Educator Expenses Templates

As an educator, you may be eligible for certain tax deductions and credits related to your education expenses. These deductions and credits can help offset the cost of supplies, materials, and professional development courses necessary for your teaching career.

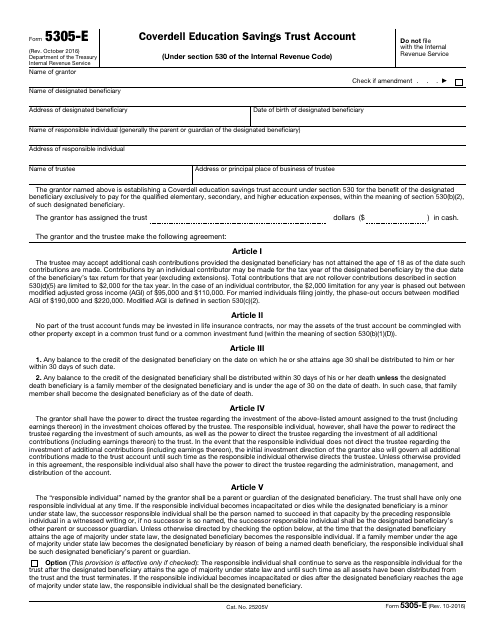

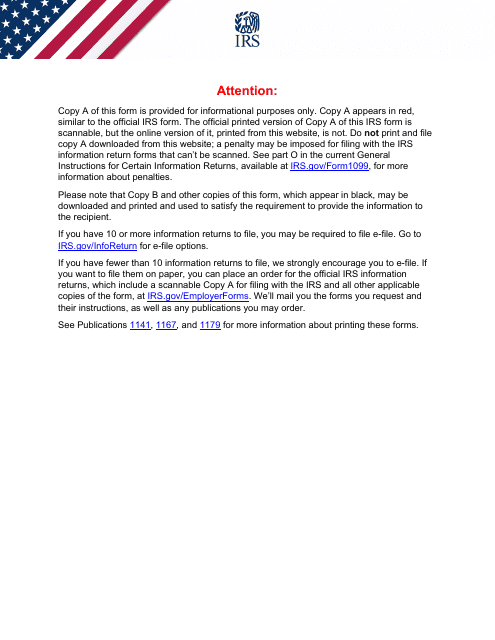

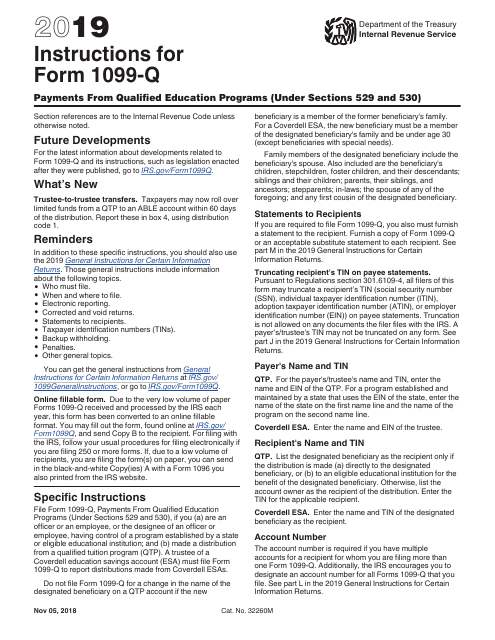

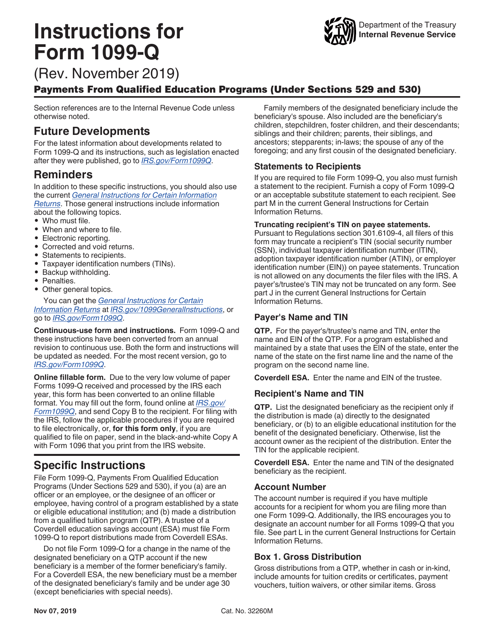

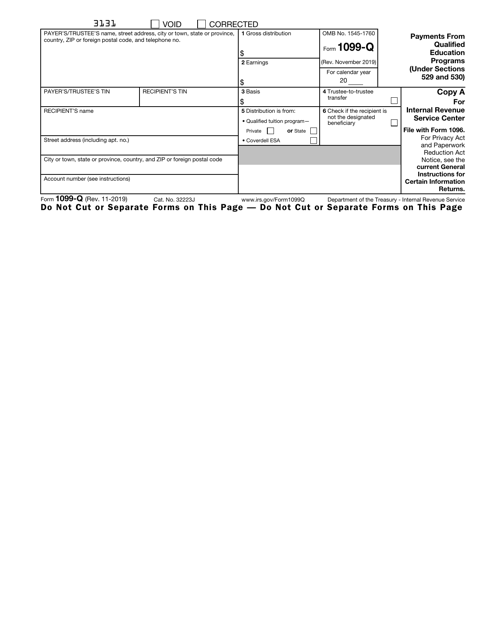

To take advantage of these benefits, you'll need to familiarize yourself with the relevant documents and forms. One such document is IRS Form 1099-Q, which reports payments received from qualified education programs. This form is essential for determining your eligibility for educational tax benefits under sections 529 and 530 of the Internal Revenue Code.

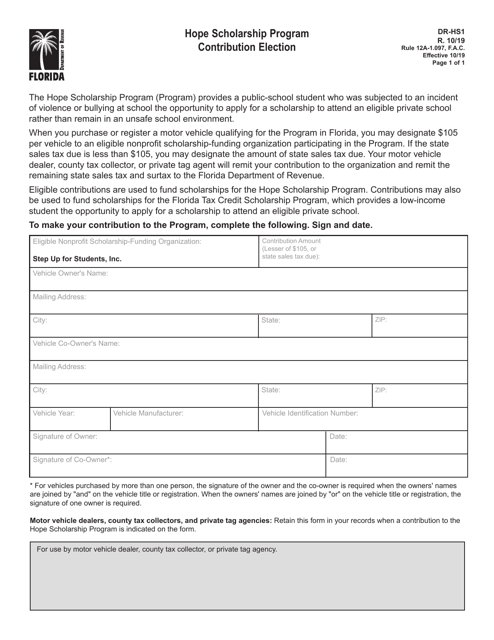

Another important document is Form DR-HS1, specifically designed for residents of Florida. This form allows you to make a contribution election to the Hope Scholarship Program, which provides scholarships to eligible students in the state.

If you or a family member has an ABLE account, IRS Form 1099-QA is crucial. This form reports distributions made from these accounts, which are tax-advantaged savings accounts for individuals with disabilities.

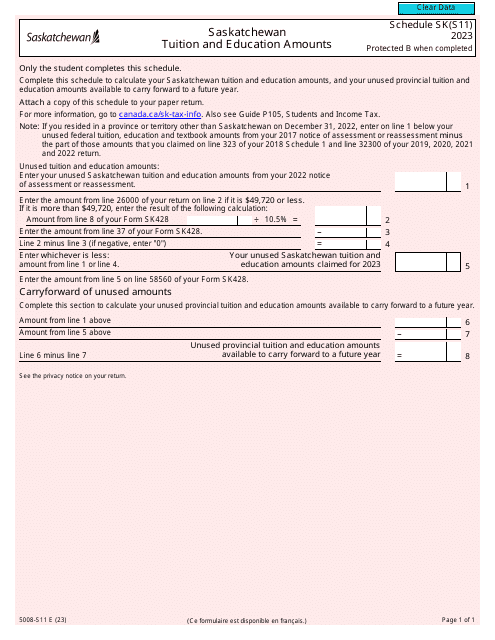

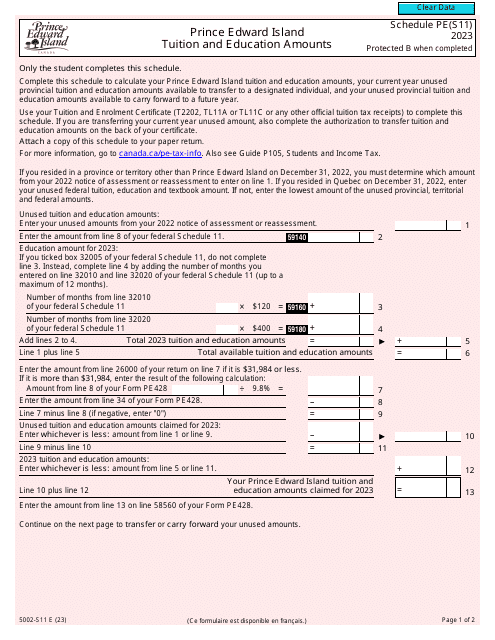

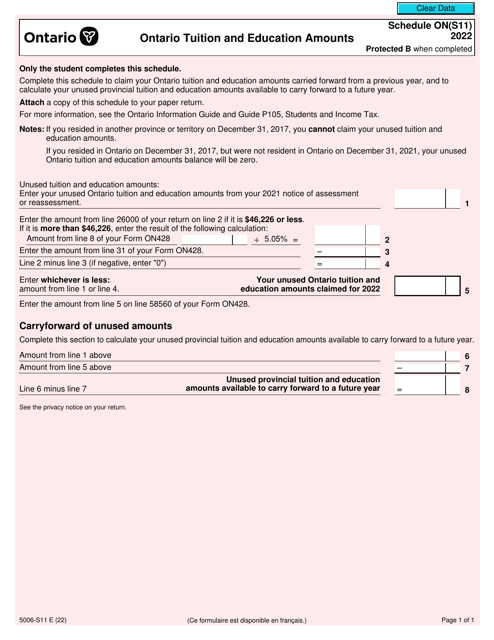

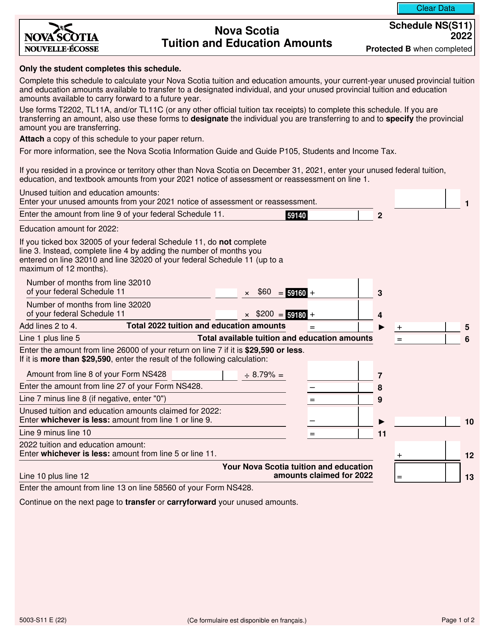

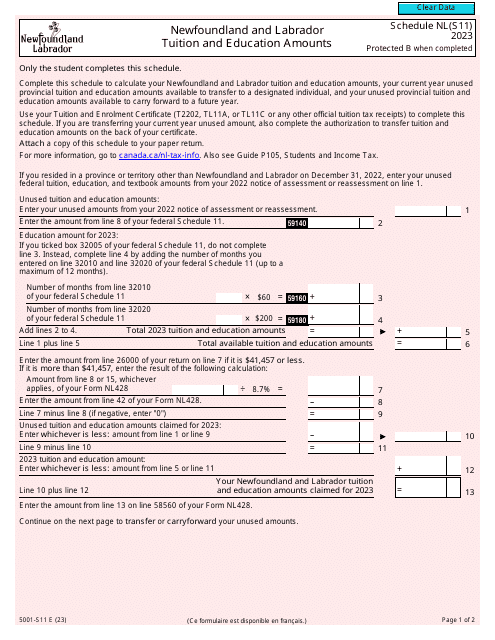

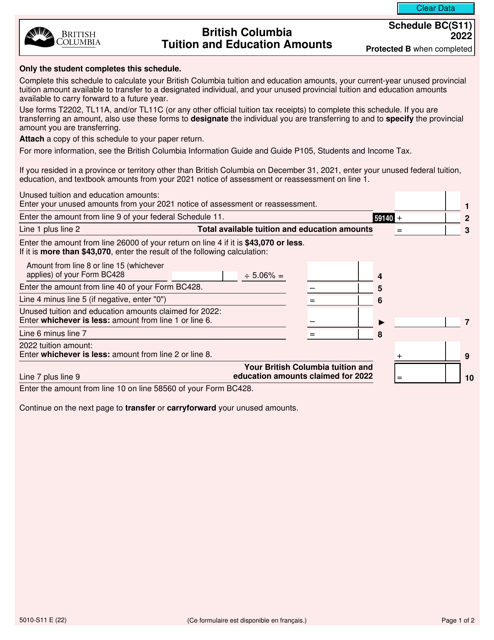

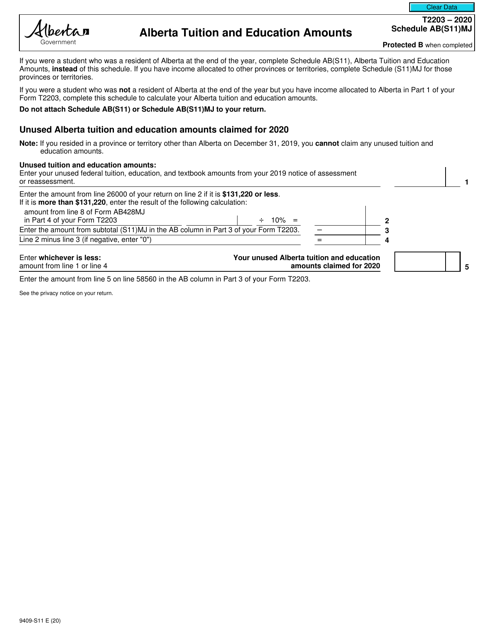

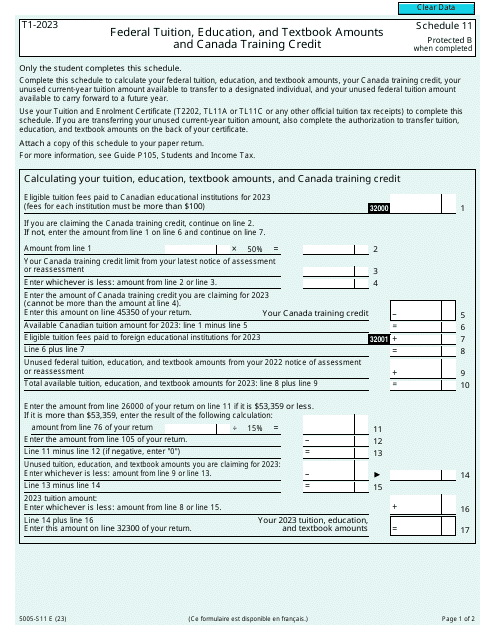

If you're a Canadian educator, you may need to refer to different forms. For example, Form 5011-S11, also known as Schedule YT(S11), is used in Yukon to report tuition, education, and textbook amounts. Similarly, Form 5007-S11, or Schedule MB(S11), is specific to Manitoba and reports tuition and education amounts.

These documents, along with others related to educator expenses, play a significant role in helping educators like you maximize their tax benefits and minimize their out-of-pocket expenses. By familiarizing yourself with these forms, you can ensure that you take full advantage of the deductions and credits available to you.

Documents:

101

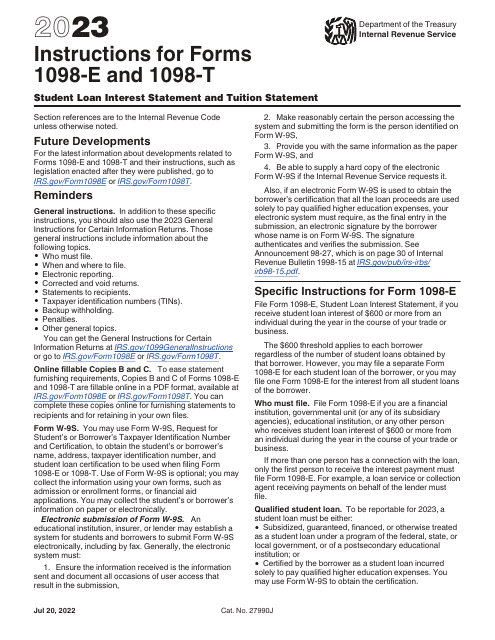

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

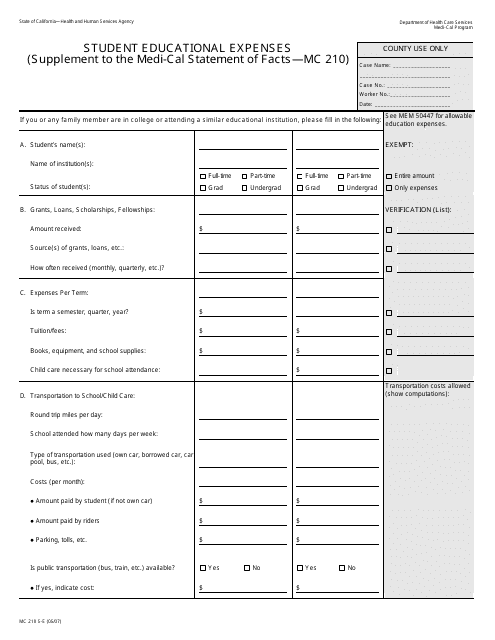

This form is used for reporting student educational expenses as a supplement to the Medi-Cal Statement of Facts in the state of California.

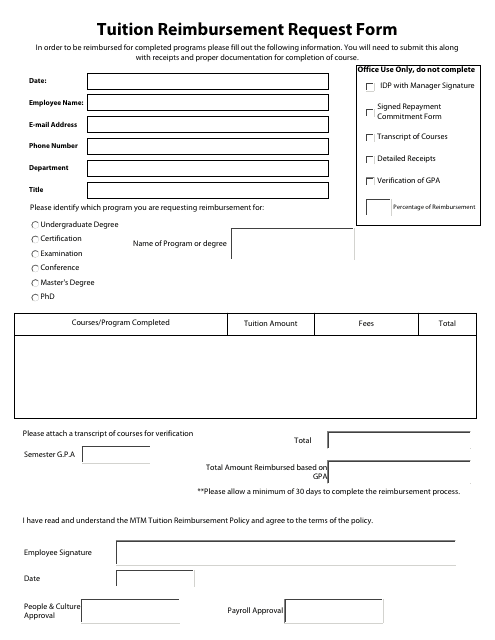

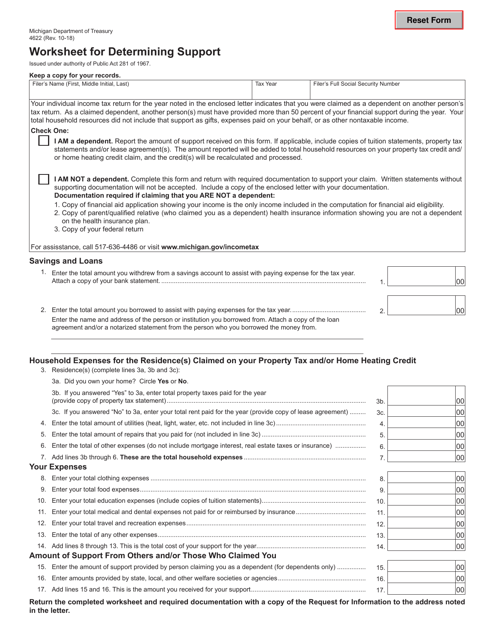

This form is used for requesting reimbursement for tuition expenses. It allows individuals to apply for financial assistance to cover the cost of their education or training.

Download this form to report the interest amount paid on a qualified student loan during the past calendar year in cases when the amount exceeded $600.

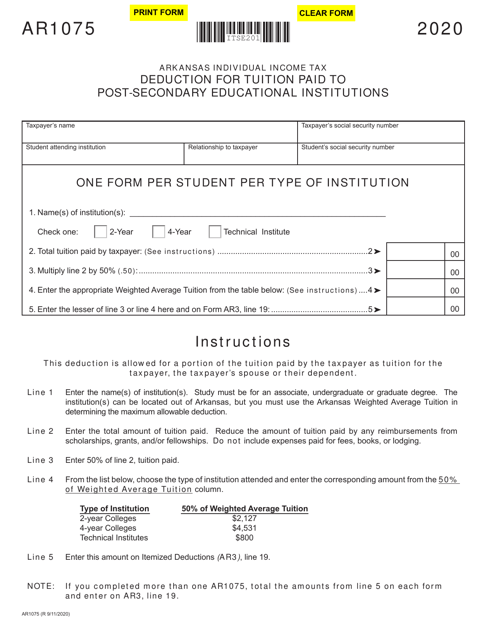

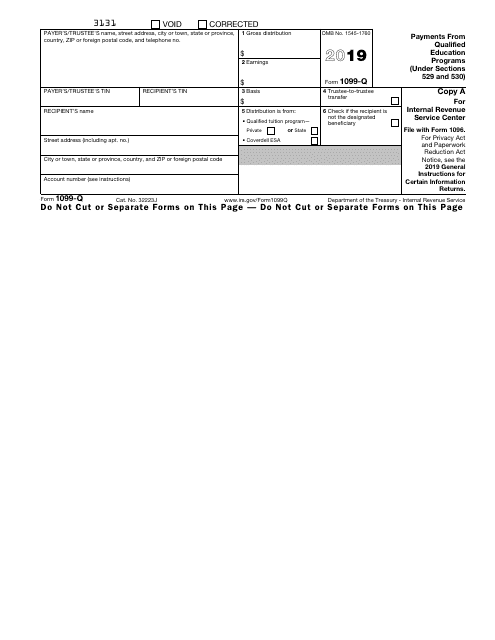

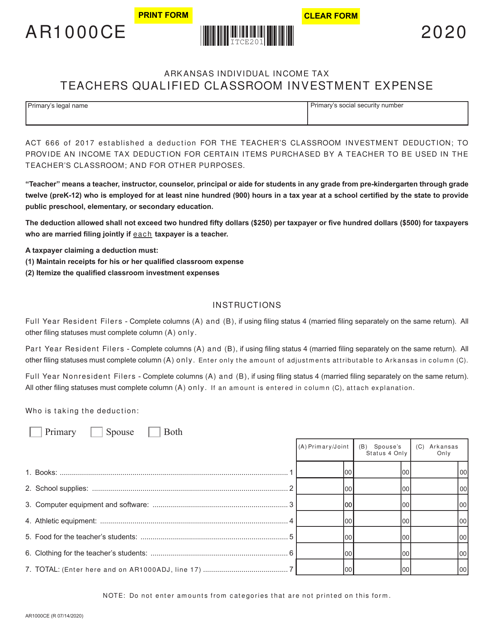

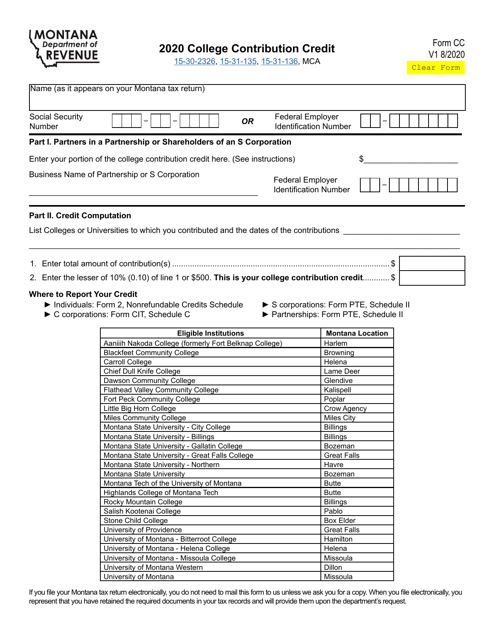

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.

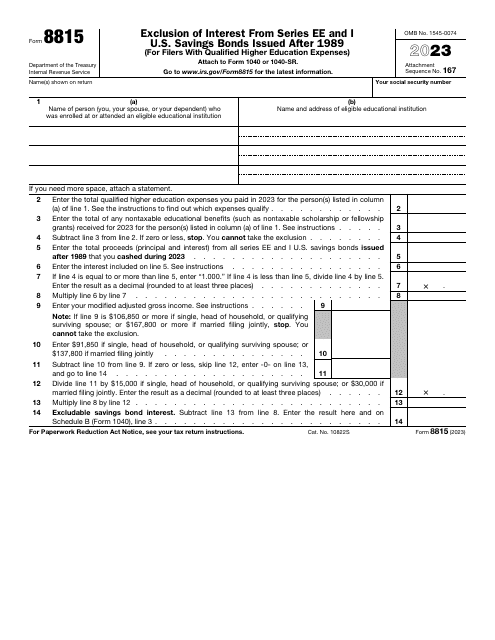

This is a fiscal document used by individual taxpayers to exclude the specific bond interest from their income.

This Form is used for reporting payments from qualified education programs for tax purposes.

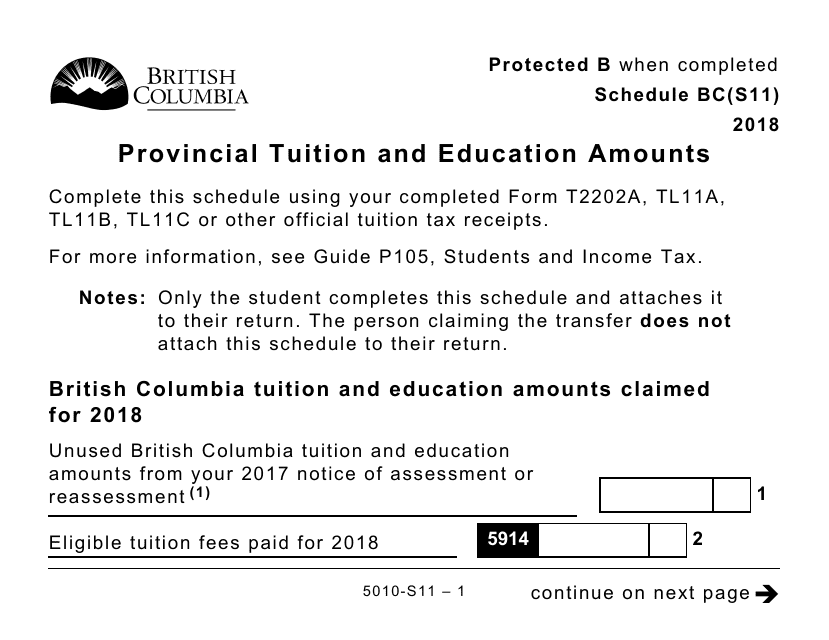

Form 5010-S11 Schedule BC(S11) Provincial Tuition and Education Amounts (Large Print) - Canada, 2018

This form is used for reporting provincial tuition and education amounts in a large print format in Canada.

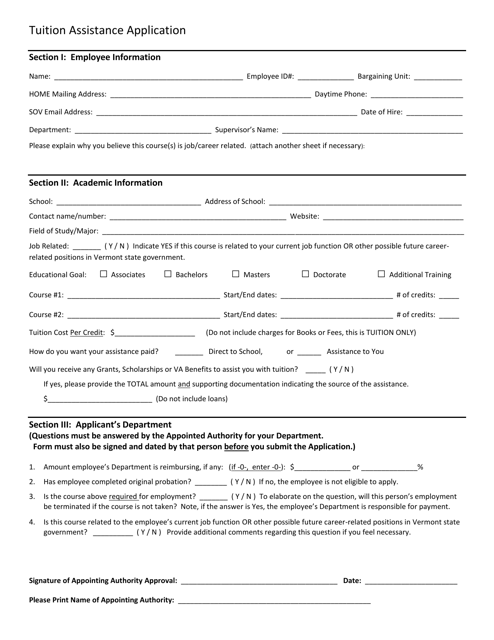

This document is for applying for tuition assistance in the state of Vermont.

This Form is used for reporting payments from qualified education programs under Sections 529 and 530 of the IRS code.

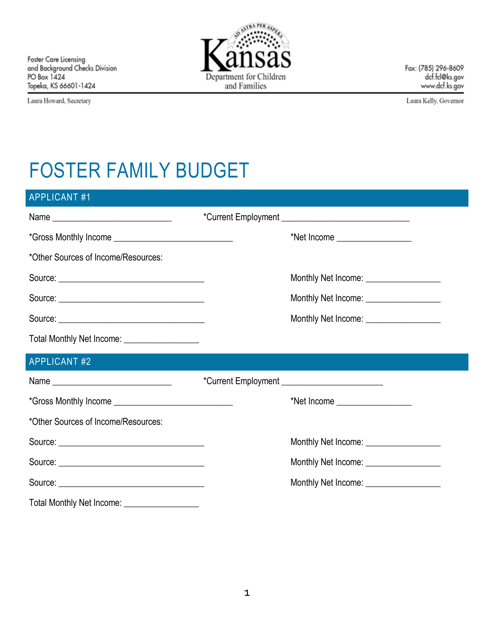

This document is a detailed budget for foster families in the state of Kansas. It provides guidelines and recommendations for managing expenses related to caring for foster children.

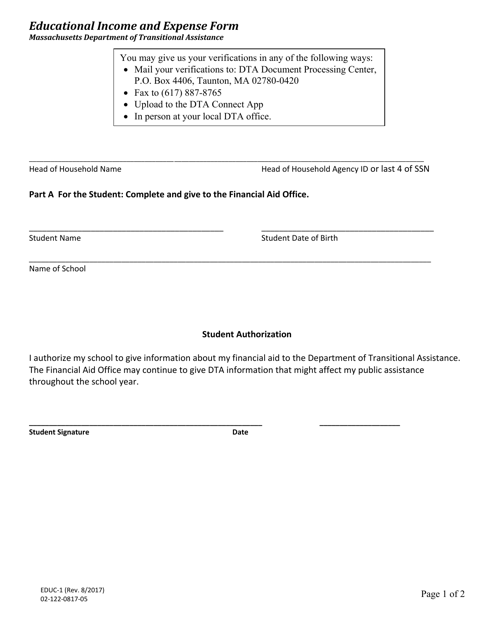

This Form is used for reporting educational income and expenses in Massachusetts.

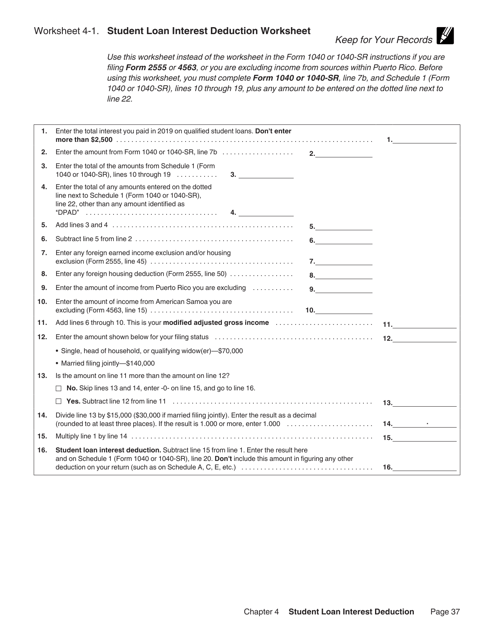

This document is a worksheet that helps you calculate the amount of student loan interest you can deduct from your taxes. It is explained in Publication 970, which provides information on tax benefits for education expenses.