Fill and Sign California Legal Forms

Documents:

19713

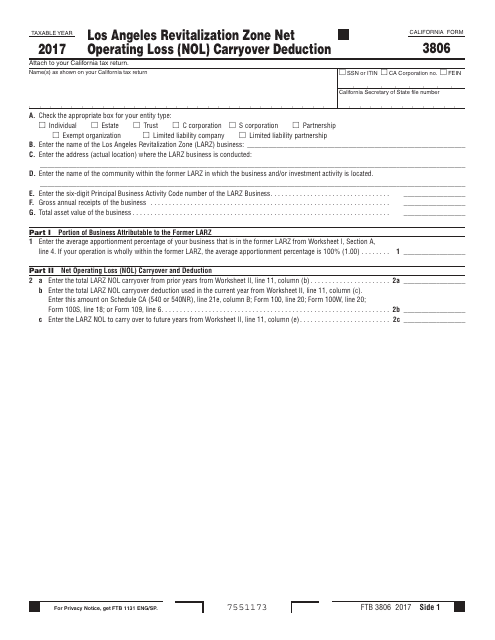

This Form is used for claiming the Los Angeles Revitalization Zone Net Operating Loss (NOL) Carryover Deduction in California.

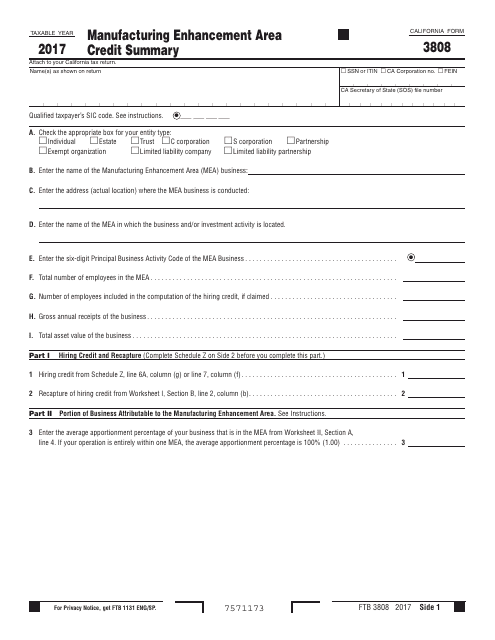

This form is used for summarizing the manufacturing enhancement area credits in California.

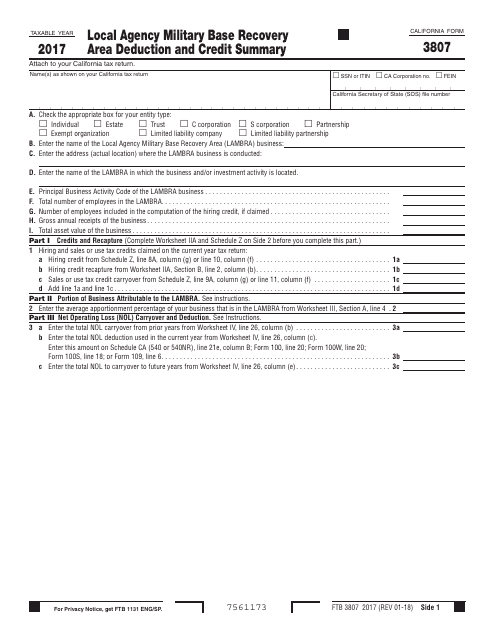

This form is used for reporting and summarizing the deductions and credits related to local agency military base recovery areas in California.

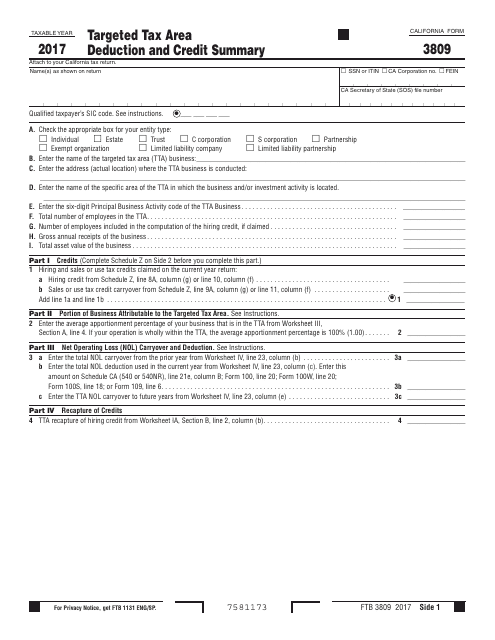

This form is used for summarizing the targeted tax area deduction and credit in California.

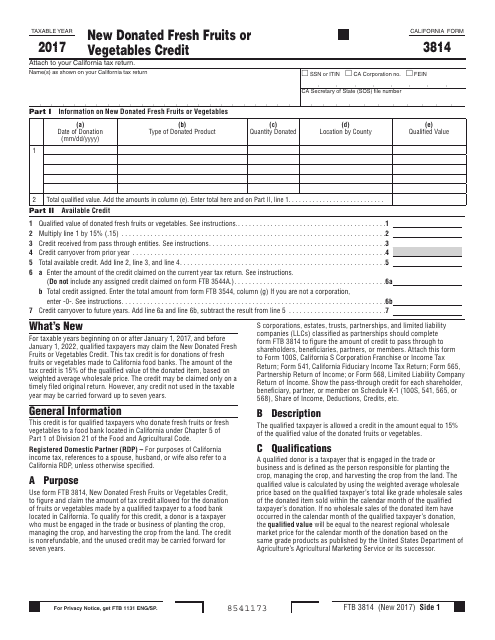

This form is used for claiming the New Donated Fresh Fruits or Vegetables Credit in California. It allows individuals or businesses to receive tax credits for donating fresh fruits or vegetables to California food banks or charitable organizations.

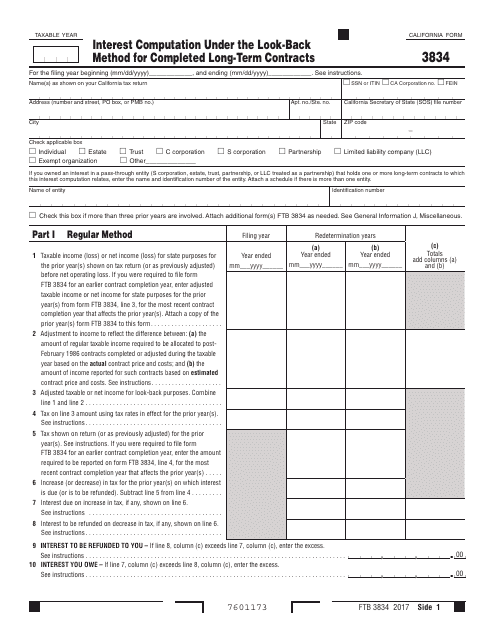

This form is used for calculating interest under the look-back method for completed long-term contracts in California.

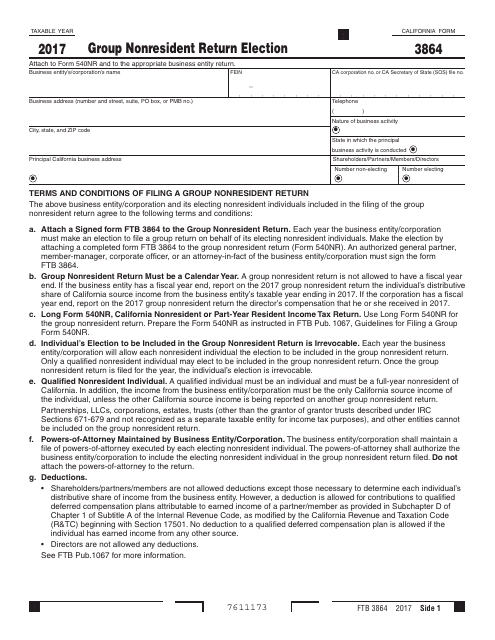

This form is used for electing to file a group nonresident return in the state of California.

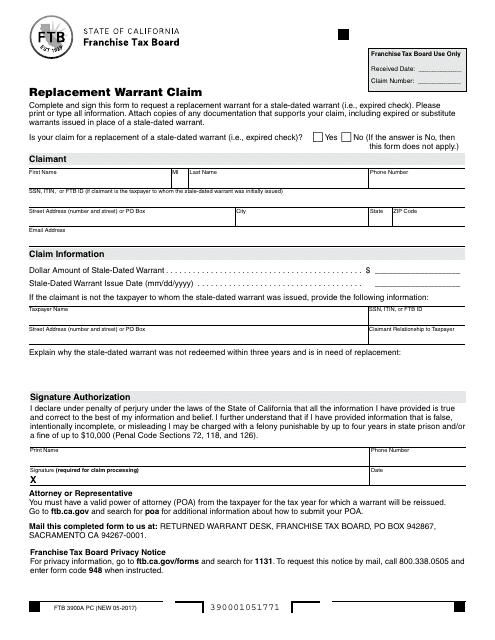

This form is used for filing a claim to replace a personal computer under warranty in the state of California.

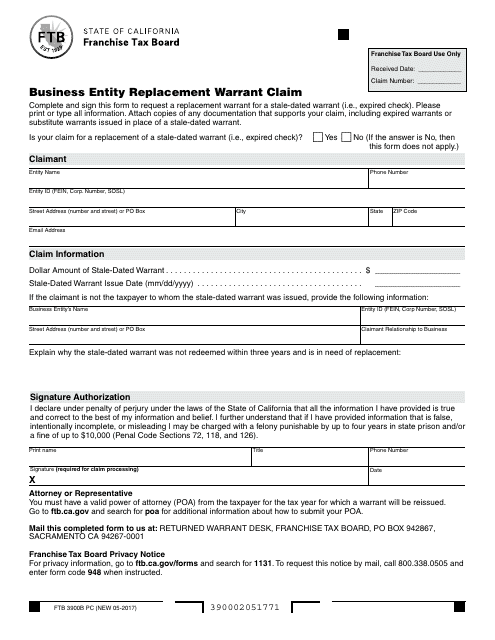

This form is used for filing a warrant claim for a business entity replacement in California.

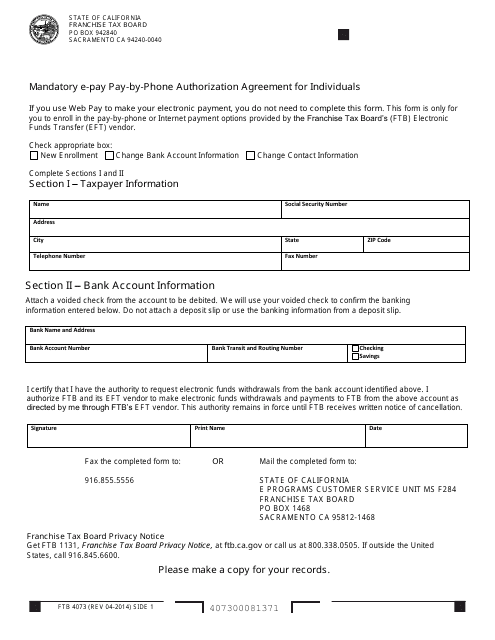

This form is used for individuals in California to authorize mandatory electronic payments via phone.

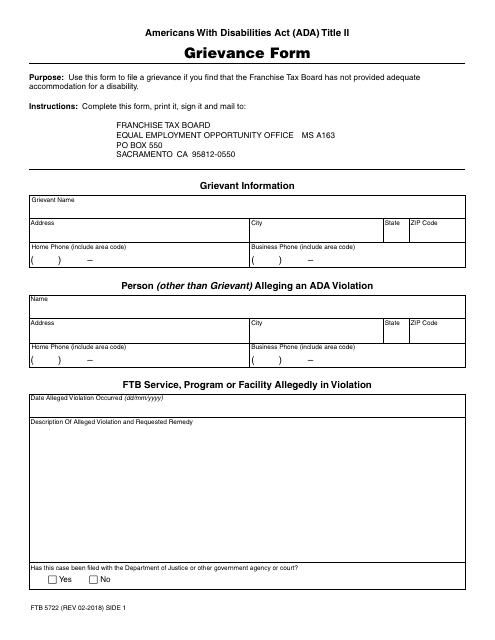

This form is used for filing a grievance with the California Franchise Tax Board (FTB).

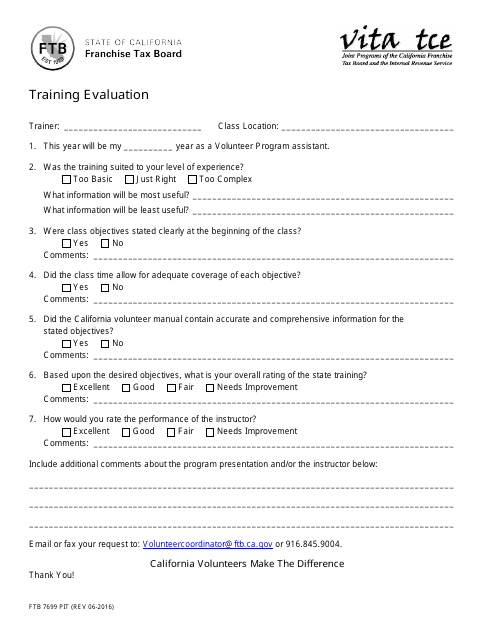

This document is used for conducting training evaluations for California's Personal Income Tax (PIT) program.

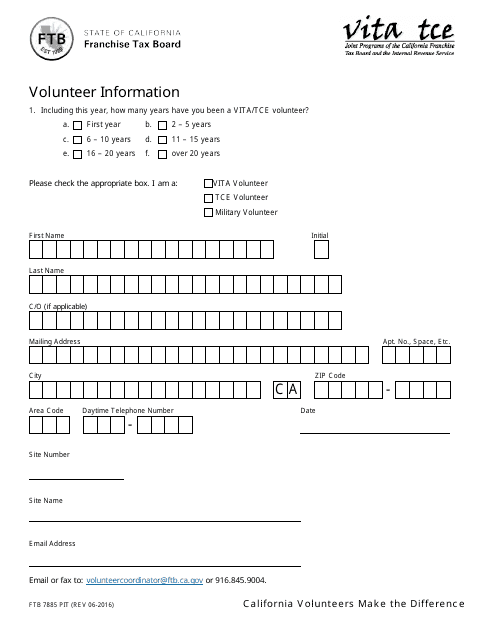

This form is used for providing volunteer information to the California Franchise Tax Board (FTB) for the Personal Income Tax (PIT) program.

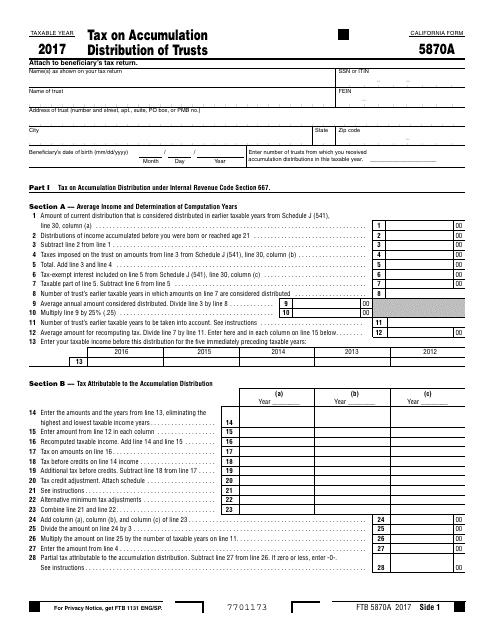

This form is used for reporting and calculating the tax on accumulation distribution of trusts in the state of California.

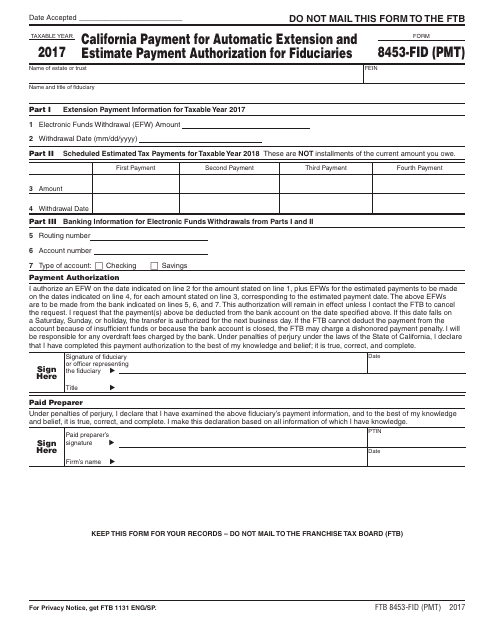

This form is used for making payment for the automatic extension and estimate payment authorization for fiduciaries in California.

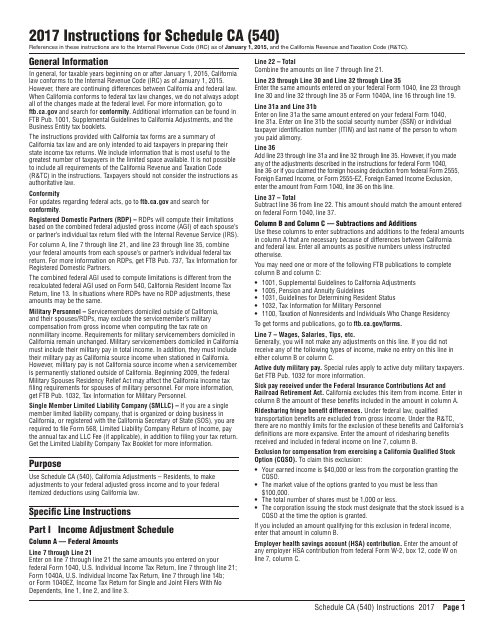

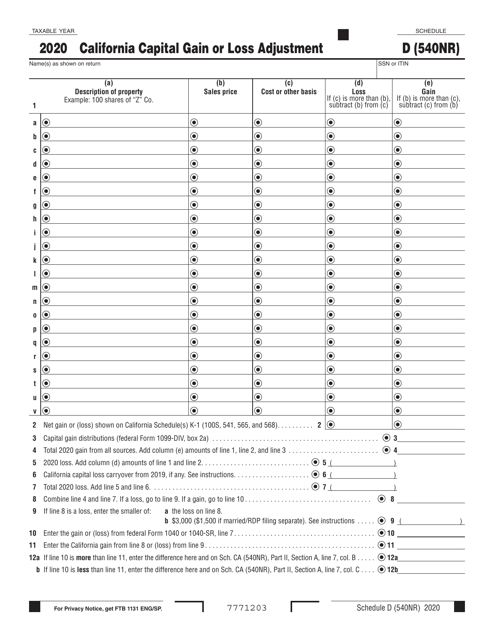

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

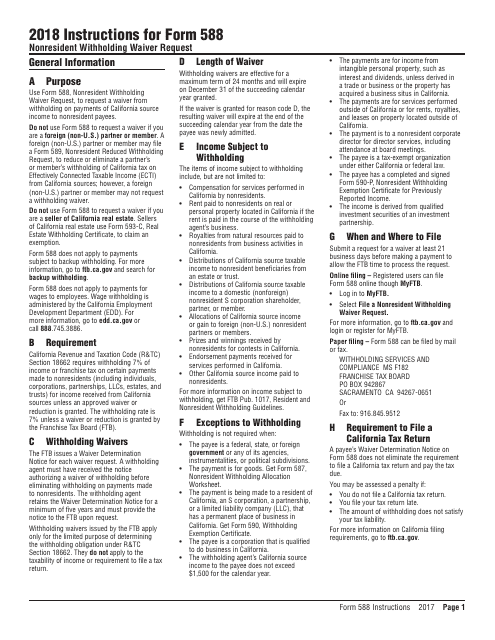

This form is used for requesting a waiver of nonresident withholding taxes in the state of California.

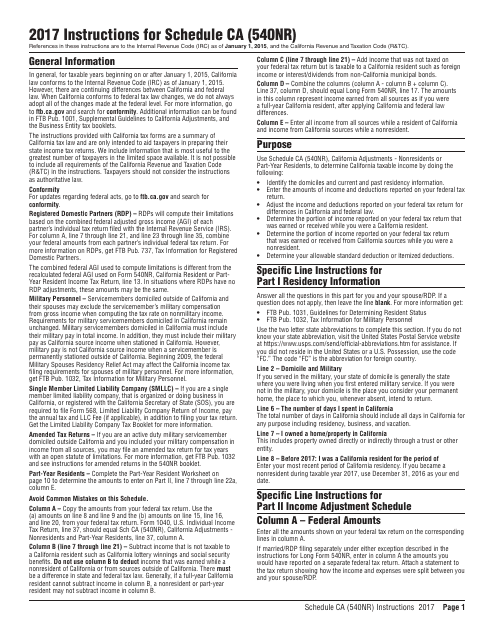

This document is used to provide instructions for completing Form 540NR Schedule CA for nonresidents or part-year residents of California. It specifies the adjustments that need to be made to the income, deductions, and credits reported on the tax return.

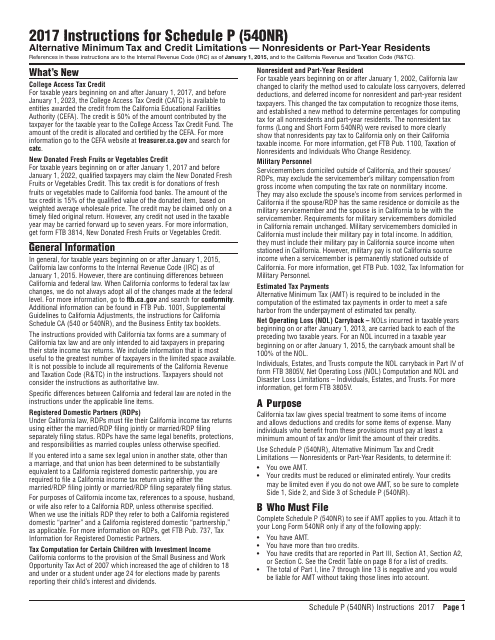

This Form is used for nonresidents or part-year residents of California to calculate their alternative minimum tax and credit limitations, as required by Form 540NR Schedule P.

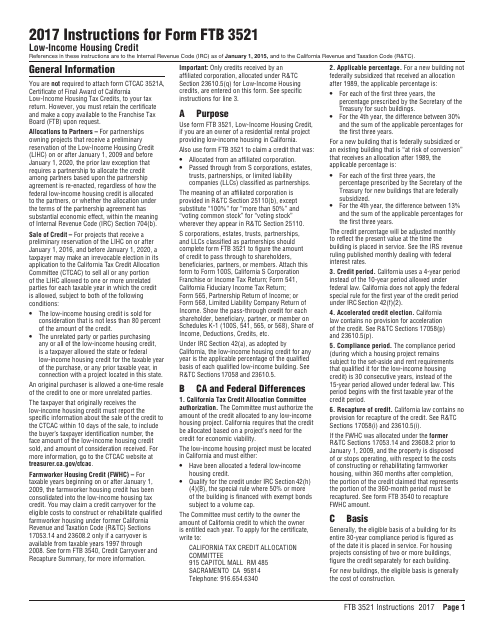

This Form is used for claiming the Low-Income Housing Credit in the state of California. It provides instructions on how to complete and submit the form to the California Franchise Tax Board.

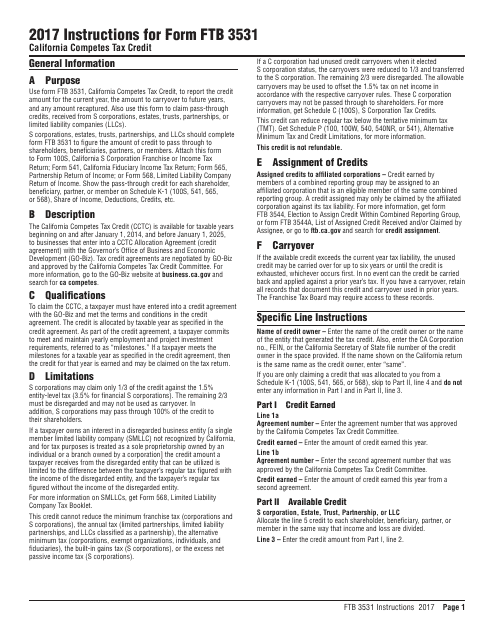

This document provides instructions on how to complete Form FTB3531, which is used to claim the California Competes Tax Credit in California. It guides taxpayers on what information to include and how to calculate their credit amount.

This Form is used for applying and electing to amortize a certified pollution control facility in California. It provides instructions on how to complete the application process.

This form is used for claiming the California Motion Picture and Television Production Credit in California. It provides instructions on how to complete the form and what documentation needs to be included.

This document provides instructions for completing Form FTB3801, which is used to calculate and report passive activity loss limitations for individuals and businesses in California. The form helps taxpayers determine the amount of passive activity losses they can deduct on their state tax returns.

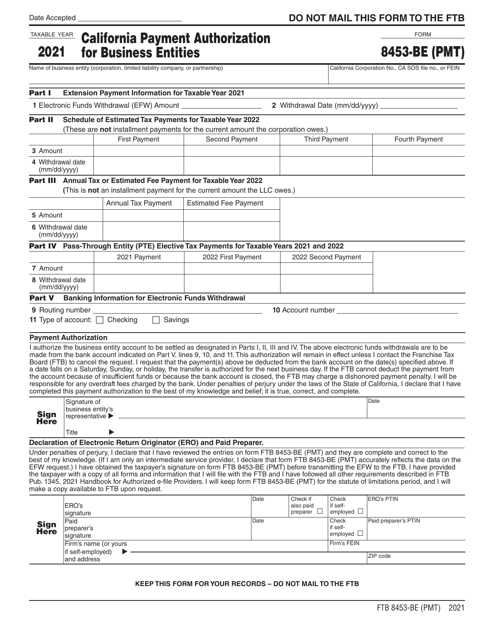

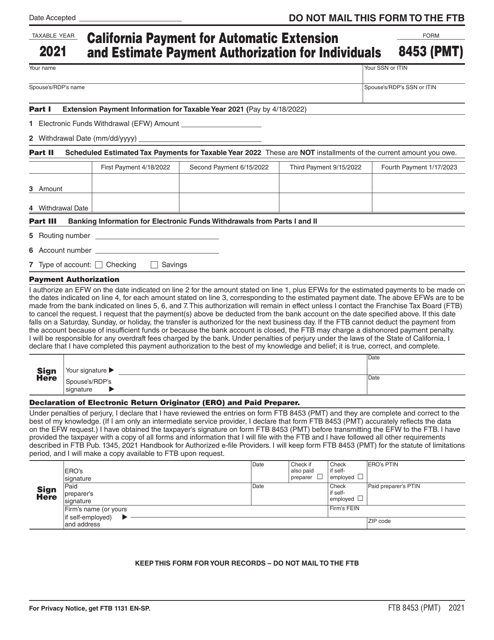

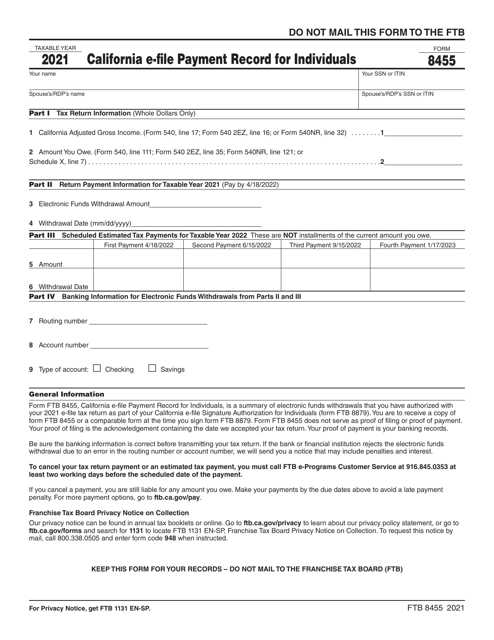

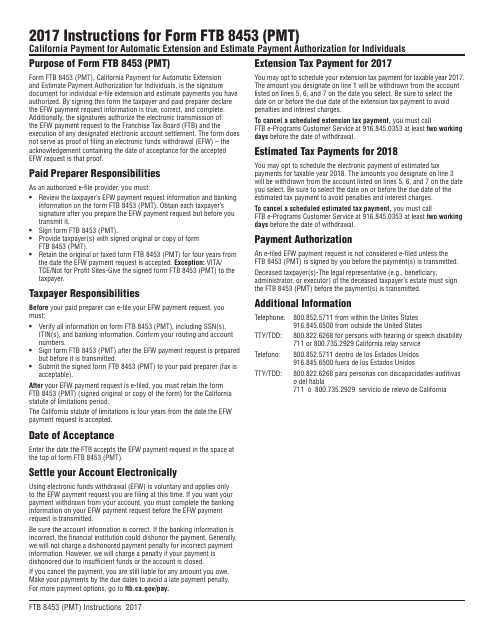

This document is for individuals in California who need to make a payment for an automatic tax extension or estimate payment authorization. It provides instructions on how to fill out and submit Form FTB8453 (PMT).

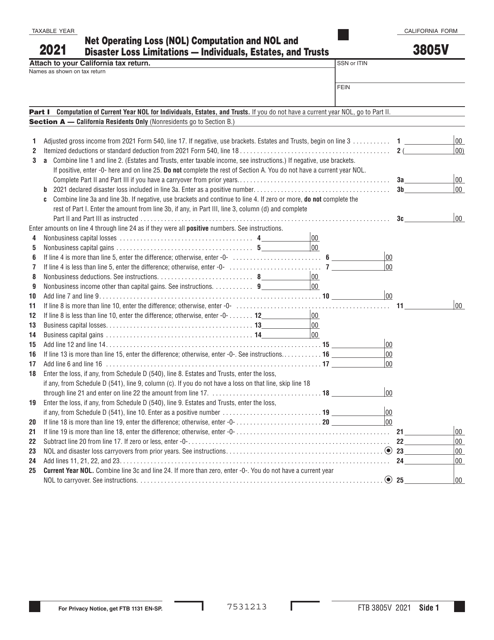

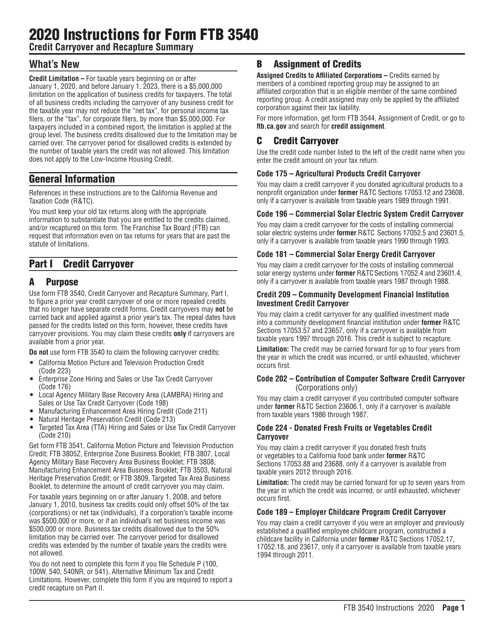

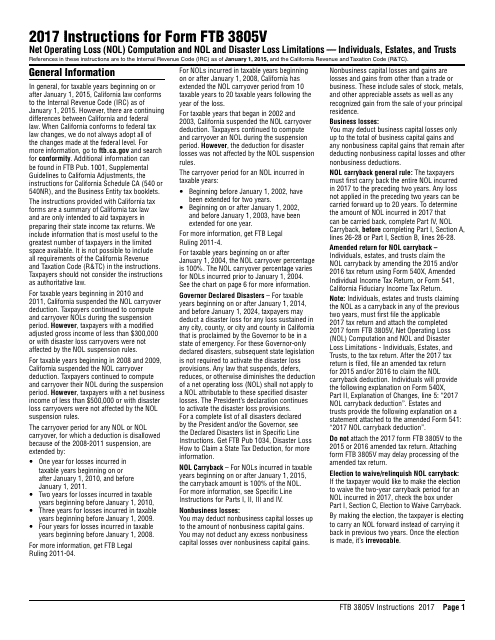

This Form is used to calculate the net operating loss (NOL) and determine the limitations on NOL and disaster losses for individuals, estates, and trusts in California.

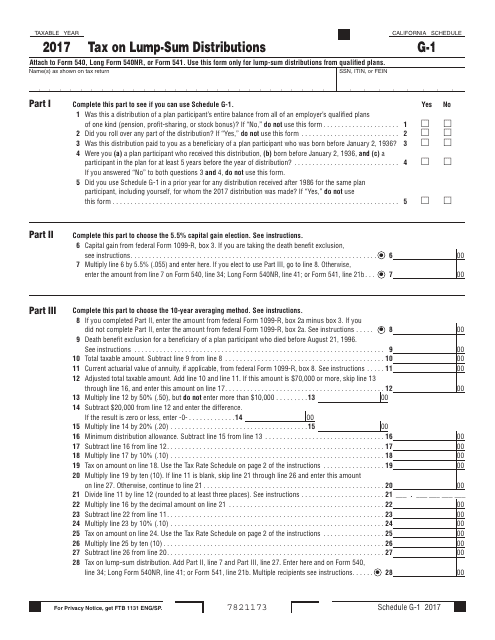

This Form is used for reporting and calculating the tax on lump-sum distributions in the state of California.

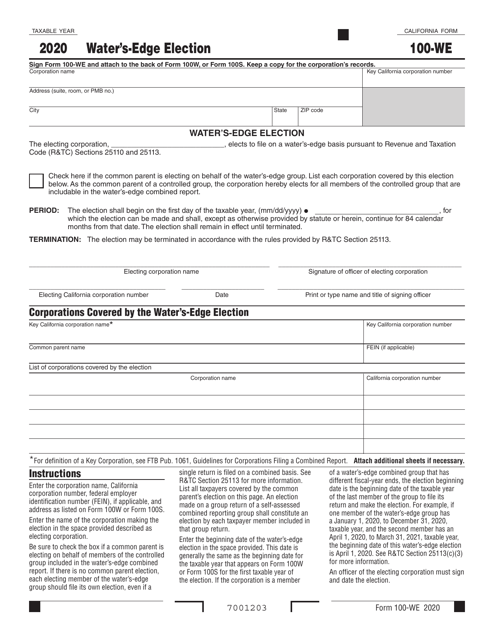

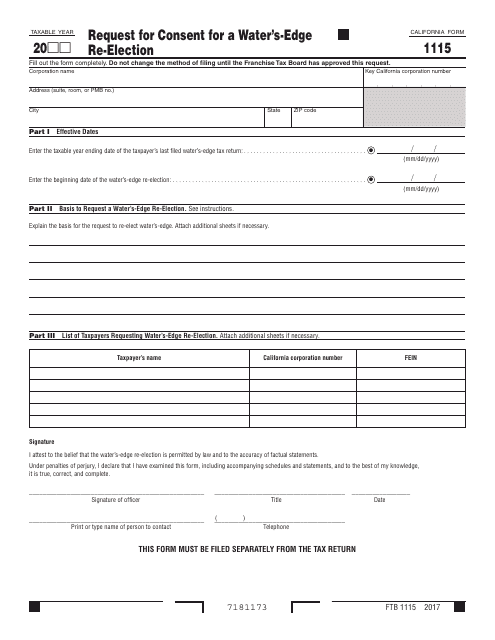

This form is used for requesting consent to re-elect California's water's-edge election method.

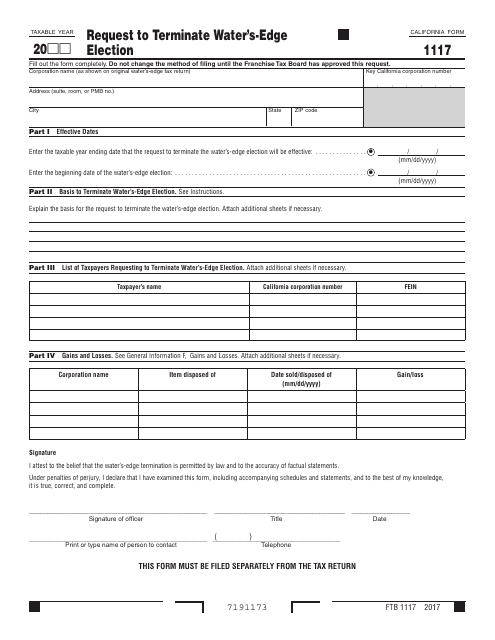

This form is used for requesting to terminate the Water's-Edge Election in California.