Indiana Department of Revenue Forms

Documents:

736

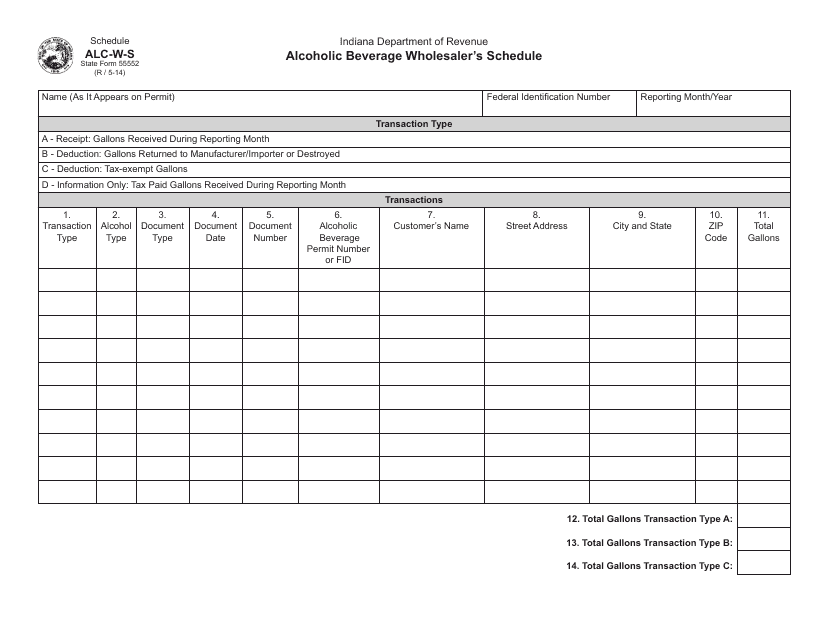

This form is used by alcoholic beverage wholesalers in Indiana to complete a schedule for reporting their sales and purchases.

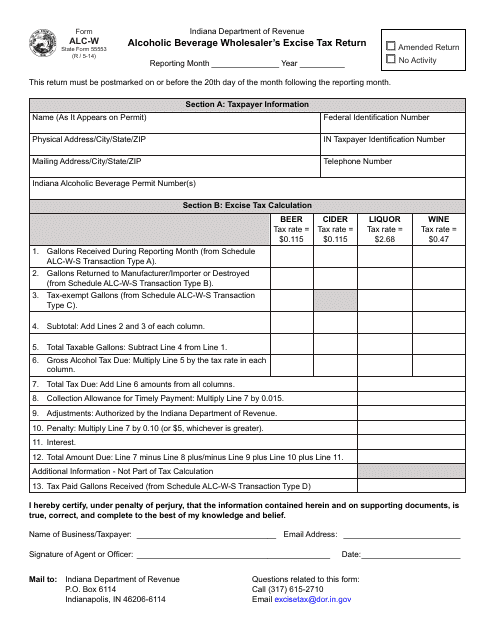

This form is used for Indiana alcoholic beverage wholesalers to file their excise tax return.

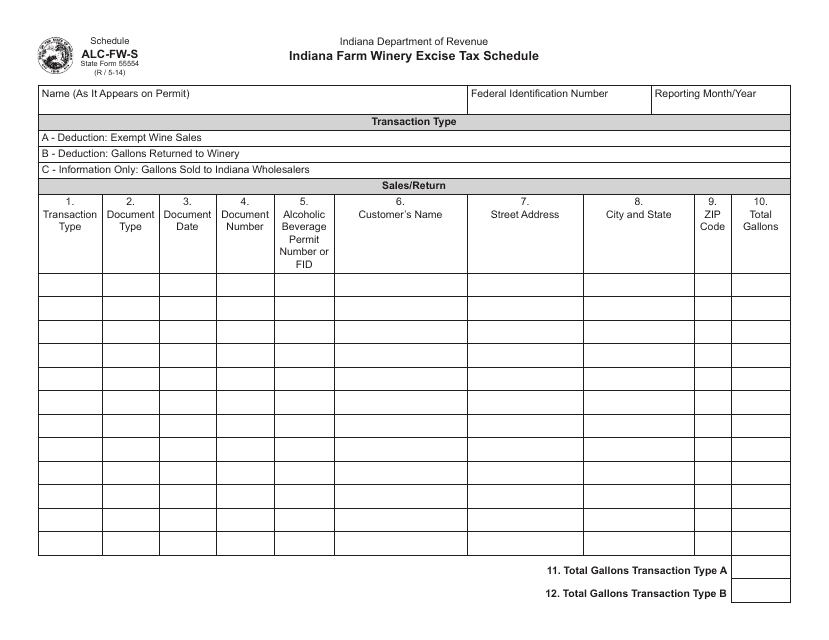

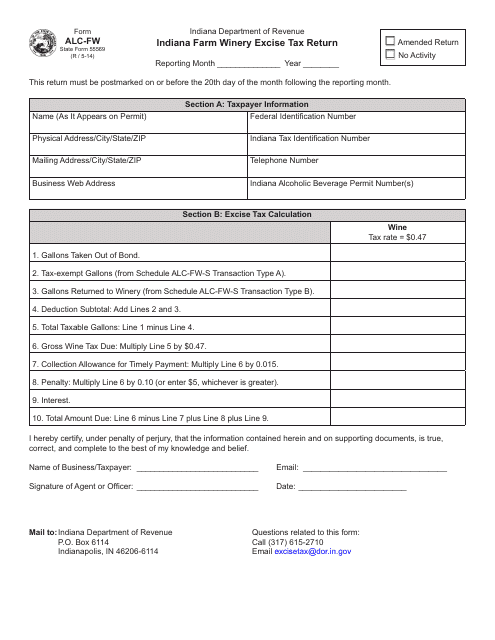

This document is used for reporting and paying excise taxes for farm wineries in Indiana.

This form is used for Indiana Farm Winery Excise Tax Return in the state of Indiana.

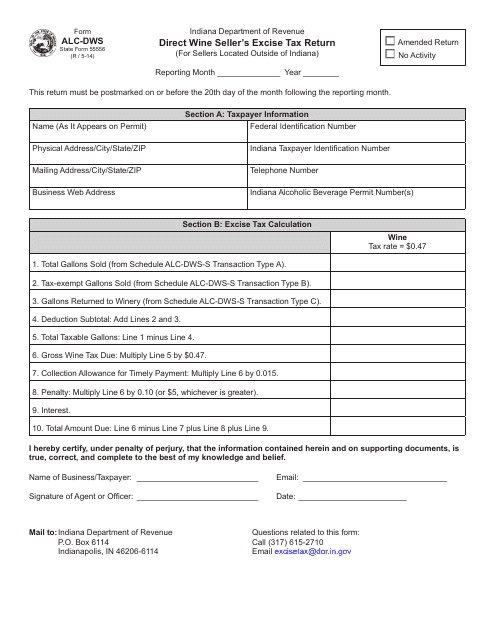

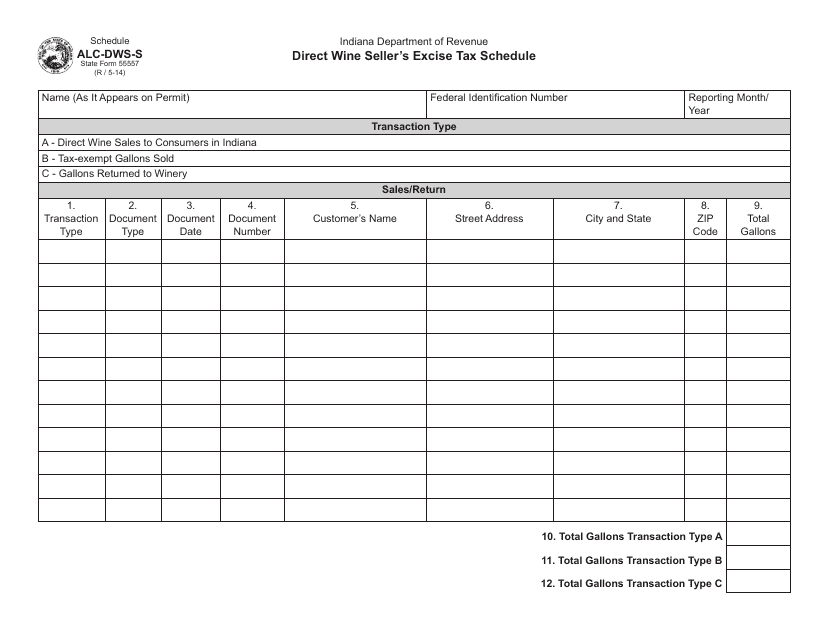

This form is used for monthly excise tax return for out-of-state direct wine sellers in Indiana.

This document is used for reporting and paying excise tax on direct wine sales in Indiana by wine sellers.

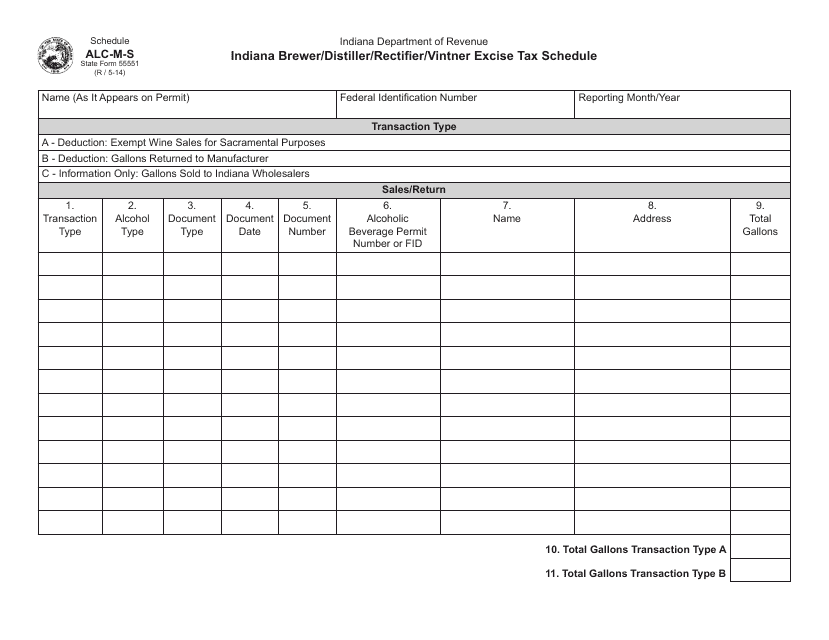

This document is a tax form used by brewers, distillers, rectifiers, and vintners in Indiana to report and pay excise taxes.

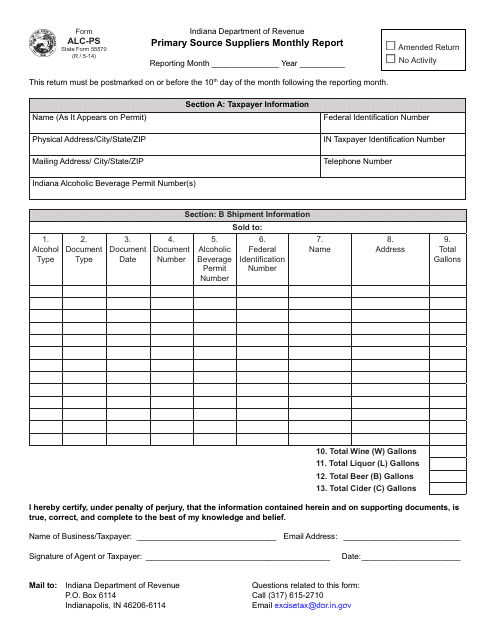

This form is used for primary source suppliers in Indiana to submit their monthly report to the state.

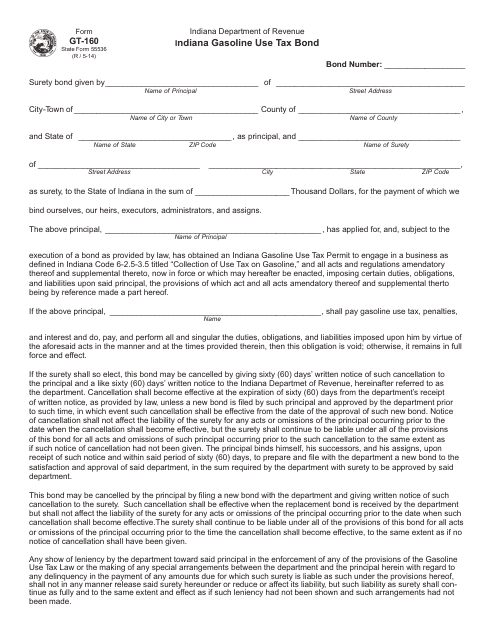

This form is used for obtaining a gasoline use tax bond in the state of Indiana. The bond is required for businesses that sell or distribute gasoline in Indiana.

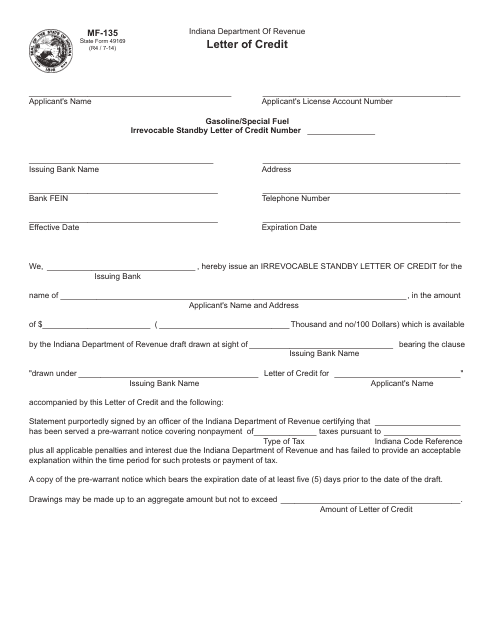

This Form is used for creating an Irrevocable Standby Letter of Credit in Indiana.

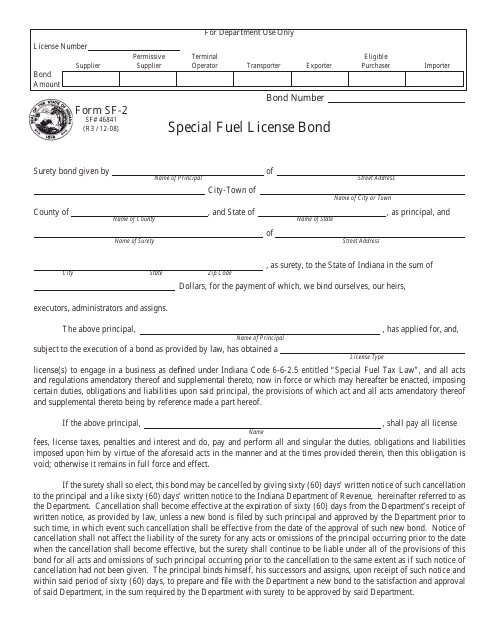

This form is used for obtaining a special fuel license bond in Indiana.

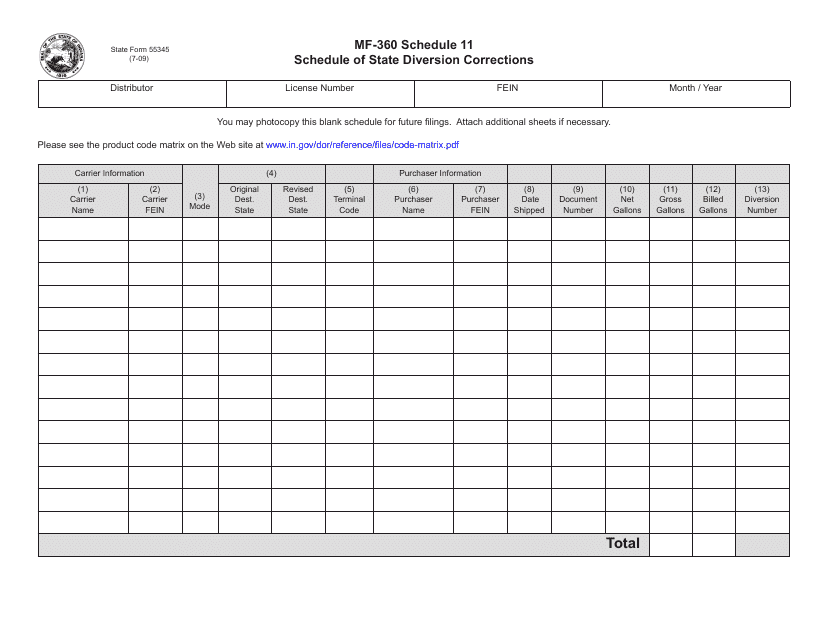

This form is used for documenting the schedule of state diversion corrections in Indiana.

This form is used for explaining the adjustments made on Schedule E-1 in the state of Indiana.

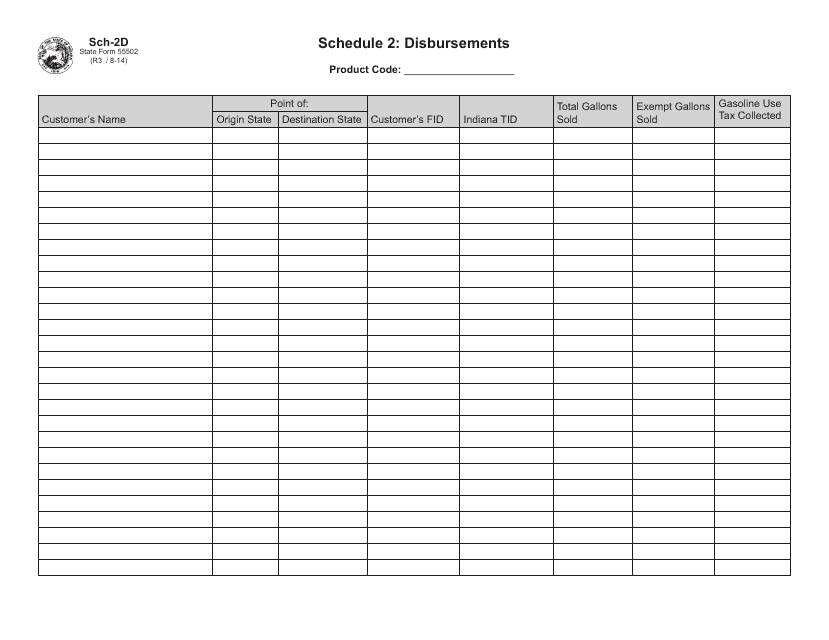

This Form is used for reporting the schedule of disbursements in the state of Indiana.

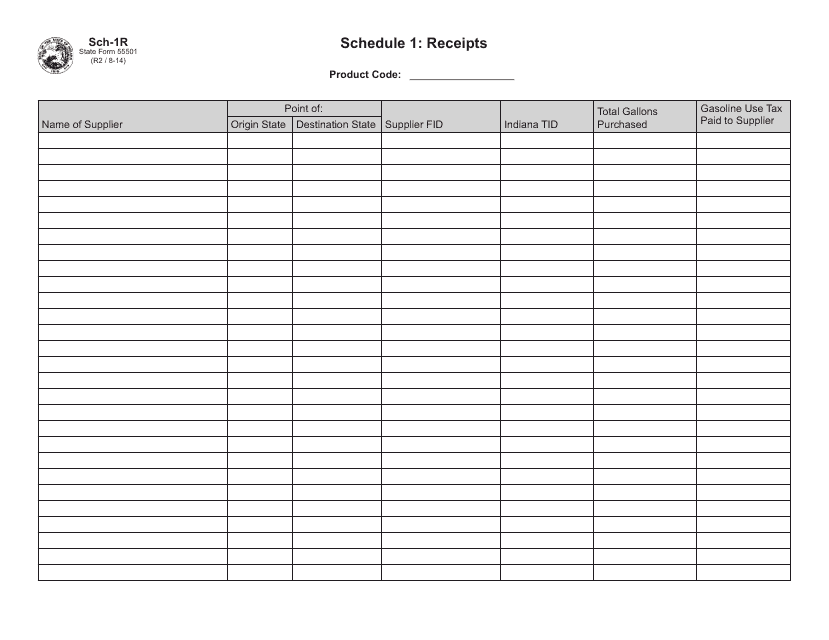

This document is used for reporting and tracking the receipts in the state of Indiana.

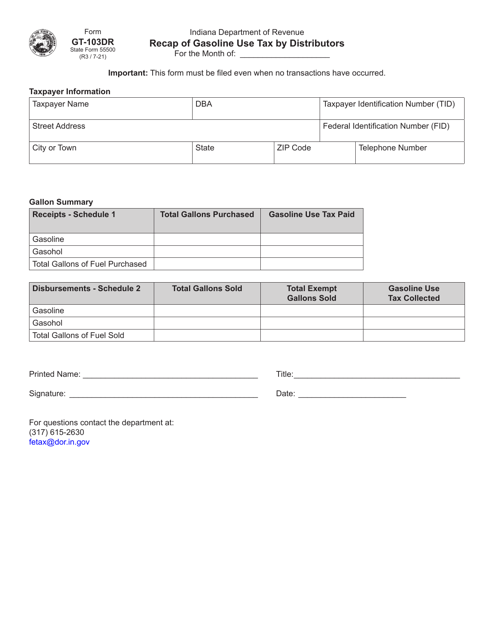

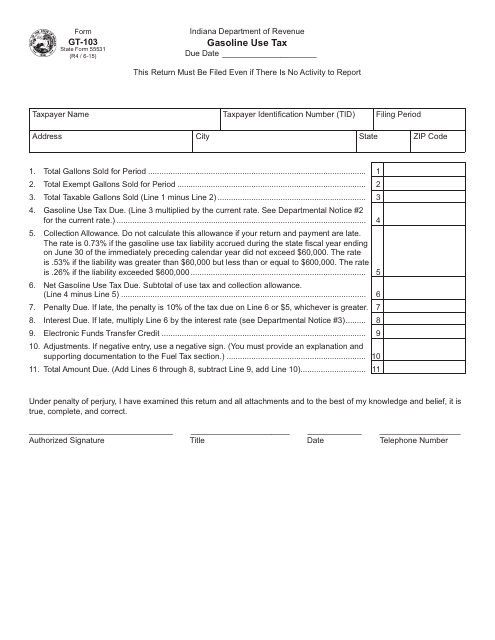

This Form is used for reporting and paying gasoline use tax in the state of Indiana. The form is also known as State Form 55531.

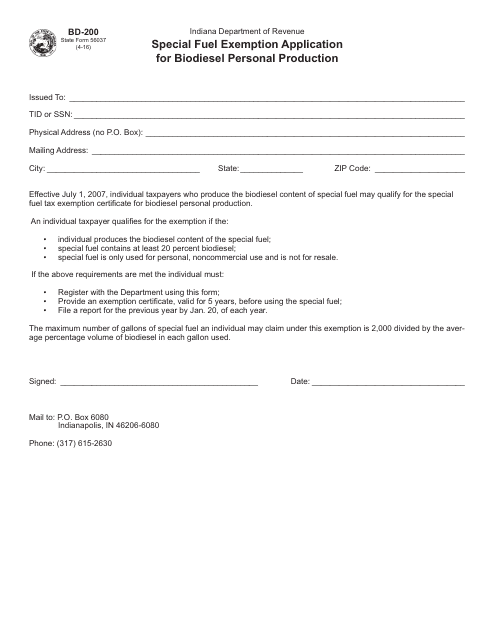

This form is used for applying for a special fuel exemption for biodiesel personal production in Indiana.

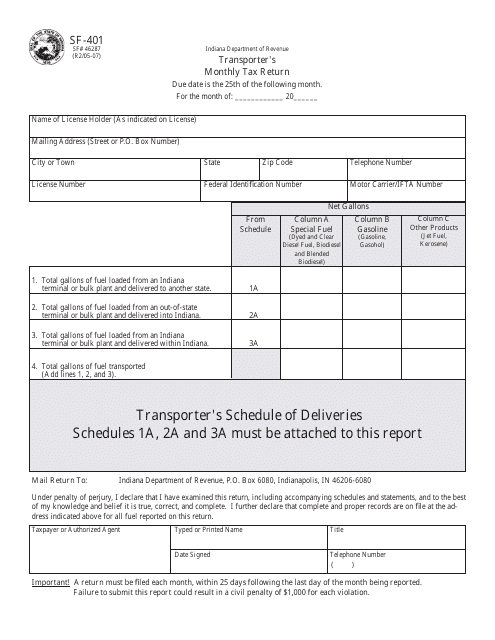

This document is used for reporting and submitting monthly taxes for transporters in the state of Indiana.

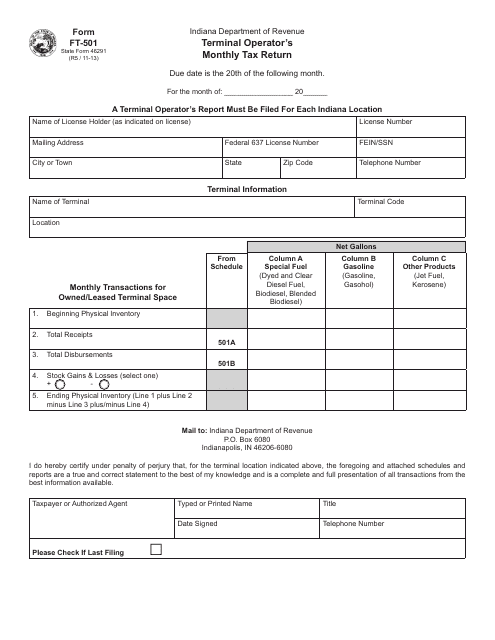

This form is used for terminal operators in Indiana to report their monthly activities.

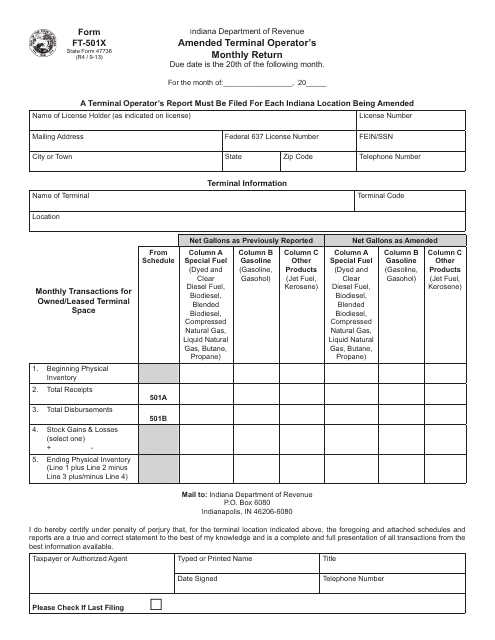

This form is used for filing an amended monthly return for terminal operators in Indiana.

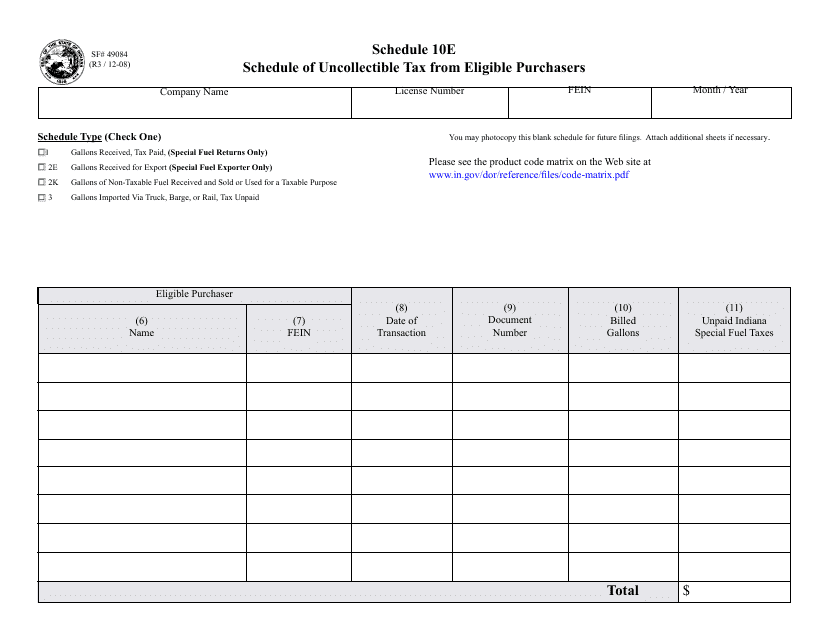

This Form is used for reporting tax uncollectable amounts from eligible purchasers in Indiana.

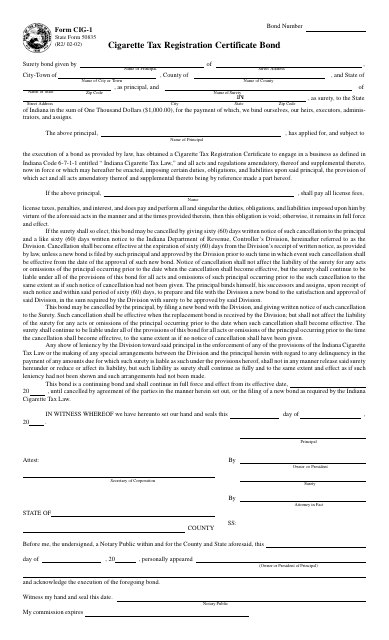

This form is used for obtaining a cigarette tax registration certificate bond in the state of Indiana.

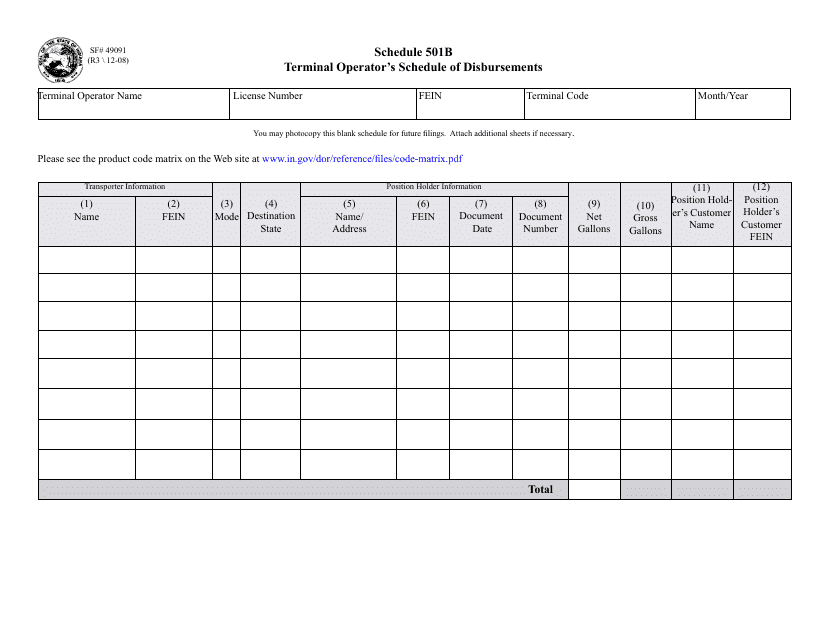

This Form is used for Terminal Operators in Indiana to report their schedule of disbursements.

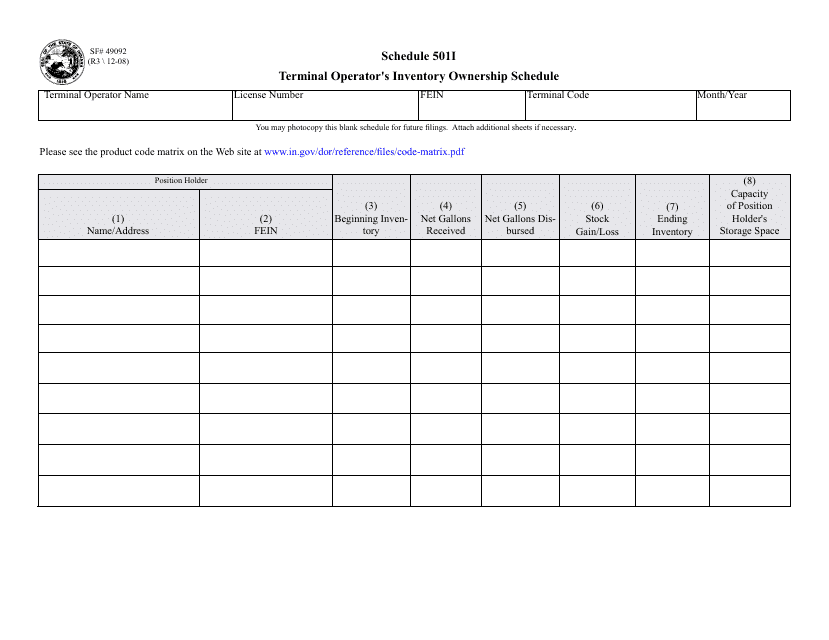

This Form is used for Terminal Operators in Indiana to report their inventory ownership.