Fill and Sign United States Federal Legal Forms

Documents:

24261

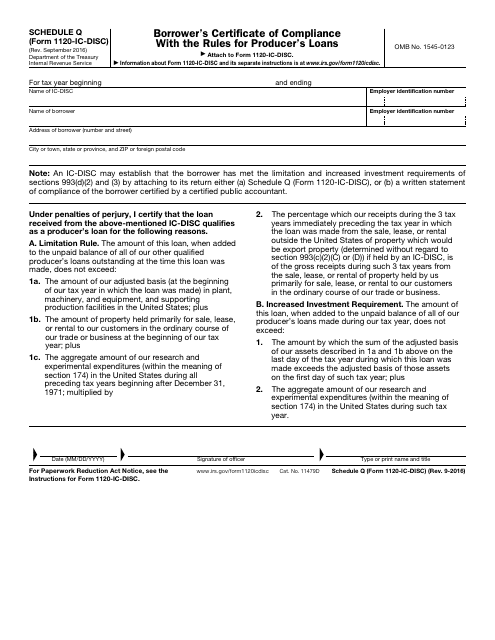

This Form is used for borrowers to certify their compliance with the rules for producer's loan related to IRS Form 1120-IC-DISC Schedule Q.

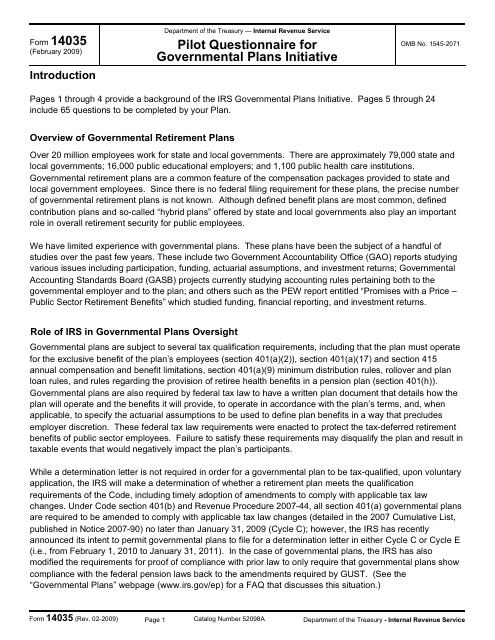

This form is used to collect information from governmental plans as part of the Pilot Questionnaire for the IRS Governmental Plans Initiative.

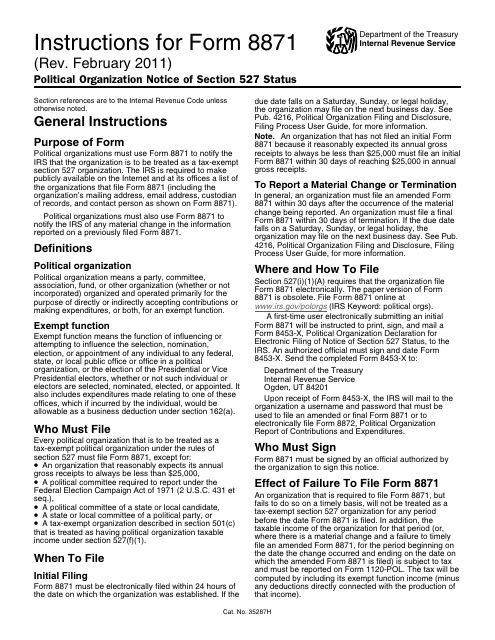

This Form is used for providing notice of section 527 status for political organizations to the IRS.

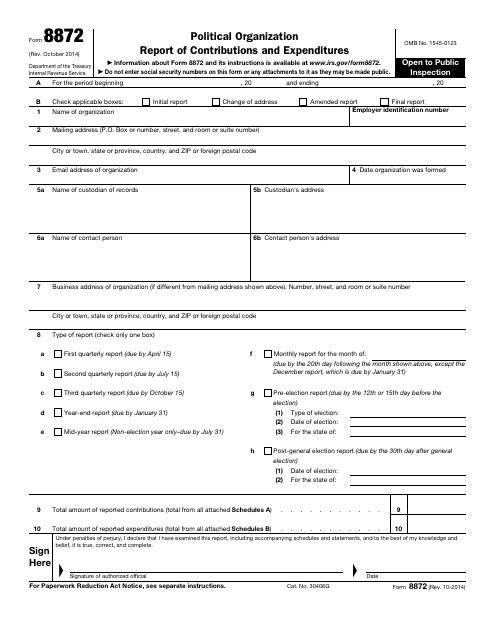

This form is used for political organizations to report their contributions and expenditures to the IRS. It is required to provide transparency in political funding and spending.

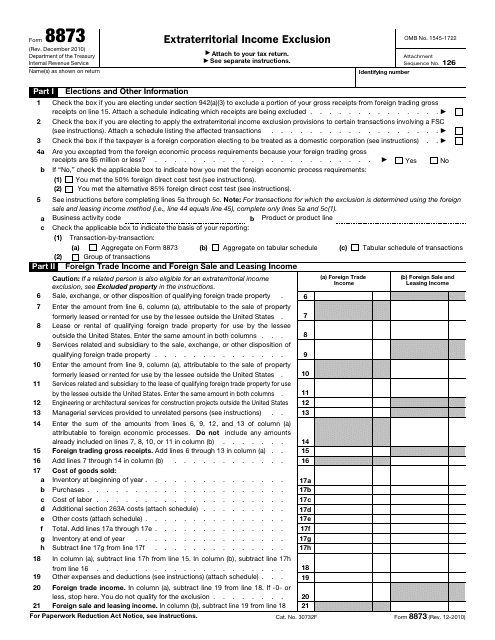

This Form is used for claiming the exclusion of certain foreign-earned income from your taxable income.

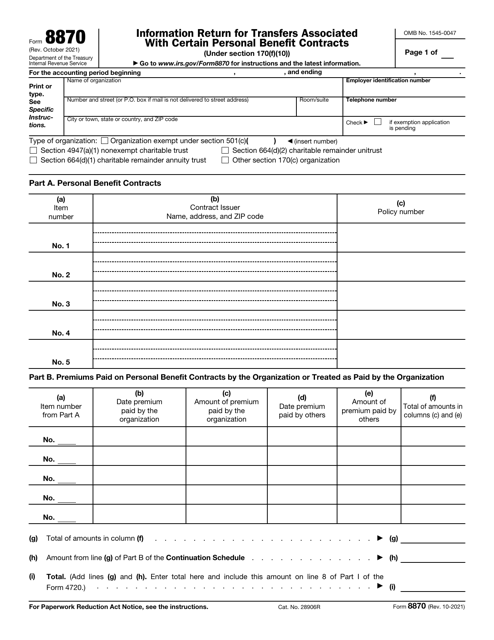

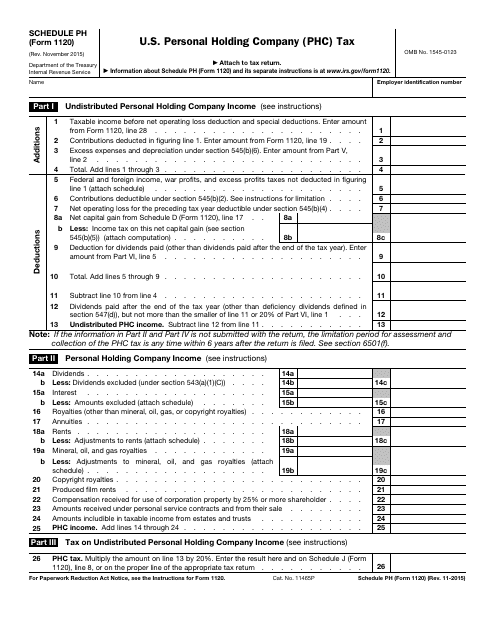

This form is used for reporting and paying U.S. Personal Holding Company (PHC) Tax for companies classified as personal holding companies.

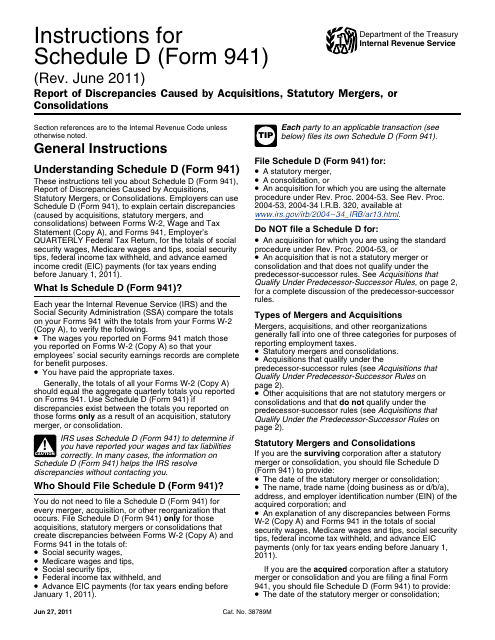

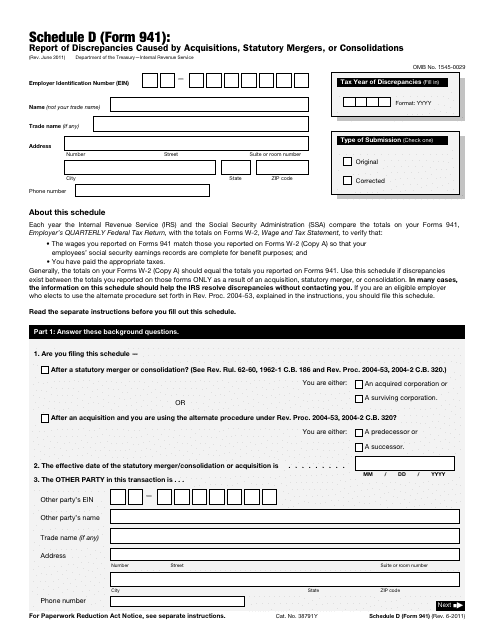

This document is used for reporting discrepancies caused by acquisitions, statutory mergers, or consolidations when filing IRS Form 941. It provides instructions on how to accurately fill out Schedule D of the form.

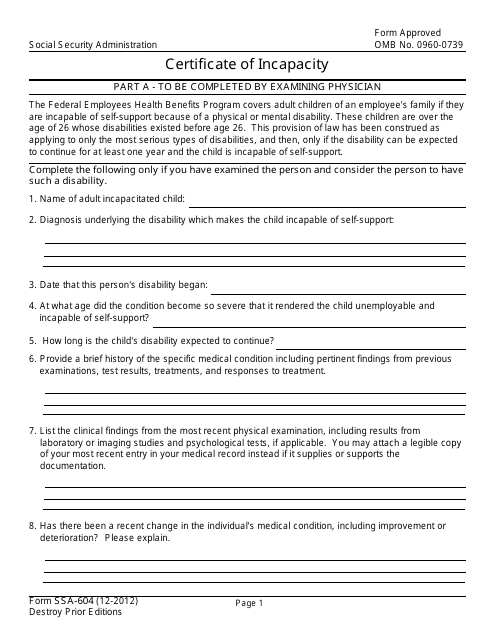

This form is used for obtaining a Certificate of Incapacity from the Social Security Administration (SSA). It certifies that an individual is unable to manage their own affairs due to a mental or physical impairment.

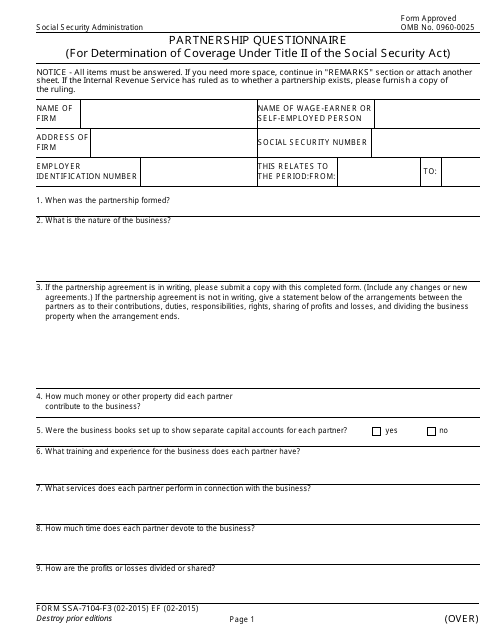

This Form is used for completing a partnership questionnaire for the Social Security Administration. It gathers information about the partnership's ownership and partners.

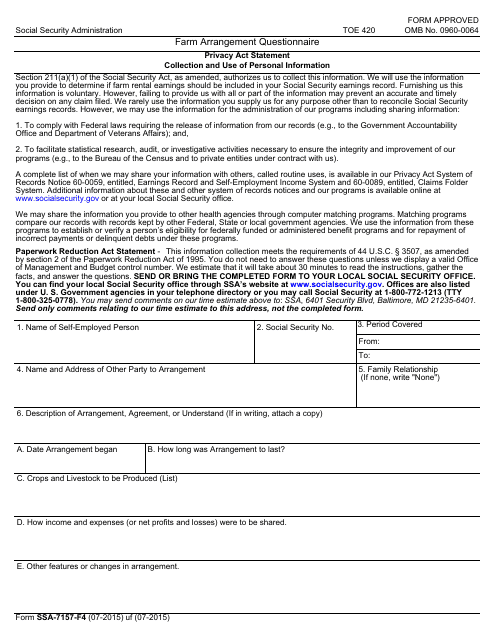

This form is used for determining farm arrangement details for Social Security benefits.

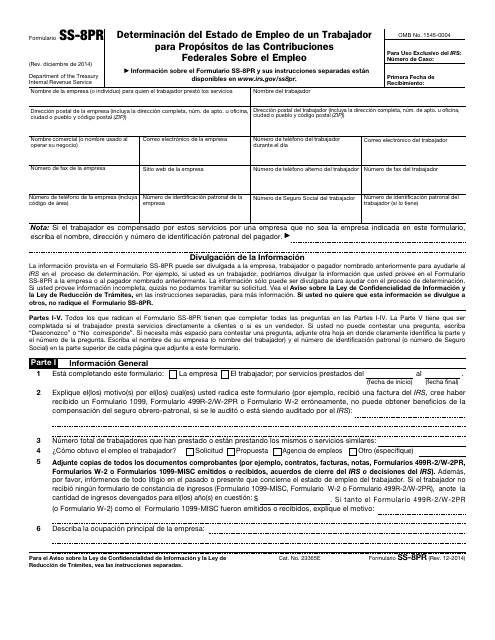

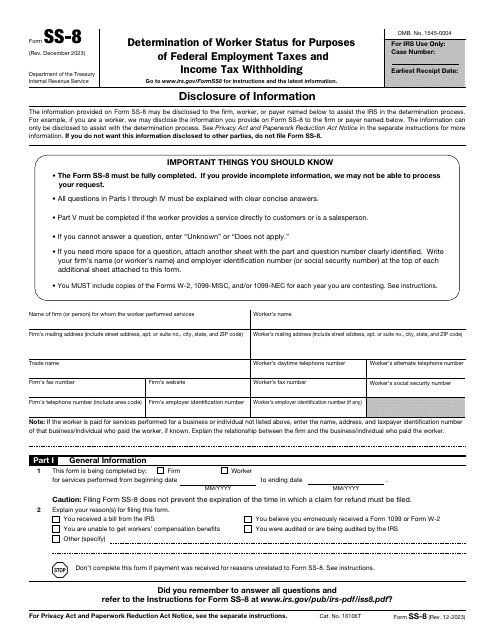

This form is used to determine the employment status of a worker for the purposes of federal employment taxes in Puerto Rico.

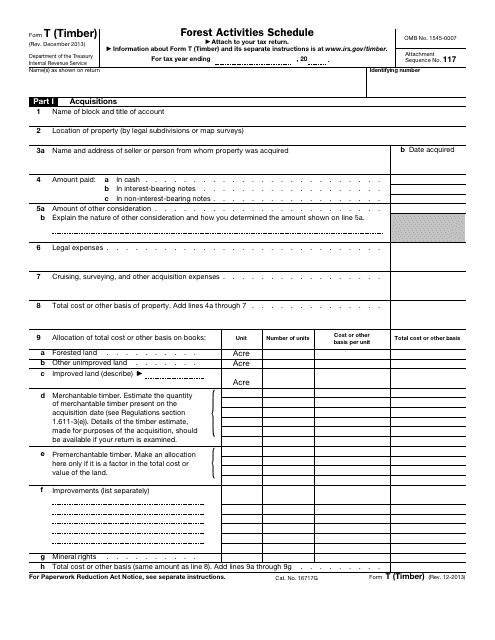

This document for reporting forest activities related to timber to the IRS.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

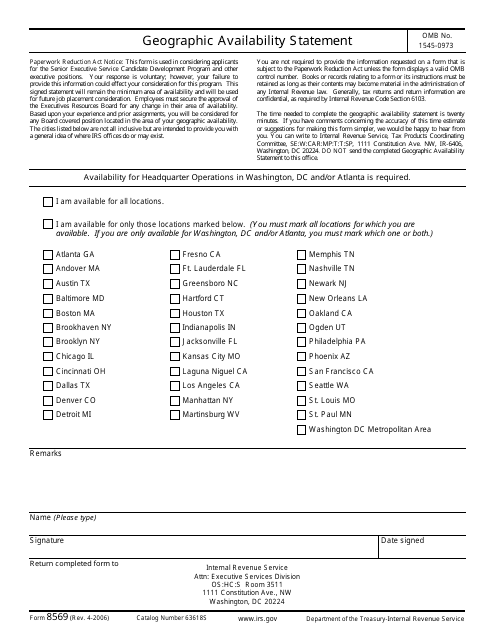

This form is used for providing information about the geographic availability of services provided by an organization to the Internal Revenue Service (IRS).

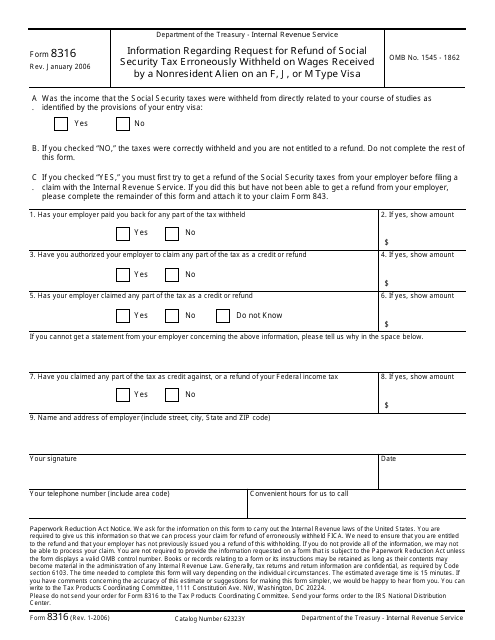

This form is used for providing information regarding a request for refund of social security tax that was mistakenly withheld on wages received by a nonresident alien on an F, J, or M type visa.

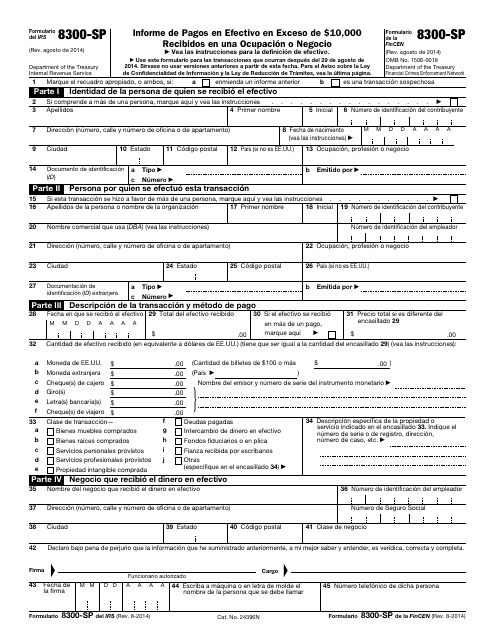

This Form is used for reporting cash payments over $10,000 received in a trade or business. (Spanish)

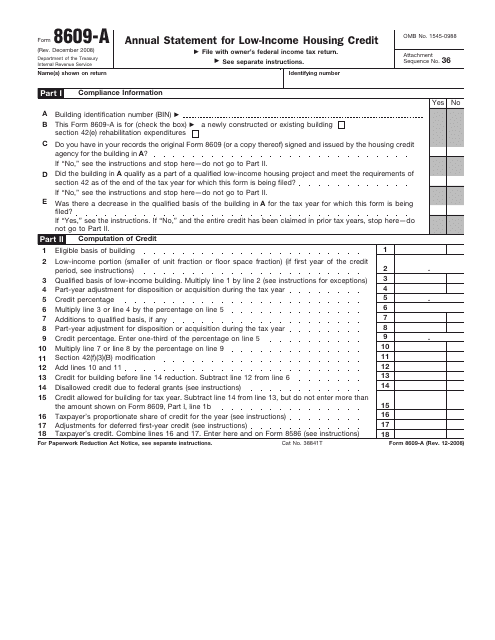

This document is used for reporting the annual statement for the Low-Income Housing Credit, as required by the IRS.

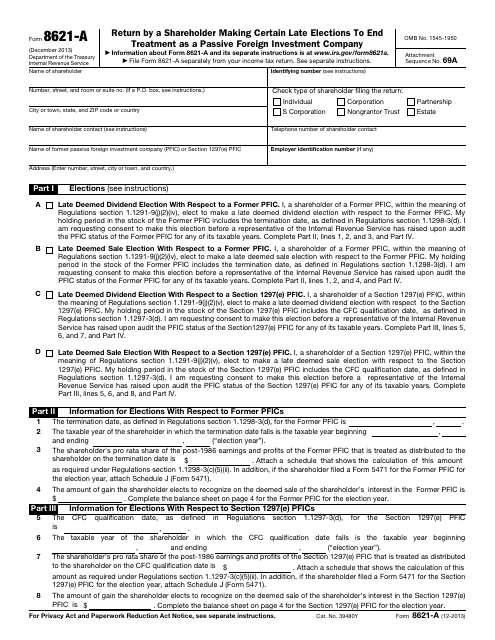

This Form is used for shareholders who need to make certain late elections to end treatment as a Passive Foreign Investment Company.

This document is used to report discrepancies resulting from acquisitions, statutory mergers, or consolidations. It is specific to Form 941, which is used by employers to report employment taxes.

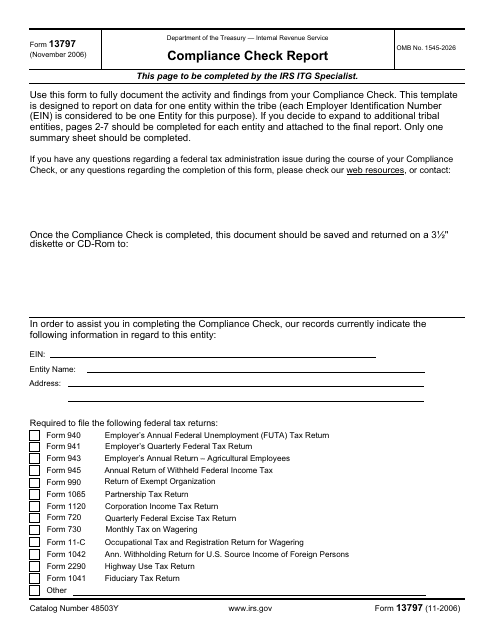

This document is used for reporting compliance checks to the IRS. It helps ensure that individuals and businesses are meeting their tax obligations.

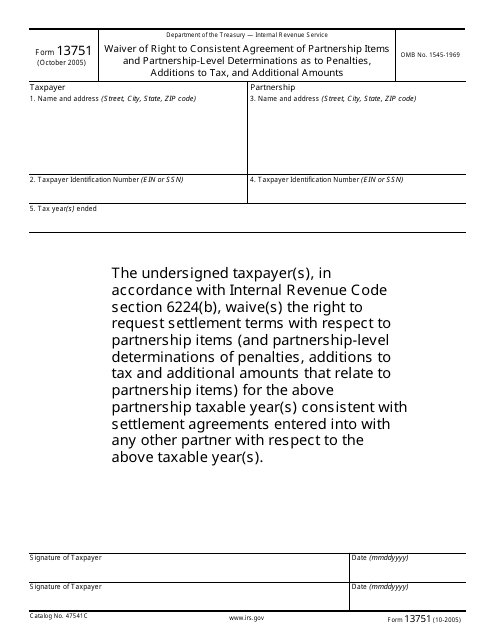

This form is used for waiving the right to consistent agreement on partnership items and penalties.

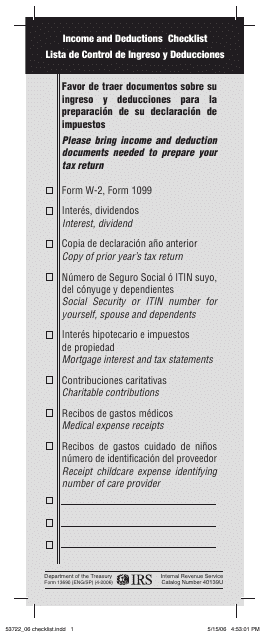

This form is used for checking income and deductions. It is available in both English and Spanish.