Self Employment Templates

Documents:

284

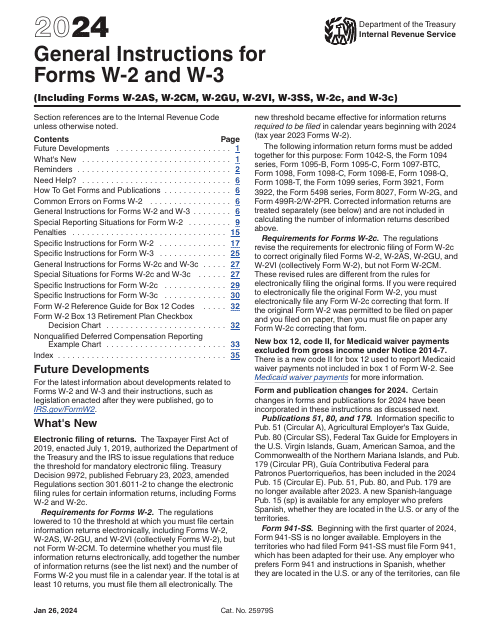

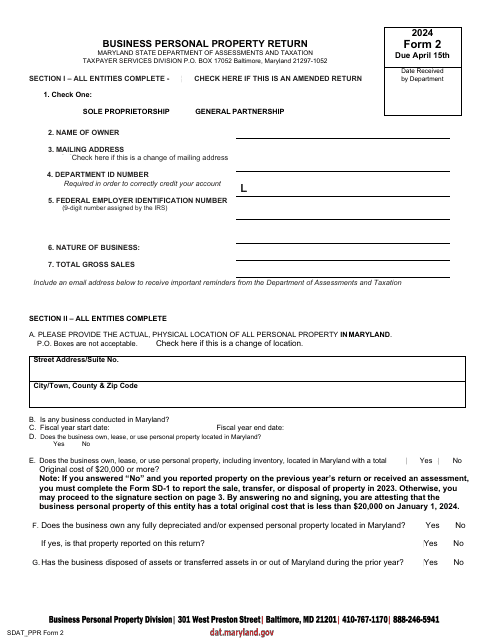

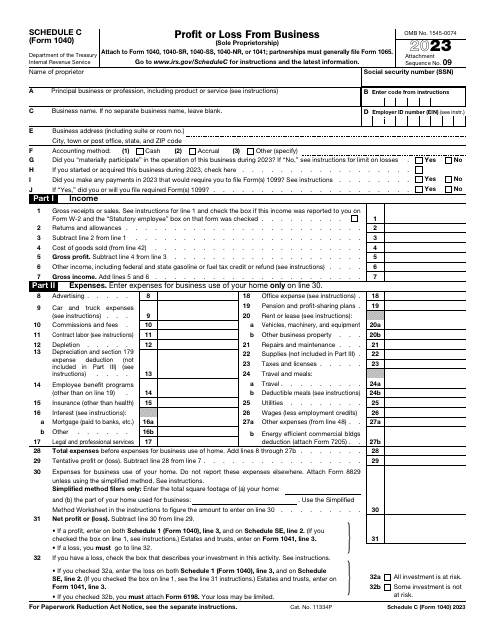

This form is used for reporting miscellaneous income received, such as freelance work or rental income. It provides instructions on how to fill out Form 1099-MISC accurately.

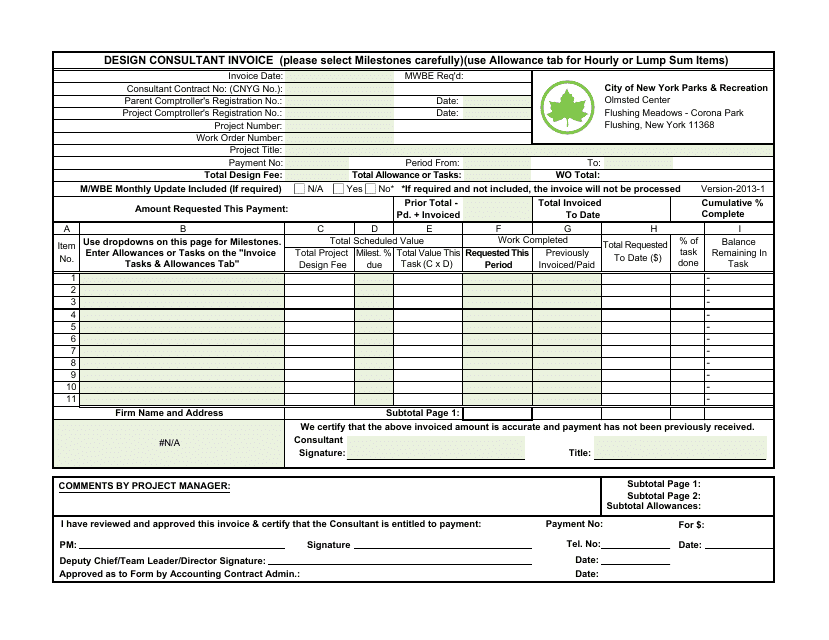

This document is used for creating an invoice for design consulting services in New York City.

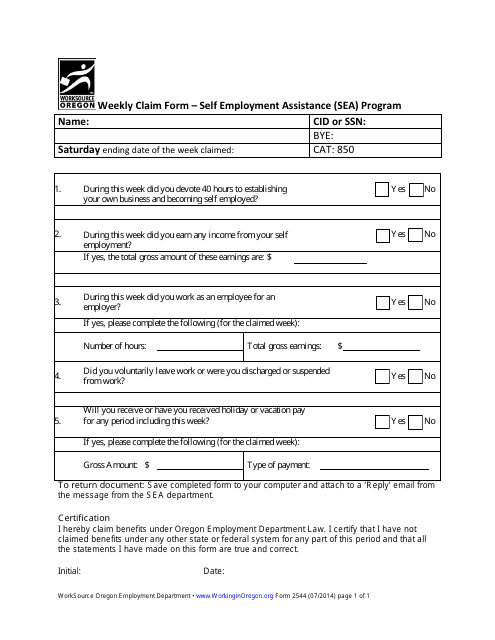

This form is used for the Weekly Claim Form in the Self Employment Assistance (SEA) Program in Oregon.

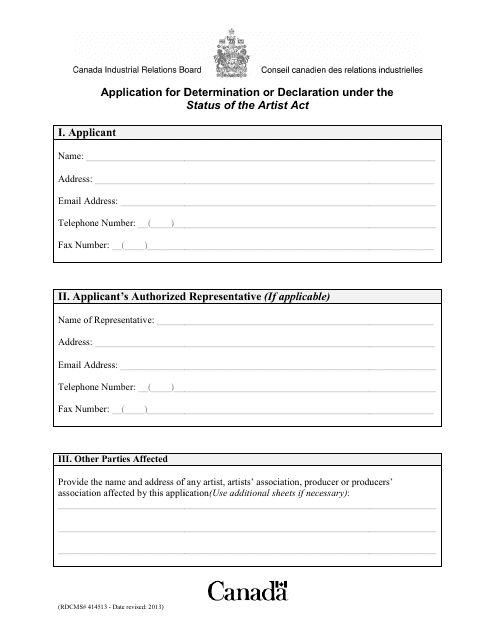

This Form is used for applying for determination or declaration of artist status under the Status of the Artist Act in Canada. It helps individuals in the artistic field to seek recognition and benefits as an artist.

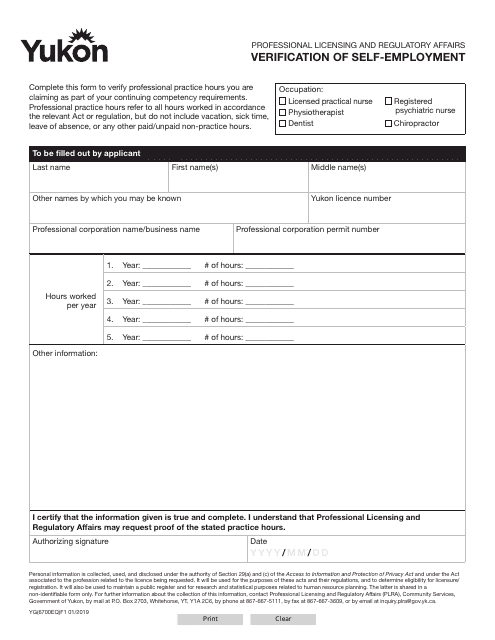

This Form is used for verifying self-employment income in Yukon, Canada.

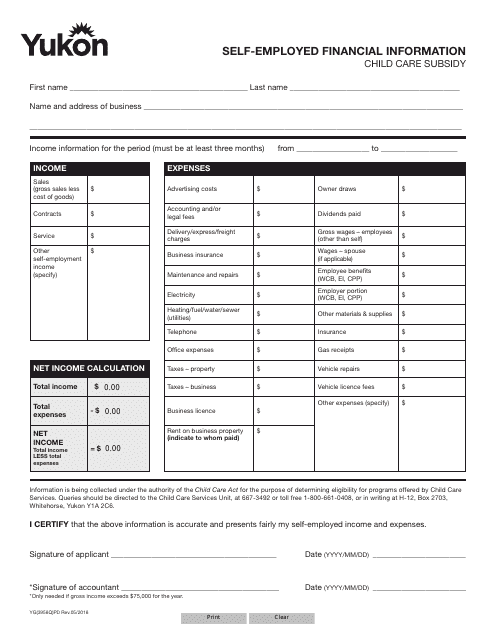

This Form is used for self-employed individuals in Yukon, Canada to provide their financial information.

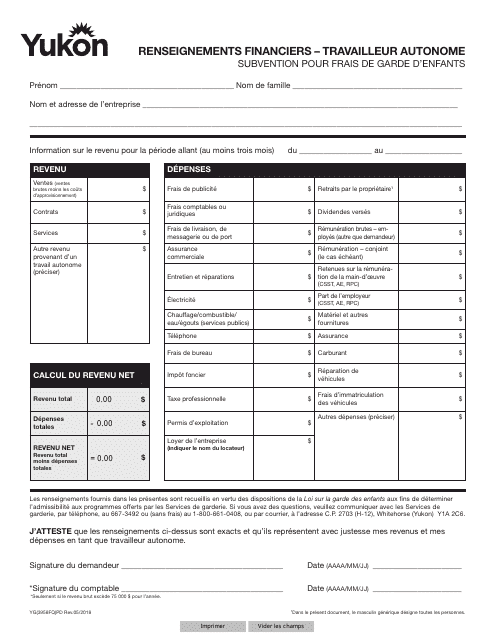

This document provides self-employed individuals in Yukon, Canada with a form to submit their financial information in French.

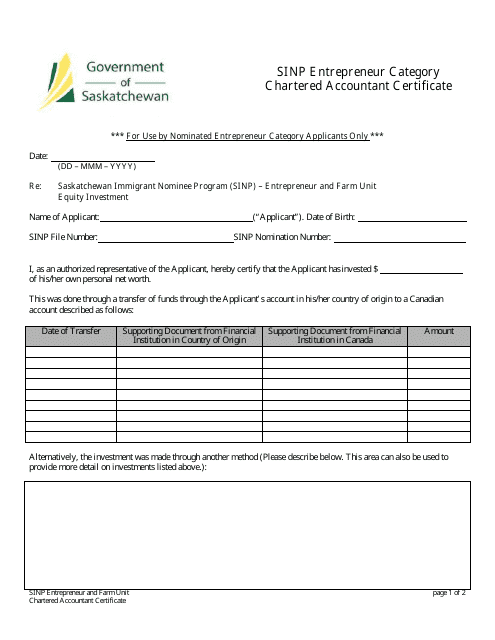

This document is for applicants who are Chartered Accountants seeking to immigrate to Saskatchewan, Canada under the SINP Entrepreneur Category.

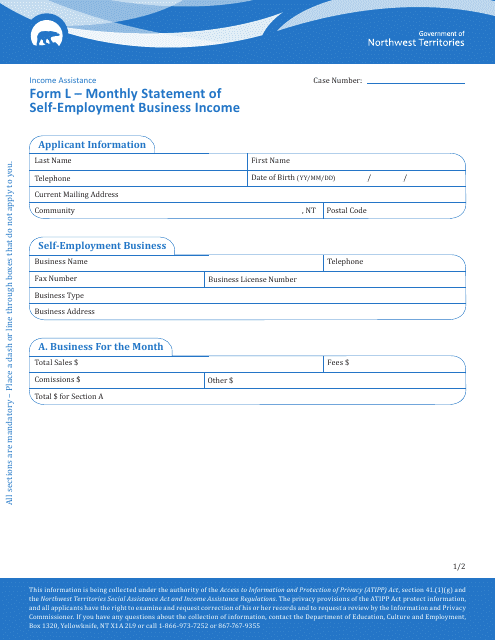

This Form is used for reporting monthly self-employment business income in the Northwest Territories, Canada.

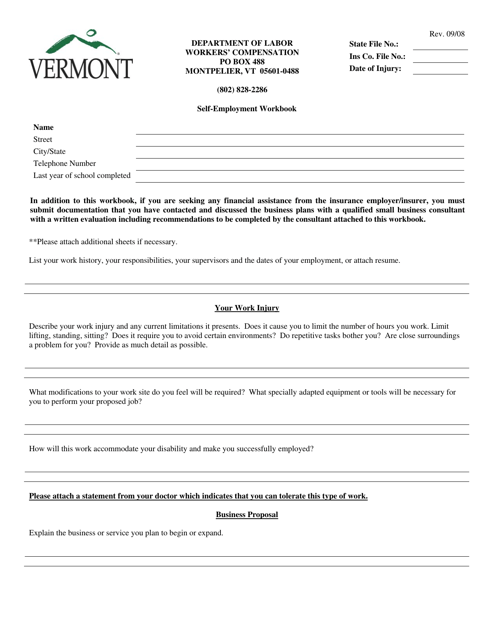

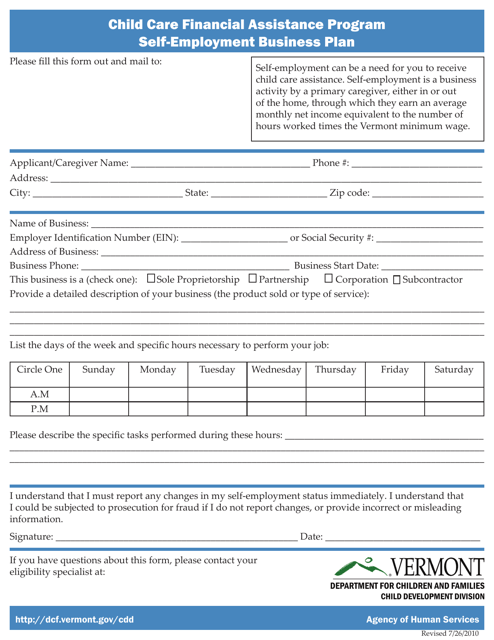

This document is a self-employment workbook specifically designed for individuals in Vermont. It provides guidance and resources for those considering starting their own business or working as self-employed.

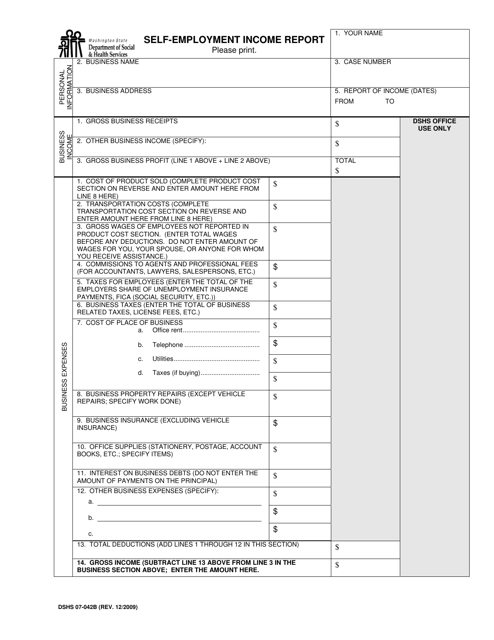

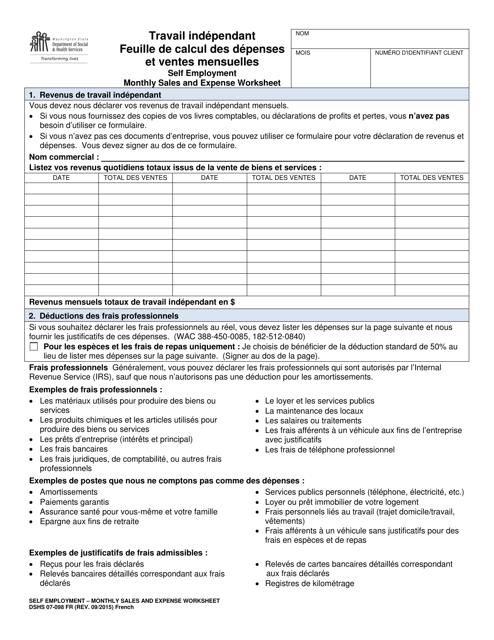

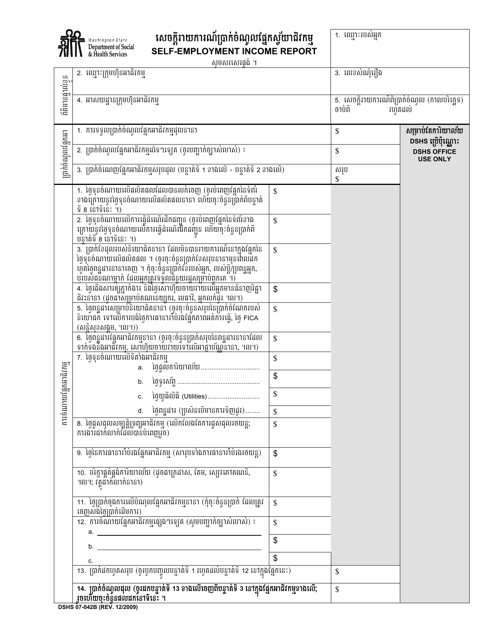

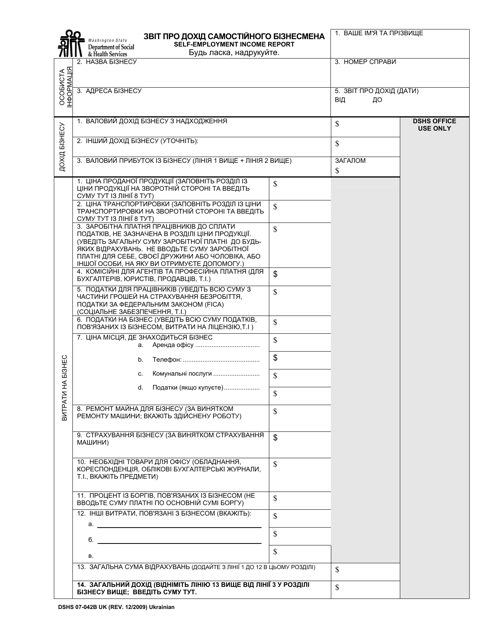

This document is used for reporting self-employment income in the state of Washington. It is necessary for individuals who are self-employed to accurately report their income for tax and benefit purposes.

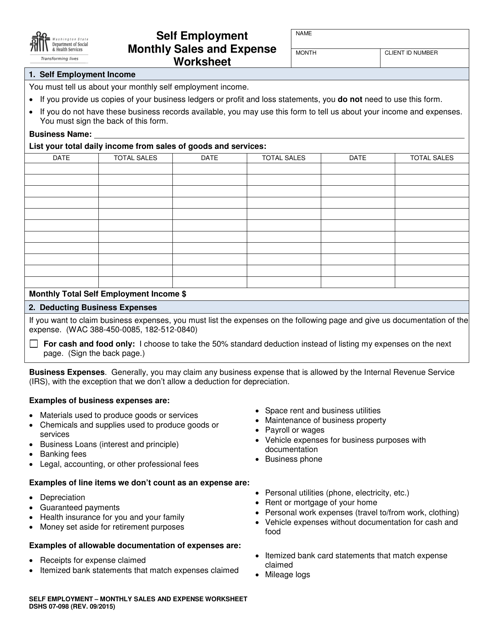

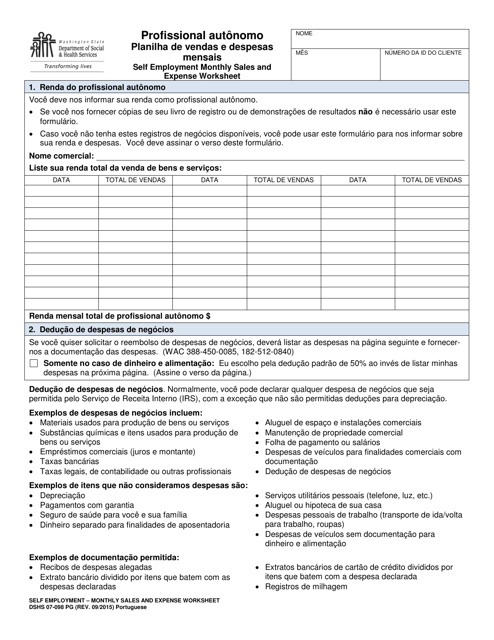

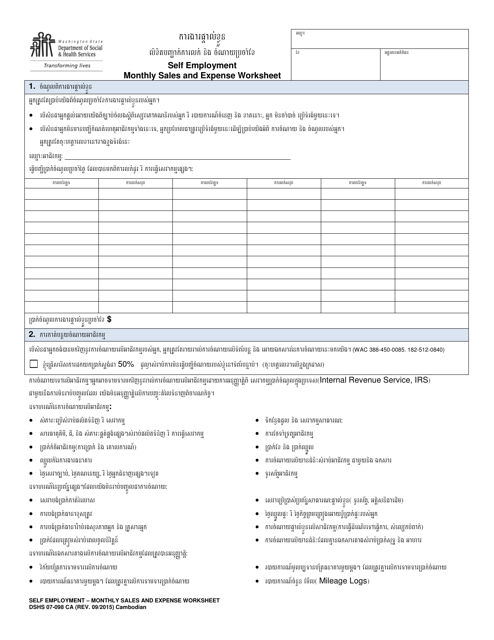

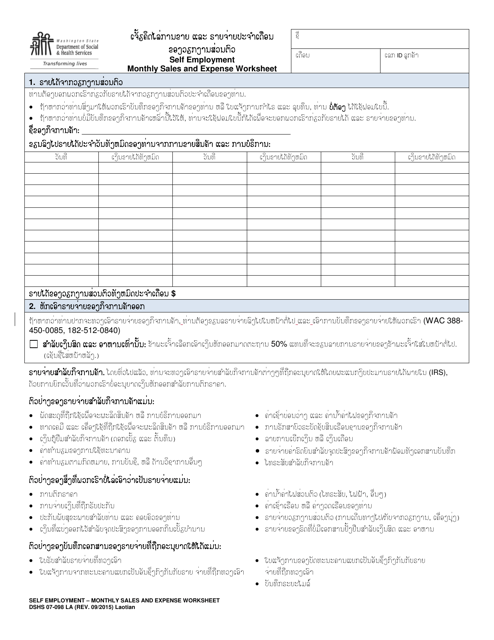

This form is used for self-employed individuals in Washington to track their monthly sales and expenses. It helps them to easily calculate their profits or losses for tax purposes.

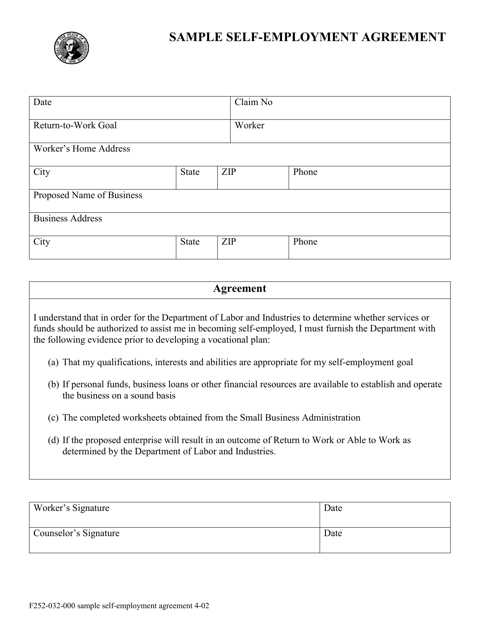

This Form is used for a sample self-employment agreement in Washington.

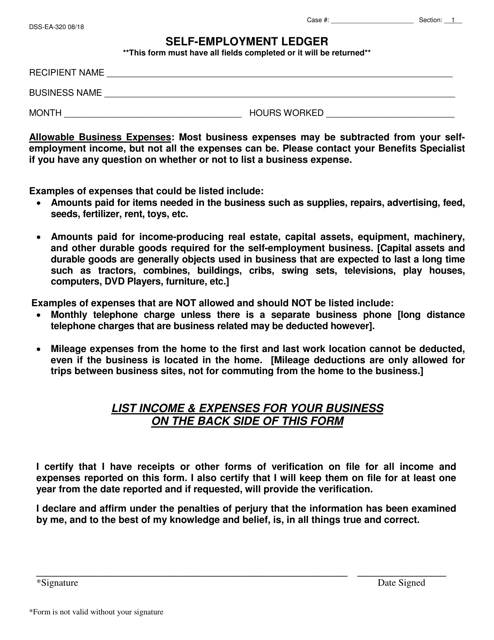

This form is used for keeping track of self-employment income and expenses in South Dakota. It helps individuals report their self-employment earnings accurately for tax purposes.

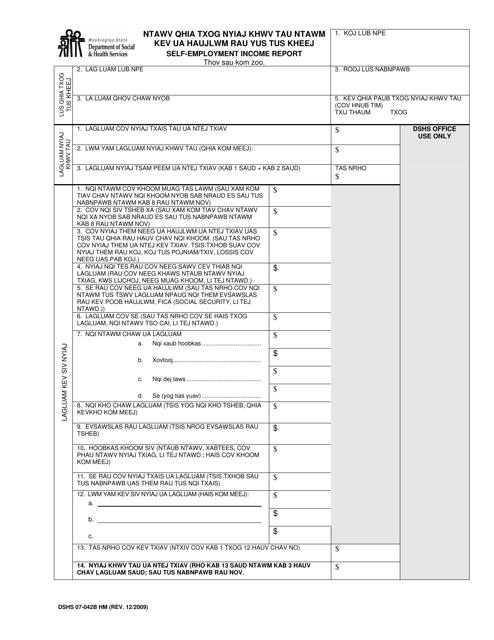

This Form is used for reporting self-employment income in Washington for individuals who speak Hmong.

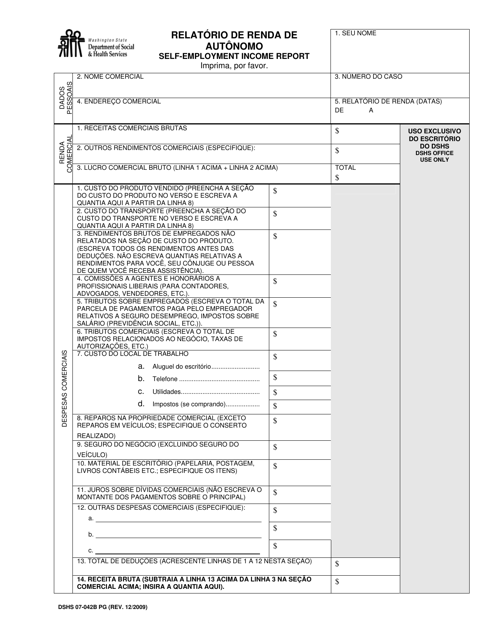

This form is used for reporting self-employment income in Washington. It is specifically for Portuguese speakers.

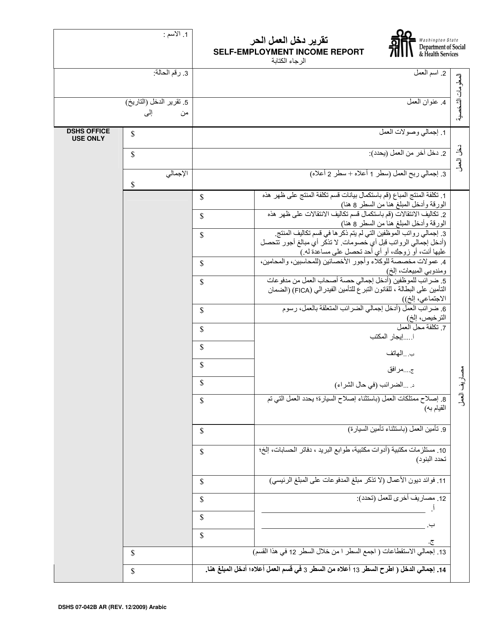

This form is used for reporting self-employment income in Arabic in the state of Washington.

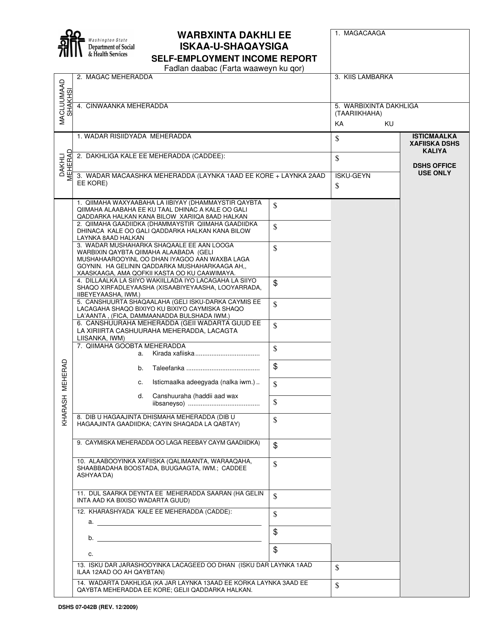

This form is used for reporting self-employment income in Washington for individuals who speak Somali.

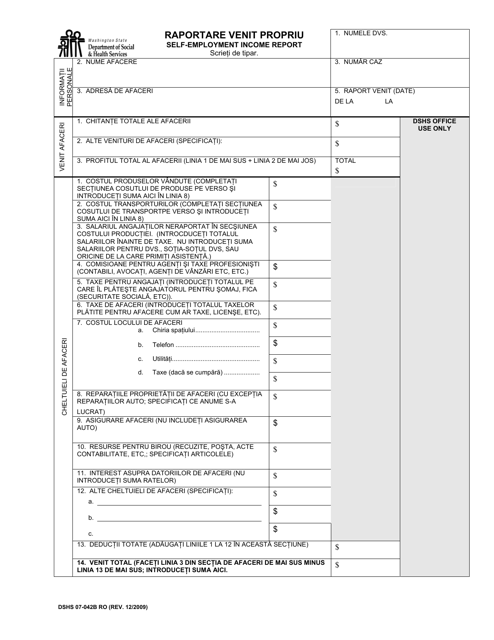

This form is used for reporting self-employment income in the state of Washington for individuals who speak Romanian.

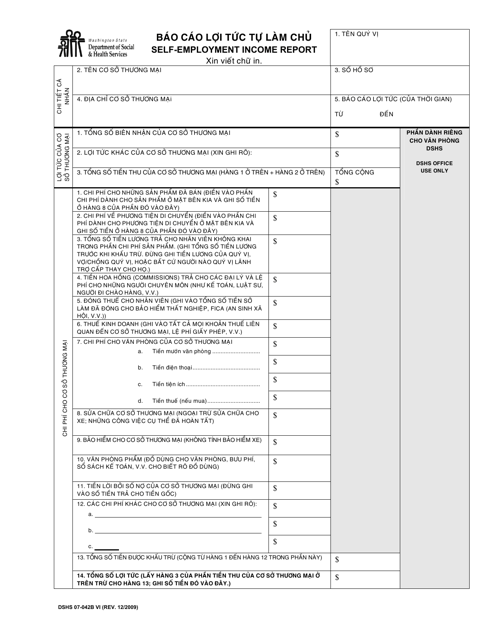

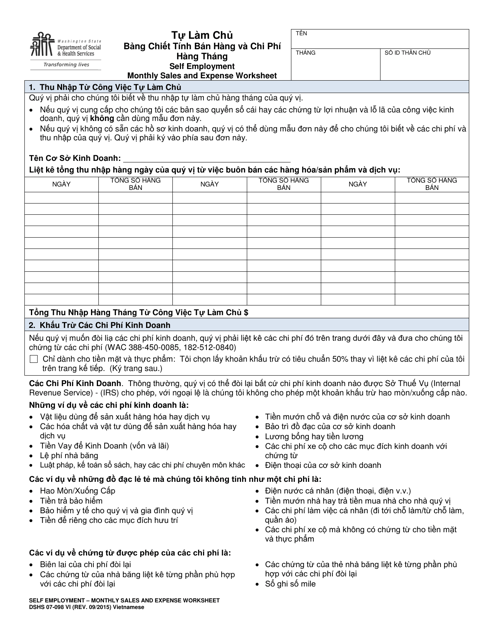

This Form is used for reporting self-employment income in Washington for Vietnamese-speaking individuals.

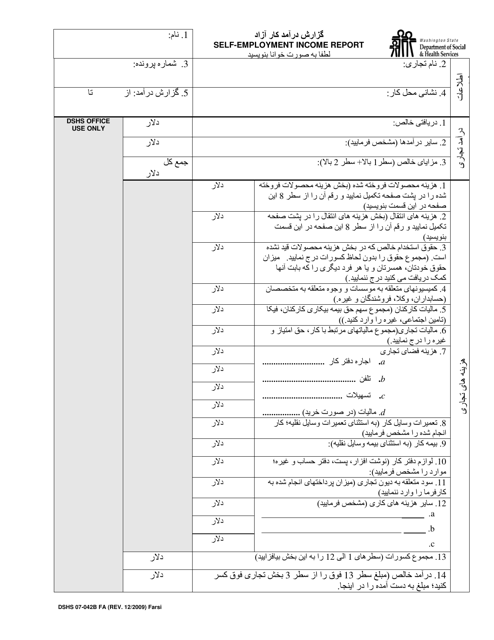

This document is for reporting self-employment income in Washington state. It is available in Farsi.

This form is used for recording monthly sales and expenses for self-employed individuals in Washington.

This Form is used for applying to the Child Care Financial Assistance Program in Vermont as a self-employed child care provider.

This form is used for self-employed individuals in Washington to report their monthly sales and expenses. It is available in Portuguese.

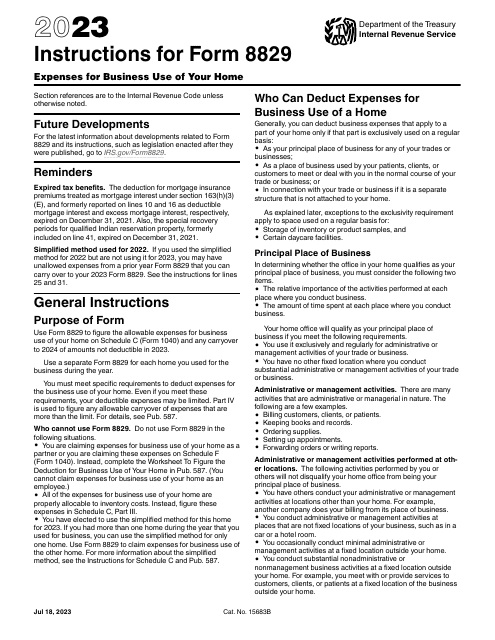

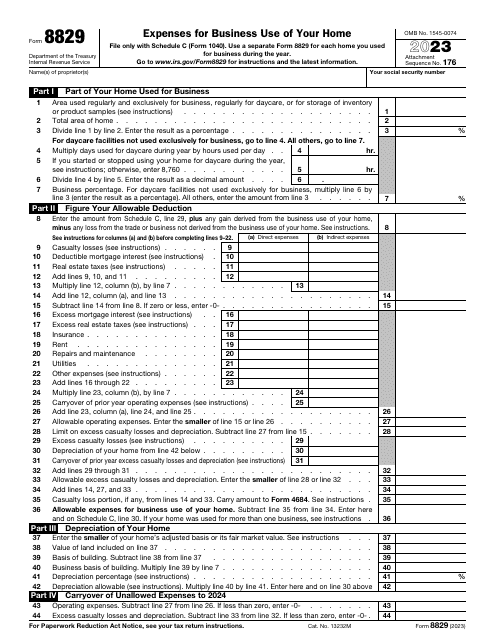

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

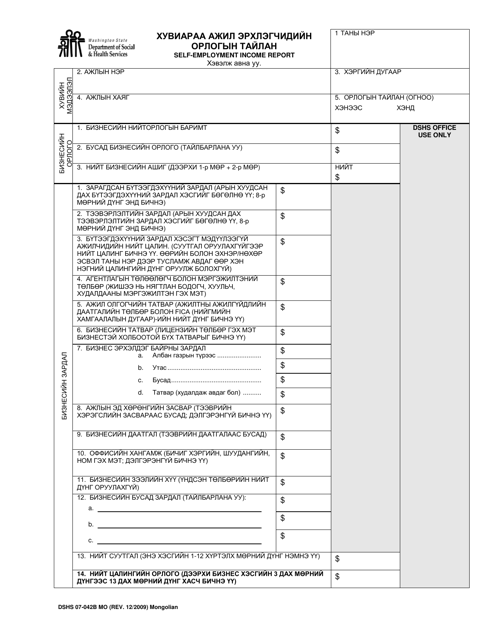

This form is used for reporting self-employment income in Washington state. It is specifically designed for individuals who are of Mongolian nationality.

This form is used for reporting self-employment income in Washington for individuals of Cambodian descent.

This document is used for reporting self-employment income in Washington state for Ukrainian residents.

This form is used for reporting monthly sales and expenses for self-employed individuals in Washington State, specifically for individuals who speak Cambodian. It helps track income and expenses for tax purposes and other financial reporting.

This document is used for reporting the monthly sales and expenses of self-employed individuals in Washington state. It is specifically designed for Lao-speaking individuals.