Canadian Federal Legal Forms and Templates

Documents:

5112

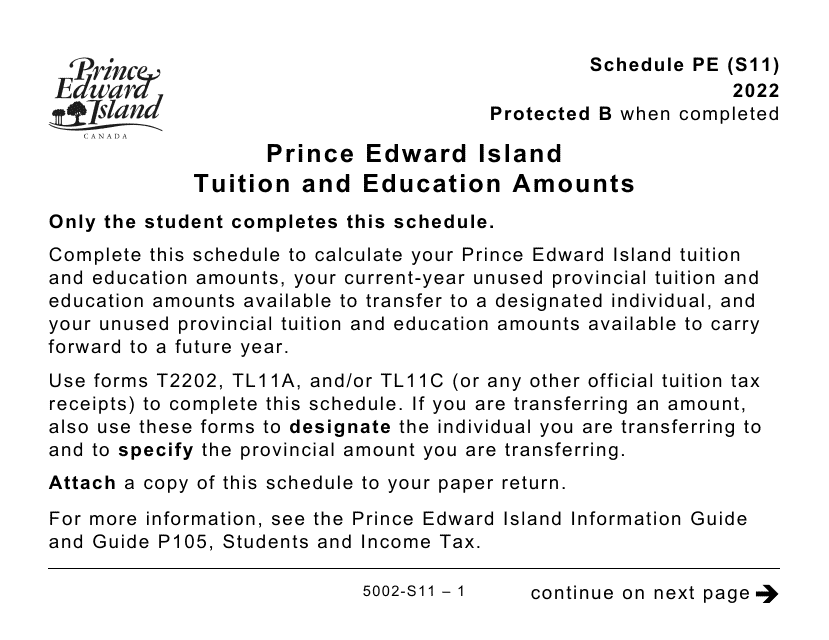

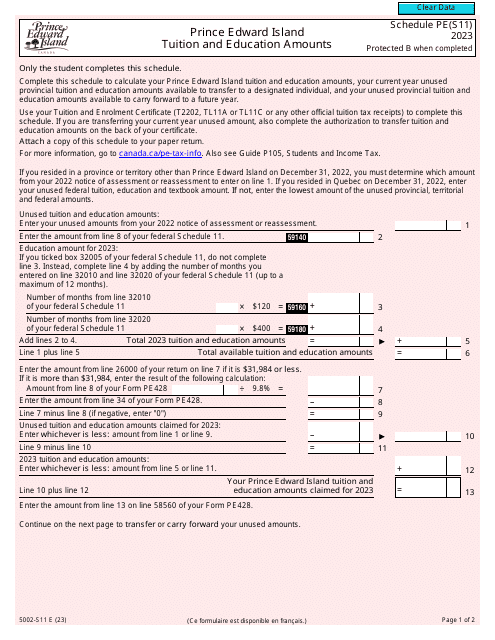

This form is used for reporting Prince Edward Island tuition and education amounts on Schedule PE (S11) in large print format.

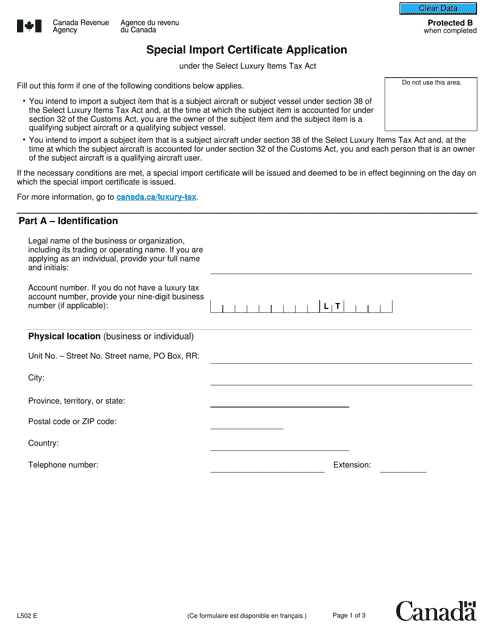

This form is used for applying for a Special Import Certificate in Canada.

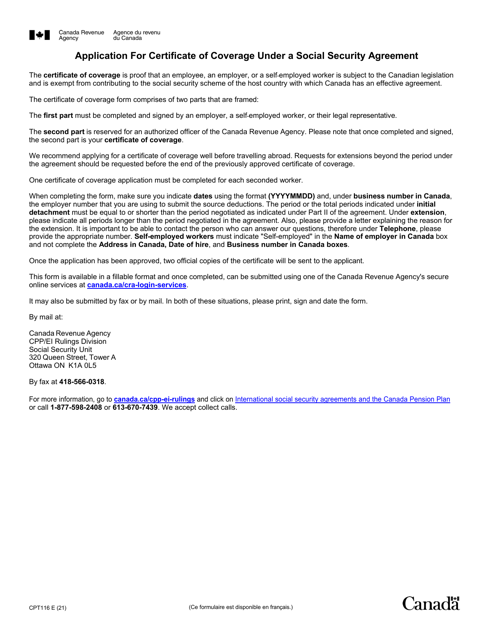

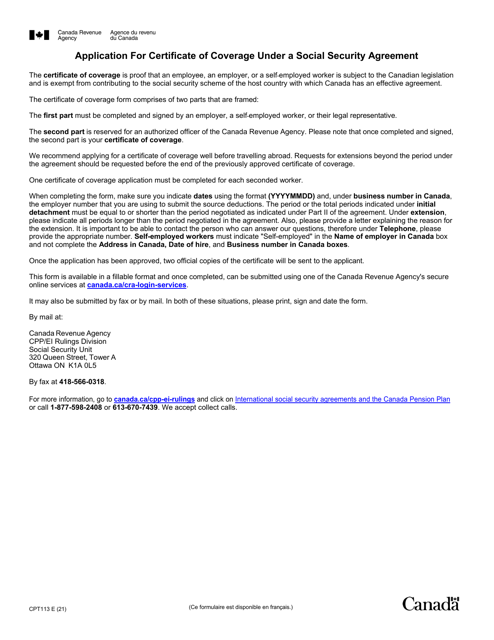

This Document is used for certifying coverage under the Canada Pension Plan for individuals covered by the social security agreement between Canada and Cyprus.

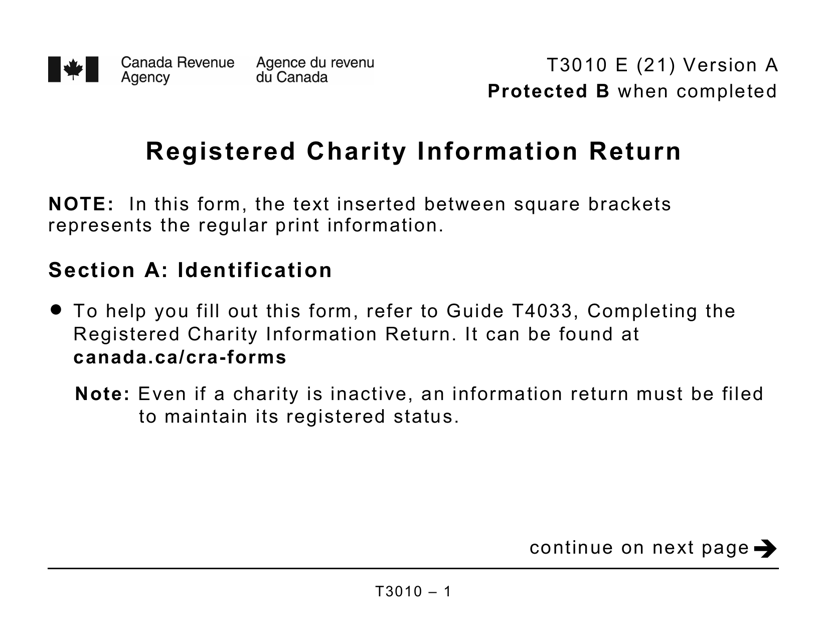

This form is used for filing the Registered Charity Information Return in Canada. It is available in large print format for visually impaired individuals.

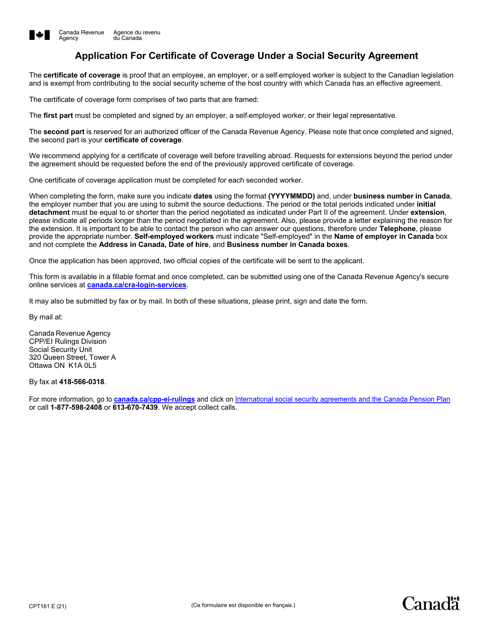

This form is used for obtaining a Certificate of Coverage under the Canada Pension Plan, specifically for individuals in Barbados who are covered by the Agreement on Social Security between Canada and Barbados.

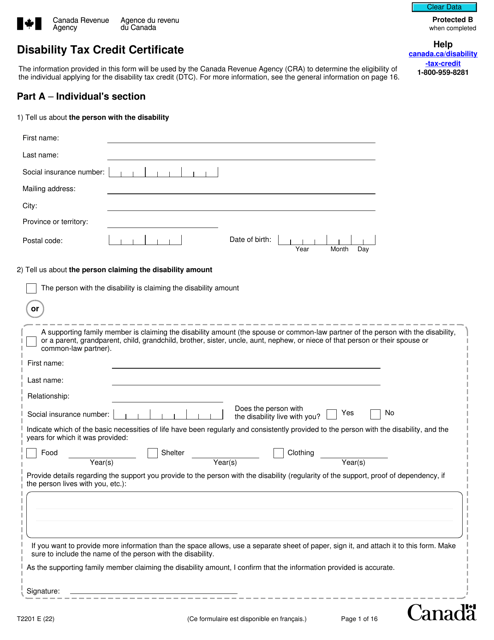

The purpose of this document is to provide the Canada Revenue Agency with information that will be enough for them to make a decision on whether an individual is eligible to receive a Disability Tax Credit.

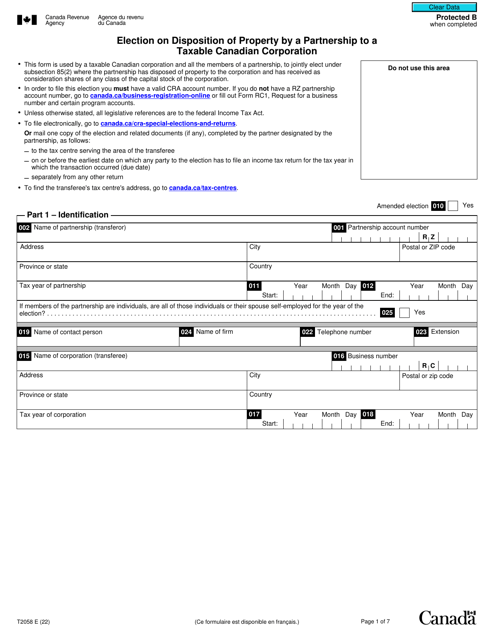

This form is used for electing the disposition of property by a partnership to a taxable Canadian corporation in Canada.

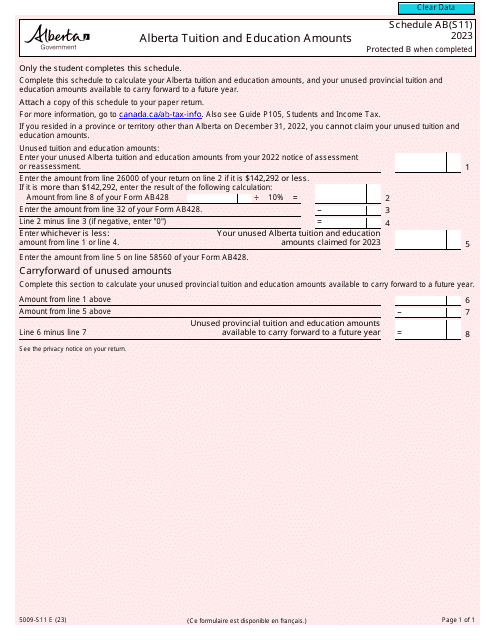

This form is used for reporting tuition and education amounts in Alberta for individuals with visual impairments in large print format.

This Form is used for providing supporting information for the Canada Recovery Caregiving Benefit (CRCB) application in large print format.

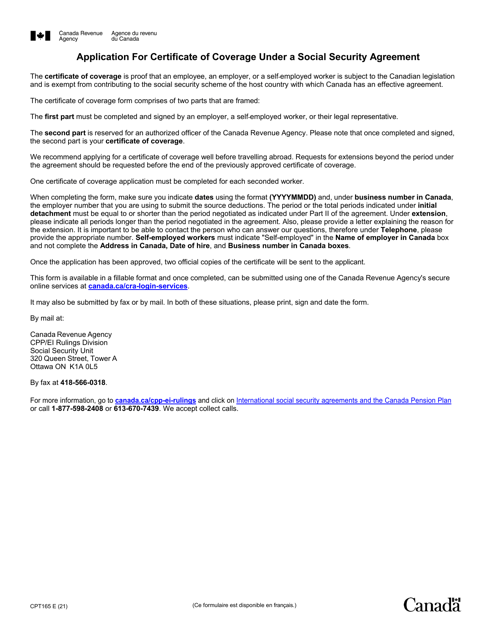

This form is used to obtain a certificate of coverage under the Canada Pension Plan for individuals who are covered by the social security agreement between Canada and the Republic of Poland.

This form is used for obtaining a Certificate of Coverage under the Canada Pension Plan for individuals covered by the Social Security Agreement between Canada and Romania.

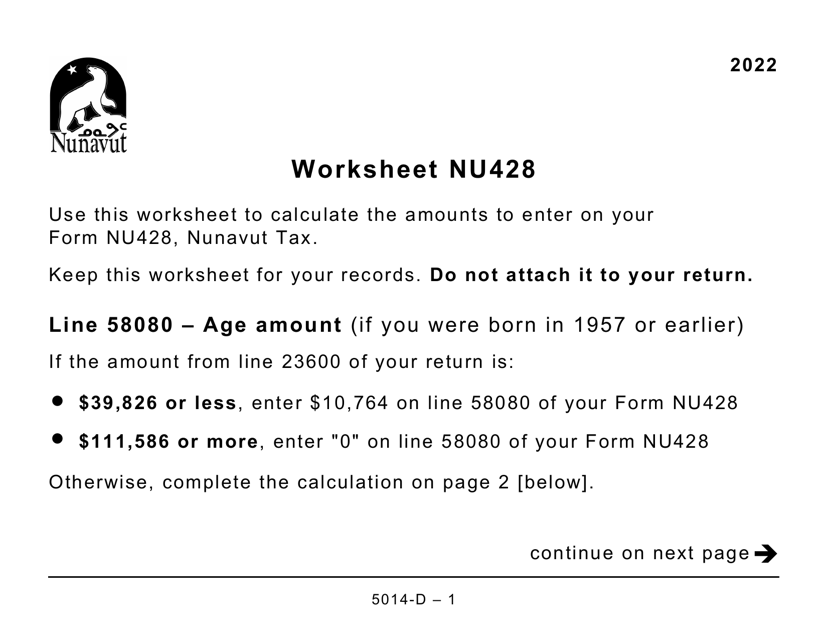

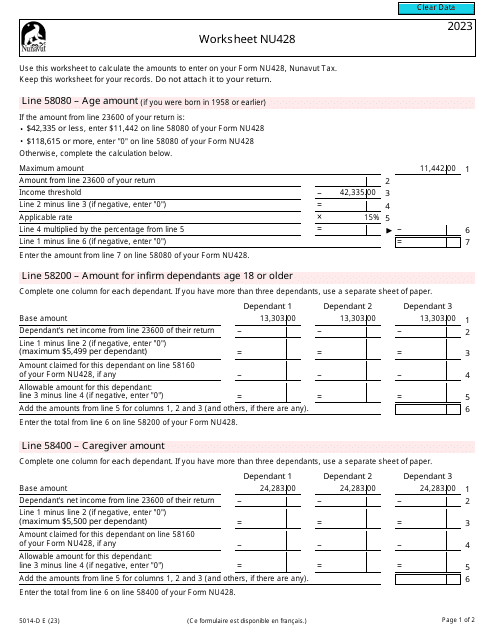

This document is a worksheet used for Form 5014-D in Nunavut, Canada.

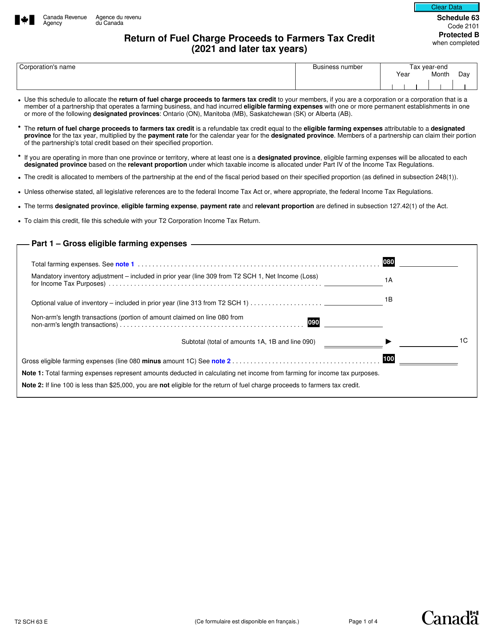

This form is used for Canadian farmers to claim a tax credit for fuel charge proceeds received. The form is applicable for the tax years 2021 and onward.