Fill and Sign United States Federal Legal Forms

Documents:

24261

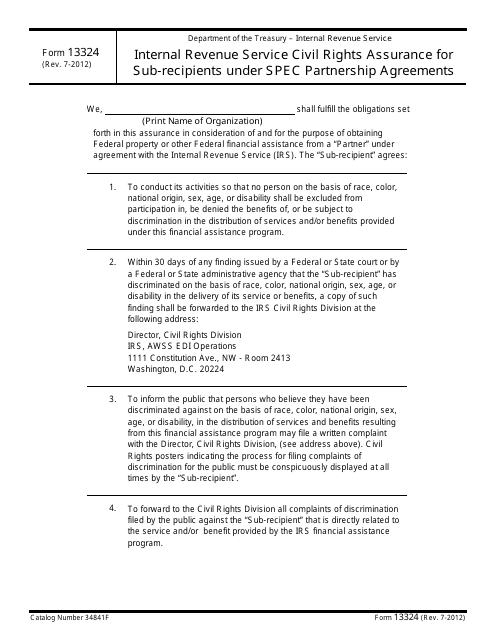

This form is used for subrecipients under specified partnership agreements to provide assurance of civil rights compliance with the Internal Revenue Service (IRS).

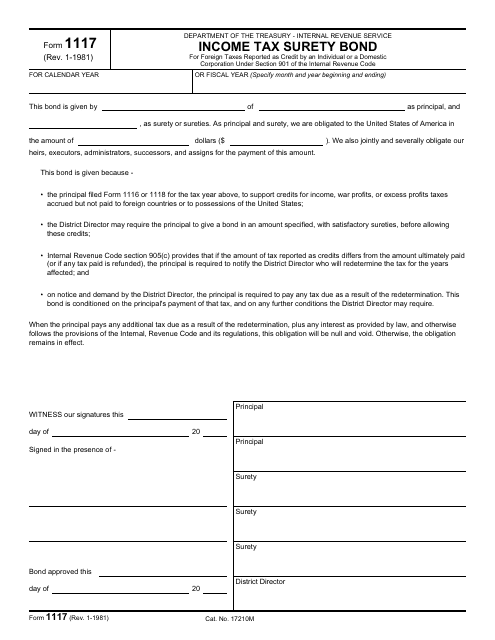

This document is used for filing an income tax surety bond with the Internal Revenue Service (IRS).

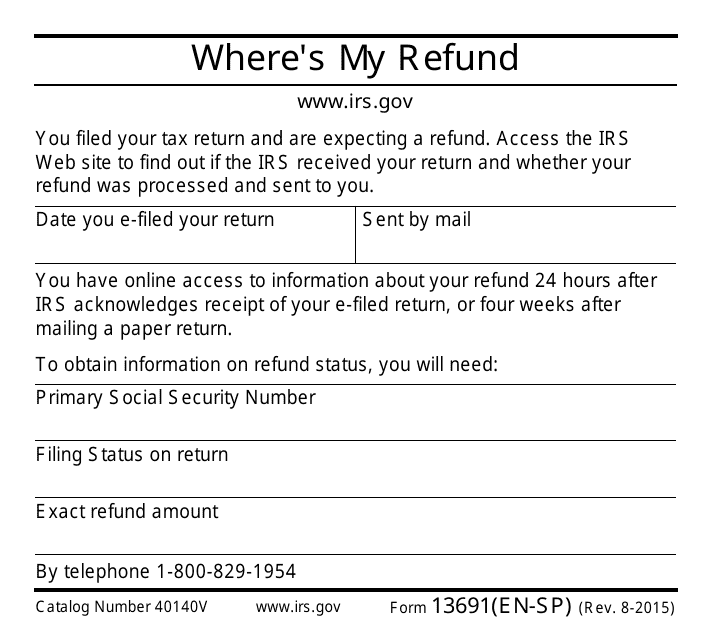

This type of document, IRS Form 13691(EN-SP) Where Is My Refund (English/Spanish), is used for tracking the status of your tax refund with the IRS. It is available in both English and Spanish.

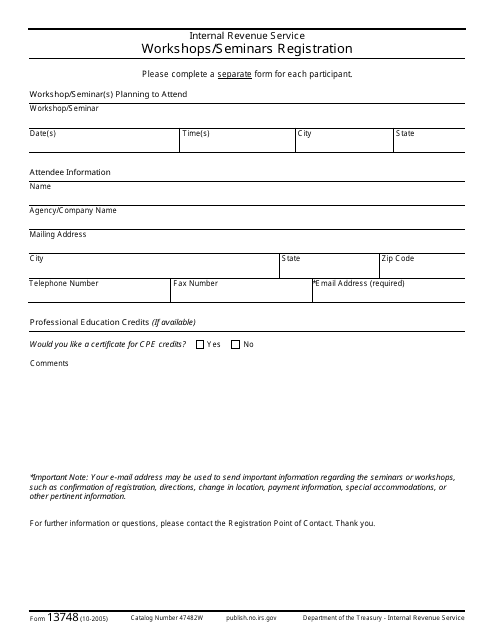

This form is used for registering for workshops or seminars with the IRS.

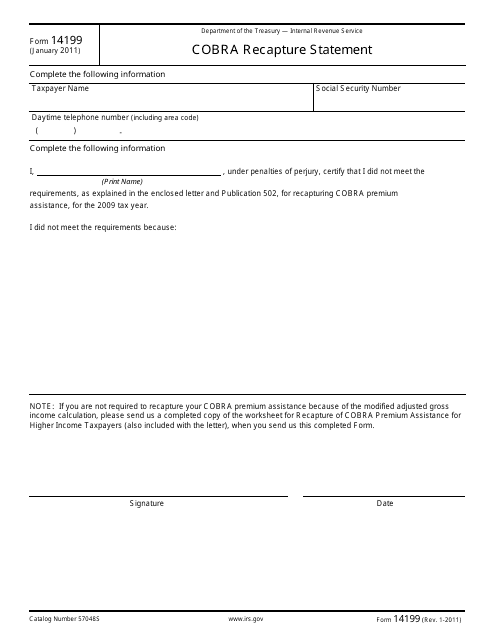

This Form is used for reporting and reconciling excess premiums paid for COBRA coverage.

This type of document, IRS Form 14534, is used for recording the intake and interview process, as well as the quality review, conducted by the Internal Revenue Service (IRS). It serves as a certificate to confirm that the intake and interview process was completed and reviewed accurately.

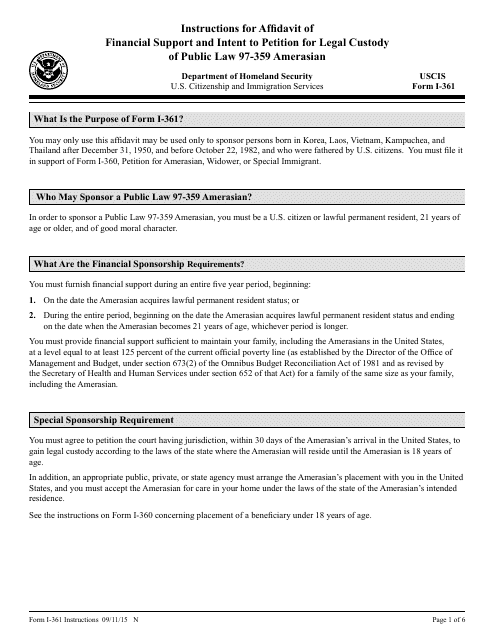

This form is used for submitting an affidavit of financial support and intent to petition for legal custody for Amerasian immigrants under Public Law 97-359. It provides guidance on fulfilling the financial obligations and demonstrating the intention to petition for legal custody.

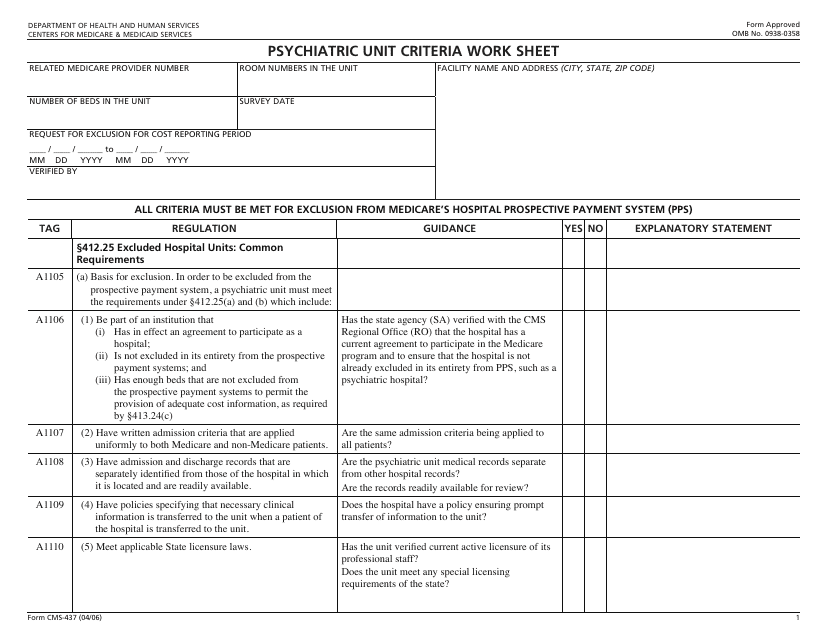

This Form is used for evaluating psychiatric unit criteria.

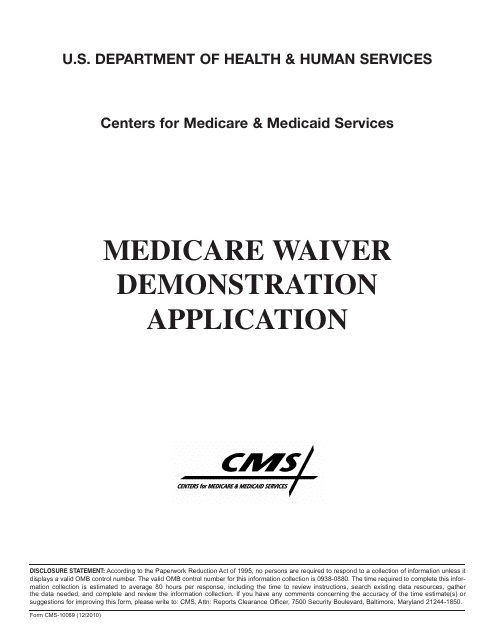

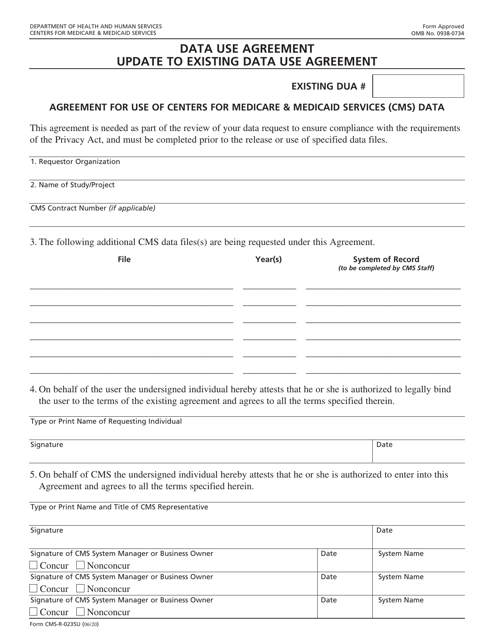

This form is used for applying for a Medicare waiver demonstration, allowing individuals to access certain healthcare services.

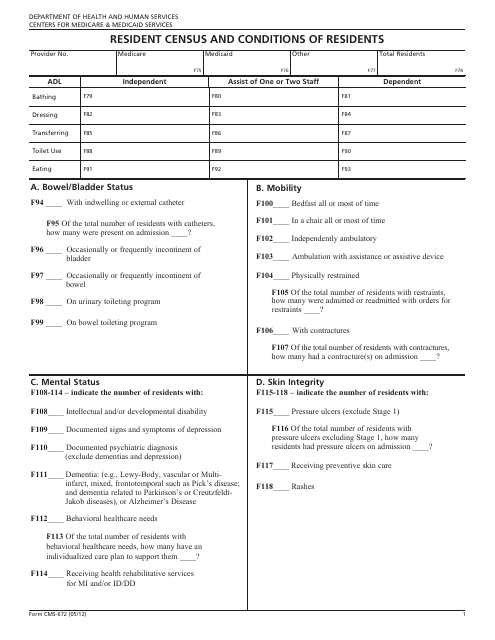

This form is used for gathering information about the residents and their conditions in a healthcare facility. It helps in maintaining accurate records and ensuring the well-being of the residents.

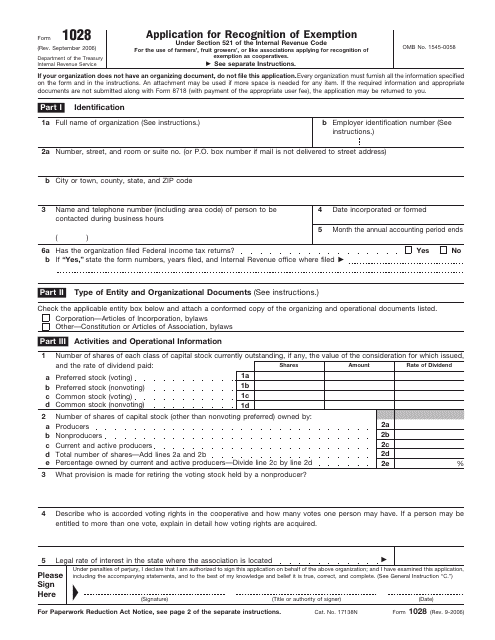

This form is used for applying recognition of exemption under Section 521 of the Internal Revenue Code.

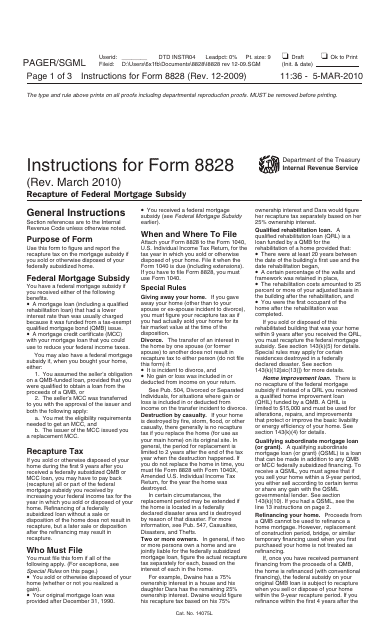

This form is used for recapturing a federal mortgage subsidy. It provides instructions for completing IRS Form 8828.

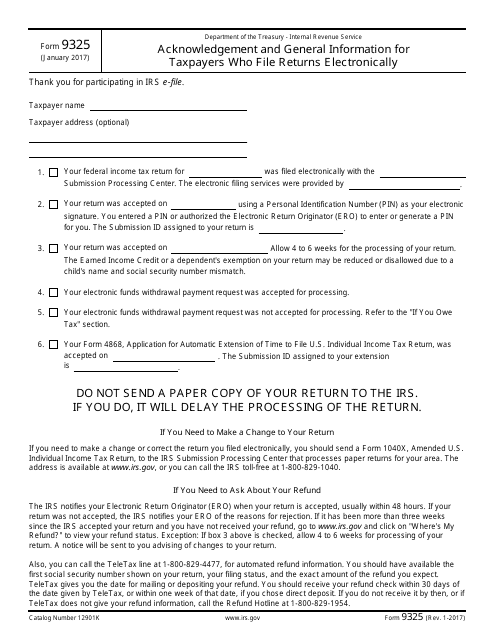

This is a formal instrument used by e-file return originators to inform taxpayers about the details of the filing process.

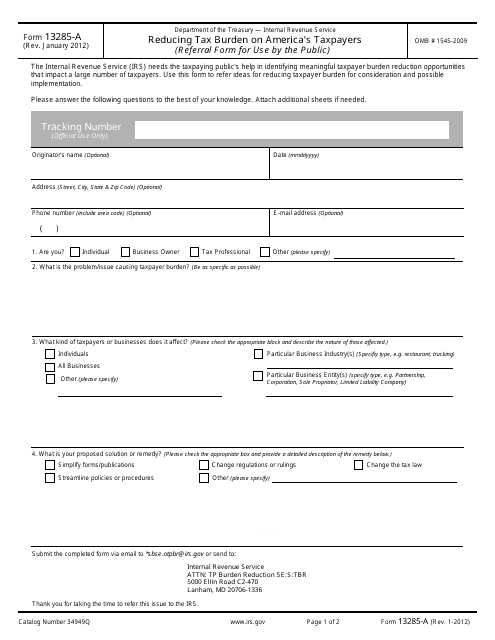

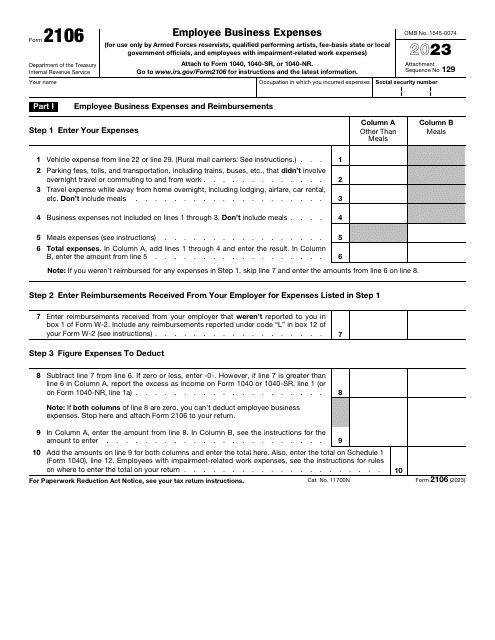

This Form is used for reducing the tax burden on American taxpayers. It provides eligible taxpayers with options to reduce their overall tax liability.

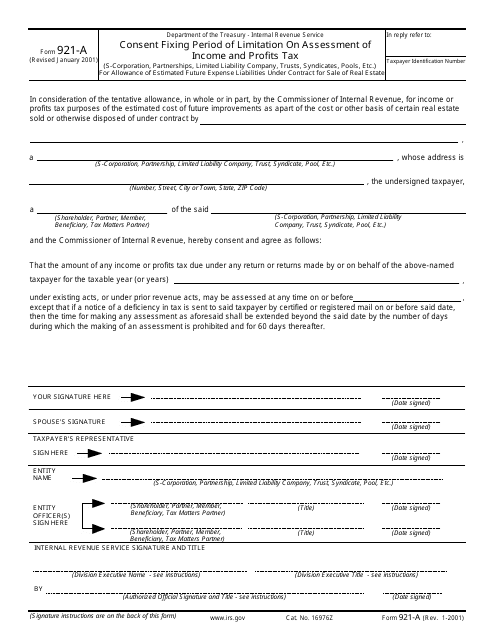

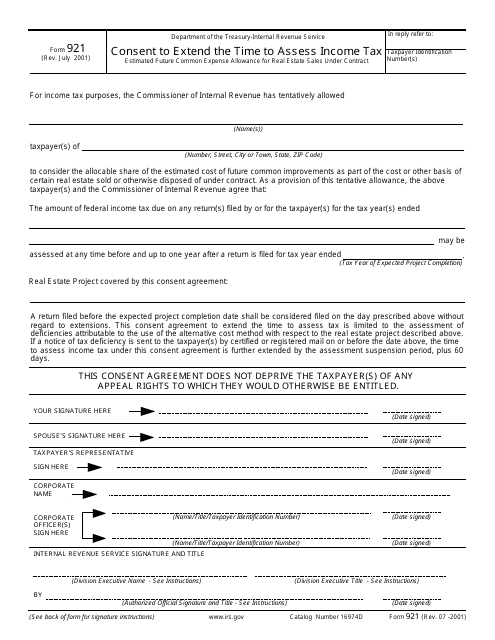

This is a legal document filed by real estate developers to extend the period for tax assessment and request the use of the estimated costs of common modifications and improvements on a project-by-project basis.

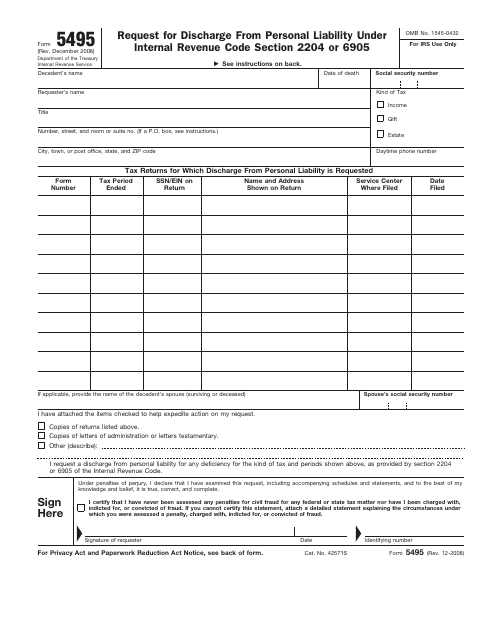

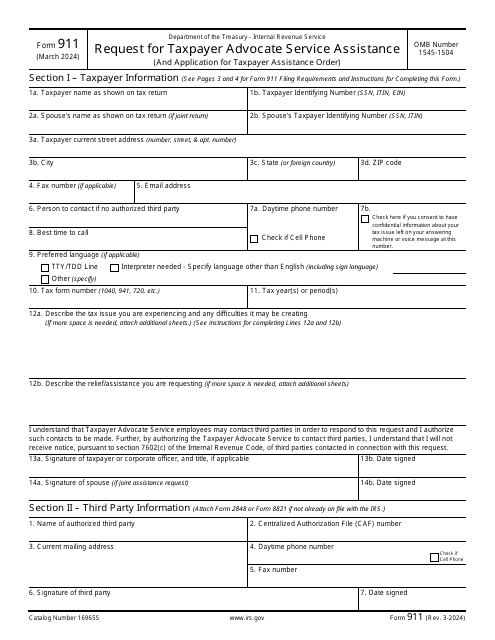

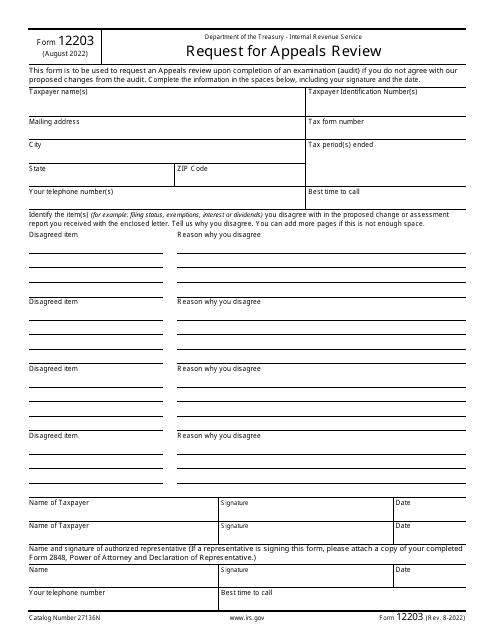

This is a fiscal form used by taxpayers that have already exhausted all other options when dealing with a tax issue.

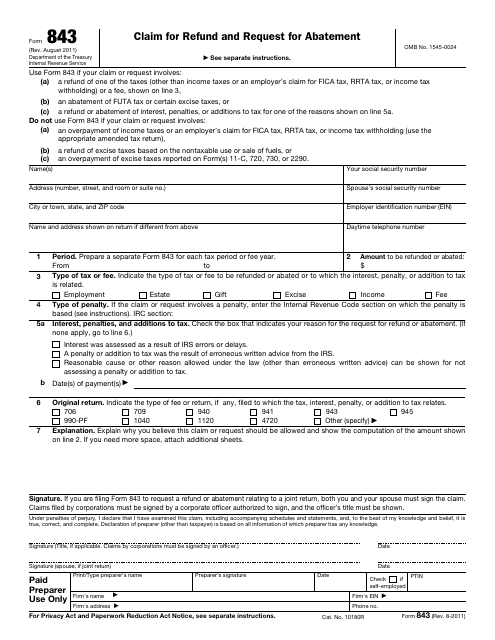

This form is used for claiming a refund and requesting a reduction in penalties or interest from the Internal Revenue Service (IRS).

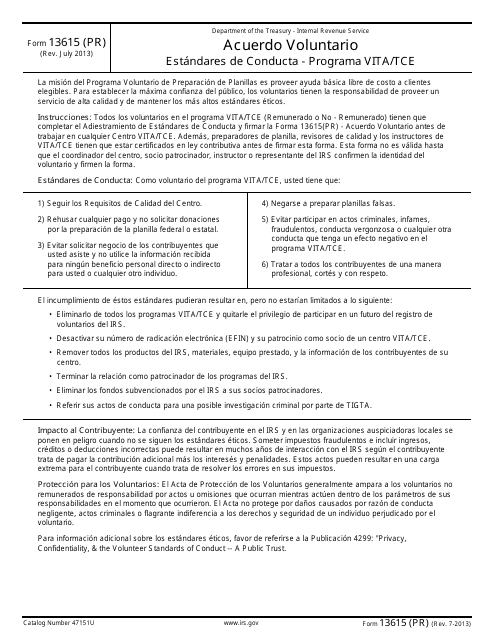

This document is for Puerto Rican residents participating in the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. It outlines the voluntary standards of conduct for participants.

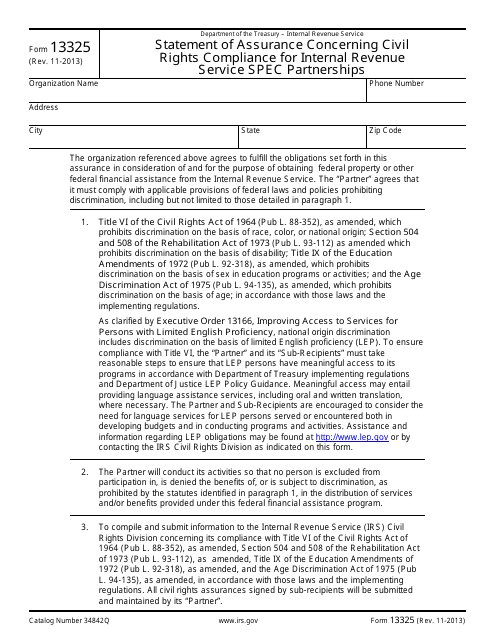

This form is used for ensuring civil rights compliance for IRS Spec Partnerships.

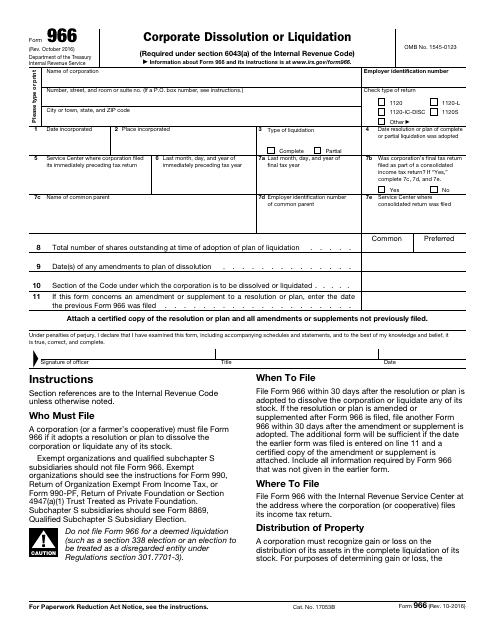

This is a form filled out and submitted by an officer authorized to act on behalf of a corporation in order to announce the dissolution of the corporation or the liquidation of the stock.

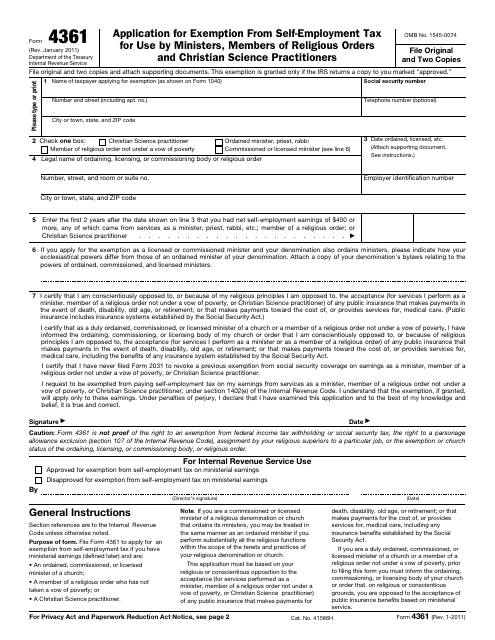

This is a fiscal form used by individuals who generate revenue through exercising their religious duties or profession and want to qualify for a self-employment tax exemption.

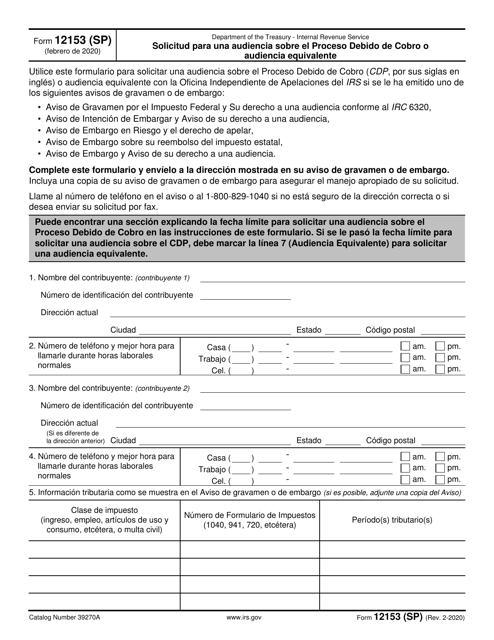

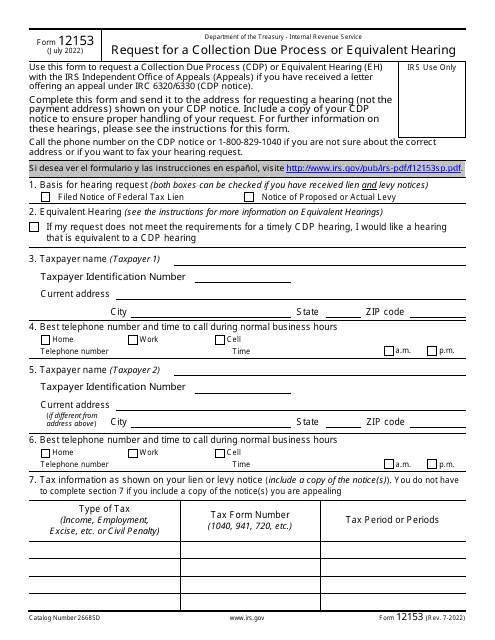

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

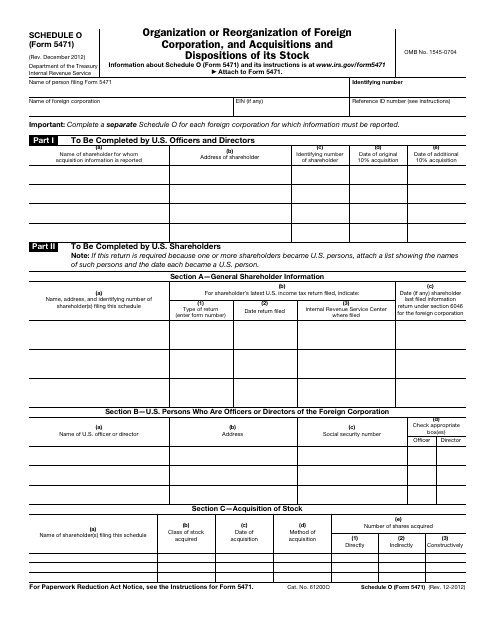

This Form is used for reporting the organization, reorganization, acquisitions, and dispositions of a foreign corporation and its stock to the IRS.

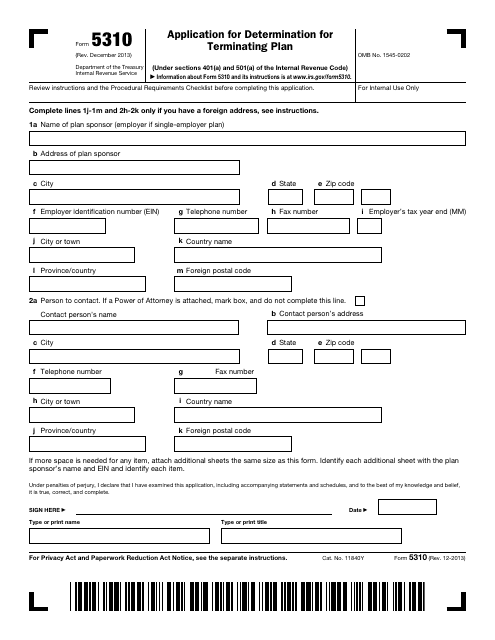

This form is used for requesting a determination from the IRS regarding the termination of a retirement plan.

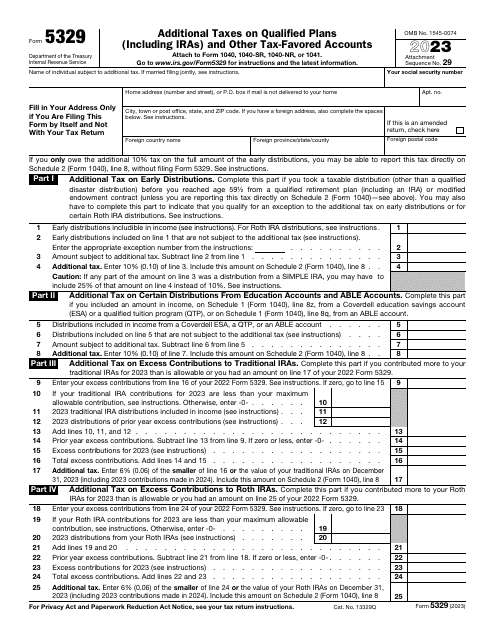

This is a fiscal document individual taxpayers need to prepare and file to demonstrate whether they need to pay the government penalties on education savings plans or retirement plans as well as a percentage of distributions they got throughout the tax year.