Tax Requirements Templates

Documents:

169

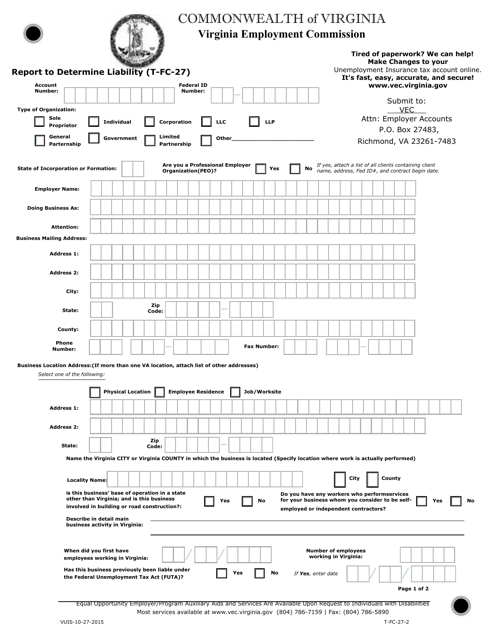

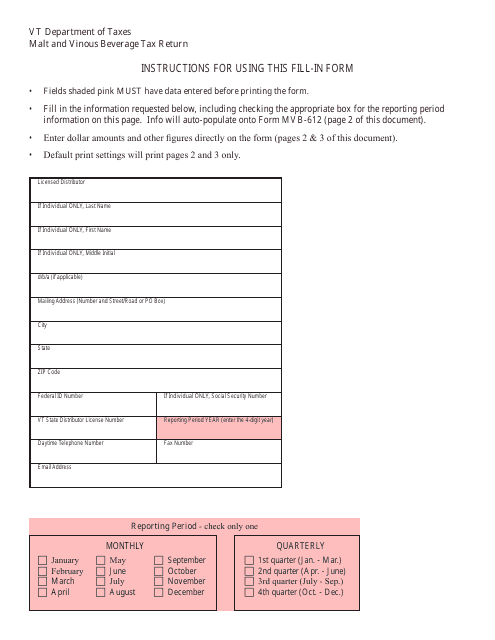

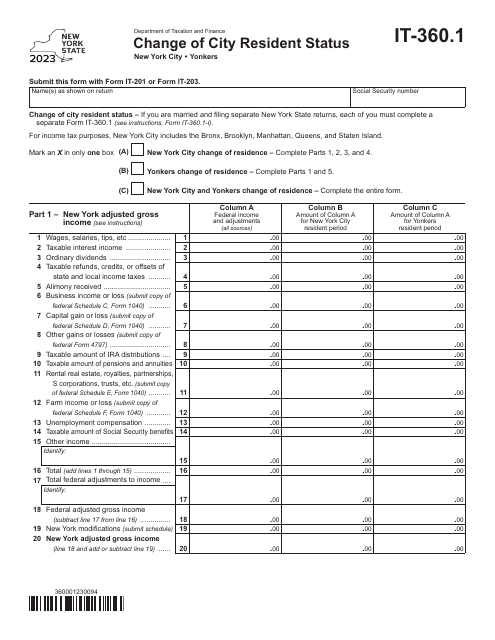

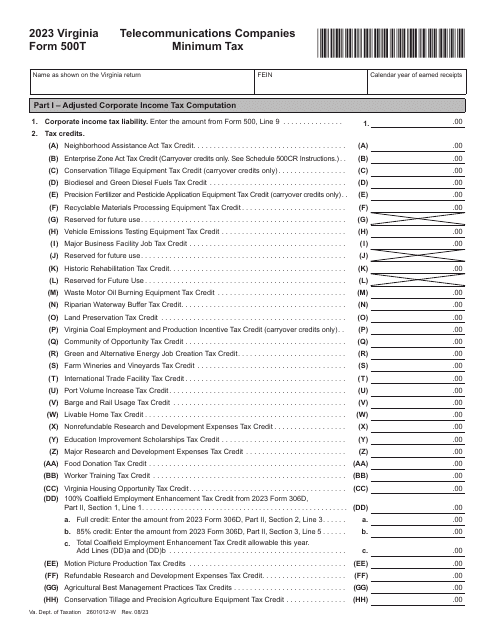

This form is used for reporting and determining liability in the state of Virginia. It is specifically for tax purposes and helps individuals or businesses report their financial obligations accurately.

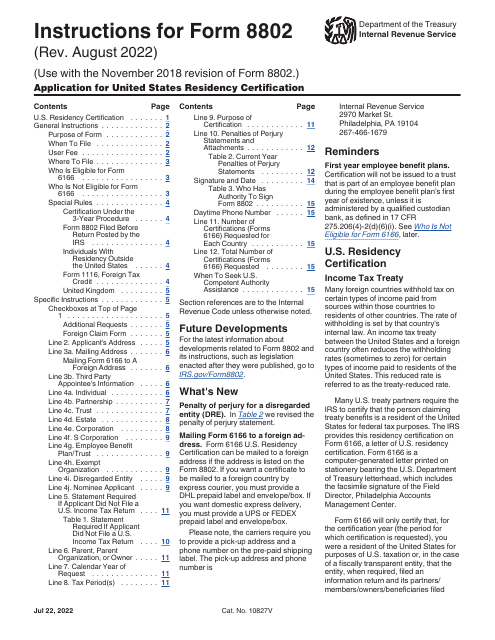

These are the official instructions for IRS Form 8802 and is used to help certify an applicant's United States residency.

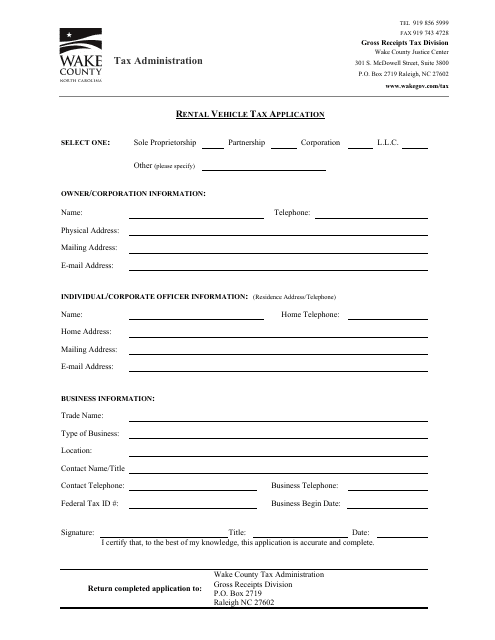

This document is for applying for rental vehicle tax in Wake County, North Carolina. It is used to report and pay taxes related to renting vehicles in the county.

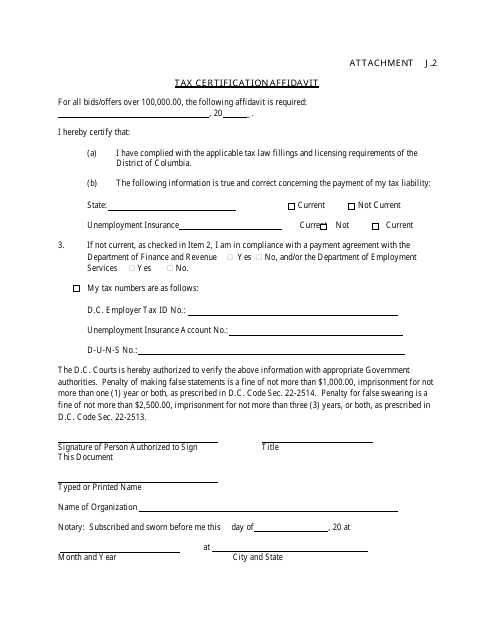

This document is for certifying tax information in Washington, D.C. It is used to confirm details related to tax obligations.

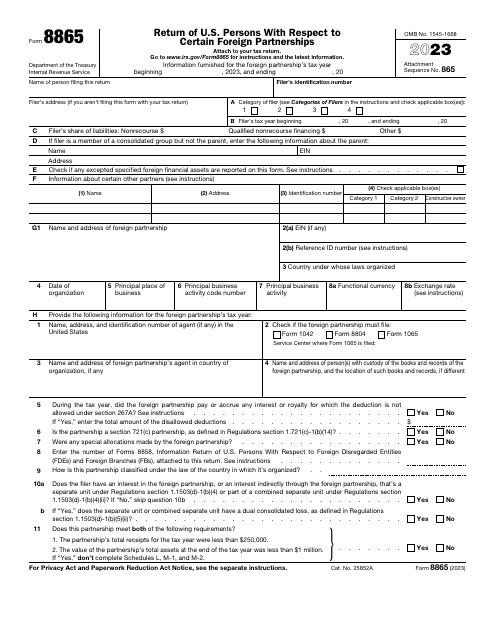

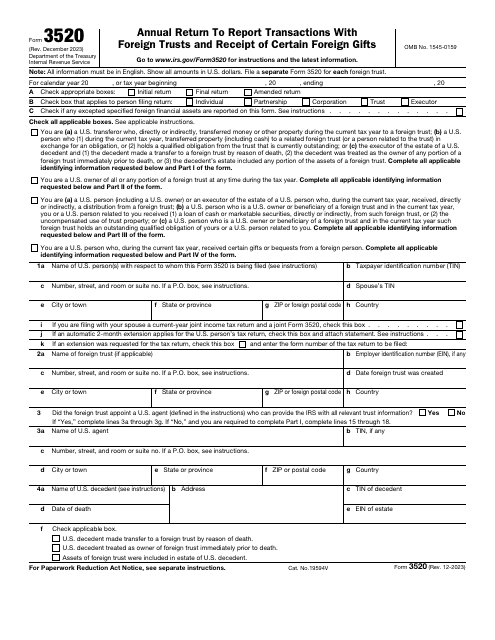

This form is a formal statement used by people and entities obliged to tell the fiscal authorities about the transactions they have had with foreign trusts throughout the year.

This document is used for reporting additions and deductions for pass-through entities, estates, and trusts in North Carolina. It is a form that taxpayers can use to accurately report their income, expenses, and deductions related to these entities.

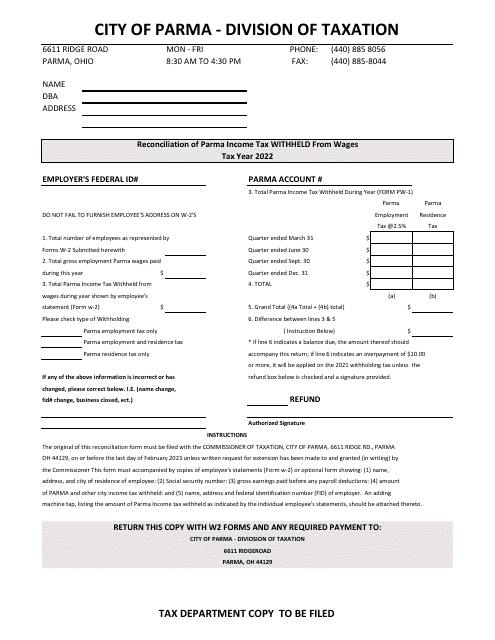

This form is used for reconciling the income tax withheld from wages in the City of Parma, Ohio.

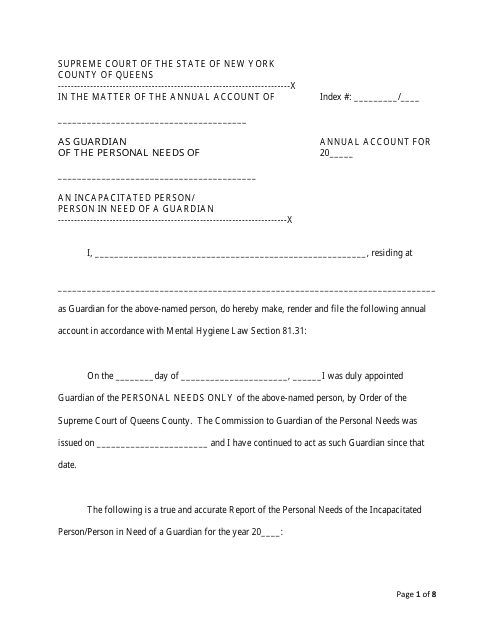

This document is used for filing annual accounts in New York. It provides a summary of a company's financial activities for the year.

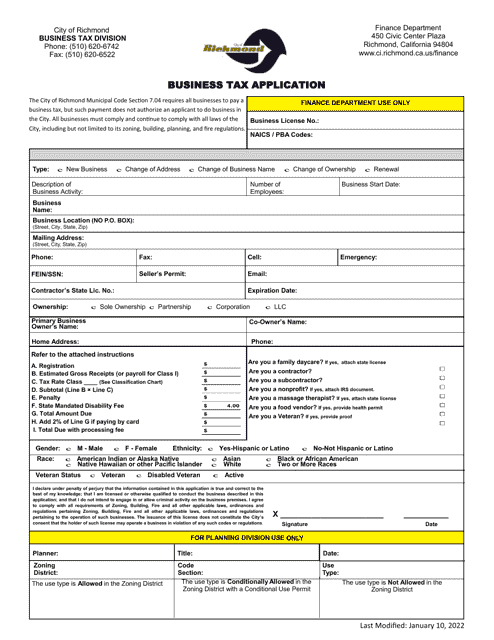

This form is used for applying for business tax in Richmond City, California.

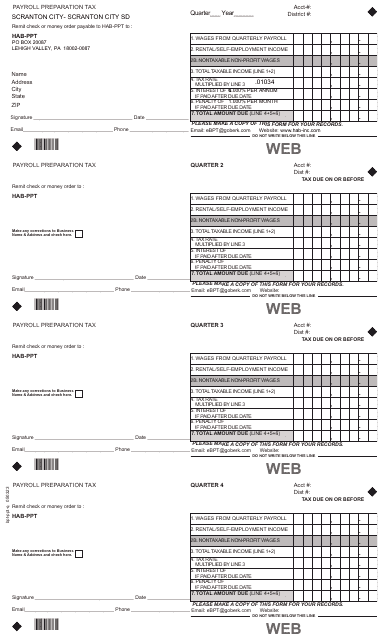

This form is used for preparing payroll and calculating taxes for employees in the City of Scranton, Pennsylvania.