Tax Requirements Templates

Documents:

169

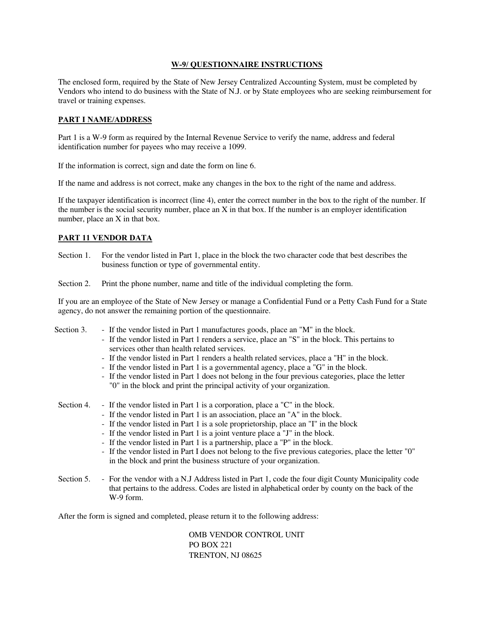

This document is a W-9 questionnaire specific to the state of New Jersey. It is used to collect taxpayer identification information for reporting purposes.

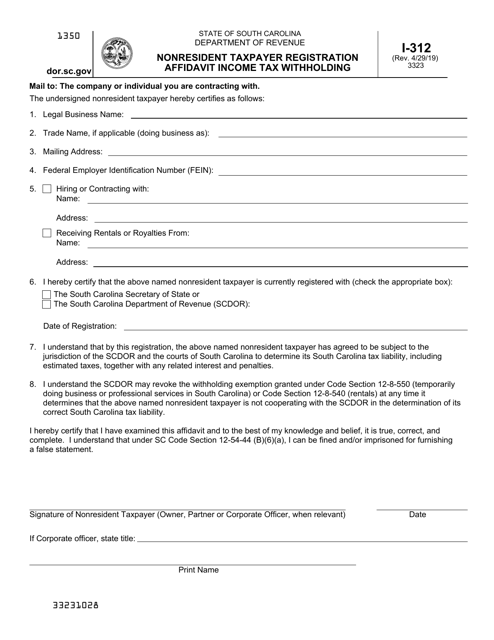

This form is used for nonresident taxpayers in South Carolina to register and declare their income tax withholding status.

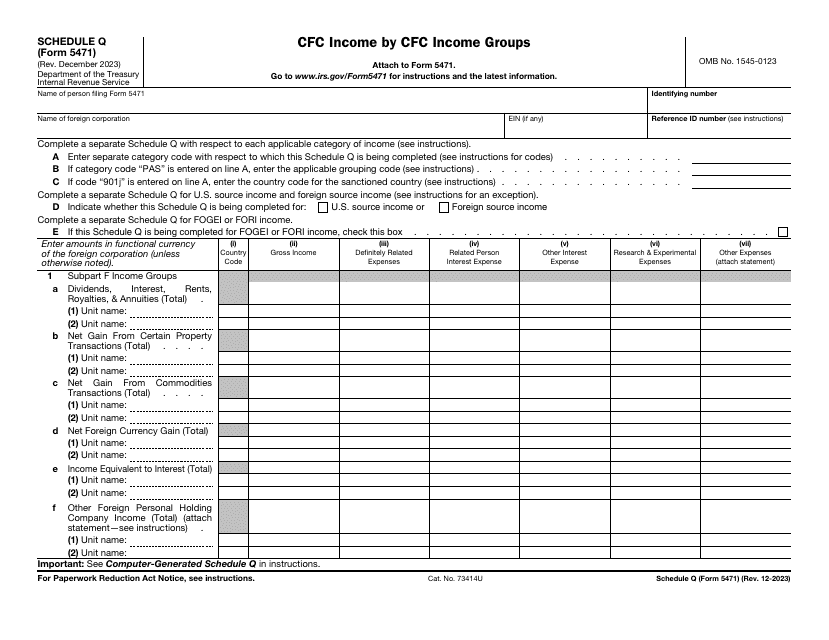

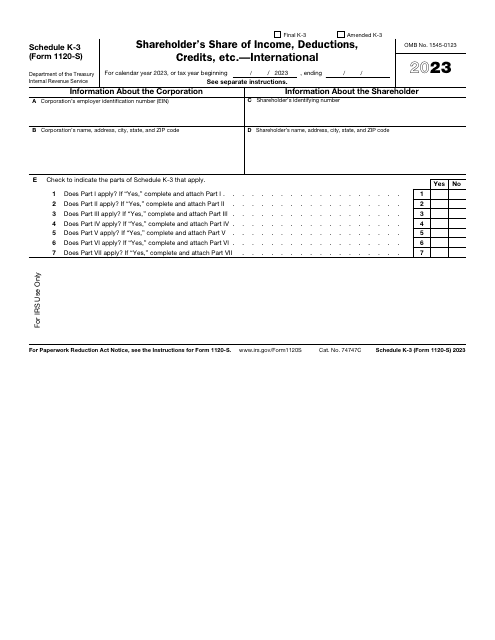

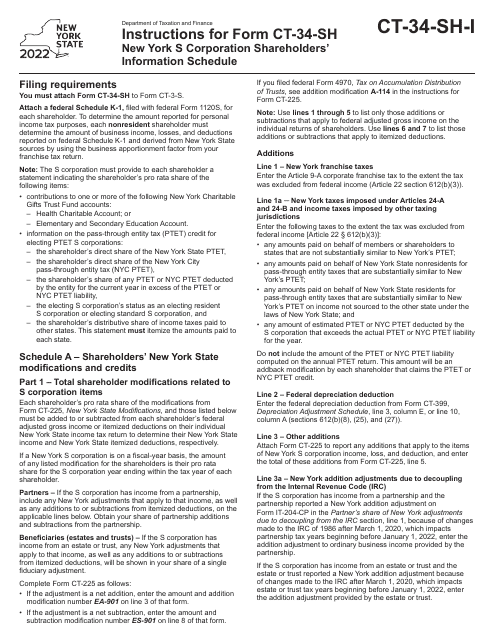

This is a fiscal form filled out by S corporations to inform the tax authorities about their international operations that are subject to tax.

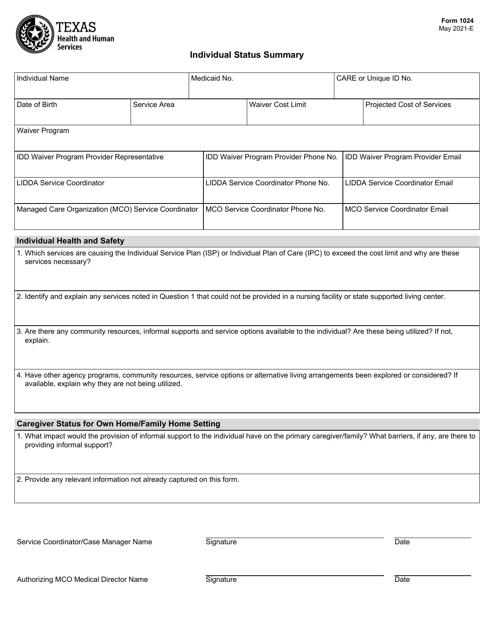

This form is used to provide a summary of an individual's tax status in the state of Texas.

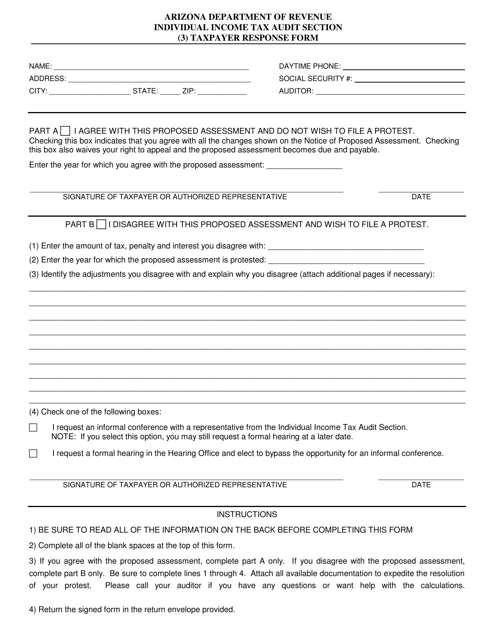

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

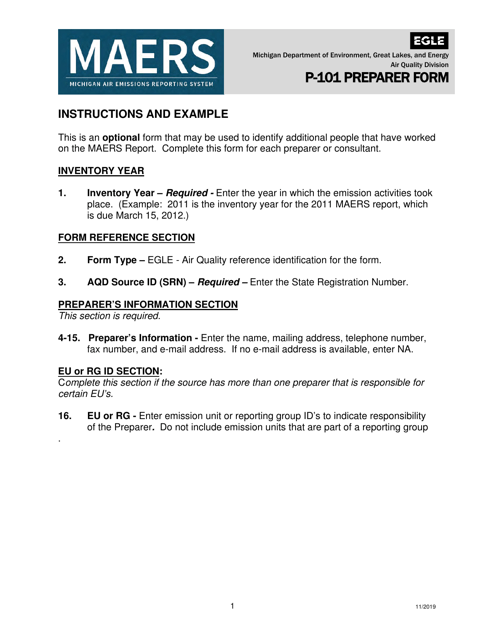

This document provides instructions for completing Form P-101, which is used by EQP5754 preparers in the state of Michigan. The form is used for... (provide specific purpose of the form).

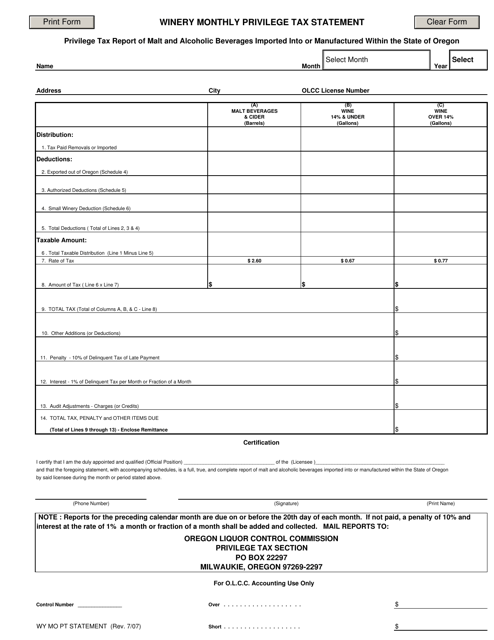

This document is used for reporting and paying monthly privilege tax for wineries in Oregon.

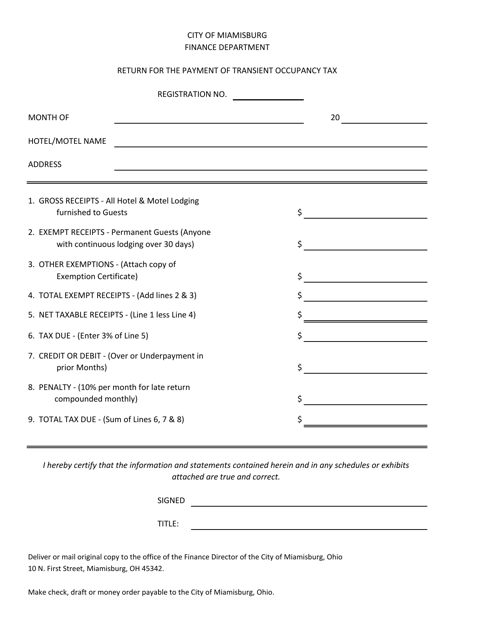

This form is used for reporting and submitting payment for the transient occupancy tax in the City of Miamisburg, Ohio.

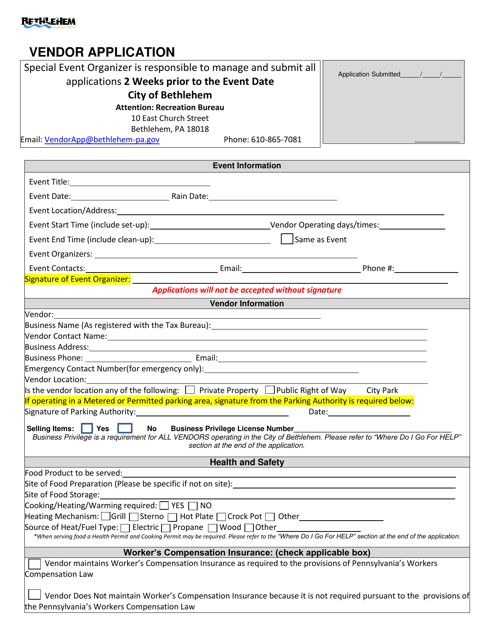

This form is used for vendors who want to apply to do business with the City of Bethlehem, Pennsylvania.

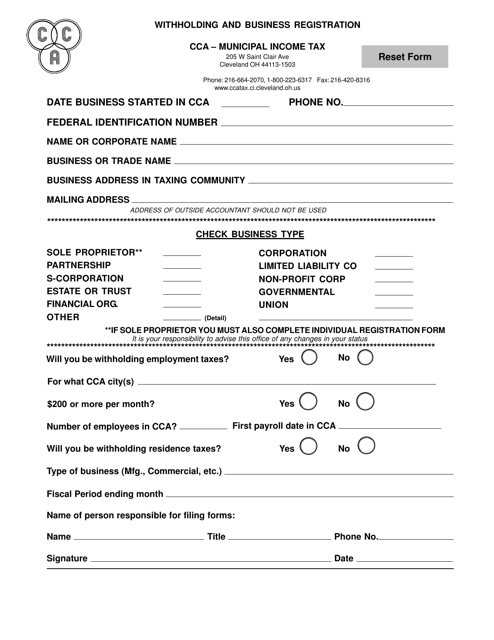

This document is for businesses in the city of Cleveland, Ohio who need to register for withholding taxes and obtain a business registration.

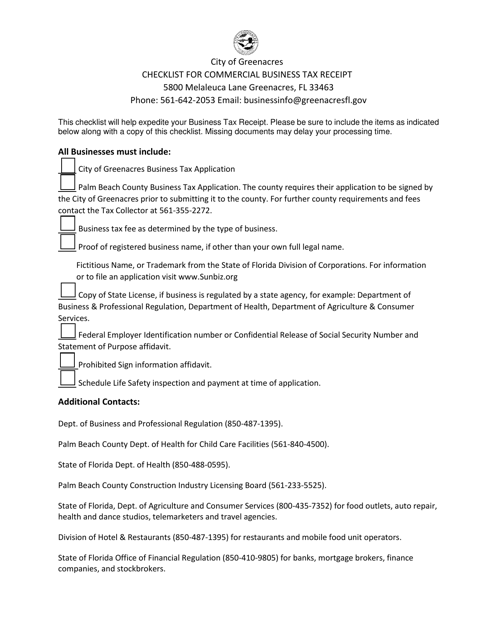

This document is a checklist for applying for a Commercial Business Tax Receipt in the City of Greenacres, Florida. It outlines the steps and requirements for obtaining a tax receipt for commercial businesses in the city.

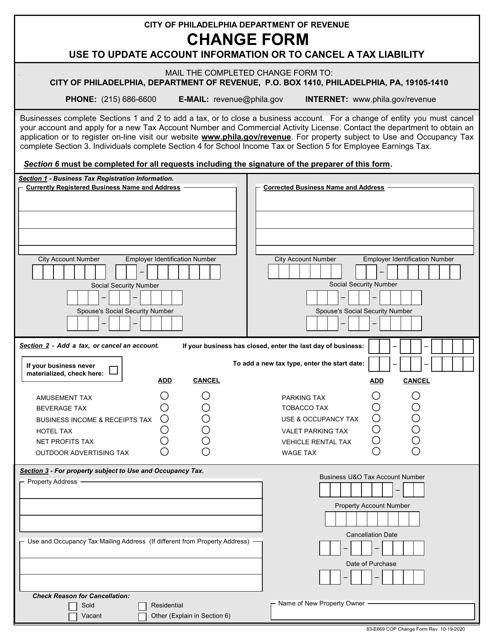

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

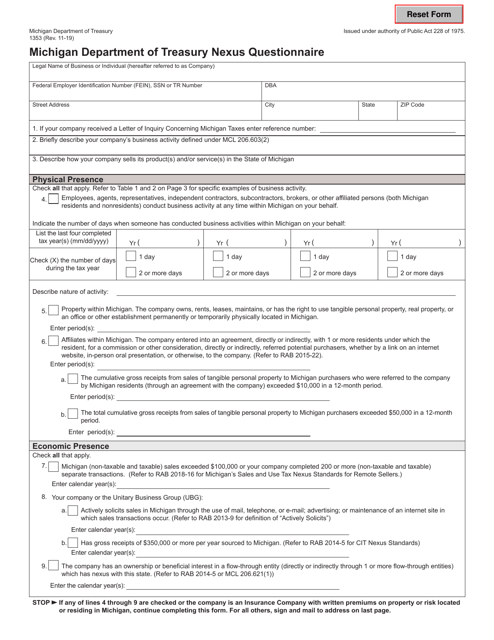

This form is used for the Nexus Questionnaire required by the Michigan Department of Treasury to determine if a business has sufficient presence in Michigan to be subject to state taxes.

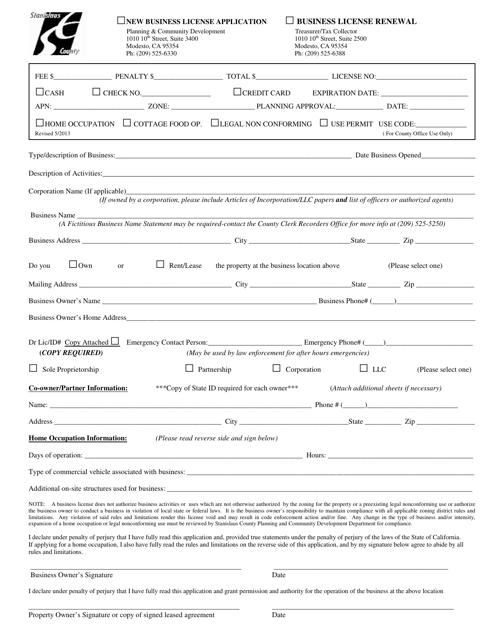

This document is for renewing the business license in Stanislaus County, California. It is required for businesses to continue operating legally in the county.

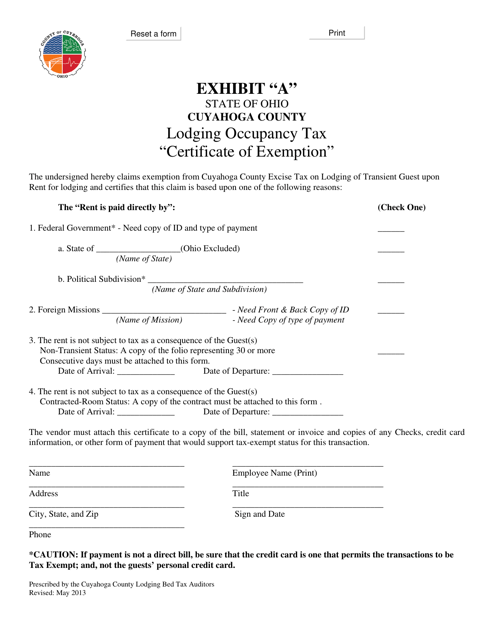

This document is a Lodging Occupancy Tax Certificate of Exemption specific to Cuyahoga County, Ohio. It is used for exempting certain types of lodging establishments from paying occupancy taxes in the county.

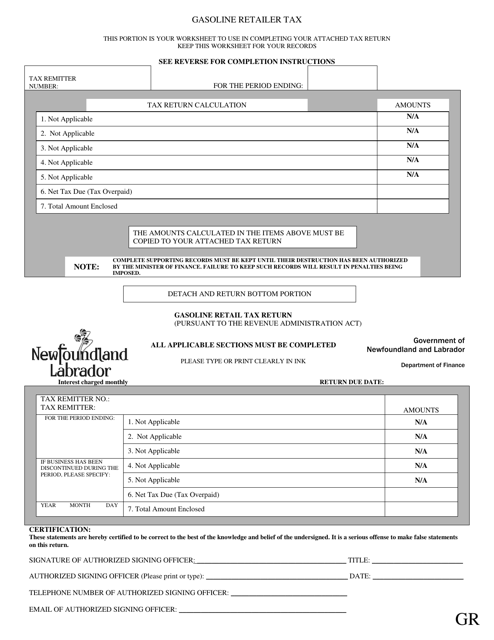

This document is used to schedule and pay the gasoline retailer tax in Newfoundland and Labrador, Canada.