Wisconsin Department of Revenue Forms

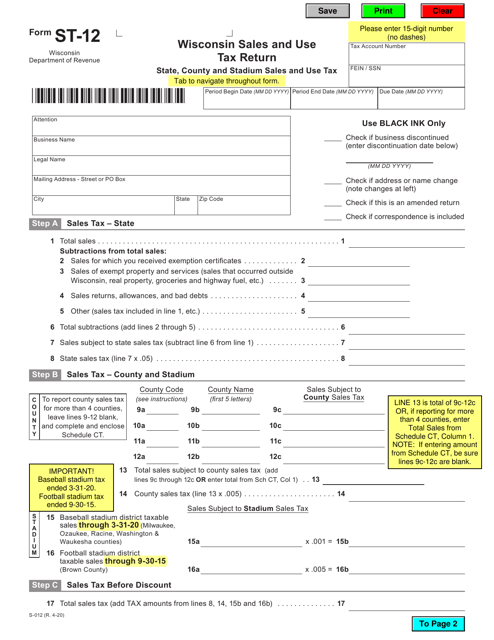

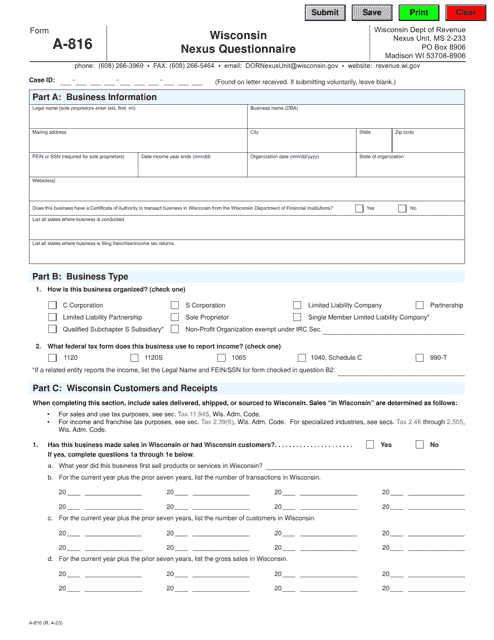

The Wisconsin Department of Revenue is responsible for administering and enforcing the tax laws of the state of Wisconsin. Their main role is to collect tax revenue, including income tax, sales tax, property tax, and other taxes and fees. They also provide taxpayer assistance and guidance, process tax returns, conduct audits, and administer various tax credits and exemptions.

Documents:

1007

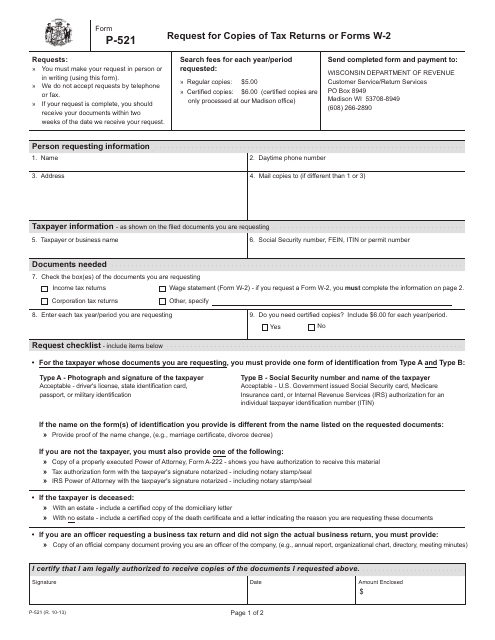

This Form is used for requesting copies of tax returns or Forms W-2 in the state of Wisconsin.

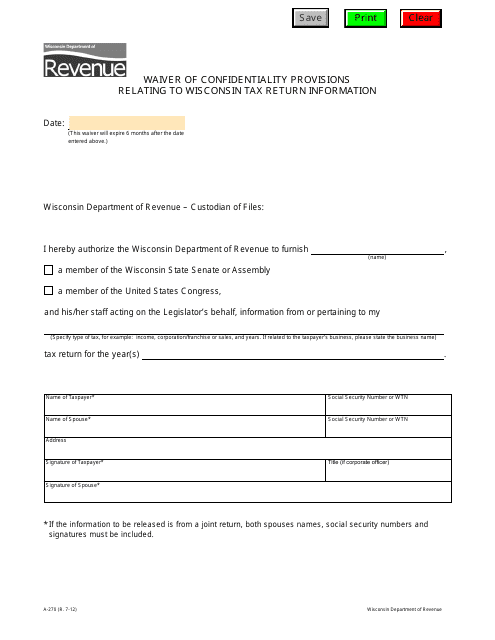

This form is used for waiving confidentiality provisions related to Wisconsin tax return information in the state of Wisconsin.

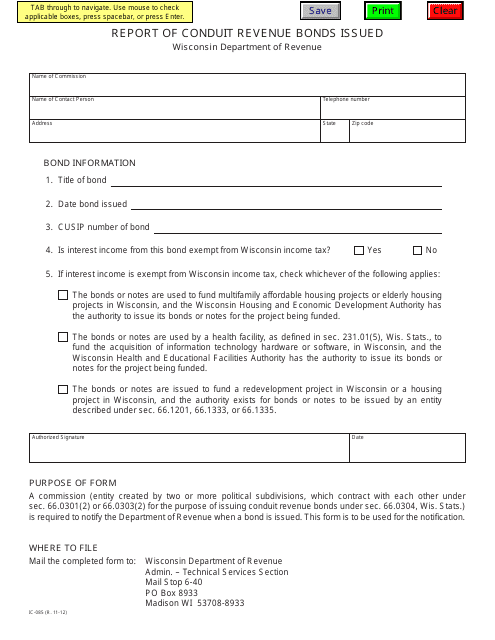

This form is used for reporting conduit revenue bonds issued in the state of Wisconsin. It helps the authorities track the issuance of these specific types of bonds and ensures compliance with regulatory requirements.

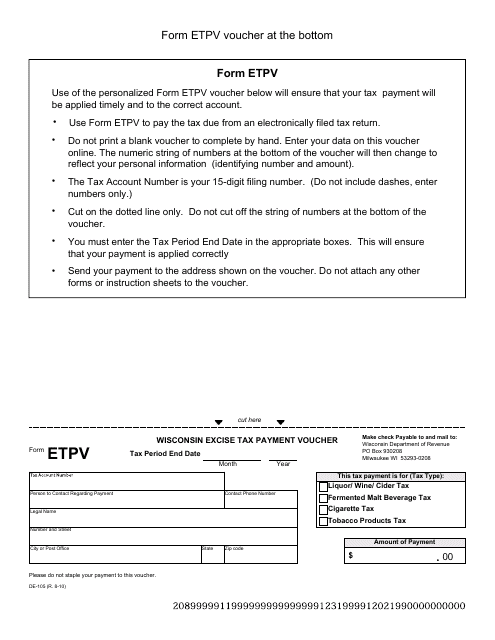

This Form is used for making excise tax payments in the state of Wisconsin.

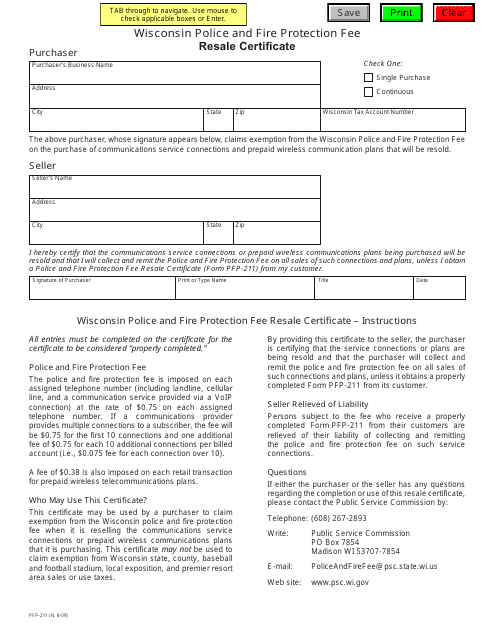

This document is a resale certificate specifically for the Police and Fire Protection Fee in Wisconsin. It allows businesses to remit sales tax on eligible purchases made for resale.

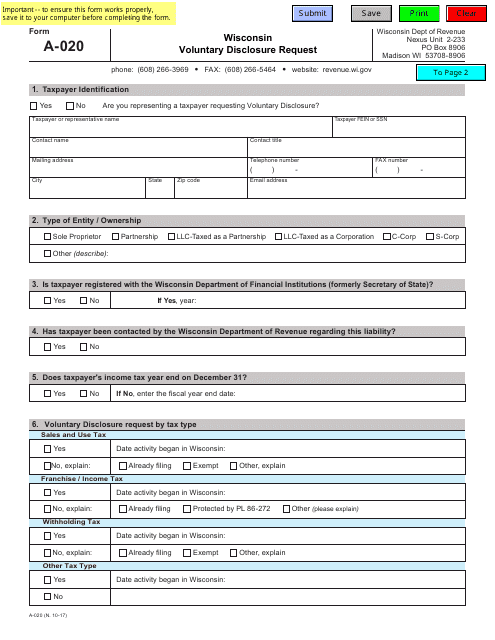

This form is used for individuals or businesses in Wisconsin to request a voluntary disclosure of taxes owed to the state.

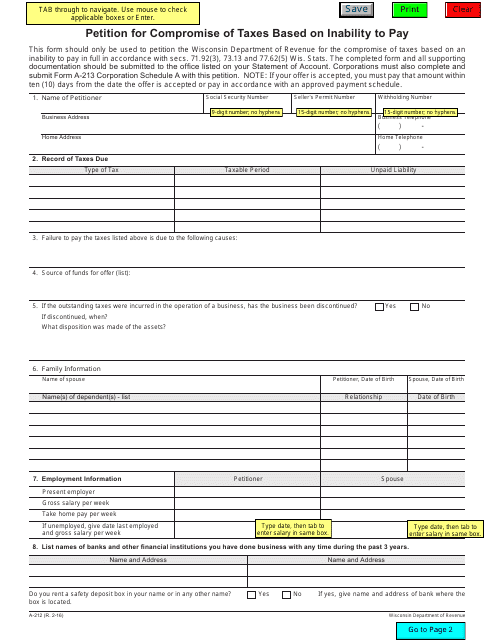

This Form is used for individuals in Wisconsin who are unable to pay their taxes and are seeking a compromise with the state.

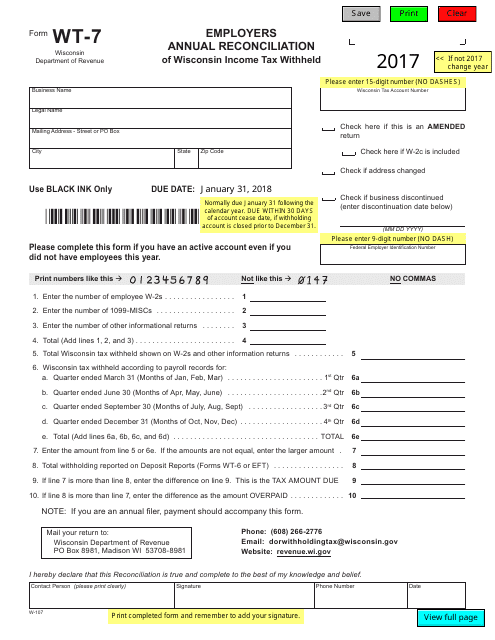

This Form is used for employers in Wisconsin to reconcile their annual income tax withholdings.

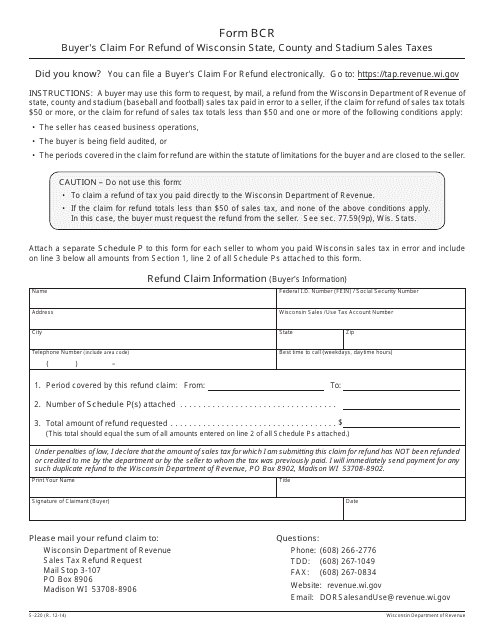

This form is used for buyers to claim a refund of Wisconsin state, county, and stadium sales taxes in Wisconsin.

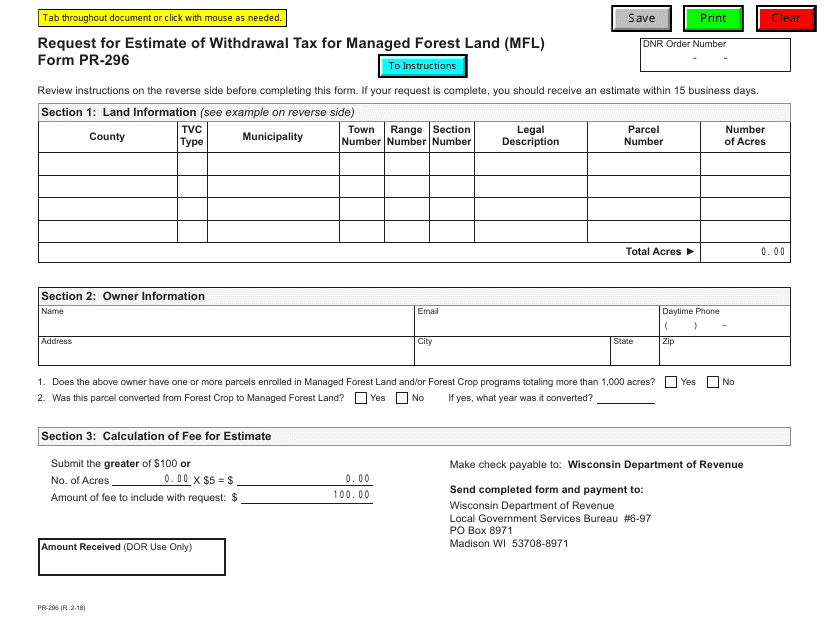

This form is used for requesting an estimate of the withdrawal tax for Managed Forest Land (MFL) in Wisconsin. It helps landowners determine the potential tax liability when withdrawing land from the managed forest program.

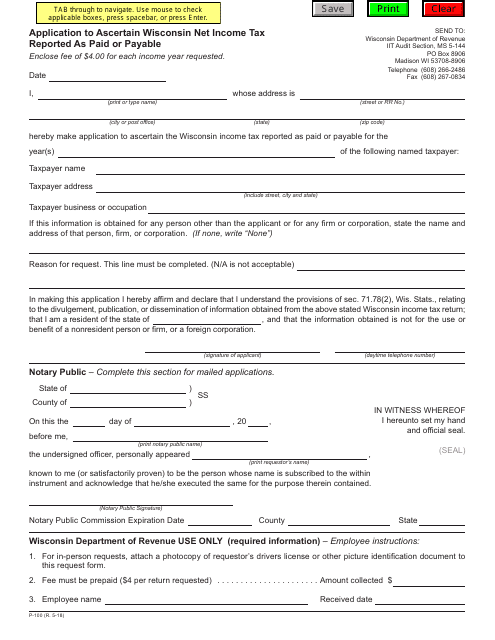

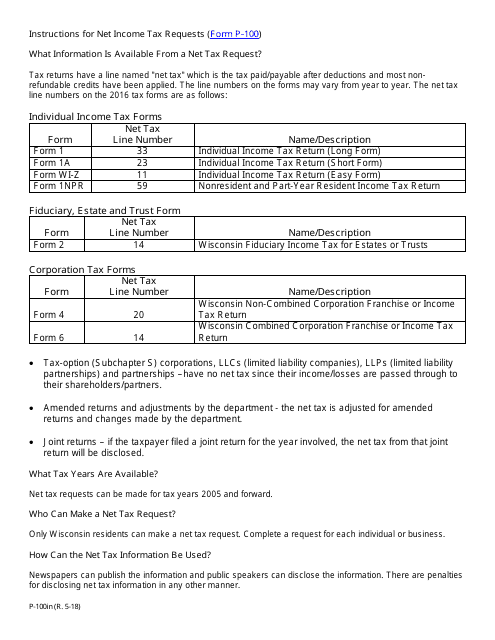

Form P-100 Application to Ascertain Wisconsin Net Income Tax Reported as Paid or Payable - Wisconsin

This Form is used for calculating the net income tax reported as paid or payable in the state of Wisconsin.

This Form is used for applying to determine the amount of Wisconsin net income tax reported as paid or payable.

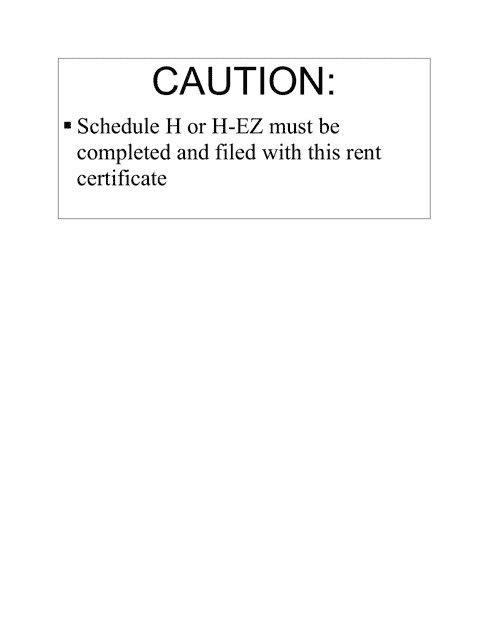

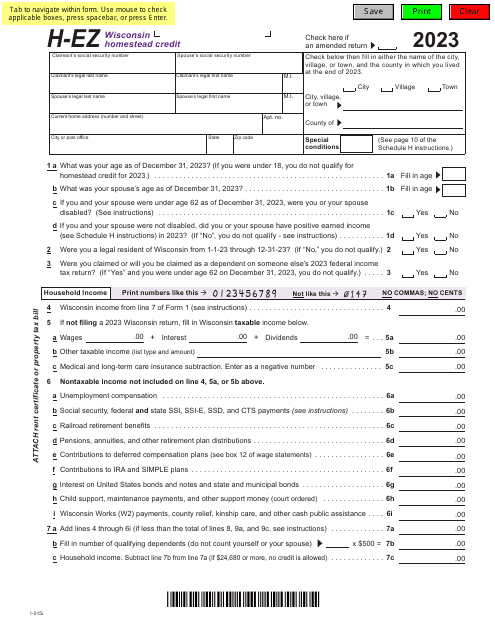

The main purpose of this document is to serve as evidence for tenants who will claim homestead credit on their Wisconsin taxes - it will verify the amount of rent paid or property tax accrued.

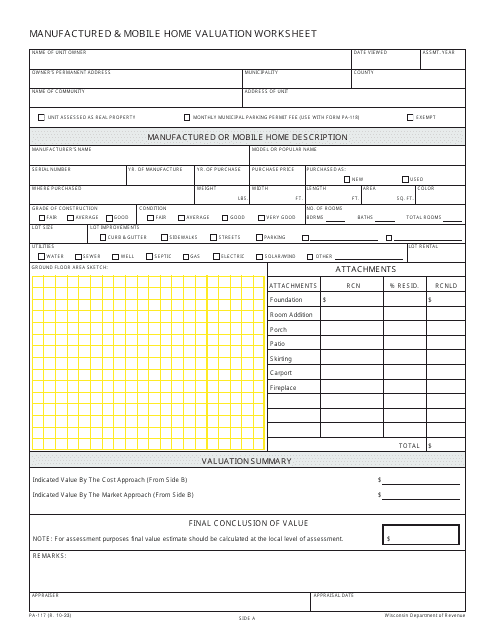

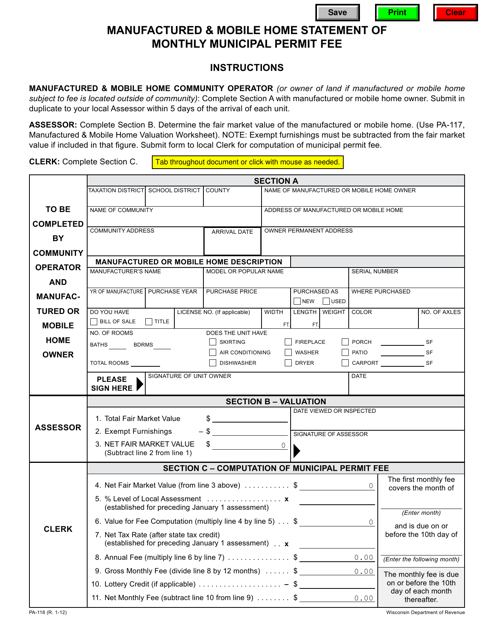

This form is used for reporting the monthly municipal permit fee for manufactured and mobile homes in Wisconsin.

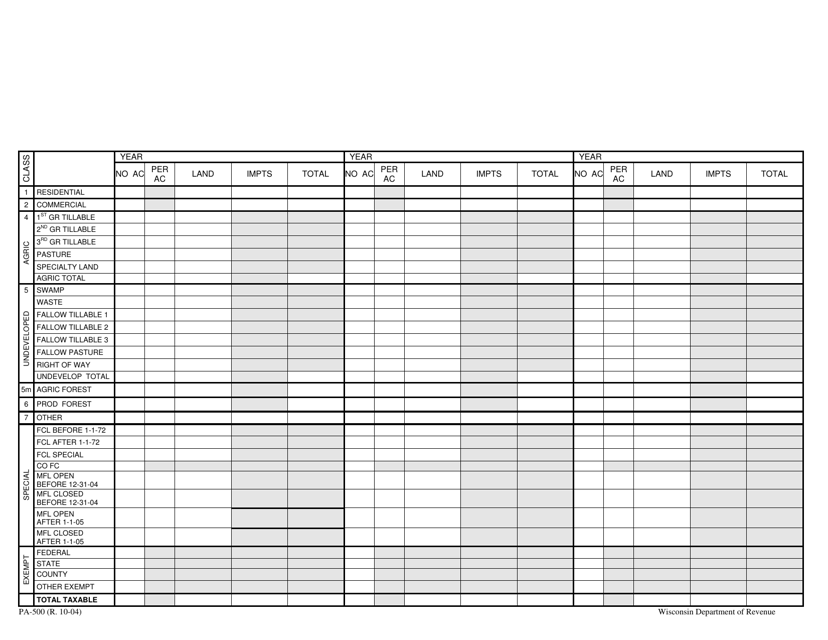

This form is used for recording residential property details in the state of Wisconsin. It allows property owners to provide information such as property address, size, and value to the relevant authorities.

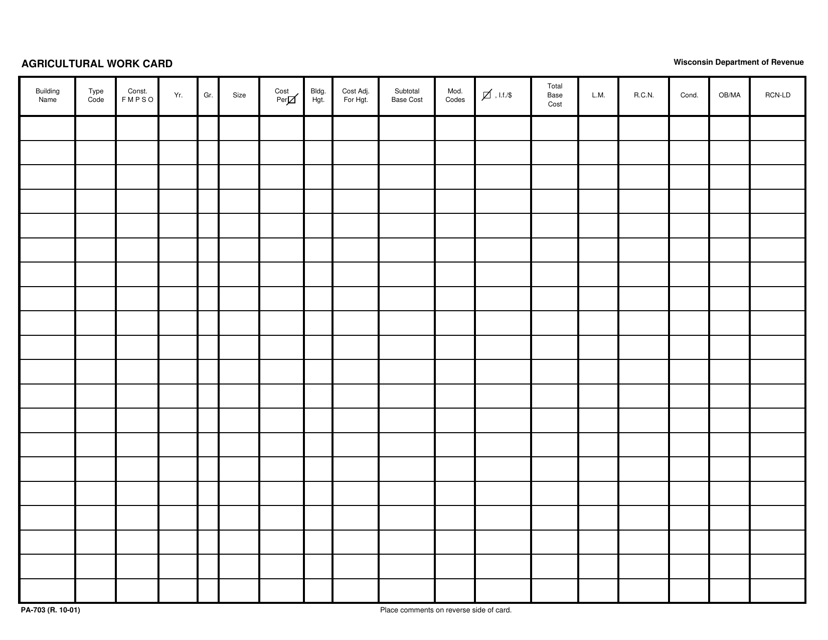

This document is for obtaining an Agricultural Work Card in Wisconsin. It is required for individuals working in the agricultural industry.

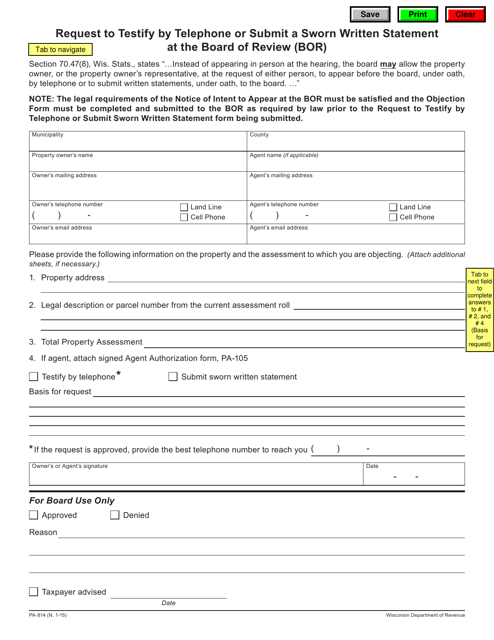

This form is used for requesting to testify by telephone or submit a sworn written statement at the Board of Review (BOR) in Wisconsin.

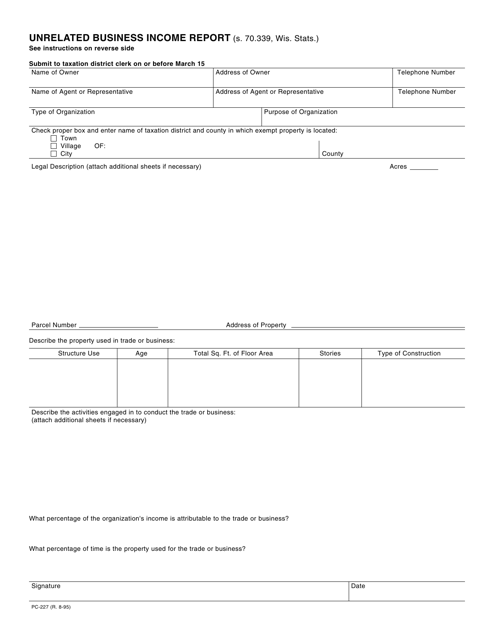

This Form is used for reporting unrelated business income in the state of Wisconsin.

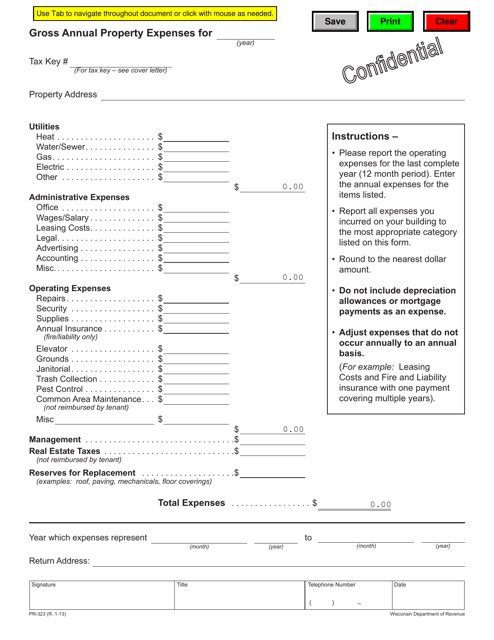

This form is used for reporting the gross annual property expenses in the state of Wisconsin.

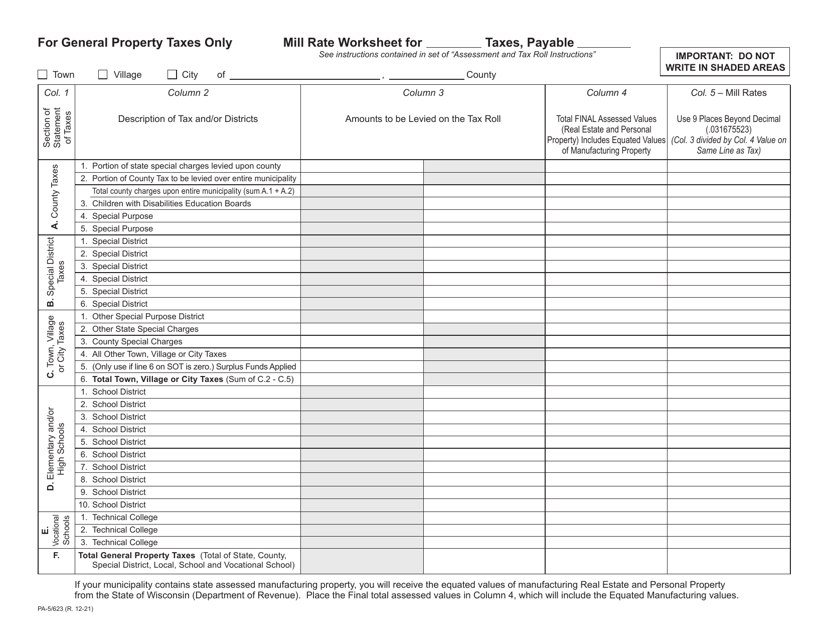

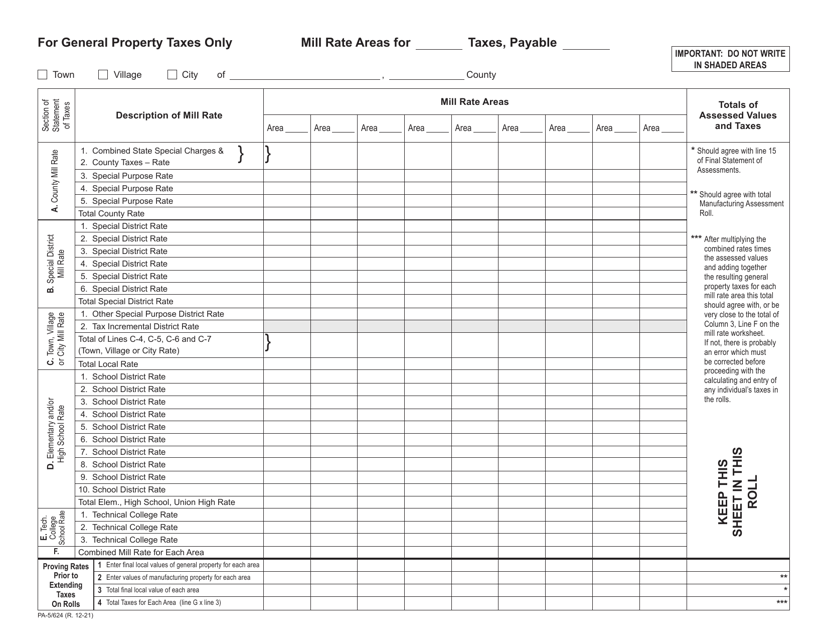

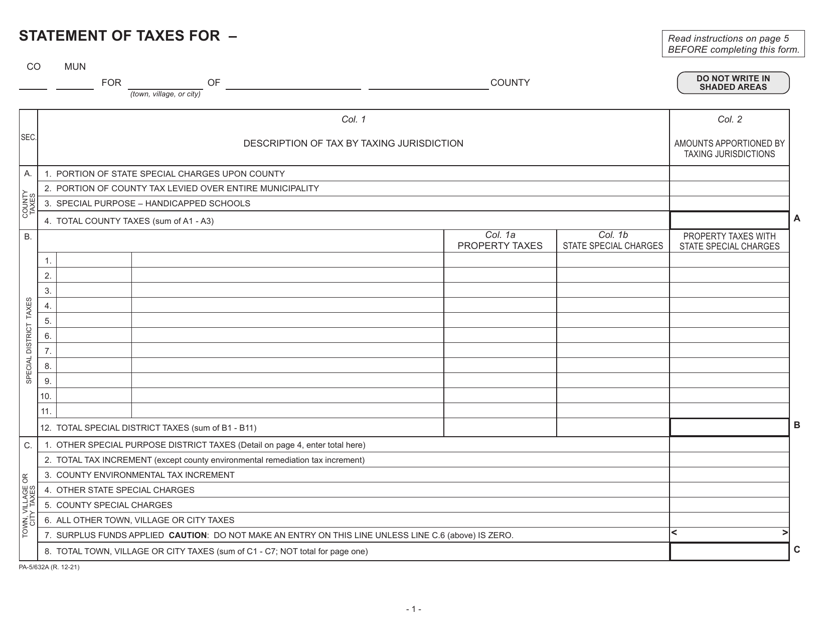

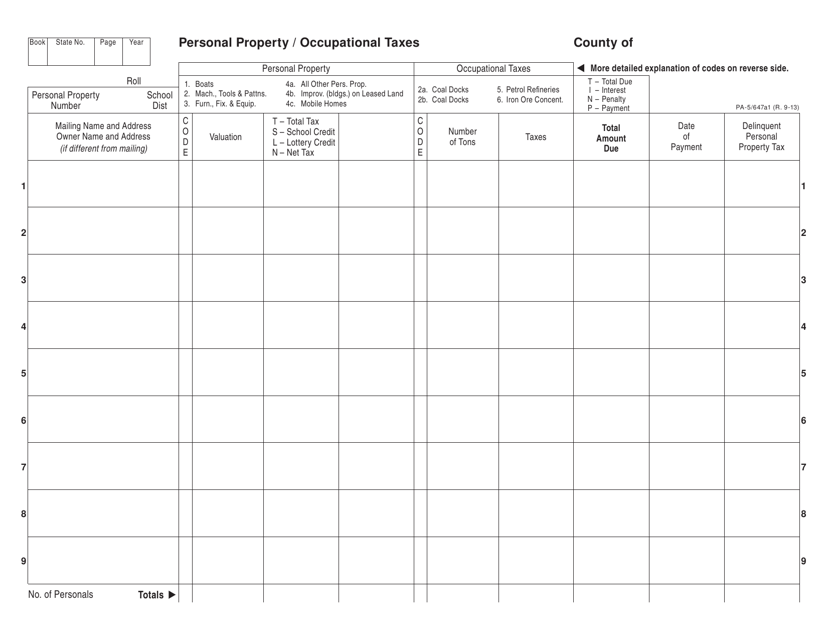

This form is used for reporting personal property and occupational taxes in the state of Wisconsin.

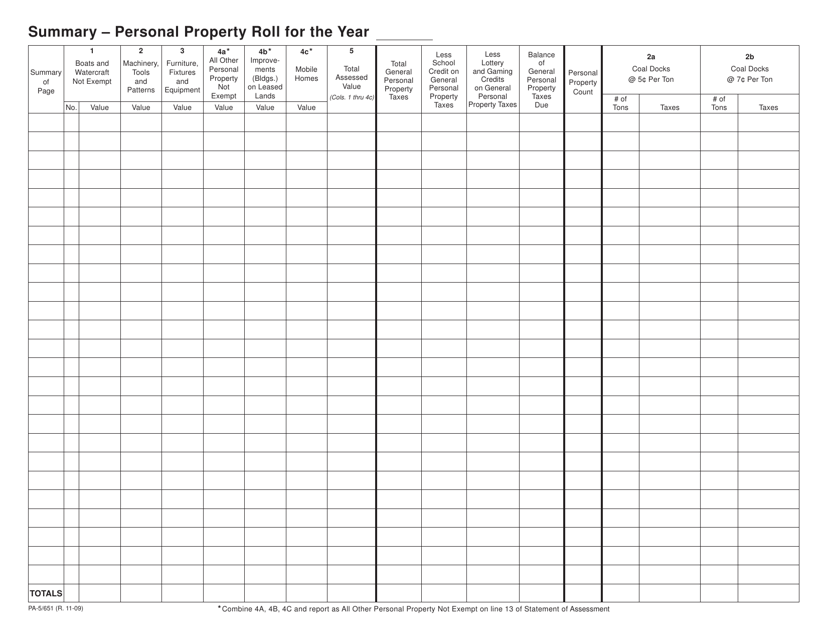

This Form PA-5/651 is used for reporting personal property in Wisconsin. It is used to create a personal property roll for tax assessment purposes.

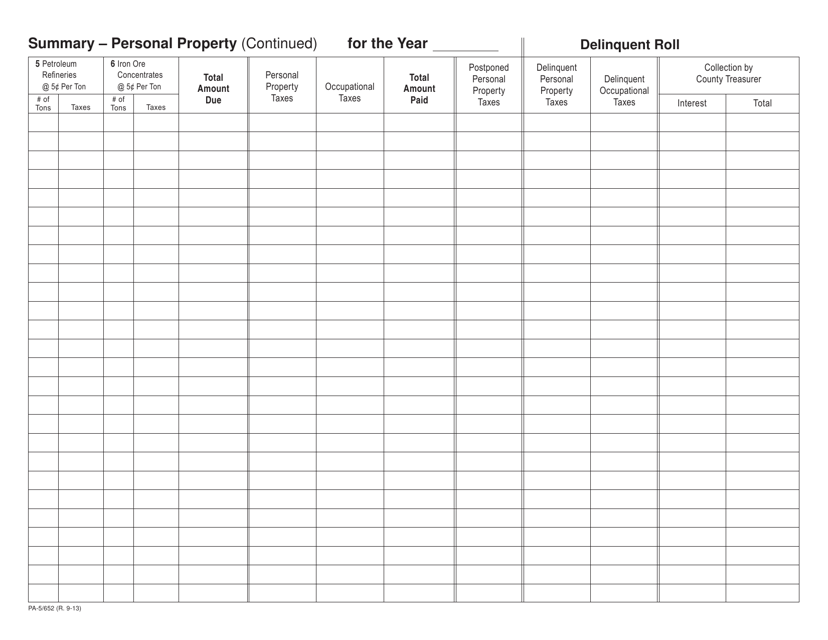

This form is used for reporting personal property in the state of Wisconsin. It is a continuation of the previous form PA-5-652.

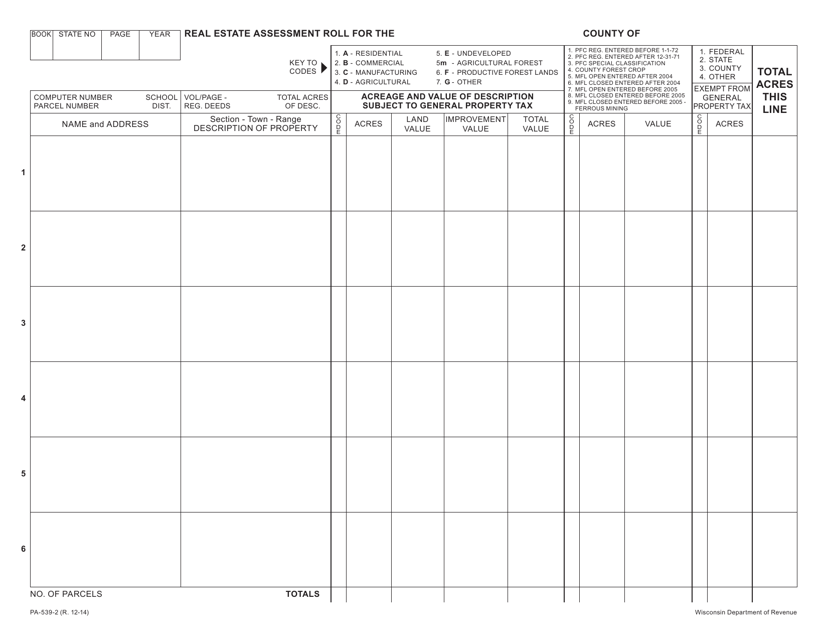

This form is used for accessing the real estate assessment roll in Wisconsin. It provides information about the assessed value of a property for tax purposes.

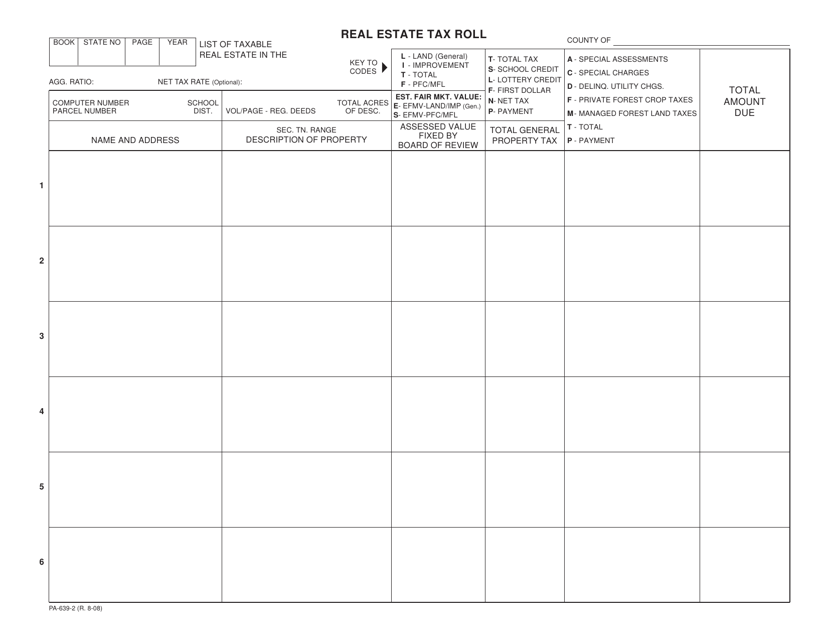

This Form is used for reporting real estate tax roll information in the state of Wisconsin.