Fill and Sign California Legal Forms

Documents:

19713

This form is used for parents who have given physical custody of an Indian child to the petitioner(s) in an independent adoption program in California. It helps explain the understanding between the custodial parent and the petitioner(s).

This form is used to document the understanding between the alleged father of an Indian child and the Independent Adoptions Program in California. It ensures that the alleged father comprehends the rights and responsibilities related to independent adoptions involving Indian children.

This form is used for parents who are placing their child for adoption with a prospective adoptive parent(s) in California. It is a statement of understanding that outlines the terms and conditions of the independent adoption program.

This form is used for the independent adoptions program in California when a parent places an Indian child with prospective adoptive parent(s). It is a statement of understanding for the process of adoption.

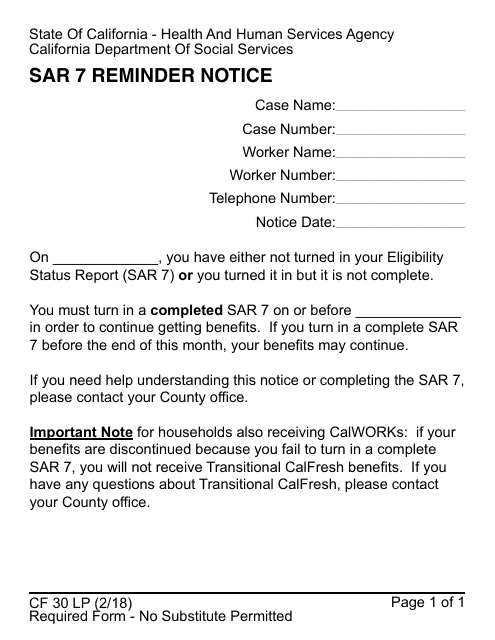

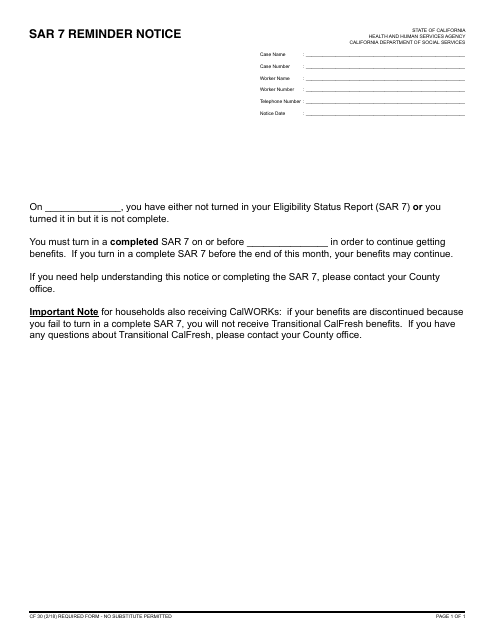

This Form is used for sending a reminder notice regarding the Sar 7 report to be filed in California.

This form is used for sending a reminder notice to recipients of welfare benefits in California. It is a reminder to submit the required CF30 SAR 7 form to continue receiving benefits.

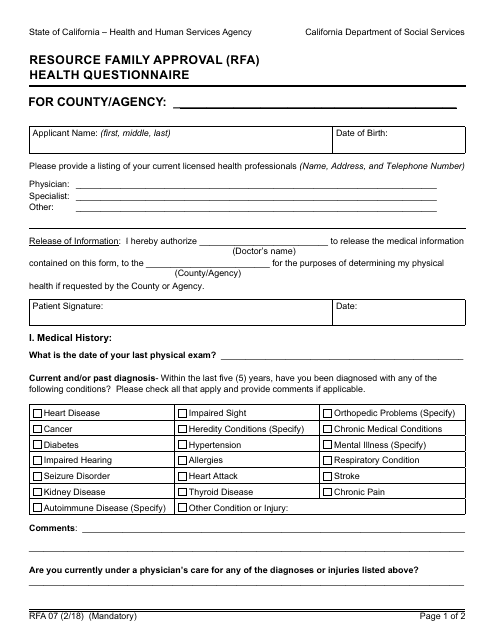

This Form is used for the Resource Family Approval (RFA) process in California. It is a health questionnaire that needs to be completed and submitted as part of the approval process for families looking to provide care for foster children.

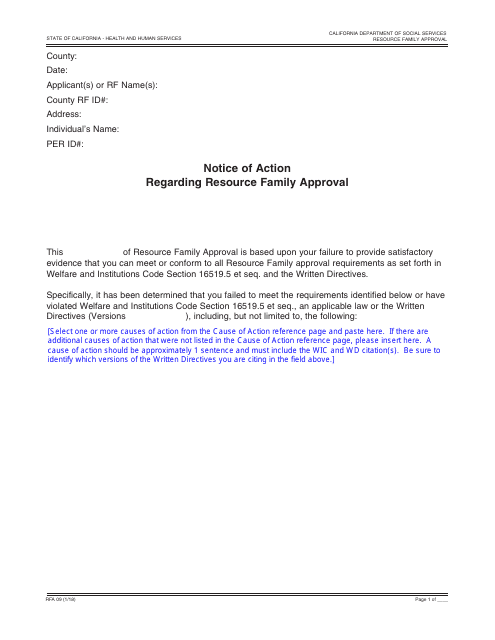

This form is used for notifying resource families in California about actions taken regarding their approval status.

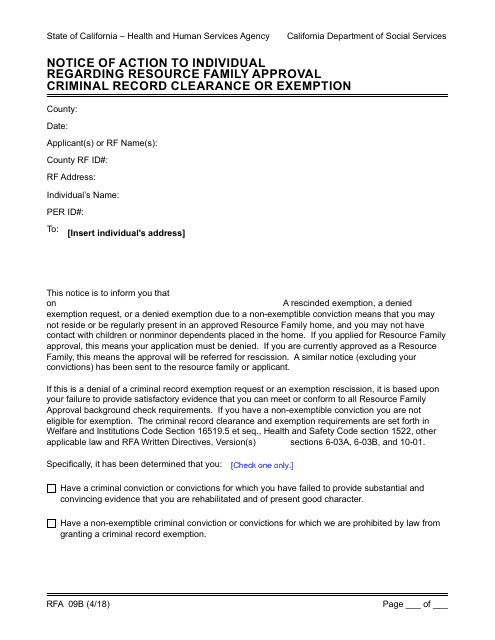

This form is used for notifying individuals in California about the decision on their criminal record exemption for resource family approval.

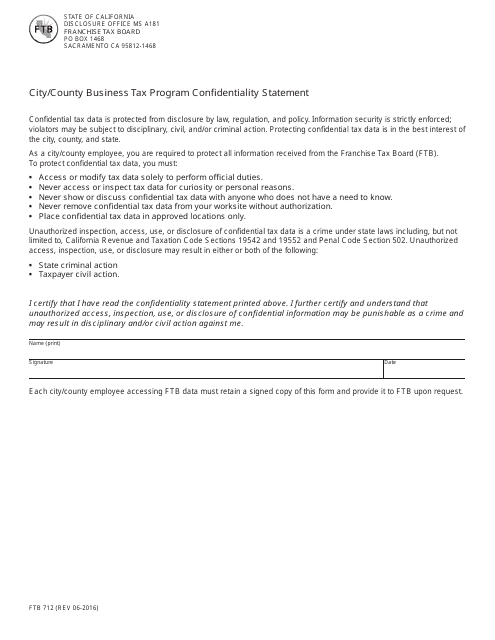

This form is used for the City/County Business Tax Program in California and contains a confidentiality statement.

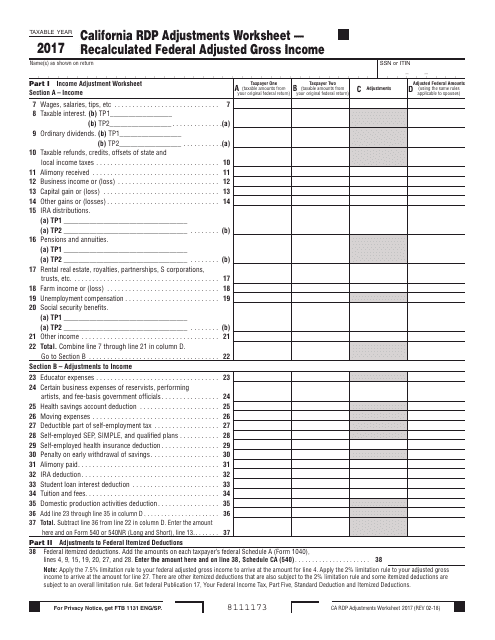

California Rdp Adjustments Worksheet " Recalculated Federal Adjusted Gross Income - California, 2017

This document is used for calculating the recalculated Federal Adjusted Gross Income for California state taxes.

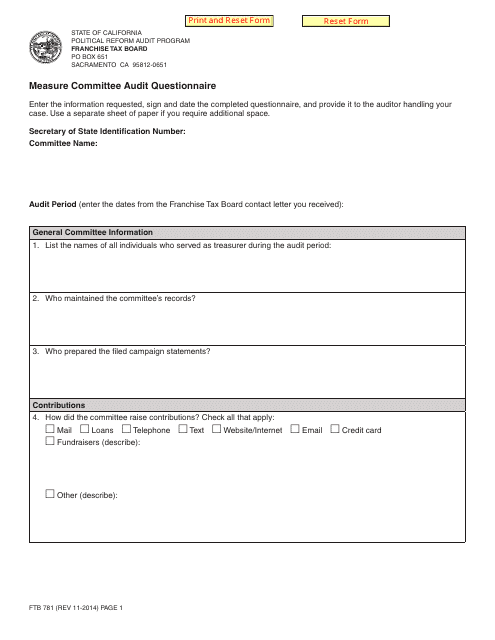

This document is a form used for conducting an audit questionnaire by the Measure Committee in California.

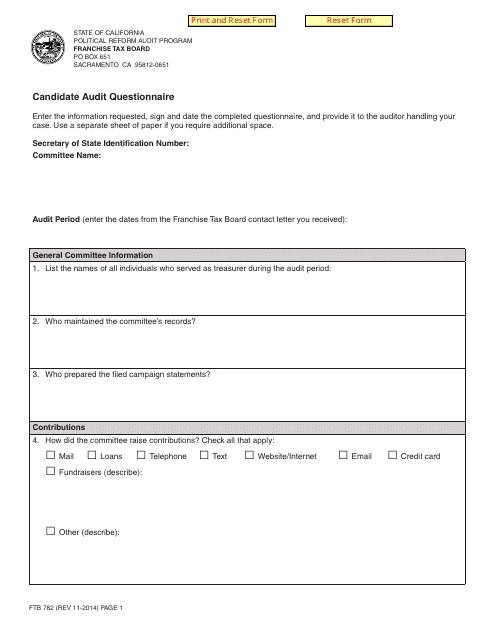

This form is used for conducting audits on candidates in the state of California.

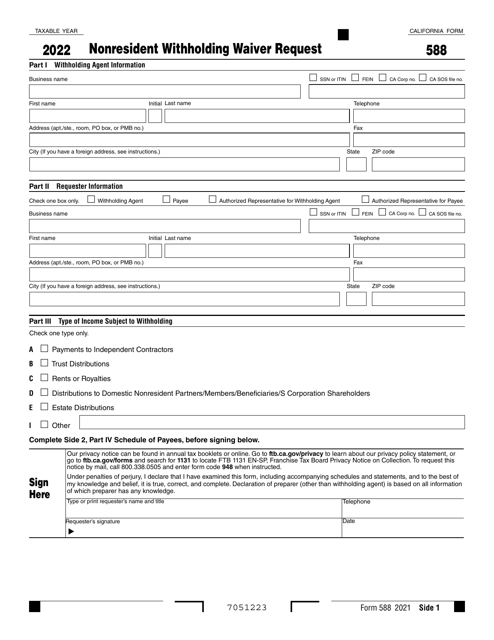

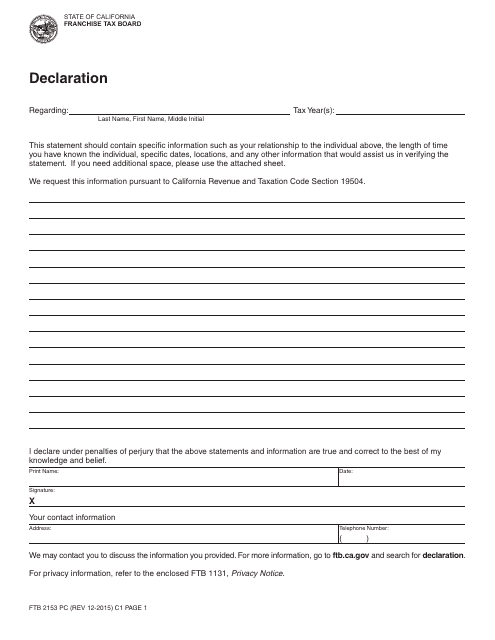

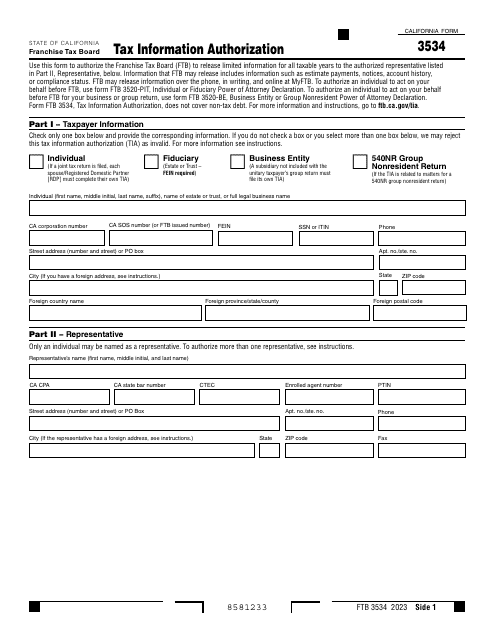

This form is used for filing a declaration of payment and/or communication of your personal income tax with the California Franchise Tax Board.

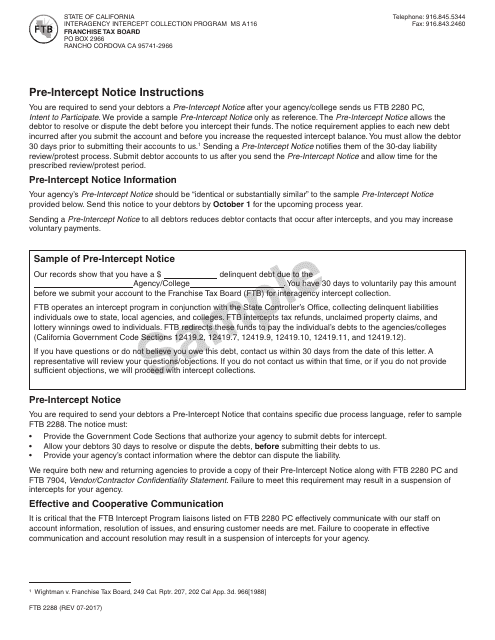

This document is a sample Pre-intercept Notice form used in California by the Franchise Tax Board (FTB). It notifies individuals of potential intercepted funds for unpaid debts.

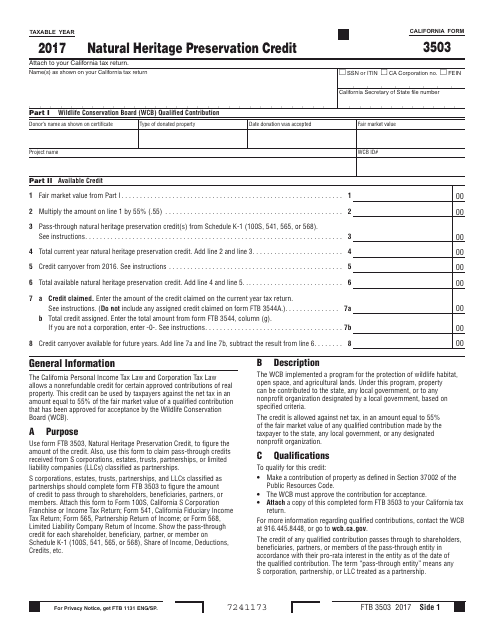

This form is used for claiming the Natural Heritage Preservation Credit in California. It allows individuals or businesses to receive a tax credit for contributing to the preservation of natural heritage sites in the state.

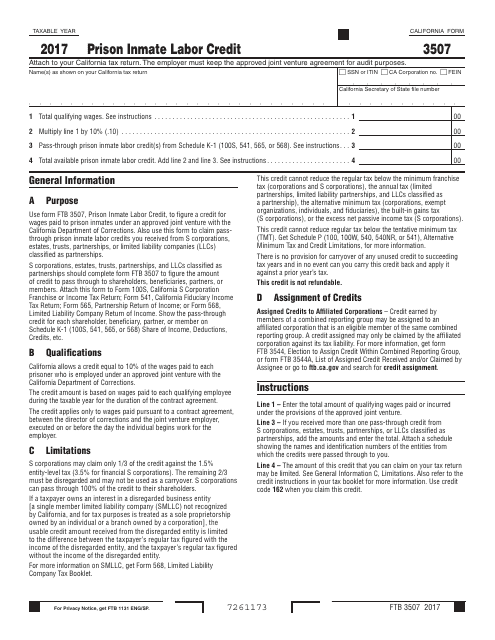

This form is used for claiming the Prison Inmate Labor Credit in California.

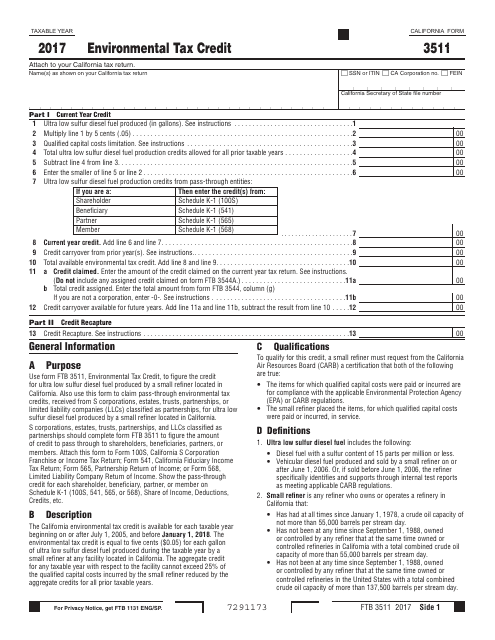

This Form is used for claiming the Environmental Tax Credit in the state of California.

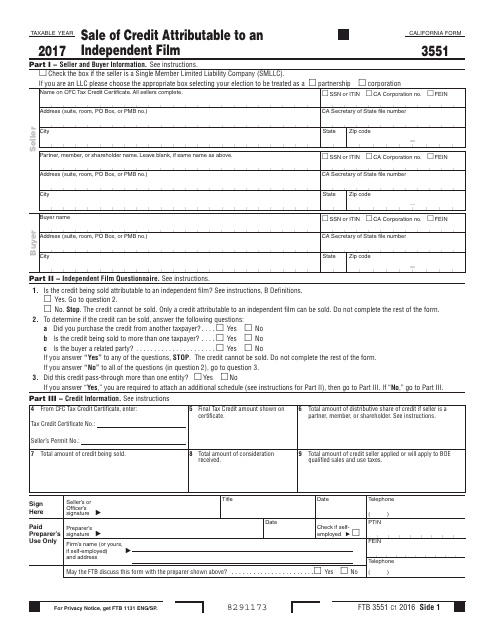

This form is used for reporting the sale of credits related to an independent film in California.

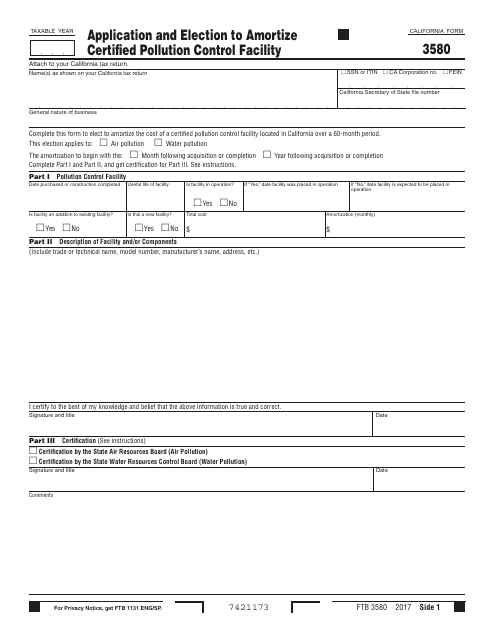

This form is used for applying and electing to amortize a certified pollution control facility in the state of California.

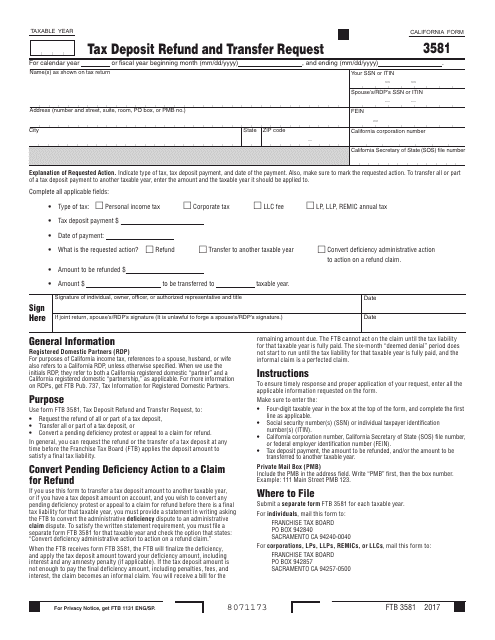

This Form is used for requesting a refund or transferring tax deposits in the state of California.

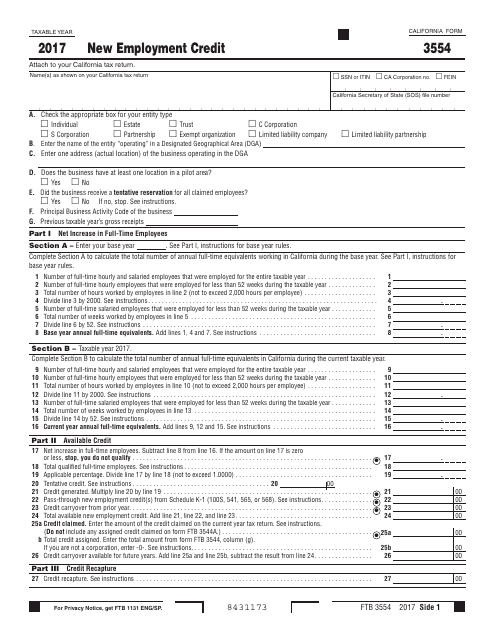

This Form is used for claiming the New Employment Credit in the state of California. It helps businesses report and calculate their eligibility for this tax credit.

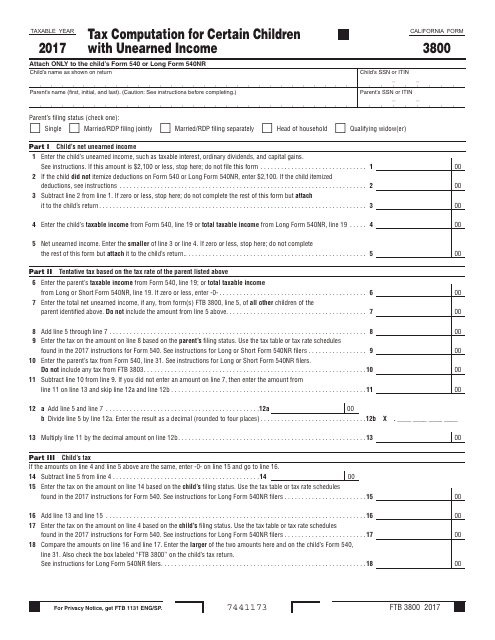

This form is used for calculating the tax for certain children in California who have unearned income. It helps determine the correct amount of tax owed based on the child's income.

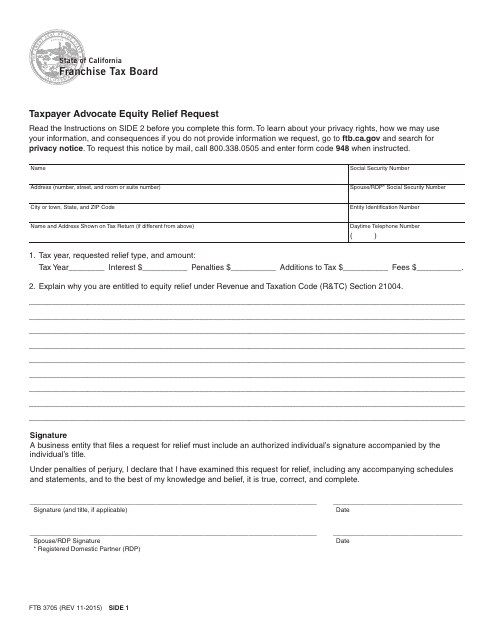

This form is used for taxpayers in California to request relief from tax-related issues through the Taxpayer Advocate program.

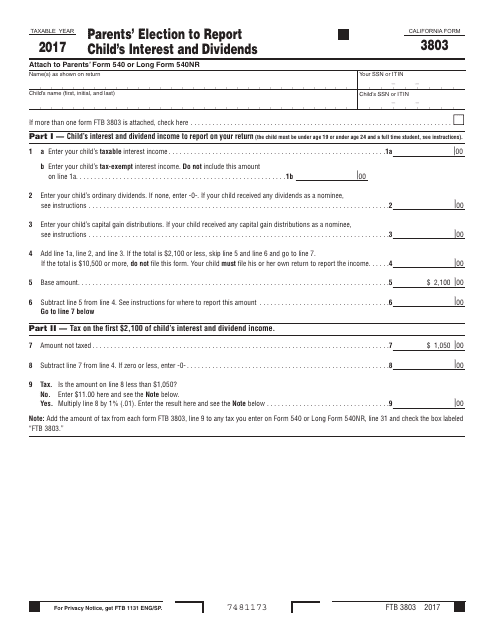

This form is used for parents in California to elect to report their child's interest and dividends on their tax return.

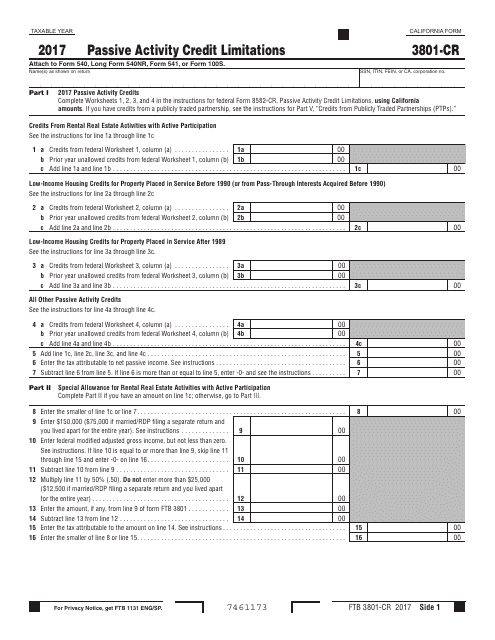

This form is used for calculating passive activity credit limitations specific to the state of California.

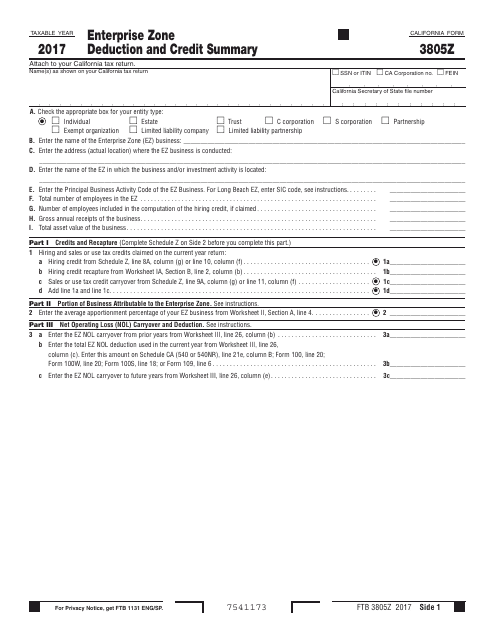

This form is used for providing a summary of the deductions and credits related to the enterprise zone in California.