Canadian Federal Legal Forms and Templates

Documents:

5112

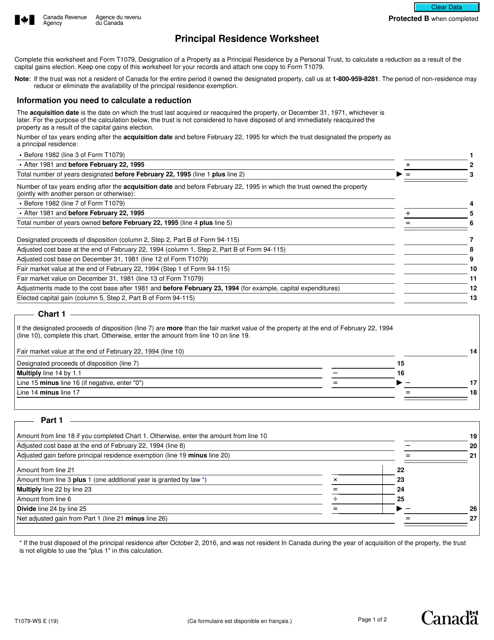

This Form is used for calculating the principal residence exemption for Canadian taxpayers.

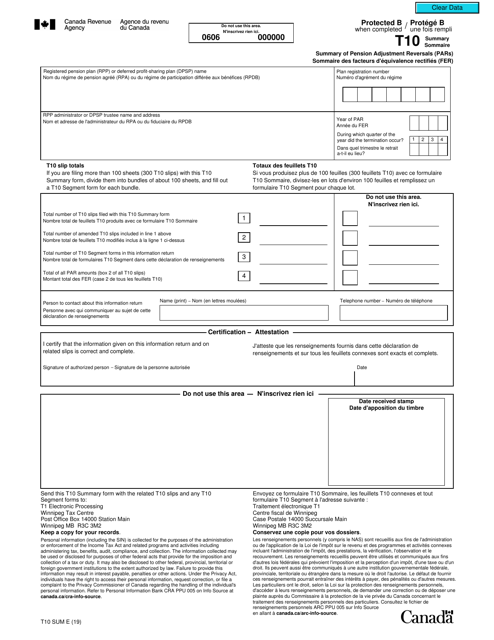

This form is used for summarizing the pension adjustment reversals (PARs) in Canada. It is available in both English and French.

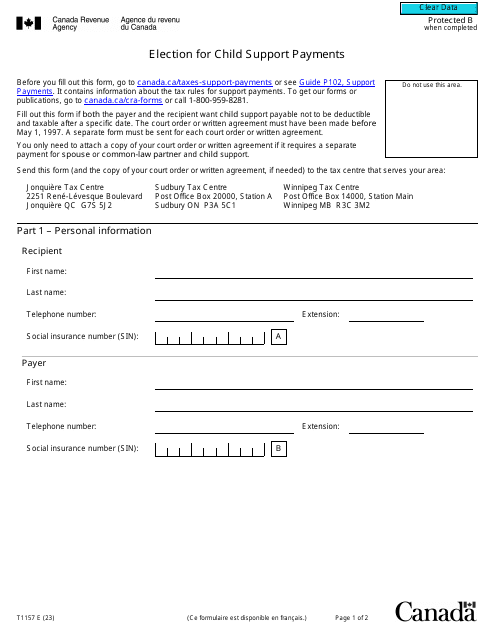

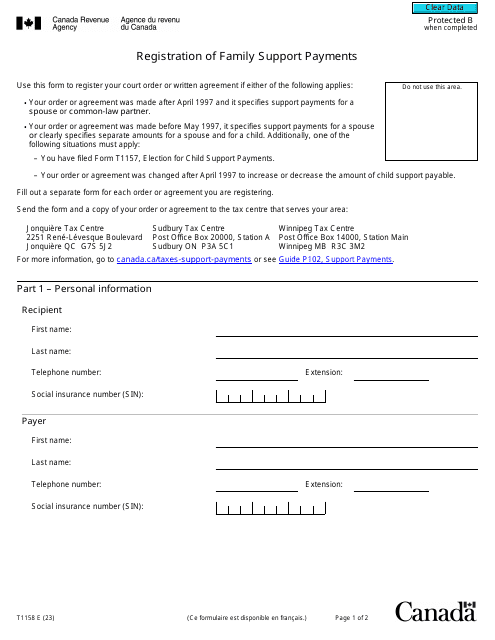

This is a legal document that needs to be completed to register an election for child support payments in Canada.

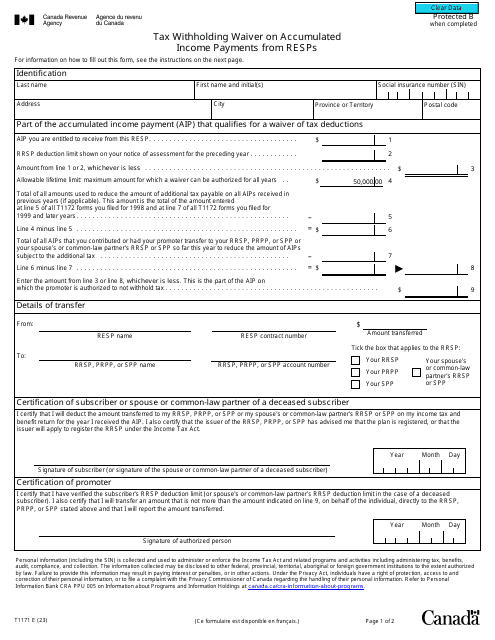

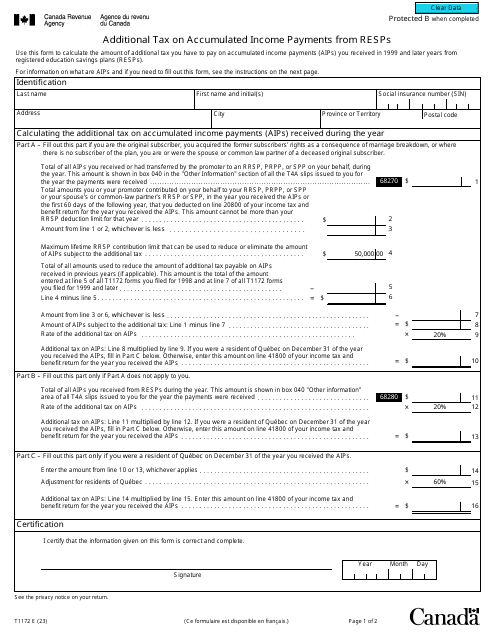

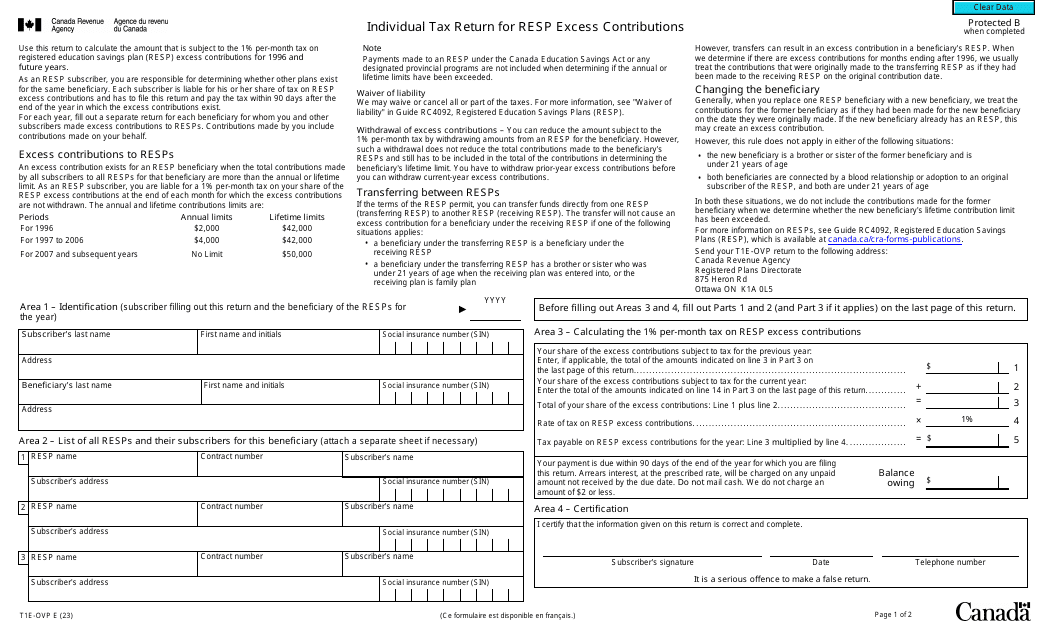

Canadian residents may fill out this form to notify their registered education savings plan (RESP) provider about their decision to withhold tax payments on accumulated income payments (AIPs) they are eligible to receive from the RESP.

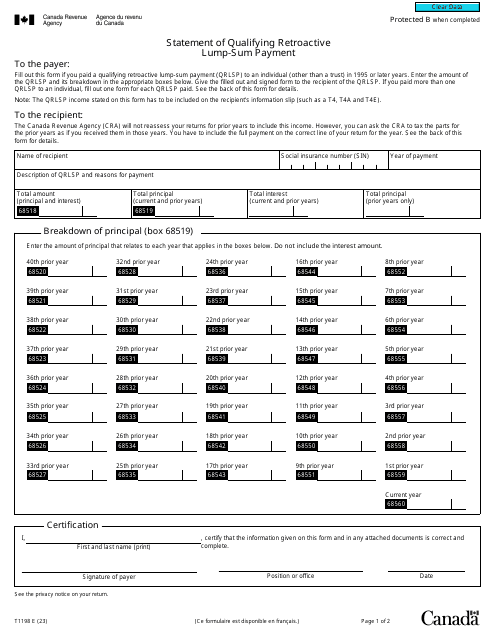

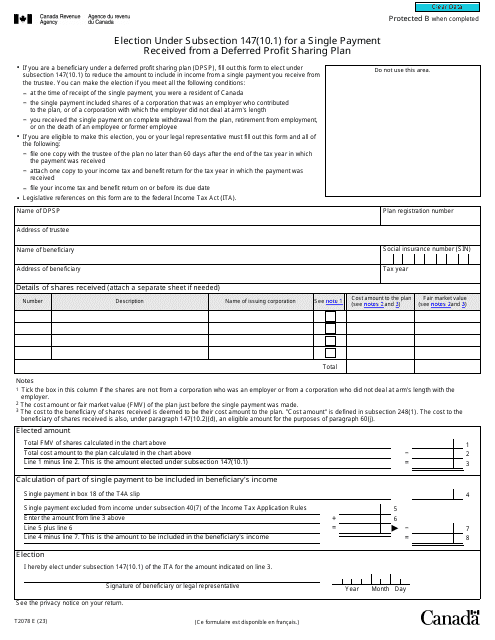

Individuals and companies residing in Canada can fill out this document if they have paid a lump-sum payment in the last twenty-five years to ask the tax authorities to compute taxes differently for the beneficiary and spare them from the necessity to pay all taxes at once.

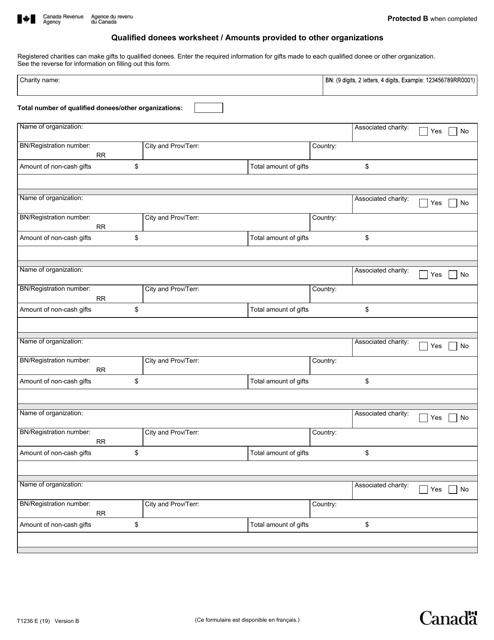

This form is used for calculating the amounts provided to other organizations by qualified donees in Canada.

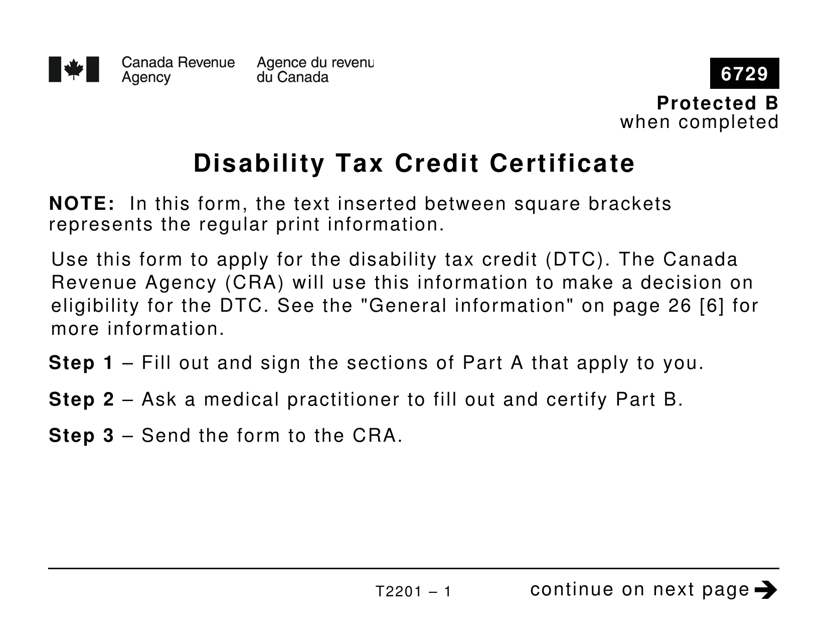

This form is used for applying for the Disability Tax Credit in Canada. It is in large print format to accommodate individuals with visual impairments.