Tax Requirements Templates

Documents:

169

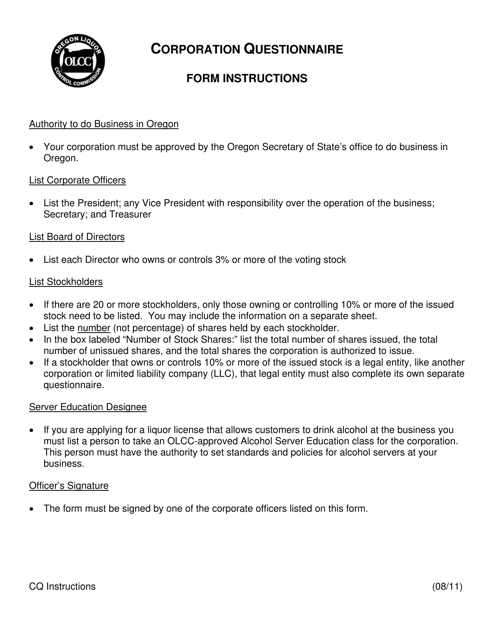

This document is used to gather information about a corporation in the state of Oregon. It helps in understanding the structure and operations of the corporation.

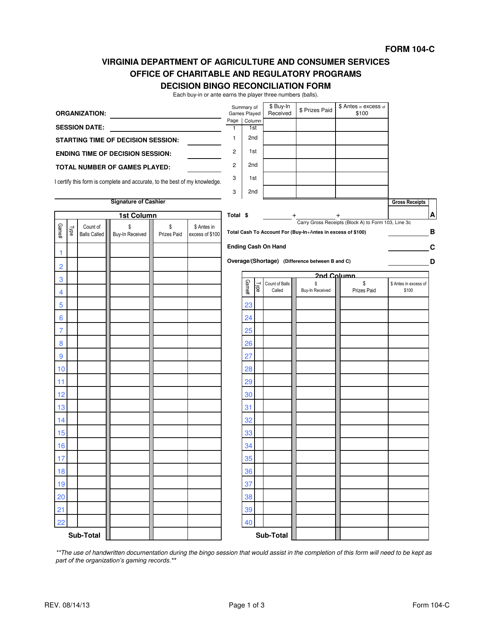

This Form is used for reconciling decisions made during a game of bingo in the state of Virginia.

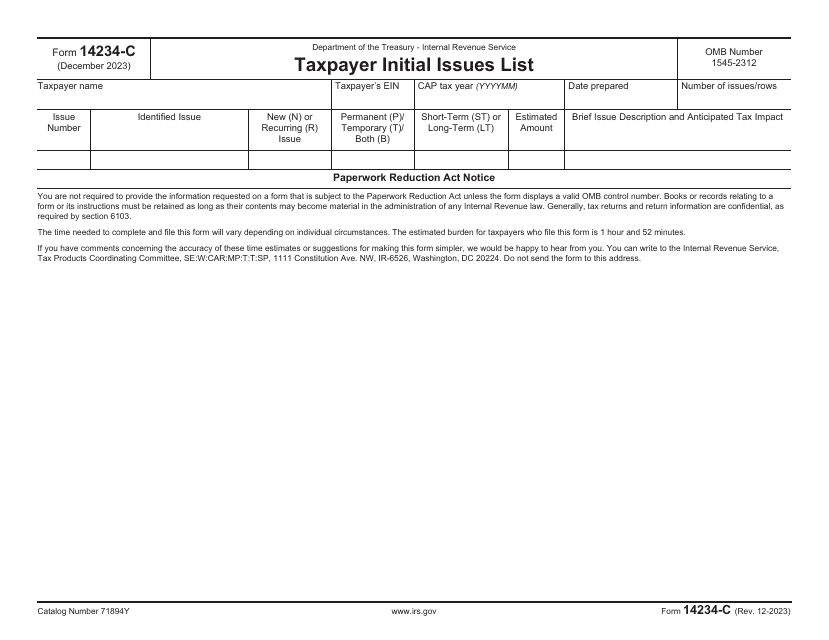

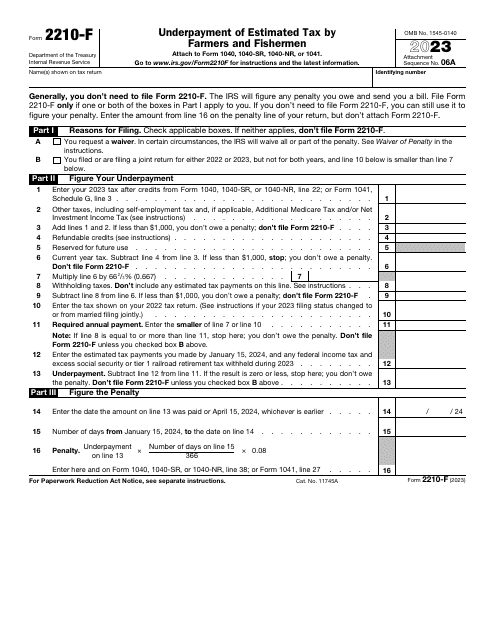

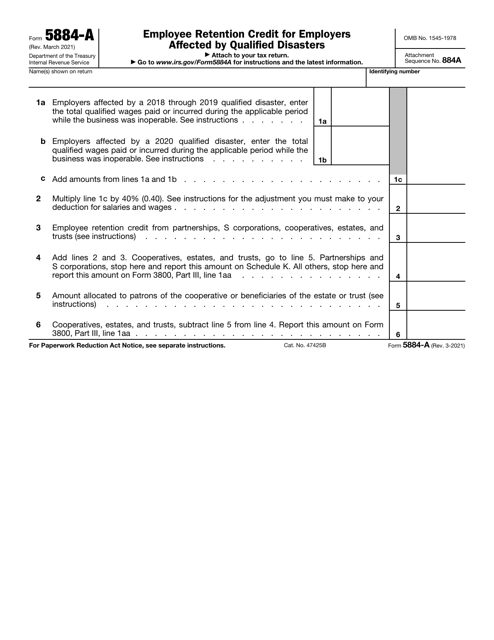

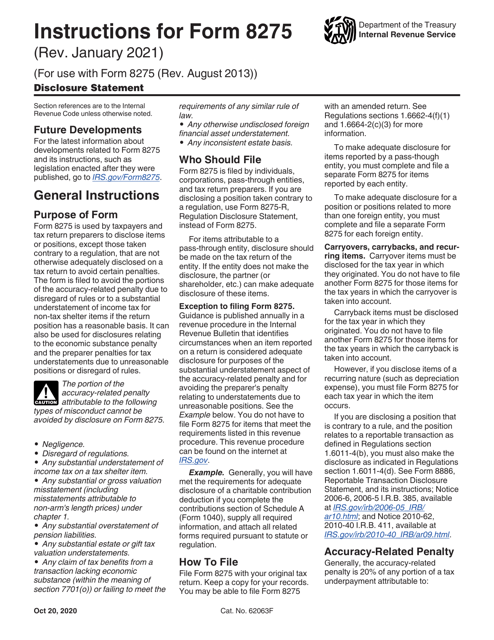

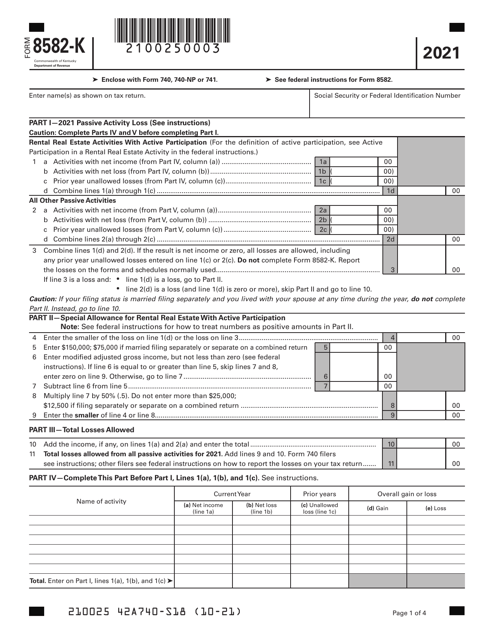

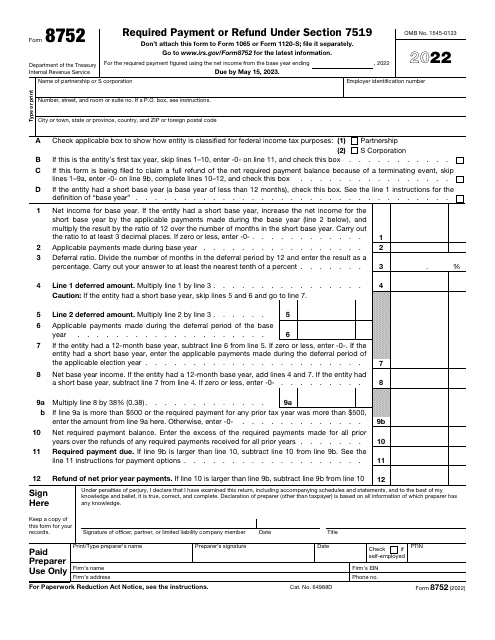

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

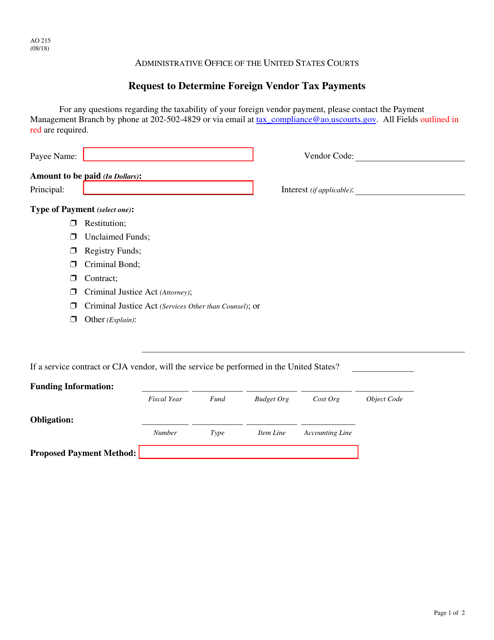

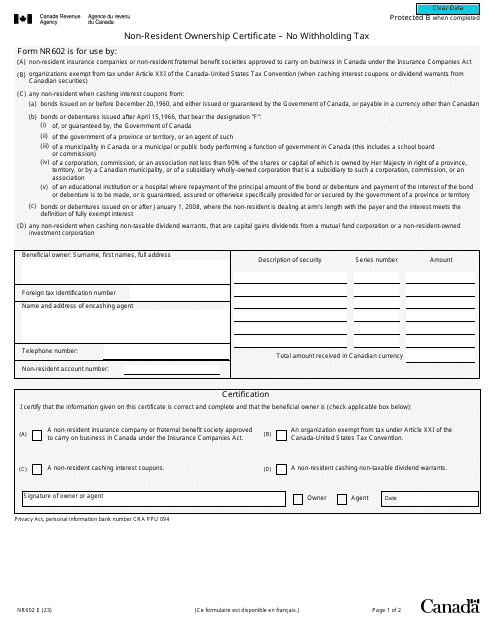

This form is used for requesting the determination of tax payments made by a foreign vendor.

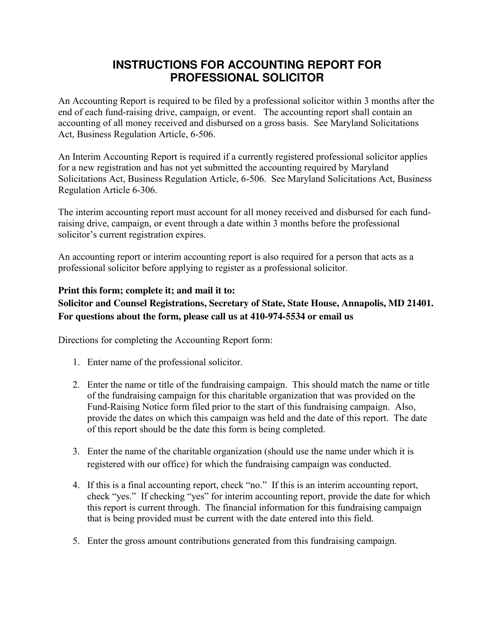

This accounting report is specifically designed for professional solicitors operating in the state of Maryland. It provides a detailed overview of financial activities and highlights compliance with Maryland's specific accounting requirements for solicitors.

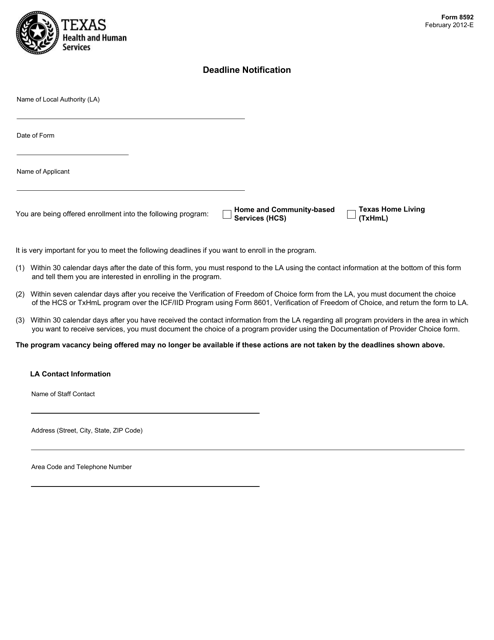

This form is used for notifying the deadline for Form 8592 in the state of Texas.

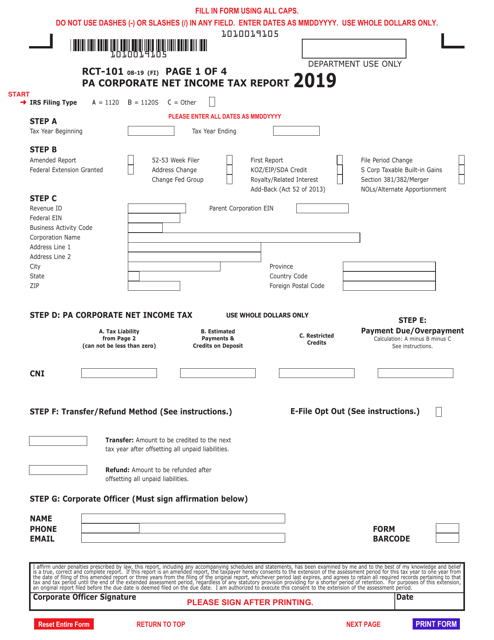

This form is used for reporting corporate net income tax in the state of Pennsylvania.

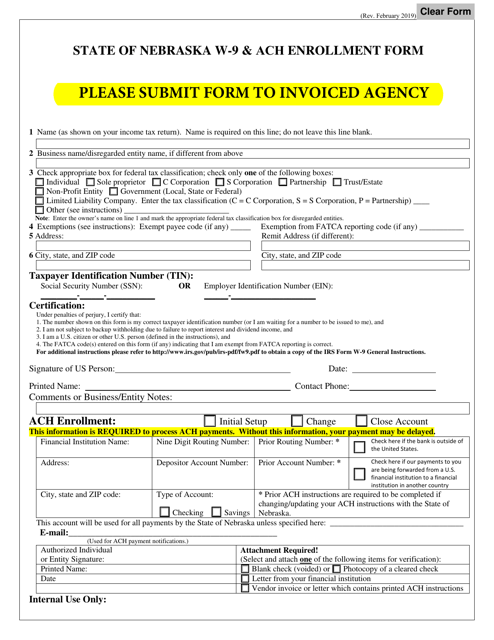

This form is used for the state of Nebraska to receive W-9 information and enroll in ACH (Automated Clearing House) payment.

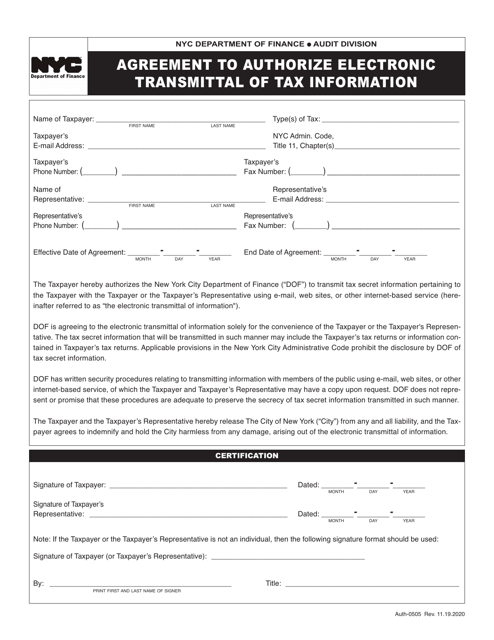

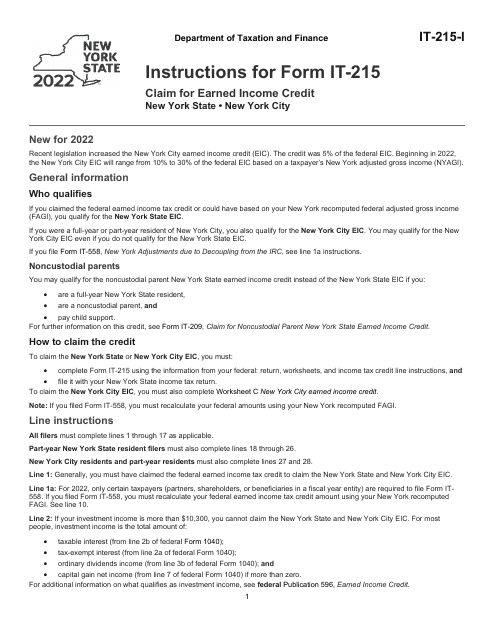

This form is used for authorizing the electronic transmittal of tax information in New York City.

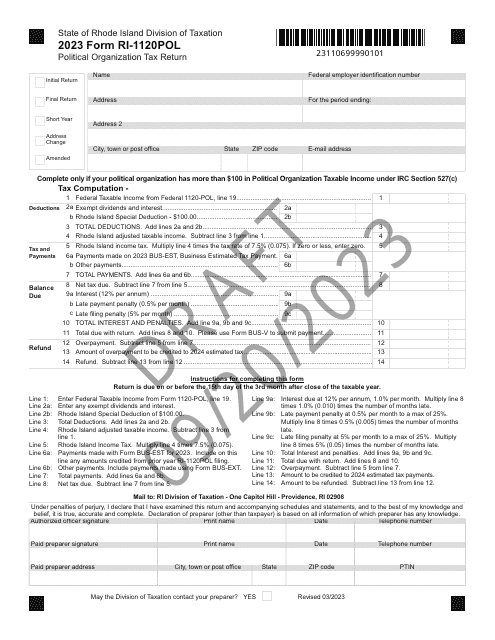

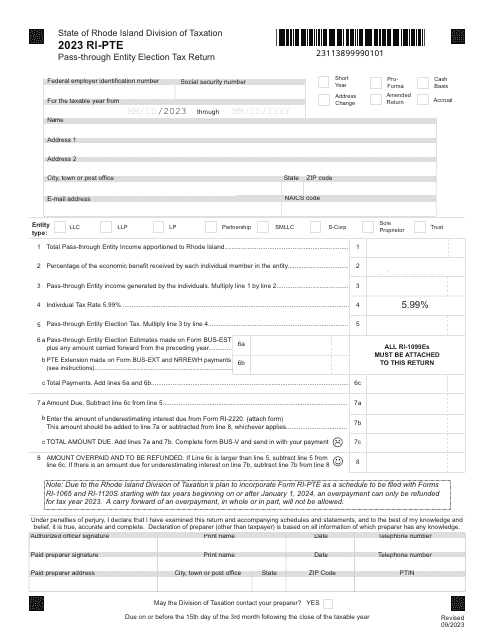

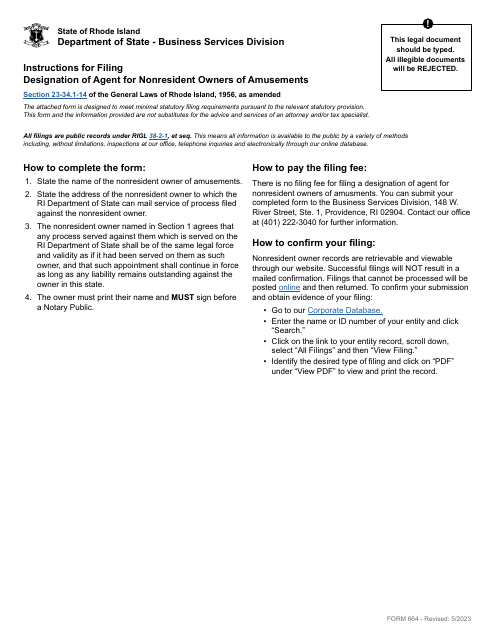

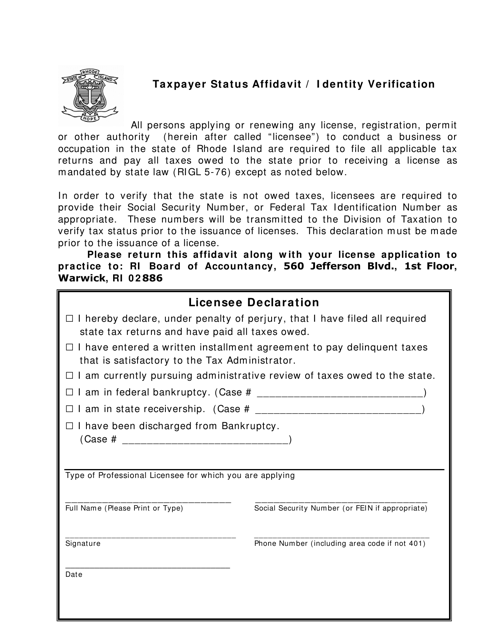

This document is used for affirming taxpayer status and verifying identity in the state of Rhode Island.

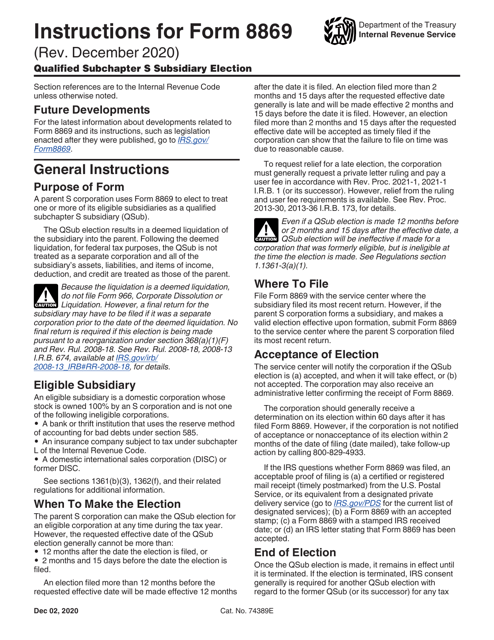

This Form is used for electing to treat a domestic corporation as a Qualified Subchapter S Subsidiary (QSub).