Canadian Federal Legal Forms and Templates

Documents:

5112

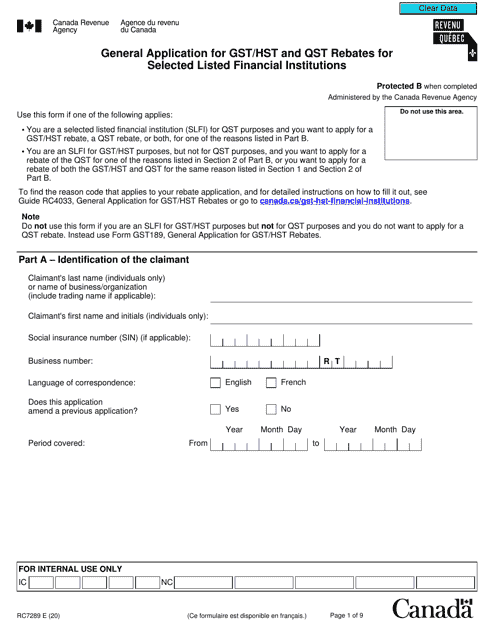

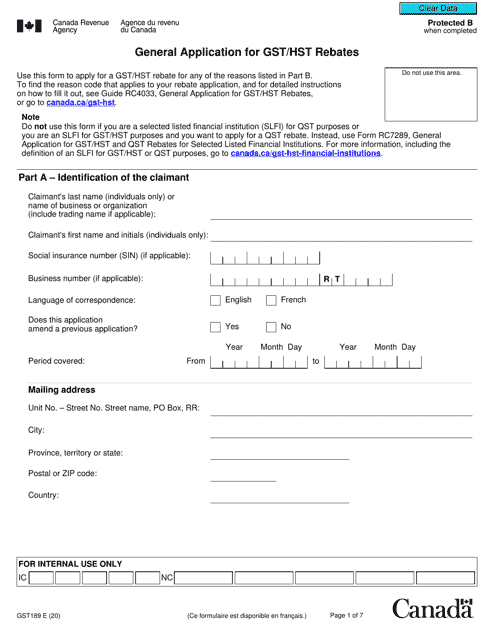

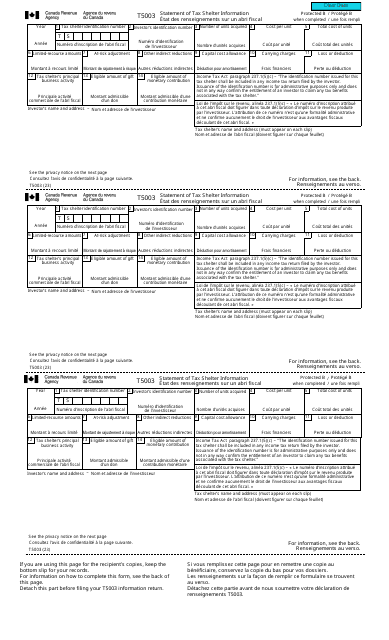

This form is used for applying for GST/HST and QST rebates for selected listed financial institutions in Canada.

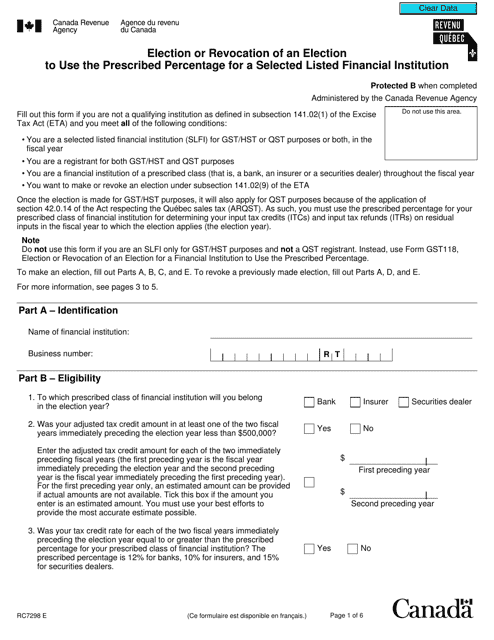

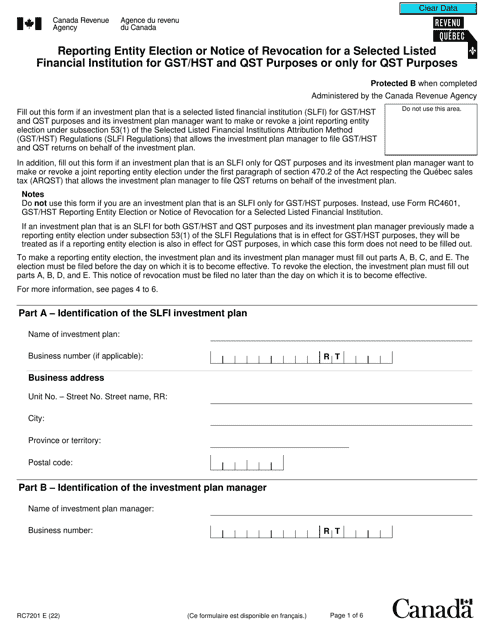

This Form is used for electing or revoking an election to use the prescribed percentage for a selected listed financial institution in Canada.

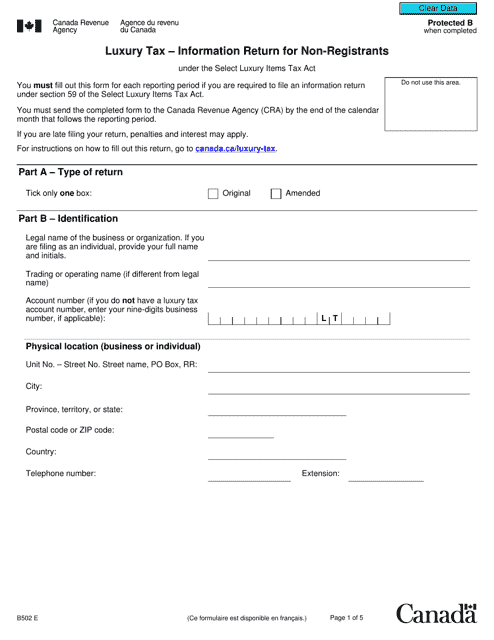

This form is used for reporting luxury tax information for individuals or businesses who are not registered for the luxury tax in Canada.

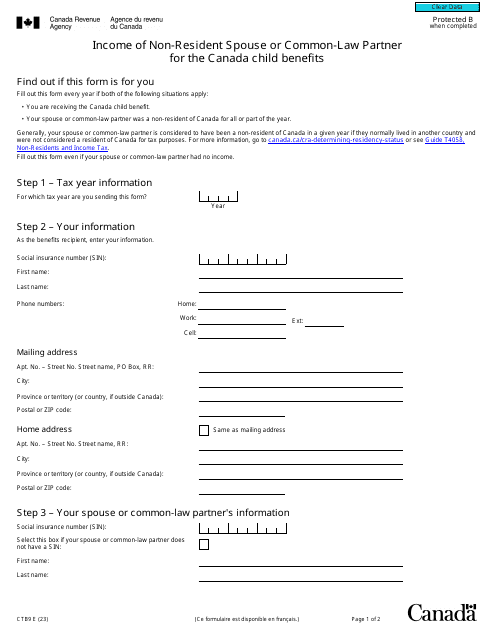

Form CTB9 Income of Non-resident Spouse or Common-Law Partner for the Canada Child Benefits - Canada

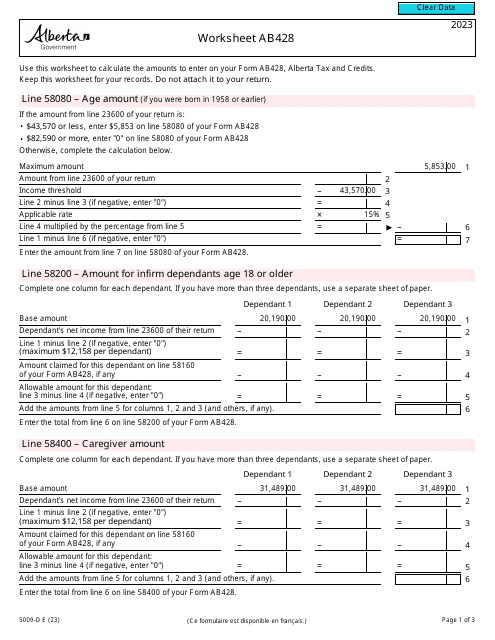

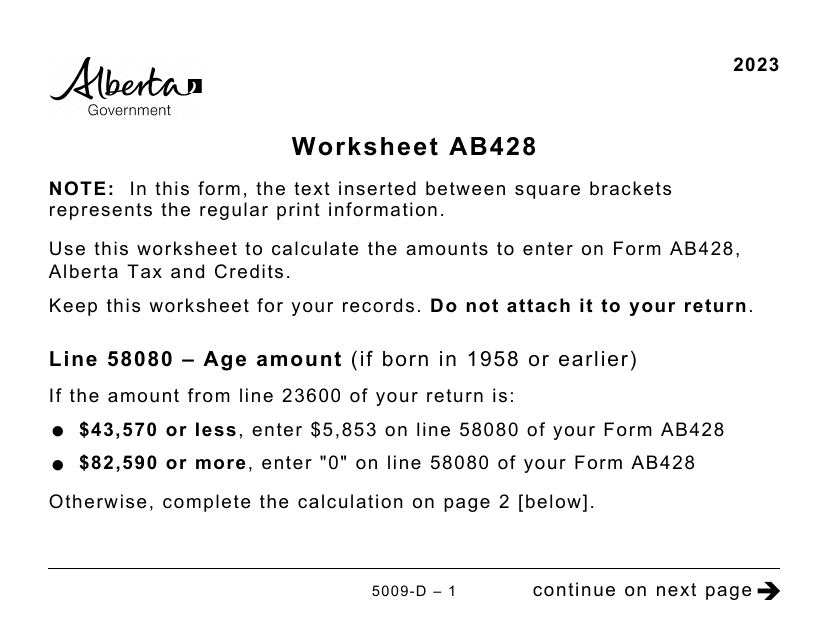

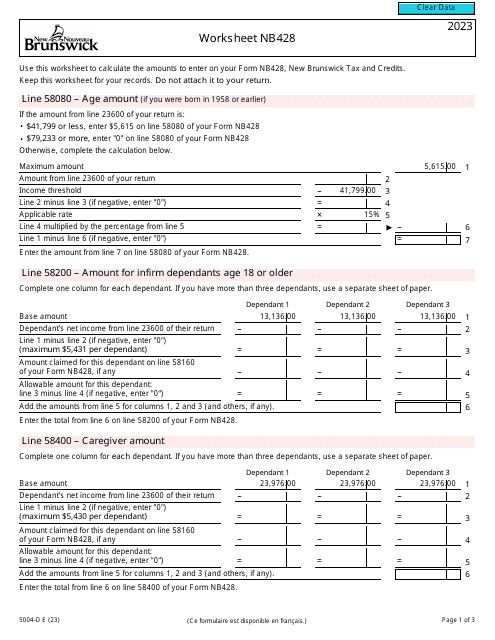

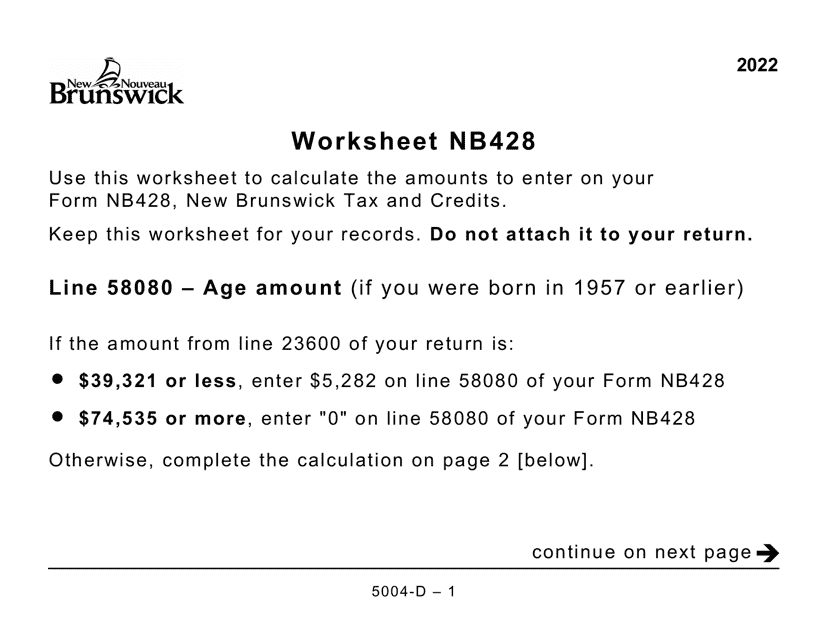

This document is a large print worksheet for Form 5004-D, which is used in New Brunswick, Canada. It is used for completing tax information or calculations for individuals or businesses.

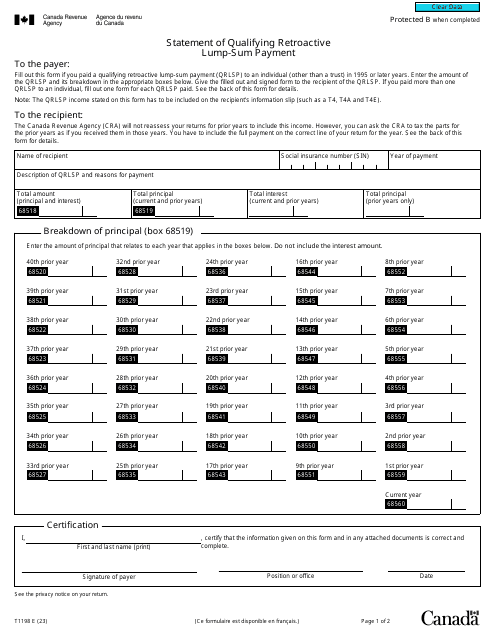

Individuals and companies residing in Canada can fill out this document if they have paid a lump-sum payment in the last twenty-five years to ask the tax authorities to compute taxes differently for the beneficiary and spare them from the necessity to pay all taxes at once.

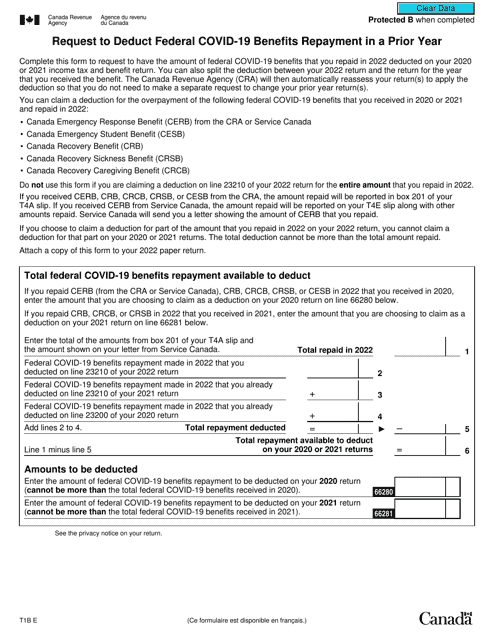

This Form is used for requesting to deduct federal Covid-19 benefits repayment from a prior year in Canada.

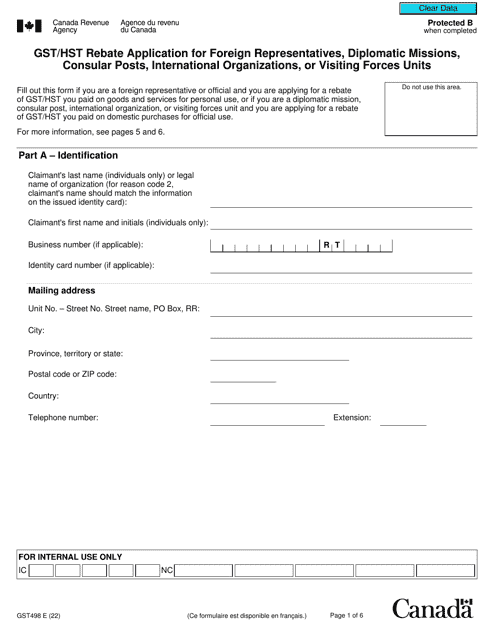

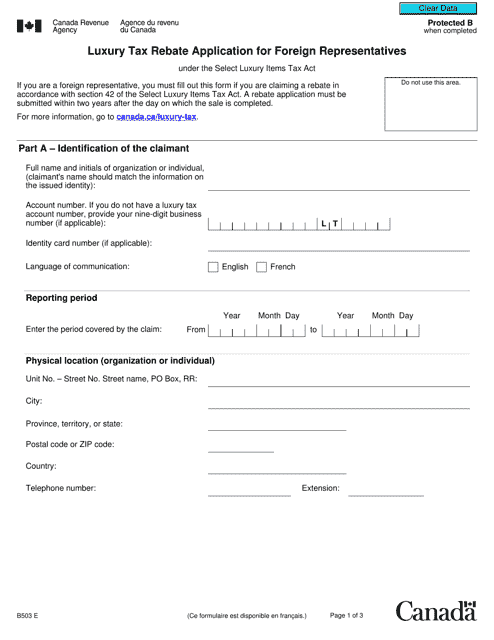

This form is used for foreign representatives in Canada to apply for a luxury tax rebate.

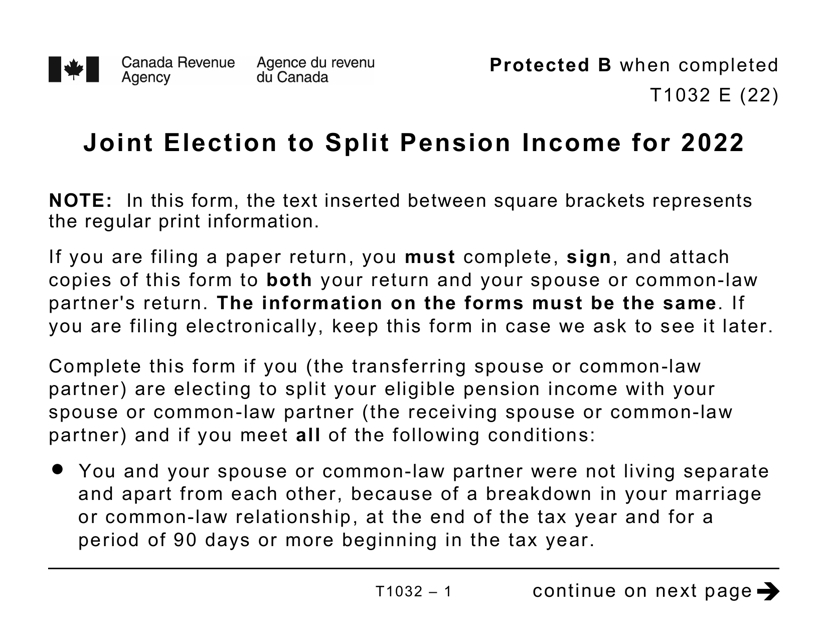

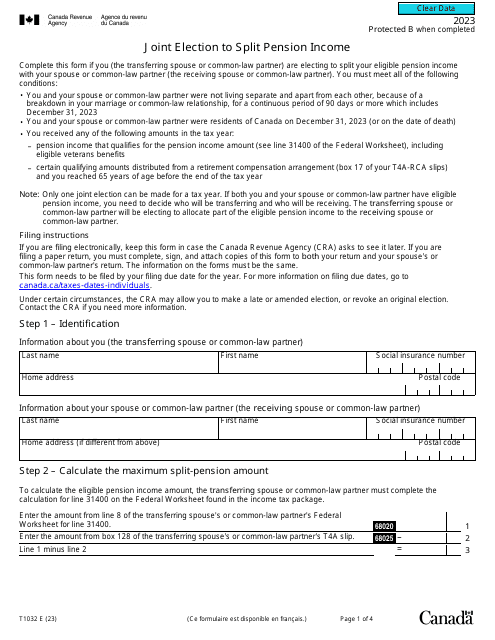

This form is used for making a joint election to split pension income for taxpayers in Canada.

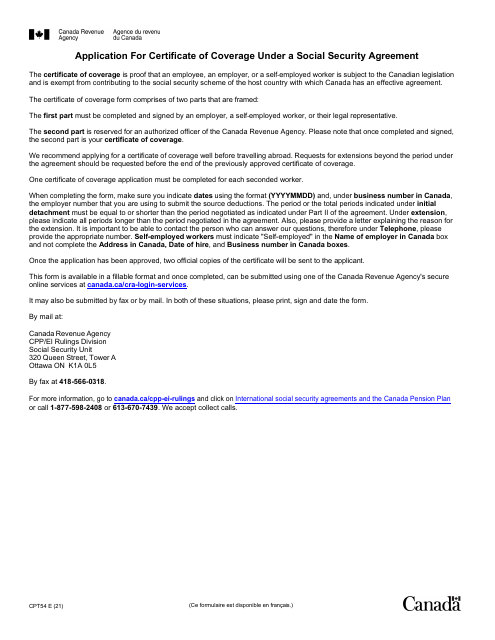

This form is used for obtaining a Certificate of Coverage under the Canada Pension Plan for individuals residing in Canada and the Hellenic Republic (Greece) as part of the social security agreement between the two countries.