Canadian Federal Legal Forms and Templates

Documents:

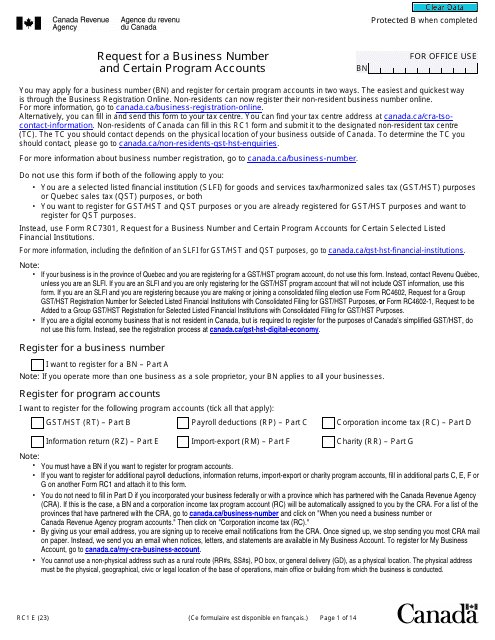

5112

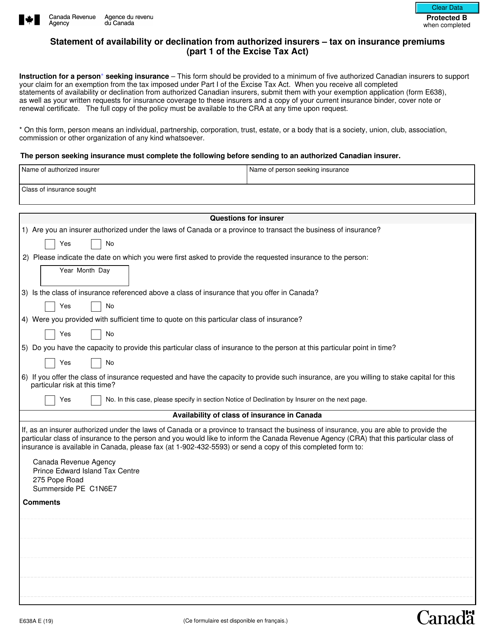

This form is used for taxpayers in Canada to declare their availability or refusal to purchase insurance from authorized insurers for the purpose of the Tax on Insurance Premiums as per the Excise Tax Act.

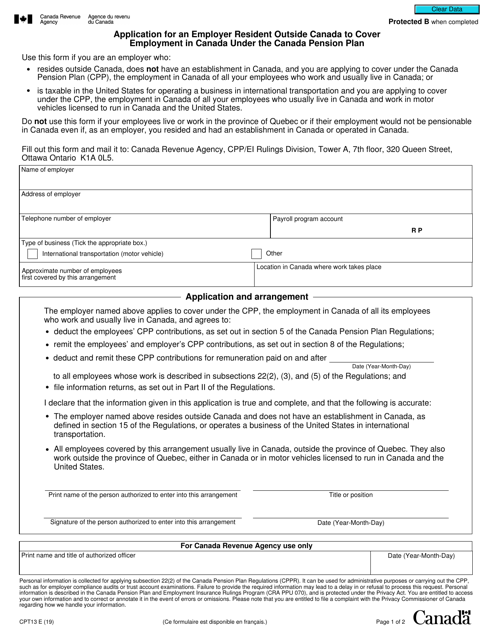

This Form is used for employers who are not residents of Canada to apply for coverage under the Canada Pension Plan for their employees working in Canada.

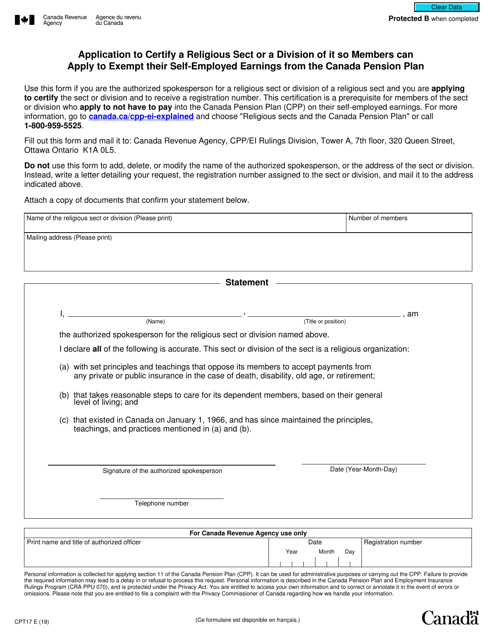

This form is used for applying to certify a religious sect or division of it in Canada, so that its members can apply to exempt their self-employed earnings from the Canada Pension Plan.

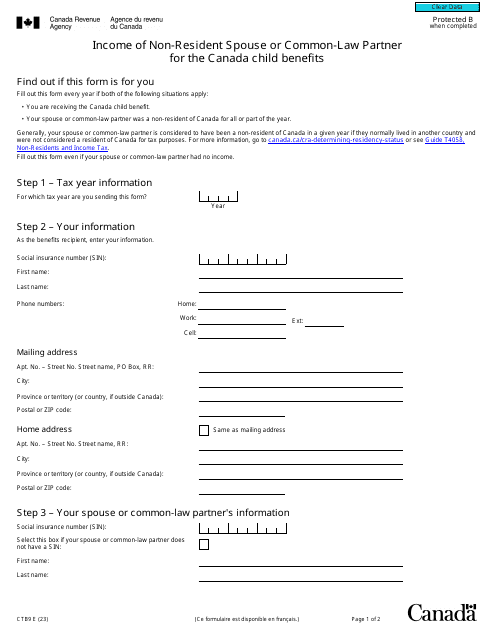

Form CTB9 Income of Non-resident Spouse or Common-Law Partner for the Canada Child Benefits - Canada

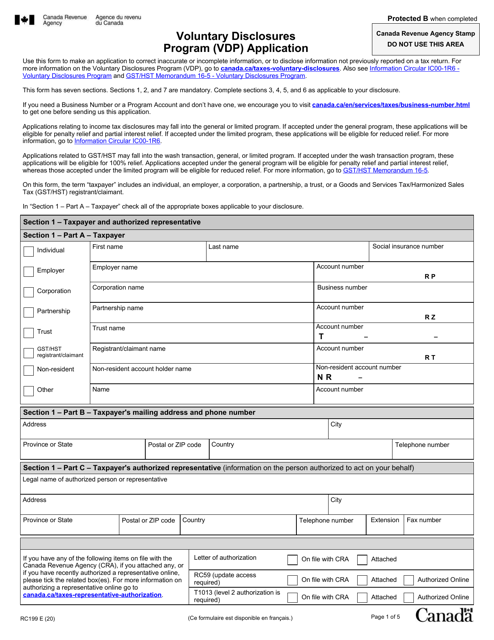

This form is used for submitting an application to the Voluntary Disclosures Program (VDP) in Canada.

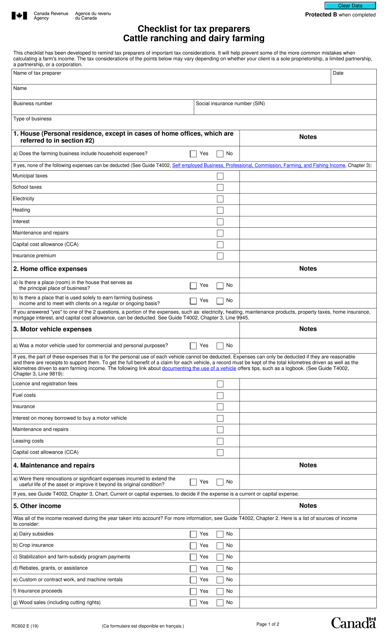

This Form is used for tax preparers in Canada who specialize in cattle ranching and dairy farming. It is a checklist that provides guidance on the specific tax considerations and requirements for these types of agricultural businesses.

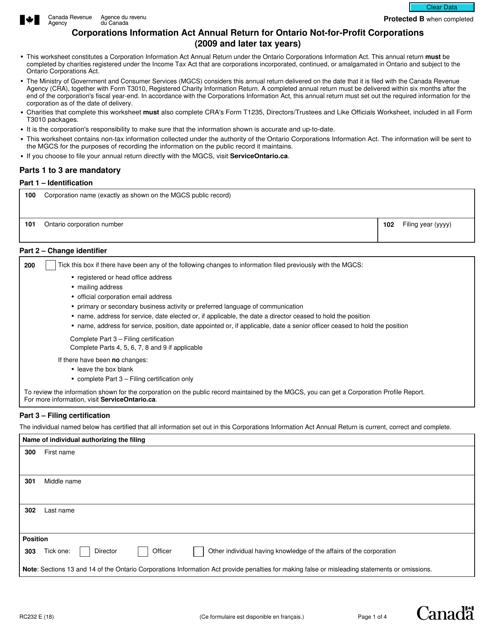

This form is used for Ontario not-for-profit corporations to file their annual return under the Corporations Information Act. It is specific to tax years 2009 and later.

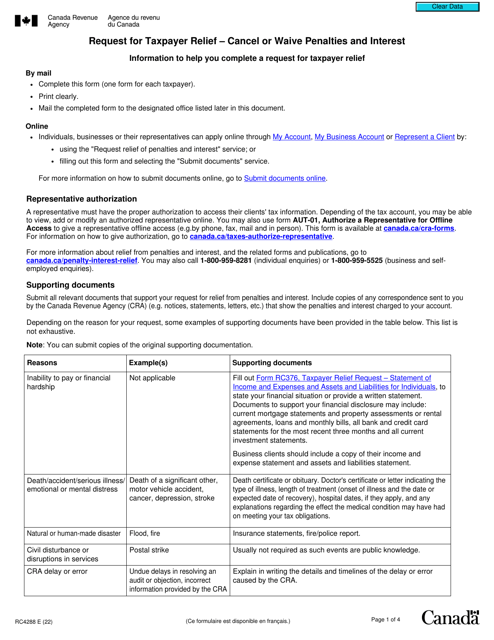

This form acts as the supporting documentation a Canadian person will need to submit when they are unable to pay their annual taxes due to extenuating circumstances.

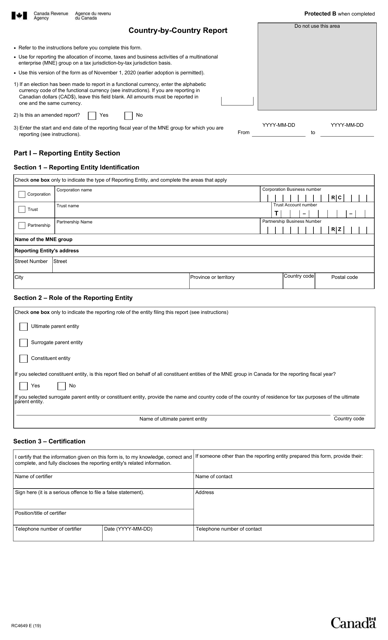

This Form is used for reporting country-by-country information in Canada. It helps multinational corporations provide details on their global operations, including revenue, taxes paid, and employees.