Indiana Department of Revenue Forms

The Indiana Department of Revenue is responsible for administering and enforcing the tax laws of the state of Indiana. It collects various types of taxes, including income tax, sales tax, property tax, and excise taxes. The department ensures that individuals, businesses, and other entities comply with their tax obligations and provides taxpayer assistance and education. It also administers various tax credits, incentives, and refund programs.

Documents:

736

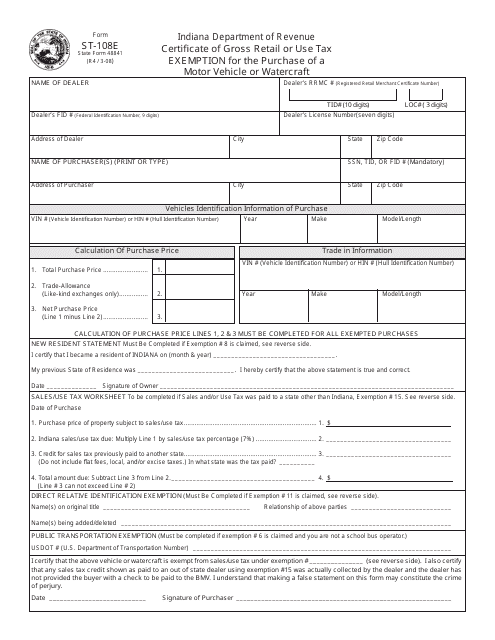

This form is used for claiming exemption from paying gross retail or use tax while purchasing a motor vehicle or watercraft in Indiana.

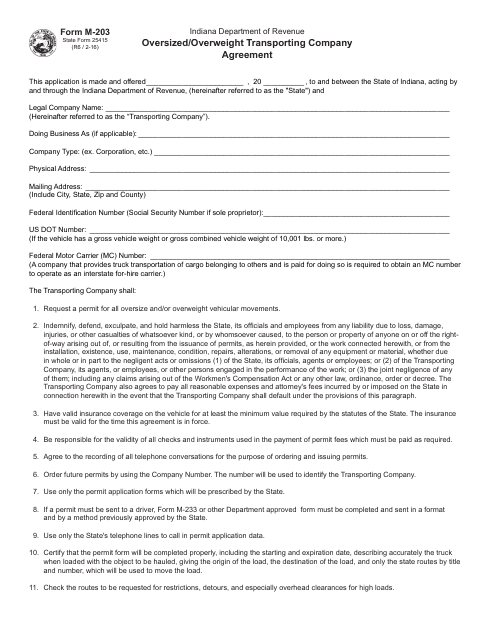

This document is used for an agreement between an oversized/overweight transporting company and the state of Indiana. It outlines the necessary terms and conditions for transporting oversized or overweight loads within the state.

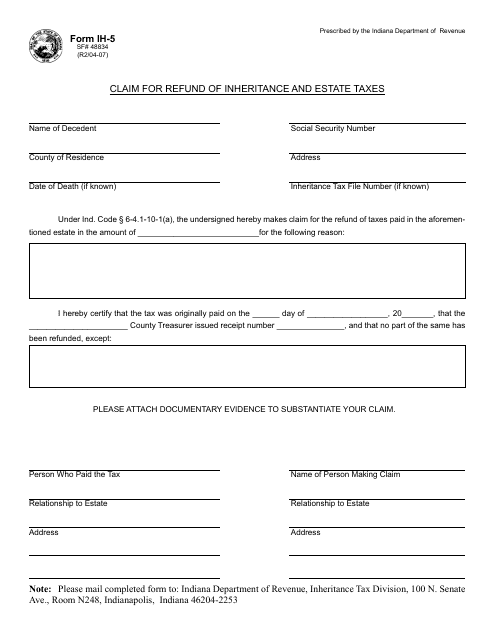

This form is used for claiming a refund of inheritance and estate taxes in the state of Indiana.

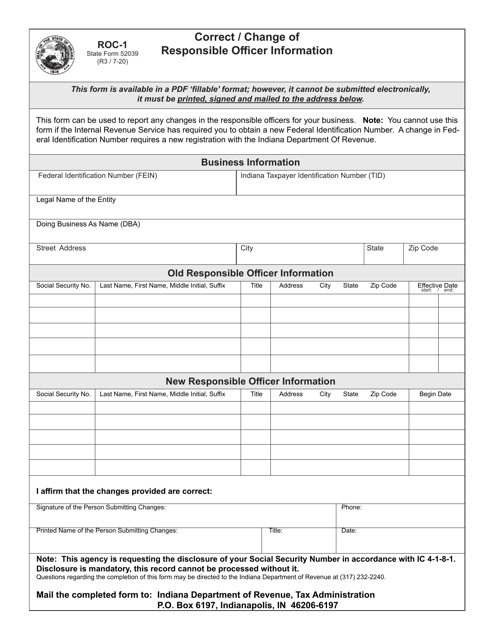

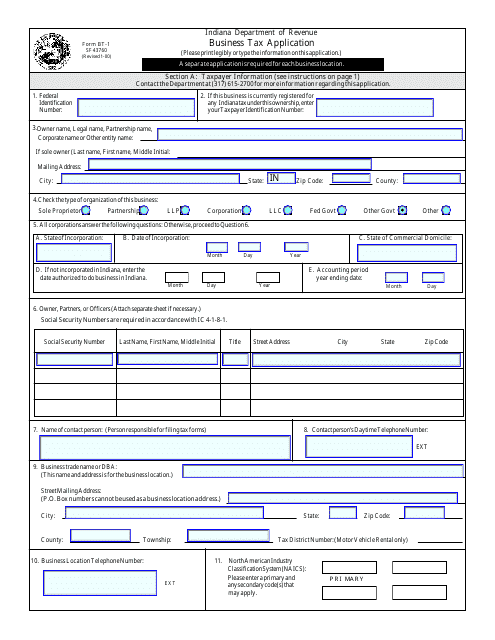

This form is used for businesses in Indiana to apply for a tax identification number. It is required for businesses to register with the state and pay their taxes.

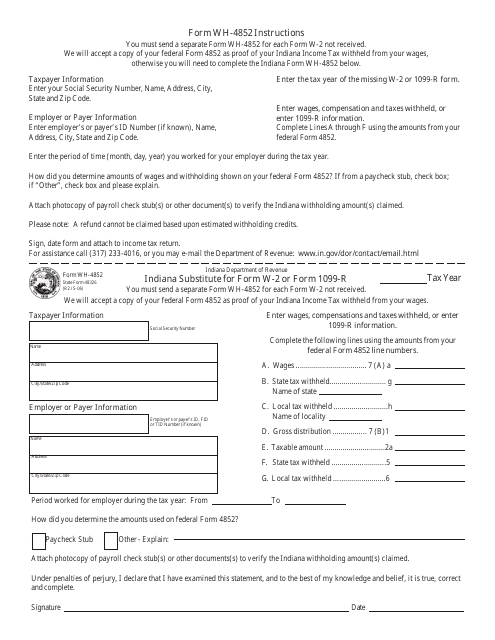

This document is used as a substitute for Form W-2 or Form 1099-R in the state of Indiana. It is used when an individual does not receive their W-2 or 1099-R and needs to report their income for tax purposes.

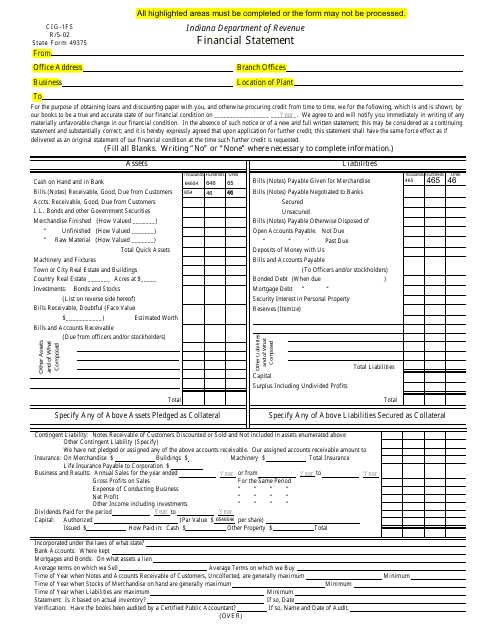

This form is used for filing a financial statement in the state of Indiana. It is also known as Form CIG-1FS or State Form 49375.

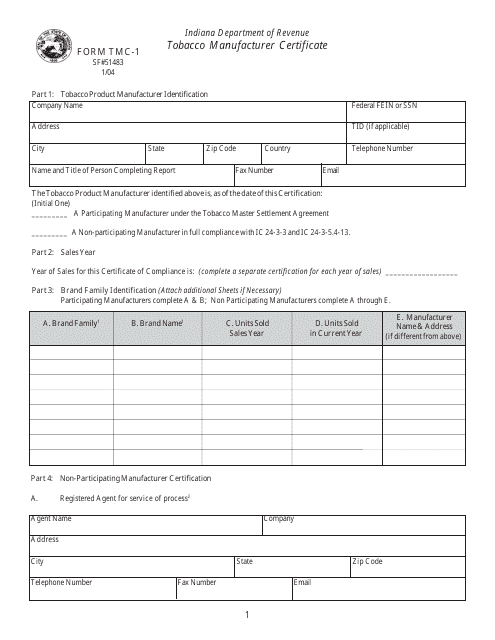

This form is used for obtaining a Tobacco Manufacturer Certificate in the state of Indiana.

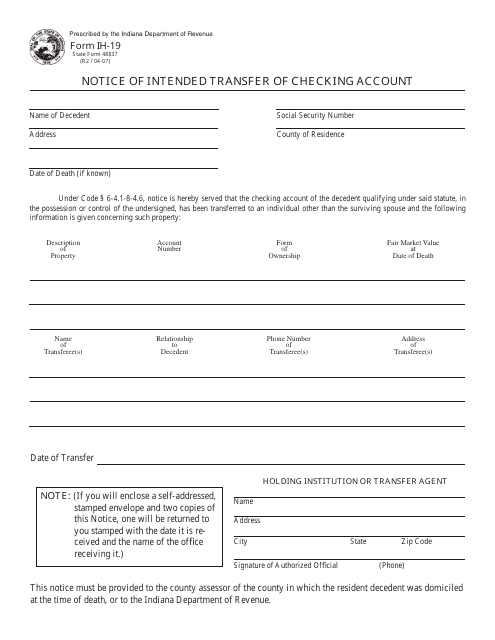

This Form is used for notifying the intended transfer of checking account in Indiana.

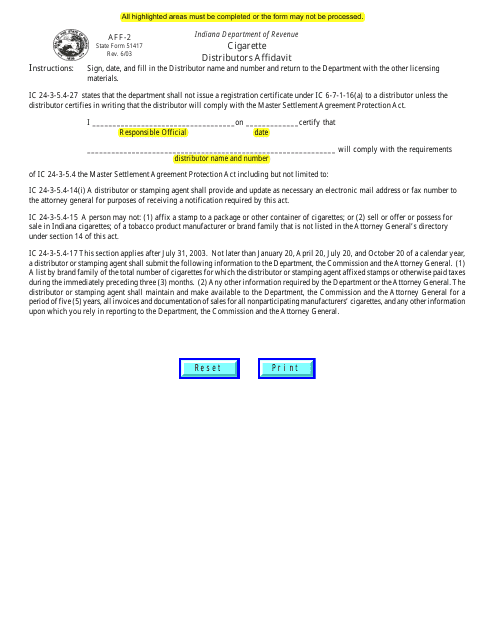

This form is used for cigarette distributors in Indiana to provide an affidavit.

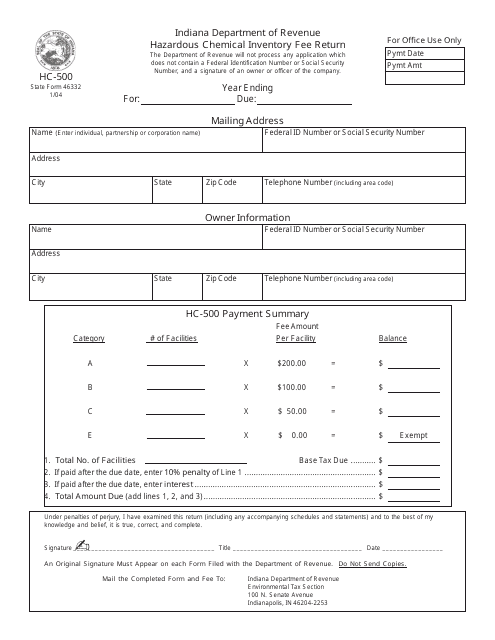

This Form is used for reporting and paying hazardous chemical inventory fees in the state of Indiana.

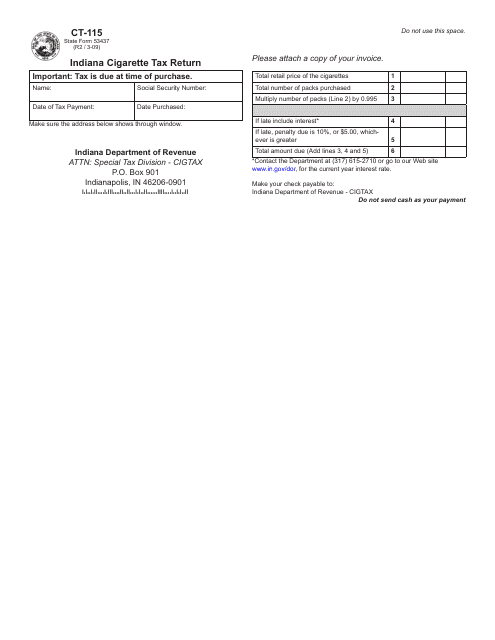

This document is used for filing the Indiana Cigarette Tax Return in Indiana.

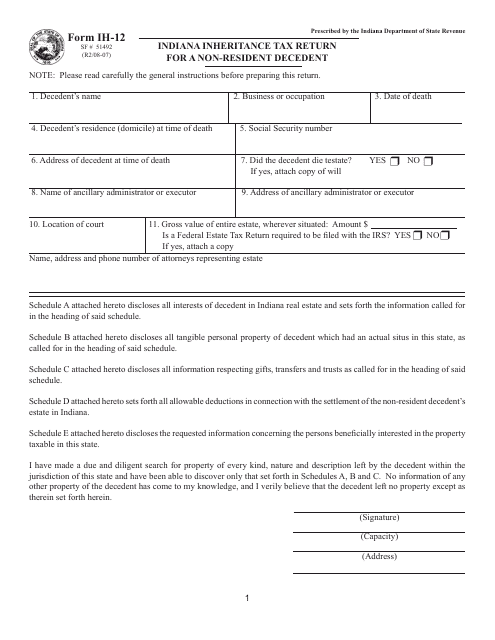

This form is used for filing an Indiana inheritance tax return for a non-resident decedent in Indiana.

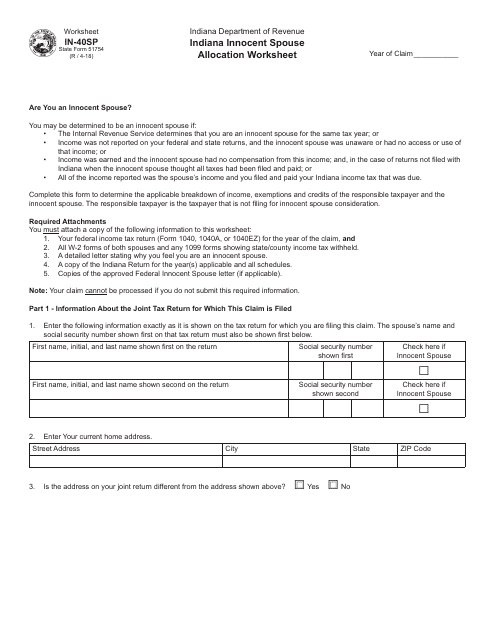

This Form is used for allocating income and tax liabilities between spouses in cases of innocent spouse relief in the state of Indiana.

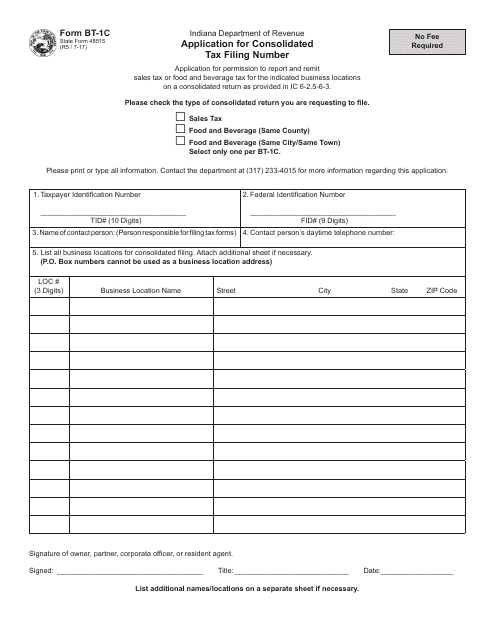

This form is used for applying for a consolidated tax filing number in the state of Indiana.

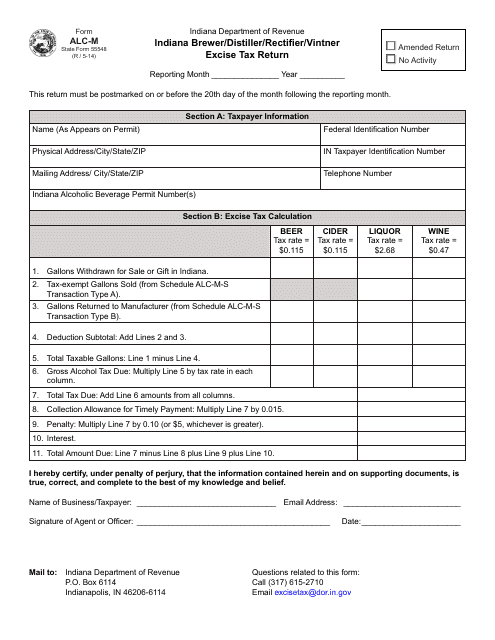

This form is used for Indiana brewers, distillers, rectifiers, and vintners to file their excise tax return.

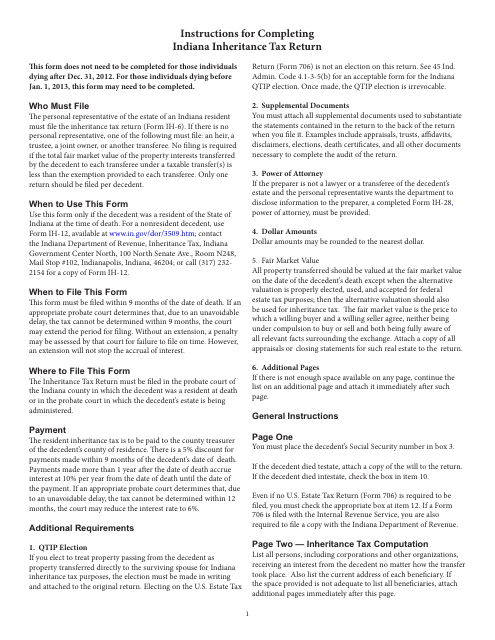

This Form is used for filing an Indiana Inheritance Tax Return in the state of Indiana. It is used to report any inheritance taxes owed on an estate.

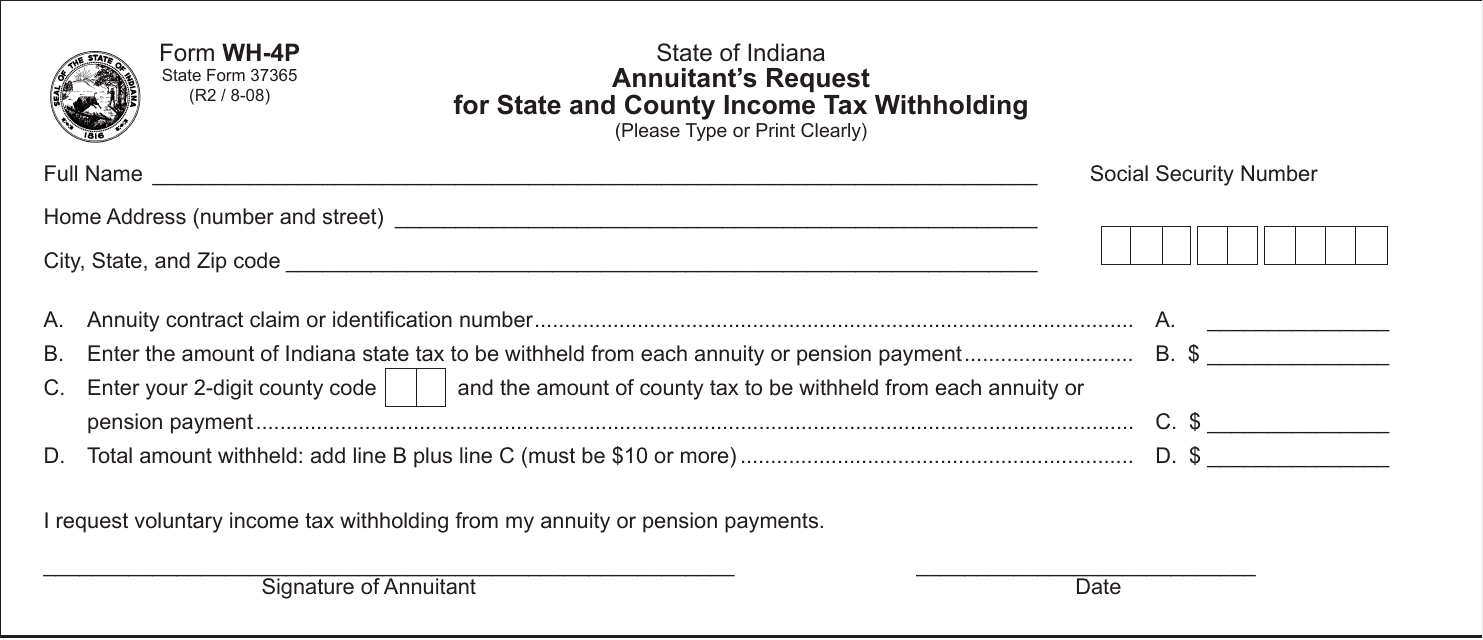

This form is used for annuitants in Indiana to request state and county income tax withholding.

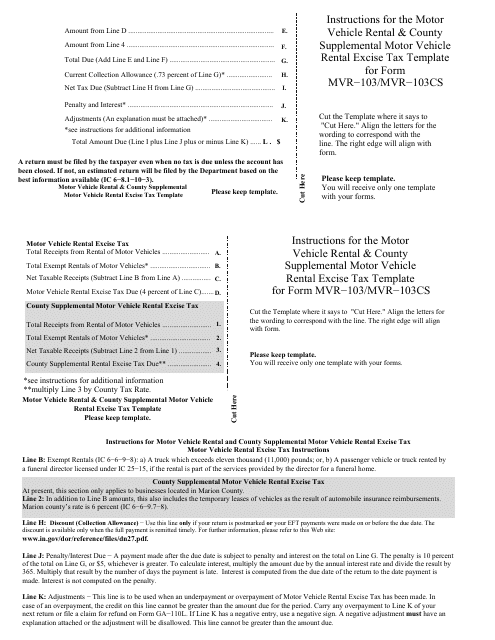

This Form is used for reporting motor vehicle rentals and county supplemental motor vehicle rental excise tax in Indiana.

This form is used for filing Indiana inheritance tax return in the state of Indiana.

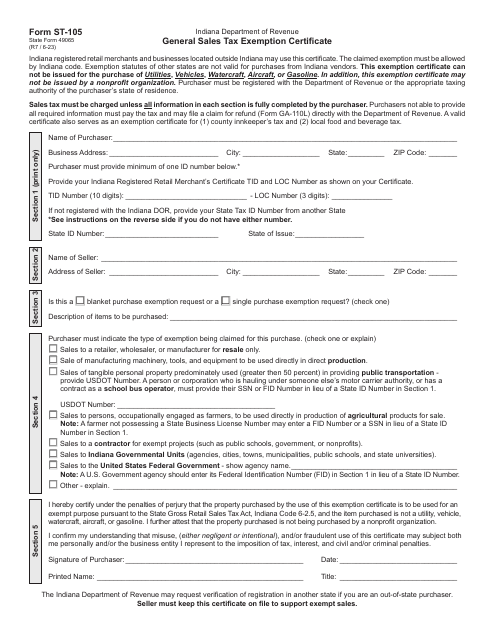

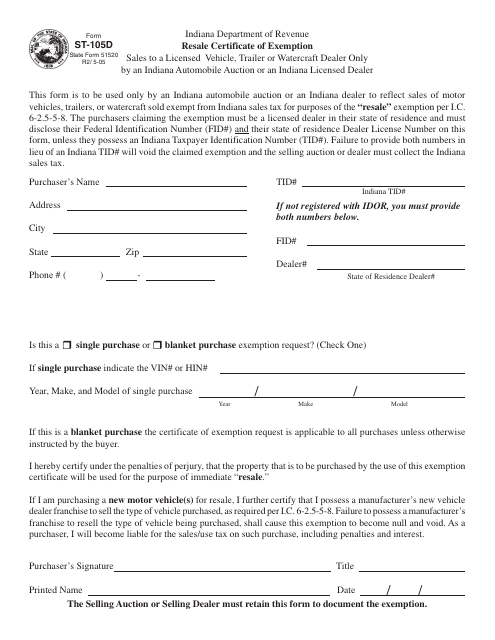

This form is used for claiming a resale exemption in the state of Indiana. It allows businesses to purchase items for resale without paying sales tax.

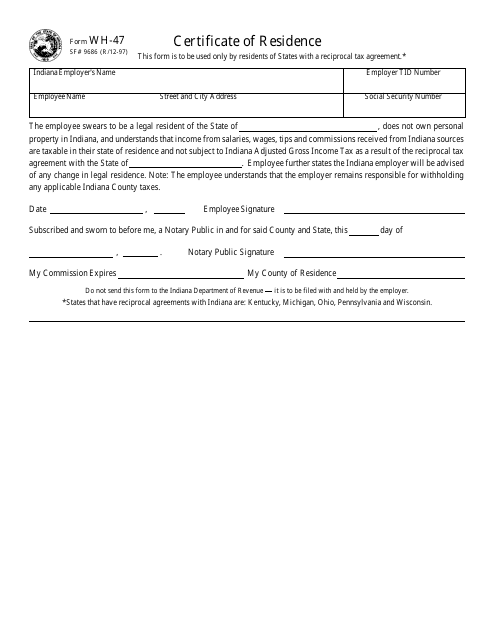

This form is used for obtaining a Certificate of Residence in the state of Indiana. It verifies that an individual is a resident of Indiana for purposes such as tax filings or tuition eligibility.

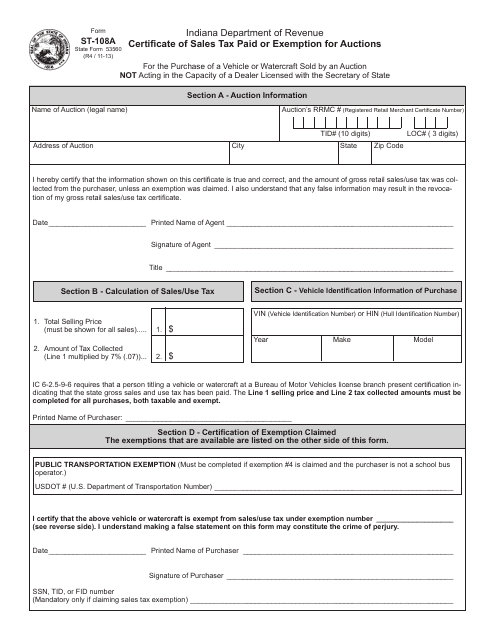

This form is used for reporting sales tax paid or claiming exemption for auctions conducted in the state of Indiana.

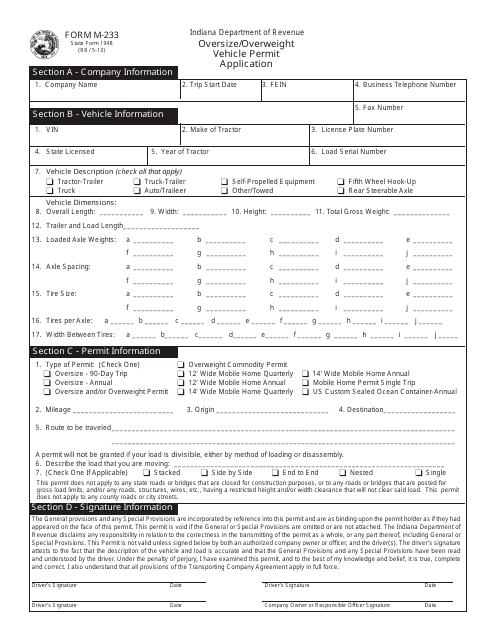

This form is used for applying for an oversize/overweight vehicle permit in Indiana.

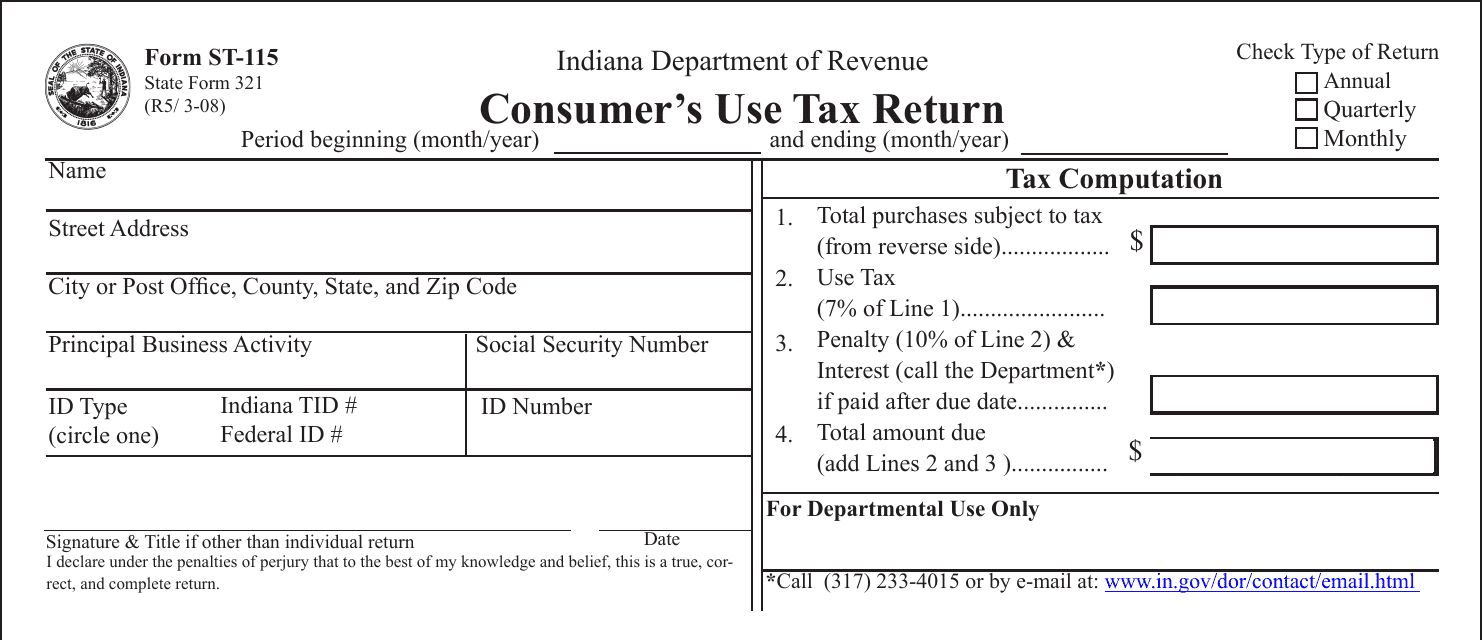

This document is used for reporting and paying consumer's use tax in the state of Indiana. It is required for individuals who have made purchases without paying sales tax and need to remit the use tax owed.

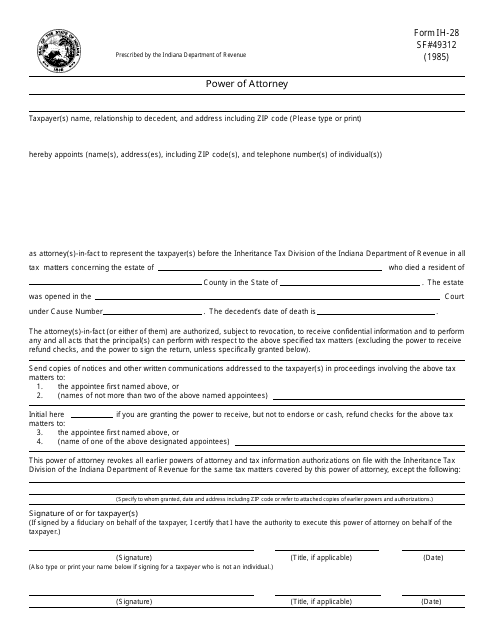

This document allows an individual to grant someone else the authority to make decisions on their behalf in the state of Indiana.

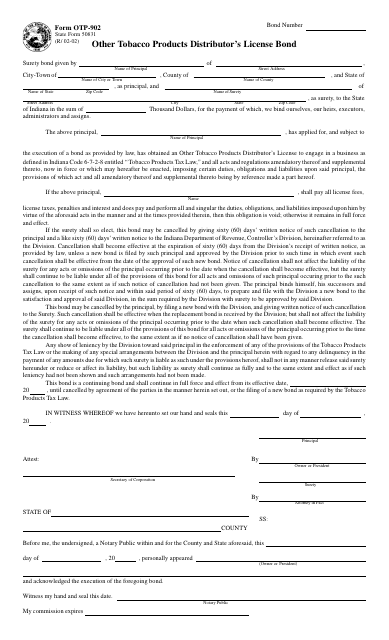

This Form is used for obtaining a distributor's license bond for selling Other Tobacco Products in Indiana.

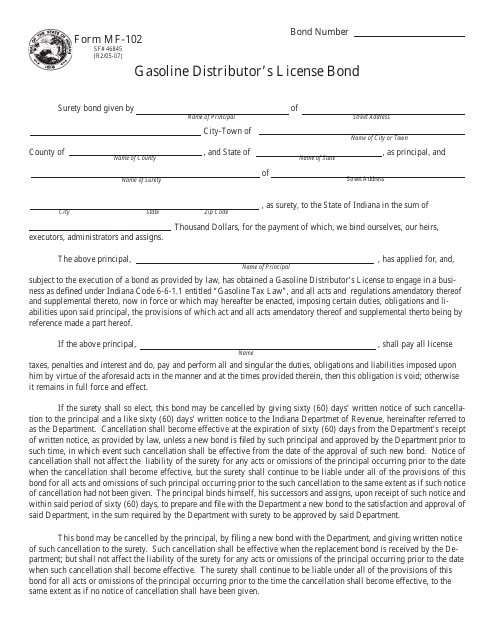

This form is used for obtaining a gasoline distributor's license bond in the state of Indiana.

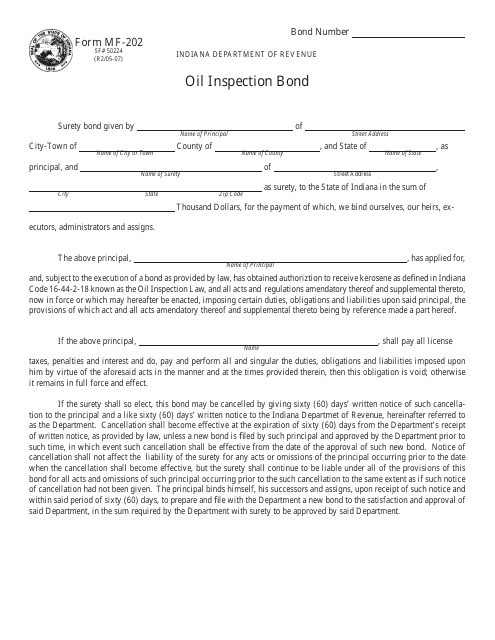

This Form is used for an Oil Inspection Bond required in the state of Indiana.

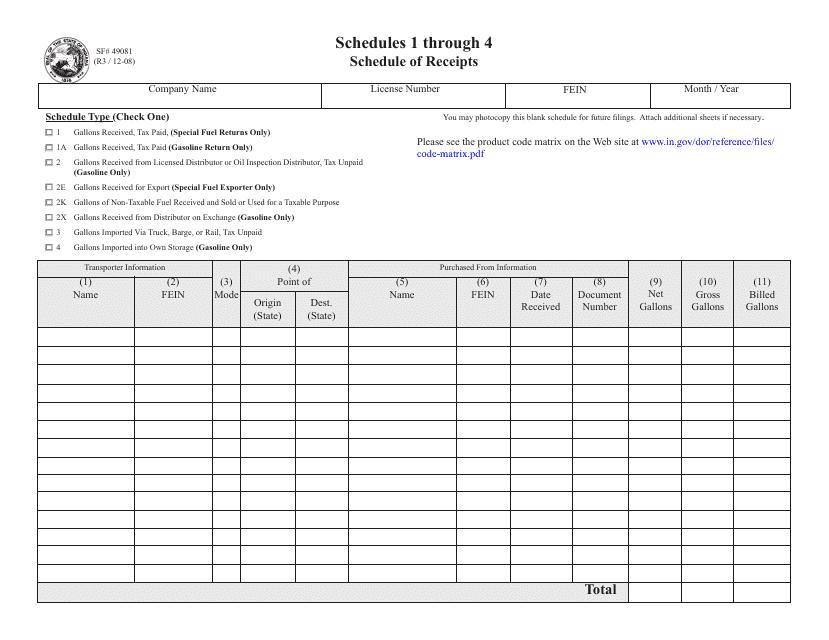

This form is used for reporting the schedule of receipts for the state of Indiana.

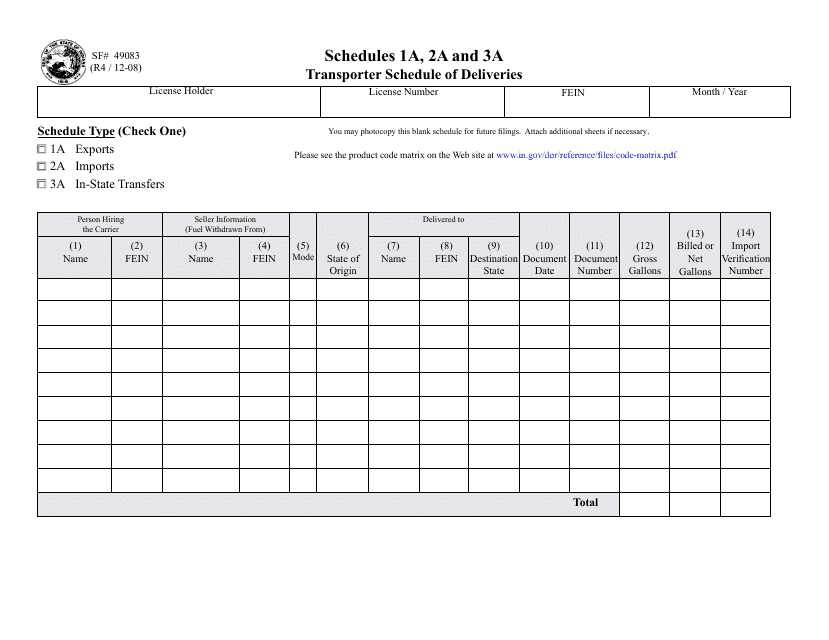

This form is used for reporting the schedule of deliveries for transporters in the state of Indiana.

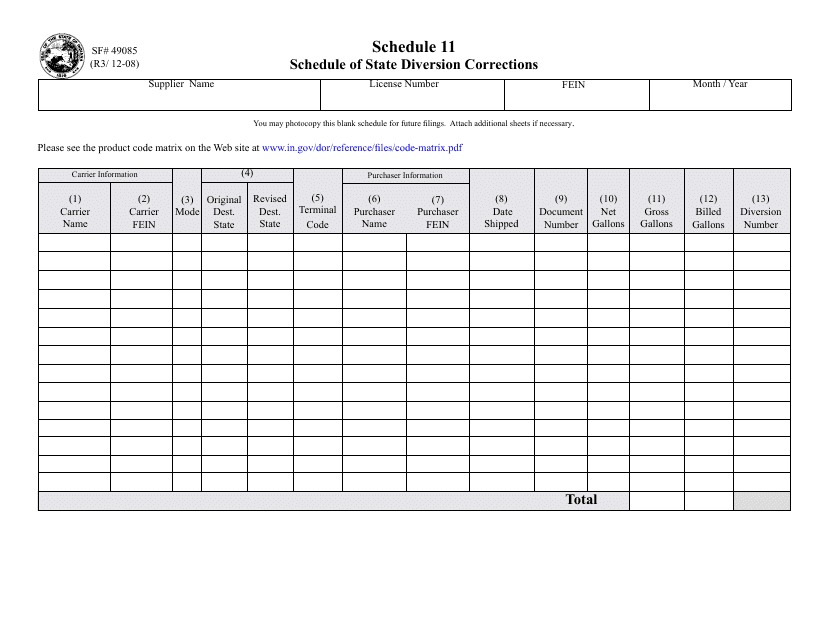

This Form is used for reporting the Schedule of State Diversion Corrections for Indiana. It helps to track and document the diversion programs and corrections activities in the state.

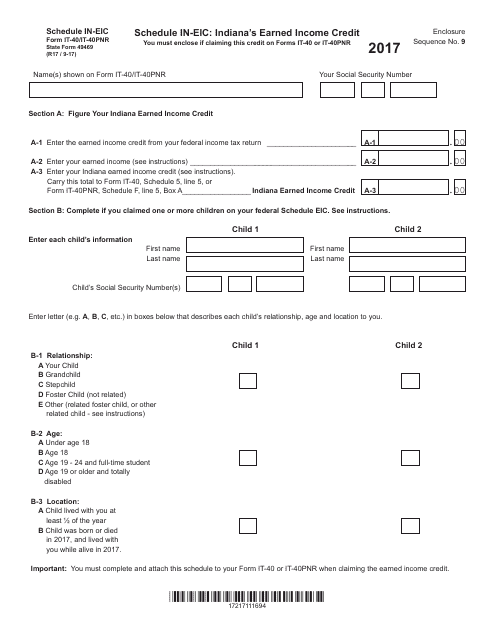

This form is used for claiming Indiana's Earned Income Credit on your state tax return if you are a resident or part-year resident of Indiana.

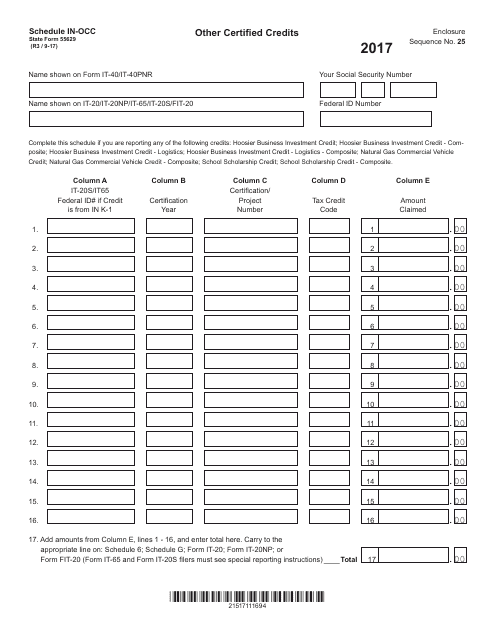

This form is used for reporting and claiming other certified credits in the state of Indiana.

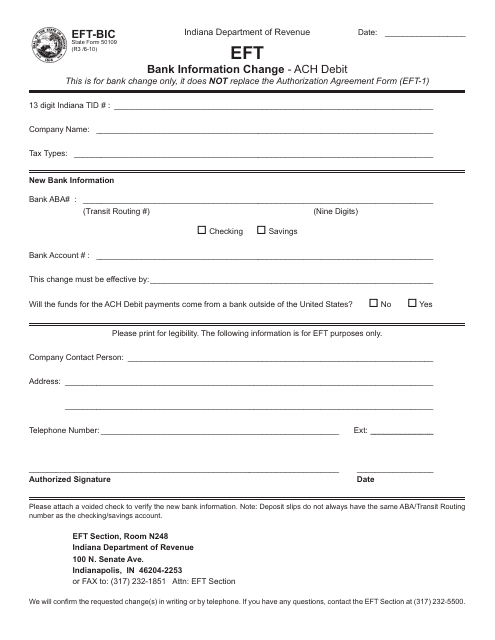

This form is used for changing bank information for ACH debit payments in the state of Indiana.

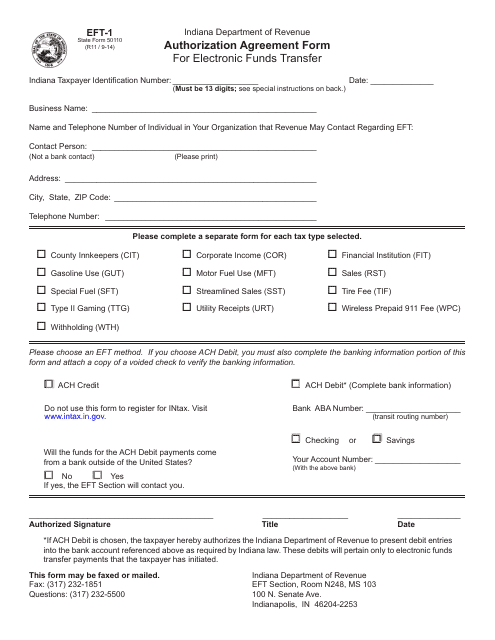

This document is used for authorization agreement for electronic funds transfer in the state of Indiana.