Indiana Department of Revenue Forms

Documents:

736

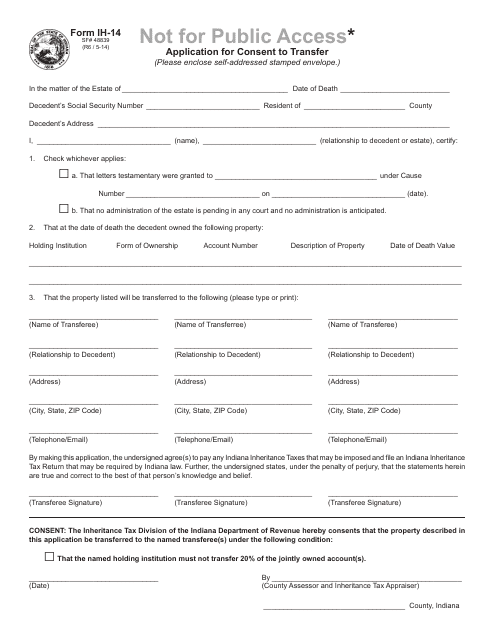

This Form is used for seeking consent to transfer property in the state of Indiana. It is specifically designed for submitting an application for consent to transfer.

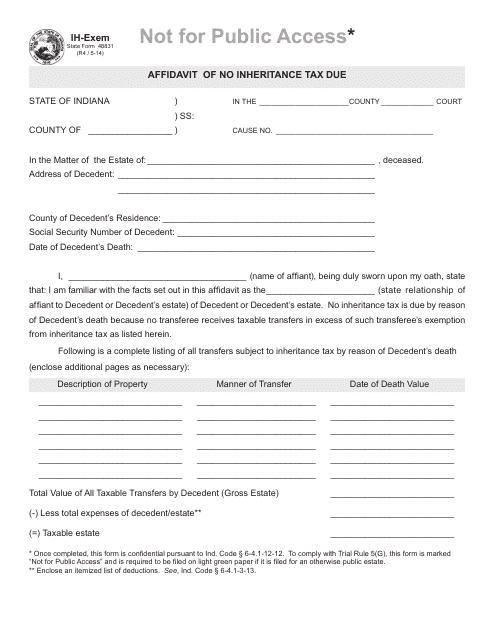

This form is used for declaring that no inheritance tax is due in the state of Indiana. It is an affidavit that must be filled out and submitted to the appropriate authorities.

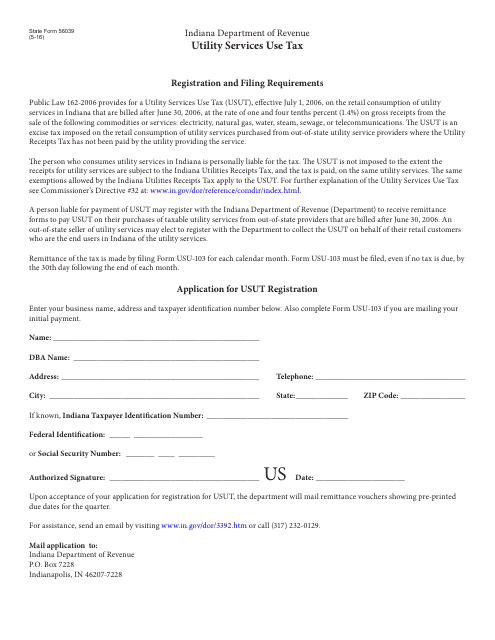

This form is used for registering for Utility Services Use Tax (USUT) in the state of Indiana.

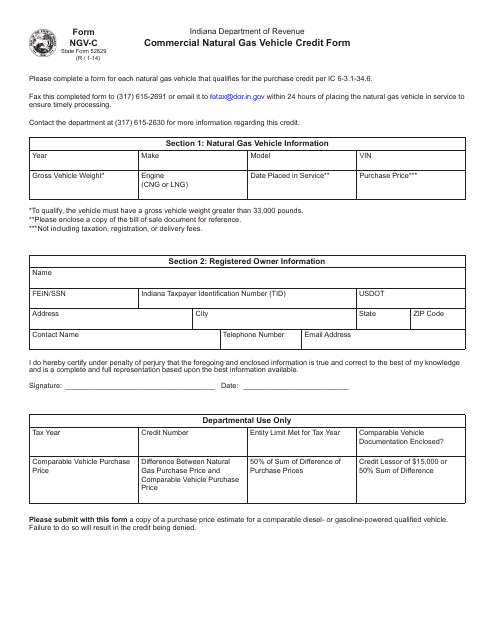

This form is used for claiming a commercial natural gas vehicle credit in Indiana. It allows businesses to receive a credit for purchasing or converting vehicles to run on natural gas.

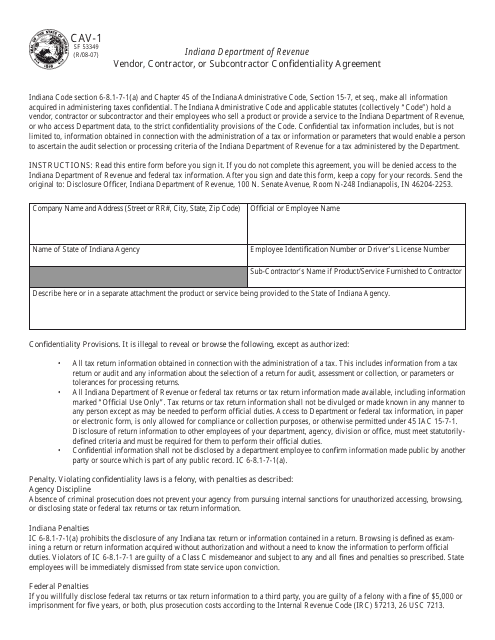

This Form is used for a Vendor, Contractor, or Subcontractor Confidentiality Agreement in the state of Indiana.

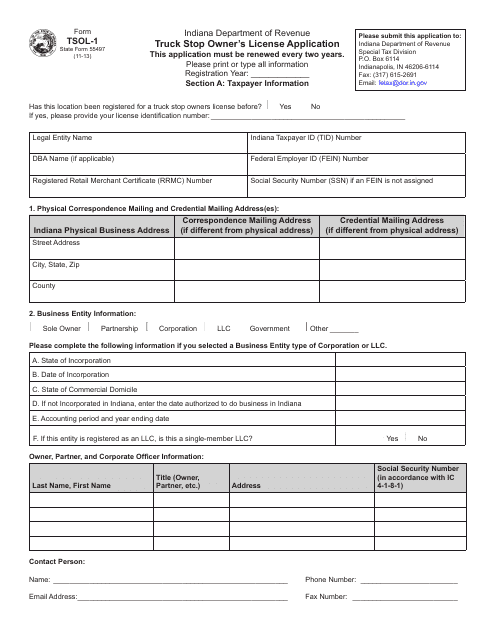

This Form is used for applying for a Truck Stop Owner's License in Indiana.

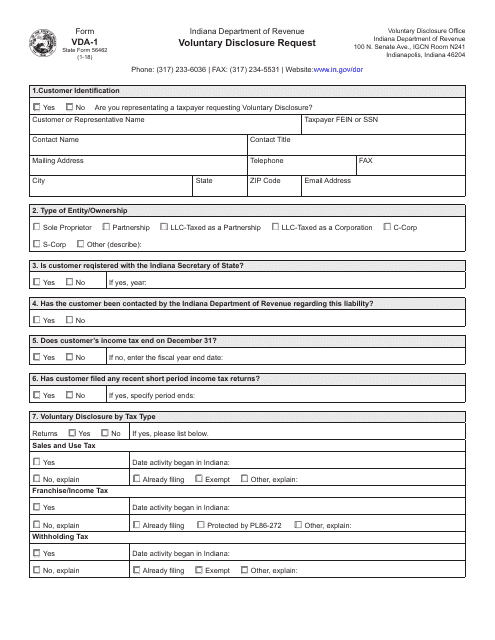

This form is used for requesting a voluntary disclosure in Indiana. It is known as the State Form 56462 (VDA-1) and is used to report any undisclosed tax liabilities.

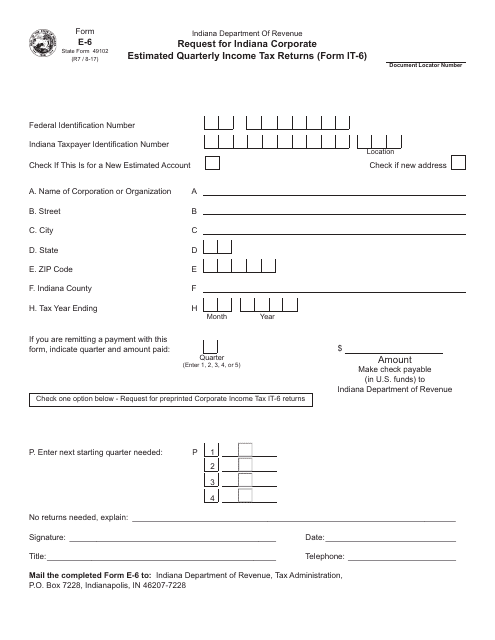

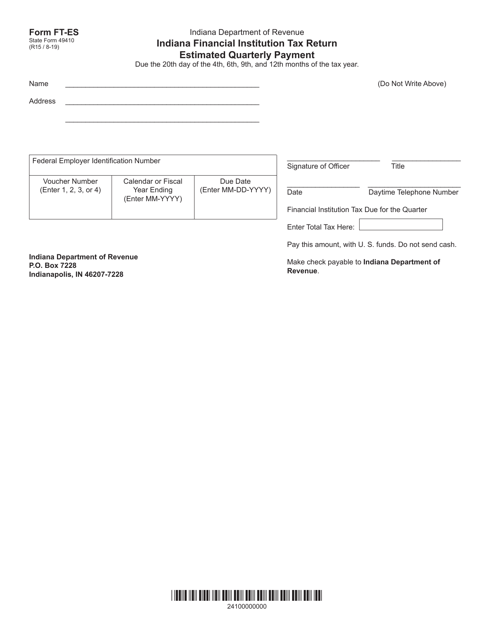

This form is used for requesting Indiana corporate estimated quarterly income tax returns.

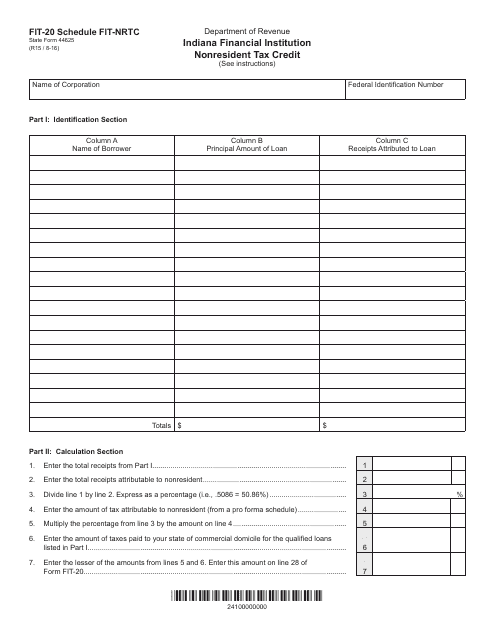

This Form is used for claiming the Indiana Financial Institution Nonresident Tax Credit for nonresident businesses in Indiana.

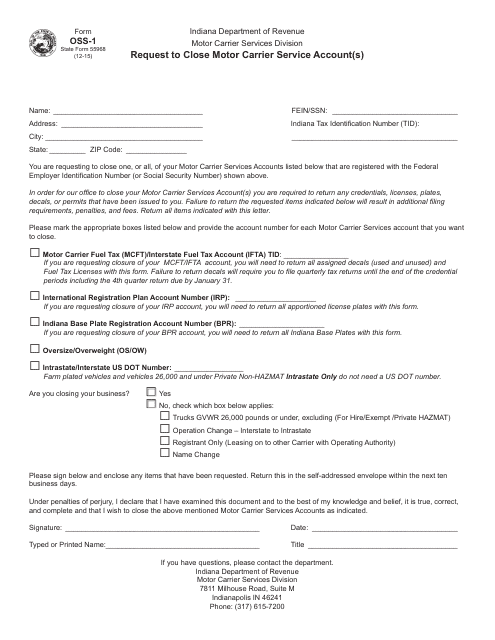

This Form is used for requesting the closure of motor carrier service account(s) in the state of Indiana.

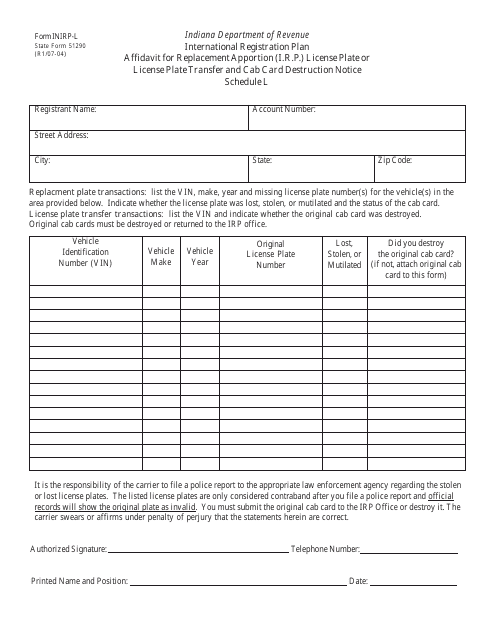

This form is used for filing an affidavit for replacement apportion license plate or license plate transfer. It also includes a notice of cab card destruction for the International Registration Plan (IRP) in Indiana.

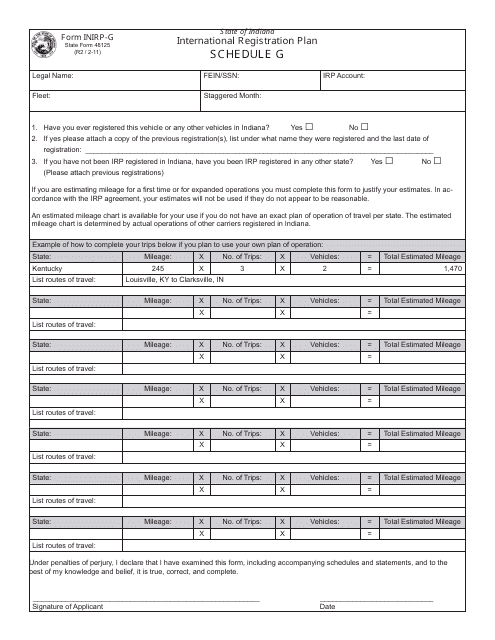

This Form is used for Indiana residents applying for international registration of commercial vehicles. It includes estimated miles and first year applicants.

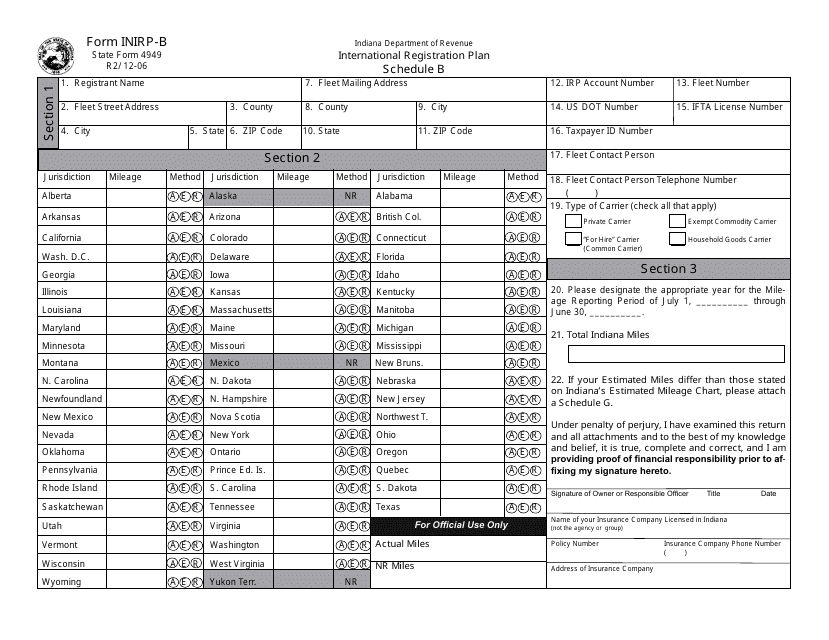

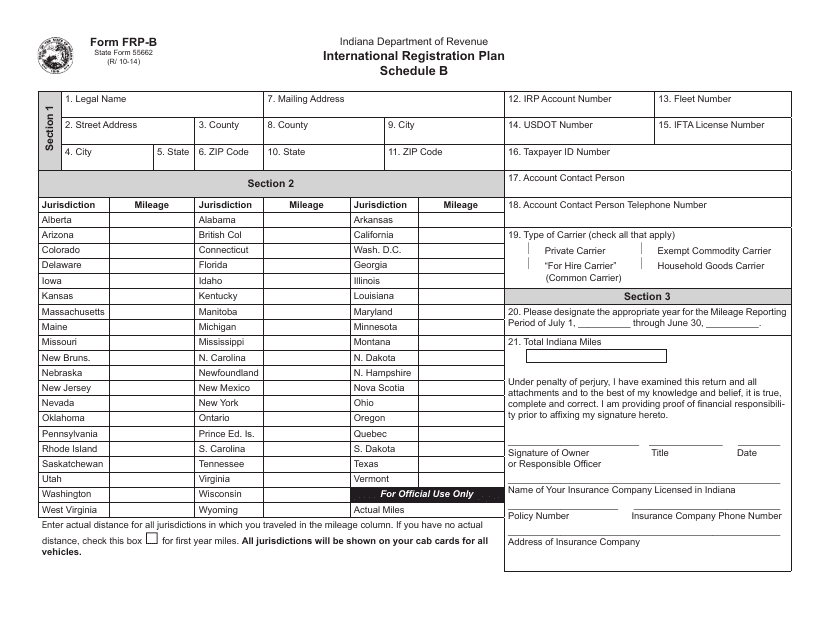

This document is a state form used for filing Schedule B International Registration Plan with the Indiana Department of Revenue. It is part of the INIRP-B form series.

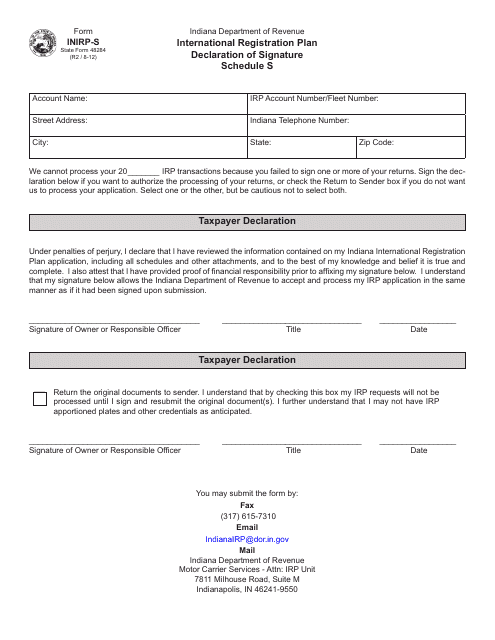

This document is used for declaring your signature on the Schedule S International Registration Plan for vehicle registration in Indiana.

This Form is used for international registration of commercial vehicles in Indiana under the International Registration Plan.

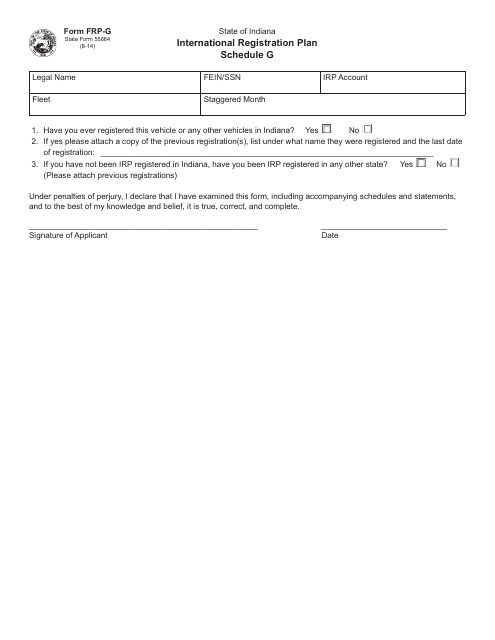

This form is used for the International Registration Plan in Indiana. It is specifically for Schedule G related to the Financial Responsibility Plan.

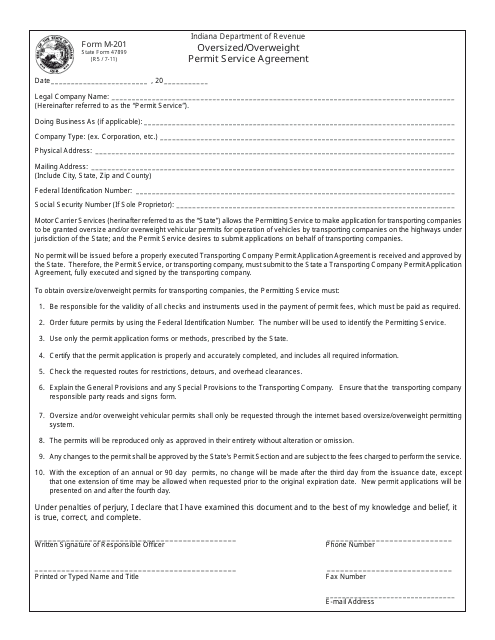

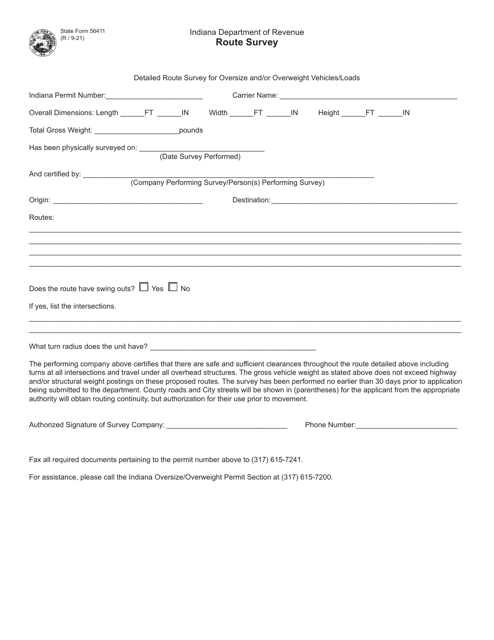

This Form is used for obtaining an Oversized/Overweight Permit Service Agreement in the state of Indiana.

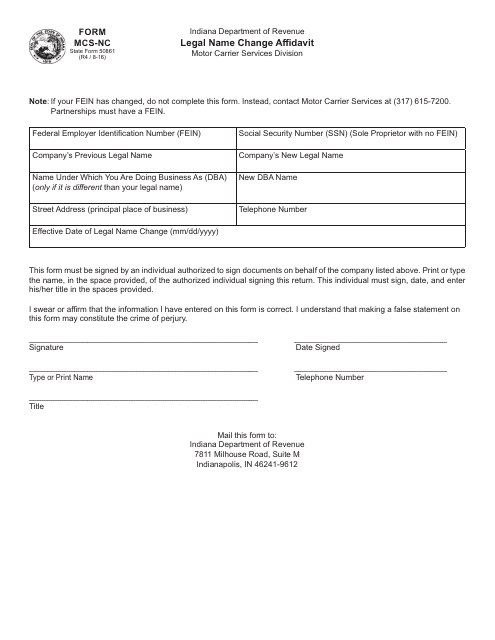

This document for legally changing your name in Indiana.

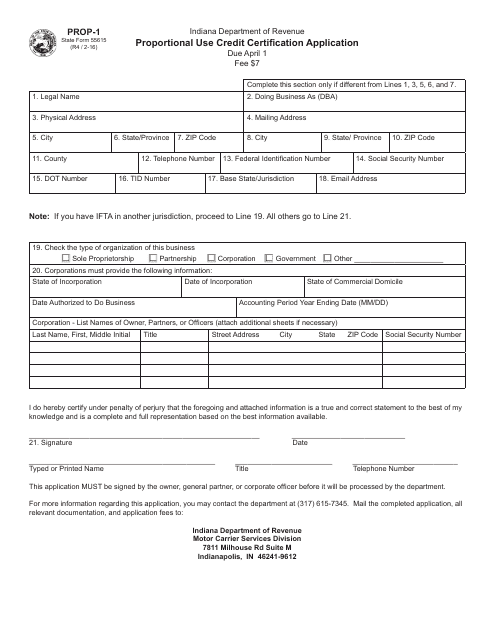

This form is used for applying for the Proportional Use Credit Certification in the state of Indiana. It is used to claim a credit for taxes paid on property in another jurisdiction.

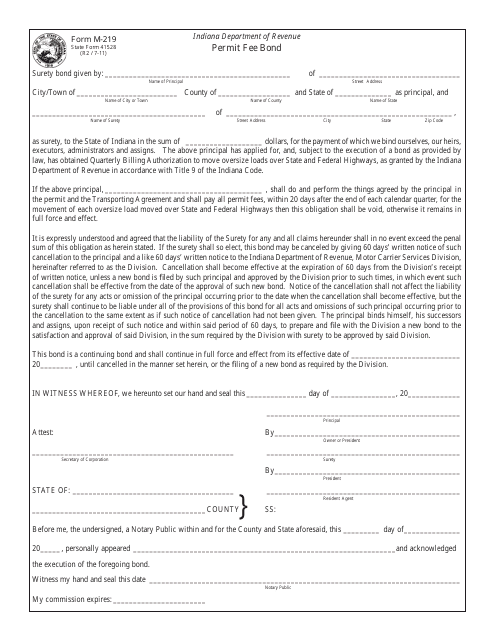

This form is used for obtaining a permit fee bond in Indiana.

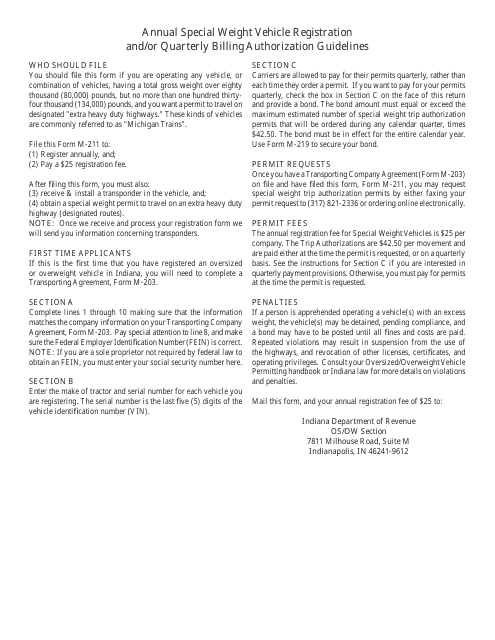

This Form is used for registering and authorizing annual special weight vehicles and quarterly billing in the state of Indiana.

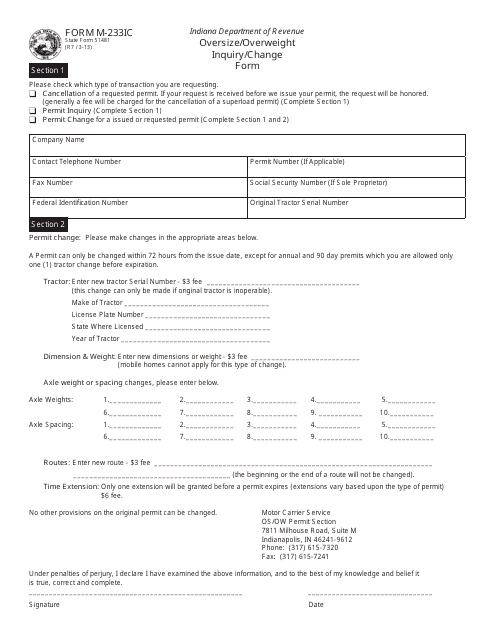

This form is used for submitting an inquiry or making changes related to oversize or overweight vehicles in the state of Indiana.

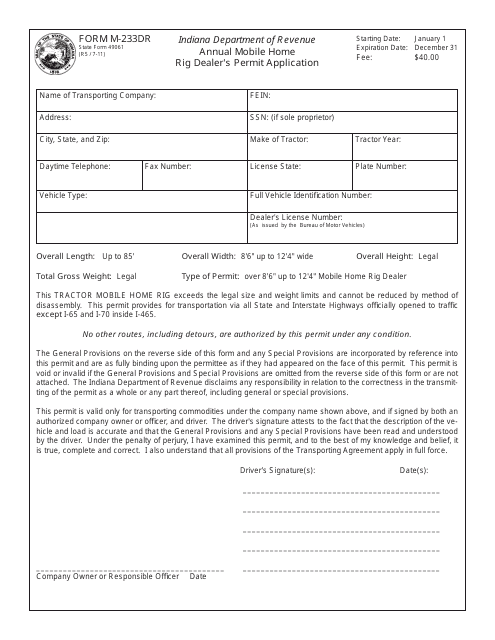

This Form is used for applying for an Annual Mobile Home Rig Dealer's Permit in Indiana. It is required for dealers who sell mobile homes.

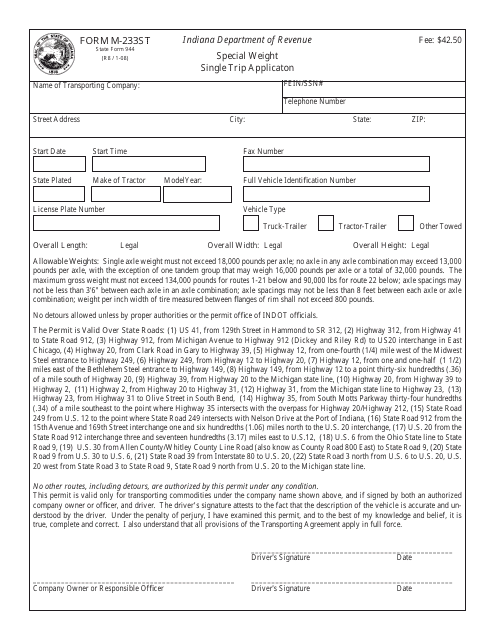

This document is used for applying for a special weight single trip permit in the state of Indiana.

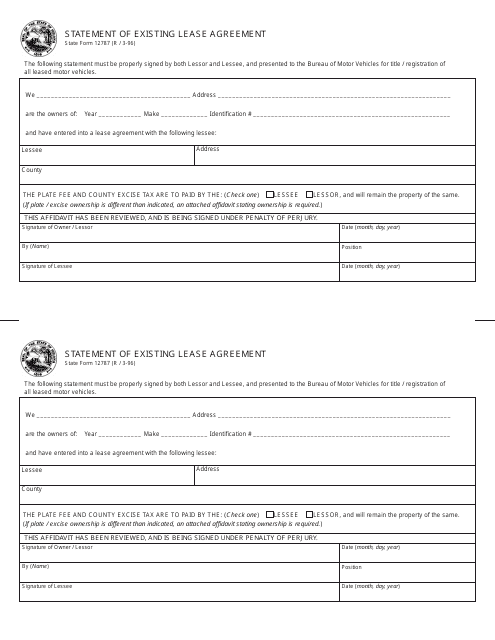

This Form is used for documenting and providing information about an existing lease agreement in the state of Indiana. It is typically used when there is a need to update or verify lease details.

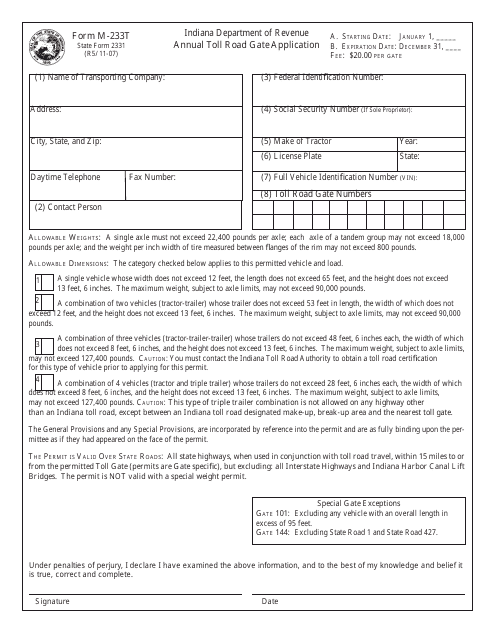

This form is used for applying for an annual toll road gate permit in the state of Indiana.

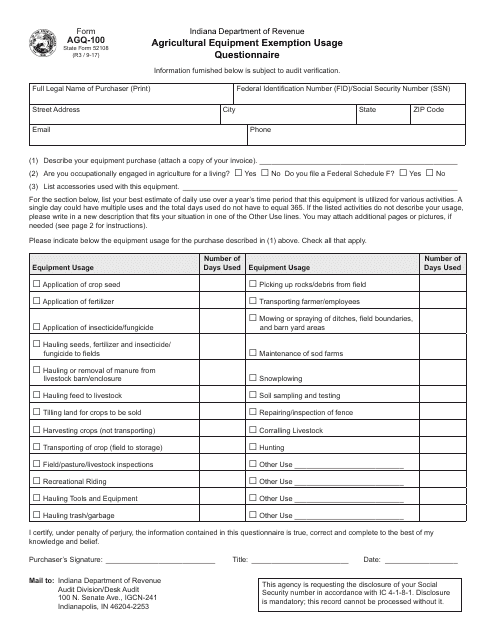

This form is used for an agricultural equipment exemption usage questionnaire in the state of Indiana.

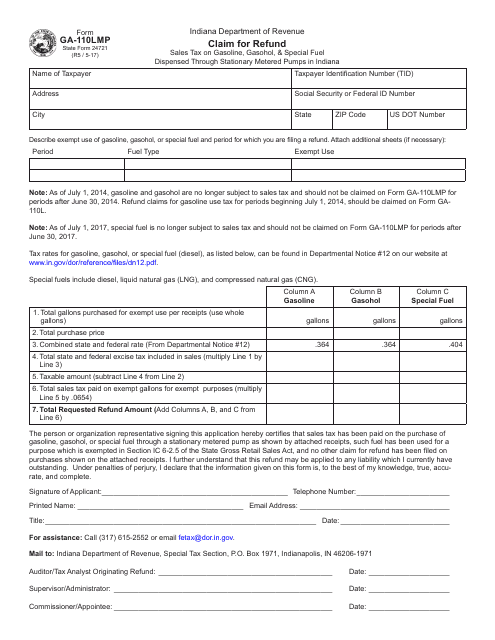

This Form is used for claiming a refund on sales tax paid for gasoline, gasohol, and special fuel dispensed through stationary metered pumps in Indiana.

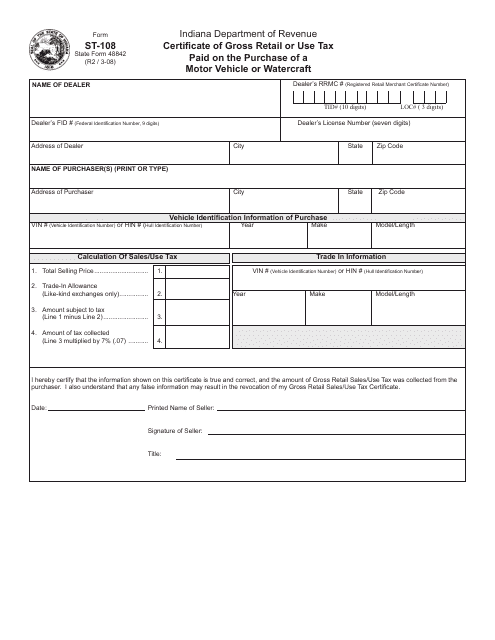

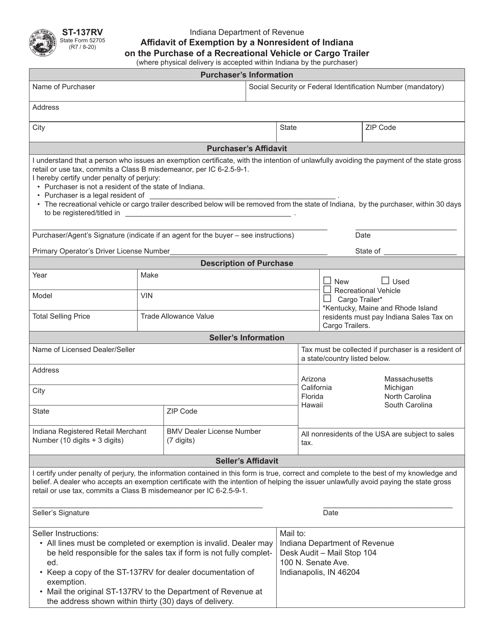

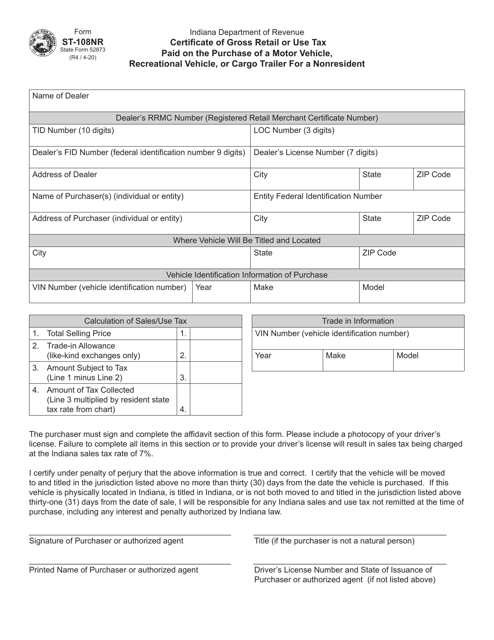

This is a formal document Indiana vehicle dealers must file to the authorities to confirm the state sales and use tax was paid during the transaction that involves a vehicle or vessel.

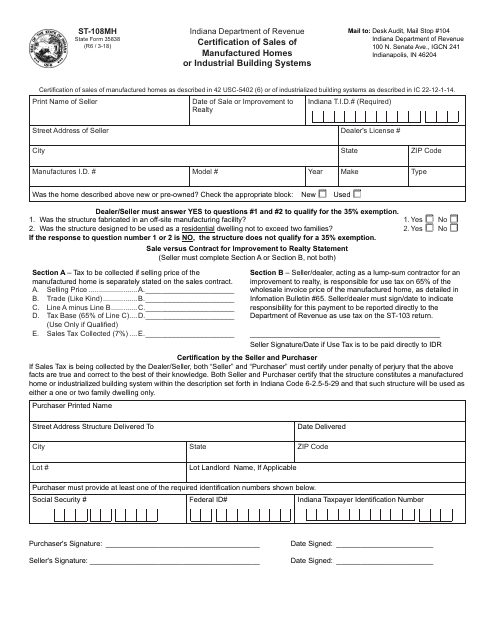

This form is used for certifying the sales of manufactured homes or industrial building systems in the state of Indiana.

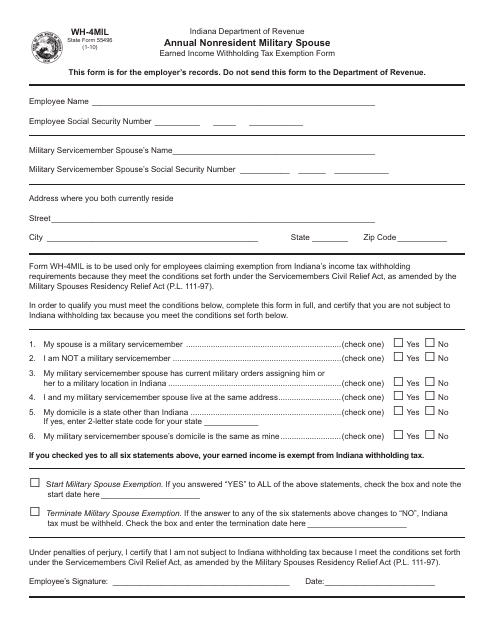

This Form is used for claiming an annual income withholding tax exemption for nonresident military spouses in Indiana.