Self Employment Templates

Documents:

284

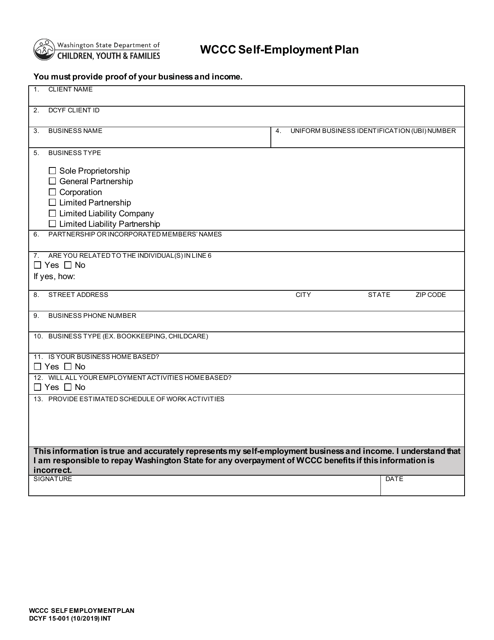

This form is used for creating a self-employment plan for individuals participating in the Washington State WorkFirst program.

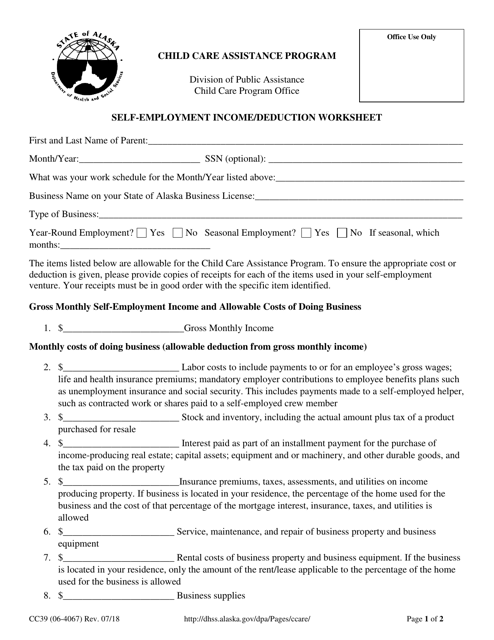

This Form is used for calculating self-employment income and deductions for individuals in Alaska.

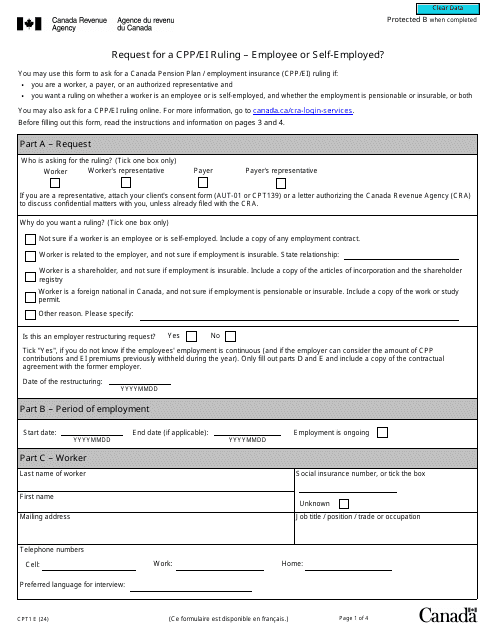

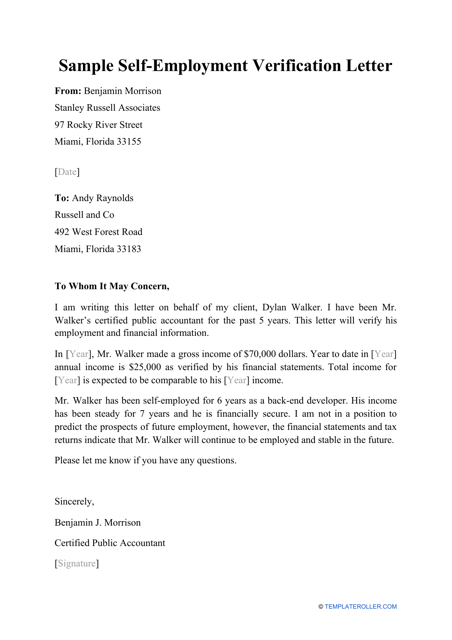

The purpose of this document is to confirm that a person is self-employed, the income they receive, and the type of business they are conducting.

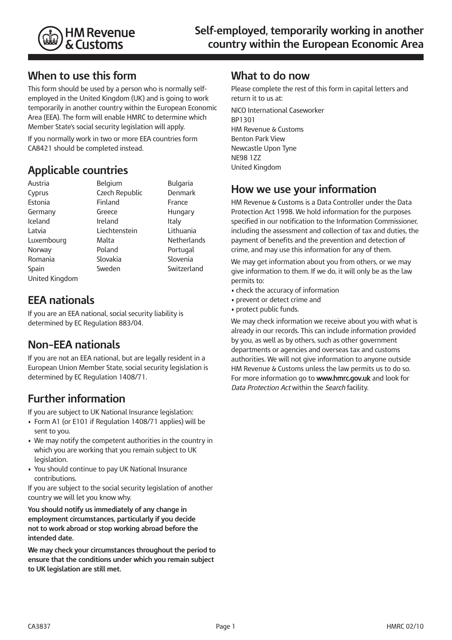

If you are a national of the United Kingdom and are going to work in a foreign country within the European Economic Area, this form may be used to decide which country's legislation will be applied to your social security.

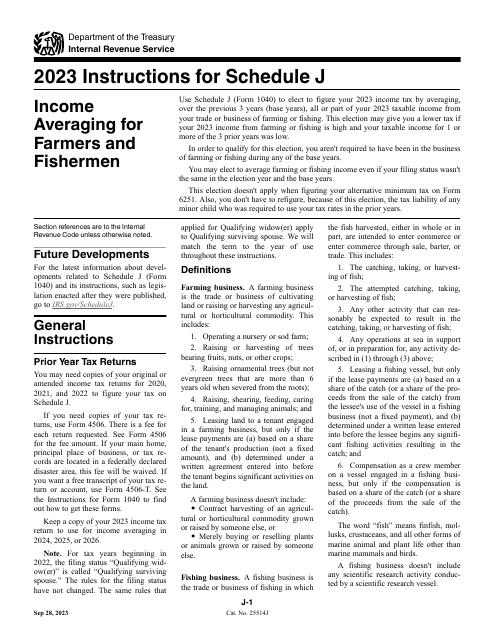

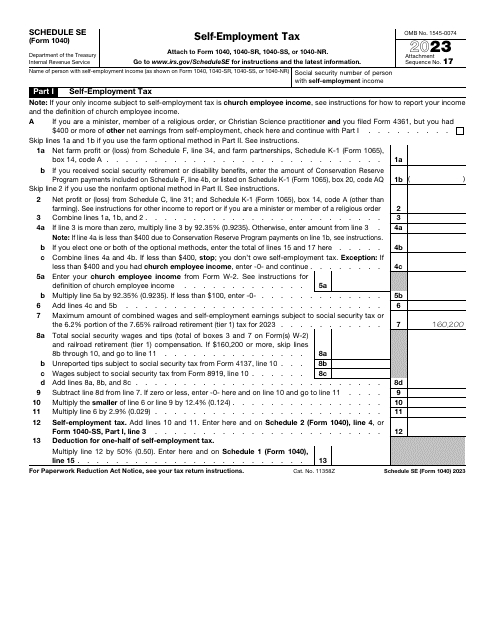

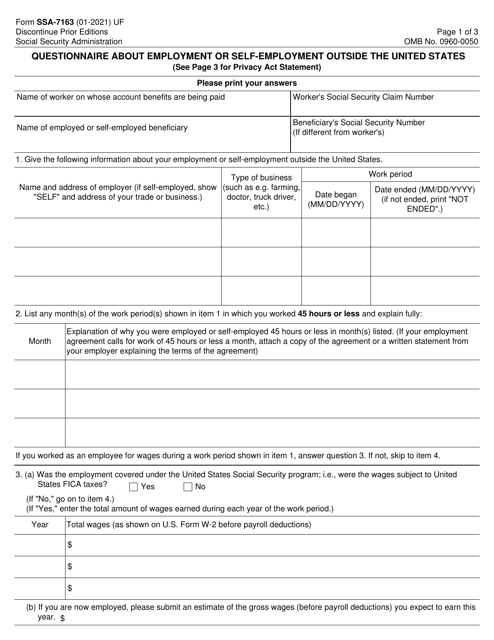

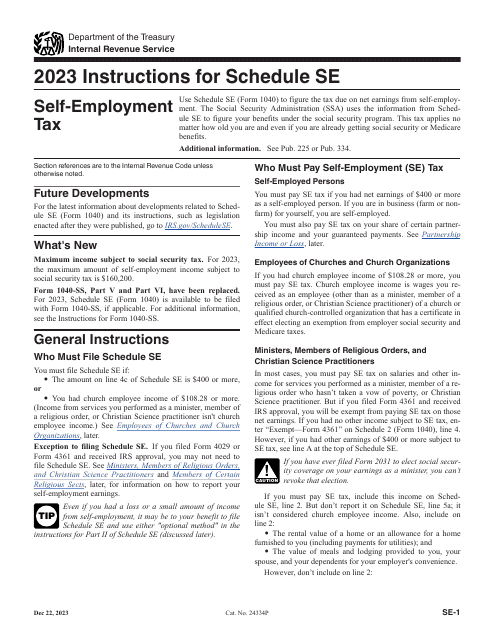

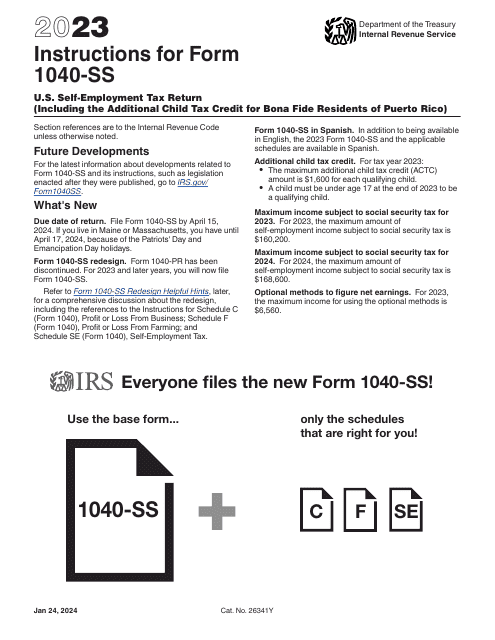

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

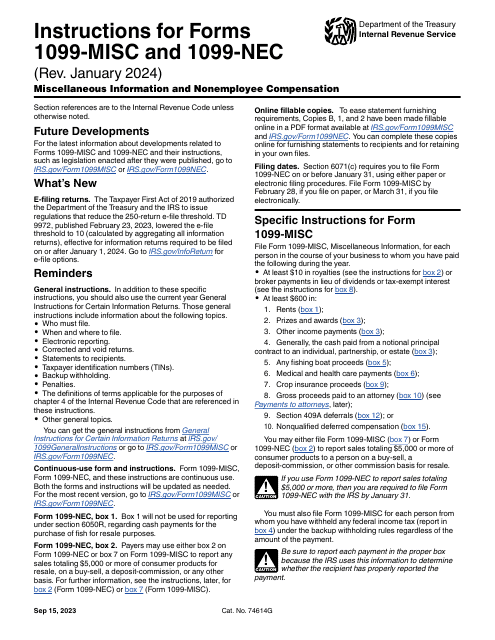

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

This is a fiscal IRS document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

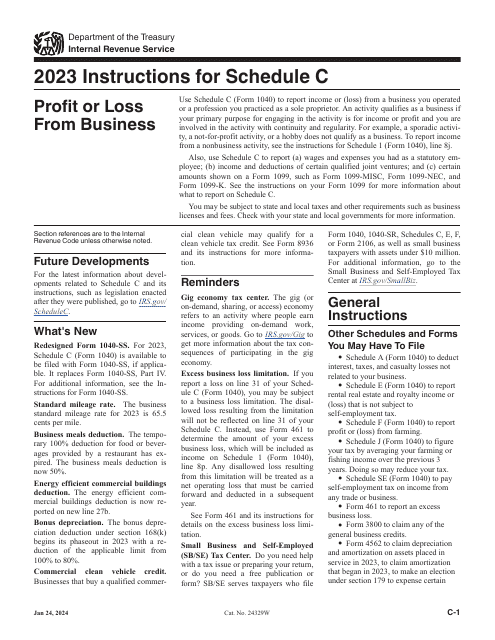

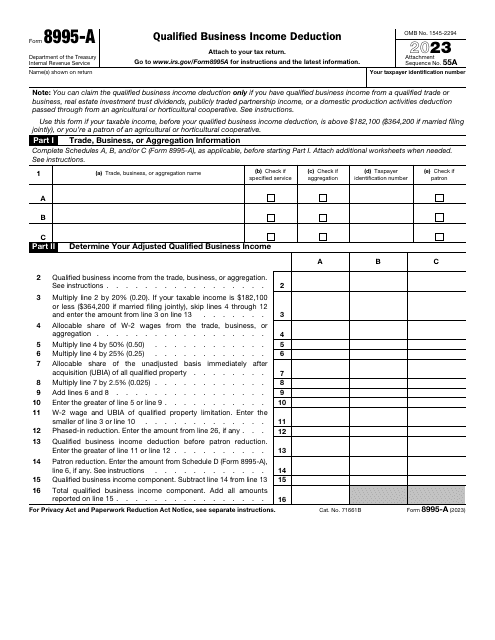

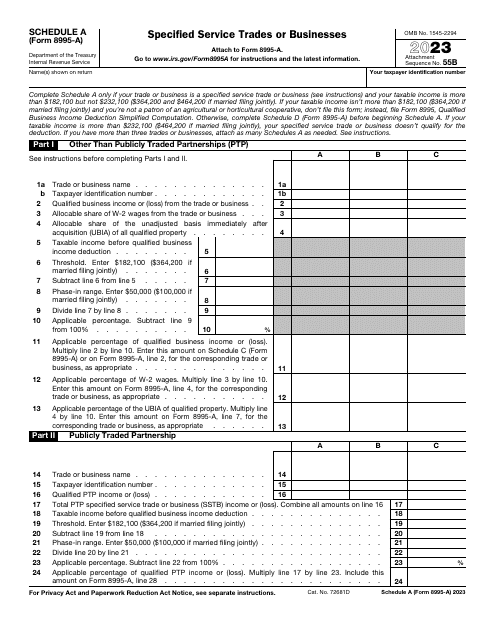

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

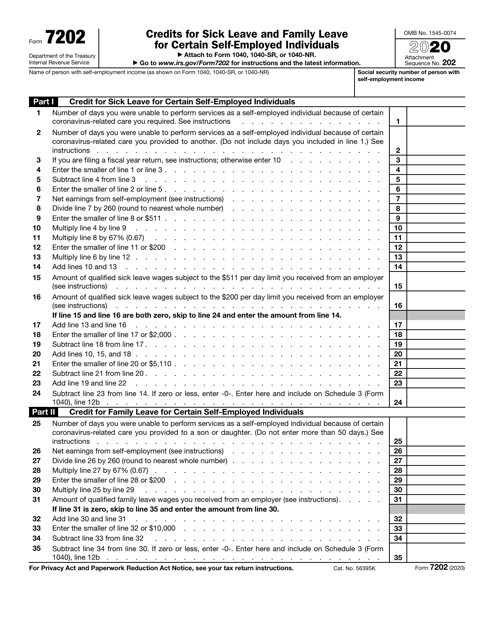

This IRS form is used for claiming credits related to sick leave and family leave for self-employed individuals.

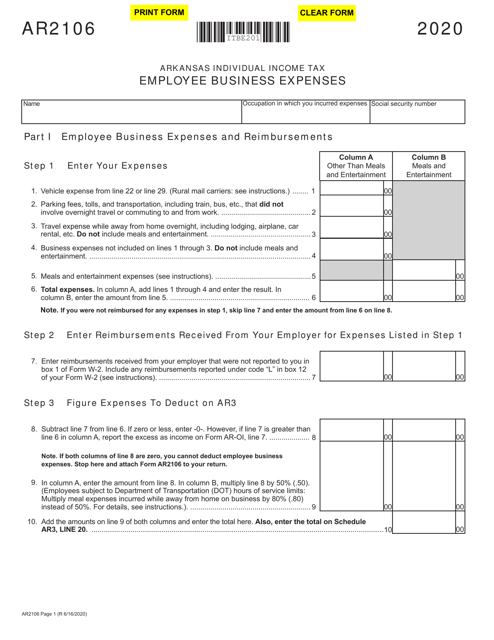

This type of document is used to track self-employment income for individuals in the state of Arkansas.

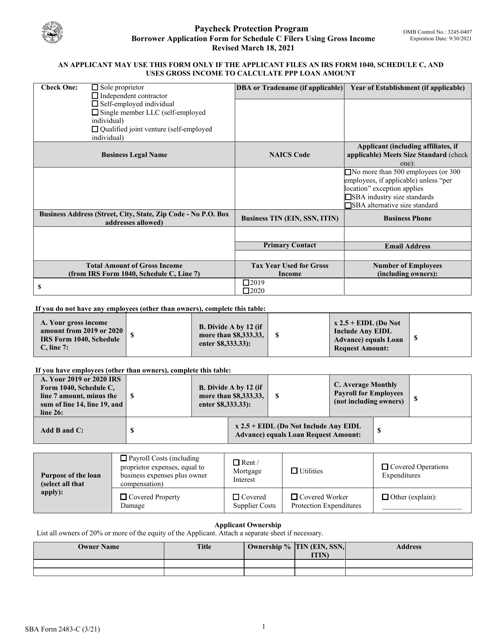

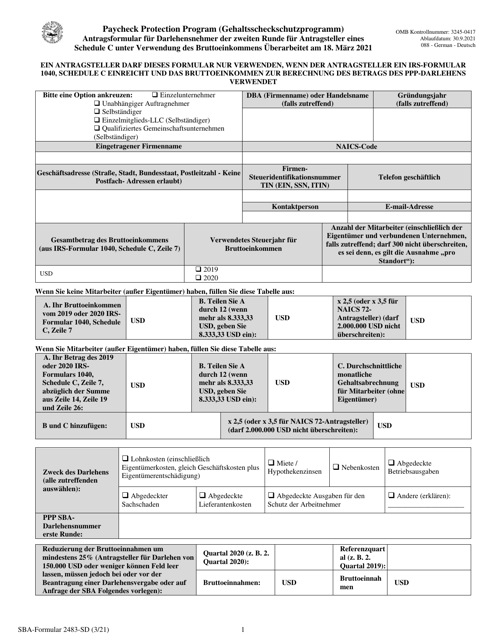

This Form is used for Schedule C filers who are applying for a loan with the Small Business Administration (SBA) and are using gross income as their method of calculation.

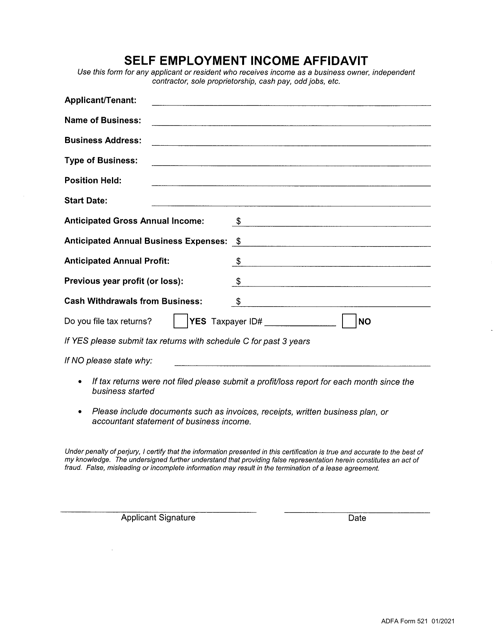

This document is used in Arkansas for individuals who have self-employment income to provide an affidavit confirming their income.

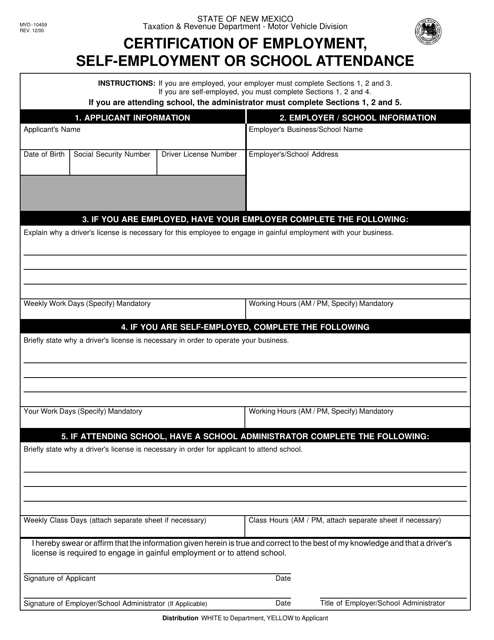

This form is used for certifying employment, self-employment, or school attendance in the state of New Mexico. It is a required document for certain purposes such as obtaining a driver's license or insurance.

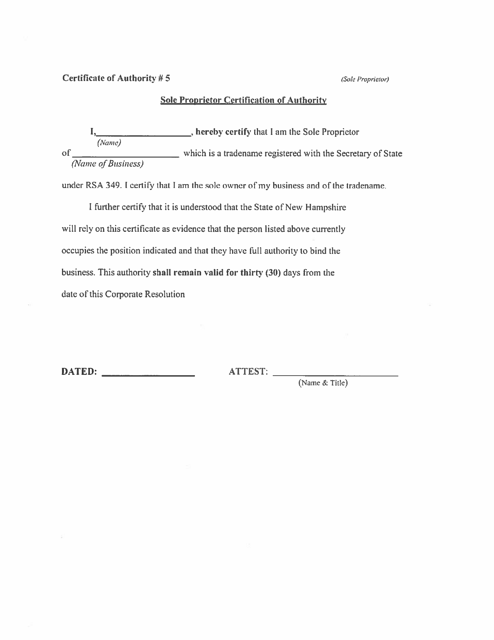

This Form is used for Sole Proprietor Certification of Authority in the state of New Hampshire.

This form is used for second draw borrowers who are self-employed using gross income and need assistance from the SBA.

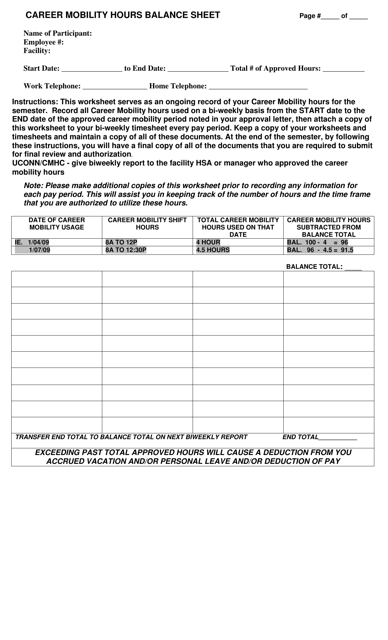

This document helps individuals in Connecticut keep track of their career mobility hours and balance sheet.

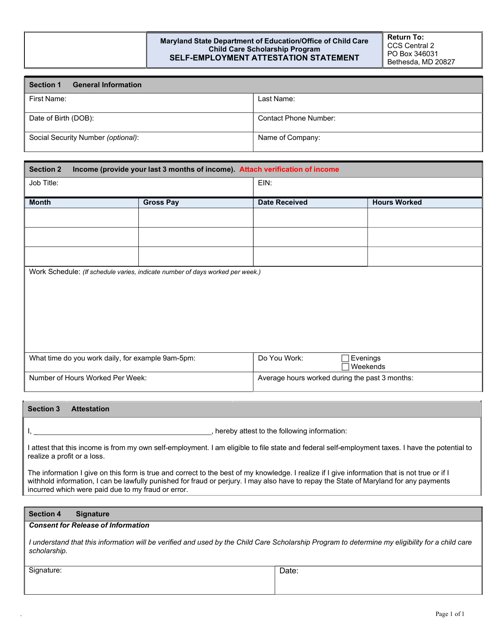

This document is used for self-employed individuals in Maryland to provide an attestation statement confirming their self-employment status.

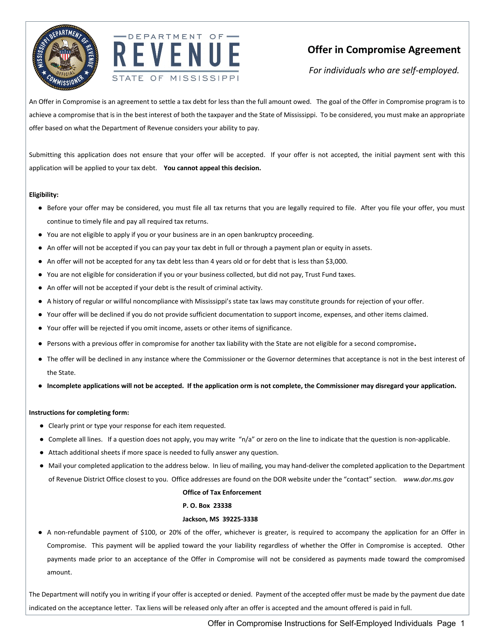

This Form is used for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to settle their tax debt with the state. It provides instructions on how to complete the application process.

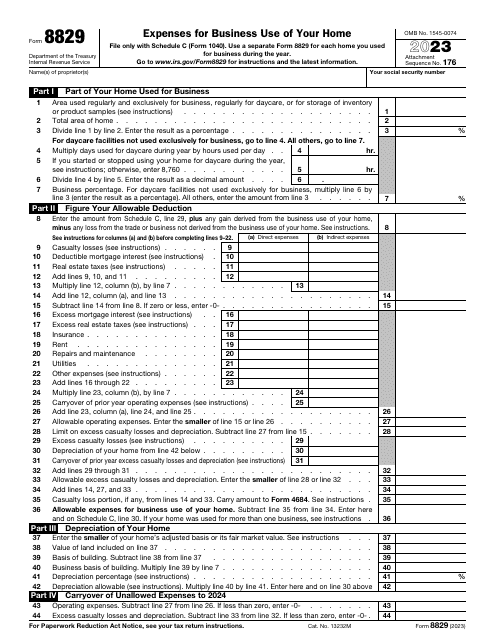

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

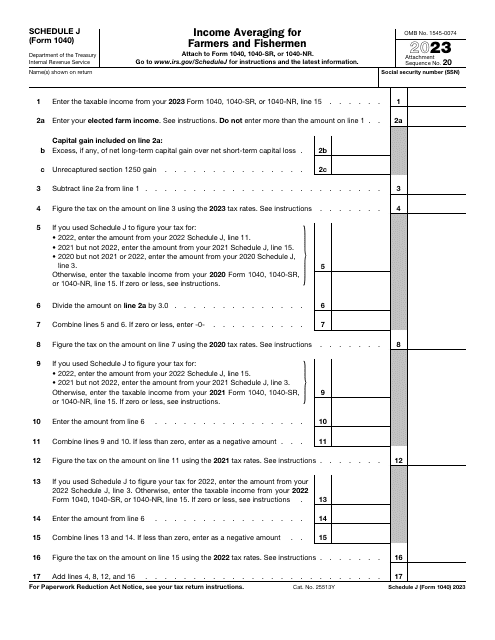

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

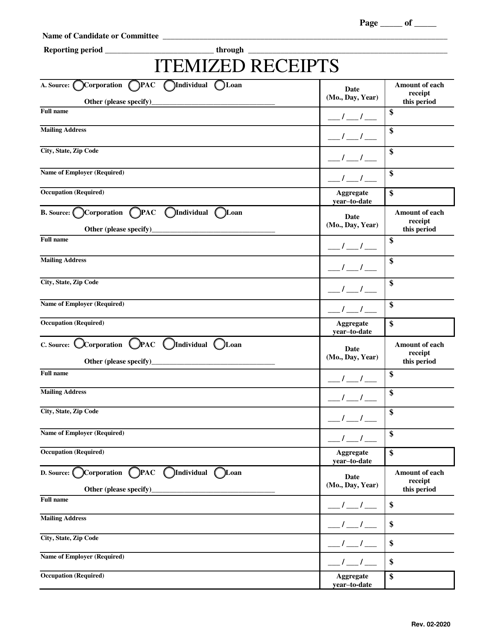

This document for itemized receipts in the state of Mississippi. It provides a detailed breakdown of expenses incurred during a transaction.