Wisconsin Department of Revenue Forms

Documents:

1007

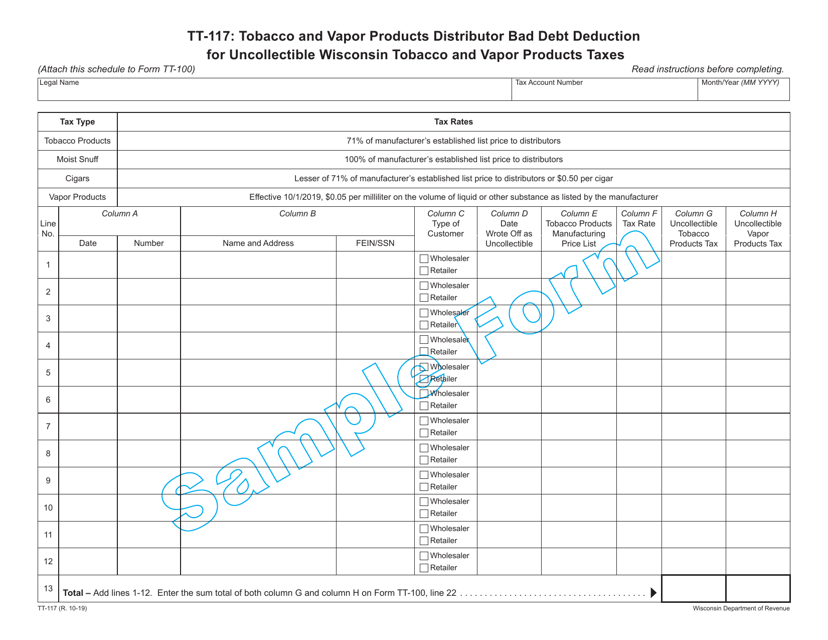

This form is used for claiming a bad debt deduction on uncollectible tobacco and vapor product taxes in Wisconsin.

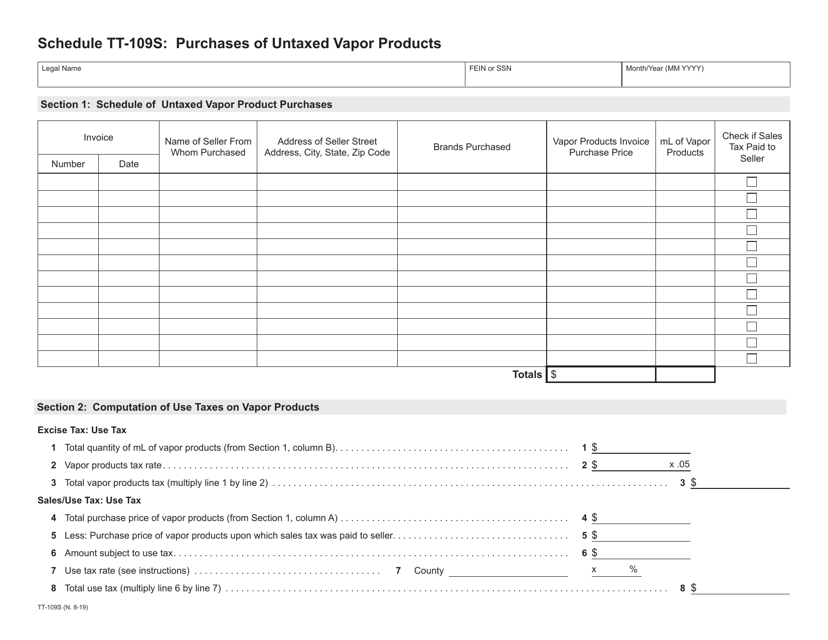

This Form is used for reporting the purchases of untaxed vapor products in Wisconsin.

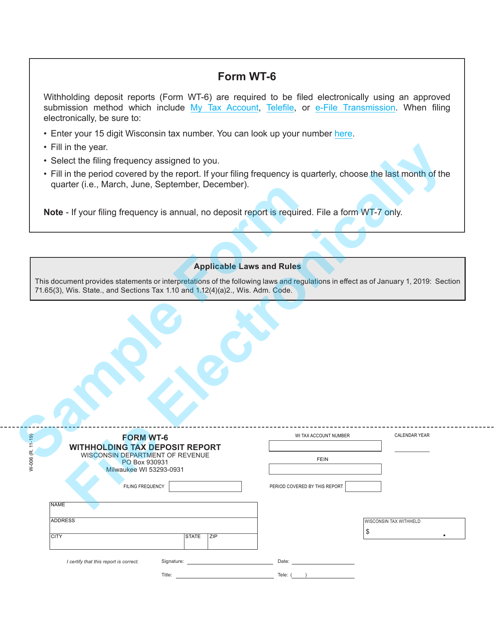

This form is used for reporting withholding tax deposits in the state of Wisconsin.

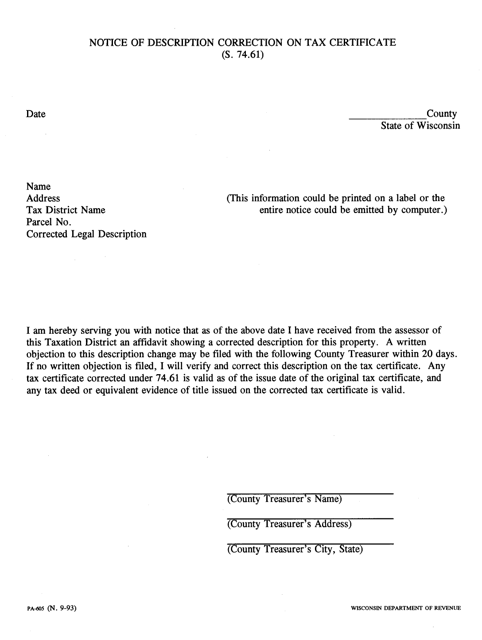

This form is used for notifying the correction of a description on a tax certificate in Wisconsin.

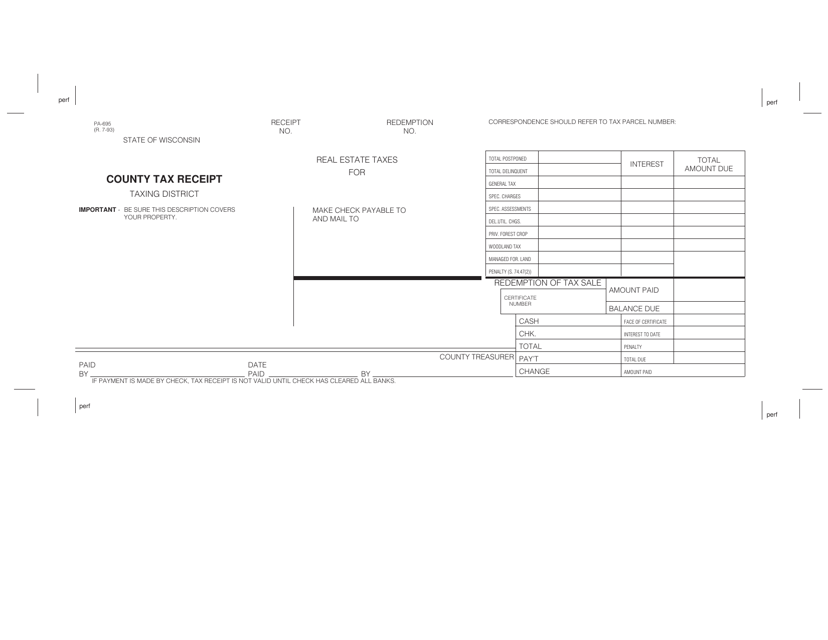

This form is used for obtaining a county tax receipt in the state of Wisconsin. It is a document that provides proof of payment for county taxes.

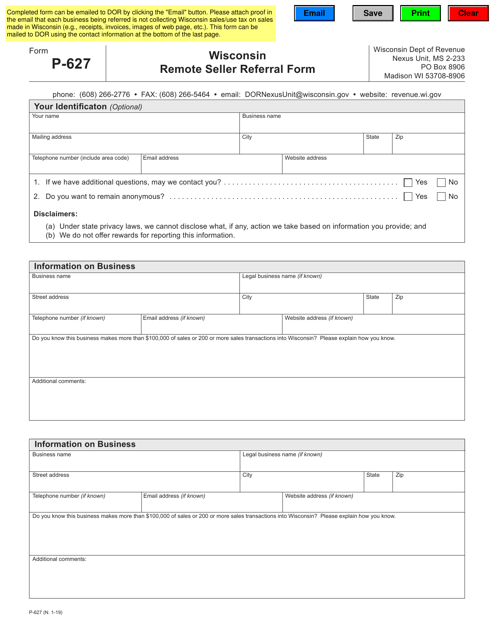

This form is used for remote sellers in Wisconsin to refer potential customers to the Wisconsin Department of Revenue for sales tax collection purposes.

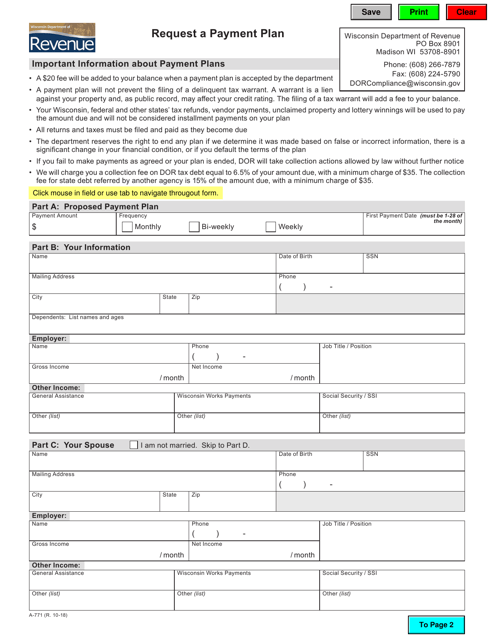

This form is used to request a payment plan in the state of Wisconsin. It allows individuals to make installment payments for certain obligations, such as taxes or fines.

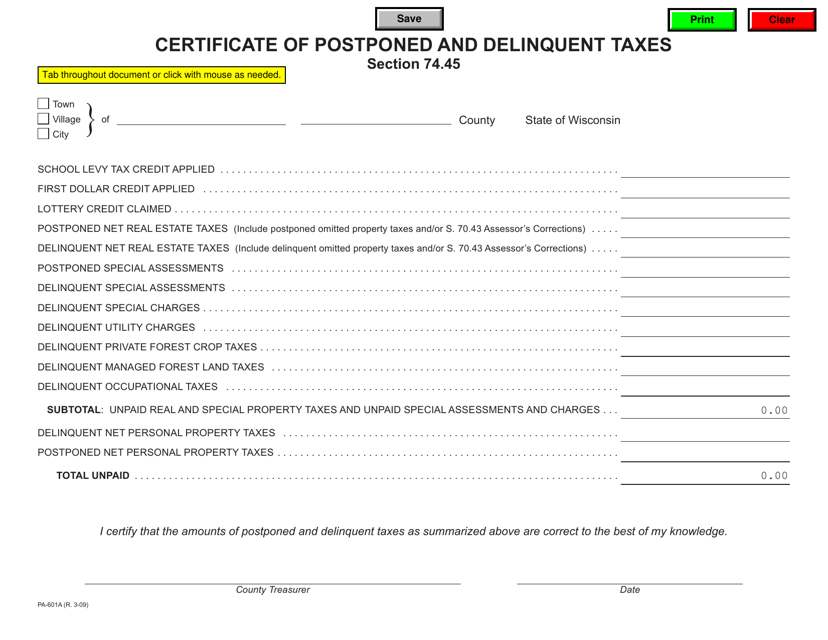

This form is used for certifying postponed and delinquent taxes in Wisconsin.

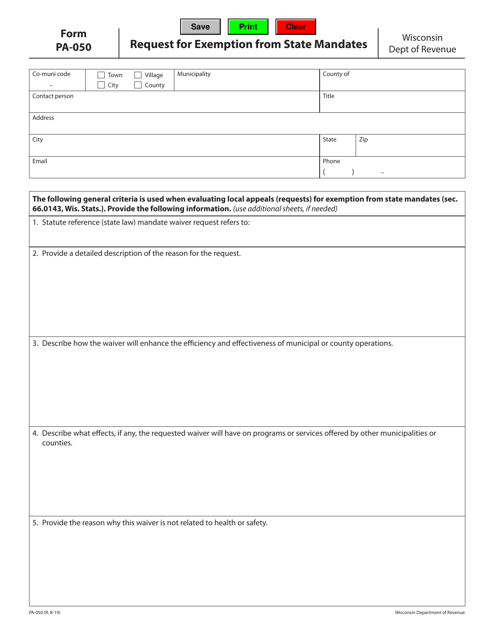

This form is used for requesting exemption from state mandates in Wisconsin.

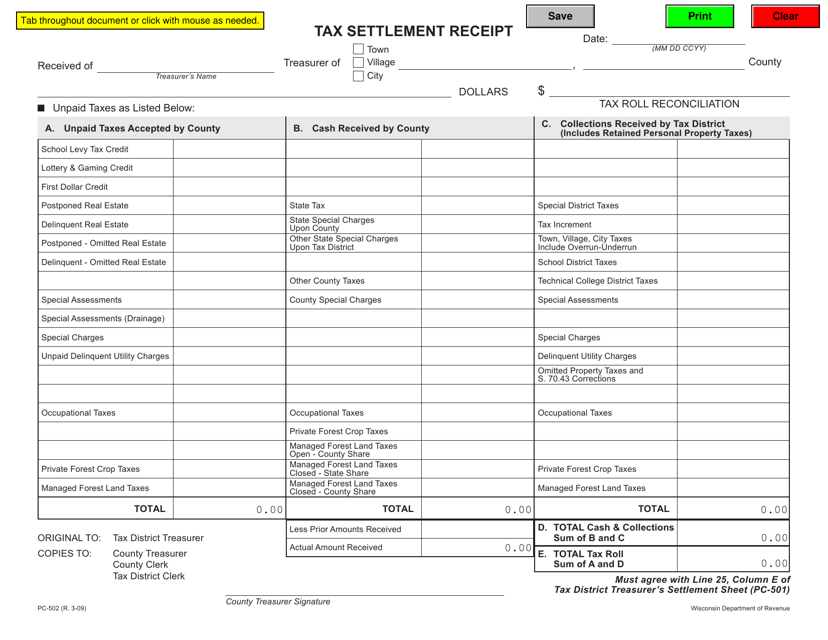

This form is used for obtaining a tax settlement receipt in the state of Wisconsin. It provides acknowledgment of a tax settlement and can be used for recordkeeping purposes.

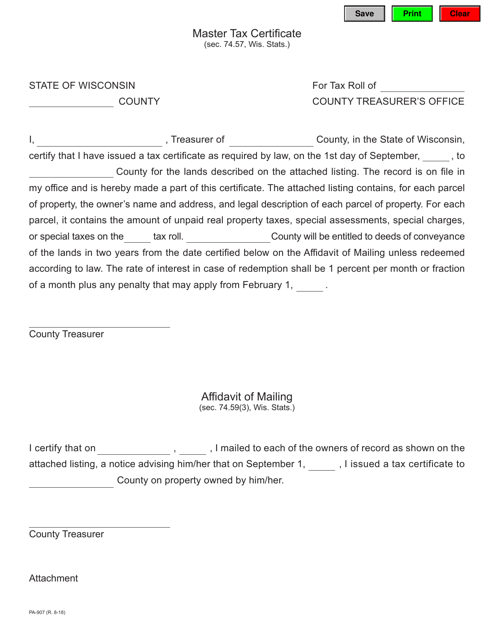

This form is used for obtaining a Master Tax Certificate in the state of Wisconsin. It is used by individuals or businesses to certify their knowledge and compliance with state tax laws and regulations.

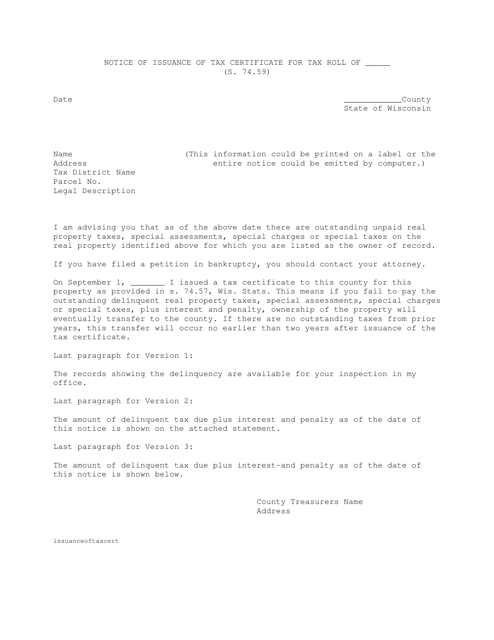

This document notifies the recipient about the issuance of a tax certificate in the state of Wisconsin.

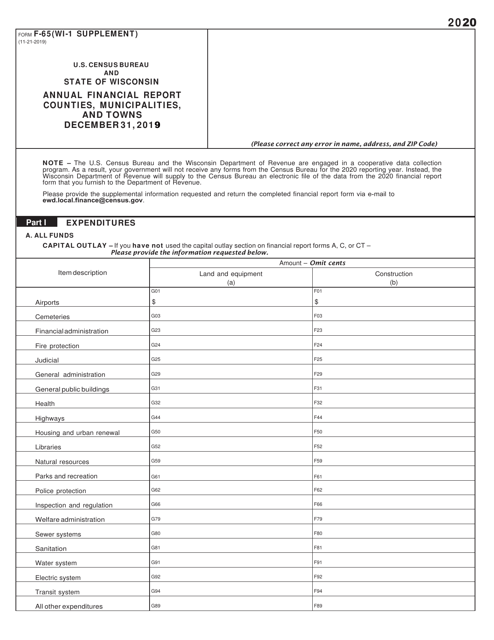

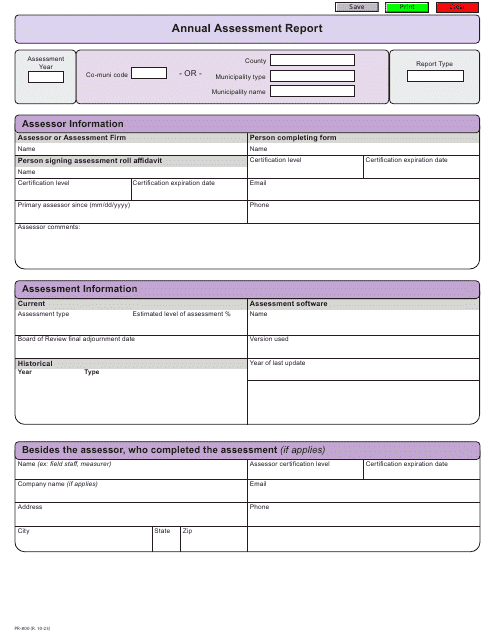

This form is used for the submission of the U.S. Census Bureau's annual financial report for the state of Wisconsin. It provides a comprehensive overview of the census bureau's financial activities and expenditures in Wisconsin.

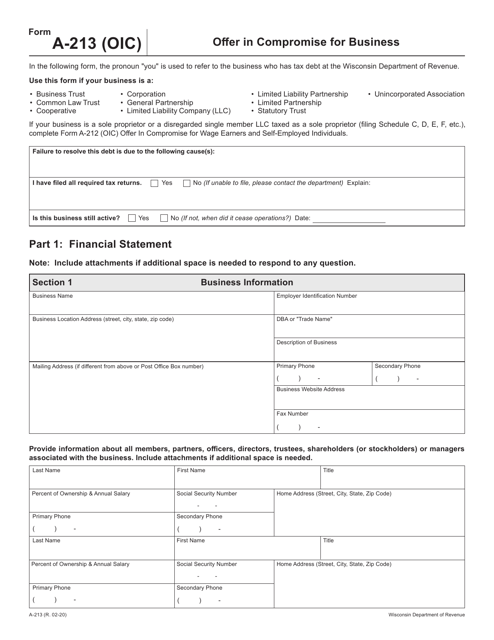

This form is used for making an offer in compromise for a business located in Wisconsin.

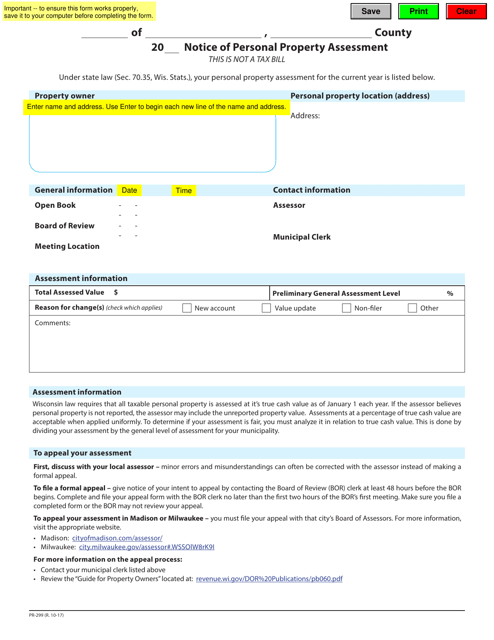

This type of document, Form PR-299, is used for providing a notice of personal property assessment in the state of Wisconsin.

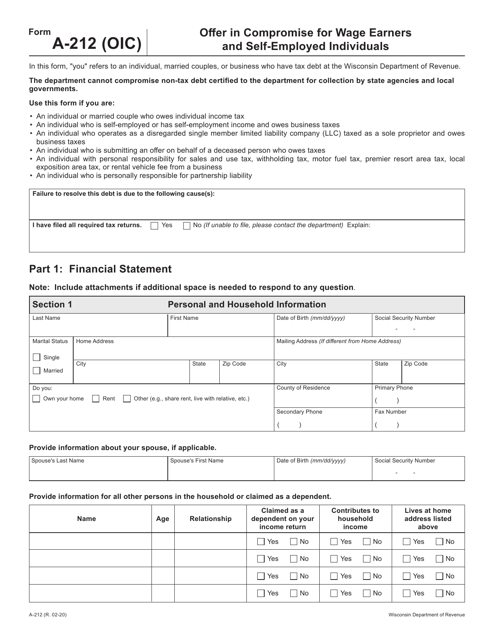

This Form is used for individuals in Wisconsin who want to make an offer in compromise for their unpaid taxes as wage earners or self-employed individuals.

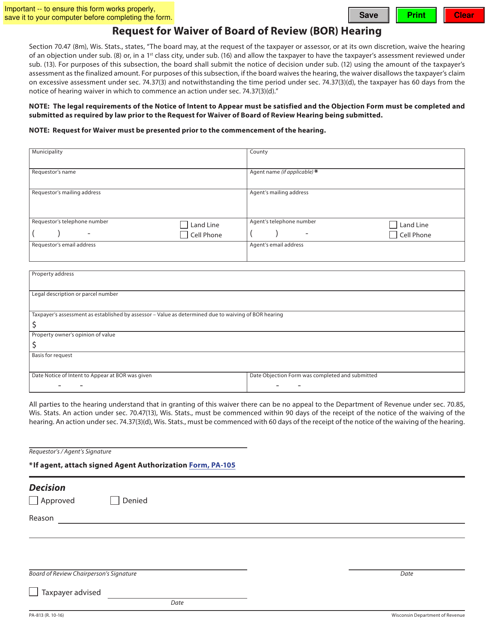

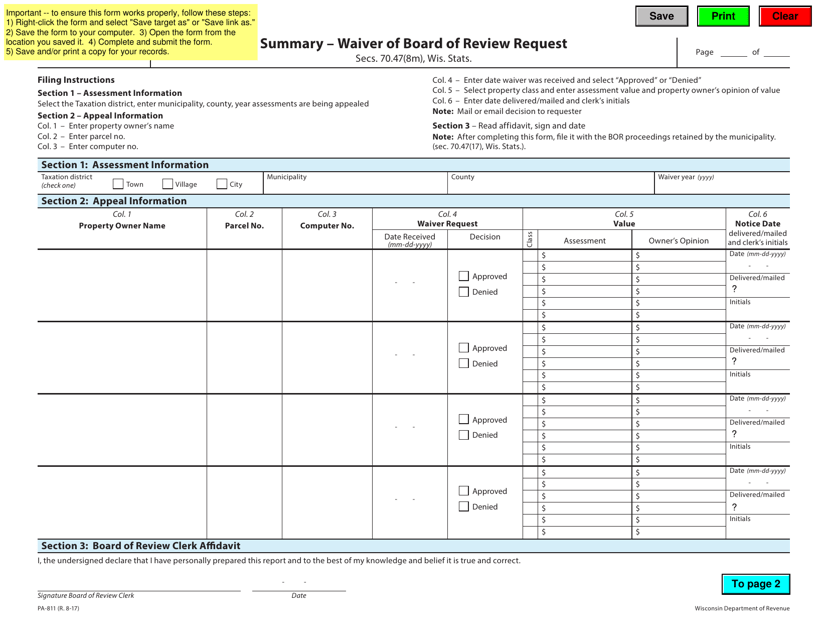

This form is used for requesting a waiver of the Board of Review (BOR) hearing in Wisconsin. It allows individuals to express their desire to have their case resolved without a hearing before the BOR.

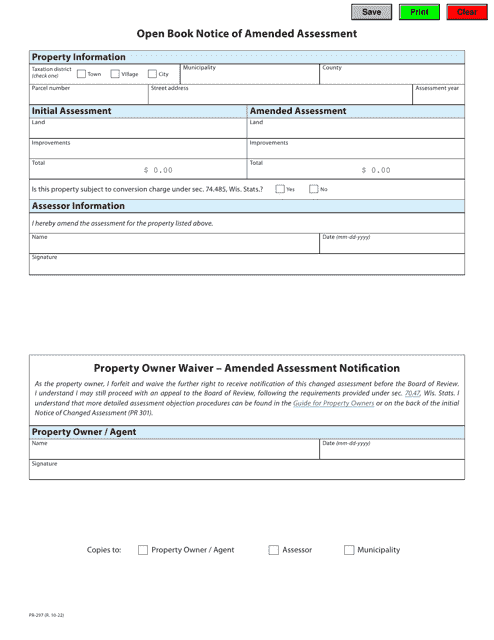

This form is used for requesting a waiver of the Board of Review in Wisconsin.

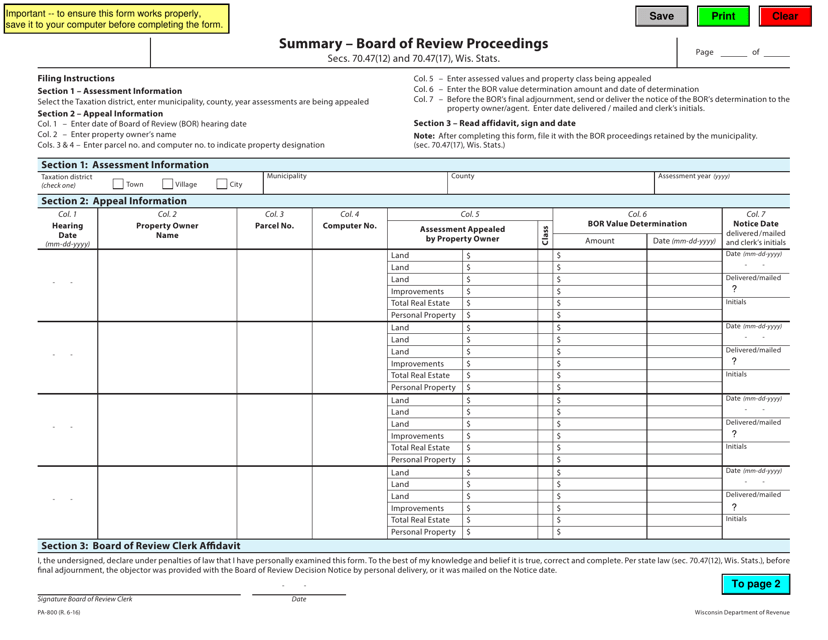

This type of document summarizes the Board of Review Proceedings in the state of Wisconsin. It is used to provide a summary of the proceedings that took place during the review process.

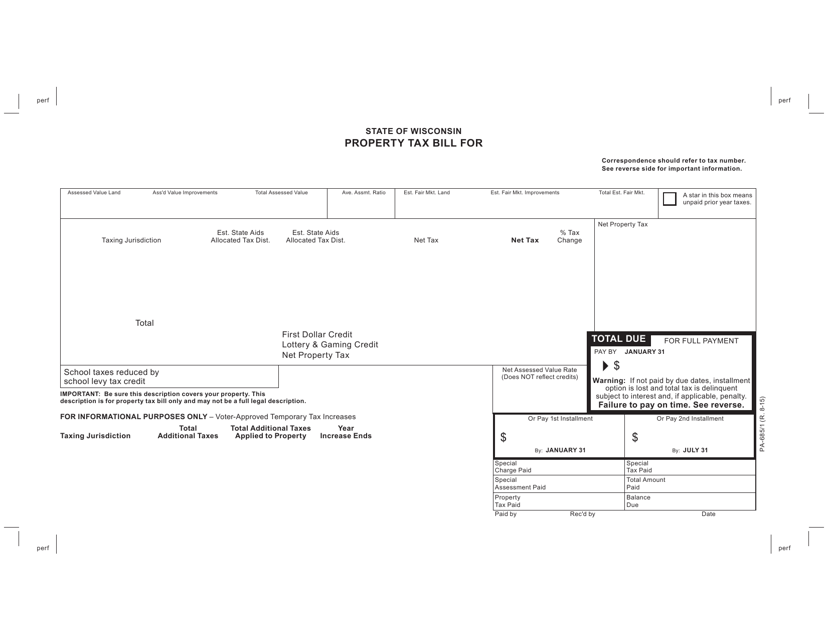

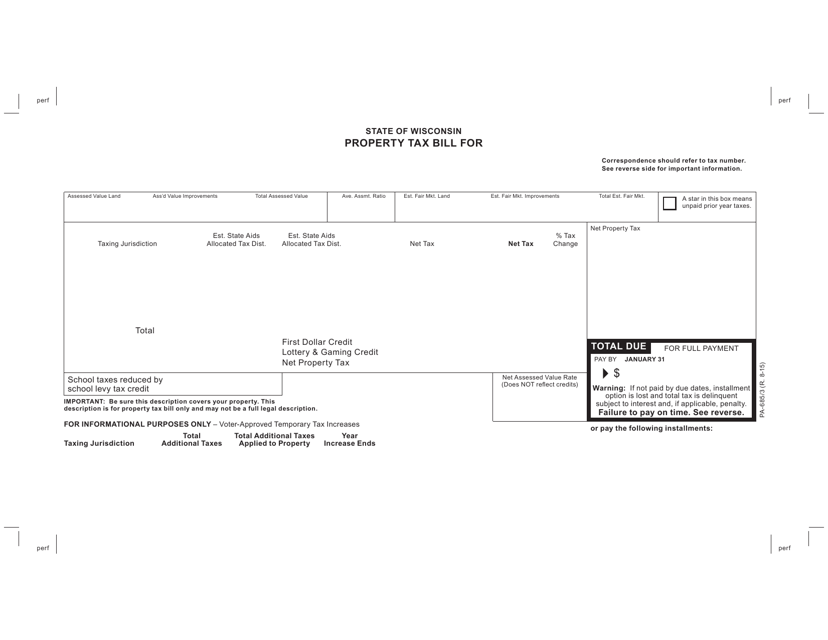

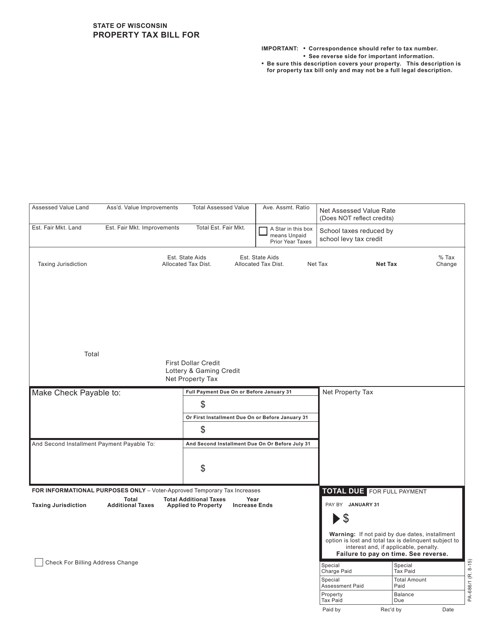

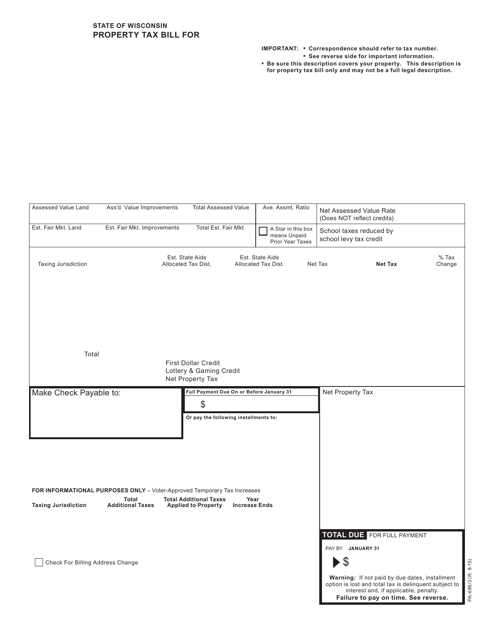

This Form is used for receiving and paying property tax bills in Wisconsin.

This form is used for paying property taxes in Wisconsin. It is the bill that homeowners receive to calculate and submit their property tax payments.

This form is used to send property tax bills to residents in Wisconsin.

This form is used for paying property tax bills in the state of Wisconsin.

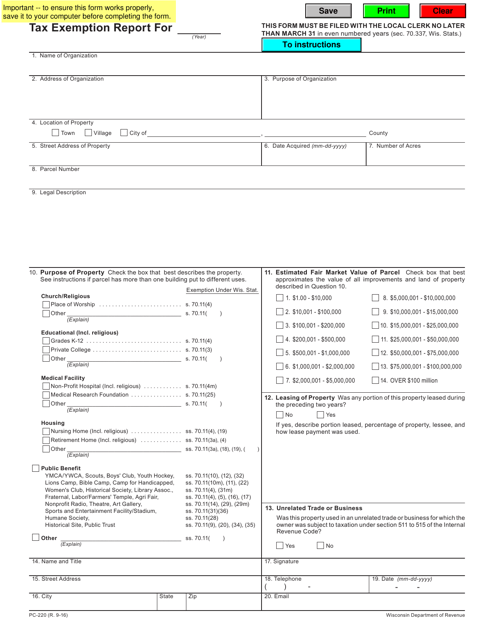

This form is used for reporting tax exemptions in the state of Wisconsin.