Educator Expenses Templates

Documents:

101

This document examines the potential impact of the growing student debt on retirement security in the United States. It discusses how the increasing amount of student debt could potentially worsen the retirement savings gap.

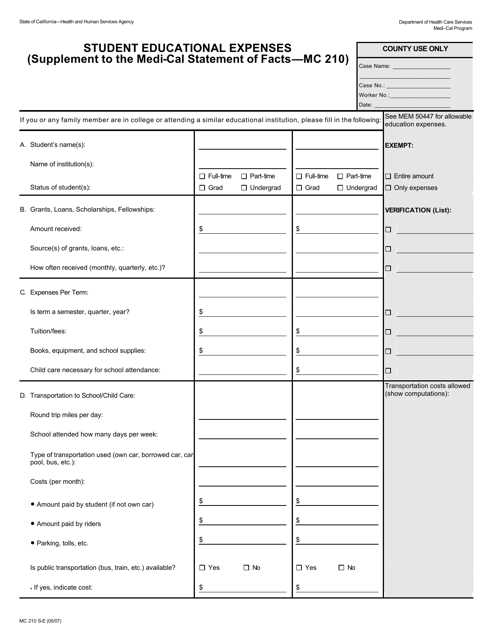

This form is used for reporting student educational expenses as a supplement to the Medi-Cal Statement of Facts in California.

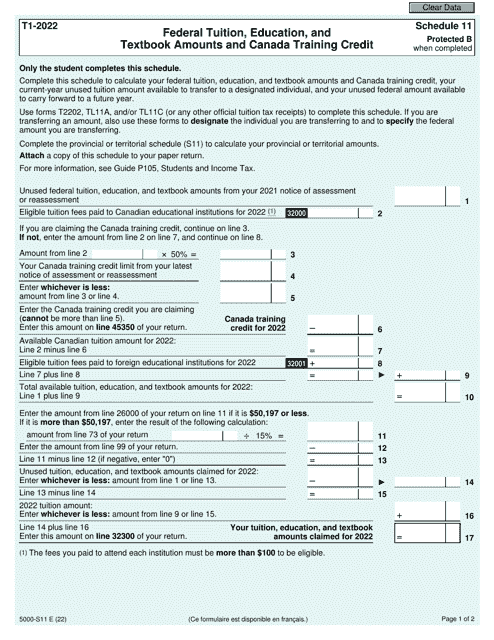

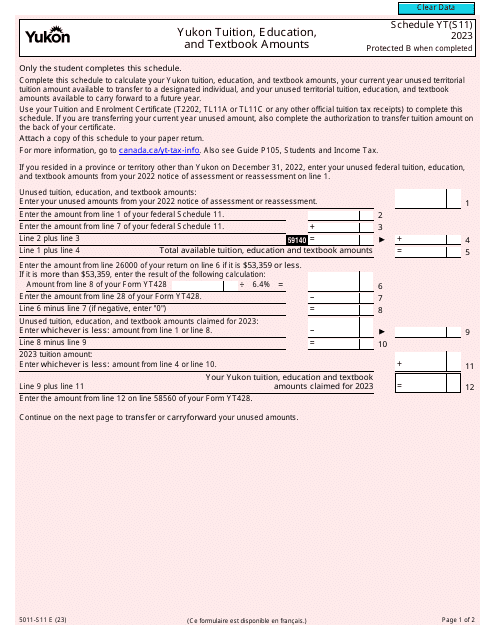

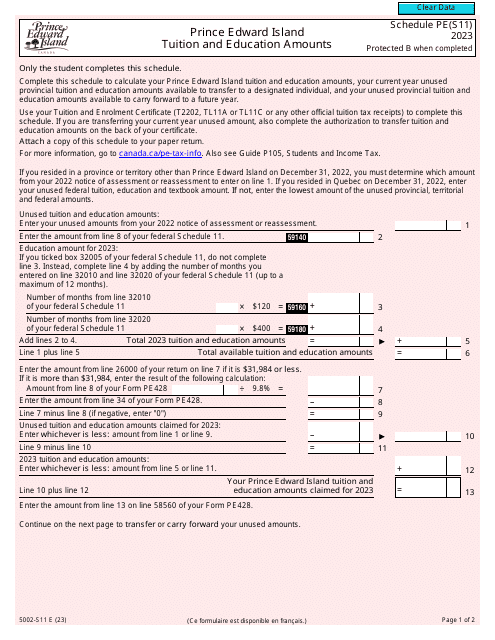

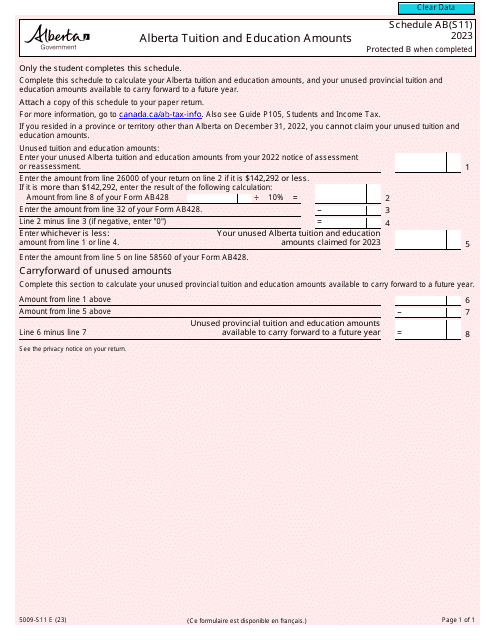

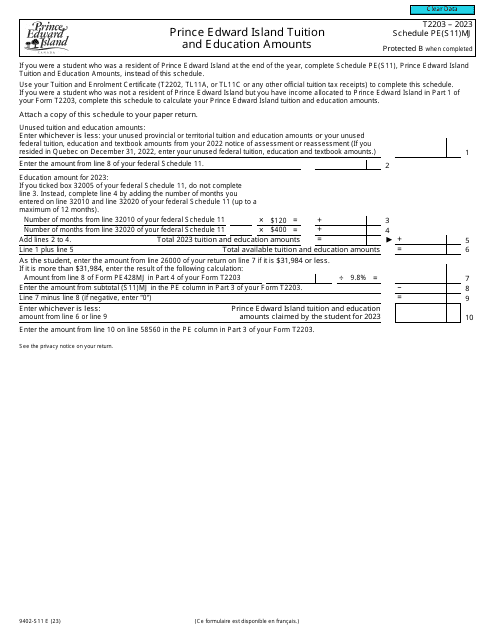

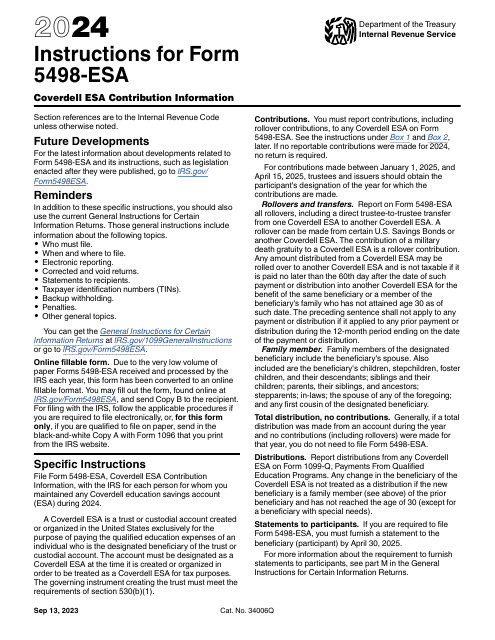

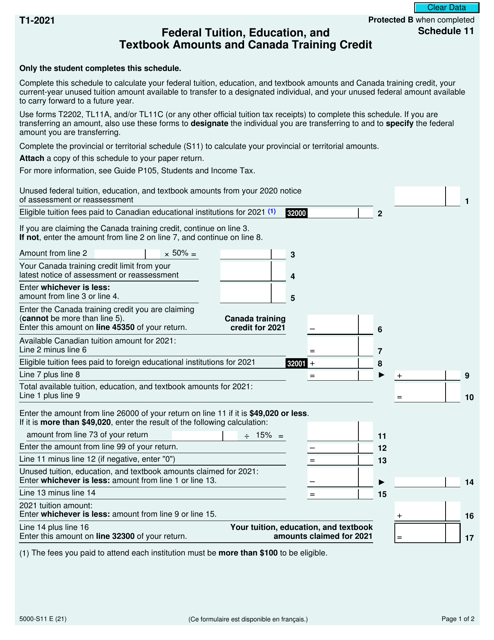

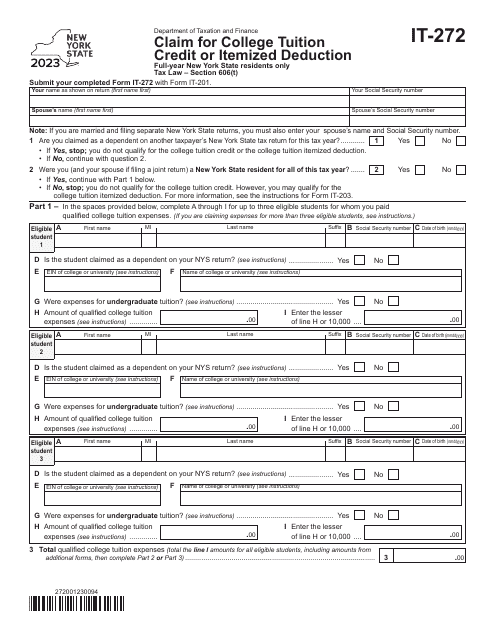

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

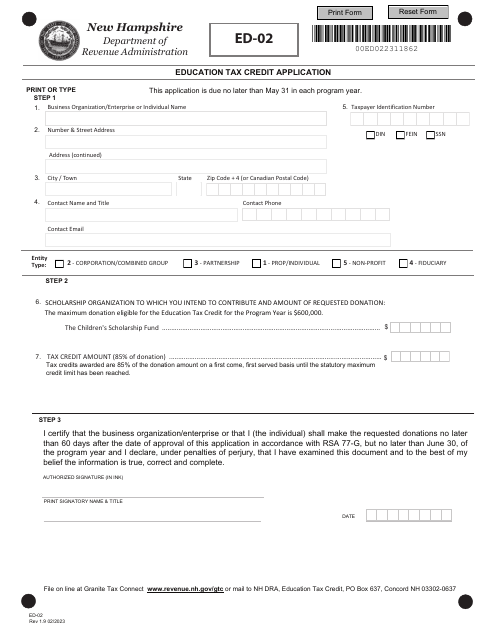

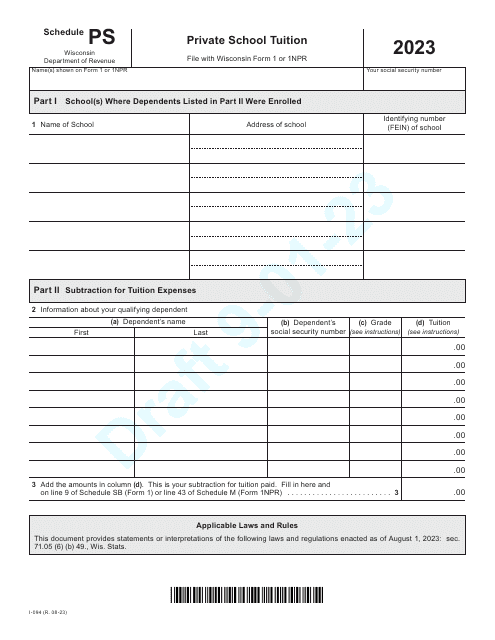

Fill in this form to claim one of the Internal Revenue Service (IRS) educational tax credits. It will provide a dollar-for-dollar reduction in the amount of tax owed at the end of the reporting year for the expenses incurred to attend educational institutions that participate in the student aid programs.

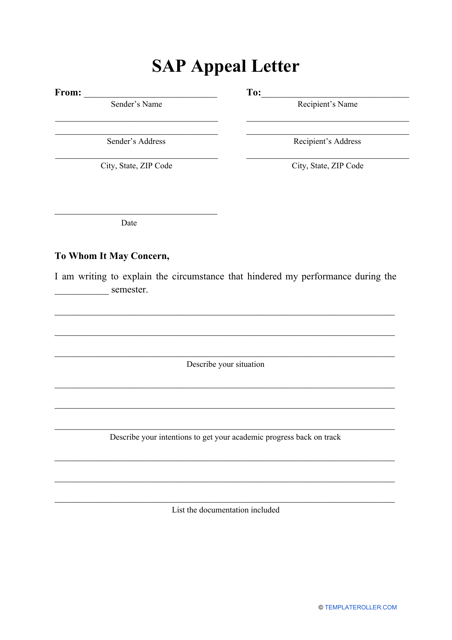

This document is prepared by students who could not make Satisfactory Academic Progress (SAP) in their studies towards their desired certificate or degree and would like to restore their eligibility to receive financial aid.

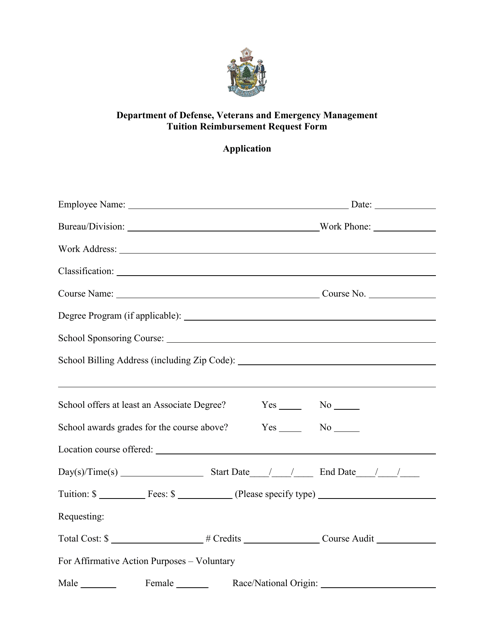

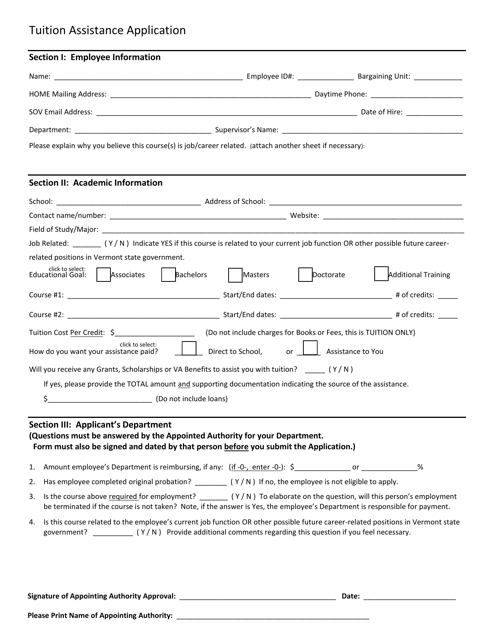

This form is used for requesting reimbursement of tuition fees in the state of Maine. It allows individuals to seek financial assistance for their education expenses.

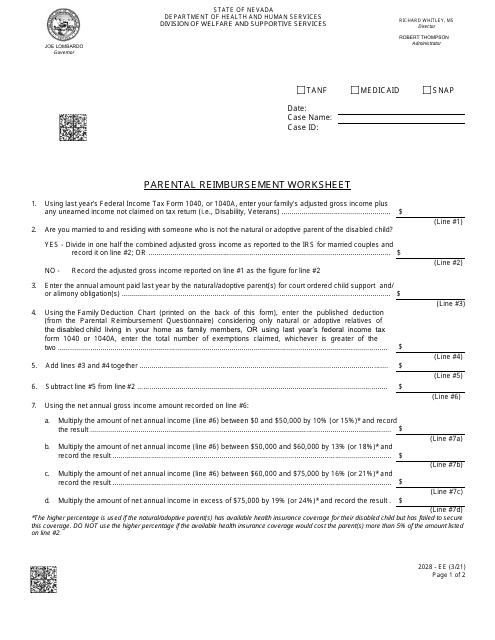

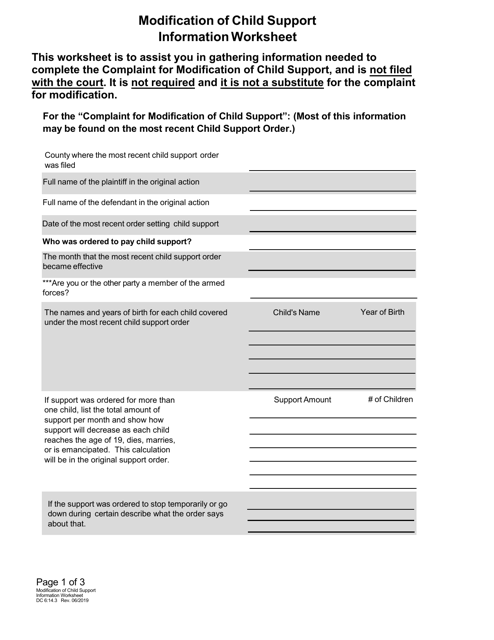

This form is used for modifying child support information in Nebraska.

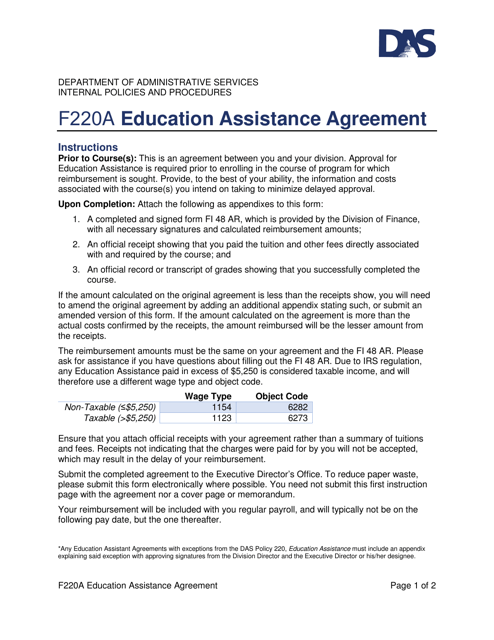

This document is a form used in Utah for the purpose of entering into an education assistance agreement.

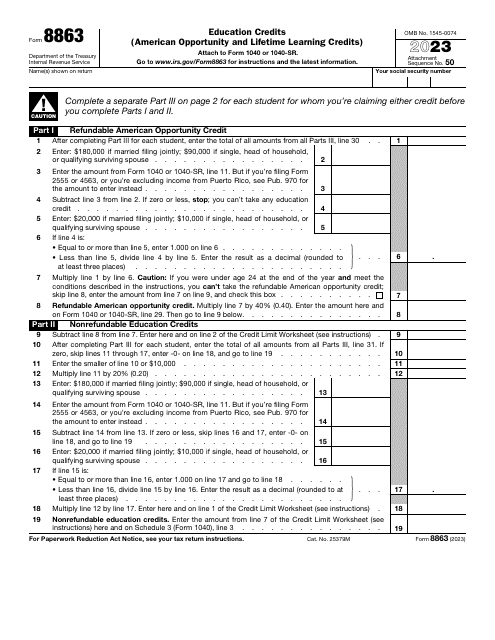

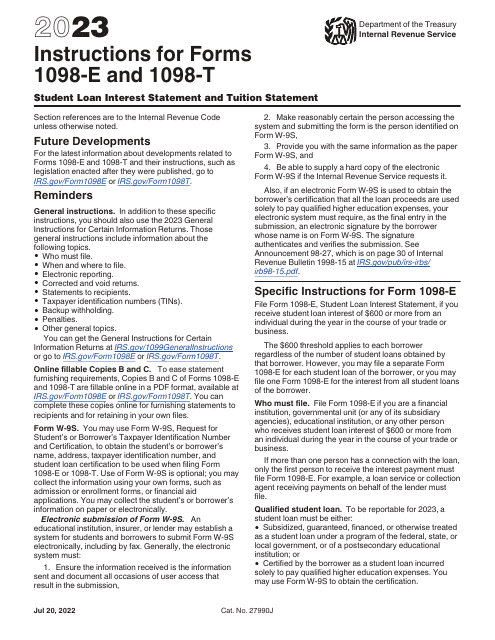

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

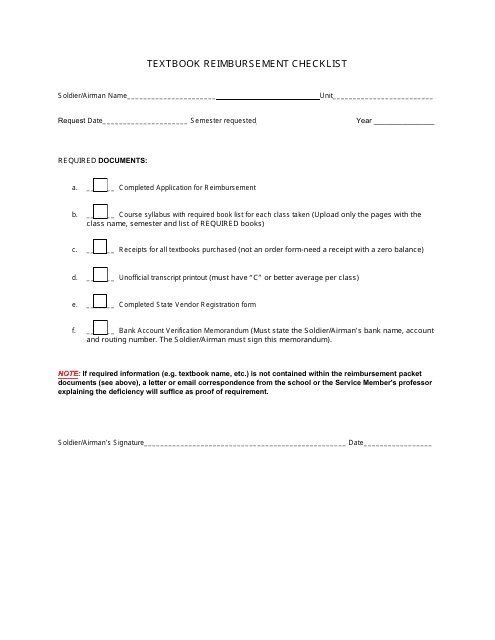

This document is a checklist used in Nevada to request reimbursement for textbooks. It ensures that all necessary information and documents are included for the reimbursement process.