Fill and Sign California Legal Forms

Documents:

19713

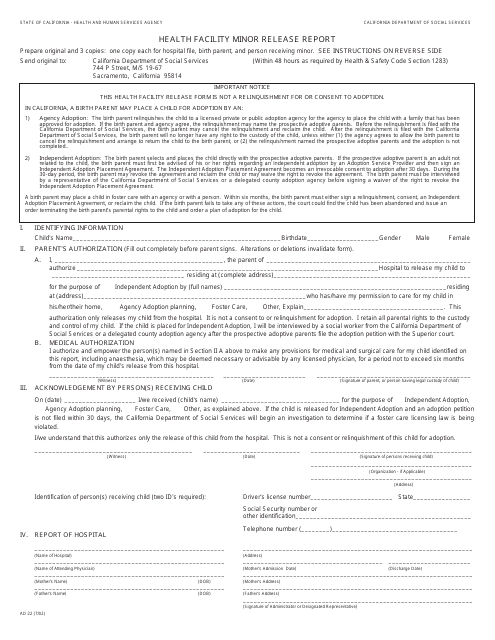

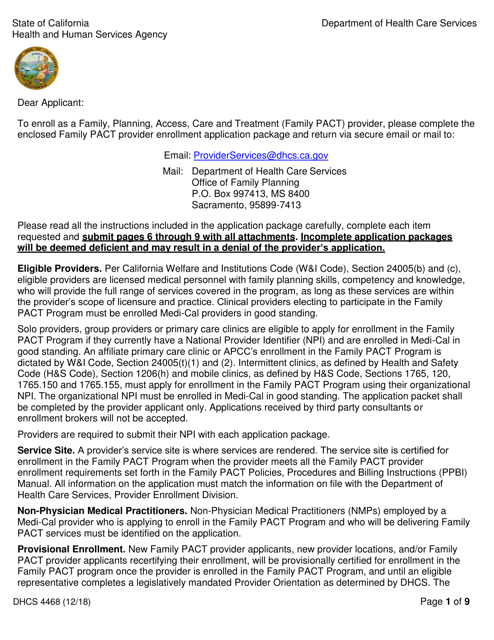

This form is used for reporting minor releases in health facilities in California.

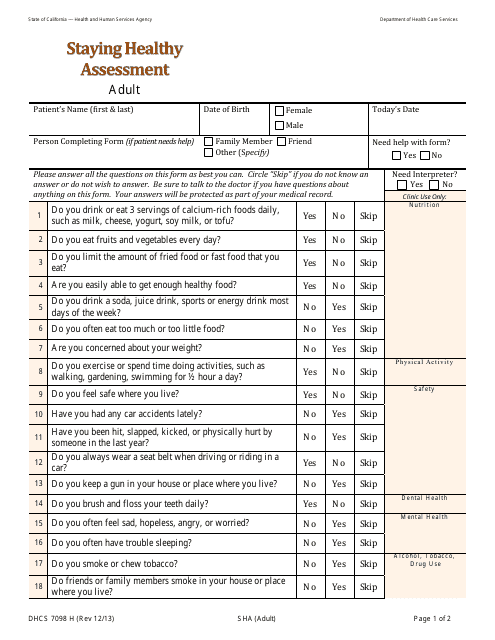

This form is used for conducting a Staying Healthy Assessment for adults in California.

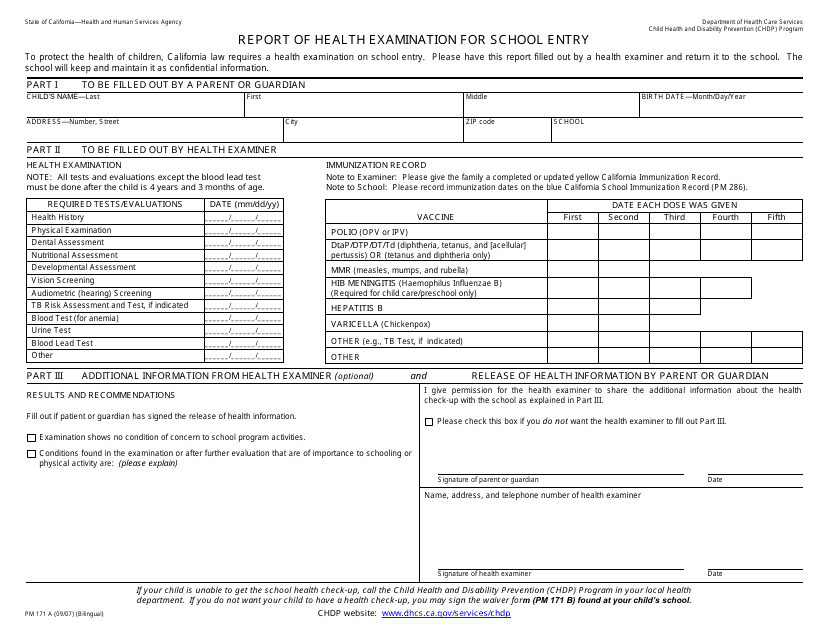

This form is used for reporting the results of a health examination required for entry into school in California.

This document provides information and instructions for businesses in California who want to make an offer in compromise to settle their tax debt with the Franchise Tax Board (FTB).

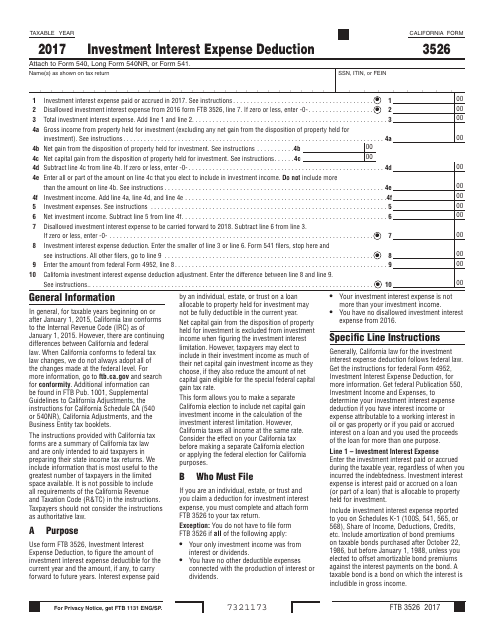

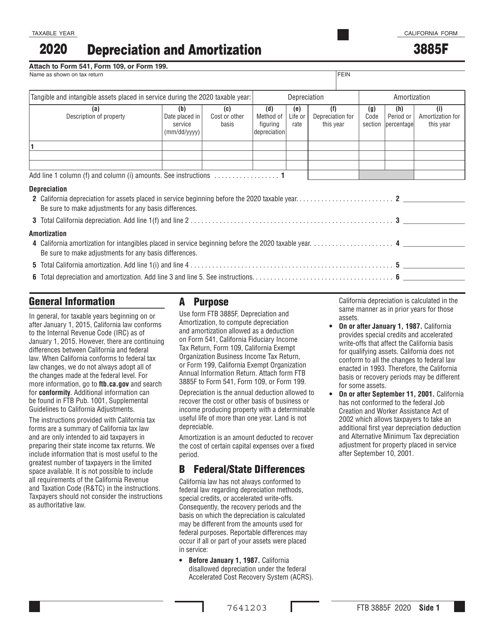

This form is used for claiming the investment interest expense deduction in the state of California. It allows taxpayers to deduct the interest expense paid on their investment loans.

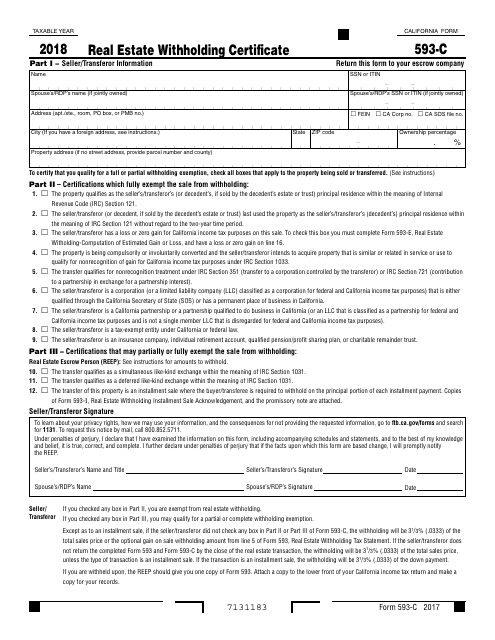

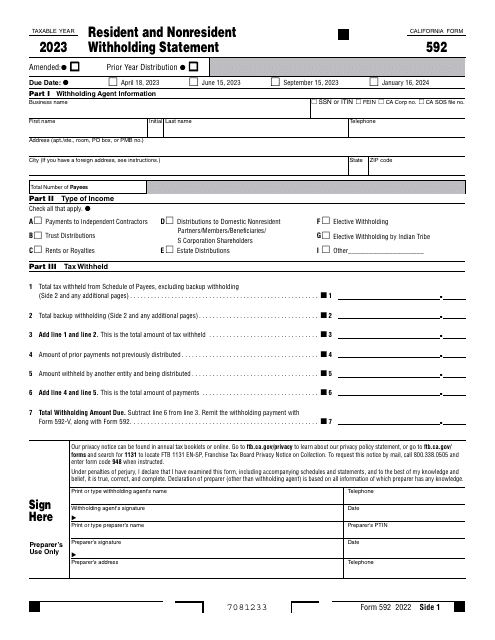

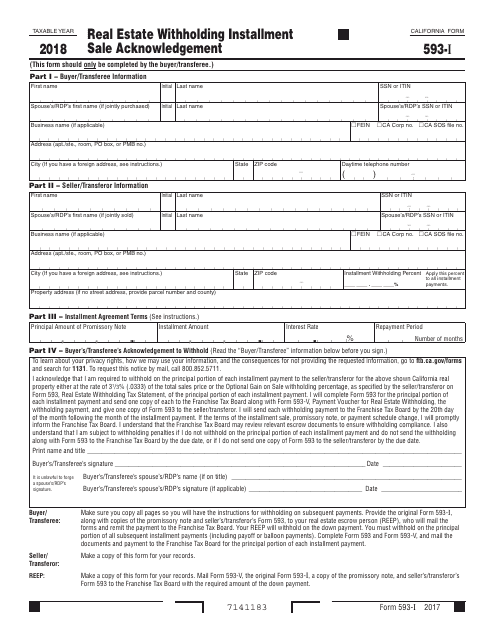

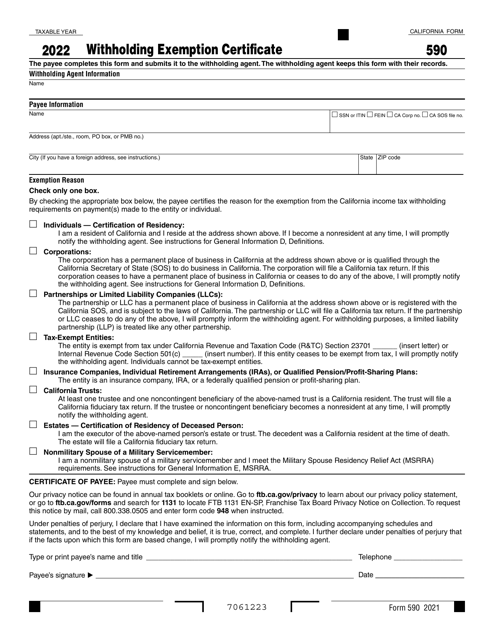

This Form is used for reporting and withholding taxes on real estate transactions in California.

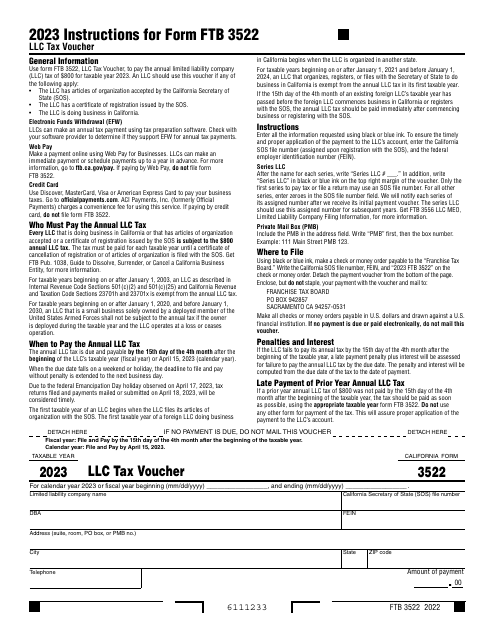

This is a legal document every California-based limited liability company (LLC) needs to submit to pay the annual LLC tax of $800. This form is a tax voucher - it details payment information you need to provide with your check or money order.

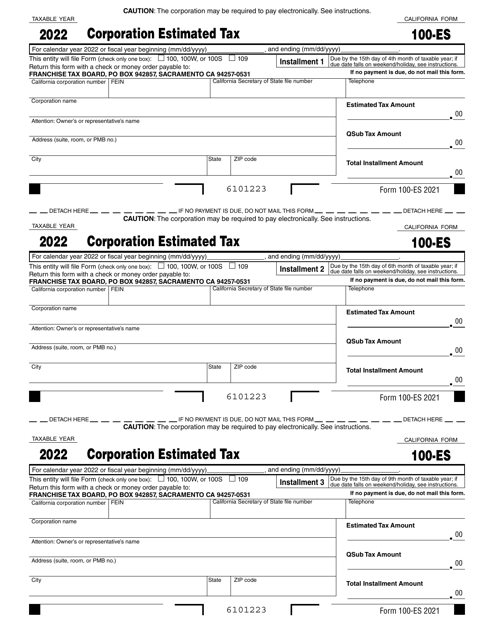

This is a legal document that various financial corporations based in California use to figure estimated tax for a corporation and then mail to the Franchise Tax Board to pay corporate income tax.

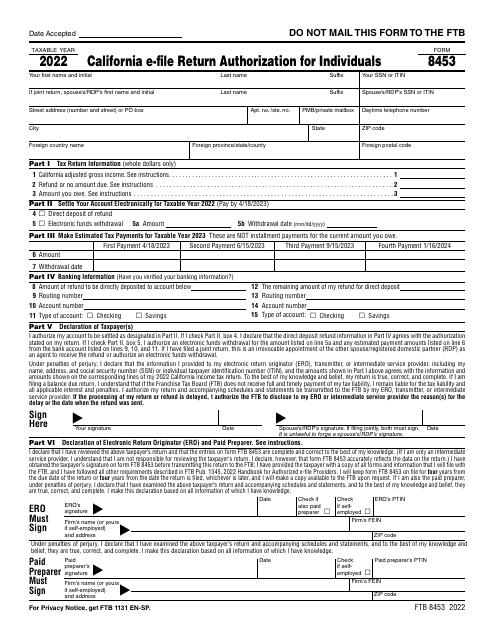

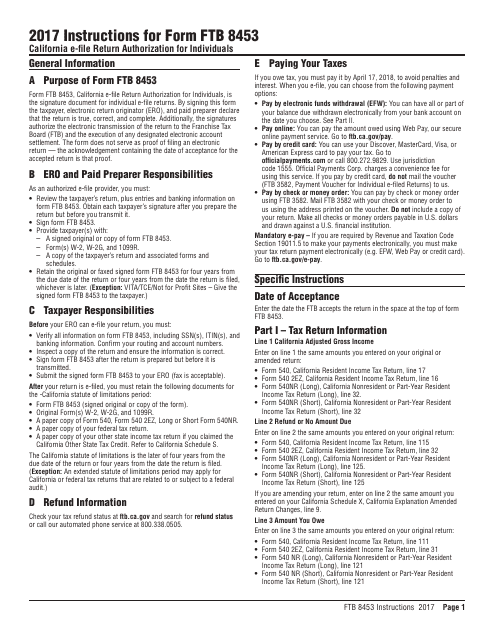

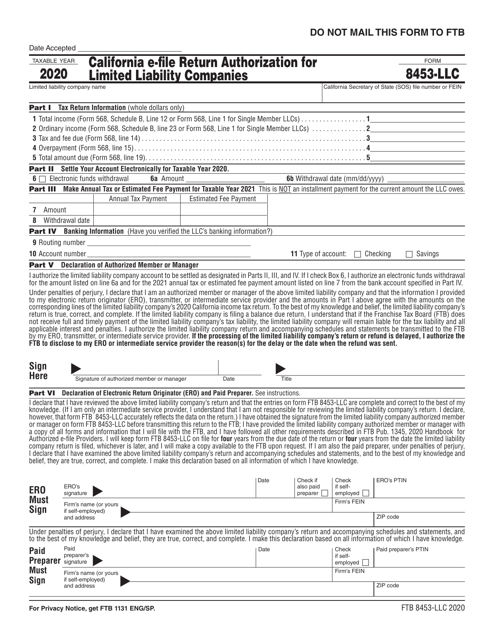

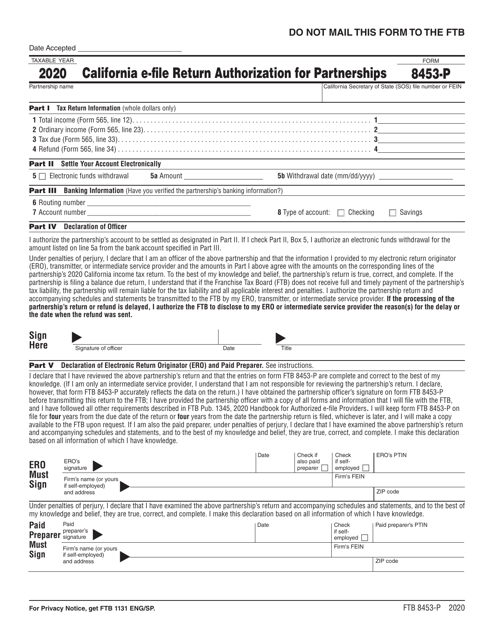

This Form is used for authorizing the electronic filing of individual tax returns in California.

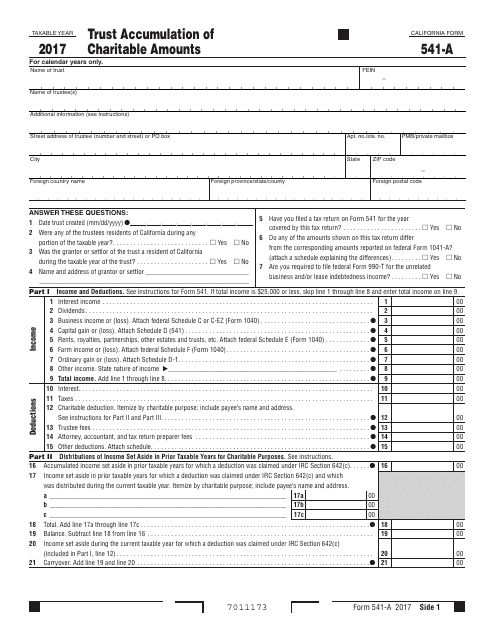

This Form is used for reporting the accumulation of charitable amounts in a trust in the state of California.

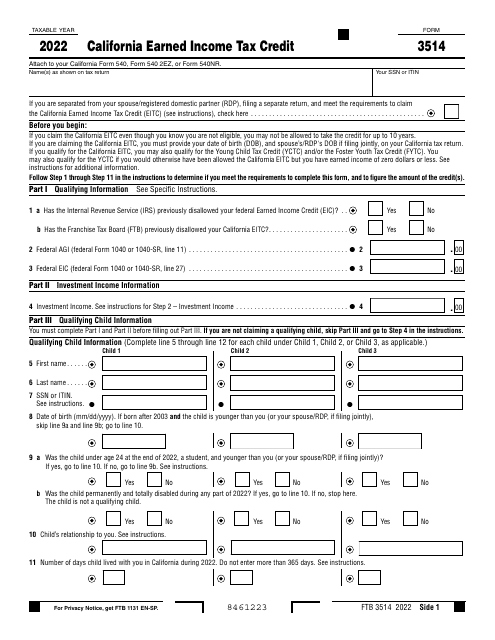

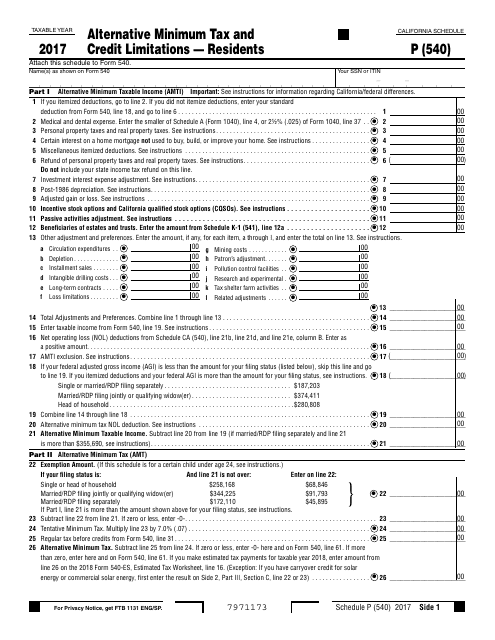

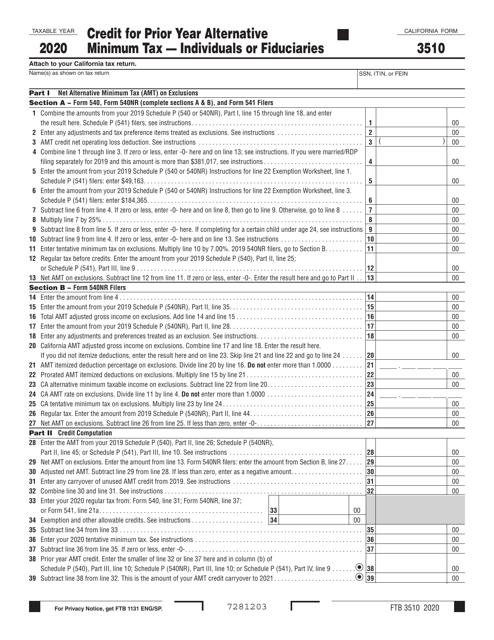

This form is used for calculating the alternative minimum tax and credit limitations for residents of California on their Form 540 tax return.

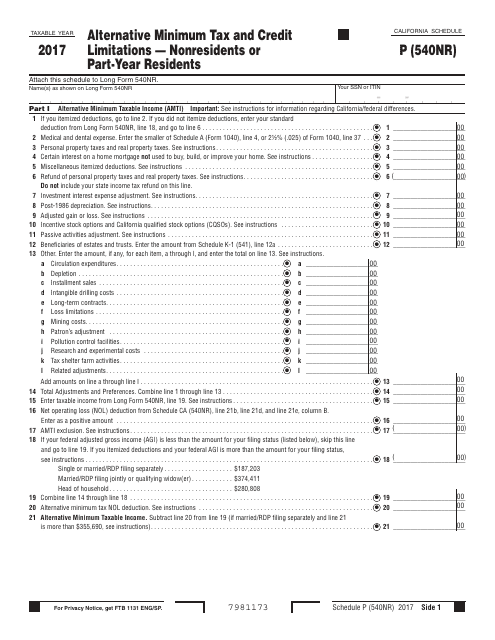

This Form is used for calculating the alternative minimum tax and credit limitations for nonresidents or part-year residents in California. It helps determine the amount of tax owed based on specific criteria and ensures that taxpayers are not subject to excessive tax burdens.

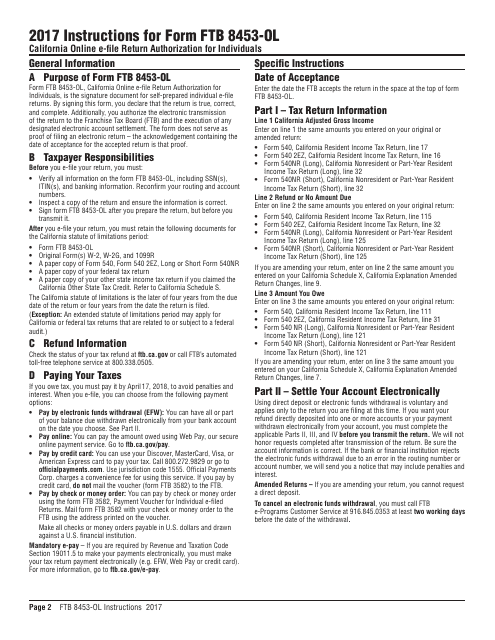

This document is for individuals who want to electronically file their tax returns in California. The form, FTB8453, is used to authorize the electronic filing of the return. It provides instructions on how to complete and submit the form.

This form is used in California for acknowledging the installment sale of real estate properties and withholding taxes.

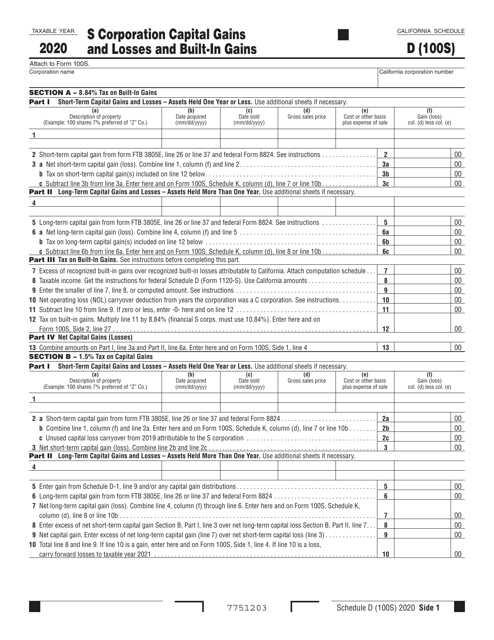

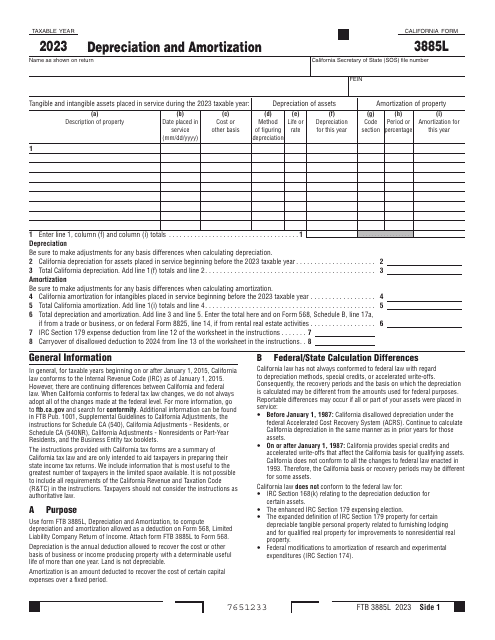

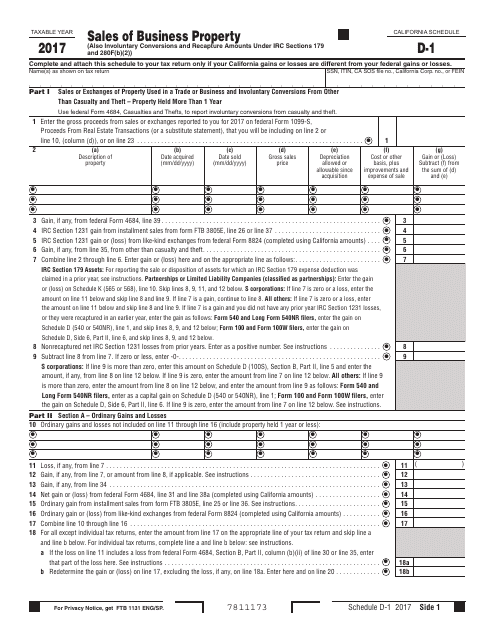

This form is used for reporting sales of business property in California on Form 540 Schedule D-1.

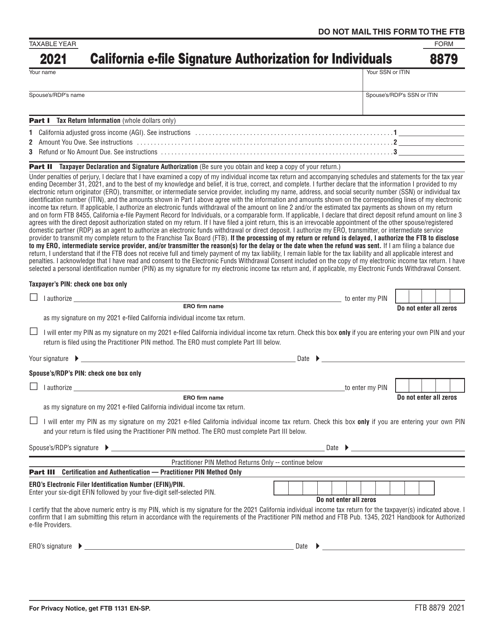

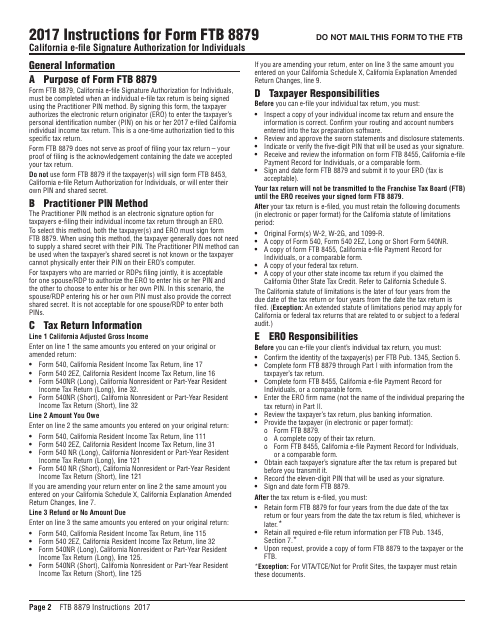

This document is used for authorizing electronic filing of tax returns for individuals in California. It provides instructions on how to complete Form FTB8879 for electronic signature authorization.

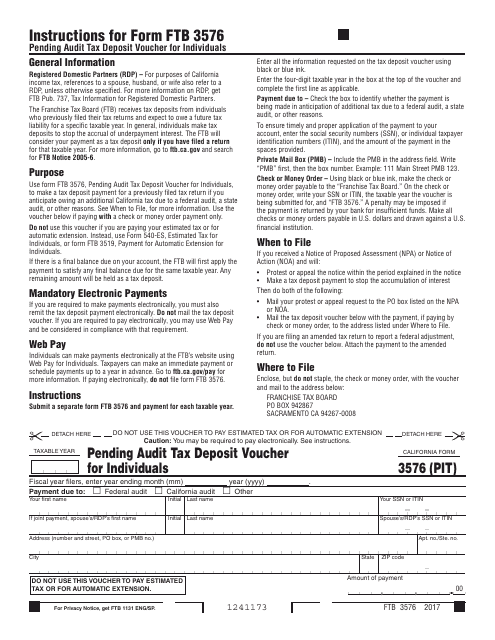

This form is used for making tax deposits for individuals who are under pending audit in the state of California. It serves as a voucher for the tax payment.

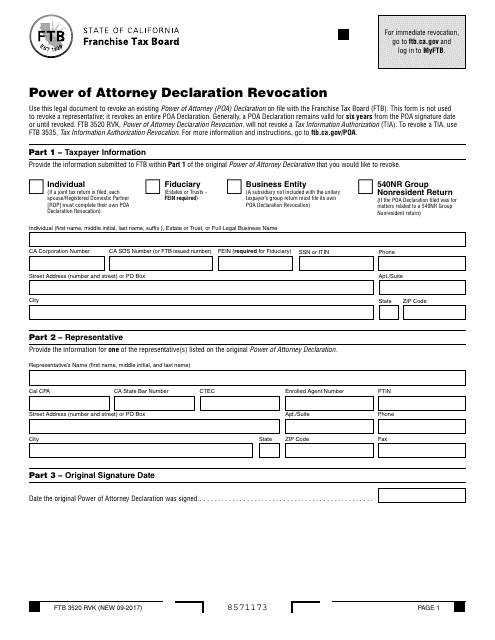

This form is used for revoking a Power of Attorney declaration in the state of California. It allows individuals to notify the Franchise Tax Board that they no longer grant another person the authority to act on their behalf in tax matters.

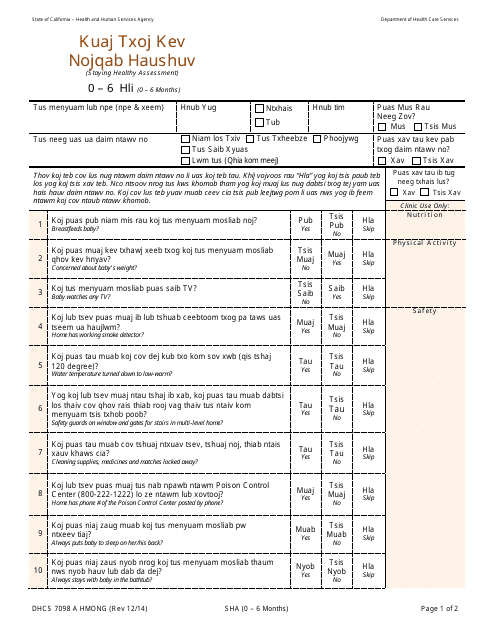

This form is used for the Staying Healthy Assessment for infants aged 0-6 months in California, with a specific version available in the Hmong language.

This form is used for parents who did not give physical custody of the child to the petitioner(s) in an independent adoption program in California. It is a statement of understanding for the non-custodial parent.

This form is used for the independent adoptions program in California specifically for the alleged father. It is a statement of understanding that outlines the rights and responsibilities of the alleged father in the adoption process.

This form is used for the Independent Adoptions Program in California to provide a statement of understanding.