Canadian Federal Legal Forms and Templates

Documents:

5112

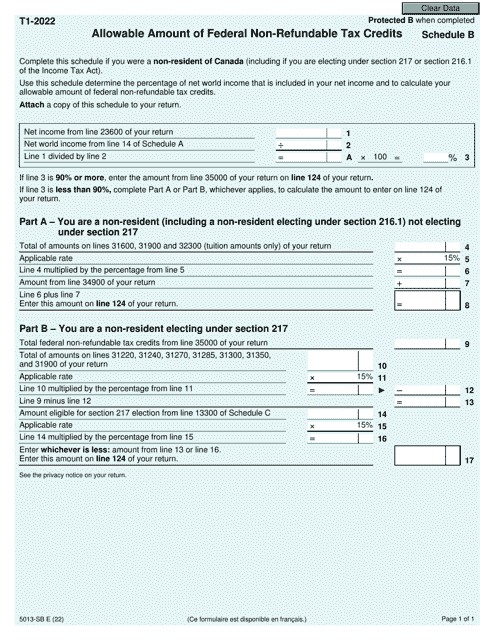

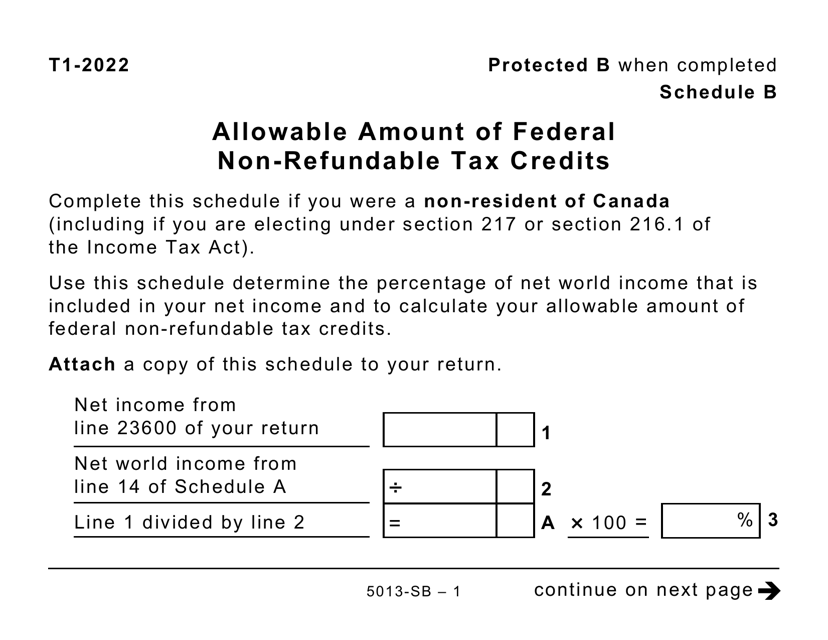

This form is used for calculating the allowable amount of federal non-refundable tax credits in Canada.

This document is for reporting the allowable amount of federal non-refundable tax credits in Canada.

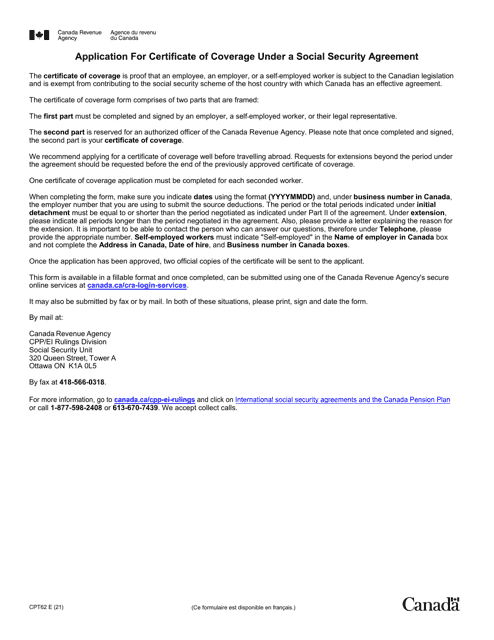

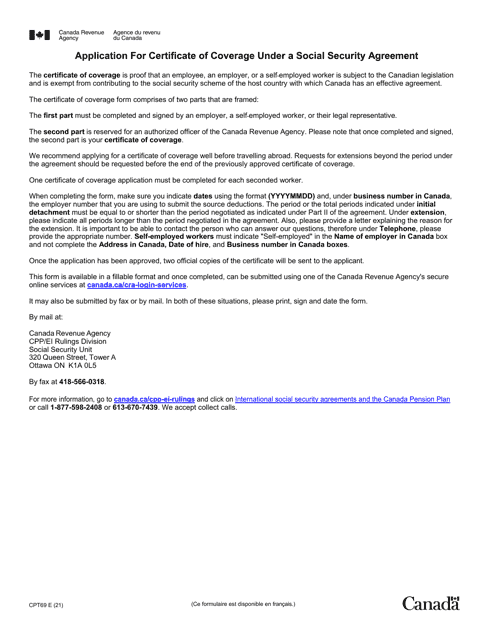

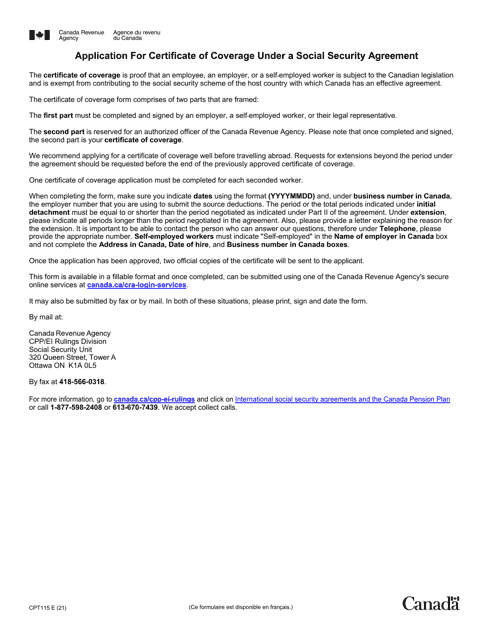

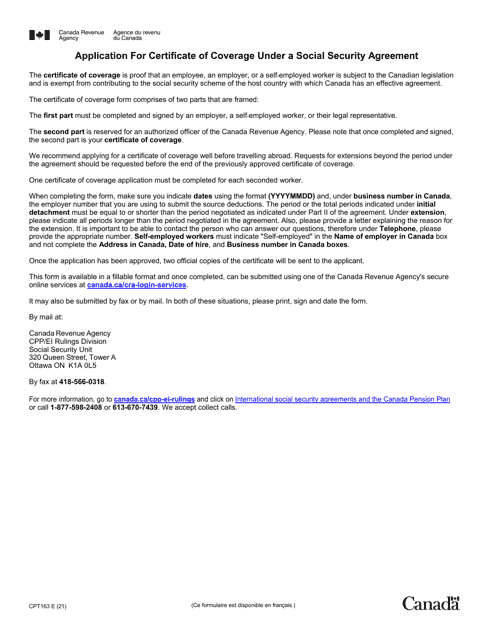

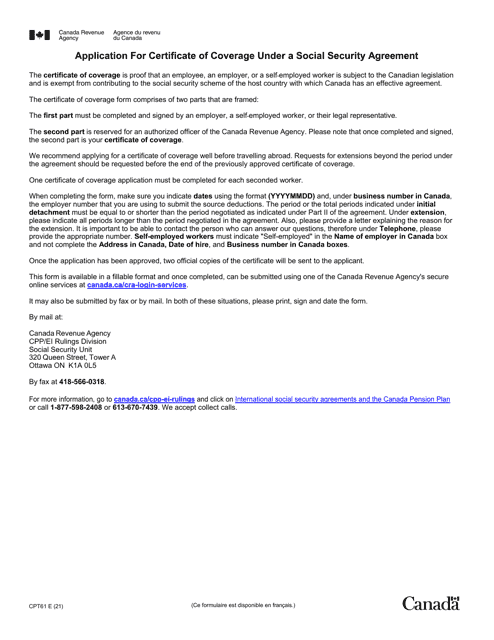

This Form is used for obtaining a Certificate of Coverage for individuals who have worked in Canada and are covered under the Canada Pension Plan. It is applicable under the agreement between Canada and Mexico regarding Social Security.

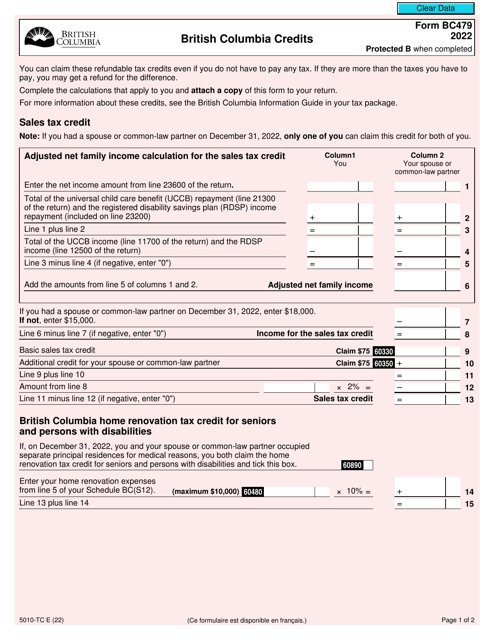

This Form is used for claiming British Columbia credits in Canada. It is provided in large print format for accessibility.

This form is used for obtaining a certificate of coverage under the Canada Pension Plan for individuals who are covered under the social security agreement between Canada and Ireland. It establishes eligibility for certain benefits.

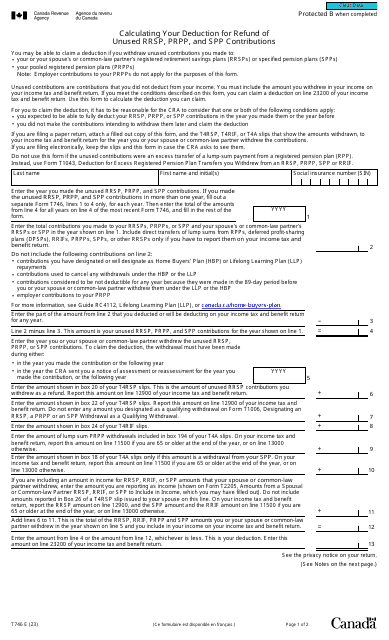

Form T746 Calculating Your Deduction for Refund of Unused Rrsp, Prpp, and Spp Contributions - Canada

This form is used for obtaining a Certificate of Coverage under the Canada Pension Plan for individuals who are subject to the social security agreement between Canada and the Republic of Serbia. It verifies the periods of coverage under the Canada Pension Plan for individuals working or residing in Serbia.

This form is used to provide certification of coverage under the Canada Pension Plan for individuals who are subject to the social security agreement between Canada and Switzerland.

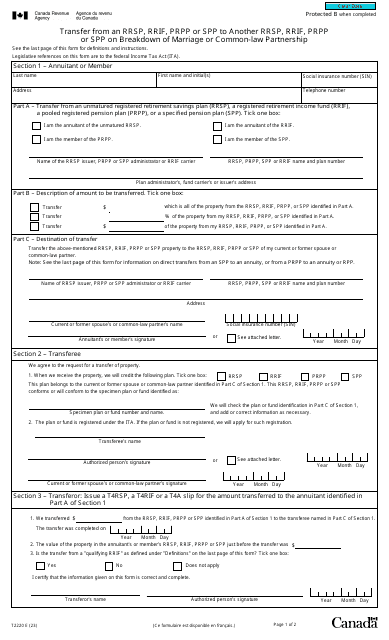

This form is completed to directly transfer property upon the breakdown of a marriage or common-law partnership.

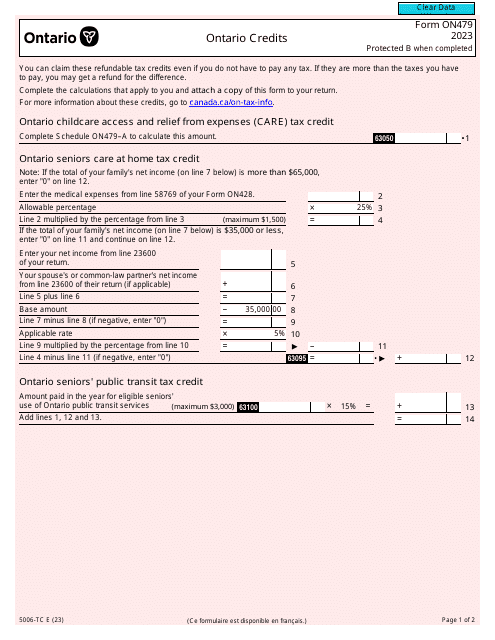

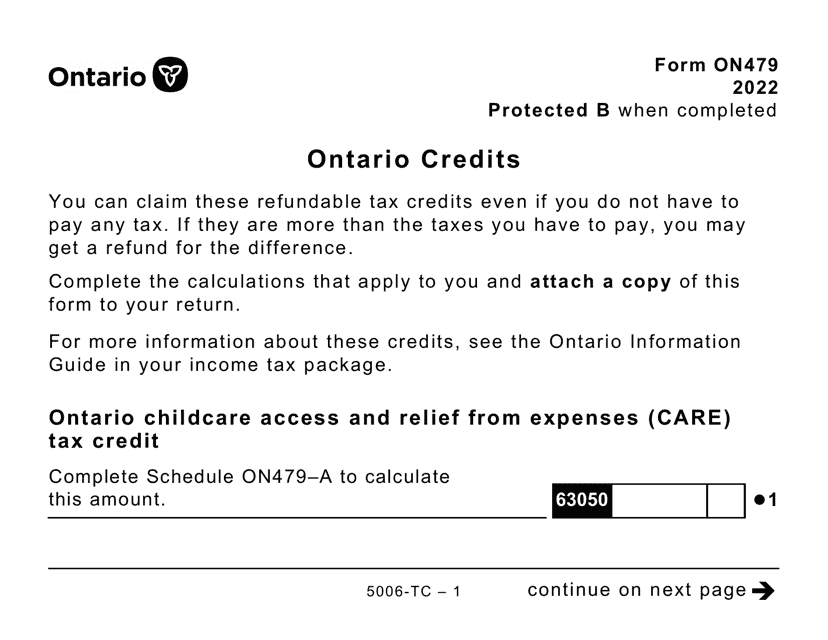

This form is used for claiming Ontario credits on tax returns in Canada. It is available in large print format for ease of reading.

This form is used for Canadian residents who are covered under the Canada Pension Plan and need to provide proof of coverage to the Republic of Croatia. The form is used in accordance with the Agreement on Social Security between Canada and Croatia.

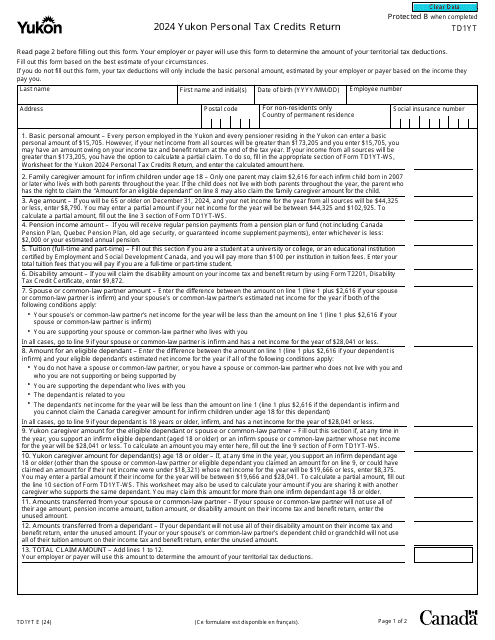

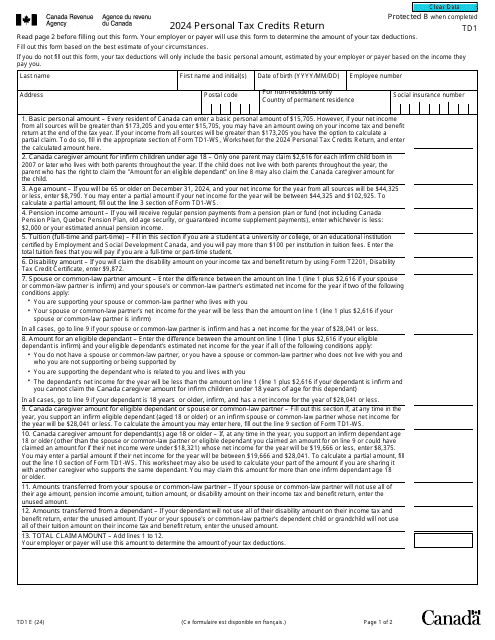

The purpose of this document is to provide a taxpayer's employer with all of the necessary information so that they will be able to determine the number of tax deductions for the Canadian taxpayer.

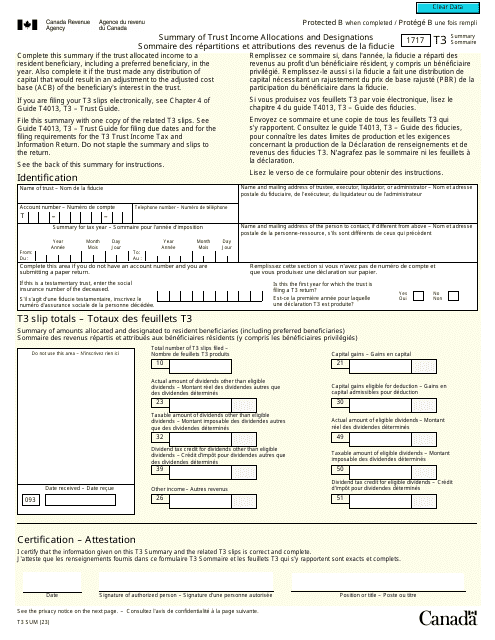

This type of document, Form T3 SUM Summary of Trust Income Allocations and Designations (Large Print), is used in Canada for summarizing the income allocations and designations for trusts.

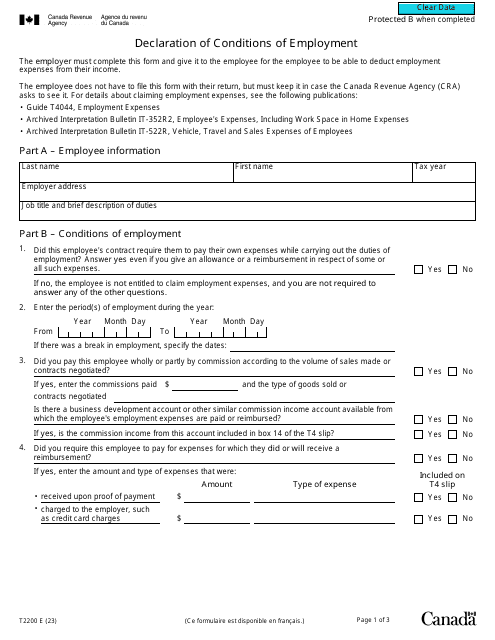

The purpose of the document is to provide an employee with information about employment expenses that can be deducted from their income in Canada.

This form is used for obtaining a Certificate of Coverage under the Canada Pension Plan for individuals covered under the Social Security Agreement between Canada and the Republic of Macedonia. It is a document that certifies the individual's eligibility for benefits and contributions made towards the Canada Pension Plan.

This form is used for obtaining a certificate of coverage under the Canada Pension Plan for individuals residing in the Republic of Malta. It is required as per the agreement on social security between Canada and Malta.

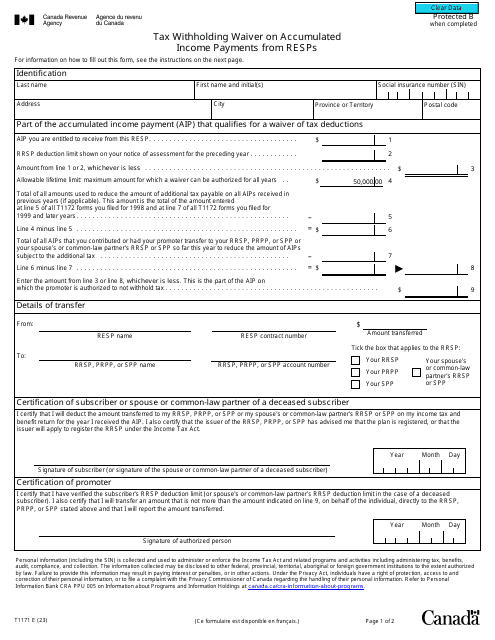

Canadian residents may fill out this form to notify their registered education savings plan (RESP) provider about their decision to withhold tax payments on accumulated income payments (AIPs) they are eligible to receive from the RESP.

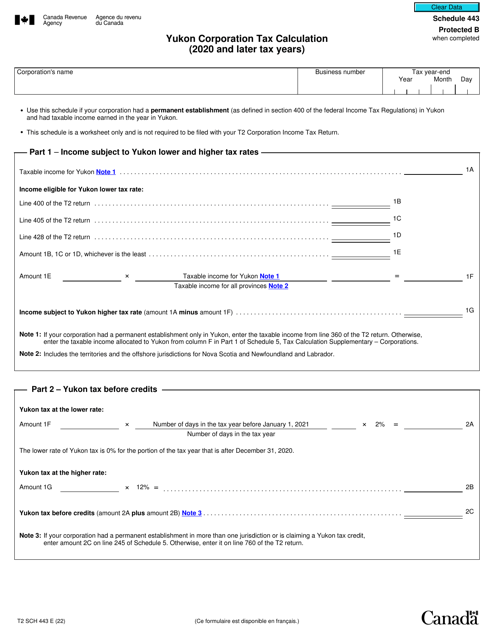

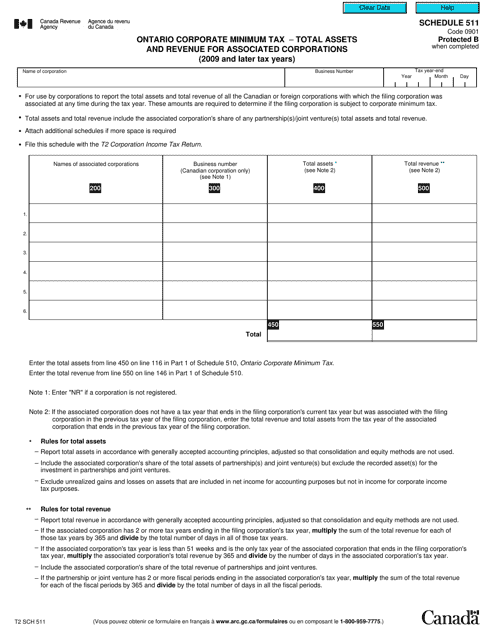

This form is used in Canada for reporting the total assets and revenue of associated corporations when calculating the Ontario Corporate Minimum Tax for tax years 2009 and later.

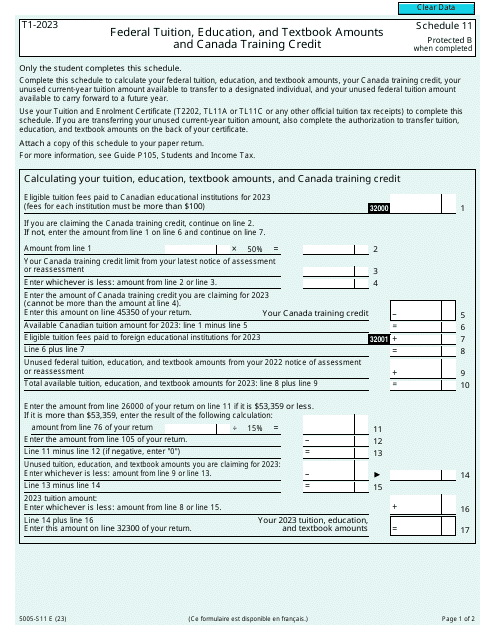

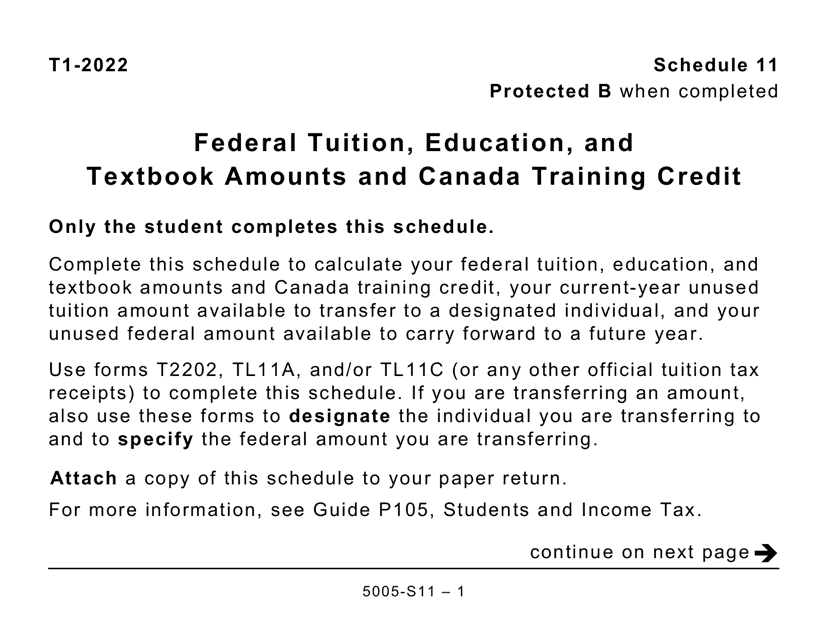

This form is used for reporting federal tuition, education, and textbook amounts, as well as the Canada Training Credit. It is available in large print format for easier readability.