North Carolina Department of Revenue Forms

The North Carolina Department of Revenue is responsible for administering and enforcing tax laws in the state of North Carolina. They collect various taxes, such as income tax, sales tax, and property tax, and ensure compliance with tax regulations. They also provide taxpayer assistance and education to help individuals and businesses understand and fulfill their tax obligations in North Carolina.

Documents:

615

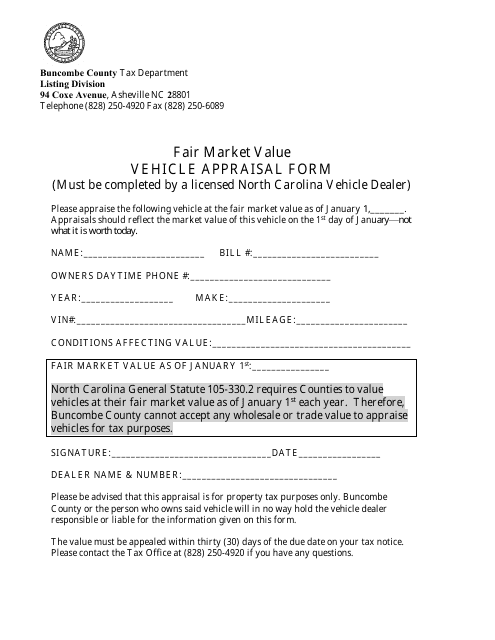

This form is used for appraising vehicles in Buncombe County, North Carolina.

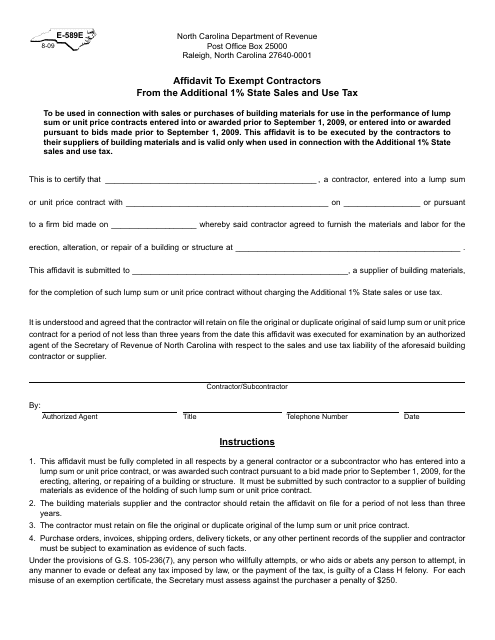

This form is used for contractors in North Carolina to request exemption from the additional 1% state sales and use tax.

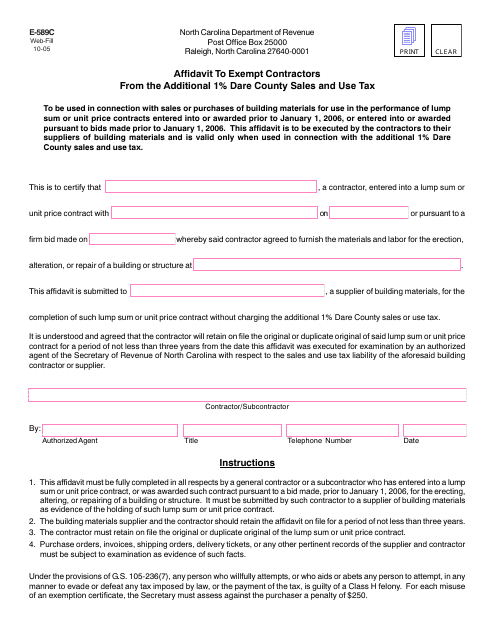

This form is used for contractors in Dare County, North Carolina to apply for exemption from the additional 1% sales and use tax.

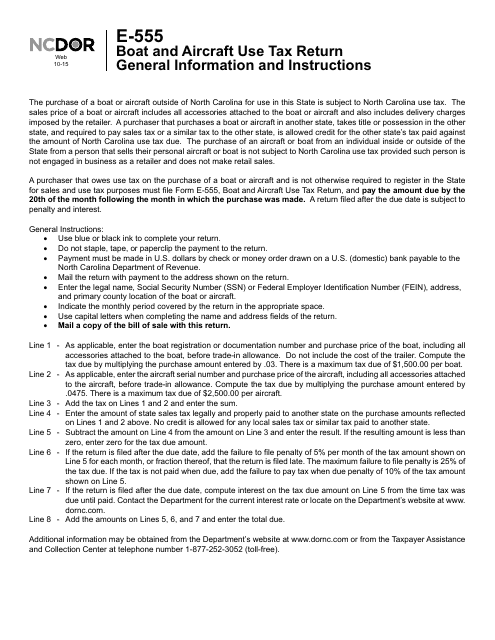

This Form is used for reporting and paying boat and aircraft use tax in North Carolina. It provides instructions on how to complete the tax return and ensure compliance with the state's tax laws for boats and aircraft.

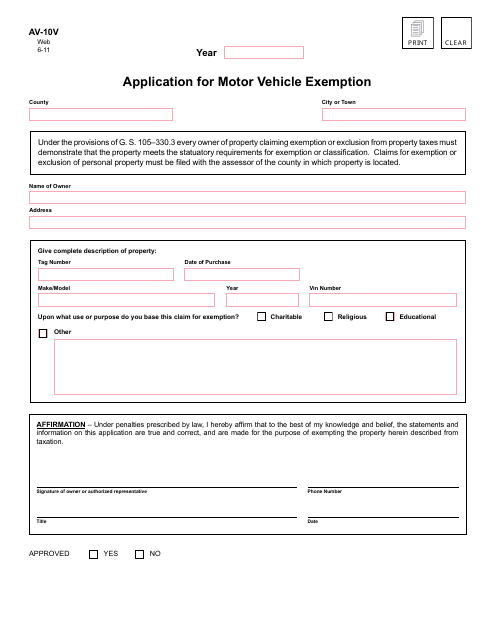

This Form is used for applying for motor vehicle exemption in North Carolina.

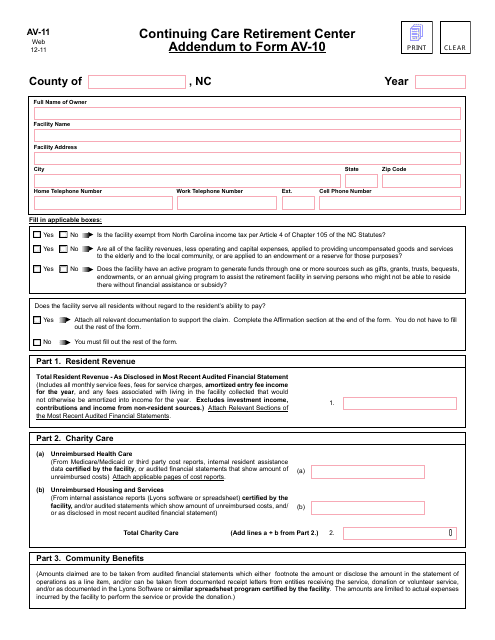

This form is used as an addendum to Form AV-10 for Continuing Care Retirement Centers in North Carolina.

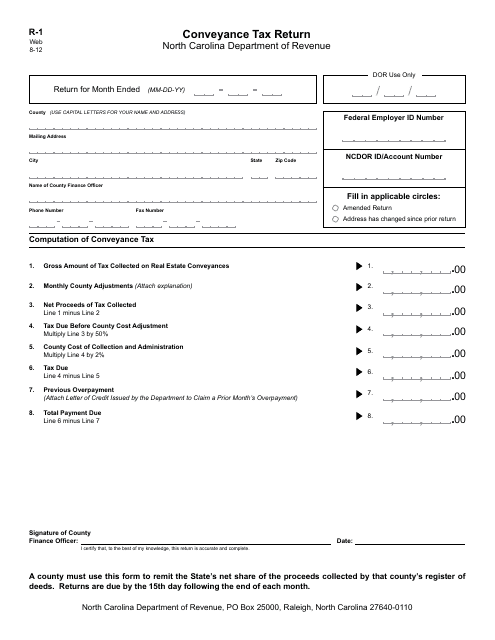

This Form is used for filing a Conveyance Tax Return in North Carolina.

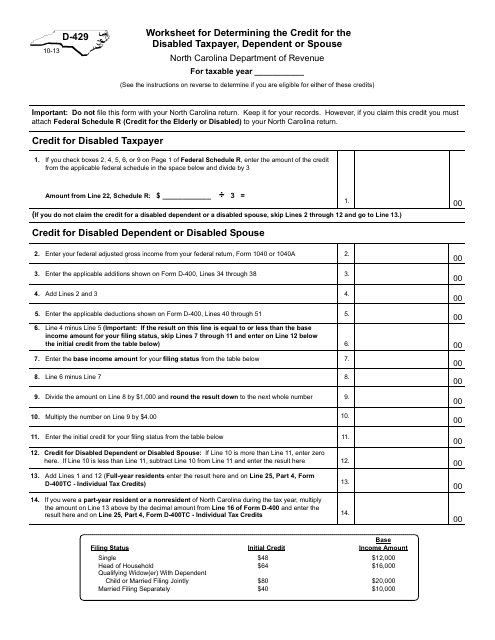

This Form is used for determining the credit for the disabled taxpayer, dependent or spouse in North Carolina.

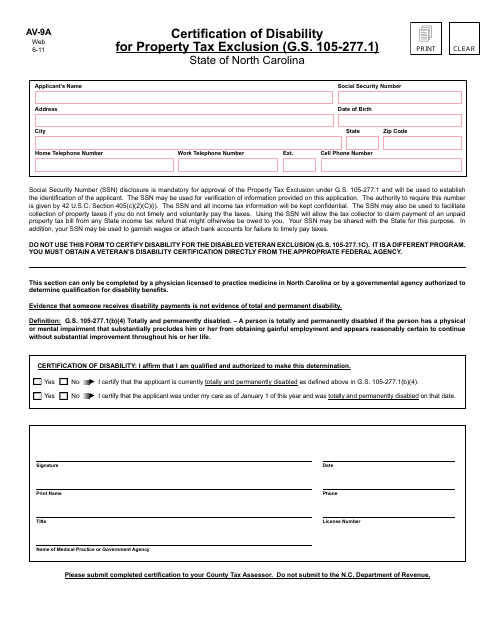

This Form is used for certifying disability for property tax exclusion in North Carolina.

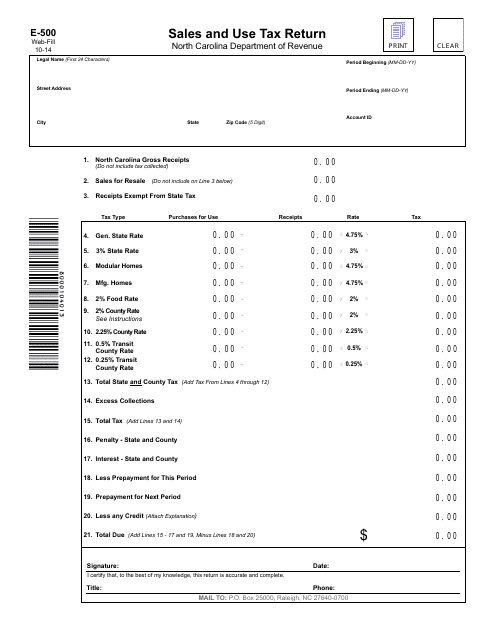

This Form is used for filing sales and use tax returns in the state of North Carolina. It ensures that businesses report and remit the correct amount of sales and use tax owed to the state.

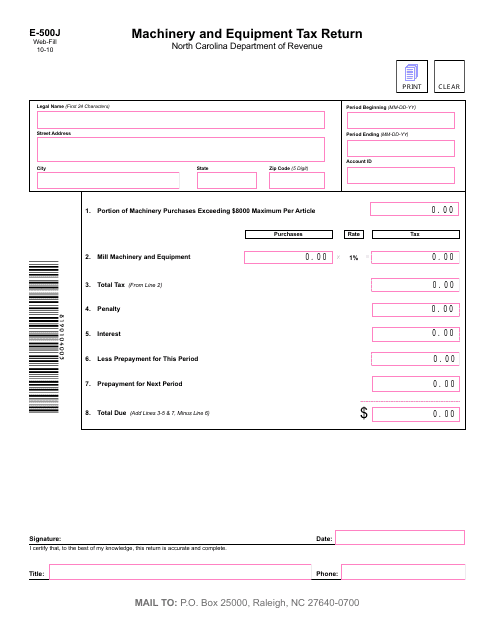

This Form is used for reporting machinery and equipment taxes in North Carolina.

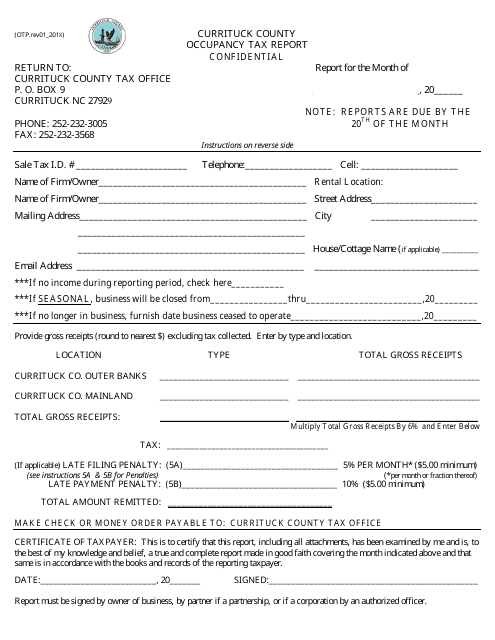

This Form is used for reporting occupancy taxes in Currituck County, North Carolina.

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

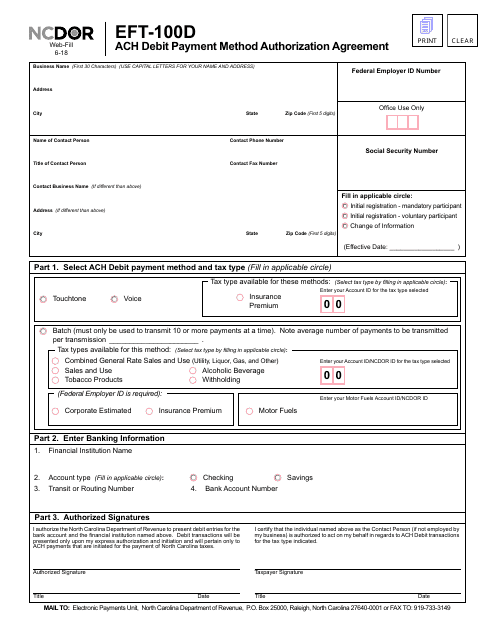

This form is used for authorizing ACH debit payment method in North Carolina.

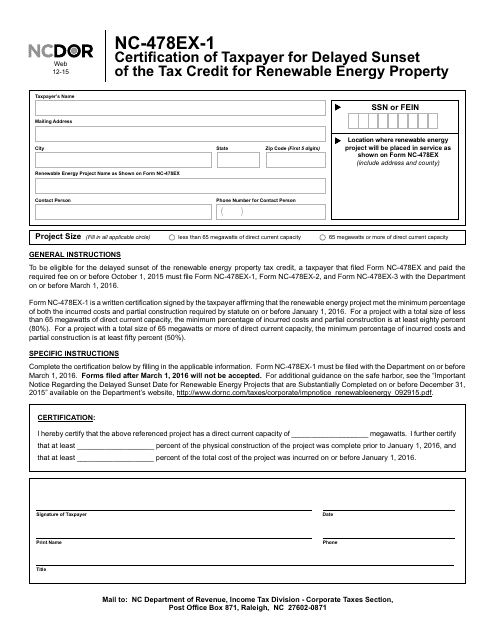

This Form is used for certifying taxpayers in North Carolina who are claiming the delayed sunset of the tax credit for renewable energy property.

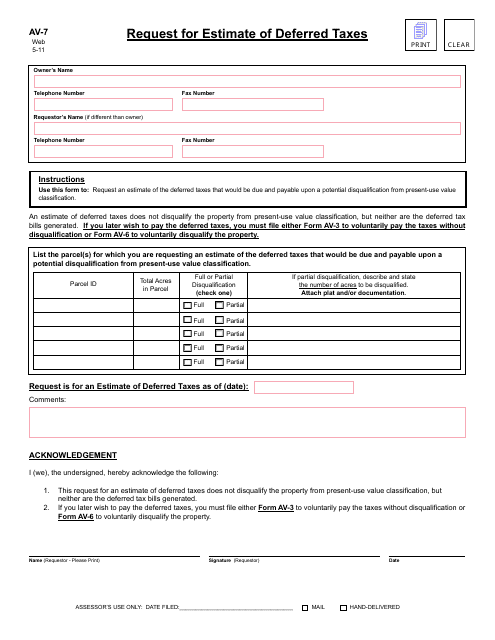

This Form is used for requesting an estimate of deferred taxes in North Carolina. It helps individuals or businesses calculate their potential tax liability for future periods.

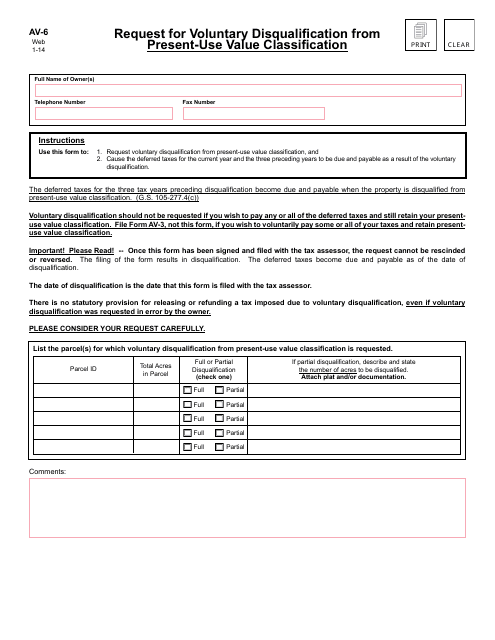

This form is used for requesting voluntary disqualification from the present-use value classification in North Carolina.

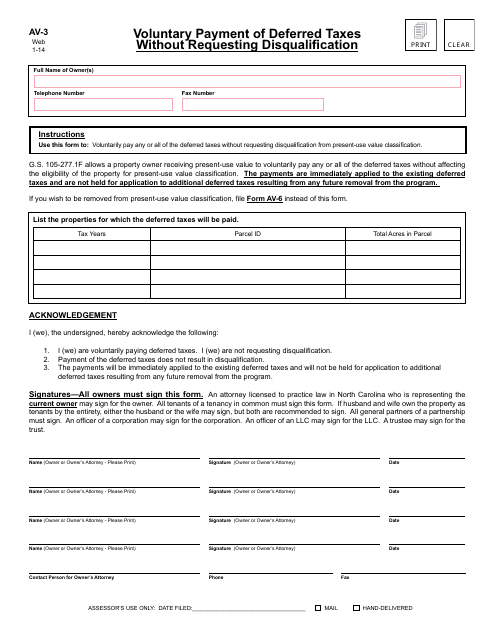

This form is used for voluntarily paying deferred taxes in North Carolina without requesting disqualification.

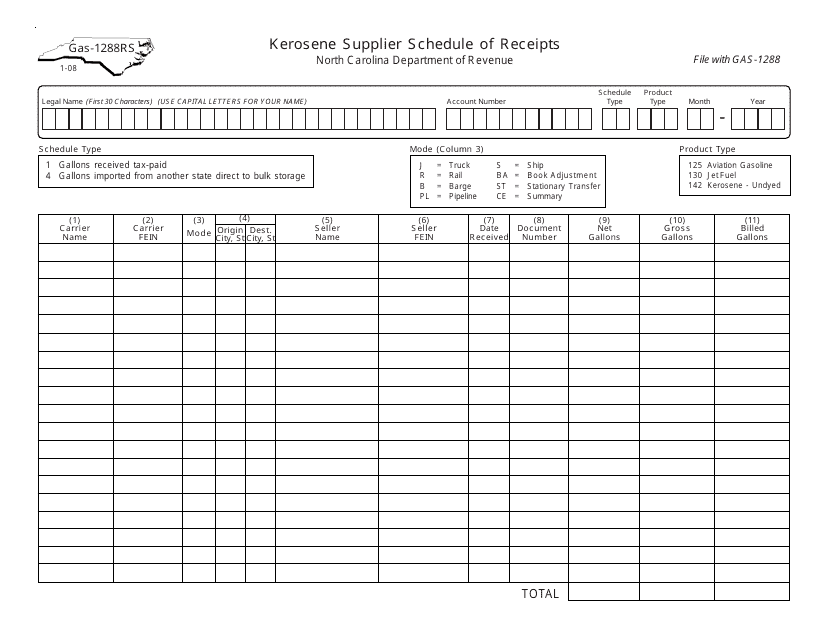

This form is used for kerosene suppliers in North Carolina to schedule and track their receipts.

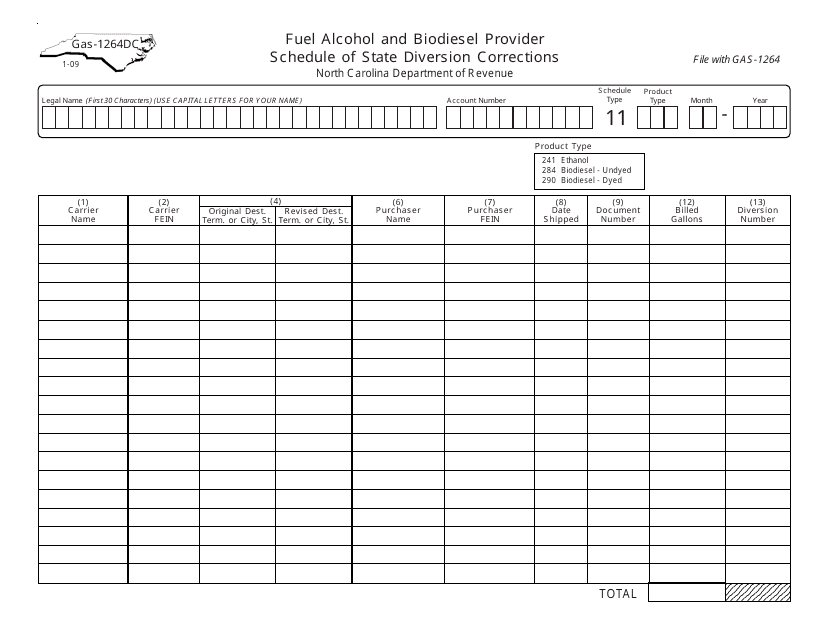

This Form is used for reporting fuel alcohol and biodiesel diversion corrections in North Carolina.

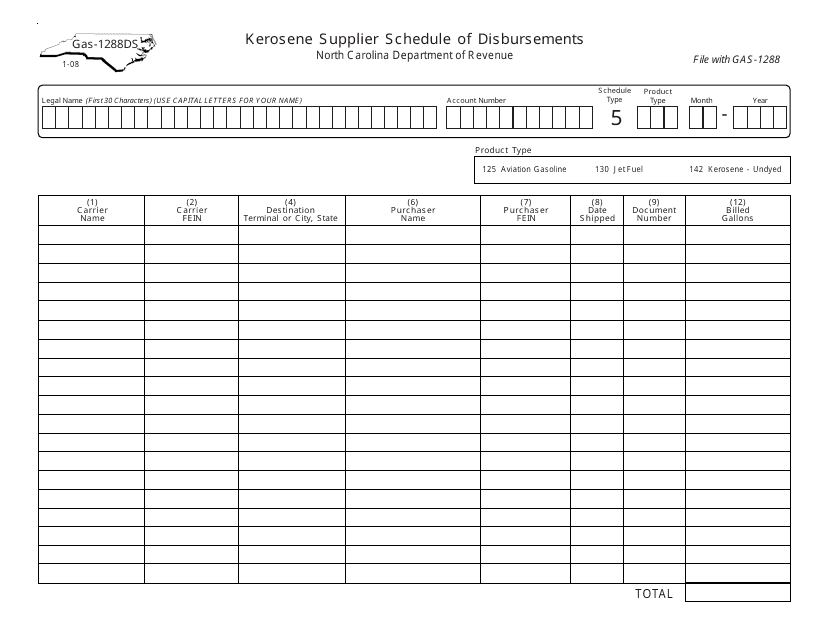

This form is used for kerosene suppliers in North Carolina to report their schedule of disbursements.

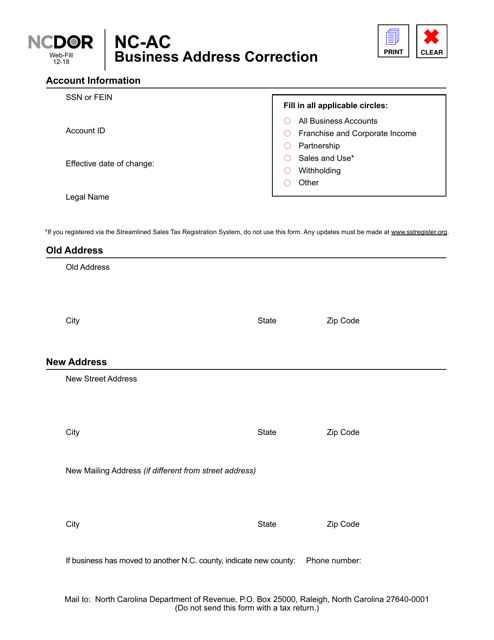

This form is used for correcting the business address in North Carolina.

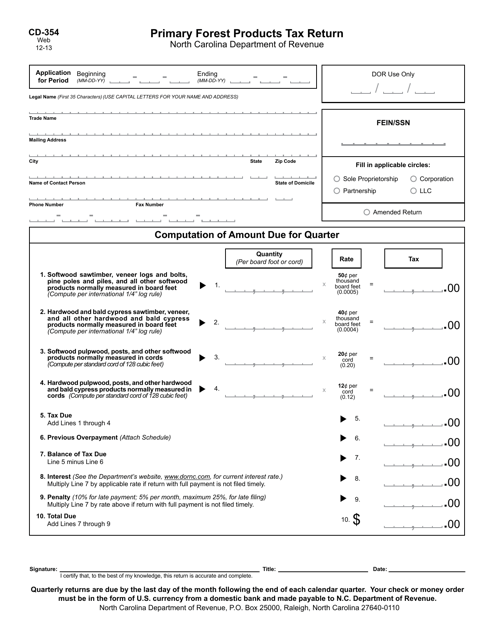

This form is used for reporting and paying taxes on primary forest products in North Carolina.

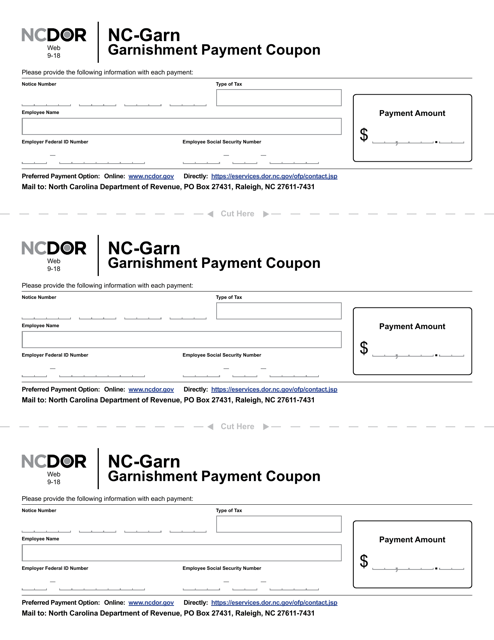

This form is used for submitting payment for garnishment in the state of North Carolina.