Tax Requirements Templates

When it comes to taxes, it's important to understand the various tax requirements that apply to you or your business. Meeting these tax documentation requirements and completing the necessary tax forms is crucial for compliance and avoiding any potential penalties.

At Templateroller.com, we provide comprehensive information and resources on tax requirements, ensuring that you have the knowledge and tools to navigate the complex world of tax compliance. Our team of experts has compiled a wide range of tax form requirements and instructions to help you understand and meet your tax obligations.

Whether you need instructions for forms like the IRS Form 8938 Statement of Specified Foreign Financial Assets or the IRS Form 2555 Foreign Earned Income, we've got you covered. We also provide guidance on local tax requirements, such as the Business License Renewal in Stanislaus County, California, or the Arizona Form 312 and ADOR forms in Arizona.

With our user-friendly platform, you can easily access all the information you need to fulfill your tax requirements. We strive to simplify the process and make it as straightforward as possible, so you can focus on what you do best - running your business or managing your personal finances.

Trust Templateroller.com as your go-to resource for tax requirement information, tax documentation requirements, and tax form requirements. Our expertise and comprehensive resources will empower you to meet your tax obligations accurately and on time. Let us guide you through the world of tax compliance and ensure your peace of mind.

Documents:

169

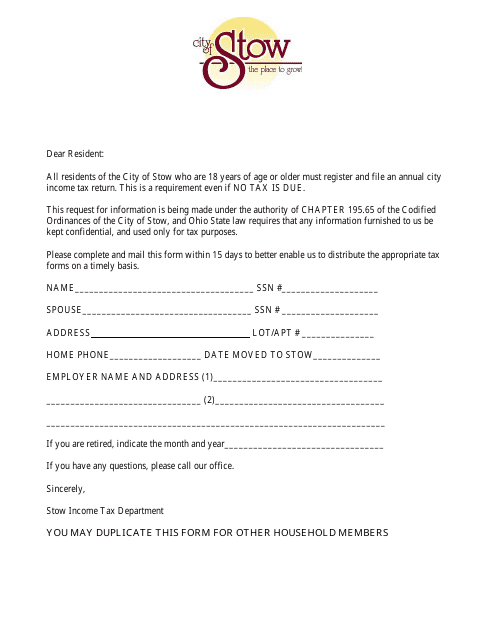

This Form is used for filing your income tax return in the City of Stow, Ohio.

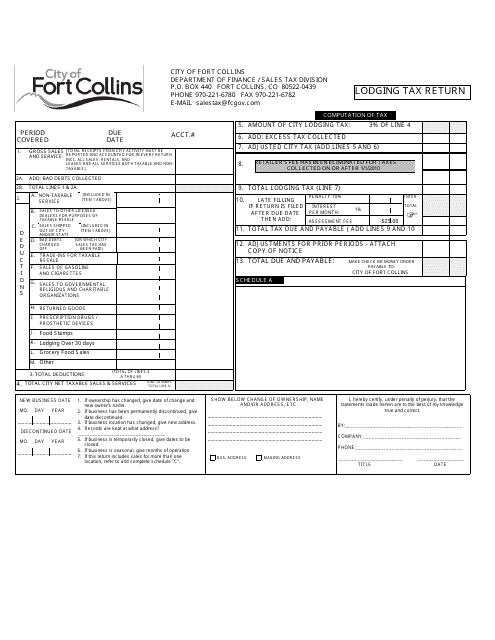

This document is used for filing a lodging tax return specifically for the city of Fort Collins, Colorado. It is required for individuals or businesses that provide lodging accommodations within the city and need to report and remit the applicable taxes.

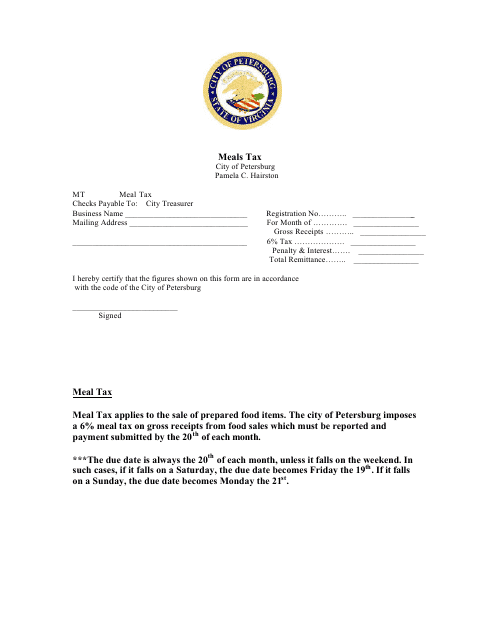

This form is used for reporting and paying the meals tax in Petersburg, Virginia. Businesses in the city that sell prepared meals are required to complete and submit this form to the local tax authority.

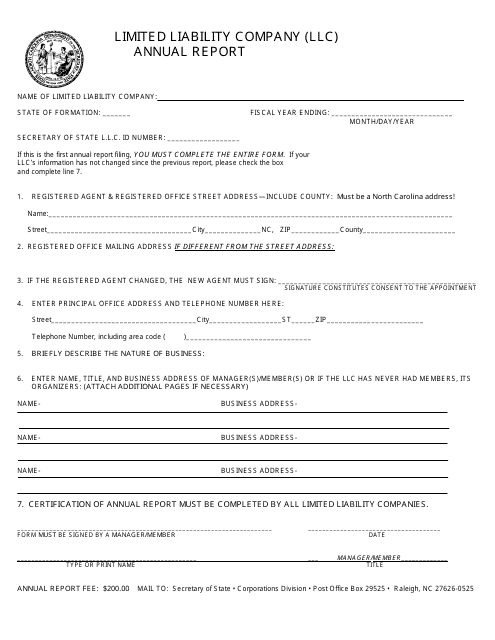

This Form is used for filing the annual report by Limited Liability Companies (LLCs) in North Carolina. It is a legal requirement to provide updated information about the business and its members to maintain active status as an LLC in the state.

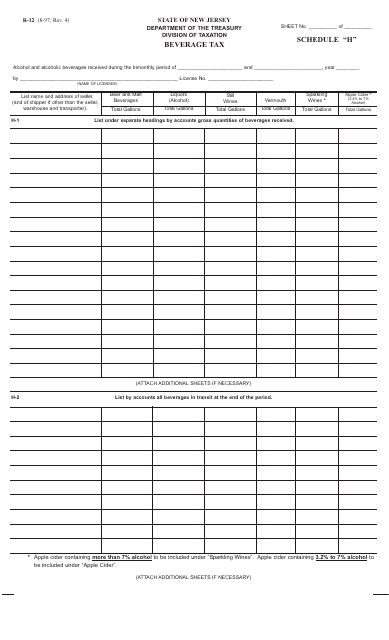

This form is used for reporting and paying beverage taxes in the state of New Jersey.

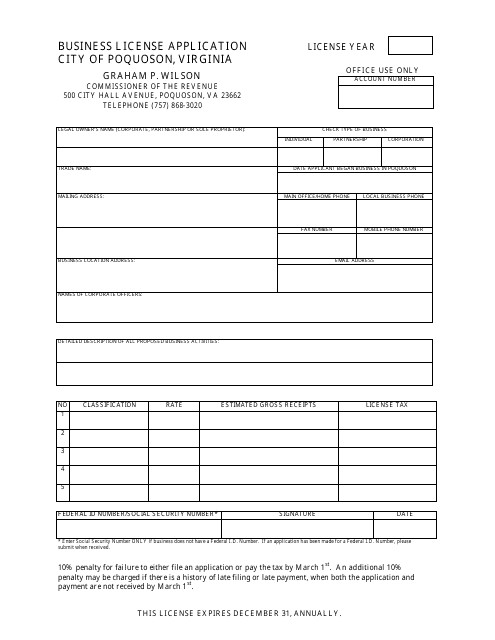

This form is used to apply for a business license in the City of Poquoson, Virginia.

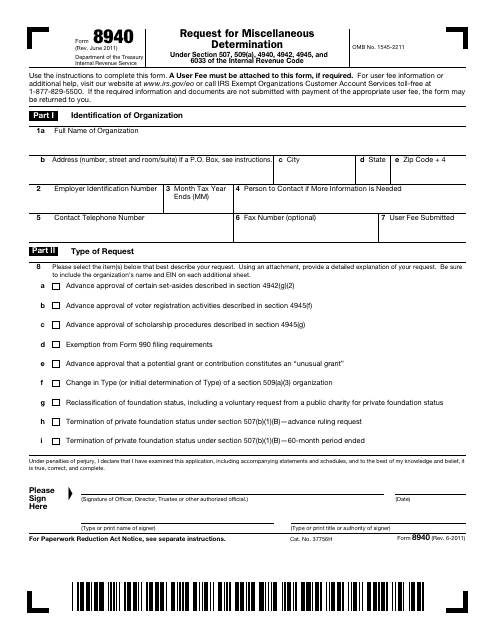

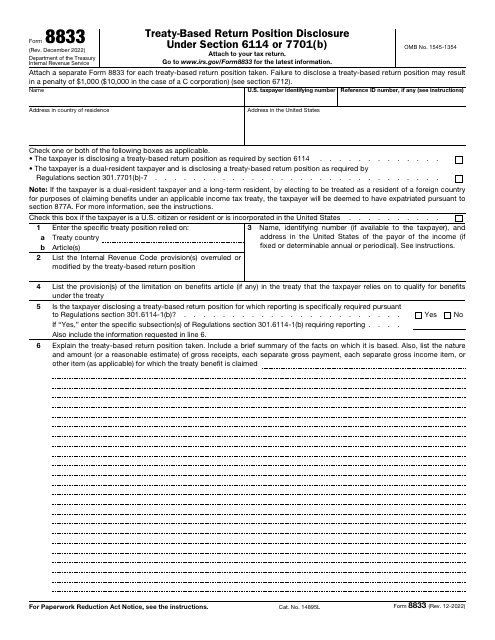

This form is used for requesting miscellaneous determinations from the IRS.

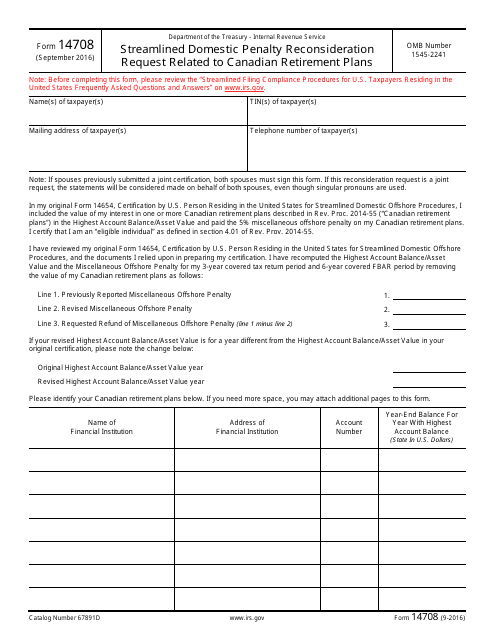

This document is used for requesting a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures.

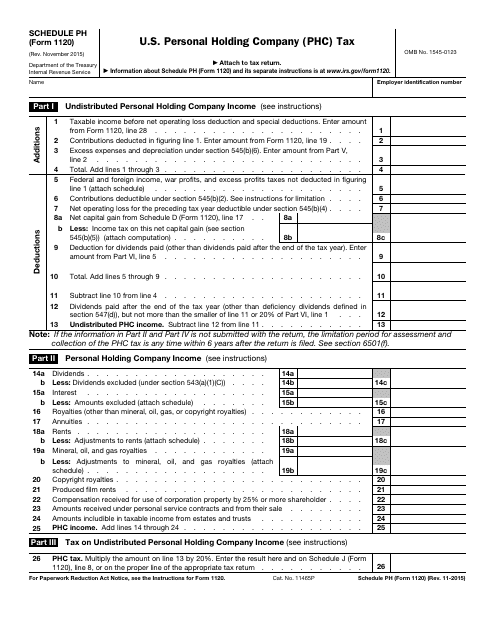

This form is used for reporting and paying U.S. Personal Holding Company (PHC) Tax for companies classified as personal holding companies.

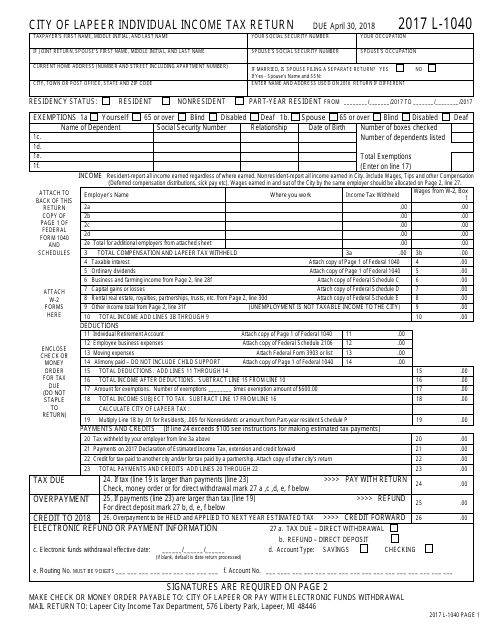

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

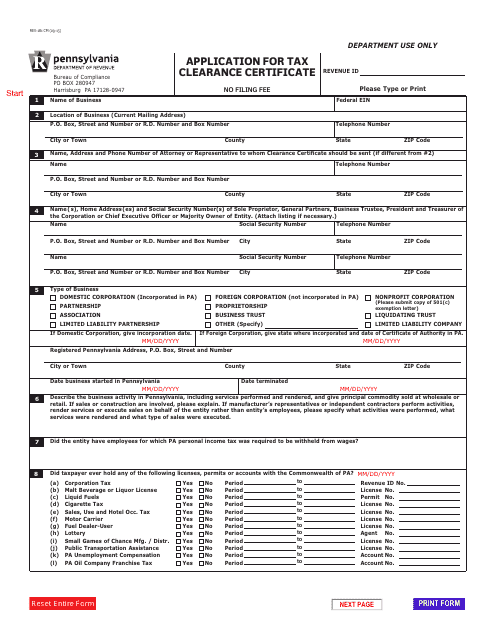

This form is used for applying for a Tax Clearance Certificate in Pennsylvania.

This form is used for reporting and paying inheritance tax for residents of New Jersey.

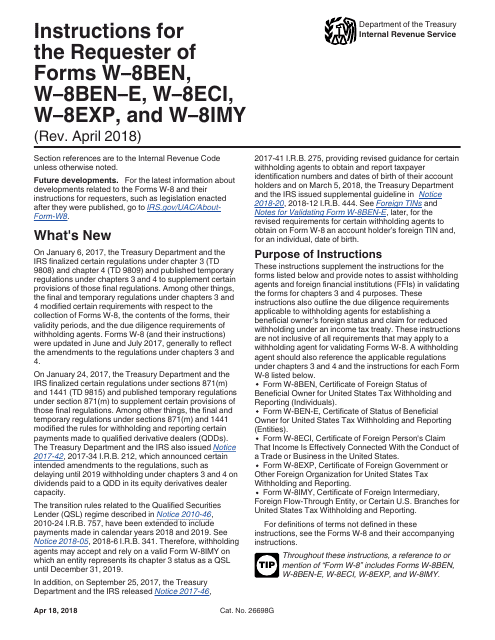

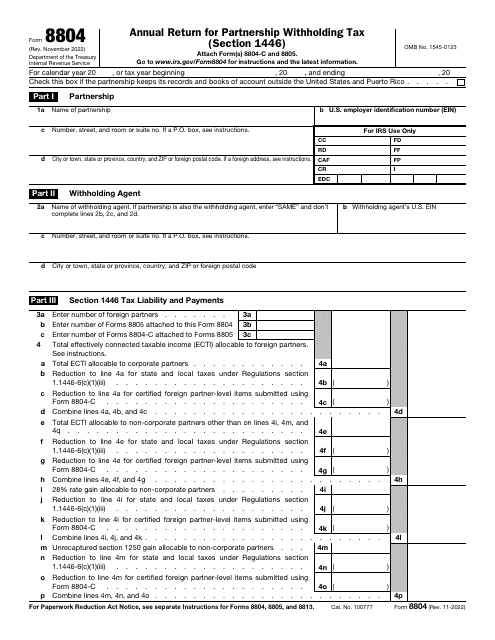

This document provides instructions for various IRS forms including W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. These forms are used to certify the foreign status of the taxpayer and claim eligibility for tax treaty benefits, exemption from withholding, or reduced withholding rates. The instructions guide taxpayers on how to complete these forms correctly and provide required information to the IRS.

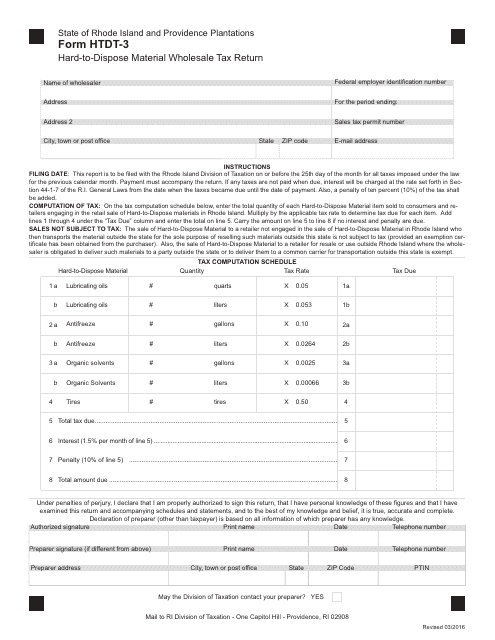

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

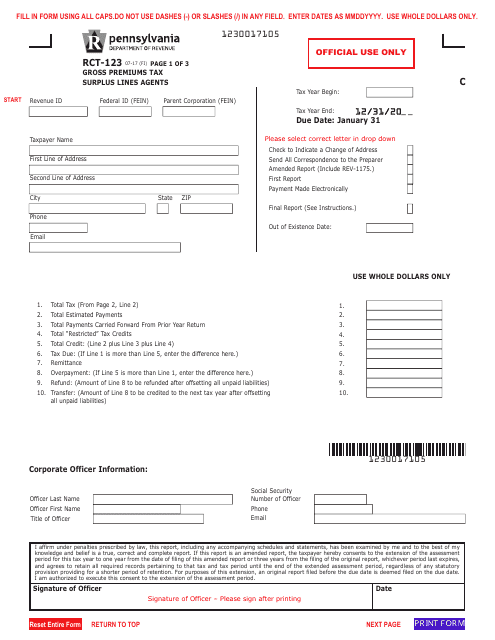

This form is used for reporting gross premiums tax for surplus lines agents in Pennsylvania.

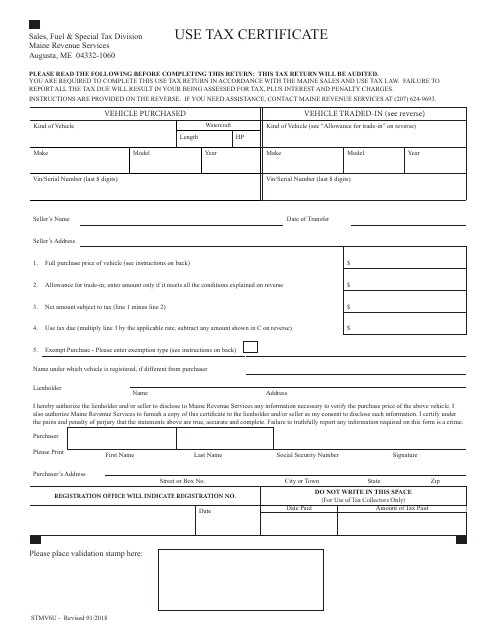

This form is used for certifying use tax payments in the state of Maine.

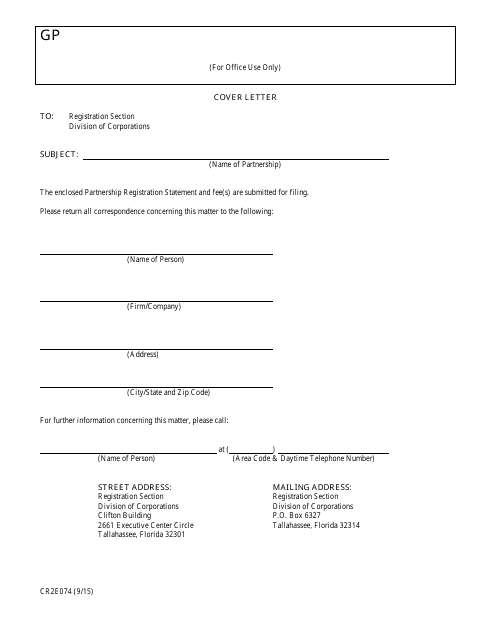

This Form is used for registering a partnership in the state of Florida.

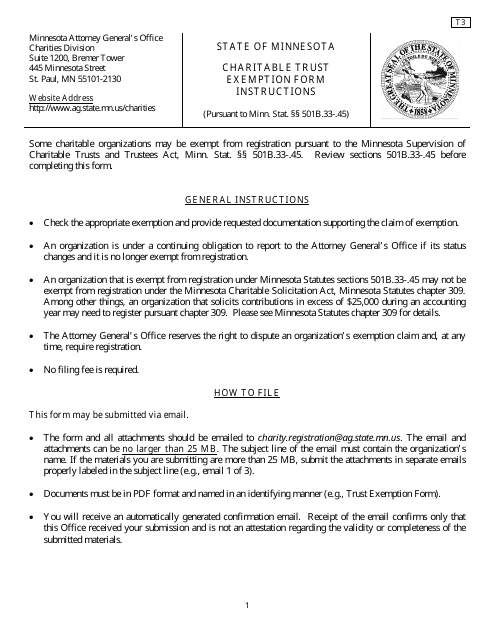

This form is used for applying for charitable trust exemption in the state of Minnesota.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

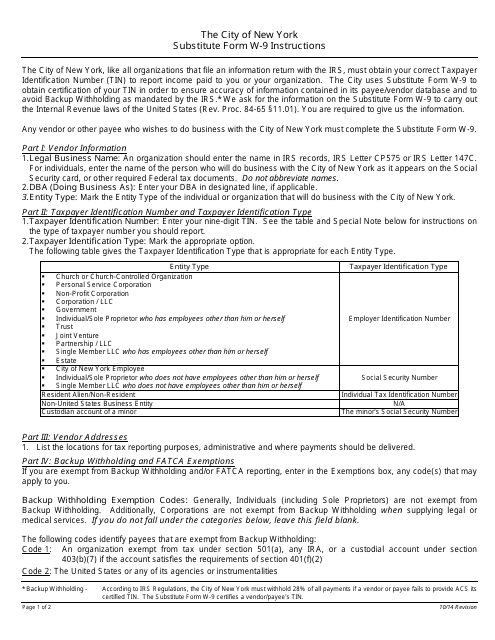

This document is for requesting taxpayer identification number and certification in New York City. It provides instructions for completing the Substitute Form W-9.

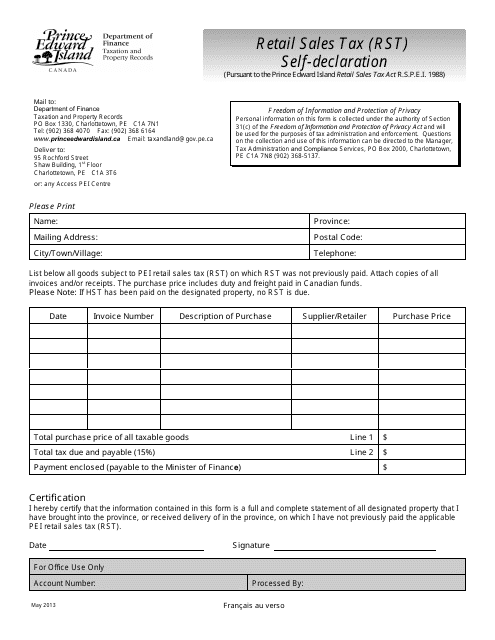

This document is used for self-declaration of Retail Sales Tax (RST) in Prince Edward Island, Canada. It pertains to businesses reporting and paying their retail sales tax obligations to the provincial government.

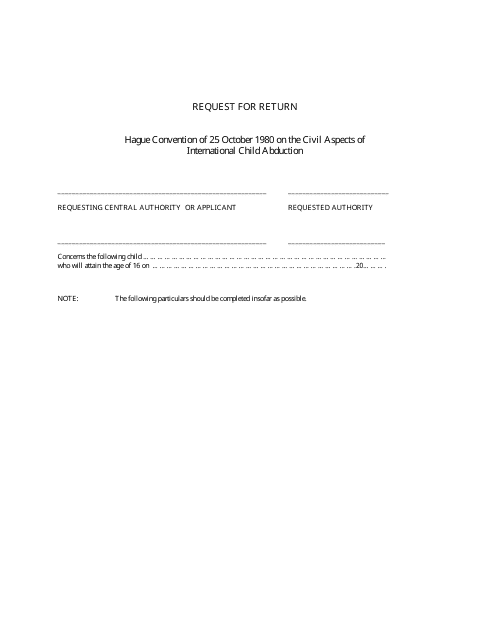

This document is used to request a return in the province of Saskatchewan, Canada.

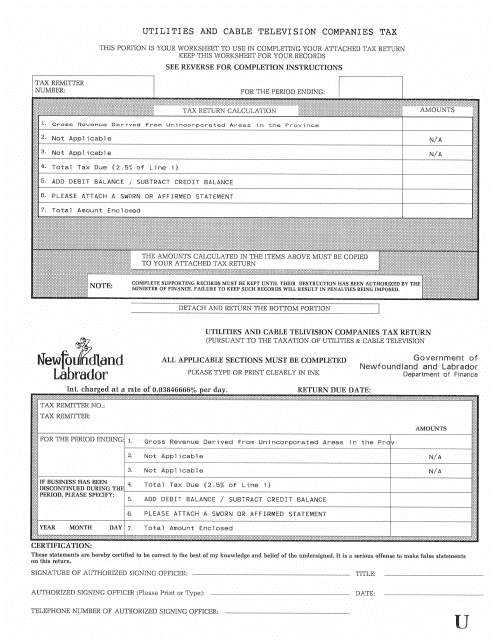

This document is for the tax regulations related to utilities and cable television companies in Newfoundland and Labrador, Canada. It provides information on the taxes applicable to these industries in the province.