Fill and Sign United States Federal Legal Forms

Documents:

24261

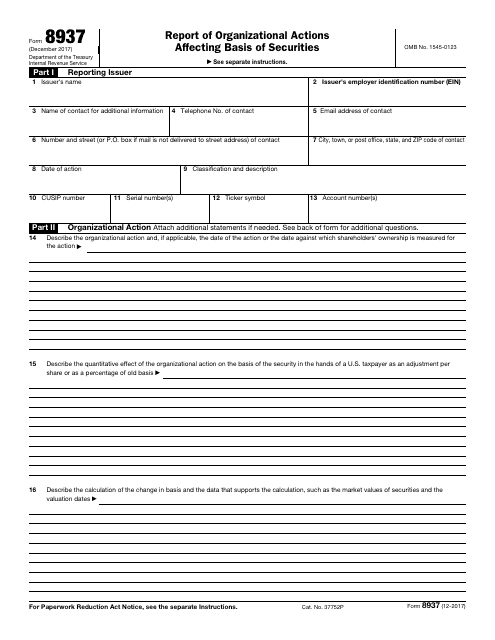

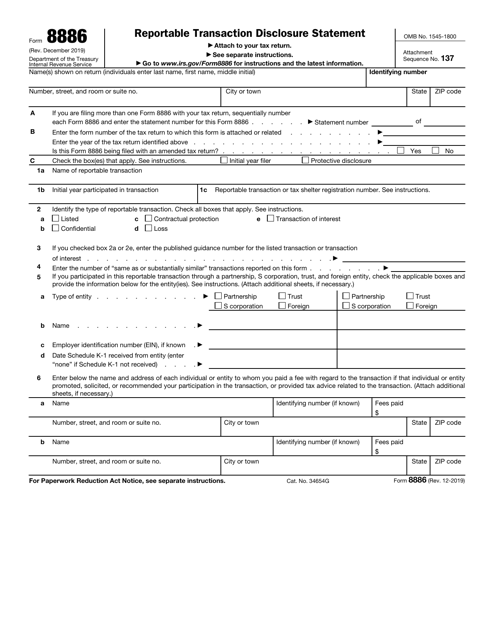

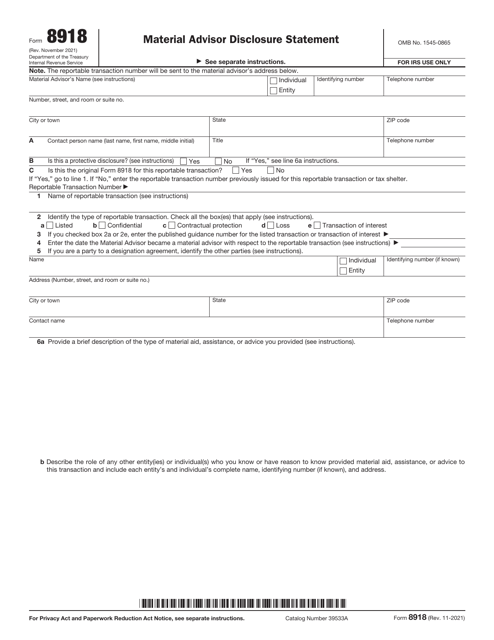

This Form is used for reporting any organizational actions that may have an impact on the basis of your securities for tax purposes. It is required by the Internal Revenue Service (IRS) to ensure accurate reporting of capital gains or losses.

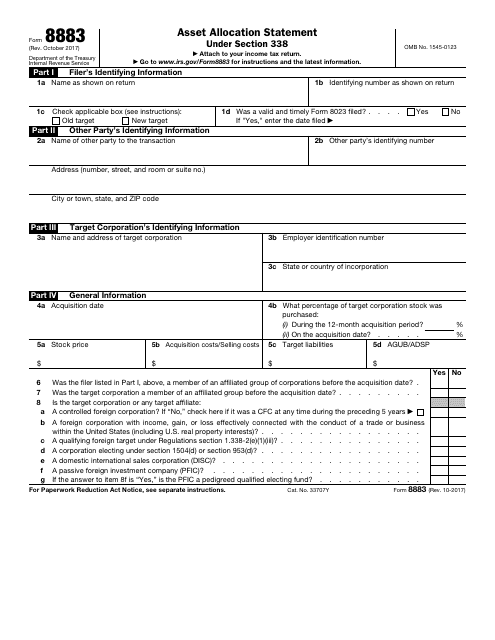

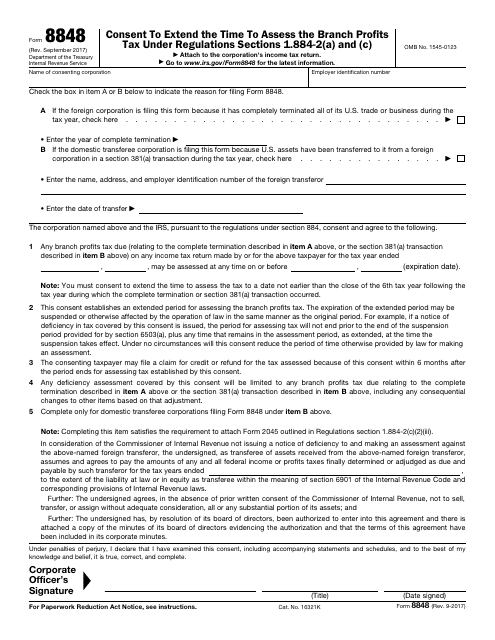

This form is used for reporting asset allocation statement under Section 338 to the IRS.

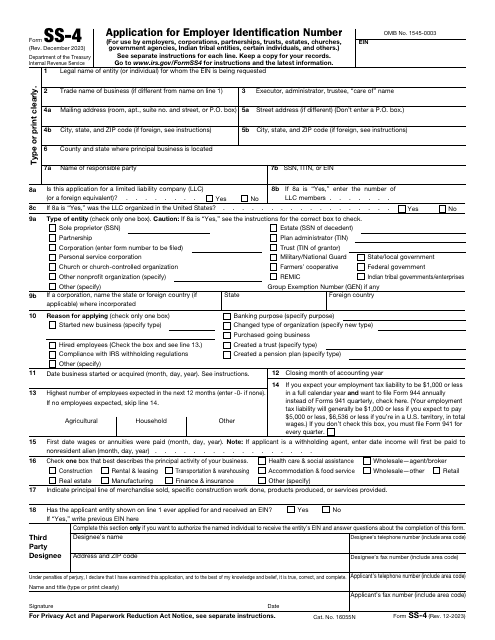

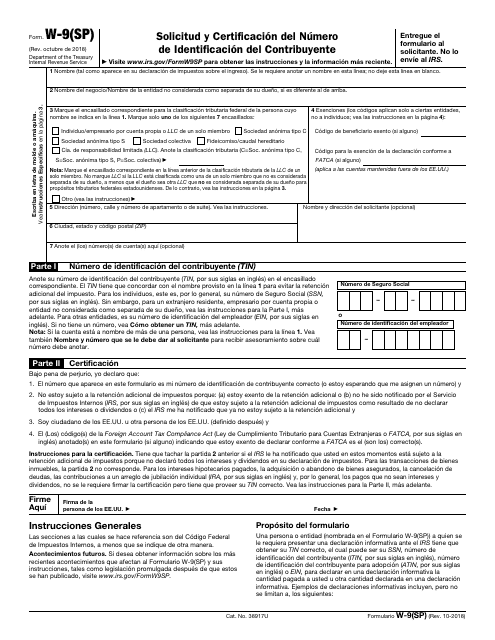

This is a fiscal document used by taxpayers - from sole proprietors to corporations - to ask tax organizations for a unique identification number.

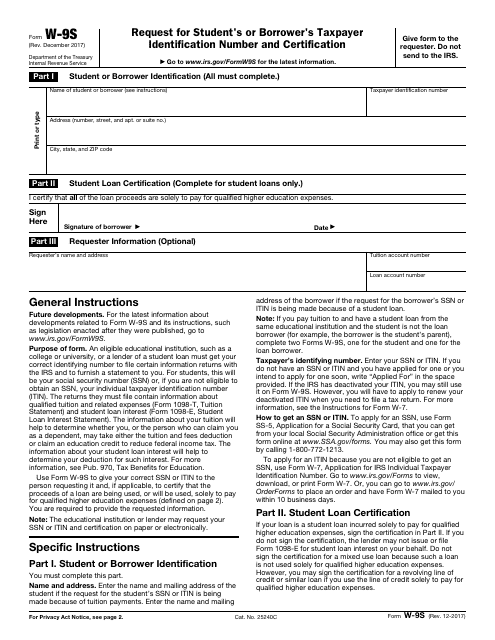

This is an IRS application requested from students to provide their taxpayer information to an educational institution (a college or university) or a lender of a student loan.

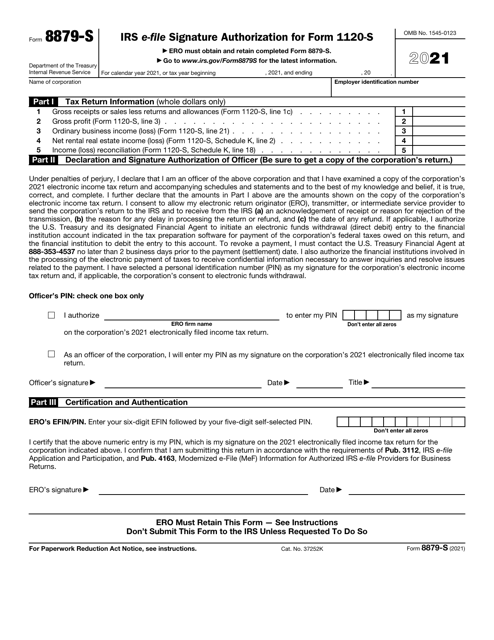

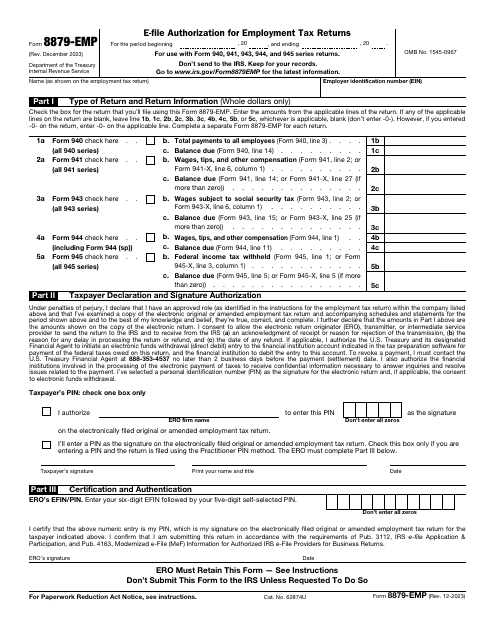

This is a supplementary form taxpayers may sign if they want to confirm their willingness to utilize a personal identification number that will allow them to provide an electronic signature when certifying employment tax returns or asking for a filing extension.

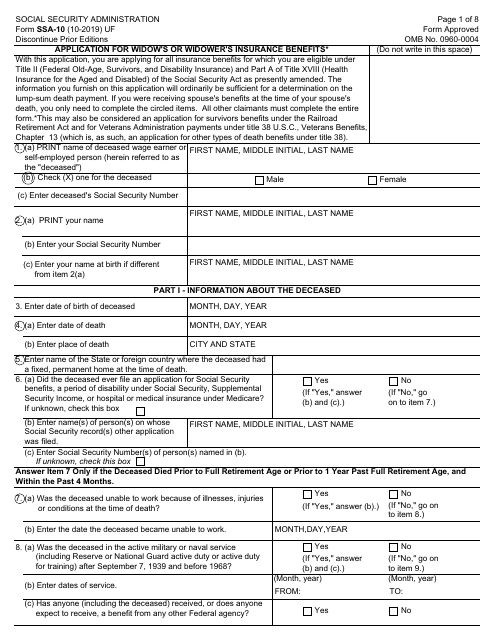

Use this form if you are the surviving spouse of a 100% insured wage earner and wish to claim the insurance benefits owed to your deceased spouse by the Social Security Administration (SSA).

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023

This form is used for reporting and claiming the extraterritorial income exclusion. It provides instructions on how to accurately complete IRS Form 8873.

This type of document, IRS Form 8883, is used for reporting asset allocation statements under Section 338 of the Internal Revenue Code. It provides instructions for completing and filing this form with the IRS.

This form is used for requesting a change in the time or place of a disability hearing.

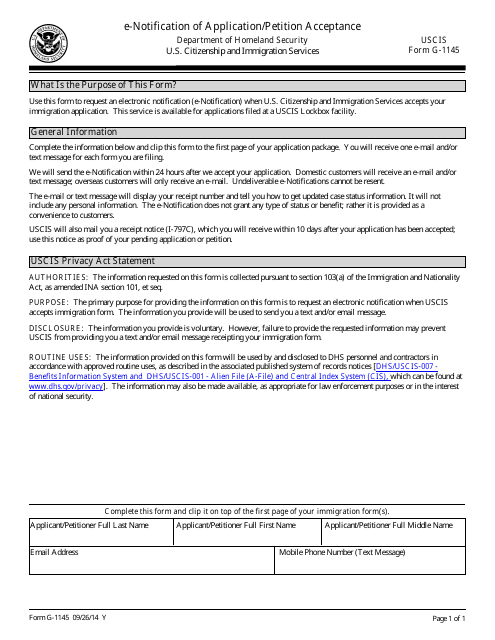

This is a form that is used to request an electronic notification when an immigration application is accepted by U.S. Citizenship and Immigration Services.