Self Employment Templates

Documents:

284

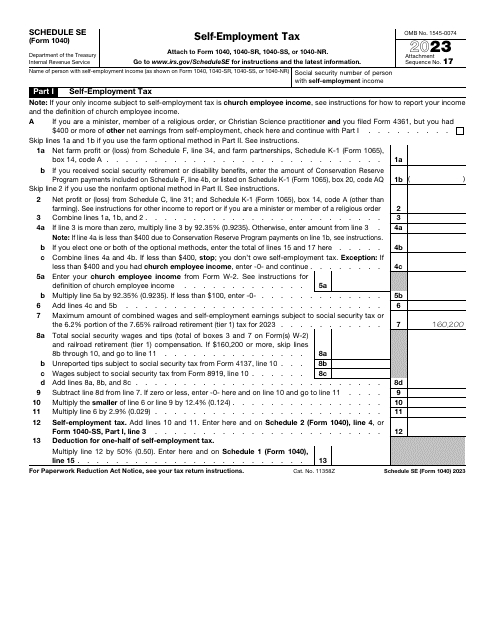

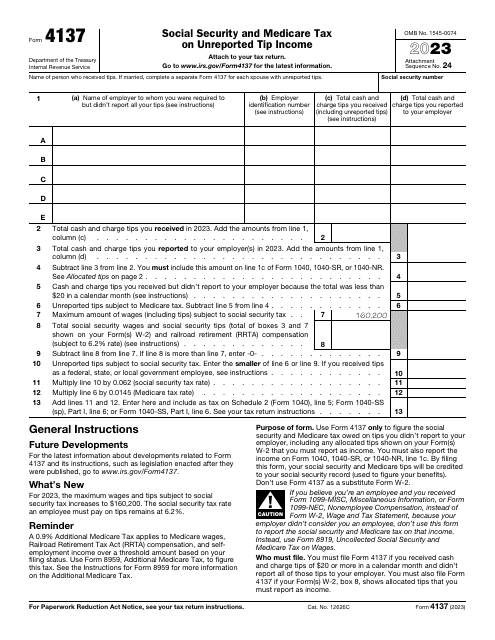

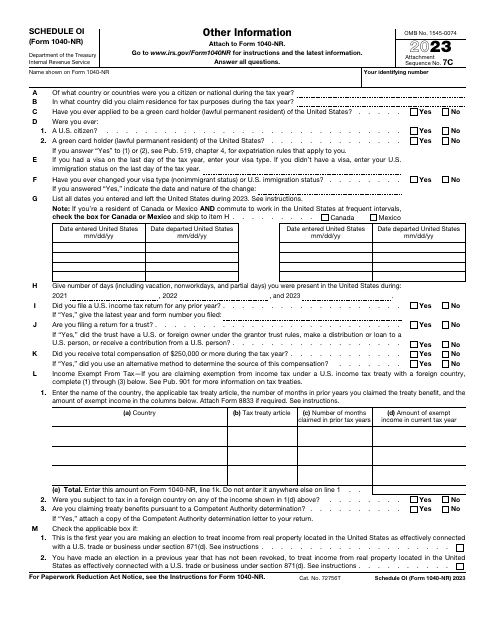

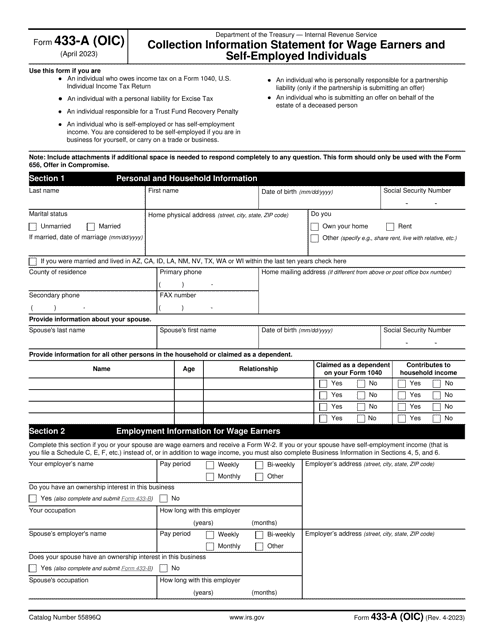

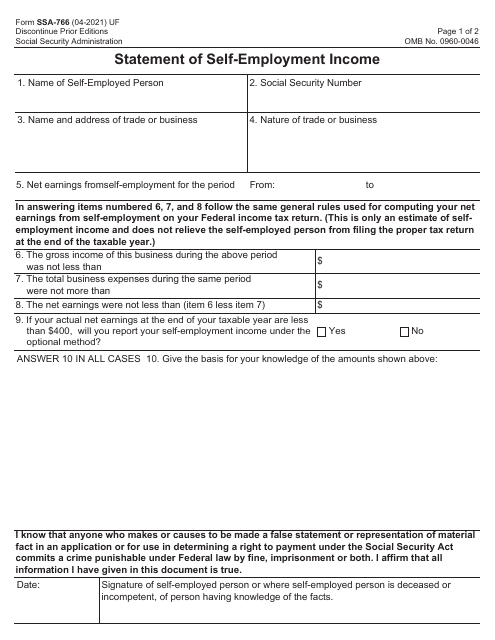

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

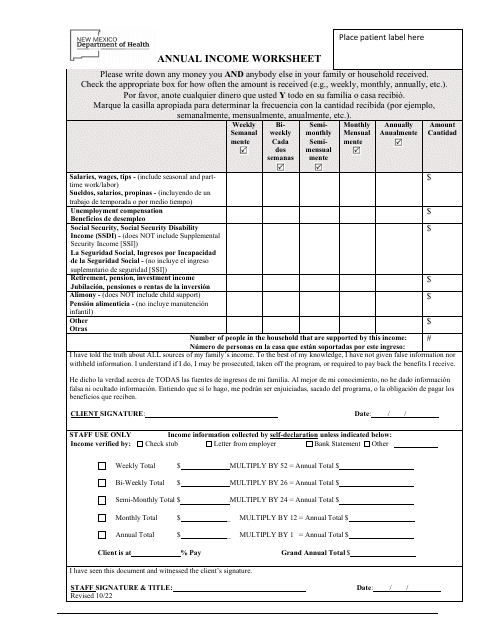

This document provides a worksheet for residents in New Mexico to calculate and record their annual income. It is available in both English and Spanish.

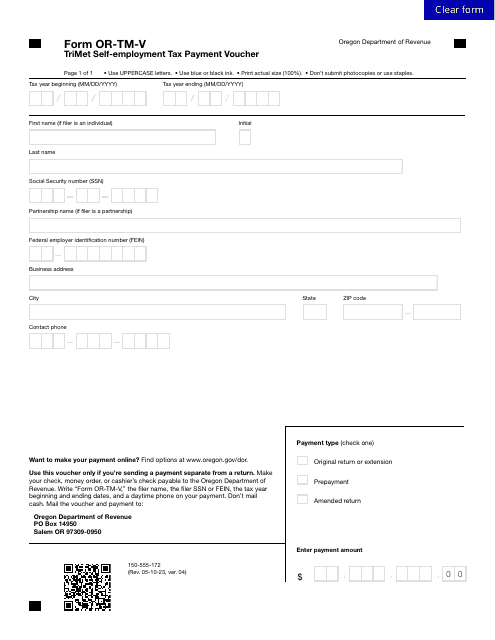

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

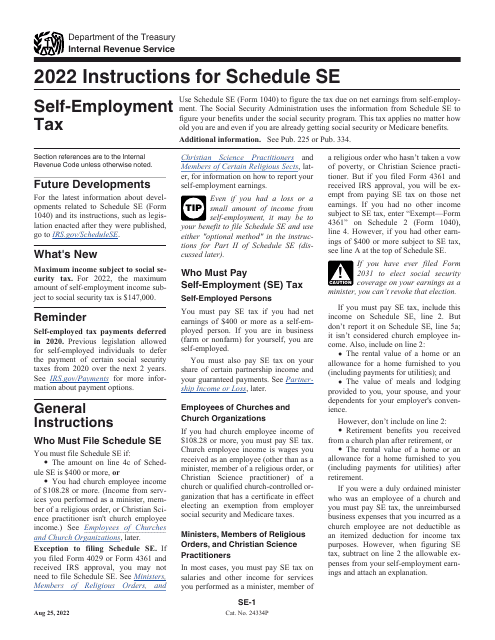

This document provides instructions for filling out Schedule SE, which is used to calculate and report self-employment tax. It covers step-by-step guidance on how to accurately complete this form.

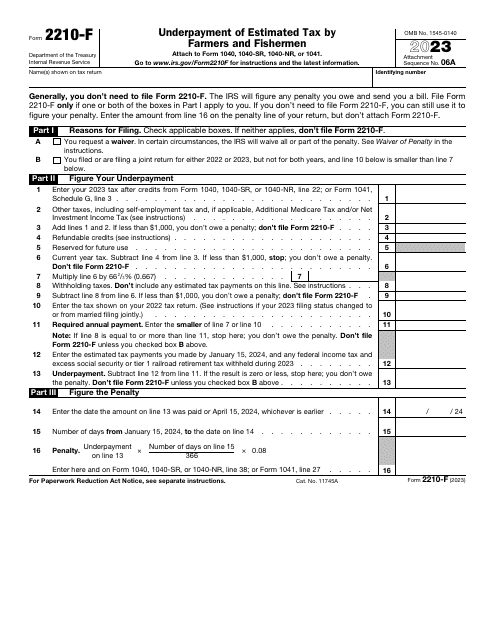

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

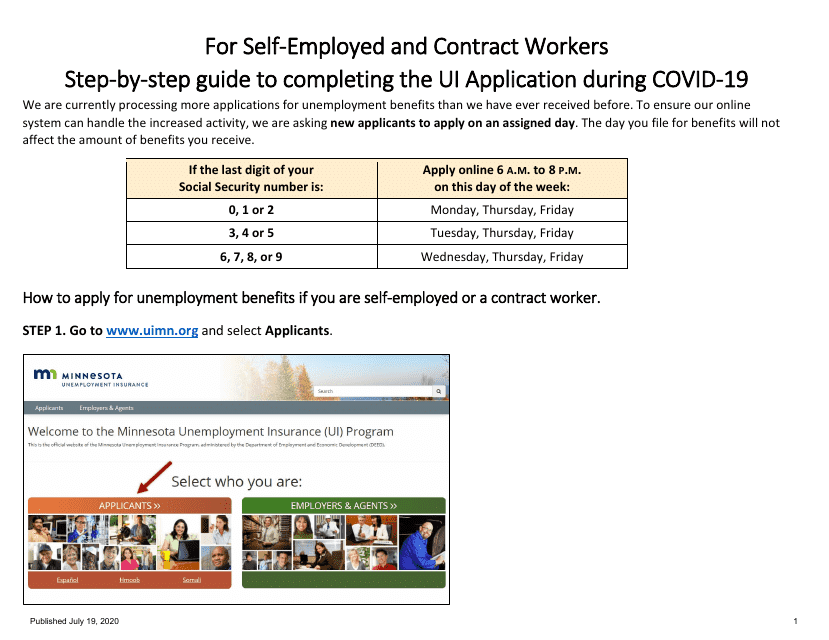

This guide provides step-by-step instructions for self-employed and contract workers in Minnesota to complete the UI application during the Covid-19 pandemic.

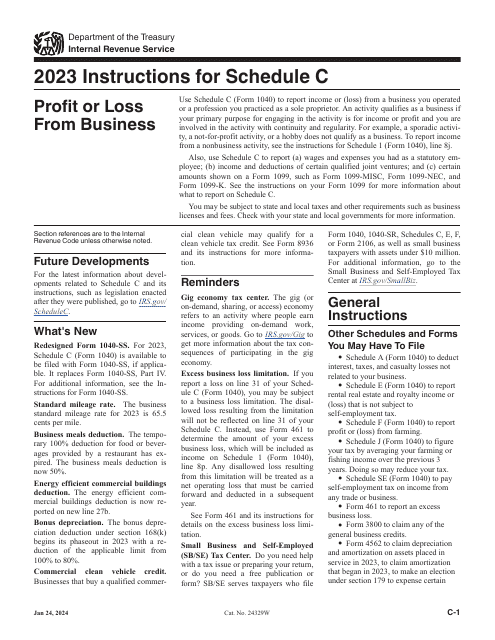

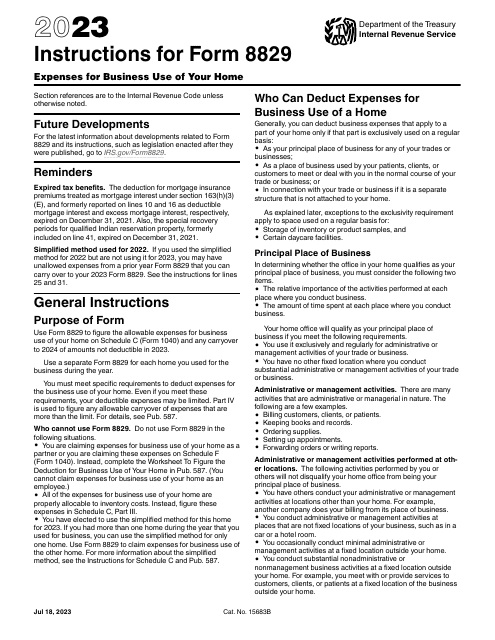

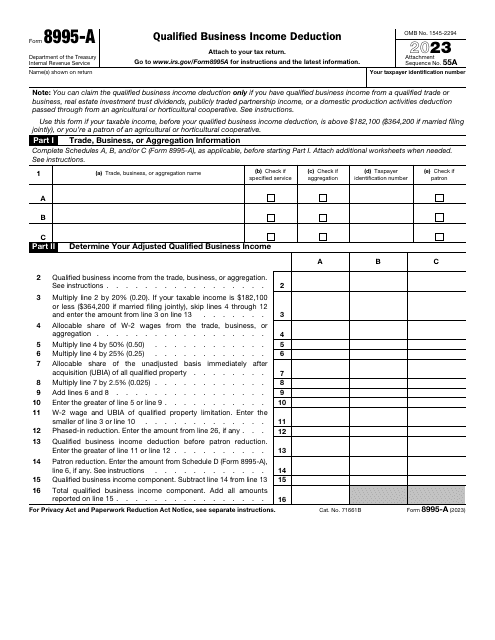

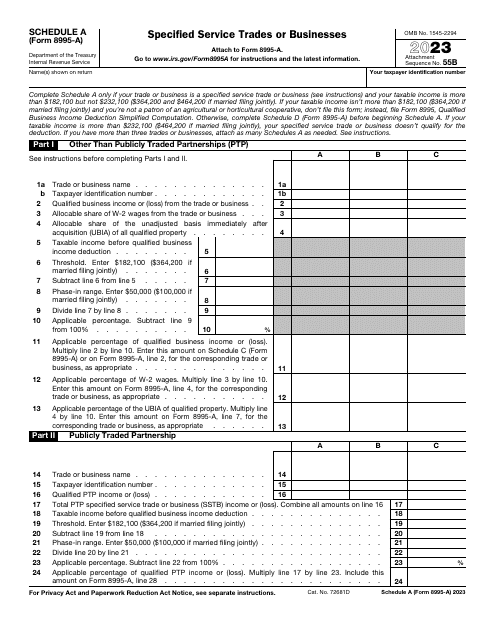

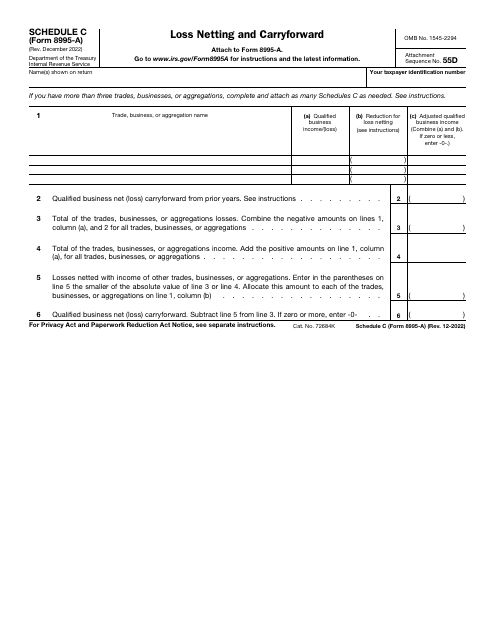

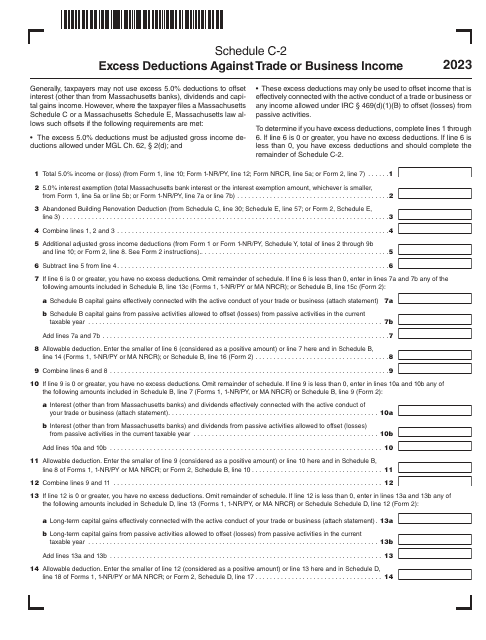

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

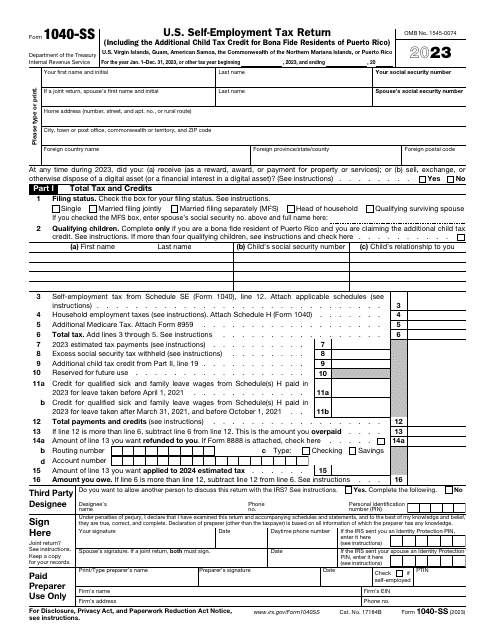

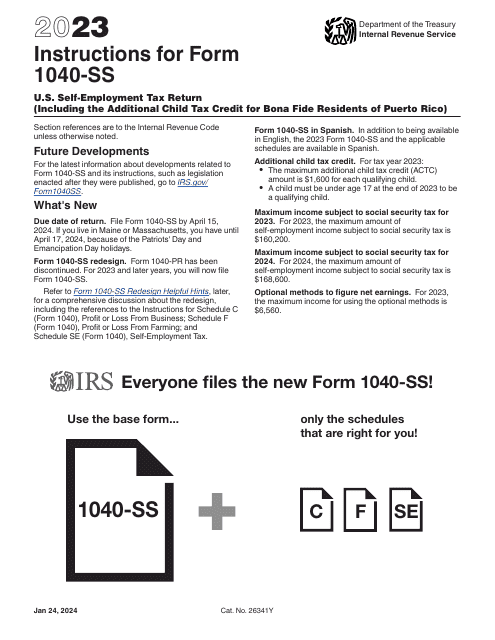

Use this document only if you are a resident of the United States Virgin Islands (USVI), Commonwealth of Puerto Rico, Commonwealth of the Northern Mariana Islands (CNMI), Guam, and American Samoa and wish to report your self-employment net earnings to the United States.

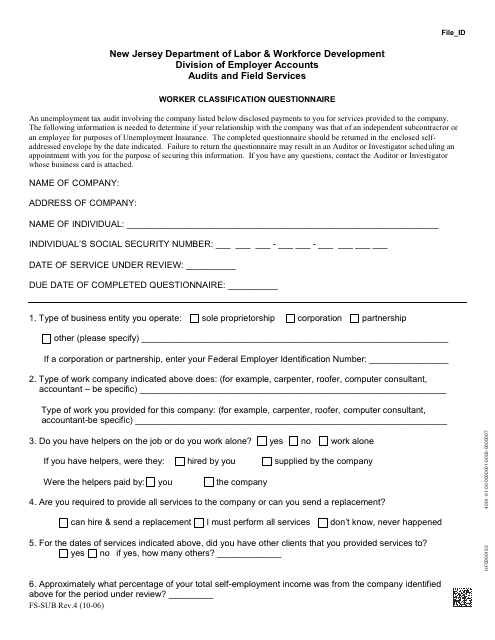

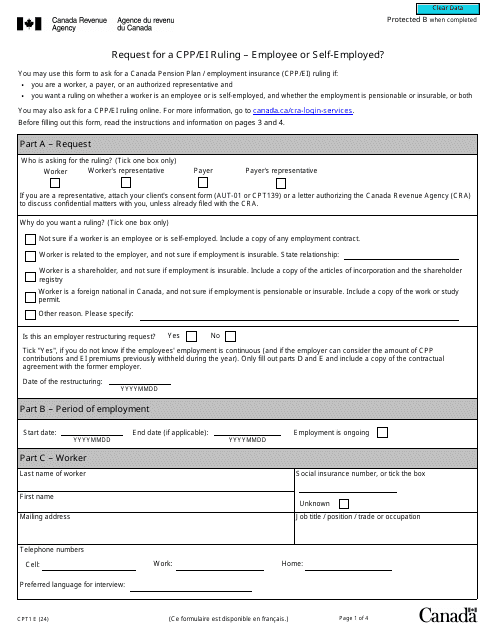

This Form is used for determining the worker classification in the state of New Jersey. It helps employers assess whether a worker should be classified as an employee or an independent contractor.

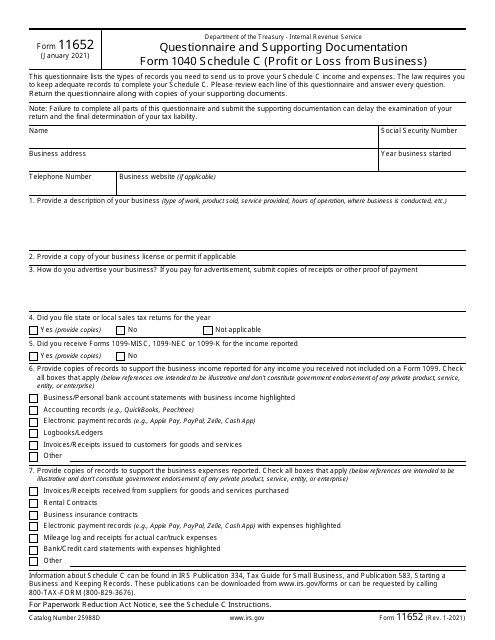

This document is used to provide additional information and supporting documents for individuals who file Form 1040 Schedule C, which reports the profit or loss from a business. It is a questionnaire that helps the IRS gather more information about the business income and expenses reported on Schedule C.

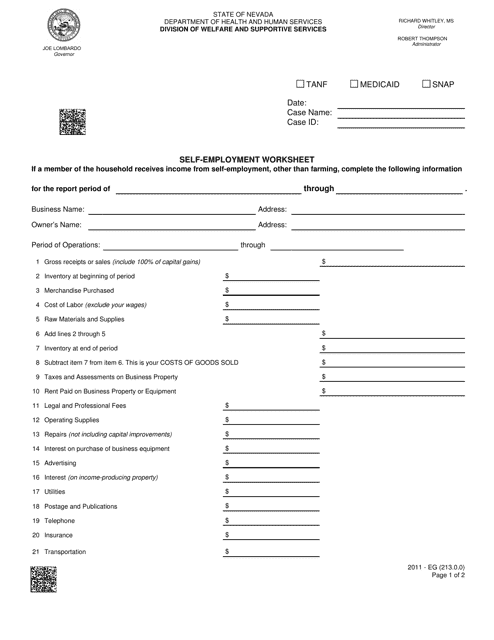

This document is for self-employed individuals in Nevada to complete a worksheet related to their income and expenses for the year 2011.

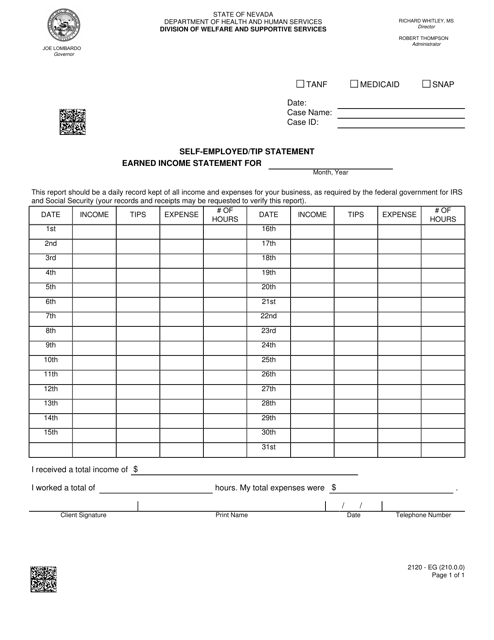

This form is used for self-employed individuals and those who receive tips in the state of Nevada. It is used to report income and calculate taxes.

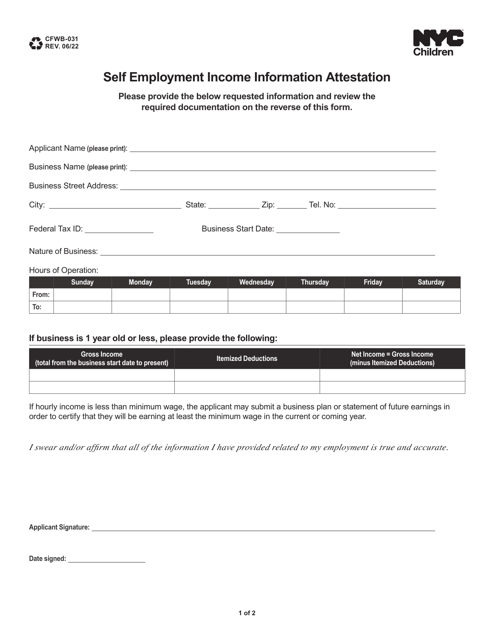

This form is used for providing attestation on self-employment income information in New York City.

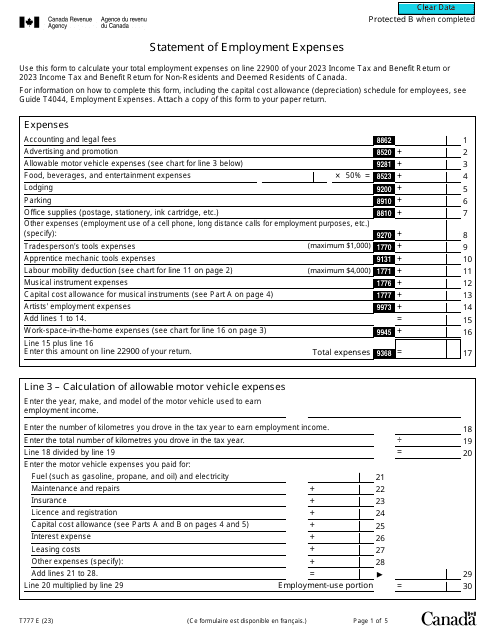

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.