Educator Expenses Templates

Documents:

101

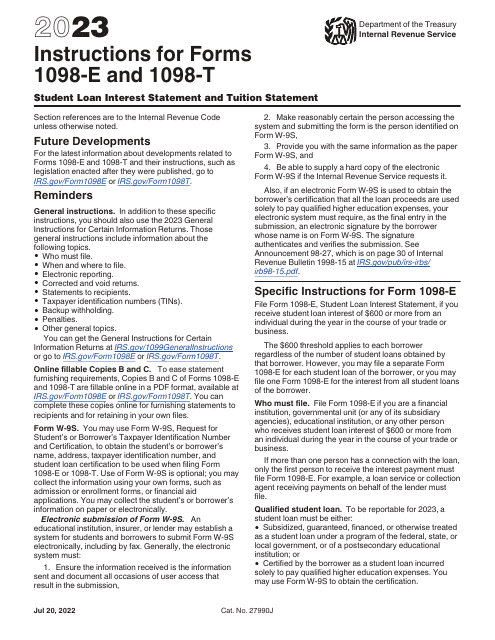

Download this form to report the interest amount paid on a qualified student loan during the past calendar year in cases when the amount exceeded $600.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

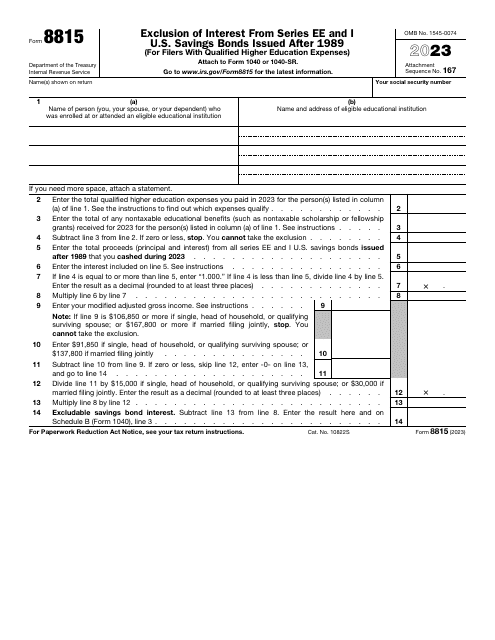

This is a fiscal document used by individual taxpayers to exclude the specific bond interest from their income.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

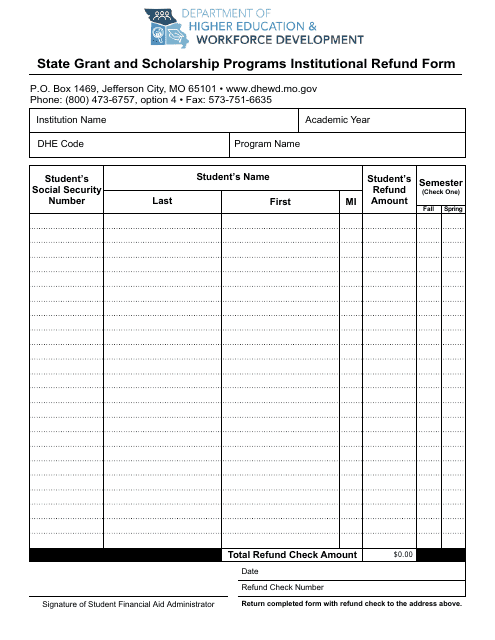

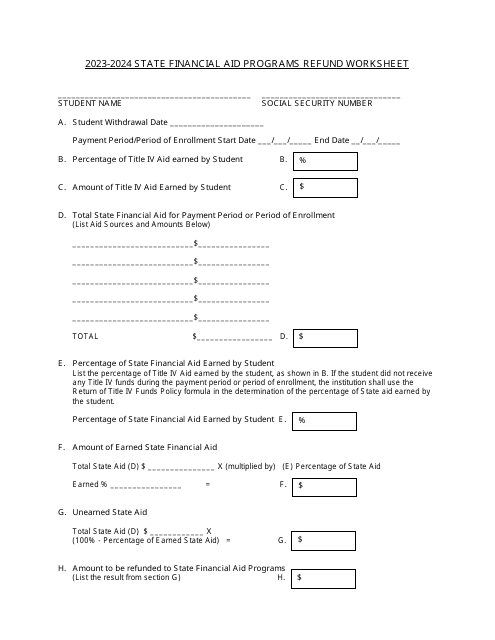

This form is used for requesting a refund from Missouri's state grant and scholarship programs at the institutional level.

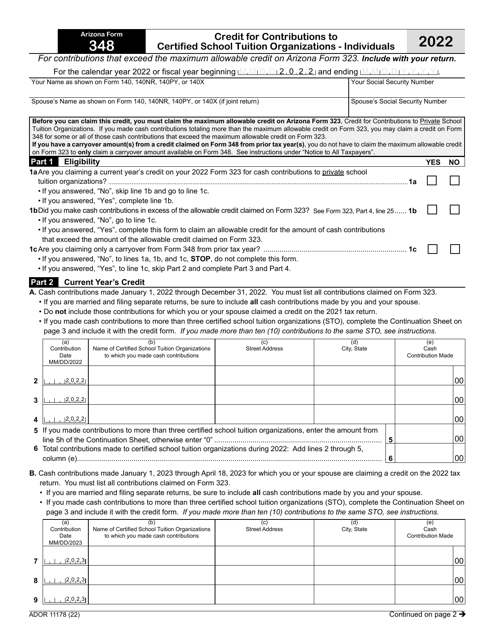

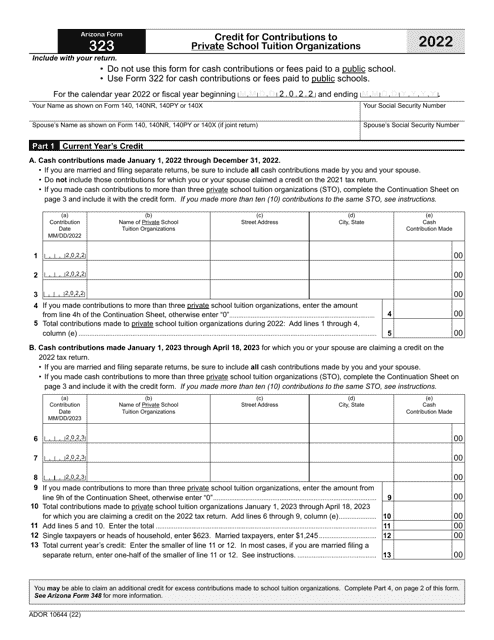

This form is used for claiming a credit for contributions made to private school tuition organizations in the state of Arizona.