Canadian Federal Legal Forms and Templates

Documents:

5112

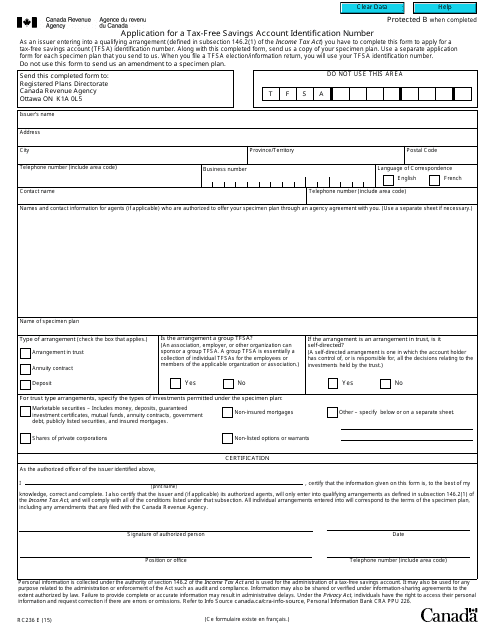

This form is used for applying for a Tax-Free Savings Account Identification Number in Canada.

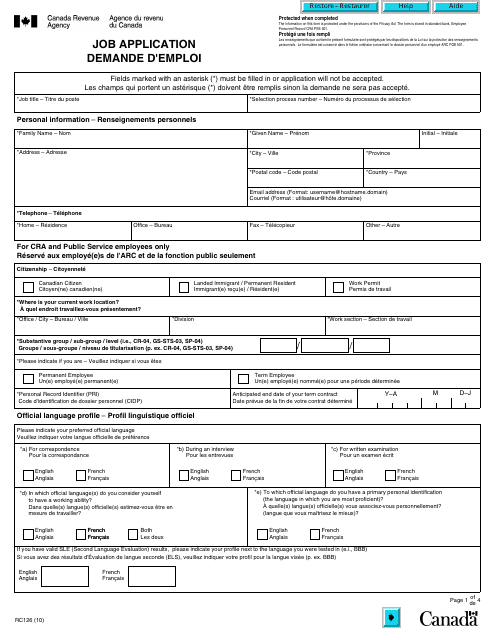

This form is used for applying for a job in Canada. It is available in both English and French.

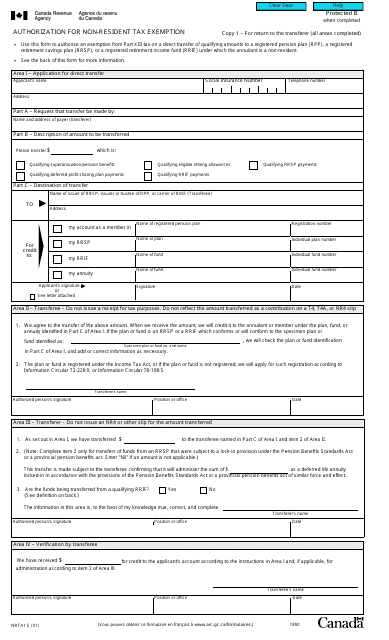

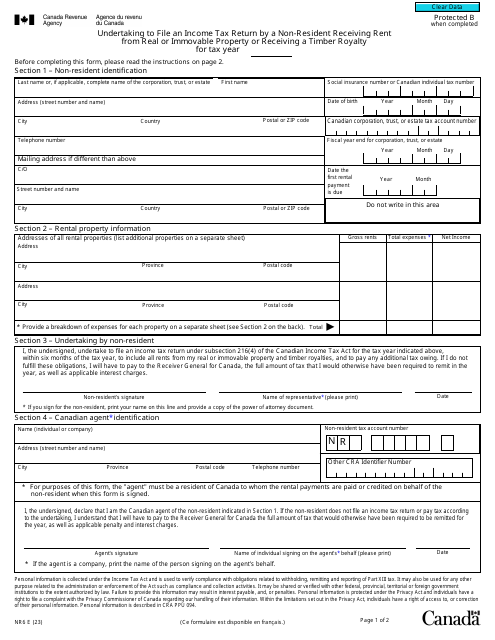

This form is used for non-residents to request a tax exemption in Canada. It authorizes the individual to be exempt from certain taxes typically paid by residents.

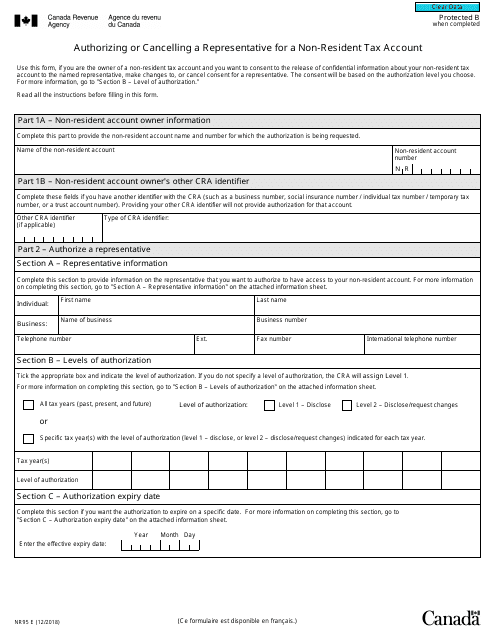

This form is used for authorizing or cancelling a representative for a non-resident tax account in Canada.

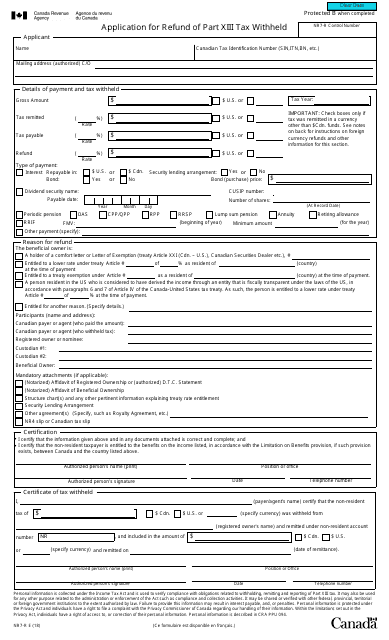

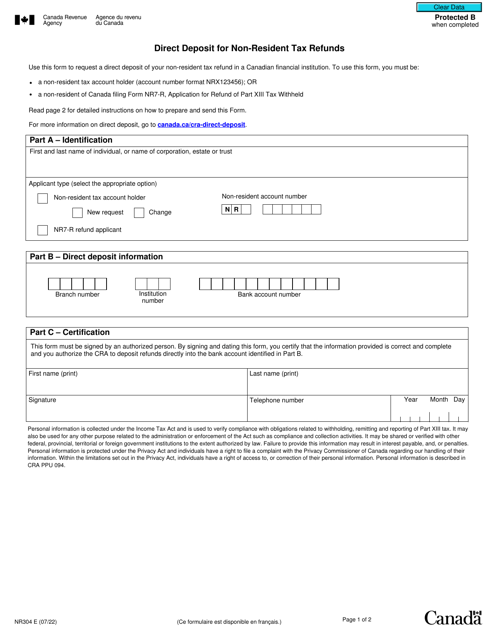

This form is used for applying for a refund of the Part XIII tax withheld in Canada.

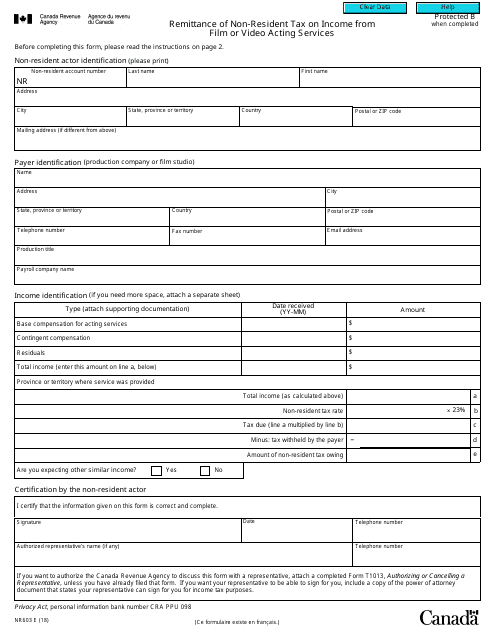

This form is used for Canadian non-residents to remit taxes on income earned from acting services in the film or video industry.

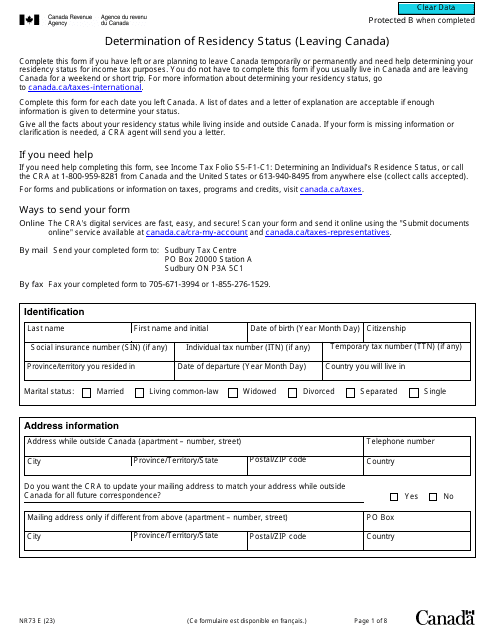

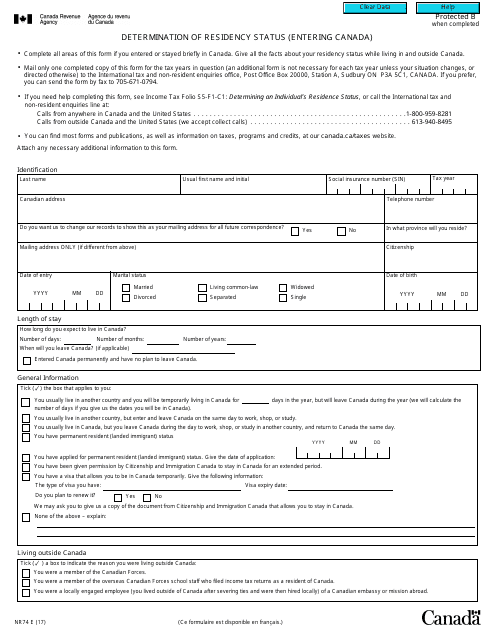

This form is used for determining an individual's residency status when entering Canada. It helps Canadian authorities determine whether the person should be classified as a resident or non-resident for tax purposes.

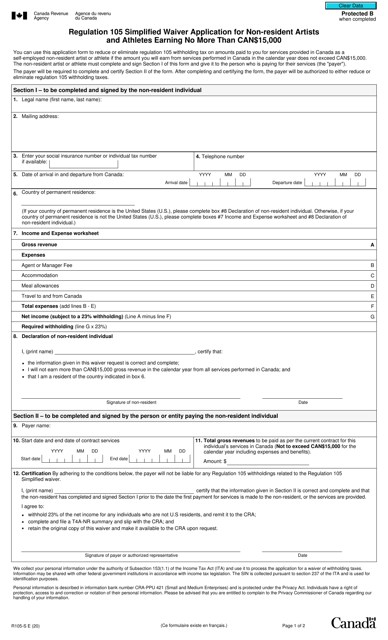

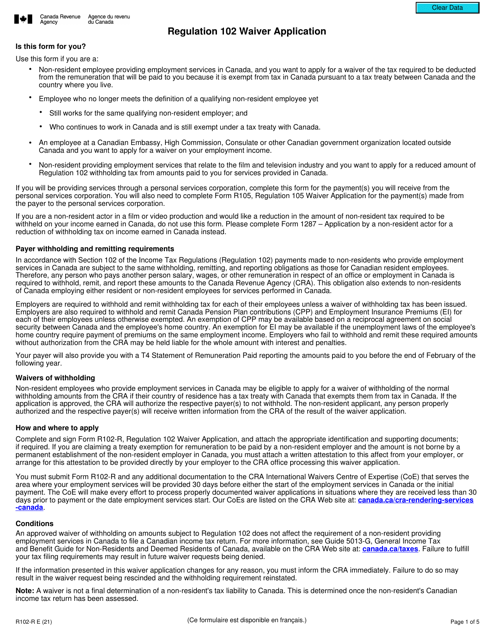

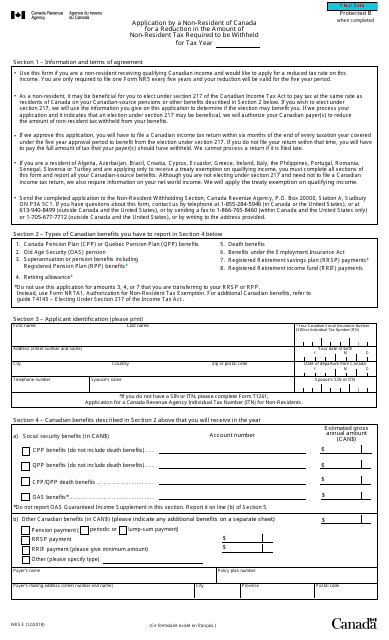

This form is used for non-residents of Canada to apply for a reduction in the amount of non-resident tax that needs to be withheld for the tax year.

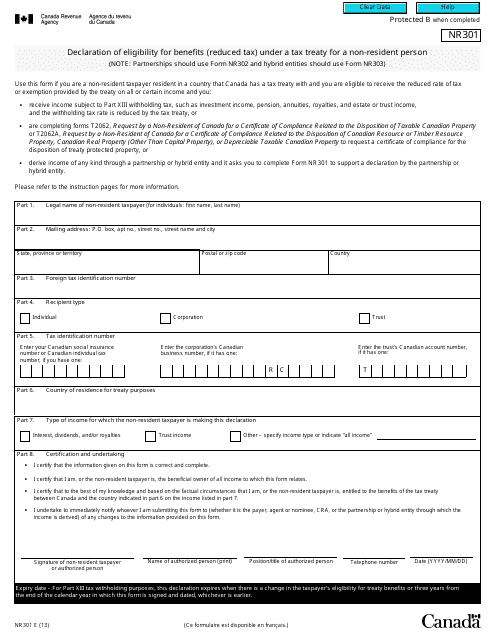

This form is used for declaring eligibility for reduced tax benefits under a tax treaty for non-resident individuals from Canada.

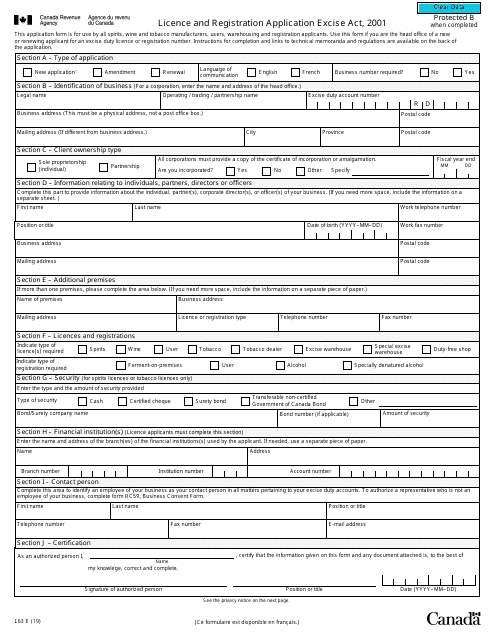

This Form is used for applying for an L63 E Licence and Registration under the Excise Act, 2001 in Canada.

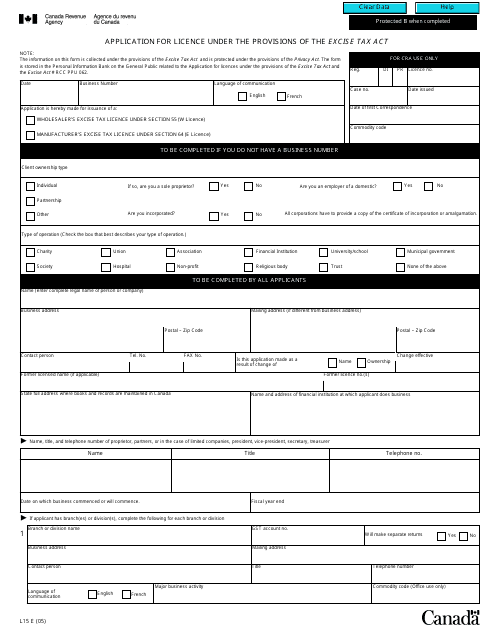

This Form is used for applying for a license under the Excise Tax Act in Canada.

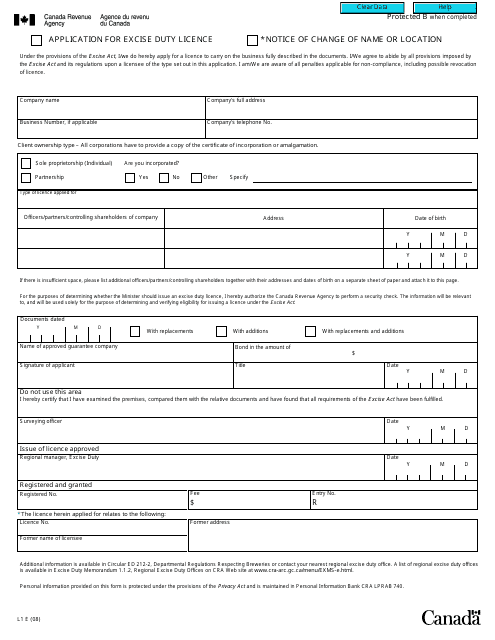

This Form is used for applying for an Excise Duty Licence in Canada, or notifying a change of name or location for an existing licence.

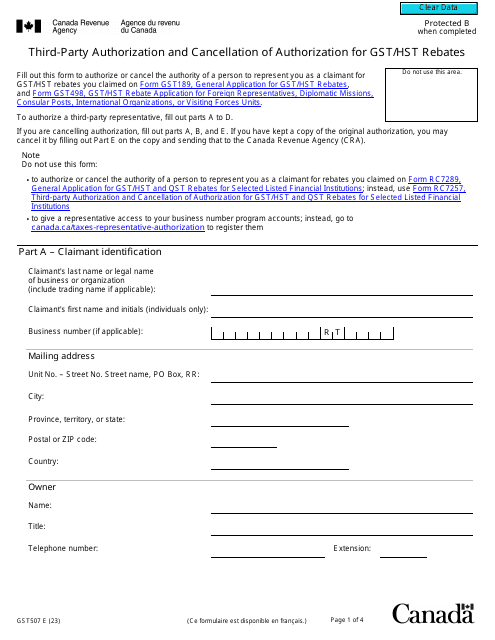

Form GST507 Third-Party Authorization and Cancellation of Authorization for Gst/Hst Rebates - Canada

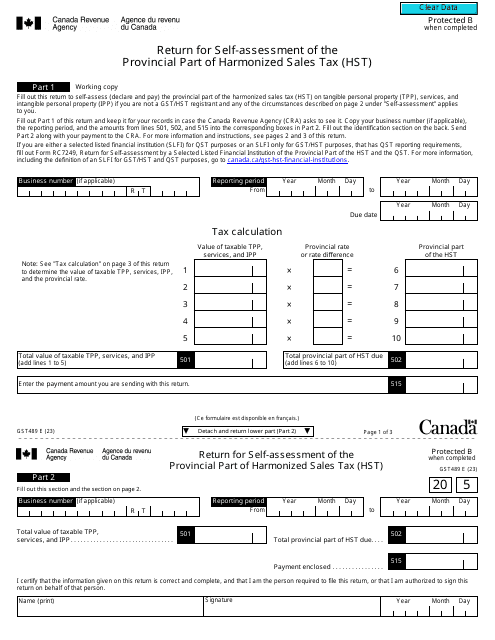

Form GST489 Return for Self-assessment of the Provincial Part of Harmonized Sales Tax (Hst) - Canada

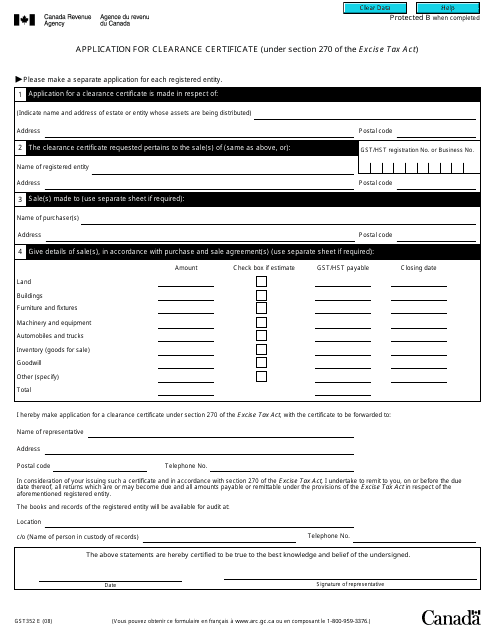

This form is used for applying for a clearance certificate in Canada regarding the Goods and Services Tax (GST).