Fill and Sign United States Federal Legal Forms

Documents:

24261

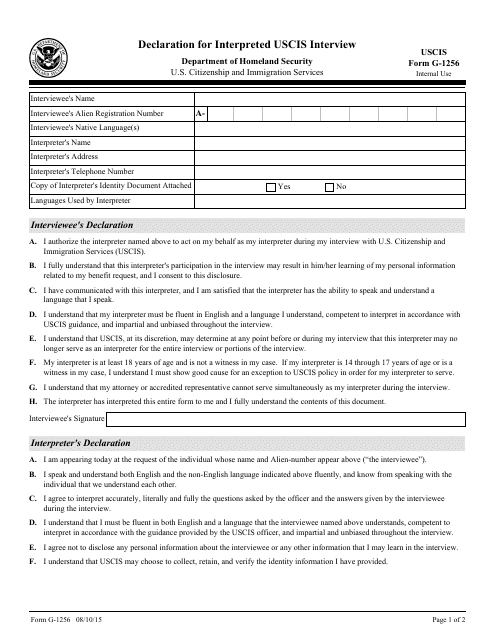

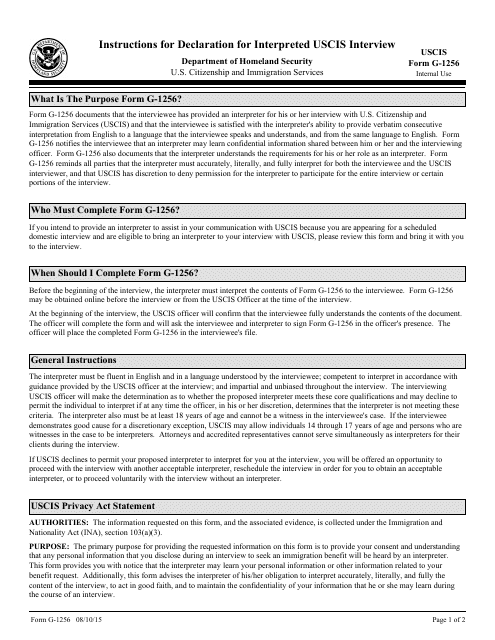

This is an official form used by qualified persons not speaking English and requiring an interpreter's assistance during a USCIS interview.

This form is used for making a declaration regarding an interpreted USCIS interview. It provides instructions on how to fill out the form and submit it to the U.S. Citizenship and Immigration Services (USCIS).

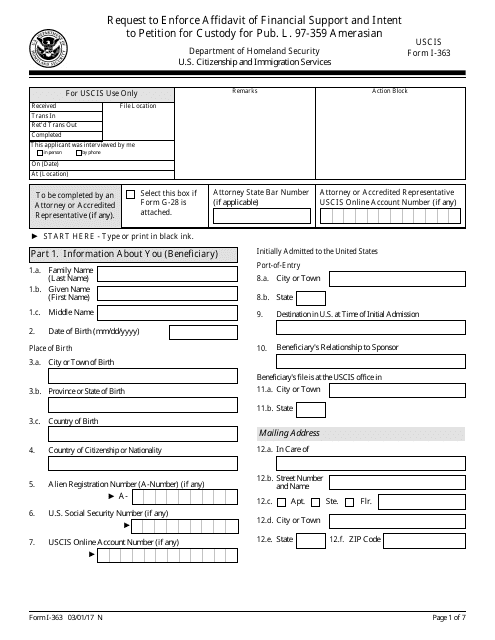

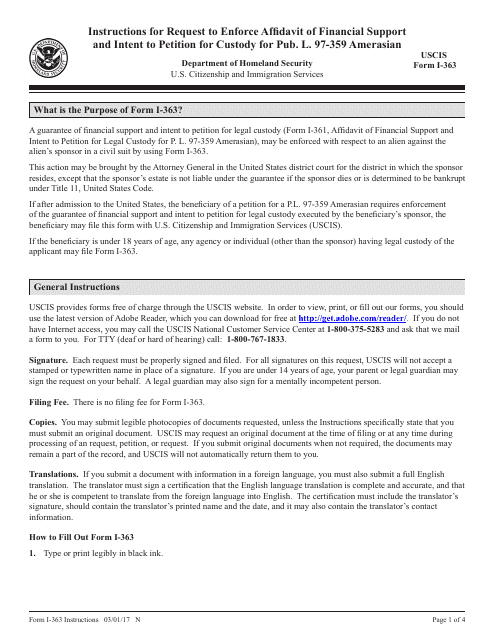

This form is used for requesting the enforcement of an Affidavit of Financial Support and Intent to Petition for Legal Custody for Public Law 97-359 Amerasian.

This form is used to request enforcement of an affidavit of financial support and petition for legal custody for Amerasian individuals under Public Law 97-359.

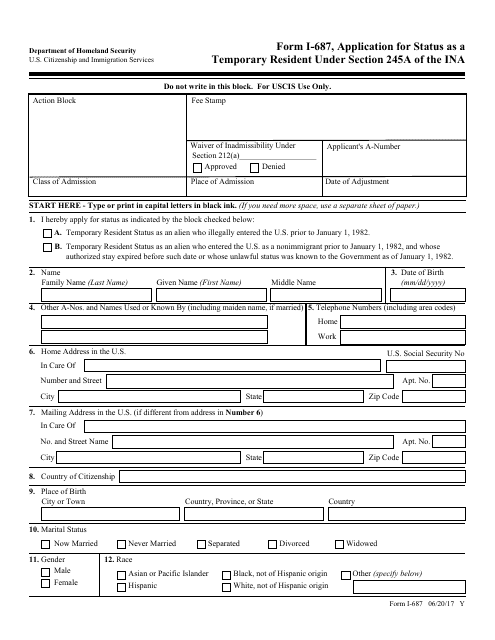

This form is used for applying for temporary resident status under Section 245a of the Immigration and Nationality Act.

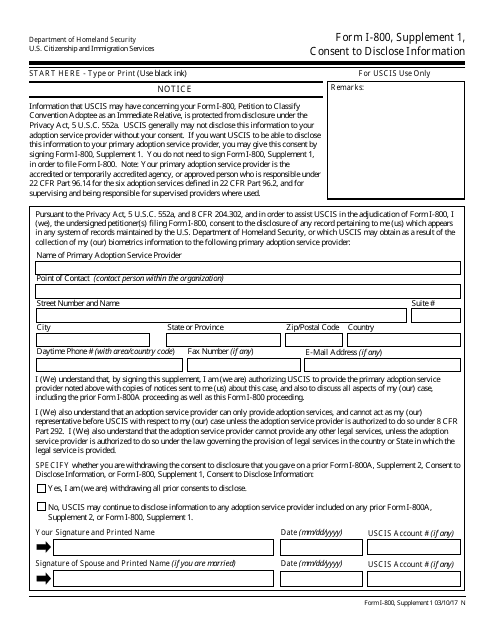

This document is used for obtaining consent to disclose information in the context of the USCIS Form I-800 process.

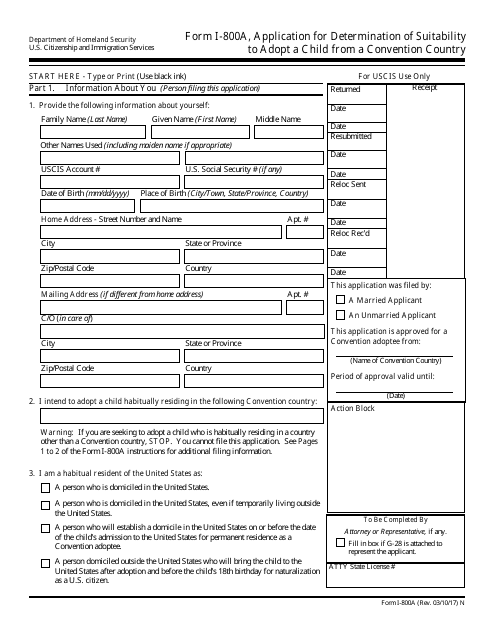

This Form is used for applying to USCIS for determination of suitability to adopt a child from a Convention country.

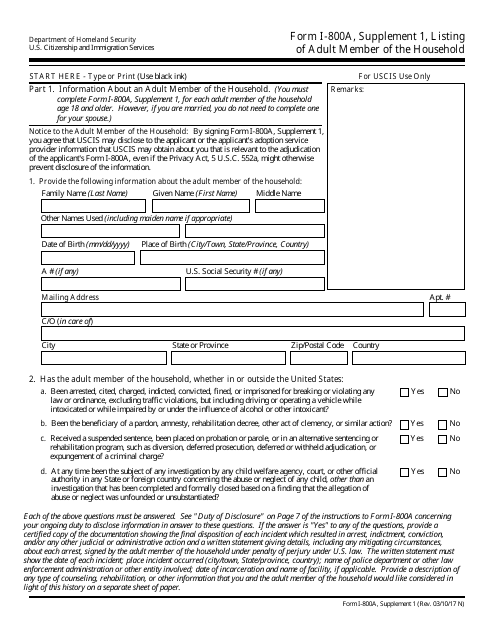

This form is used for listing adult members of the household when filing for USCIS Form I-800A Supplement 1.

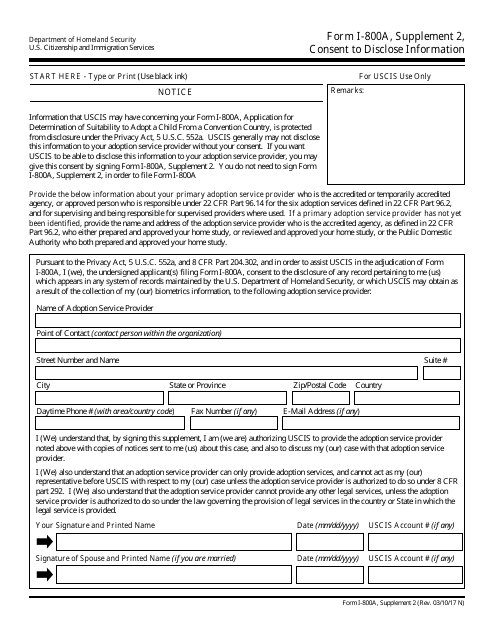

This form is used for providing consent to disclose information for USCIS Form I-800A Supplement 2.

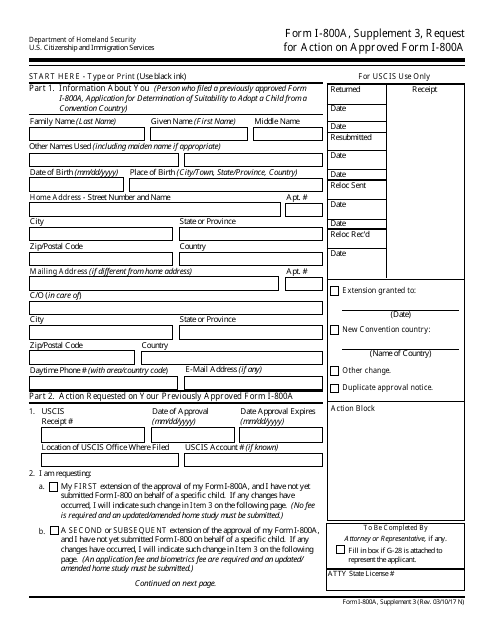

This form is used to request action on an approved Form I-800A.

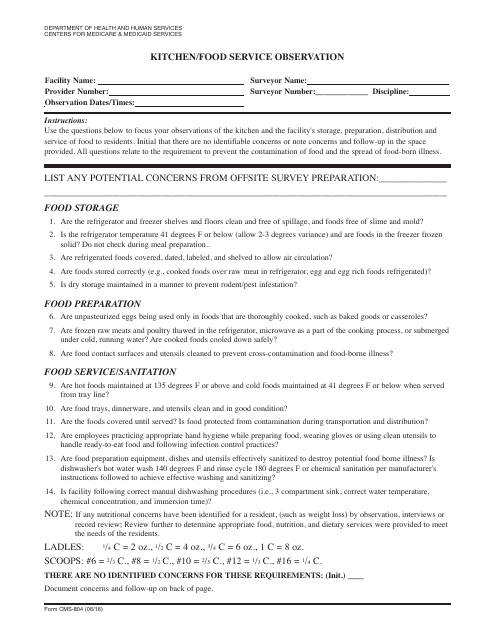

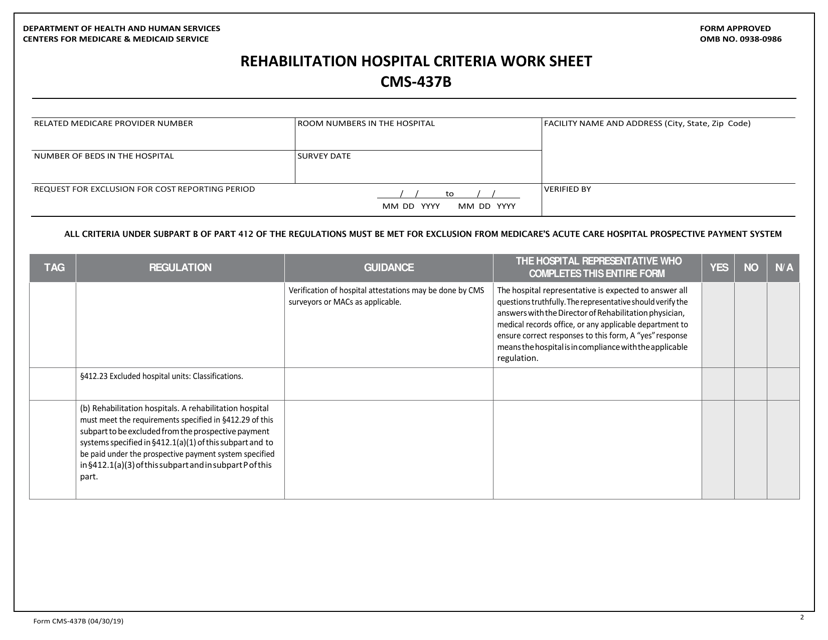

This Form is used for observing and evaluating the kitchen and food service areas in healthcare facilities to ensure compliance with relevant regulations and standards.

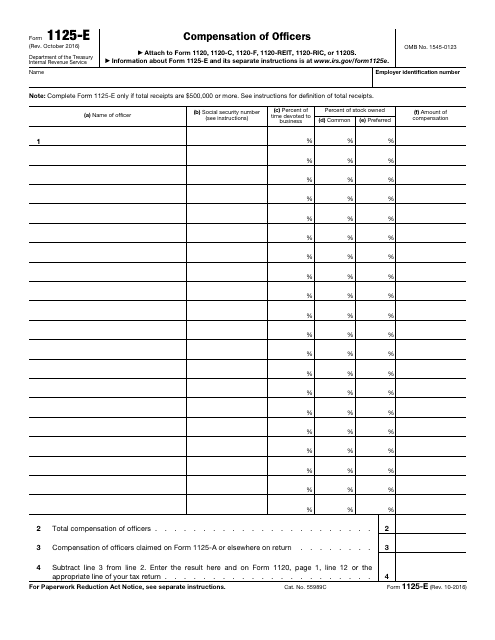

This IRS form is used to provide a detailed report in regards to the deduction for compensation of officers when an entity has $500,000 or more in total receipts.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

This Form is used for applying to adopt, change, or retain a tax year with the IRS. It is typically used by businesses or organizations that want to align their tax year with their fiscal year or have a specific reason for changing their tax year.

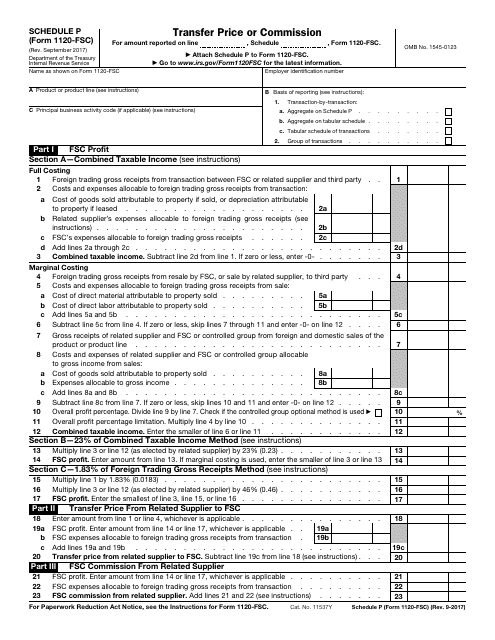

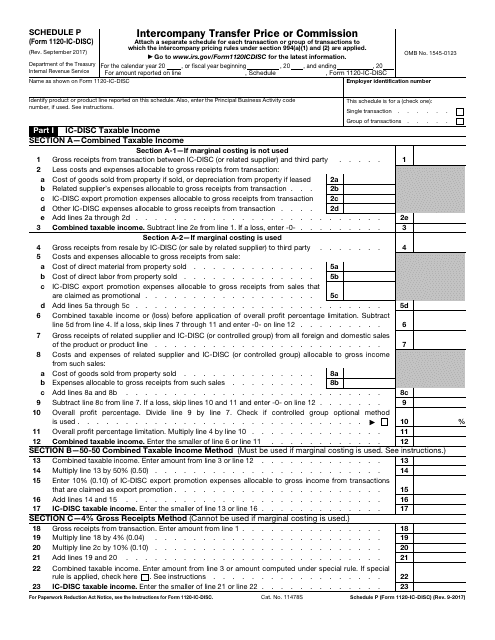

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

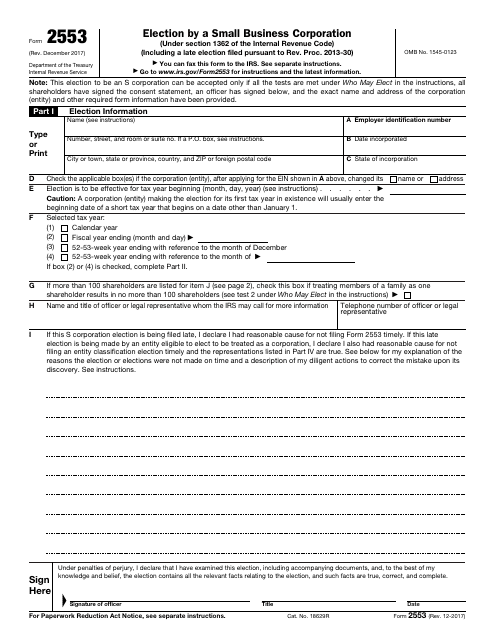

This is a fiscal statement filed by companies that want to be recognized as S corporations.

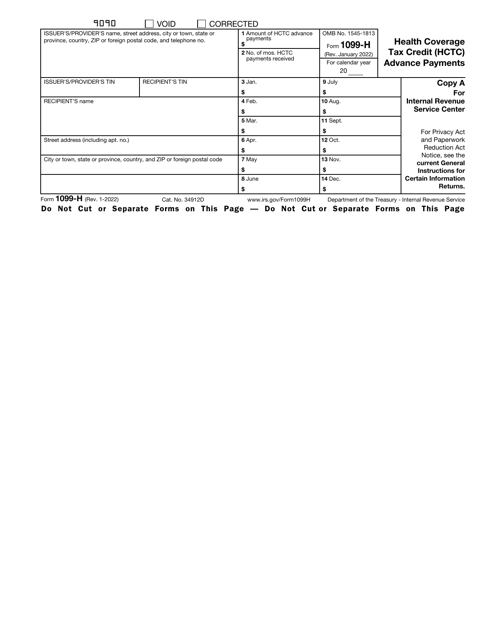

This is an IRS document released for those individuals who got payments during the calendar year of qualified health insurance payments for the benefit of eligible trade adjustment assistance.

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

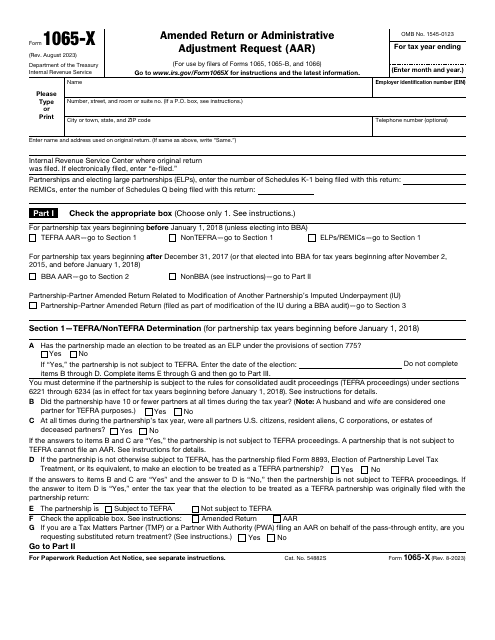

This is a fiscal statement used by partnerships and real estate mortgage investment conduits to fix the errors in previously filed IRS Form 1065, IRS Form 1065-B, IRS Form 1066.

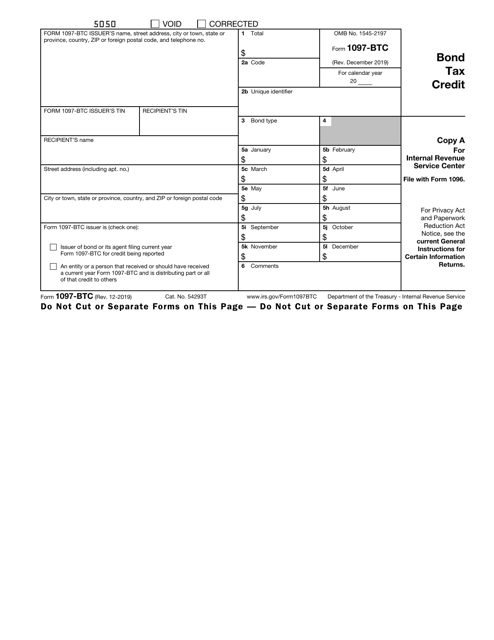

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

Submit this form to the Internal Revenue Service (IRS) if you are a corporation that offers their employees an incentive stock option (ISO) to report to the IRS about your transfers of stock made to any transferee when that transferee exercises an ISO under Section 422(b).