Canadian Federal Legal Forms and Templates

Documents:

5112

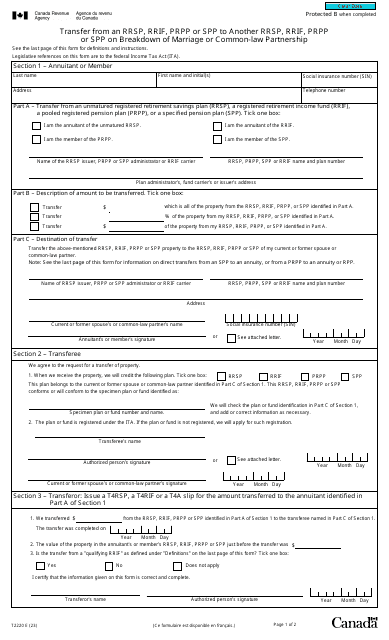

This form is completed to directly transfer property upon the breakdown of a marriage or common-law partnership.

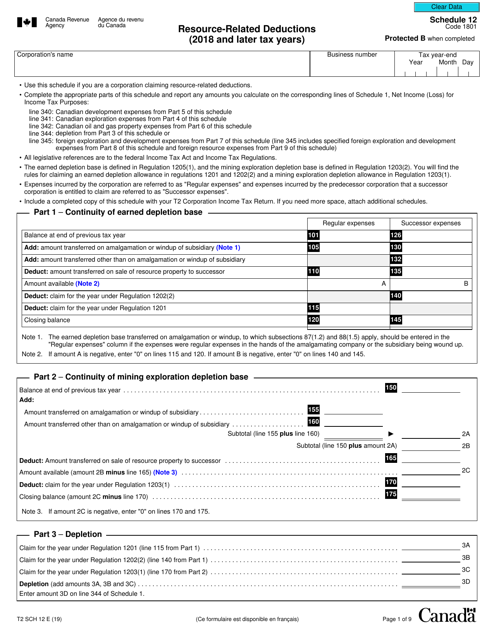

This form is used for claiming resource-related deductions on the T2 tax return in Canada for the tax years 2018 and later. It allows businesses to deduct expenses related to resource exploration, development, and extraction.

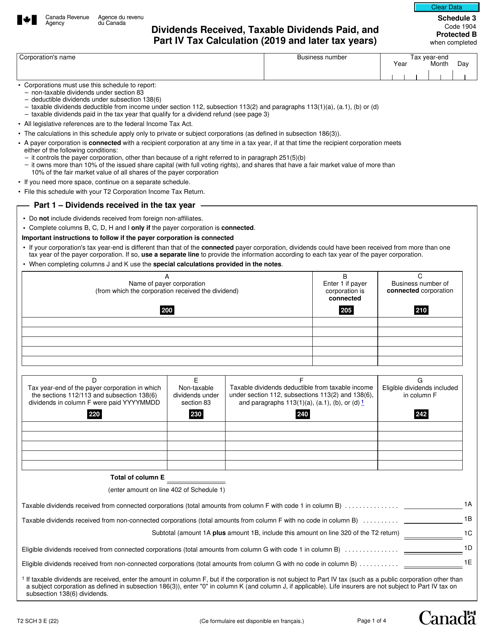

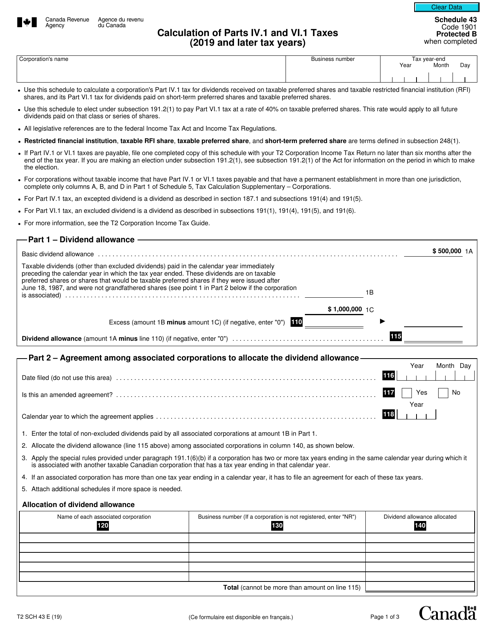

This form is used for calculating Parts IV.1 and VI.1 taxes for the tax years 2019 and later in Canada.

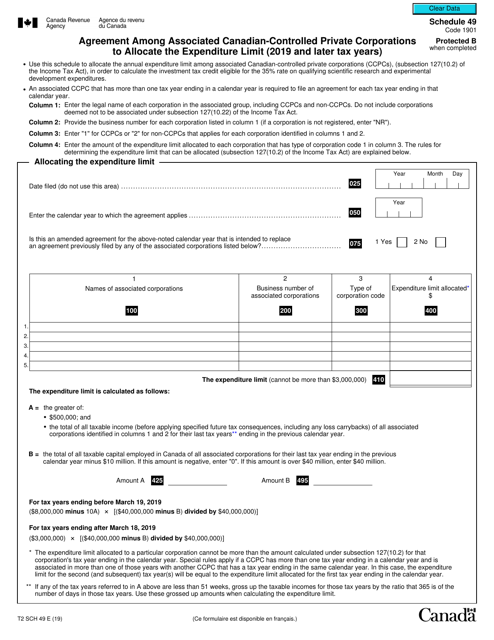

This Form is used for Canadian-controlled private corporations (CCPCs) to allocate the expenditure limit for the tax years 2019 and later. It is used to determine how certain expenses are shared among associated CCPCs in Canada.

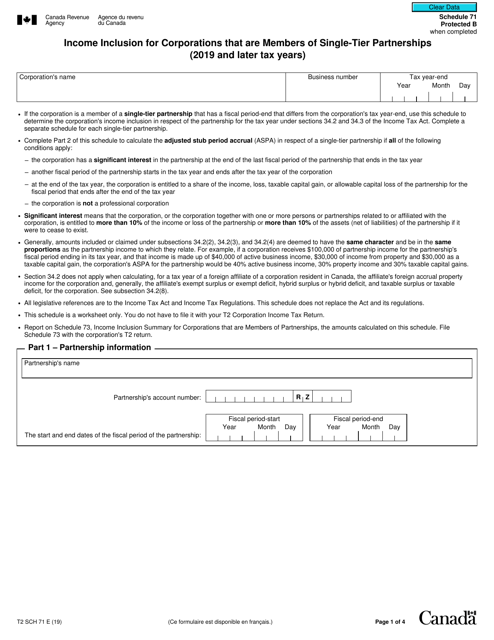

This form is used for calculating the income inclusion for corporations that are members of single-tier partnerships in Canada for the 2019 and later tax years. It helps determine the amount of income that should be included in the corporation's taxable income.

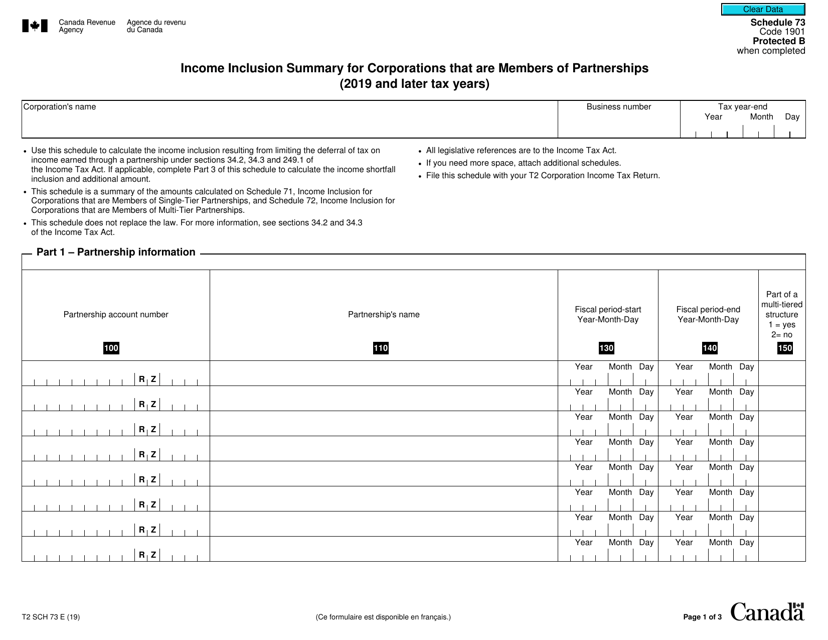

This form is used for corporations in Canada that are members of partnerships to summarize their income inclusion for tax years 2019 and later.

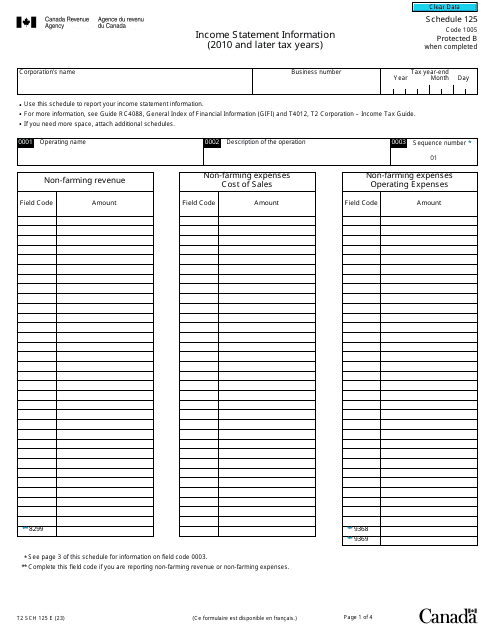

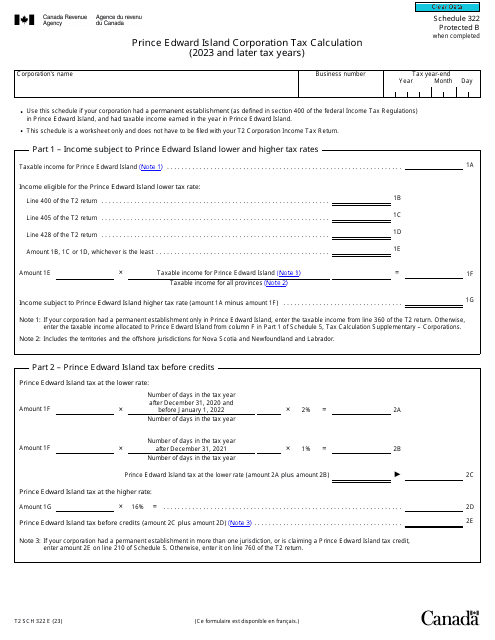

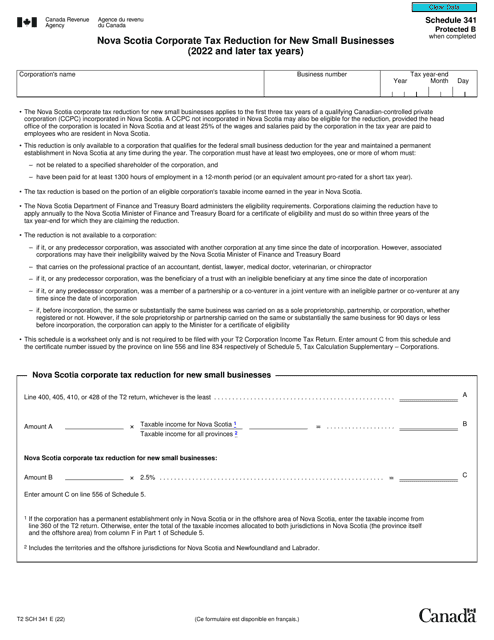

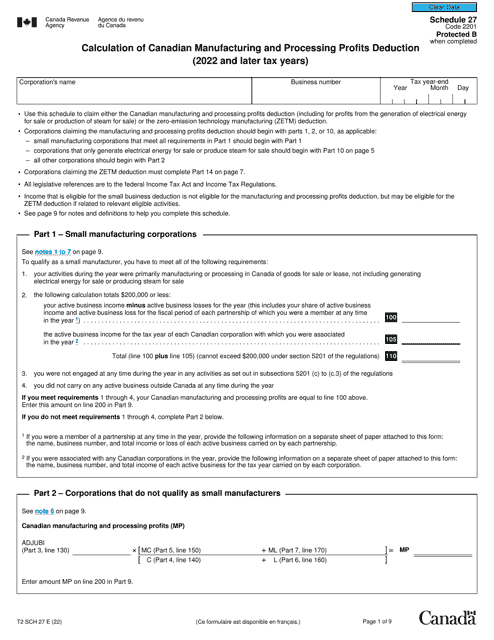

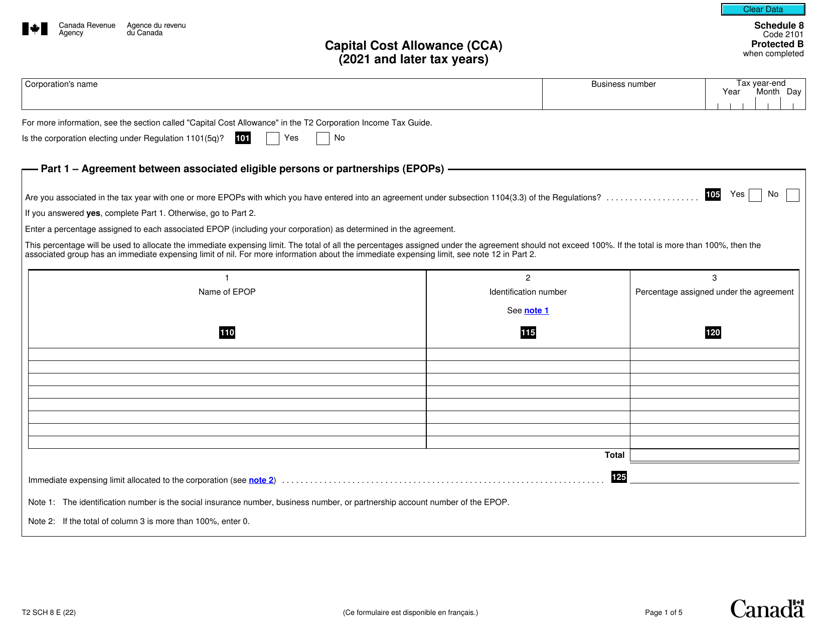

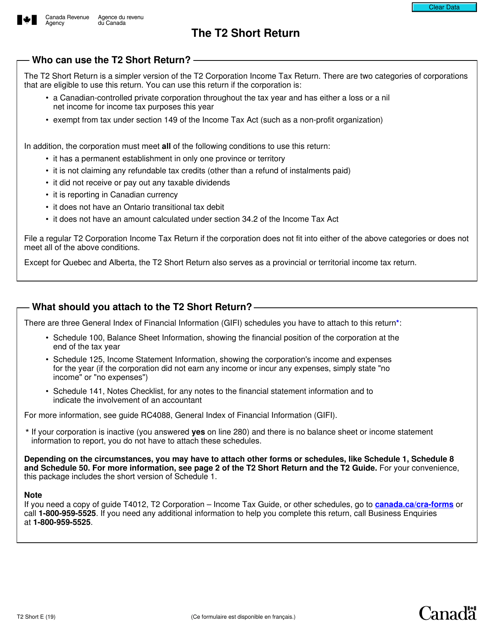

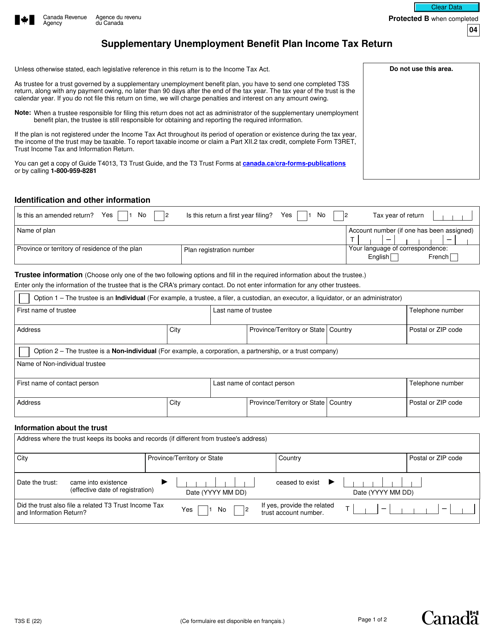

Certain categories of Canadian corporations can complete this formal document to report their income during the year.