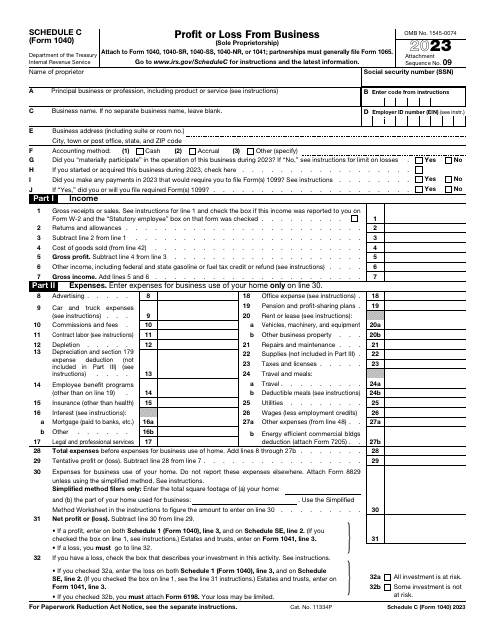

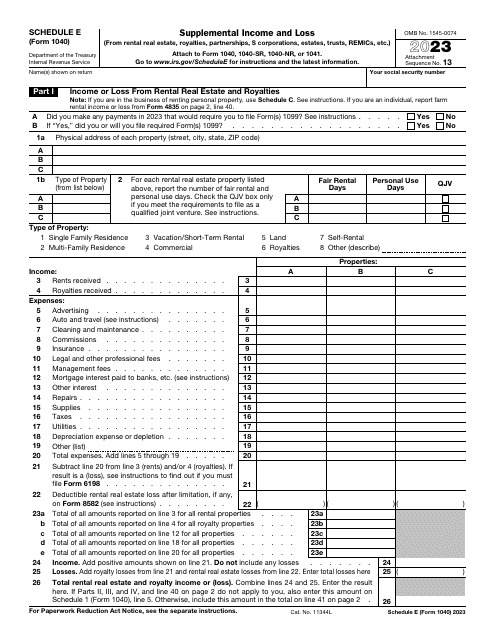

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.